Global Polyurethane Dispersion Market By Type (Solvent-Free and Low Solvent), By Nature (Aliphatic and Aromatic), By Functionality (One-Component (1K) and Two-Component (2K)), By Application (Paints And Coatings, Textile Finishing, Leather Finishing, Textiles And Fibers, and Others), By End-Use (Building And Construction, Automotive And Transportation, Furniture & Woodworking, Footwear, Textiles And Apparel, Packaging, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173551

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

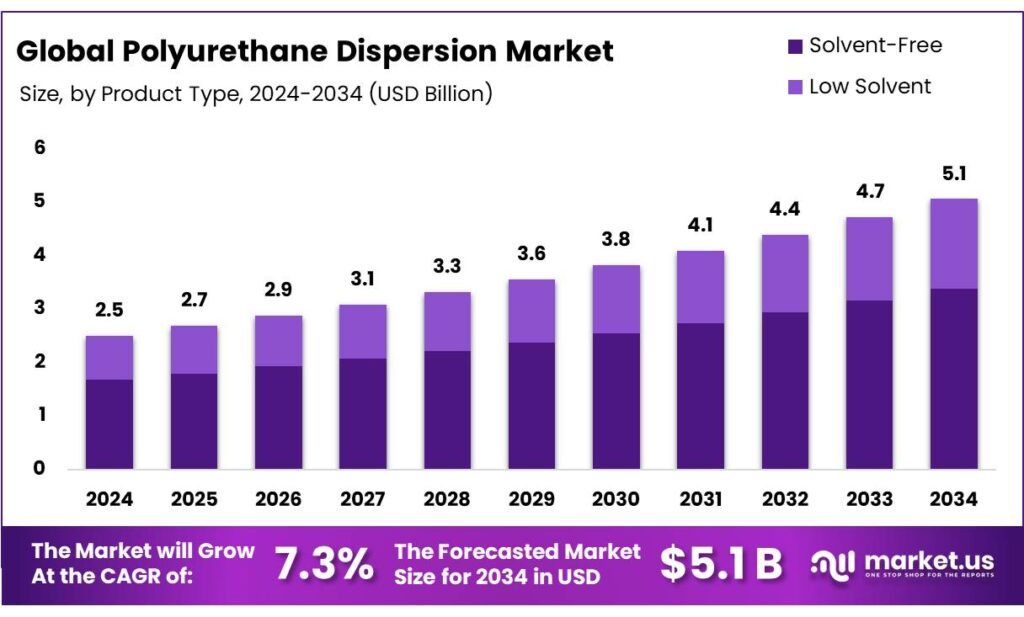

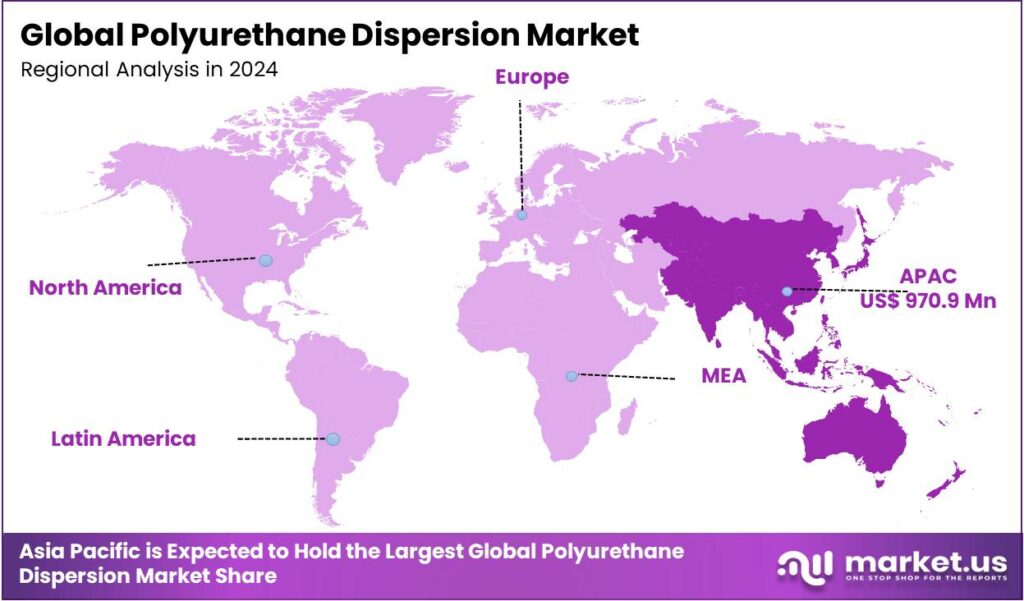

Global Polyurethane Dispersion Market size is expected to be worth around USD 5.1 Billion by 2034, from USD 2.5 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific held a dominant market position, capturing more than a 38.8% share, holding USD 0.9 Billion in revenue.

A polyurethane dispersion (PUD) is a stable, water-based liquid containing tiny polyurethane polymer particles, acting as an eco-friendly alternative to solvent-based coatings by significantly lowering VOCs. The polyurethane dispersion market is characterized by its significant demand across various sectors, driven by the demand for sustainable, high-performance materials. PUDs are widely utilized in the building and construction industry for their durability, moisture resistance, and compliance with environmental regulations, particularly in coatings, sealants, and floor finishes.

According to a case study, 67% of professionals in the construction industry claim to evaluate the carbon footprint of their projects. As the consumer demand for greener buildings rises, it creates opportunities for sustainable materials, such as PUDs. Their utilization is growing in automotive and transportation applications due to their adhesion and long-term properties.

Additionally, they are preferred in textiles and leather finishes for their flexibility, water resistance, and eco-friendly formulations. Despite the advantages, PUDs face challenges, including the high costs of key raw materials, such as polyols and isocyanates. However, the shift towards eco-friendly and low-VOC solutions continues to drive demand, particularly as industries prioritize sustainability.

Key Takeaways

- The global polyurethane dispersion market was valued at USD 2.5 billion in 2024.

- The global polyurethane dispersion market is projected to grow at a CAGR of 7.3% and is estimated to reach USD 5.1 billion by 2034.

- On the basis of types, solvent-free polyurethane dispersion dominated the market, constituting 66.9% of the total market share.

- Based on the nature, aliphatic polyurethane dispersion dominated the market, with a substantial market share of around 55.5%.

- Based on the functionality of polyurethane dispersion, one-component (1K) led the market, comprising 60.2% of the total market.

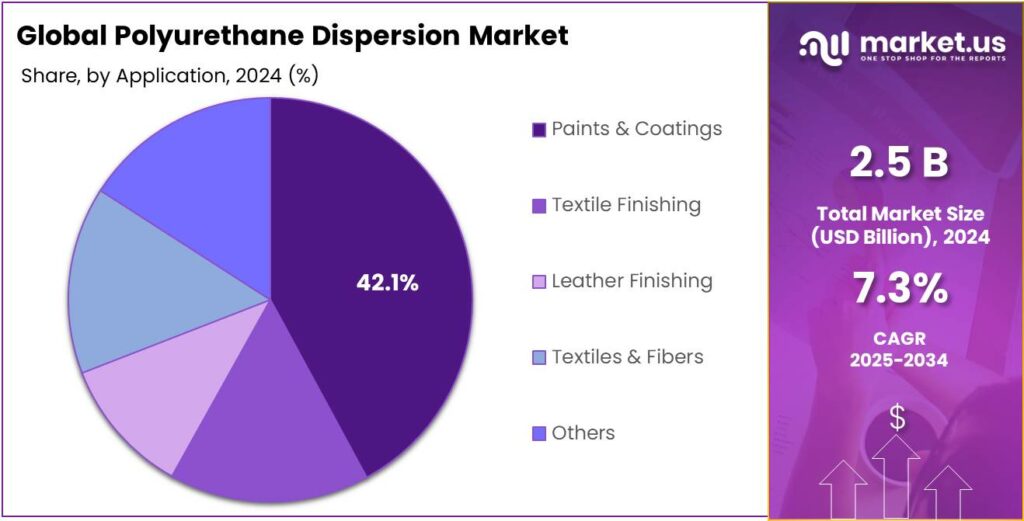

- In 2024, paints and coatings applications of the polyurethane dispersion dominated the market, with around 42.1% of the market share.

- Among the end-uses, the building & construction sector held a major share in the polyurethane dispersion market, 30.6% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the polyurethane dispersion market, accounting for 38.8% of the total global consumption.

Type Analysis

The Solvent-Free Polyurethane Dispersion is a Key Segment in the Market.

The polyurethane dispersion market is segmented based on types into solvent-free and low-solvent. The solvent-free polyurethane dispersion led the market, comprising 66.9% of the market share. Solvent-free polyurethane dispersion is more widely utilized than low-solvent PU dispersion due to its superior environmental and performance benefits.

Solvent-free PUs contain no volatile organic compounds (VOCs), making them a more sustainable option that meets stringent environmental regulations and reduces harmful emissions. This aligns with the growing global emphasis on eco-friendly and health-conscious manufacturing practices. While low-solvent PUs provide some environmental advantages, the higher concentration of active ingredients in solvent-free PUs makes them more cost-effective and efficient in many applications, further driving their preference across industries.

Nature Analysis

Aliphatic Polyurethane Dispersion Held a Dominant Position in the Market.

On the basis of the nature of the polyurethane dispersion, the market is segmented into aliphatic and aromatic. The aliphatic polyurethane dispersion dominated the market, comprising 55.5% of the market share, due to its superior aesthetic and performance qualities, particularly in coatings and finishes. Aliphatic PUs are known for their UV stability, which prevents yellowing or discoloration when exposed to sunlight, making them ideal for outdoor and high-performance applications.

This makes them especially popular in automotive, architectural coatings, and textile industries where appearance and durability are critical. In contrast, aromatic PUs, while generally more cost-effective, tend to degrade under UV exposure, leading to discoloration and reduced longevity. As industries increasingly prioritize long-term results and visually appealing products, aliphatic PUs are favored for their ability to maintain their appearance over time, despite harsher environmental conditions.

Functionality Analysis

Polyurethane Dispersions Mostly Utilize One-Component (1K) Curing.

Based on the functionality of polyurethane dispersion, the market is divided into one-component (1K) and two-component (2K). One-component (1K) dominated the market, with a notable market share of 60.2%, due to the simplicity, convenience, and cost-effectiveness they offer. One-component systems cure through moisture or heat, eliminating the need for a separate hardener or catalyst, which reduces the risk of mistakes during mixing and improves ease of application. This makes 1K systems ideal for industries that require fast processing and lower labor costs, such as in coatings and adhesives. Furthermore, 1K PUDs offer good storage stability, allowing manufacturers to maintain consistent quality without the need for immediate use after production.

In contrast, 2K systems require precise mixing of components and have a shorter pot life, which increases the potential for waste and handling complexity, making 1K systems a more practical and widely preferred choice in many applications.

Application Analysis

Polyurethane Dispersions Were Mostly Utilized for Paints & Coatings.

Based on the application of polyurethane dispersion, the market is divided into paints & coatings, textile finishing, leather finishing, textiles & fibers, and others. The paints & coatings manufacturing is a key segment in the market, with a notable market share of 42.1%. Polyurethane dispersions provide coatings with superior adhesion, abrasion resistance, and weatherability, making them ideal for protecting a wide range of substrates, including wood, metal, and concrete. Furthermore, polyurethane dispersions are favored in coatings due to their low VOC content and environmentally friendly characteristics, aligning with the growing demand for sustainable solutions.

While polyurethane dispersions are used in textile and leather finishing for their flexibility and water resistance, the larger volume and diversity of applications in the paints and coatings industry drive their widespread use. The performance benefits and regulatory compliance in coatings applications make polyurethane dispersion a more dominant choice compared to other sectors, such as textiles, fibers, or leather finishing.

End-Use Analysis

The Building & Construction Sector Held a Major Share of the Polyurethane Dispersion Market.

Among the end-uses, 30.6% of the total global consumption of polyurethane dispersion is for the building & construction sector. PUDs are primarily utilized in floor coatings, wall finishes, and sealants, where they provide superior adhesion, abrasion resistance, and moisture resistance, which are crucial for construction materials exposed to harsh environmental conditions.

The growing emphasis on sustainable and low-VOC products in the construction industry further drives the demand for polyurethane dispersions, as they meet stringent regulatory standards for emissions and toxicity. Moreover, the long-term results and protective qualities of polyurethane dispersions make them highly effective in maintaining the integrity of buildings and infrastructure, making them a preferred choice. In contrast, while PUDs have applications in automotive, furniture, and textiles, their demand in construction is more significant due to the broader range of use cases and more pressing regulatory requirements.

Key Market Segments

By Type

- Solvent-Free

- Low Solvent

By Nature

- Aliphatic

- Aromatic

By Functionality

- One-Component (1K)

- Two-Component (2K)

By Application

- Paints & Coatings

- Textile Finishing

- Leather Finishing

- Textiles & Fibers

- Others

By End-Use

- Building & Construction

- Automotive & Transportation

- Furniture & Woodworking

- Footwear

- Textiles & Apparel

- Packaging

- Others

Drivers

Global Shift Towards Regulatory Compliant Polyurethane Dispersion Drives the Market.

The global shift towards regulatory-compliant polyurethane dispersion, which has significantly low VOCs, has significantly influenced the market, driven by increasing environmental regulations and the demand for sustainable materials. Governments worldwide are enforcing stricter environmental standards against VOCs, encouraging manufacturers to adopt eco-friendly alternatives.

For instance, in the US, laws against VOCs primarily target their role in forming smog or depleting ozone under the federal Clean Air Act (CAA), with the EPA setting national limits for products such as paints, aerosols, and cleaners. Similarly, in the EU, the National Emission Ceilings (NEC) Directive caps total national VOC emissions for each EU country, forcing member states to meet overall air quality goals. Polyurethane dispersions, due to their water-based nature and low volatile organic compound content, align well with these regulations. In addition, as all the industries seek to meet environmental goals, the demand for PUDs is expected to continue growing, driven by the emphasis on low-impact, high-performance solutions.

Restraints

High Costs of Raw Materials Might Pose a Challenge to the Polyurethane Dispersion Market.

The high costs of key raw materials, such as polyols and isocyanates, represent a significant challenge to the polyurethane dispersion market. These raw materials are critical to the production of polyurethane, and their price volatility can greatly impact manufacturing costs. For instance, polyols, derived primarily from petrochemicals, are subject to fluctuations in crude oil prices, which can lead to unpredictable cost increases.

Similarly, isocyanates have been affected by supply chain disruptions and rising raw material costs, particularly due to increased demand in the construction and automotive sectors. These price hikes can lead to increased production costs for PUD manufacturers, potentially resulting in higher prices for end consumers. Furthermore, smaller manufacturers may struggle to absorb these costs, reducing their competitiveness in the market.

Opportunity

Expansion of the Construction Industry Creates Opportunities in the Polyurethane Dispersion Market.

The expansion of the construction industry presents significant opportunities for the polyurethane dispersion market, particularly in the development of eco-friendly and durable building materials. In 2025, over 80% of the total global population lived in cities and towns combined. As global urbanization accelerates, there is a growing demand for high-performance coatings, adhesives, and sealants that can withstand harsh environmental conditions. Polyurethane dispersions, known for their water-based composition and low VOC content, are gaining favor in this sector due to their ability to meet stringent environmental regulations. In construction, polyurethane dispersions are used in applications such as floor coatings, wall finishes, and waterproofing, providing enhanced durability, resistance to wear and tear, and improved aesthetics.

- According to a report by the United Nations Environment Programme, in 2024, the construction sector consumed 32% of global energy, caused 34% of carbon dioxide emissions, and generated massive waste. However, there is a significant focus on reducing these numbers.

For instance, in a case study, 85% of the professionals in the construction industry revealed that some or all of their activity is in sustainable construction. Similarly, the US alone has added almost 5 million new housing units in the country. As construction activity continues to rise, particularly in emerging markets, the demand for PUD-based solutions is expected to grow, offering opportunities for companies to tap into a rapidly expanding segment.

Trends

Rapid Adoption of Polyurethane Dispersions in Booming Textile and Leather Industries.

The rapid adoption of polyurethane dispersions in the textile and leather industries is becoming a prominent trend in the polyurethane dispersion market. Polyurethane dispersions are increasingly favored for their flexibility, durability, and environmentally friendly properties, making them ideal for use in textile coatings and leather finishing. In textiles, polyurethane dispersions are used in applications such as fabric coatings, providing water resistance, stain protection, and improved fabric durability without compromising breathability. Similarly, in the leather industry, polyurethane dispersions are utilized for producing high-quality finishes that offer abrasion resistance, enhanced flexibility, and a smooth appearance, while adhering to stringent environmental regulations.

The shift towards water-based formulations is especially significant, as many companies seek to reduce the use of harmful solvents in favor of sustainable alternatives. This growing demand is evident in the fashion and automotive sectors, where polyurethane dispersion-coated materials are becoming increasingly common in upholstery, footwear, and automotive interiors.

In addition, in 2023, global fiber production reached an all-time high of 124 million tons. Similarly, in 2023, the EU alone invested approximately EUR4.5 billion in the industry. Similarly, the US alone has imported over US$1.4 billion of leather apparel. As these industries continue to grow at a significant pace, there is consistent demand for sustainable products such as polyurethane dispersions from the industry.

Geopolitical Impact Analysis

End-Use Industries and Raw Materials of Polyurethane Dispersion Severely Affected Due to Geopolitical Tensions.

The geopolitical tensions, including trade conflicts, supply chain disruptions, and political instability, have had a notable impact on the polyurethane dispersion market. Escalating trade tensions between major economies, such as the United States and China, have resulted in tariffs on raw materials, such as polyols and isocyanates, which are critical for polyurethane dispersion production. This has led to price volatility, affecting the cost structure for manufacturers and creating challenges for maintaining competitive pricing. Additionally, geopolitical instability in key oil-producing regions, such as Russia and the Middle East, has caused fluctuations in crude oil prices, indirectly impacting the cost of petrochemical-based raw materials used in polyurethane production.

Furthermore, these tensions have affected the end-use industries, impacting the polyurethane dispersion market. For instance, driven by the uncertainty surrounding the U.S. customs dispute, in Europe, textile imports surged by 13% in the first half of 2024, reaching US$43.4 billion, of which US$32.9 billion came from Asia. In contrast, these tensions have prompted some manufacturers to diversify their supply chains, seeking alternative sourcing strategies to mitigate risks. This shift towards local sourcing and regional manufacturing could influence the market dynamics, as companies adapt to the changing geopolitical landscape by investing in more resilient and flexible production models.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Polyurethane Dispersion Market.

In 2024, the Asia Pacific dominated the global polyurethane dispersion market, holding about 38.8% of the total global consumption. The region has maintained the largest share of the global polyurethane dispersion market, driven by robust industrialization, growing urbanization, and increasing demand for sustainable materials. For instance, in 2022, the region alone contributed to 41% of global gross domestic product (GDP), 55% of global manufacturing value added (MVA), and 48% of total manufacturing exports.

Similarly, in 2024, the urbanization in the region was surging, with countries such as Singapore and Hong Kong attaining 100% urbanization. In addition, countries such as China and India, with their rapidly expanding automotive, construction, and textile sectors, have been significant contributors to this trend. In addition, those 42.08 million units represented a slight decline of about 0.6% compared with 2023, reflecting softer demand in markets such as Thailand and Indonesia despite continued growth in India & China. India and some emerging markets in Asia maintained solid demand for compact cars and SUVs, backed by income growth and improving credit access, partially offsetting ASEAN and North Asia declines. Furthermore, in several Asian countries, the government’s strong push for green building certifications and environmentally compliant materials has led to the widespread adoption of polyurethane dispersion in coatings and adhesives.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the polyurethane dispersion market employ several strategies to increase sales, focusing on product development, geographic expansion, and expanding manufacturing capacities. The companies mainly focus on investments in their R&D to develop innovative products for differentiation of the same. In addition, the players emphasize strategic partnerships with major distributors to diversify their distribution line and key industries, such as construction, automotive, and textiles, to tailor polyurethane dispersion products to specific sector needs. Similarly, these companies focus on regional expansion, particularly in emerging markets, to capture new customer bases.

The Major Players in The Industry

- Covestro AG

- Mitsui Chemicals, Inc.

- Chase Corporation

- DIC Corporation

- BASF SE

- Dow Inc.

- Lubrizol Corporation

- SNP, Inc.

- UBE Corporation

- Alberdingk Boley GmbH

- Stahl Holdings B.V.

- PETRONAS Chemicals Group Berhad

- Hauthaway Corporation

- Taiwan PU Corporation

- Lamberti S.p.A.

- Other Key Players

Key Development

- In December 2025, BASF and OQEMA, one of Europe’s leading chemical distributors, entered a distribution partnership for polymer dispersions for construction and architectural coatings, as well as additives for paints & coatings in selected Central and Eastern European countries.

- In July 2025, Lubrizol announced the launch of a water-borne, high-solids polyurethane dispersion that enables the formulation of advanced, high-performance wood coatings. Sancure 942 polyurethane dispersion is a versatile polymer designed for residential and commercial wood floor finishes and OEM wood coatings.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Bn Forecast Revenue (2034) USD 5.1 Bn CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Solvent-Free and Low Solvent), By Nature (Aliphatic and Aromatic), By Functionality (One-Component (1K) and Two-Component (2K)), By Application (Paints & Coatings, Textile Finishing, Leather Finishing, Textiles & Fibres, and Others), By End-Use (Building & Construction, Automotive & Transportation, Furniture & Woodworking, Footwear, Textiles & Apparel, Packaging, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Covestro AG, Mitsui Chemicals, Inc., Chase Corporation, DIC Corporation, BASF SE, Dow Inc., Lubrizol Corporation, SNP, Inc., UBE Corporation, Alberdingk Boley GmbH, Stahl Holdings B.V., PETRONAS Chemicals Group Berhad, Hauthaway Corporation, Taiwan PU Corporation, Lamberti S.p.A., and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Polyurethane Dispersion MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Polyurethane Dispersion MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Covestro AG

- Mitsui Chemicals, Inc.

- Chase Corporation

- DIC Corporation

- BASF SE

- Dow Inc.

- Lubrizol Corporation

- SNP, Inc.

- UBE Corporation

- Alberdingk Boley GmbH

- Stahl Holdings B.V.

- PETRONAS Chemicals Group Berhad

- Hauthaway Corporation

- Taiwan PU Corporation

- Lamberti S.p.A.

- Other Key Players