Global Polyol Sweeteners Market By Type (Sorbitol, Xylitol, Mannitol, Maltitol, Isomalt and Other Products), By Form (Powder and Liquid), By Function (Flavoring & Sweetening Agents, Excipients, Bulking Agents, Humectants and Other Functions), By Application (Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals and Other Applications) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 26546

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

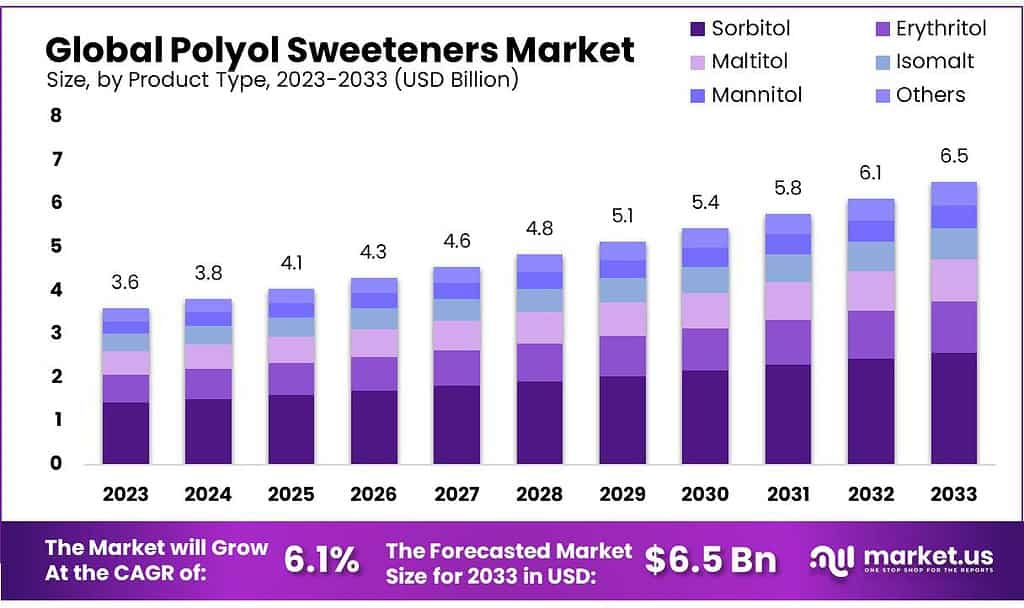

The Polyol Sweeteners Market size is expected to be worth around USD 6.5 billion by 2033, from USD 3.6 Bn in 2023, growing at a CAGR of 6.1% during the forecast period from 2023 to 2033.

The market is expected to grow due to growing demand for replacements for sugar in food & beverages, and growing buyer awareness about general health & wellbeing. Polyol sweeteners, which are saccharide products, are made from hydro-generation or fermentation of carbohydrates like corn cob, birch bark, and pulp & paper waste.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: The Polyol Sweeteners Market is projected to reach around USD 6.5 billion by 2033, growing from USD 3.6 billion in 2023, at a steady CAGR of 6.1% during 2023-2033.

- Market Leaders: Sorbitol dominates with a 39.7% share in the market due to its widespread use in various food and beverage products, driven by lower caloric intake and dental health benefits.

- Application Diversity: These sweeteners find applications beyond food and beverages, extending to personal care, pharmaceuticals, and industrial uses like paints, coatings, and textiles.

- Form Preferences: Powder/Crystal form holds over 72.3% of the share due to ease of use, versatility across industries, longer shelf life, and suitability for various manufacturing processes.

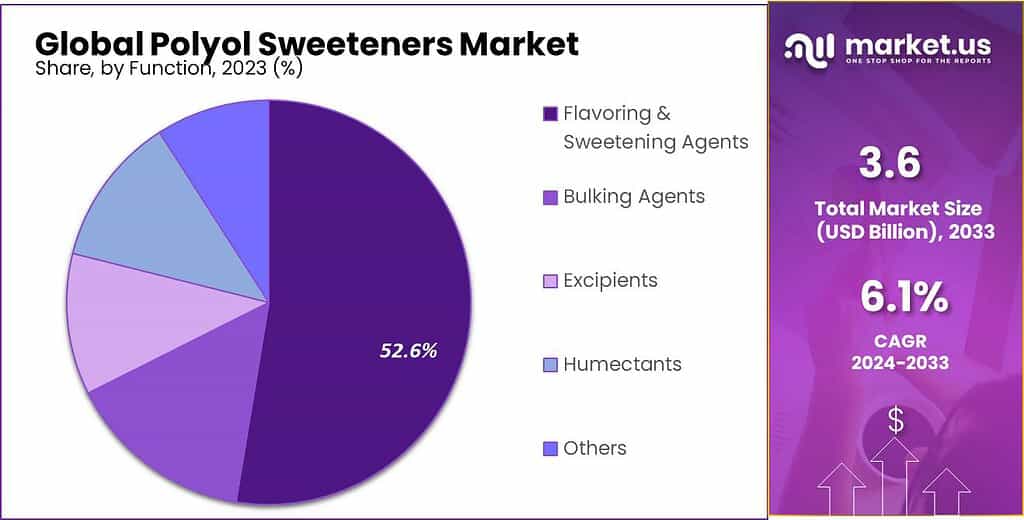

- Function Significance: Flavoring and sweetening Agents lead with 52.6% market share, playing a crucial role in enhancing taste profiles without the drawbacks of regular sugar.

- Challenges: Despite advantages, challenges like higher costs compared to traditional sugars, potential digestive discomfort, and differing taste profiles pose hurdles to widespread adoption.

- Opportunities: Growing consumer preference for healthier options and ongoing technological advancements to improve taste profiles offer significant growth prospects for polyol sweeteners.

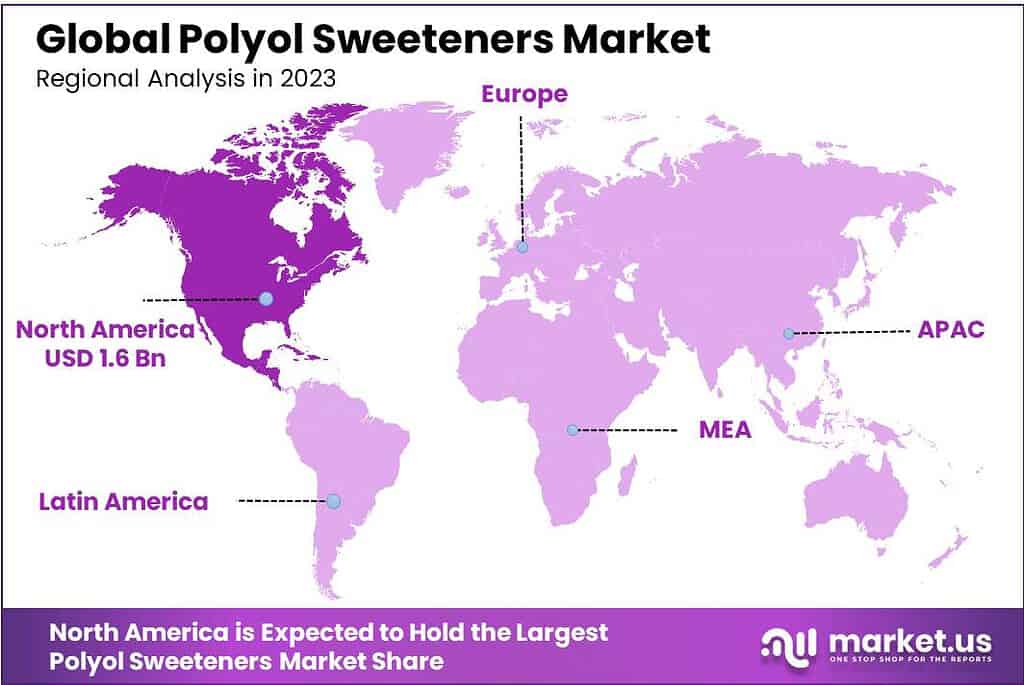

- Regional Dynamics: North America currently holds the highest revenue share at over 44.6%, but the fastest growth rate is expected in the Asia Pacific due to increased purchasing power and rising demand for sugar-free products.

- Market Players: Key companies like Cargill, Archer Daniels Midland, Dupont, and others are investing in innovation and research to enhance production processes and expand product offerings.

Product Analysis

Sorbitol became the leader in the Polyol Sweeteners market by holding onto a 39.7% share. Sorbitol is an extensively utilized sugar alternative in many food and drink products, drawing widespread consumer approval due to its lower caloric intake and positive effect on dental health. Therefore, sorbitol’s popularity makes sense in today’s market.

Surimi is a highly refined and uncooked fish paste made with sorbitol. It is also used in the harmony of flavors in drinks, such as carbonated beverages or fruit juices. The product’s demand is expected to rise due to increased intake of sorbitol-based sugars in the manufacture of famous food & beverages and dietary supplements.

The widely-used thickener and moisturizer sorbitol is used in the formulation of milky lotions, face creams, and face masks. The expanding application range in paints and coatings and the textile, surfactant, tobacco, and other industries will likely open up new growth opportunities.

Because of its capacity to lower intracranial pressure and treat patients with oliguric kidney failure, the demand for sweeteners mannitol-based in pharmaceutical applications is expected to continue to grow. The product was given intravenously and then filters in the kidney.Form Analysis

In 2023, the Powder/Crystal form dominated the Polyol Sweeteners market, holding over 72.3% of the share. The Powder/Crystal form of sweeteners is liked because it’s easy to use and works well in different industries like food, drinks, medicine, and personal care. It’s simple to store, handle, and mix into recipes. That’s why many companies prefer it when making their products.

The demand for powdered and crystalline sugar alcohols will continue to rise over the predicted period. Sugar alcohols in powder form are easier to transport, store, and handle. They also have a longer shelf life, are less likely to spoil, and are simple to carry. Powdered sweetness enters perform much of the same tasks as their liquid equivalents. They’re frequently utilized in the manufacturing process as bulking or coating agents.

Mint tablets, polydextrose, and sugar-free meals like shrimp ball fillets, roasted fish fillets, frozen rawfish, dried Squid Thread, and other frozen aquatic items are among these food additives. Crystal and xylitol, as well as powder edsorbitol, are used. This market will develop due to rising demand for these items as well as rising frozen food consumption in countries like South Korea and China.

Sugar sweeteners made from syrup or liquid have a significant advantage in terms of water solubility. They’re perfect for pharmaceutical, nutraceutical, and other industrial operations because of this. Liquid sugar alcohols will become more popular as consumers become more aware of the benefits of low-calorie diets.

Function Analysis

Flavoring & Sweetening Agents topped the Polyol Sweeteners Market in 2023, securing over half the market share at around 52.6%. These sweeteners are super important in food and drinks. They make things taste sweet, just like sugar, but without all the sugar. That’s why they’re in lots of stuff like candies, desserts, drinks, and even some medicines. They’re handy because they make things taste great without too much sugar.

To make sugar-free confectionery, combine these sweeteners with high-calorie sweeteners (such as saccharin, acesulfame pot, and neotame). Polyols have a modest sweetness and weight, as well as a texture similar to normal sugar. In the food and beverage industry, this will be a major driver of product demand.

A high-heat solution found in several crystalline polyols (erythritol, xylitol) has cooling effects in the mouth. These polyols will see greater demand as a result of their increased use in the production of menthol and other menthol-based products.

It can also help bulk up food or beverage products. Polyols can be added to sweeten and texture bakery and confectionery items, including sorbitol, xylitol, maltitol and Mannitol. Increased use of cosmetics polyols as humectants will drive market growth.

Note: Actual Numbers Might Vary In The Final Report

Application Analysis

In 2023, Food & Beverages was a big leader in the Polyol Sweeteners market, grabbing over 40.6% of the whole share. That means these sweeteners were mainly used in making food and drinks. These sweeteners go into lots of things like candies, drinks, desserts, and even some dairy products to make them sweet without using too much sugar.

Polyol sweetnesseners have been approved by the US Food and Drug Administration (FDA) for use in food additives and are Generally Recognized as Safe (GRAS) chemicals and compounds within food items. Erythritol or isomalt, as well as polyglycitols (lactitol) and polyglycitols, are GRAS goods. Mannitol is still on hold; xylitol, on the other hand, can be used as a special dietary element.

Due to their non-hygroscopic nature, sugar alcohols are frequently utilized as coatings for confectionery products such as chewing gums and candies. Mannitol and Sorbitol are polyols with fewer calories.

The personal and cosmetics sector is expected to increase steadily over the next few years. The segment’s growth is likely to be aided in part by rising consumer interest in dental health and oral cleanliness.Key Market Segments

By Product

- Sorbitol

- Xylitol

- Mannitol

- Maltitol

- Isomalt

- Other Products

By Form

- Powder

- Liquid

By Function

- Flavoring & Sweetening Agents

- Excipients

- Bulking Agents

- Humectants

- Other Functions

By Application

- Food & Beverages

- Personal Care & Cosmetics

- Pharmaceuticals

- Other Applications

Drivers

Polyol sweeteners are popular because they taste sweet but have fewer calories than sugar. People worry about health problems like obesity and diabetes from eating too much sugar. That’s why these sweeteners are in demand—they offer a healthier choice for food and drinks without losing the yummy sweetness. That’s why the market for these sweeteners keeps growing steadily.

Polyol sweeteners aren’t just for food—they’re used in lots of other stuff too! From medicines to toothpaste and even in industries making things like glue and cleaning stuff. People who care about health like them because they’re a way to cut down on sugar in different parts of their lives.

So, these sweeteners are getting popular in many different places, not just in food and drinks. The increased focus on health and the quest for healthier choices in what we eat and use every day have really made polyol sweeteners super popular. People want healthier options, and these sweeteners fit the bill perfectly.

Restraints

Polyol sweeteners, despite their numerous advantages, encounter several challenges within the market landscape. One significant hurdle lies in their comparatively higher cost when juxtaposed with traditional sugars. This pricing differential can restrict their broader adoption, particularly in markets where price sensitivity significantly influences consumer choices.

Another constraint stems from potential digestive discomfort experienced by some individuals upon consuming significant amounts of these sweeteners. Side effects such as bloating or diarrhea can impact consumer perception and limit their widespread acceptance.

Moreover, the distinct taste profile and potential cooling effect associated with polyol sweeteners may not always align with the taste preferences of consumers accustomed to regular sugar. These differences in sensory experiences could influence consumer decisions, particularly in specific product applications, creating a barrier to widespread adoption.

Opportunities

The polyol sweeteners market presents several promising opportunities poised to drive its growth in the coming years. One significant avenue is the expanding scope of applications across various industries beyond food and beverages. Sweeteners’ increased use in pharmaceuticals, personal care products and industrial applications such as adhesives and solvents offers significant growth prospects. Consumers increasingly opting for healthier lifestyles and diet choices present a substantial opportunity.

As awareness about health increases, people increasingly favor reduced-sugar or sugar-free alternatives; polyol sweeteners’ low-calorie properties and minimal impact on blood sugar levels make them ideal candidates to meet this trend, providing further opportunities for market expansion.

Ongoing advancements in sweetener technology, particularly in enhancing taste profiles and reducing any residual aftertaste associated with polyol sweeteners, present a promising opportunity. Addressing sensory concerns and improving taste could significantly bolster consumer acceptance and drive wider adoption in various products and applications.

Challenges

One challenge with polyol sweeteners is their taste. Even though they’re healthier with fewer calories, some people don’t like the aftertaste they leave. Making these sweeteners taste more like sugar is tough for the industry. Also, making polyol sweeteners costs more than regular sugars. This higher cost can make it harder for more people to use them. Companies need to find ways to keep the price fair while making sure the sweeteners are good quality.

Regulatory challenges also play a role, especially concerning labeling regulations and standards for sweeteners in different regions. Compliance with varied regulatory frameworks across countries or regions can pose complexities for manufacturers operating in global markets. Despite the expanding market, consumer awareness and understanding of polyol sweeteners might still be limited. Educating consumers about the benefits and safety of these sweeteners compared to traditional sugars remains an ongoing challenge for the industry.

Regional Analysis

North America held the highest revenue share at over 44.6% in 2023. The region’s demand is expected to grow in the future due to the rising demand for natural ingredients and the rapid expansion in personal care in countries such as France and Germany.

The Horizon 2020 Strategy was approved by the European Parliament in April 2019. This provisional agreement was made to encourage the development of naturally derived products. This will in turn increase demand for polyol sweeteners in Europe’s food industry over the forecast period.

Polyol sweeteners are also used as detergents and dispersants, foaming, wetting agents, detergents, and emulsifiers. Europe’s growing demand for bio-based products will likely lead to a rise in the use of biobased surfactants like sorbitol and rhamnolipids. Regulations to reduce Greenhouse Gas emissions and increase market growth in Europe will likely drive demand for biobased surfactants.

The fastest growth rate in Asia Pacific markets is expected between 2023-2032 due to increased purchasing power, growing use of sugar-free and sugar-reduced nutrition supplements, and pharmaceutical products.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Market leaders are investing heavily in research and innovation to develop sustainable and improved processes for sugar alcohol production from industrial waste. Manufacturers such as zuChem, and Tang Chuan Biotechnology(Xiamen) Co., Ltd., are focusing on microbial fermentation, a process that uses biotechnological processes to produce polyols.

Ingredion Inc. introduced ERYSTA Erythritol in May 2020 for European-Middle East Africa (EMEA), food and beverage processing industry. This strategic initiative was designed to allow manufacturers to replace or reduce sugar in order to achieve nutrition-related claims such as “calorie-reduced” or “no added sugar” in certain applications. The following are some of the most prominent players in the polyol sweeteners’ market:

Key Market Players

- Cargill

- Archer Daniels Midland

- Dupont

- Roquette Freres

- Tereos Starch & Sweeteners

- Sudzucker

- Ingredion

- Jungbunzlauer Suisse

- Gulshan Polyols

- Batory Foods

- B Food Science

- Dfi

- Sweeteners Plus Inc.

Recent Development

In March 2022, Azcuba Sugar Business Group aims to increase their annual production capacity of 1,100 tons of sorbitol this year. Their sorbitol can be found in toothpaste production as well as food, cosmetic and drug applications.

In March 2022, Drink Loud has introduced its cannabis potion across dispensaries throughout California, US. Containing 100 milligrams of cannabis and packed in a 1.8-ounce bottle with the use of proprietary nanotechnology, the products are sweetened using sugar as well as xylitol, are gluten-free, vegan, and have no GMOs.

Report Scope

Report Features Description Market Value (2023) US$ 5.4 Bn Forecast Revenue (2033) US$ 9 Bn CAGR (2024-2033) 5.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Process(Wet Chemical, Direct, Indirect, Others), By Form(Powder, Pellets, Liquid), By Grade(Standard, Treated, USP, FCC , Others), By Application(Chemicals, Rubber, Pharmaceuticals, Ceramics, Paints & Coatings, Cosmetics and Personal Care, Agriculture, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape EverZinc, Ace Chemie Zynk Energy Limited, AG CHEMI GROUP s.r.o., CCL, EverZinc, Zinc Nacional, HAKUSUI TECH, LANXESS, IEQSA, Neo Zinc Oxide, Pan-Continental Chemical Co., Ltd., Rubamin, Tata Chemicals Ltd., TOHO ZINC CO., LTD., TP Polymer Private Limited, Upper India, Weifang Longda Zinc Industry Co., Ltd., Yongchang zinc industry Co., Ltd., Zinc Oxide Australia, Zochem, Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- zuChem

- Tang Chuan Biotechnology (Xiamen) Co., Ltd.

- Cargill Inc.

- B Food Science Co. Ltd.

- Sweeteners Plus LLC

- Ingredion Inc.

- Roquette Frères

- Gulshan Polyols Ltd.

- Other Key Players