Global Polysilicon Market Size, Share and Industry Analysis Report By Type(Series Connection, Parallel Connection), By Manufacturing Technology(Siemens Process, FBR Process, Upgraded Metallurgical-Grade Silicon Process, Others), By Form(Chips, Chunks, Rods, Others), By Application(Photovoltaic, Electronics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 20642

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

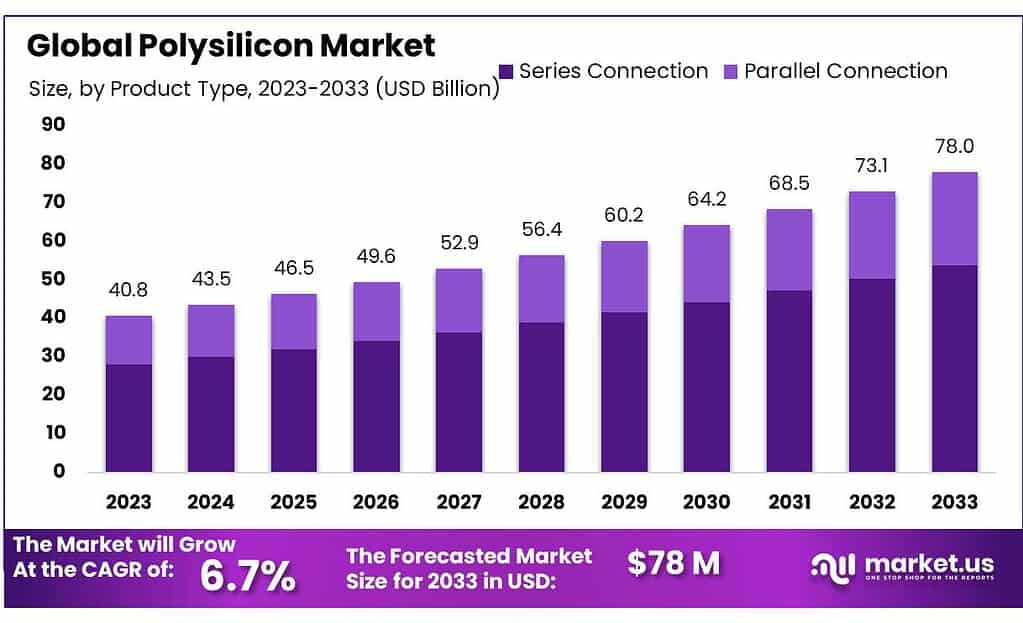

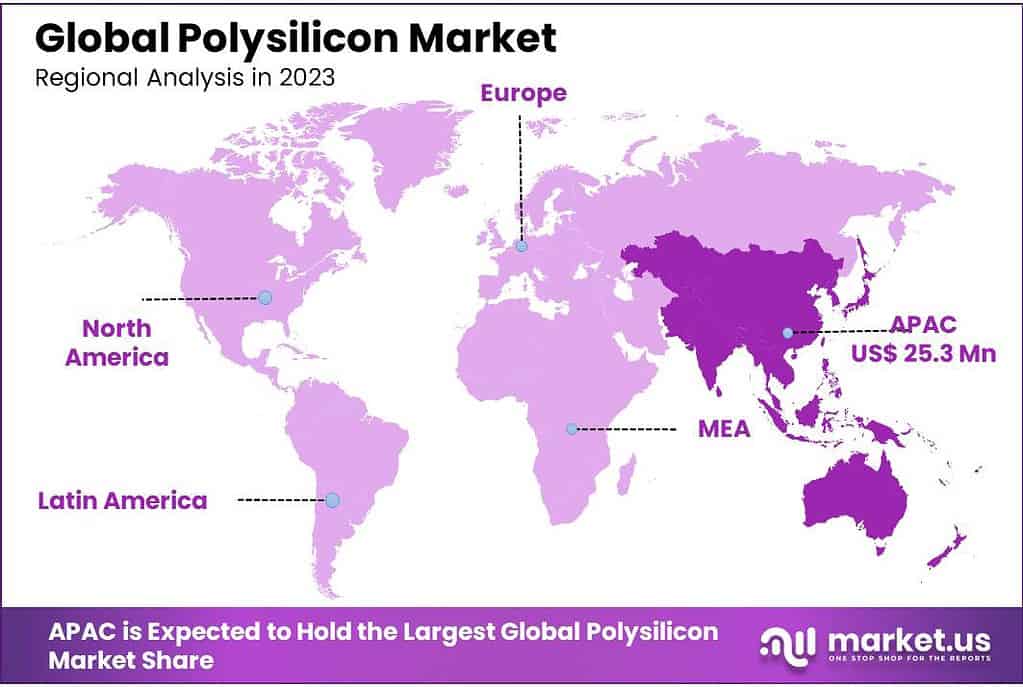

The global polysilicon market size is expected to be worth around USD 78.0 billion by 2033, from USD 40.8 billion in 2023, growing at a CAGR of 6.7% during the forecast period from 2023 to 2033. In 2023, Asia Pacific held a 63.2% market share, leading the polysilicon industry. Moreover, the electronics industry’s strong need for semiconductor manufacturing is expected to fuel the growth of the U.S. polysilicon market, which is expected to reach an estimated volume of $25 billion by 2033.

Production of solar panels has increased dramatically as a result of the growing use of solar energy as a sustainable and clean power source. Furthermore, the need for polysilicon has increased due to the growth of the electronics and semiconductor sectors, which is being fueled by the introduction of 5G, IoT, and AI technologies. The demand for polysilicon in the solar sector is also rising as a result of government policies and incentives such tax credits, subsidies, and objectives for renewable energy.

Polysilicon is in high demand in the United States because it is used in the production of semiconductors and solar photovoltaic (PV) systems. The nation’s dedication to renewable energy sources has increased demand for solar modules and cells, which has benefited the US industry. The semiconductor industry’s steady reliance on premium polysilicon to produce the semiconductor wafers needed to make sophisticated electronic devices, including computers and smartphones, has given rise to rich development prospects for the polysilicon business.

Polysilicon, or polycrystalline silicon, comes from a type of basic silicon known as metallurgical grade silicon. This form of silicon is incredibly pure and made up of many small crystals. It plays a vital role in making solar cells and other electronic devices.

In the electronics sector, polysilicon is especially pure, typically having impurities less than one part per billion. However, the polysilicon used in solar photovoltaics isn’t quite as pure but still meets the necessary standards for effective use in solar technology. This makes polysilicon essential for both renewable energy solutions and various electronic applications.

Key Takeaways

- Polysilicon market size is expected to be worth around USD 78.0 billion by 2033, from USD 40.8 billion in 2023, growing at a CAGR of 6.7%.

- Series Connection segment held a dominant market position, capturing more than a 65% share.

- Siemens Process held a dominant market position in the polysilicon market, capturing more than a 41.2% share.

- Chips held a dominant market position in the polysilicon market, capturing more than a 34.2% share.

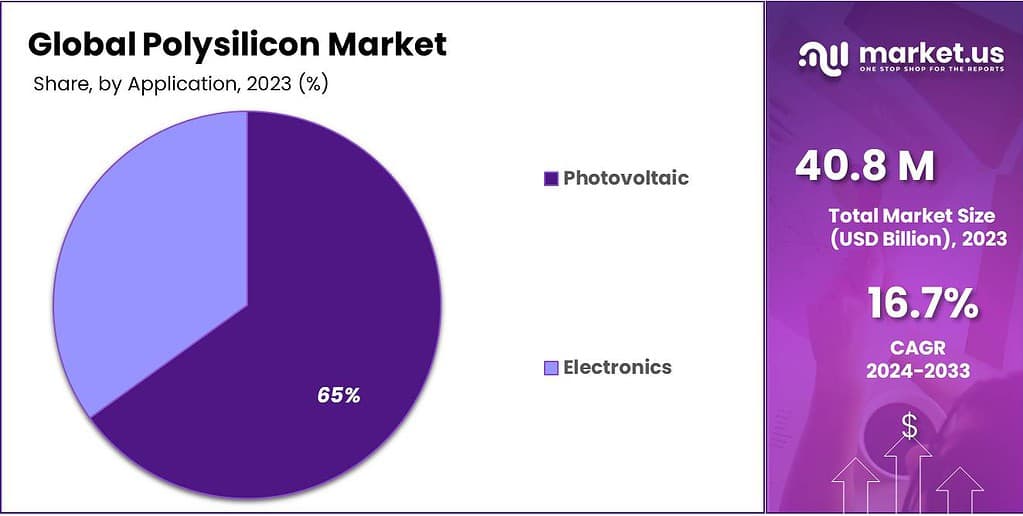

- Photovoltaic held a dominant market position in the polysilicon market, capturing more than a 78% share.

- Asia Pacific held the largest share of 63.2% in 2023 total market share due to its rapid growth in the solar energy sector

By Type

In 2023, the Series Connection segment held a dominant market position, capturing more than a 65% share of the polysilicon market. This type of connection is favored for its efficiency in maintaining a consistent voltage output, which is critical for applications in solar panels and electronics. Series connections are preferred in systems where higher voltage levels are required, as they can combine the voltage outputs of individual solar cells, enhancing overall system performance.

On the other hand, the Parallel Connection segment also plays a crucial role in the polysilicon market. Although it held a smaller market share compared to the Series Connection, parallel connections are indispensable in applications that demand higher current outputs.

This setup connects multiple devices across the same voltage level, allowing for better current flow and reducing the risk of system failure due to overloading. Parallel connections are particularly useful in larger solar installations, where managing energy distribution efficiently is key to maintaining system stability and performance.

By Manufacturing Technology

In 2023, the Siemens Process held a dominant market position in the polysilicon market, capturing more than a 41.2% share. This method is highly regarded for producing high-purity polysilicon, making it a preferred choice for semiconductor and photovoltaic cell manufacturers. The process involves chemical vapor deposition, which ensures a controlled environment for silicon deposition, leading to superior quality polysilicon.

The Fluidized Bed Reactor (FBR) Process also holds a significant place in the market, known for its energy efficiency and lower production costs. Unlike the Siemens Process, FBR technology uses less energy and raw material, making it a cost-effective alternative for producing polysilicon. This method is gaining traction as it supports the production of solar panels at a lower environmental impact.

The Upgraded Metallurgical-Grade Silicon Process is another key segment, providing a cheaper alternative to traditional methods by purifying silicon through metallurgical means rather than chemical processes. This method is particularly attractive in markets sensitive to cost pressures.

By Form

In 2023, Chips held a dominant market position in the polysilicon market, capturing more than a 34.2% share. Polysilicon chips are highly valued for their precise application in the manufacturing of semiconductor devices, where uniformity and purity are crucial. Their small form factor and high quality facilitate efficient processing and integration into various electronic components.

Chunks also represent a substantial segment of the market, favored for their versatility in both semiconductor and solar industries. Chunks are typically used in applications where larger amounts of silicon are needed, as they can be easily melted and refined for further processing.

Rods are another important form of polysilicon, often used in the solar power sector. Polysilicon rods are produced through the Siemens process, forming the basis for cutting wafers used in solar cells. Their structured shape makes them suitable for precise slicing, which is essential for achieving high-performance solar panels.

Application Analysis

In 2023, Photovoltaic held a dominant market position in the polysilicon market, capturing more than a 78% share. This segment benefits significantly from the global push towards renewable energy, with polysilicon serving as a crucial material in the production of solar panels. Its high purity level ensures efficient energy conversion, making it ideal for photovoltaic applications where performance is critical.

Meanwhile, the Electronics segment also plays a vital role in the polysilicon market. Polysilicon is essential in manufacturing various electronic components, including microchips and semiconductors. The demand in this sector is driven by the continuous advancement and miniaturization of electronic devices, which require high-quality silicon to maintain performance and reliability.

Key Market Segments

By Type

- Series Connection

- Parallel Connection

By Manufacturing Technology

- Siemens Process

- FBR Process

- Upgraded Metallurgical-Grade Silicon Process

- Others

By Form

- Chips

- Chunks

- Rods

- Others

By Application

- Photovoltaic

- Electronics

Investment in the Polysilicon Industry

Investing in partnerships with solar panel companies offers exposure to the polysilicon industry, as it is a fundamental material used in the production of solar panels. Suppliers who are able to produce solar panels and mc-Si have a competitive advantage.

One can gain exposure to the mc-Si market and other renewable energy sectors by investing in exchange-traded funds (ETFs) that prioritize solar energy.

It’s important to remember that while making investing selections, investors give priority to ESG considerations. This shift in emphasis means that companies in the polysilicon (or mc-Si) business who have robust environmental policies and are obligated to reduce their carbon footprint are both wise investments and responsible options.

Driving Factors

Expansion of the Solar Photovoltaic (PV) Industry

The primary driving force behind the expansion of the polysilicon market is the significant growth in the solar PV industry. In 2023, the solar PV segment accounted for over 76% of the polysilicon market’s revenue. This dominance is largely due to increasing global installations of solar PV systems, which are heavily reliant on high-purity polysilicon for the manufacturing of solar cells.

The worldwide shift towards renewable energy is another critical factor bolstering the demand for polysilicon. With countries aiming to reduce carbon emissions, the adoption of solar energy has seen substantial government support through incentives and regulatory policies, further driving the market growth. For instance, the International Energy Agency highlighted that the solar photovoltaic industry accounts for almost two-thirds of net energy capacity globally, underscoring the scale and impact of solar energy initiatives.

Technological Innovations and Cost Reductions Advances in polysilicon production technology have also contributed significantly to market growth. Innovations aimed at increasing the efficiency and reducing the cost of solar cells are pivotal, as they make solar energy more competitive against traditional fossil fuels. Enhanced production techniques have led to higher purity levels of polysilicon, improving the performance of solar panels.

Increased Production Capacities In response to the burgeoning demand, polysilicon manufacturers are ramping up their production capacities. This scale-up is essential not only to meet the current demand but also to keep pace with the anticipated growth in solar energy adoption, driven by both governmental policies and market forces.

Restraint Factors

Supply Chain Disruptions and High Production Costs

Supply Chain Volatility One of the most significant restraint factors for the polysilicon market is the volatility in the supply chain. The global polysilicon industry has been experiencing fluctuating prices due to periodic oversupply and subsequent shortages.

This instability is exacerbated by trade disputes and tariffs, particularly involving major producers like China, which dominates the global polysilicon production with a market share exceeding 90% as of recent years. These geopolitical tensions have led to punitive duties on imports, affecting global price stability and supply chain efficiency.

Rising production costs constitute another major challenge. The complex manufacturing processes required to produce high-purity polysilicon are energy-intensive and costly. As demand for solar PV systems and semiconductor devices surges, the pressure on polysilicon supply has led to significant price increases. For instance, due to a supply shortage, prices for polysilicon have risen by 40%, impacting the overall affordability of solar technologies and semiconductor production.

The production of polysilicon is also subject to stringent environmental regulations, which can lead to increased operational costs and investment in pollution control technologies. Moreover, allegations of forced labor in some manufacturing facilities have led to calls for more transparent and ethically sourced materials, further complicating the market dynamics and potentially delaying project timelines.

Opportunities

Expansion of the Solar Photovoltaic Sector

The global shift towards renewable energy is significantly propelling the demand for solar photovoltaic (PV) systems, which predominantly use polysilicon. This trend is strengthened by governmental efforts worldwide to reduce carbon emissions and increase the adoption of clean energy.

The International Energy Agency has noted that solar PV, along with wind energy, represented 96% of all renewable power capacity additions in 2023, with predictions for these additions to more than double by 2028. This surge in solar installations is a primary driver for the increased demand for high-purity polysilicon.

Innovations in polysilicon manufacturing processes are enhancing production efficiency and reducing costs, making solar energy more competitive against traditional energy sources. Fluidized Bed Reactor (FBR) technology, for example, is lauded for its energy efficiency, reducing energy consumption by up to 80% compared to traditional Siemens processes. This not only improves the economic viability of polysilicon but also aligns with global sustainability goals.

Government Incentives and Support Many countries have implemented incentives such as tax rebates, subsidies, and financial support for solar power, which directly benefits the polysilicon industry. These incentives make investments in solar energy projects more attractive, thereby boosting the market for polysilicon. For instance, the U.S. and European nations have set ambitious targets for reducing greenhouse gas emissions, which include significant expansions in renewable energy capacity.

Challenges

Increasing Focus on High-Purity Polysilicon for Advanced Applications

The polysilicon market is witnessing a significant trend towards the increasing demand for high-purity polysilicon, especially driven by its applications in the semiconductor and solar photovoltaic (PV) industries. As electronic devices become smaller and more powerful, the semiconductor industry’s need for ultra-pure polysilicon continues to rise. Similarly, the growing solar energy sector demands high-purity polysilicon to improve the efficiency and performance of solar panels.

Advances in manufacturing technologies, such as the Siemens process and Fluidized Bed Reactor (FBR) technology, are pivotal in meeting these purity requirements. The Siemens process, in particular, dominates the market due to its capability to produce high-purity polysilicon, which is essential for manufacturing advanced solar cells and semiconductor devices. Continuous improvements in this technology have also helped in enhancing cost efficiency and reducing energy consumption during production.

Government policies and incentives promoting renewable energy significantly contribute to the growth of the solar PV market, which in turn drives the demand for polysilicon. For instance, regions like Asia Pacific, North America, and Europe have seen substantial investments in solar energy projects, bolstered by supportive government initiatives aimed at reducing carbon emissions and promoting sustainable energy sources.

Regional Analysis

Asia Pacific (APAC) is the leading region in the polysilicon market, commanding a 63.2% share with a valuation around USD 25 billion. This dominance is largely due to extensive manufacturing capacities, particularly in China, which alone accounts for a substantial portion of the global output. The region benefits from robust government support for renewable energy and significant investments in solar and semiconductor manufacturing technologies.

North America follows, with a strong focus on integrating renewable energy sources as part of its energy policy. The U.S. market is bolstered by federal and state incentives that encourage solar PV installations and advancements in high-purity polysilicon for electronics and solar applications. This region is poised for rapid growth, propelled by technological innovations and sustainable energy goals.

Europe also shows significant activity in the polysilicon sector, driven by stringent environmental regulations and targets for carbon reduction. The European Union’s commitment to a substantial increase in renewable energy consumption by 2030 supports the expansion of solar energy installations, subsequently fuelling the demand for high-quality polysilicon.

The Middle East & Africa region is gradually expanding in the polysilicon market, with countries like Saudi Arabia and the United Arab Emirates investing heavily in solar energy to diversify energy resources beyond oil and gas. Governmental initiatives aimed at developing renewable energy projects are key drivers for the market in this region.

Latin America is emerging as a promising market for polysilicon, with nations like Brazil and Chile making significant strides in solar energy. The increase in solar projects, supported by government incentives for clean energy, is expected to boost the demand for polysilicon in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

In the polysilicon market, several key players dominate due to their extensive production capabilities and technological advancements. Among these, Wacker Chemie AG stands out as a significant contributor, known for its high-quality polysilicon products that are widely used in the semiconductor and solar industries. Wacker Chemie AG, along with REC Silicon ASA and Xinte Energy Co., Ltd, are considered leaders due to their substantial market shares and influence over the polysilicon pricing and supply dynamics.

Other important market participants include OCI COMPANY Ltd., Hemlock Semiconductor Operations LLC, and Tokuyama Corporation, which have solidified their market positions through strategic global operations and continuous investment in manufacturing technologies. These companies are pivotal in meeting the global demand for polysilicon, which is driven by the expanding solar energy sector and the ever-growing semiconductor industry.

Furthermore, companies like DAQO NEW ENERGY CO., LTD., and GCL-TECH are also key players, with substantial contributions to the supply of polysilicon, especially in China, the largest market for polysilicon due to its massive solar panel manufacturing sector.

The competitive landscape is further shaped by strategic partnerships and expansions, as companies aim to leverage the growing demand for renewable energy technologies and high-performance electronic devices. These firms are actively enhancing their production capabilities to not only support the growing demand but also to innovate and reduce costs, which is crucial for maintaining competitive edge in this high-stakes market.

Key Market Players

- High-Purity Silicon America Corporation

- OCI COMPANY Ltd.

- Qatar Solar Technologies

- REC Silicon ASA

- Tongwei Group Co., Ltd

- Tokuyama Corporation

- Wacker Chemie AG

- Xinte Energy Co., Ltd

- DAQO NEW ENERGY CO., LTD.

- GCL-TECH

- Hemlock Semiconductor Operations LLC and Hemlock Semiconductor

Recent Developments

- August 2022: REC Silicon ASA and Mississippi Silicon collaborated to develop a solar supply chain in the United States. They plan to develop this solar supply chain from raw silicon to polysilicon and finally to fully assembled modules.

- April 2022: OCI Company Ltd signed a binding memorandum of understanding (MoU) with the South Korean-based solar manufacturer Hanwha Solutions, which is a unit of Hanwha, for the supply of polysilicon. The order was valued at about USD 1.2 billion. This has helped the company in increasing its profit margins.

Report Scope

Report Features Description Market Value (2023) USD 40.8 Billion Forecast Revenue (2033) USD 78.0 Billion CAGR (2023-2032) 6.7% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Series Connection, Parallel Connection), By Manufacturing Technology(Siemens Process, FBR Process, Upgraded Metallurgical-Grade Silicon Process, Others), By Form(Chips, Chunks, Rods, Others), By Application(Photovoltaic, Electronics) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape High-Purity Silicon America Corporation, OCI COMPANY Ltd., Qatar Solar Technologies, REC Silicon ASA, Tongwei Group Co., Ltd, Tokuyama Corporation, Wacker Chemie AG, Xinte Energy Co., Ltd, DAQO NEW ENERGY CO., LTD., GCL-TECH, Hemlock Semiconductor Operations LLC and Hemlock Semiconductor Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- High-Purity Silicon America Corporation

- OCI COMPANY Ltd.

- Qatar Solar Technologies

- REC Silicon ASA

- Tongwei Group Co., Ltd

- Tokuyama Corporation

- Wacker Chemie AG

- Xinte Energy Co., Ltd

- DAQO NEW ENERGY CO., LTD.

- GCL-TECH

- Hemlock Semiconductor Operations LLC and Hemlock Semiconductor