Global Polyvinyl Chloride Paste Resin Market by Manufacturing Process (Micro-Suspension Process and Emulsion Process), By Grade (High K-Value Grade, Mid K-Value Grade, Low K-Value Grade, Vinyl Acetate Copolymer Grade, and Blend Resin Grade), By End-Use Industry (Automotive, Construction, Electronics, Packaging), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 105652

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

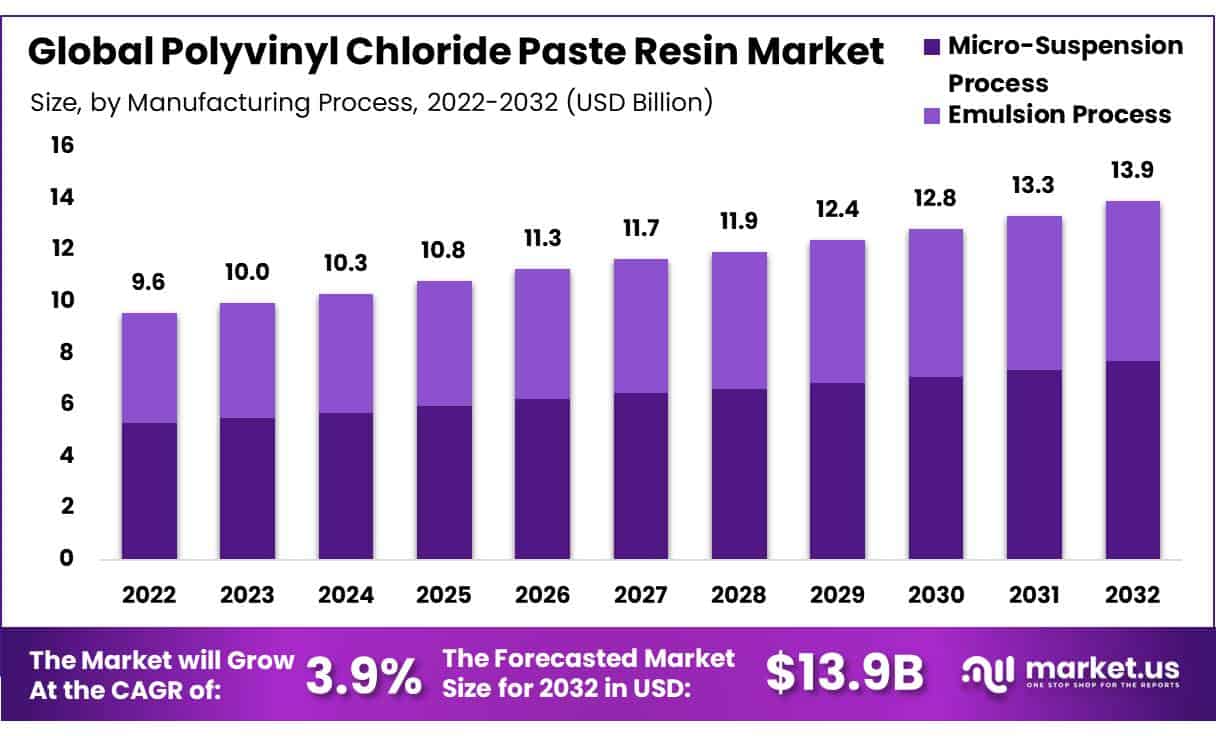

In 2022, the Global Polyvinyl Chloride Paste Resin Market was valued at USD 9,598.7 Million and is expected to reach USD 13,960.4 Million in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 3.9%.

Polyvinyl Chloride (PVC) is a kind of material used in the creation of plastic and rubber. PVC resin is offered in powder form and color white. It is used in producing flooring products such as plastic tiles and sheets for building purposes. When compared to other conventional materials such as concrete or wood.

PVC paste resin is used to produce various value-added goods, including gloves, wall and floor coverings, surface layers, and artificial leather. PVC Paste Resin is extensively used in various industries, which is expected to drive the market. It is a versatile and widely used material with various applications due to its excellent properties, such as durability, chemical resistance, electrical insulation, and affordability.

Actual Numbers Might Vary in the Final Report.

Key Takeaways

- Market Growth and Forecast: The Polyvinyl Chloride Paste Resin Market was valued at USD 9,598.7 million in 2022 and is projected to reach USD 13,960.4 million by 2032, demonstrating a steady compound annual growth rate (CAGR) of 3.9% over the forecast period.

- PVC Resin in Construction: The construction industry plays a significant role in driving the market’s growth. With increasing investments in infrastructure development and the need for affordable and lightweight materials, PVC-related products like window frames, vinyl claddings, and piping systems are in demand, thereby boosting PVC resin production.

- Raw Material Price Fluctuations: The fluctuation in raw material prices can affect the cost of PVC paste resin production, impacting its competitiveness and demand in the market. Additionally, the prohibition of certain toxic phthalates in several countries has hindered the expansion of the PVC paste resin market.

- Sustainability Focus: The industry is increasingly focusing on sustainability, exploring recycled materials and sustainable practices to minimize environmental impact. Manufacturers are also looking to reduce carbon emissions and energy use during PVC pipe manufacturing.

- Growth Opportunities: The demand for PVC paste resin is expected to grow further with the modernization of aging infrastructure, especially in renovation and retrofitting projects. Moreover, technological advancements are likely to create new revenue opportunities in the market.

- Regional Dominance: The Asia-Pacific (APAC) region, particularly countries like China and Japan, dominates the market due to their vast manufacturing capabilities. The demand for PVC paste resin in various applications, such as synthetic leather, automotive interiors, and construction products, is high in this region.

- Key Market Players: Major players in the PVC paste resin market include INEOS Group Limited, LG Chem, Westlake Corporation, Hanwha Solutions Corporation, Orbia, Tosoh Corporation, Formosa Plastics Corporation, SCG Chemicals Public Company Limited, KANEKA CORPORATION, and Chemplast Sanmar, among others.

Driving Factors

Rising Demand from the Construction Industry Driving the Global Polyvinyl Chloride Paste Resin Market.

The construction industry is witnessing a boost in investment for infrastructure by the government, building and construction companies, and private developers due to the growing need for housing and commercial spaces. There’s an increasing preference for lightweight and affordable substitutes to traditional materials such as wood and metal.

This has led to a rise in the use of PVC-related products, including window frames, vinyl claddings, swipe cards, and piping systems. As a result, PVC materials are becoming more significant in the building industry. Thus, with increased investment activities and construction production across the globe, production and demand for PVC resins are growing, which, in turn, is predicted to boost this market.

Restraining Factors

Fluctuations in Raw Material Prices May Hamper the Growth of The PVC Paste Resin Products.

Fluctuations in raw material prices can impact the overall cost of PVC paste resin production, affecting its price competitiveness and demand in the market. Moreover, due to their toxicity, phthalates have been outlawed in several nations, which is expected to impede trade expansion in the polyvinyl chloride (PVC) paste resin market.

Phthalates are typically employed as plasticizers, compounds added to plastics to enhance their flexibility, transparency, toughness, and lifespan. They are mainly used to soften polyvinyl chloride. Because phthalates do not have an immediate harmful effect, they were once thought to be safe.

However, risk analyses conducted in the EU have revealed that certain phthalates need to be categorized as harmful to reproduction. The four phthalates DBP, DEHP, DIBP, and BBP are among the most widely used phthalates and are stared as harmful to reproduction in the EU. Since they were labeled, phthalate use has decreased. These factors may hamper the revenue growth of this market.

Market Scope

Manufacturing Process Analysis

The Micro-Suspension Process Segment was Dominant in 2022 Due to its Better Processing Characteristics Over Other Processes.

The polyvinyl chloride paste resin market is segmented into micro-suspension and emulsion processes based on the manufacturing process. Among these, the micro-suspension process segment is estimated to account for a 52.9% revenue share in the global polyvinyl chloride paste resin market in 2022, with a CAGR of 4.4%.

The micro-suspension process typically produces PVC particles with a larger average size compared to the emulsion process. This can result in improved filtration, faster plasticizer absorption, and better processing characteristics, making it preferred in applications where these factors are crucial.

Grade Analysis

The High K-Value Grade Holds the Majority of Revenue Share in the Market Owing to Its Excellent Properties

By grade, the polyvinyl chloride paste resin market is further divided into High K-Value Grade, Mid K-Value Grade, Low K-Value Grade, Vinyl Acetate Copolymer Grade, and Blend Resin Grade. Among these, the high k-value grade segment is estimated to account for a 42.2% revenue share in the global polyvinyl chloride paste resin market in 2022.

A high K-value grade improves mechanical strength, chemical resistance, and processability. As such, it is commonly used in rigid pipes, fittings, profiles, and other structural applications.

End-Use Industry Analysis

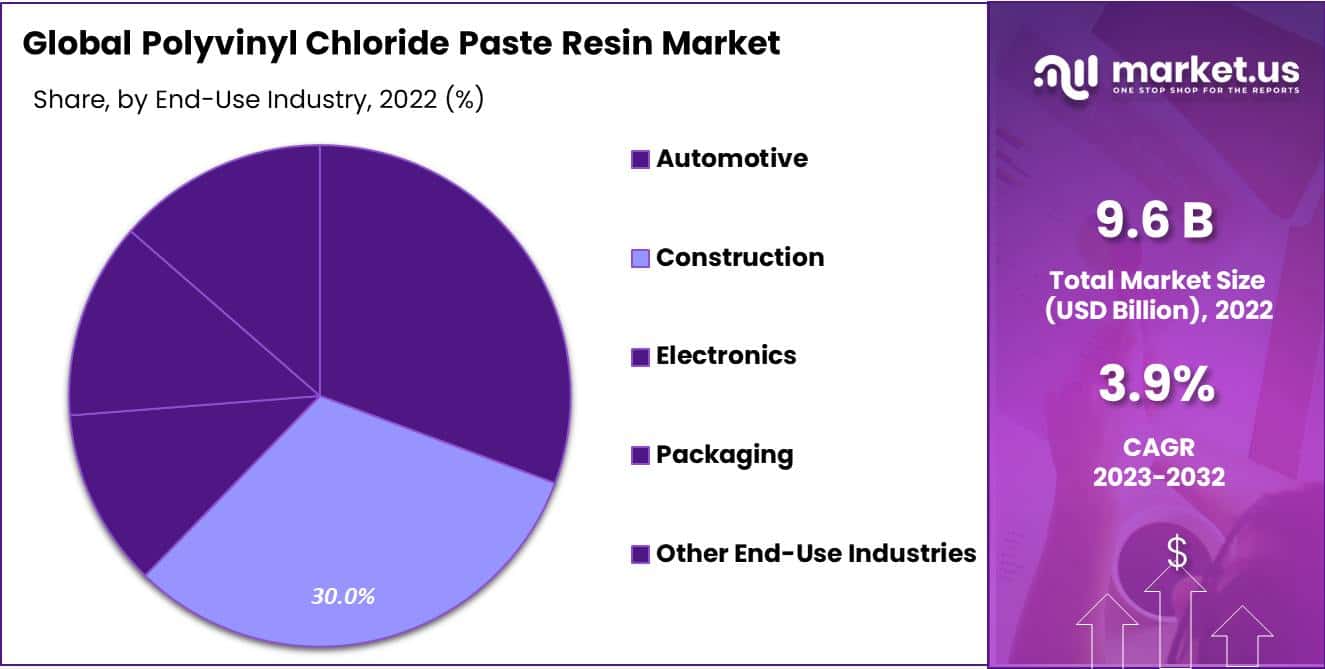

The Global Construction Sector is Bolstering the Market Growth and accounts the Largest Market Share Among Other End-User Sectors

By grade, the polyvinyl chloride paste resin market is further divided into automotive, construction, electronics, packaging, and other end-use industries. Among these, the construction segment is accounted for a 35.1% revenue share in the global polyvinyl chloride paste resin market.

Owing to renovation and retrofitting of existing infrastructure and buildings that offer opportunities for the PVC paste resin manufacturers. Upgrading plumbing systems, electrical wiring, and interior components often involve the use of PVC-based products.

Key Market Segments

Based on the Manufacturing Process

- Micro-Suspension Process

- Emulsion Process

Based on Grade

- High K-Value Grade

- Mid K-Value Grade

- Low K-Value Grade

- Vinyl Acetate Copolymer Grade

- Blend Resin Grade

Based on End-Use Industry

- Automotive

- Construction

- Electronics

- Packaging

- Other End-Use Industries

Growth Opportunities

Aging Infrastructure Requires Modernization, Which Creates Demand of PVC Paste Resin for Renovation.

Renovation and retrofitting of existing infrastructure and buildings offer opportunities for the PVC paste resin market. Upgrading plumbing systems, electrical wiring, and interior components often involves using PVC-based products. As aging infrastructure requires modernization, the demand for PVC Paste Resin for renovation projects is expected to grow.

Moreover, increasing technological advancements are anticipated to create immense revenue-generation opportunities for all entities engaged in this market.

Latest Trends

There is a growing focus on sustainability within the PVC Paste Resin industry. Manufacturers are increasingly adopting sustainable practices, such as incorporating recycled PVC materials, exploring bio-based alternatives, and optimizing resource utilization. Sustainability is gaining prominence in the construction sector, with a heightened emphasis on green and sustainable materials.

While PVC pipes are already environmentally friendly because of their recyclability, manufacturers are now focusing on enhancing their sustainability by minimizing carbon emissions and energy use during manufacturing. The industry is also actively promoting the recycling and responsible disposal of PVC products to reduce waste and support a circular economy approach.

Integrating digital technologies, including the Internet of Things (IoT) and smart sensors, revolutionizes infrastructure management and monitoring. In the coming years, PVC pipes might incorporate sensors to identify leaks, blockages, and other challenges, potentially lowering maintenance expenses and enhancing the effectiveness of water and drainage systems.

Regional Analysis

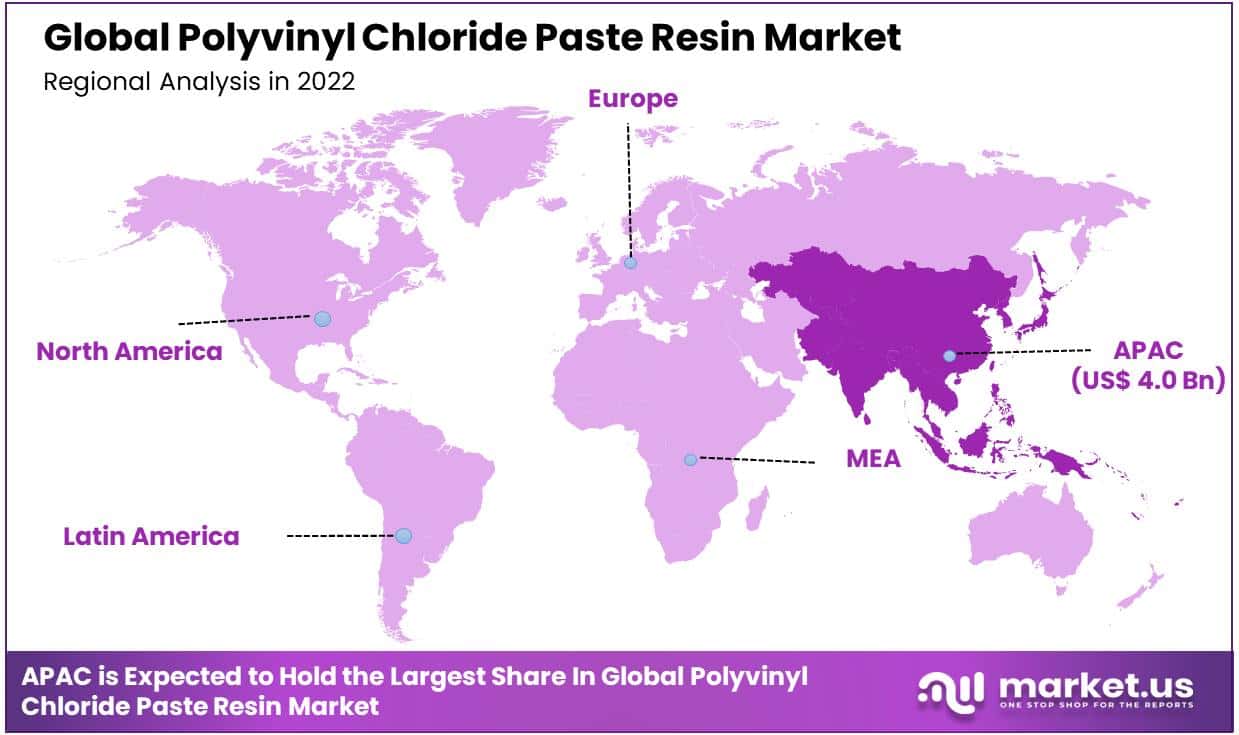

APAC Dominated the Global Polyvinyl Chloride Paste Resin Market with a Majority of Market Share

In 2022, APAC was the most dominant region in the market. APAC market contributed 42% revenue share to the global polyvinyl chloride paste resin market. The APAC region, especially countries such as China, Japan, etc., has manufacturing facilities in the world’s largest manufacturing hubs.

The demand for PVC paste resin in products such as synthetic leather, automotive interiors, wallpapers, flooring, and other applications is significantly high due to this vast manufacturing base. The APAC region has been witnessing rapid urbanization and infrastructure development.

This leads to an increased demand for PVC products in construction, including wallpapers, flooring, and more. Historically, regulatory constraints in the APAC region might have been less stringent compared to the Western Countries, allowing for easier setup and operation of PVC resin manufacturing facilities.

The Asia Pacific PVC market is the most expansive and rapidly evolving owing to escalating PVC requirements in the construction, automotive, and electronics sectors. The primary producers and consumers of PVC in this region are its three economic giants: China, India, and Japan. In Latin America, the surge in PVC demand within the building and construction industry drives the market’s growth.

Moreover, Brazil is the leading market in terms of both manufacturing and consumption of PVC in Latin America. Meanwhile, in the Middle East and Africa, the PVC industry’s expansion is primarily attributed to its growing popularity in the realms of construction and packaging sectors.

Notably, Saudi Arabia and the UAE emerge as key players, being the principal producers and consumers of PVC in that region. Projecting forward, the global PVC market is expected to witness growth in the upcoming years, driven by the surging demand across diverse end-use industries and the burgeoning construction sector in emerging nations.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The new product launches by prominent players in their existing product portfolios strengthen their given market presence and respective footprints. Acquiring or merging with companies in desired markets allows for rapid expansion, access to new customers, and elimination of competition. Companies across various industries employ several strategies to expand their global market share.

Market Key Players

- INEOS Group Limited

- LG Chem

- Westlake Corporation

- Hanwha Solutions Corporation

- Orbia

- Tosoh Corporation

- Formosa Plastics Corporation

- SCG Chemicals Public Company Limited

- KANEKA CORPORATION

- Chemplast Sanmar

- Other Key Players

Recent Developments

- In October 2022, Westlake Vinnolit added GreenVin®bio-attributed PVC made from renewable ethylene to its lineup of lower-carbon GreenVin® products, which are now available.

Report Scope

Report Features Description Market Value (2022) USD 9,598.7 Mn Forecast Revenue (2032) USD 13,960.4 Mn CAGR (2023-2032) 3.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Manufacturing Process (Micro-Suspension Process and Emulsion Process), By Grade (High K-Value Grade, Mid K-Value Grade, Low K-Value Grade, Vinyl Acetate Copolymer Grade, and Blend Resin Grade), By End-Use Industry (Automotive, Construction, Electronics, Packaging, and Other End-Use Industries) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape INEOS Group Limited, LG Chem, Westlake Corporation, Hanwha Solutions Corporation, Orbia, Tosoh Corporation, Formosa Plastics Corporation, SCG Chemicals Public Company Limited, KANEKA CORPORATION, Chemplast Sanmar, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the market size for Polyvinyl Chloride Paste Resin MarketIn 2022, the Global Polyvinyl Chloride Paste Resin Market was valued at USD 9,598.7 Million, and is expected to reach USD 13,960.4 Million in 2032.

What CAGR is projected for the Polyvinyl Chloride Paste Resin Market?The Polyvinyl Chloride Paste Resin Market is expected to grow at 3.9% CAGR (2023-2032).What is Polyvinyl Chloride Paste Resin market?Polyvinyl chloride paste resin, often referred to as PVC paste resin, is a versatile polymer material commonly used in various industries for its adhesive, flexible, and durable properties.

Polyvinyl Chloride Paste Resin MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Polyvinyl Chloride Paste Resin MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- INEOS Group Limited

- LG Chem

- Westlake Corporation

- Hanwha Solutions Corporation

- Orbia

- Tosoh Corporation

- Formosa Plastics Corporation

- SCG Chemicals Public Company Limited

- KANEKA CORPORATION

- Chemplast Sanmar

- Other Key Players