The Global Polyols And Polyurethane Market Size, Share, And Business Benefits By Polyol Type (Polyether Polyols, Polyester Polyols, Polycarbonate Polyols, Others), By Polyurethane Type (TPU (Thermoplastic Polyurethane), PUR (Polyurethane Resin), PUF (Polyurethane Foam), Others), By Application (Flexible Foam, Rigid Foam, Coating and Adhesives, Elastomers, Others), By End-Use (Construction, Automotive, Furniture, Appliances, Packaging, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153338

- Number of Pages: 236

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

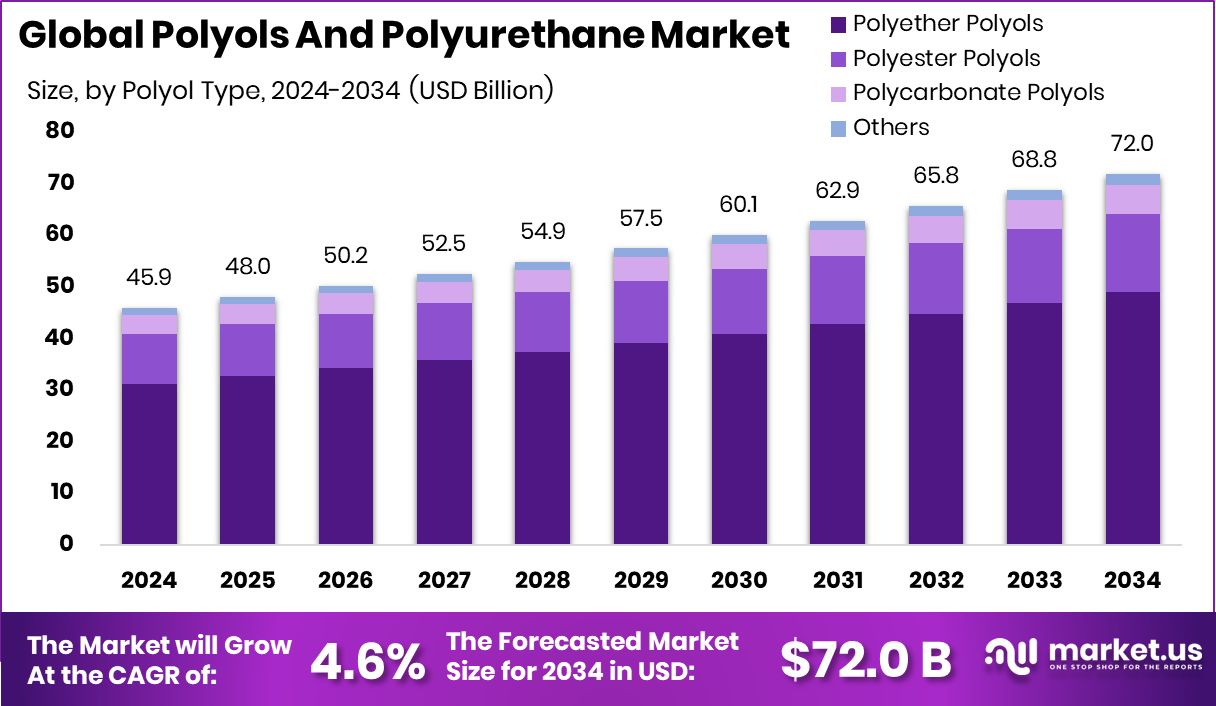

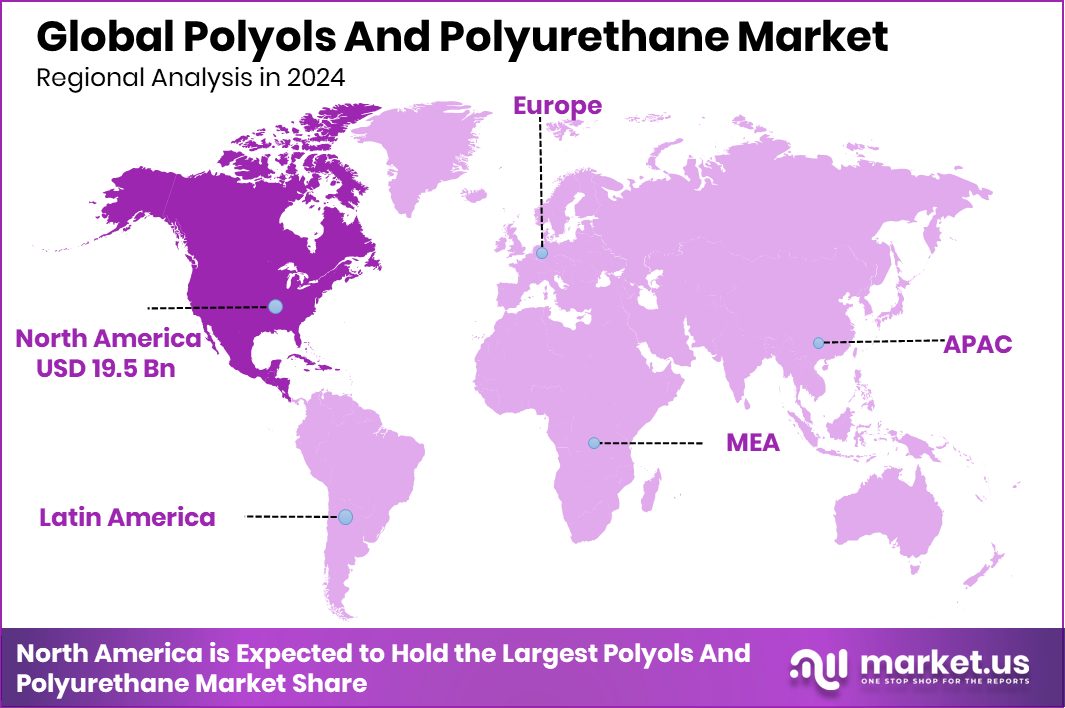

The Global Polyols And Polyurethane Market is expected to be worth around USD 72.0 billion by 2034, up from USD 45.9 billion in 2024, and is projected to grow at a CAGR of 4.6% from 2025 to 2034. Strong demand for insulation and foams boosted North America’s USD 19.5 billion growth.

Polyols are organic compounds containing multiple hydroxyl groups and are fundamental building blocks in the production of polyurethane. They are usually derived from petroleum-based or natural sources and come in two primary forms: polyether polyols and polyester polyols. Polyurethane, on the other hand, is a versatile polymer created through the reaction of polyols with diisocyanates. It exists in various forms, such as rigid foams, flexible foams, coatings, adhesives, and elastomers.

The polyols and polyurethane market encompasses the global trade, production, and application of these chemicals across diverse industries. This market is closely tied to sectors such as construction, automotive, and consumer goods due to polyurethane’s ability to improve insulation, reduce weight, and enhance product durability. The market includes raw material suppliers, manufacturers, processors, and end-users.

One of the key drivers of market growth is the increasing use of polyurethane in insulation applications, particularly in the building and construction sector. As energy efficiency standards tighten, rigid polyurethane foams are being widely adopted for thermal insulation in residential and commercial buildings. Additionally, the lightweight and durable nature of polyurethane makes it a preferred material in the automotive sector, supporting weight reduction and fuel efficiency goals.

Rising urbanization and increased consumer spending on durable goods such as mattresses, furniture, and footwear have significantly contributed to the rising demand for polyurethane products. Furthermore, the growth of electric vehicles and the push for lighter automotive components have increased the use of polyurethane in vehicle interiors and seating systems.

Key Takeaways

- The Global Polyols And Polyurethane Market is expected to be worth around USD 72.0 billion by 2034, up from USD 45.9 billion in 2024, and is projected to grow at a CAGR of 4.6% from 2025 to 2034.

- In the Polyols and Polyurethane Market, polyether polyols accounted for a dominant 68.1% market share.

- Polyurethane Foam (PUF) emerged as the leading type, capturing a strong 71.2% of the market.

- Flexible foam applications held a significant position, contributing 38.9% to total polyurethane product utilization globally.

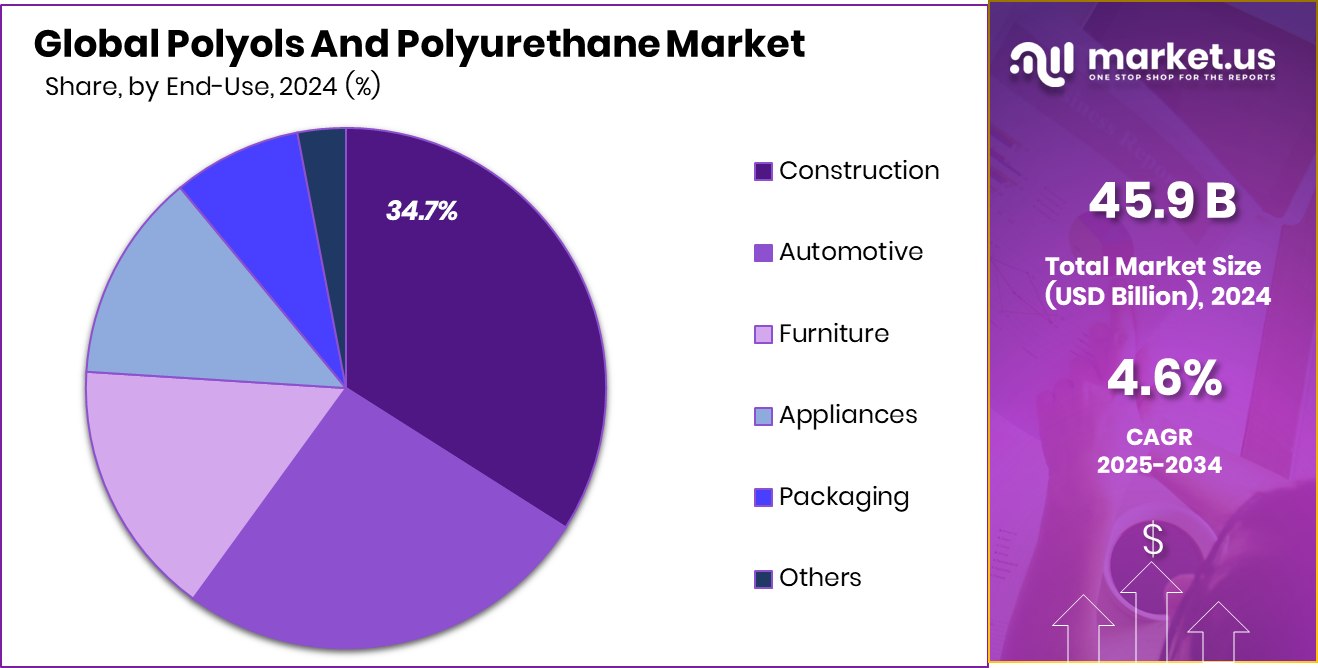

- The construction industry led end-use demand, representing 34.7% share in the polyols and polyurethane market.

- The market value in North America reached approximately USD 19.5 billion.

By Polyol Type Analysis

Polyether polyols dominate the Polyols and Polyurethane market at 68.1%.

In 2024, Polyether Polyols held a dominant market position in the By Polyol Type segment of the Polyols and Polyurethane Market, with a 68.1% share. This substantial share reflects the widespread application of polyether polyols in various polyurethane-based products, particularly in flexible foams, which are extensively used in furniture, bedding, automotive seating, and packaging.

The inherent advantages of polyether polyols, such as superior hydrolytic stability, low volatility, and cost-effective processing, have contributed to their strong preference among manufacturers over other polyol types.

The dominance of polyether polyols can also be attributed to their ease of handling and compatibility with a broad range of isocyanates, making them suitable for both rigid and flexible formulations. Their ability to deliver high resilience, durability, and moisture resistance makes them a core ingredient in modern industrial and consumer applications.

In addition, growing demand from end-use industries such as construction and transportation—driven by the need for lightweight, insulating, and energy-efficient materials—has reinforced the position of polyether polyols in the market. As production technologies evolve and demand for high-performance polymers continues to rise, polyether polyols are expected to maintain their lead in the polyol type segment, supporting overall market expansion.

By Polyurethane Type Analysis

PUF leads polyurethane type usage in the market with 71.2%.

In 2024, PUF (Polyurethane Foam) held a dominant market position in the By Polyurethane Type segment of the Polyols and Polyurethane Market, with a 71.2% share. This leadership can be primarily attributed to the extensive usage of polyurethane foam across a broad spectrum of end-use industries, including construction, automotive, furniture, and consumer goods.

The material’s lightweight nature, high cushioning ability, and superior thermal insulation properties make it a preferred choice for manufacturers seeking performance, comfort, and energy efficiency.

The dominance of PUF in the market reflects its adaptability in both rigid and flexible forms, which allows it to serve multiple application requirements effectively. In building insulation, it contributes significantly to energy savings, while in the furniture and bedding sector, it offers durability and ergonomic support.

The high market share also underscores the consistent industrial demand for foam-based materials that enhance product functionality while optimizing cost and resource efficiency. With rising consumer expectations for comfort, longevity, and sustainable materials, PUF continues to lead the polyurethane type segment, reinforcing its critical role in driving product innovations and supporting long-term market growth.

By Application Analysis

Flexible foam applications hold a strong 38.9% market share today.

In 2024, Flexible Foam held a dominant market position in the By Application segment of the Polyols and Polyurethane Market, with a 38.9% share. This commanding position is largely driven by the widespread use of flexible foam in comfort-related products such as mattresses, cushions, sofas, and automotive seating. The inherent properties of flexible foam—such as softness, resilience, and long-term durability—have made it the material of choice for manufacturers catering to both residential and commercial demand.

The 38.9% share also reflects strong consumer preference for enhanced comfort and ergonomic support in everyday products, particularly in furniture and bedding segments. Additionally, flexible foam is lightweight and offers excellent impact absorption, making it highly suitable for packaging and interior vehicle components. Its ability to be easily molded into various shapes and densities provides manufacturers with the flexibility to meet diverse design and performance needs.

The dominance of flexible foam in this segment highlights its critical role in addressing growing consumer expectations for quality and comfort. As lifestyles evolve and living standards rise globally, the demand for flexible foam in both household and commercial applications continues to grow, reinforcing its leading position in the application landscape of the Polyols and Polyurethane Market.

By End-Use Analysis

Construction sector drives demand, accounting for 34.7% market usage.

In 2024, Construction held a dominant market position in the By End-Use segment of the Polyols and Polyurethane Market, with a 34.7% share. This significant share is primarily supported by the increasing use of polyurethane-based materials in modern building practices. Polyurethane, known for its high thermal insulation efficiency and durability, is widely adopted in the construction industry for applications such as insulation panels, sealants, coatings, and adhesives.

The dominance of the construction segment can also be linked to growing infrastructure investments and urbanization in both developed and developing economies. As building codes continue to emphasize energy conservation and environmental performance, the use of polyurethane-based materials has expanded rapidly. The 34.7% share indicates the strong demand for high-performance materials that not only improve building comfort but also contribute to long-term energy cost savings.

Furthermore, polyurethane products offer resistance to moisture, chemicals, and mechanical stress, making them suitable for both residential and commercial structures. The continued emphasis on sustainable building solutions and advanced insulation technologies is expected to support the construction sector’s leading role in the end-use landscape of the Polyols and Polyurethane Market.

Key Market Segments

By Polyol Type

- Polyether Polyols

- Polyester Polyols

- Polycarbonate Polyols

- Others

By Polyurethane Type

- TPU (Thermoplastic Polyurethane)

- PUR (Polyurethane Resin)

- PUF (Polyurethane Foam)

- Others

By Application

- Flexible Foam

- Rigid Foam

- Coating and Adhesives

- Elastomers

- Others

By End-Use

- Construction

- Automotive

- Furniture

- Appliances

- Packaging

- Others

Driving Factors

Energy-Efficient Insulation Demands Boost Polyurethane Usage

One of the main driving forces behind the growth of the Polyols and Polyurethane Market is the rising demand for energy-efficient insulation materials. Polyurethane foams, especially rigid forms, are widely used in building insulation because they help reduce energy loss and maintain indoor temperature. As governments across the world set stricter rules on energy savings in buildings, construction companies are using more polyurethane-based insulation to meet these goals.

These materials help lower heating and cooling costs, which is important for both residential and commercial buildings. With growing urbanization and the focus on sustainable construction, the need for advanced insulating materials continues to rise. This trend strongly supports the increasing demand for polyols and polyurethane products in the market.

Restraining Factors

Health and Safety Concerns Limit Market Growth

A key restraining factor for the Polyols and Polyurethane Market is the growing concern over health and safety risks linked to their raw materials. Polyurethane products are made using isocyanates, which can cause respiratory problems, skin irritation, and other health issues when not handled properly. In workplaces, workers must follow strict safety rules while dealing with these chemicals, which increases production costs and slows down manufacturing.

Additionally, some environmental regulations are limiting the use of certain ingredients used in polyurethane production. These concerns have led to increased scrutiny from health agencies and environmental groups. As a result, companies are under pressure to develop safer and greener alternatives, which adds complexity and cost to the production process, limiting market expansion.

Growth Opportunity

Bio-Based Polyols Open New Market Opportunities

A major growth opportunity in the Polyols and Polyurethane Market lies in the rising development and use of bio-based polyols. These are made from natural sources like vegetable oils and reduce reliance on petroleum-based chemicals. As people and industries become more aware of environmental issues, there is a growing demand for sustainable and eco-friendly materials.

Bio-based polyols not only help lower carbon emissions but also meet stricter environmental rules in many countries. Manufacturers are now investing in research to improve the performance and cost-efficiency of these renewable options.

As governments support green technologies and customers prefer cleaner products, the shift toward bio-based polyols is creating new business opportunities and helping shape the future of the market.

Latest Trends

Lightweight Polyurethane Adoption in Electric Vehicles

A major latest trend in the Polyols and Polyurethane Market is the increasing use of lightweight polyurethane materials in electric vehicles (EVs). As automakers seek ways to extend EV range, reducing vehicle weight has become essential. Polyurethane foams and components offer excellent strength-to-weight ratios, making them ideal for interior parts, insulation, and structural elements.

They help lower overall vehicle mass, which directly contributes to improved battery efficiency and longer driving range. Additionally, the flexibility in foam densities allows for tailored cushioning and noise reduction in EV cabins.

This trend also supports comfort and safety without compromising performance. With the electric mobility sector rapidly expanding, the demand for specialized polyurethane solutions tailored for lightweight design continues to grow, reinforcing its role as a strategic material in sustainable transportation.

Regional Analysis

In 2024, North America led the market with a 42.7% share overall.

In 2024, North America held the dominant position in the global Polyols and Polyurethane Market, accounting for 42.7% of the total share with a market value of USD 19.5 billion. This regional leadership is supported by high demand for polyurethane-based products across key sectors such as construction, automotive, and consumer goods. Strong infrastructure development, coupled with strict energy efficiency regulations, has encouraged the use of polyurethane insulation materials in buildings throughout the United States and Canada.

In Europe, the market maintained steady growth, driven by sustainability-focused manufacturing practices and growing applications in green buildings and lightweight vehicle components. The Asia Pacific region demonstrated promising momentum, with expanding industrialization and urbanization fueling consumption, particularly in countries like China and India.

Meanwhile, the Middle East & Africa region showed emerging potential, supported by construction activities and increasing use of insulation materials in high-temperature environments. Latin America exhibited gradual progress, with polyurethane adoption increasing in packaging, furniture, and footwear applications.

Despite regional variations in growth drivers and application trends, North America remained the key contributor to global revenues, underpinned by advanced manufacturing capabilities, regulatory compliance, and a well-established demand base across industries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Mitsubishi Chemical continued to reinforce its position through targeted investments in sustainable polyols. The company advanced research in bio-based and high-performance polyether and polyester polyols, aligning with industrial clients’ growing expectations for environmentally conscious solutions. Their global manufacturing footprint, spanning Asia, Europe, and North America, has proved pivotal in supporting consistent supply and meeting diverse regional demand effectively.

Dow maintained a strong competitive stance by leveraging integrated supply chain advantages, particularly in North America, where market maturity and premium application demand are highest. Dow’s focus on broad polyurethane product lines—such as insulation foams, elastomers, and coatings—offered tailored solutions for industries including construction and electronics.

Evonik stood out for its specialization in high-value polyurethanes, such as additives and specialty polyols. These products enabled demanding applications in automotive interiors, sports equipment, and high-end industrial use cases. Evonik’s flexible production capabilities allowed rapid customization and shortened time-to-market, strengthening their appeal to manufacturers requiring precise formulation control.

LyondellBasell expanded its market presence primarily through petrochemical-based polyol capacity. Their cost-competitive, large-scale production facilities supported aggressive pricing strategies, attracting high-volume buyers in packaging, furniture, and footwear sectors. Additionally, their strategic plant investments in emerging Asia were instrumental in gaining share within fast-growing regional markets.

Top Key Players in the Market

- Mitsubishi Chemical

- Dow

- Evonik

- LyondellBasell

- Huntsman

- Mitsui Chemicals

- Covestro

- INEOS

- Toray Industries

- BASF

- Momentive Performance Materials

- DIC Corporation

- Wanhua Chemical

- Sumitomo Chemical

Recent Developments

- In June 2025, Dow finalized an agreement to sell its 50% interest in DowAksa Advanced Composites Holdings, a joint venture specializing in advanced composite materials. The $125 million transaction aligns with Dow’s strategic refocus on core polyols and polyurethane businesses while unlocking capital for reinvestment.

- In October 2024, Mitsubishi Chemical Group introduced BioPTMG, a plant-based polyol designed for polyurethane and polyester use. It offers flexibility, durability, and high resilience comparable to petroleum-based alternatives. This material was adopted by Kahei Co., Ltd. in bio-synthetic leather items—like shoulder bags and tissue cases—launched by “tonto” (Triple A Co., Ltd.).

Report Scope

Report Features Description Market Value (2024) USD 45.9 Billion Forecast Revenue (2034) USD 72.0 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Polyol Type (Polyether Polyols, Polyester Polyols, Polycarbonate Polyols, Others), By Polyurethane Type (TPU (Thermoplastic Polyurethane), PUR (Polyurethane Resin), PUF (Polyurethane Foam), Others), By Application (Flexible Foam, Rigid Foam, Coating and Adhesives, Elastomers, Others), By End-Use (Construction, Automotive, Furniture, Appliances, Packaging, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mitsubishi Chemical, Dow, Evonik, LyondellBasell, Huntsman, Mitsui Chemicals, Covestro, INEOS, Toray Industries, BASF, Momentive Performance Materials, DIC Corporation, Wanhua Chemical, Sumitomo Chemical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Polyols And Polyurethane MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Polyols And Polyurethane MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Mitsubishi Chemical

- Dow

- Evonik

- LyondellBasell

- Huntsman

- Mitsui Chemicals

- Covestro

- INEOS

- Toray Industries

- BASF

- Momentive Performance Materials

- DIC Corporation

- Wanhua Chemical

- Sumitomo Chemical