Global Ponzu Sauce Market Size, Share, And Business Benefits By Flavor (Traditional, Yuzu Ponzu, Sudachi Ponzu, Kabosu Ponzu, Others), By Nature (Conventional, Organic), By End-use (Foodservice, Industry, Retail), By Distribution Channel (Hypermarkets and Supermarkets, Specialty Store, Convenience Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159053

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

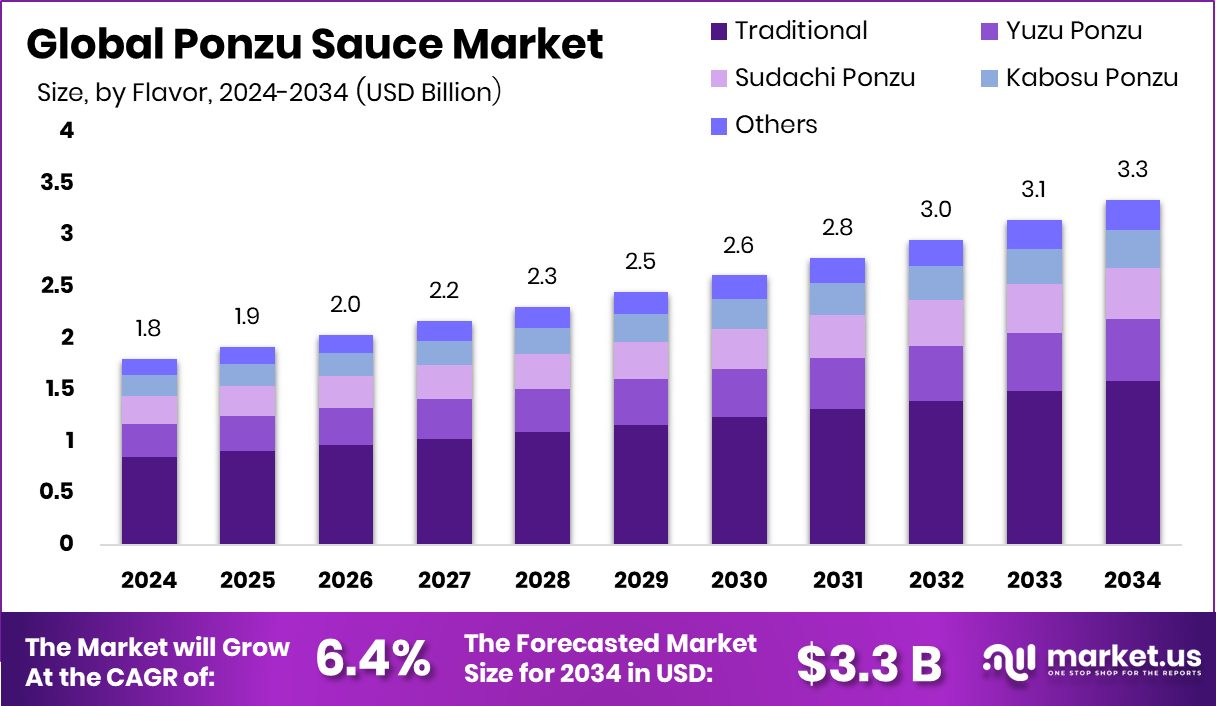

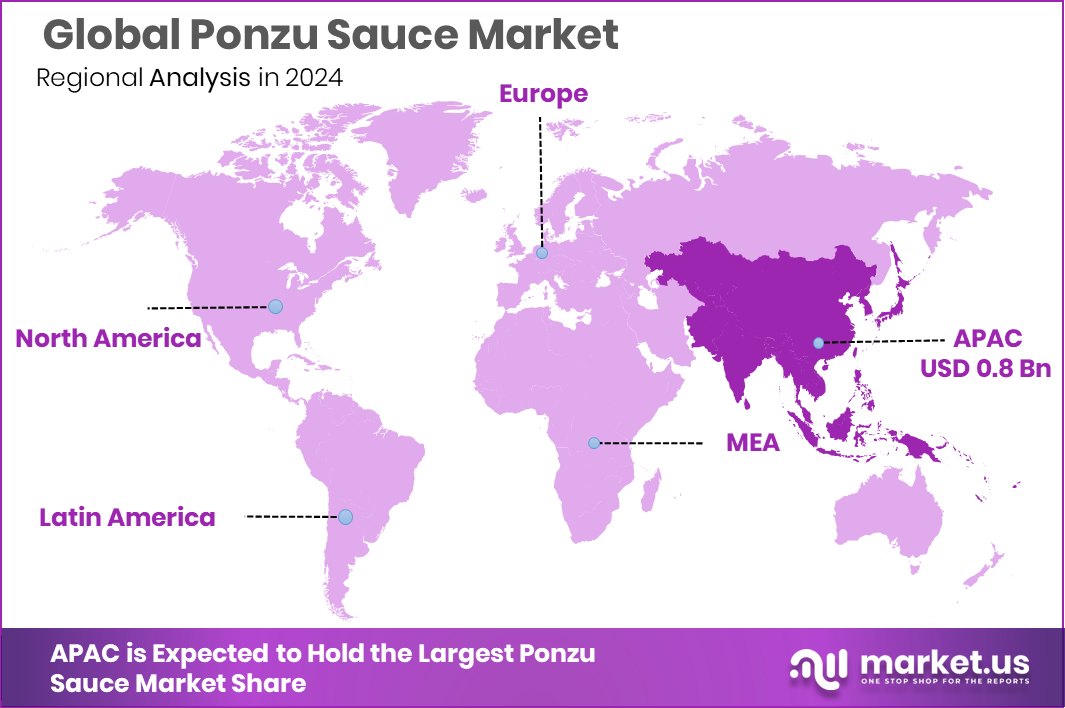

The Global Ponzu Sauce Market is expected to be worth around USD 3.3 billion by 2034, up from USD 1.8 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034. Asia Pacific’s Ponzu Sauce Market, valued at USD 0.8 Bn, reflects rising culinary and retail adoption.

Ponzu sauce is a traditional Japanese condiment made from a blend of citrus juice, soy sauce, rice vinegar, and sometimes mirin or dashi. It is known for its tangy, savory, and slightly sweet flavor, making it a popular choice for dipping sauces, marinades, and salad dressings. Its versatility allows it to complement a wide range of dishes, from seafood and grilled meats to vegetables and noodles, adding a refreshing zing that enhances the overall taste experience.

The ponzu sauce market has been expanding steadily due to the growing interest in Japanese cuisine and global culinary trends. Increasing awareness of healthy, low-calorie, and flavorful condiments has encouraged households and restaurants to incorporate ponzu sauce into daily cooking. Its compatibility with both traditional and modern dishes makes it an attractive option for food enthusiasts seeking unique taste profiles. According to an industry report, Hyphen secures $25 million in funding with support from CAVA.

Rising consumer demand is driven by the shift towards international flavors and healthier alternatives to conventional sauces. Many consumers prefer Ponzu sauce for its natural ingredients, light sodium content, and ability to elevate dishes without overwhelming them. Its appeal spans across home cooking, fine dining, and ready-to-eat meals, supporting consistent growth in retail and foodservice channels. According to an industry report, Embargo was awarded a £350,000 grant to upgrade its foodservice app using AI.

Opportunities for Ponzu sauce lie in product innovation and the development of convenient formats. Ready-to-use bottled sauces, flavored variations, and organic versions can attract health-conscious and time-sensitive consumers. Additionally, as global fusion cuisine continues to gain popularity, ponzu sauce is likely to see wider adoption beyond Japanese cuisine, opening avenues for increased market penetration in diverse culinary markets. According to an industry report, Branded Hospitality unveils a $50 million fund for new foodservice ventures.

Key Takeaways

- The Global Ponzu Sauce Market is expected to be worth around USD 3.3 billion by 2034, up from USD 1.8 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034.

- The Ponzu Sauce market shows that traditional flavors lead with a 47.3% share globally.

- Conventional ponzu sauce dominates the market, accounting for 87.9% of overall sales worldwide.

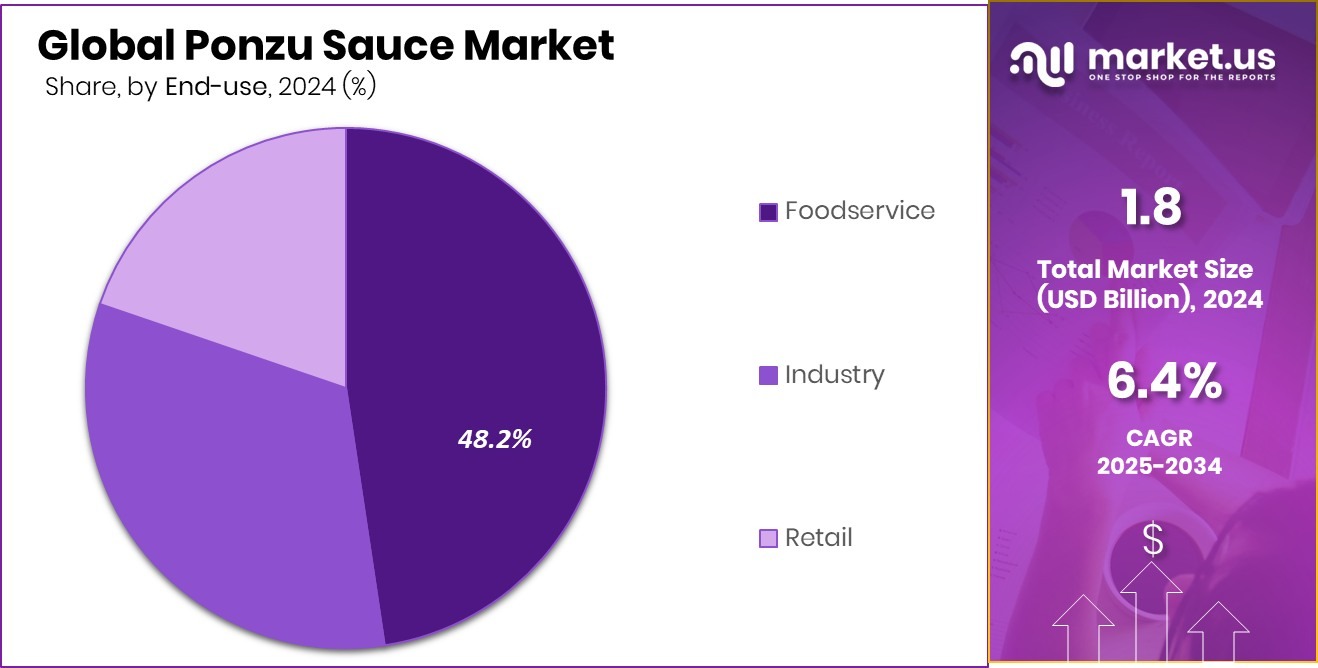

- Foodservice remains the top end-use segment, representing 48.2% of Ponzu Sauce consumption.

- Hypermarkets and supermarkets lead distribution channels, capturing 51.2% of the Ponzu Sauce market reach.

- The growing demand in the Asia Pacific, USD 0.8 Bn, drives the Ponzu Sauce market expansion significantly.

By Flavor Analysis

The Ponzu Sauce Market shows traditional flavor dominating with a 47.3% share.

In 2024, Traditional held a dominant market position in the By Flavor segment of the Ponzu Sauce Market, with a 47.3% share. The preference for traditional flavors is largely driven by consumer trust in authentic taste profiles and the popularity of classic Japanese cuisine. Traditional Ponzu sauce continues to appeal to both home cooks and professional chefs for its versatility and balanced flavor, which enhances a wide variety of dishes such as seafood, salads, and grilled items.

Consumers value its familiar and consistent taste, which aligns with their expectations of genuine Japanese condiments. This strong foothold of traditional flavors underscores the continued demand for authentic culinary experiences in the growing Ponzu sauce market.

By Nature Analysis

Conventional Ponzu Sauce leads the market, accounting for 87.9% of sales.

In 2024, Conventional held a dominant market position in the By Nature segment of the Ponzu Sauce Market, with an 87.9% share. The strong preference for conventional Ponzu sauce is primarily driven by its widespread availability and consistent quality, which appeals to both household consumers and foodservice providers.

Conventional products are often favored for their familiarity, ease of use, and cost-effectiveness, making them a practical choice for daily cooking and restaurant applications. The dominance of conventional Ponzu sauce reflects consumer confidence in traditional production methods and flavor profiles, which continue to meet expectations for authenticity and taste. This solid market presence highlights the ongoing demand for dependable, widely accepted Ponzu sauce products in 2024.

By End-use Analysis

Foodservice applications represent 48.2% of the Ponzu Sauce Market demand globally.

In 2024, Foodservice held a dominant market position in the by-end-use segment of the Ponzu Sauce Market, with a 48.2% share. The prominence of the foodservice sector is driven by the widespread use of Ponzu sauce in restaurants, hotels, and catering services, where it is valued for enhancing the flavor of diverse dishes, from sushi and grilled seafood to salads and marinades.

Professional chefs prefer Ponzu sauce for its consistent quality, ease of integration into recipes, and ability to elevate menu offerings with authentic Japanese taste. The strong adoption in foodservice highlights the growing demand for flavorful, ready-to-use condiments that meet both operational efficiency and consumer satisfaction requirements in 2024.

By Distribution Channel Analysis

Hypermarkets and supermarkets hold 51.2% of the distribution channel share for ponzu sauce.

In 2024, Hypermarkets and Supermarkets held a dominant market position in the By Distribution Channel segment of the Ponzu Sauce Market, with a 51.2% share. Their leading role is driven by the convenience, wide product variety, and accessibility they offer to consumers seeking authentic Japanese condiments. These retail formats provide organized shelf space, promotional activities, and bulk purchasing options, making them the preferred choice for both individual buyers and small-scale foodservice operators.

The strong presence of Ponzu sauce in hypermarkets and supermarkets reflects consumer trust in established retail channels for quality assurance and easy availability. This dominance underscores the importance of organized retail in shaping purchase behavior and supporting market growth in 2024.

Key Market Segments

By Flavor

- Traditional

- Yuzu Ponzu

- Sudachi Ponzu

- Kabosu Ponzu

- Others

By Nature

- Conventional

- Organic

By End-use

- Foodservice

- Industry

- Retail

By Distribution Channel

- Hypermarkets and Supermarkets

- Specialty Store

- Convenience Stores

- Others

Driving Factors

Rising Popularity of Japanese Cuisine Worldwide

The growing global interest in Japanese cuisine is a key driving factor for the Ponzu Sauce Market. Consumers are increasingly exploring authentic international flavors, and Japanese dishes like sushi, sashimi, and grilled seafood have become household favorites. Ponzu sauce, with its tangy and savory profile, perfectly complements these dishes, making it a staple in kitchens and restaurants alike. Its versatility allows it to be used in marinades, dipping sauces, and salad dressings, increasing its demand across different culinary settings.

Moreover, initiatives like Friendlier’s $4.5 million funding to help more food service operators ditch single-use containers encourage restaurants to experiment with sustainable, high-quality ingredients, further boosting Ponzu sauce adoption. This trend is expected to support steady market growth in the coming years.

Restraining Factors

Limited Consumer Awareness in Emerging Markets

One of the main restraining factors for the Ponzu Sauce Market is limited consumer awareness in emerging regions. Many consumers in these markets are still unfamiliar with Japanese cuisine and its traditional condiments, which can limit the adoption of Ponzu sauce. Without widespread knowledge of its flavor profile and versatile uses, demand remains concentrated in areas with established culinary exposure.

Additionally, smaller foodservice operators may hesitate to stock specialty sauces due to perceived low demand. Even with significant investments in the industry, such as Restaurant365 gobbling up $135M to supersize its software for the food service sector, educating both businesses and consumers about authentic ingredients remains a challenge. Overcoming this awareness gap is crucial for expanding the Ponzu sauce market reach globally.

Growth Opportunity

Expansion Through Ready-to-Use Bottled Variants

A major growth opportunity for the Ponzu Sauce Market lies in the development and promotion of ready-to-use bottled variants. Convenience is a significant factor for both home cooks and busy foodservice operators, and pre-packaged Ponzu sauce allows easy integration into recipes without preparation time. Bottled products also support wider distribution through retail and online channels, making the sauce more accessible to new consumers.

Additionally, innovations such as flavored or organic versions can attract health-conscious buyers and culinary enthusiasts. Funding initiatives like the EU-Armenia SME Fund, managed by Amber Capital Armenia, investing USD 5.5 million in Alpha Food Service, demonstrate growing support for expanding production and distribution, further enhancing market opportunities for Ponzu sauce globally.

Latest Trends

Rising Demand for Sustainable and Eco-Friendly Packaging

A notable trend in the Ponzu Sauce Market is the shift towards sustainable and eco-friendly packaging. Consumers and foodservice operators are increasingly conscious of environmental impact and prefer products that reduce waste and use recyclable materials. Ponzu sauce brands are responding with glass bottles, biodegradable labels, and minimal-plastic packaging to meet these demands. Such packaging not only appeals to eco-conscious buyers but also enhances brand image and customer loyalty.

Moreover, innovations in packaging convenience make it easier for restaurants and home cooks to store and use the sauce efficiently. Supporting this movement, Bear Robotics raises $117M to fund food service robots, highlighting the broader trend of sustainability and efficiency in the food industry, which aligns with evolving consumer preferences.

Regional Analysis

In 2024, the Asia Pacific held 45.80% of the Ponzu Sauce Market, valued at USD 0.8 Bn.

In 2024, the Ponzu Sauce Market across global regions shows a strong presence, with Asia Pacific emerging as the dominating region, holding 45.80% of the market share and valued at USD 0.8 Bn. The region’s dominance is driven by high consumer interest in Japanese and other Asian cuisines, coupled with increasing disposable incomes and the rapid growth of the foodservice sector.

Rising awareness about authentic flavors and international culinary trends has encouraged both restaurants and households in countries like Japan, China, and South Korea to adopt Ponzu sauce extensively. Meanwhile, regions such as North America, Europe, the Middle East & Africa, and Latin America are witnessing gradual growth, supported by expanding retail channels, rising culinary curiosity, and increasing demand for versatile condiments.

However, their market presence is comparatively smaller than Asia Pacific, which benefits from cultural familiarity, established production infrastructure, and strong distribution networks. Overall, the high adoption in the Asia Pacific, accounting for nearly half of the global market, positions it as the key growth engine for Ponzu sauce, with promising opportunities for further expansion in both retail and foodservice segments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Kikkoman, a renowned name in the soy sauce industry, has expanded its product portfolio to include Ponzu sauce, leveraging its established brand reputation. The company has reported increased sales in key markets, including Asia and Oceania, with notable growth in countries like Indonesia and the Philippines. This expansion reflects Kikkoman’s strategic focus on catering to the rising demand for authentic Japanese condiments in these regions.

Mizkan Holdings, a leading Japanese food manufacturer, has been instrumental in popularizing Ponzu sauce globally. The company’s Ajipon Ponzu sauce has become a staple in many households and restaurants, known for its balanced flavor profile. Mizkan’s commitment to quality and innovation continues to drive its success in the Ponzu sauce market.

YAMASA CORPORATION, another key player in the soy sauce industry, offers a range of Ponzu sauces that cater to diverse consumer preferences. The company’s focus on traditional brewing methods and high-quality ingredients has garnered a loyal customer base. YAMASA’s products are widely available in both domestic and international markets, contributing to the global reach of Ponzu sauce.

Top Key Players in the Market

- Kikkoman Corporation

- Mizkan Holdings Co., Ltd.

- YAMASA CORPORATION

- Gold Mine Natural Foods

- Lee Kum Kee

- Shoda Sauces Europe Company Limited

- Marukan Vinegar

- Otafuku Foods

- Yamasan Ltd.

Recent Developments

- In June 2024, Kikkoman broke ground on a new $560 million production facility in Jefferson County, Wisconsin. This facility aims to bolster the company’s manufacturing capacity, supporting the growing demand for its products, including Ponzu sauce, in North America.

- In June 2024, Lee Kum Kee Sauce Group announced plans to invest up to USD 288 million in a new manufacturing facility in LaGrange, Georgia. This strategic move aims to bolster the company’s production capacity and meet the growing demand for its products, including Ponzu sauce, in the U.S. market.

Report Scope

Report Features Description Market Value (2024) USD 1.8 Billion Forecast Revenue (2034) USD 3.3 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Flavor (Traditional, Yuzu Ponzu, Sudachi Ponzu, Kabosu Ponzu, Others), By Nature (Conventional, Organic), By End-use (Foodservice, Industry, Retail), By Distribution Channel (Hypermarkets and Supermarkets, Specialty Store, Convenience Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kikkoman Corporation, Mizkan Holdings Co., Ltd., YAMASA CORPORATION, Gold Mine Natural Foods, Lee Kum Kee, Shoda Sauces Europe Company Limited, Marukan Vinegar, Otafuku Foods, Yamasan Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kikkoman Corporation

- Mizkan Holdings Co., Ltd.

- YAMASA CORPORATION

- Gold Mine Natural Foods

- Lee Kum Kee

- Shoda Sauces Europe Company Limited

- Marukan Vinegar

- Otafuku Foods

- Yamasan Ltd.