Global Polymer Coated Npk Fertilizers Market Size, Share, And Business Benefits By Product Type (Slow-Release, Controlled-Release), By Crop Type(Cereals And Grains, Fruits And Vegetables, Oilseeds And Pulses, Turf And Ornamentals, Others), By Application(Agriculture, Horticulture, Gardening, Others), By Distribution Channel (Direct Sales, Retail Stores, Online Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159022

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

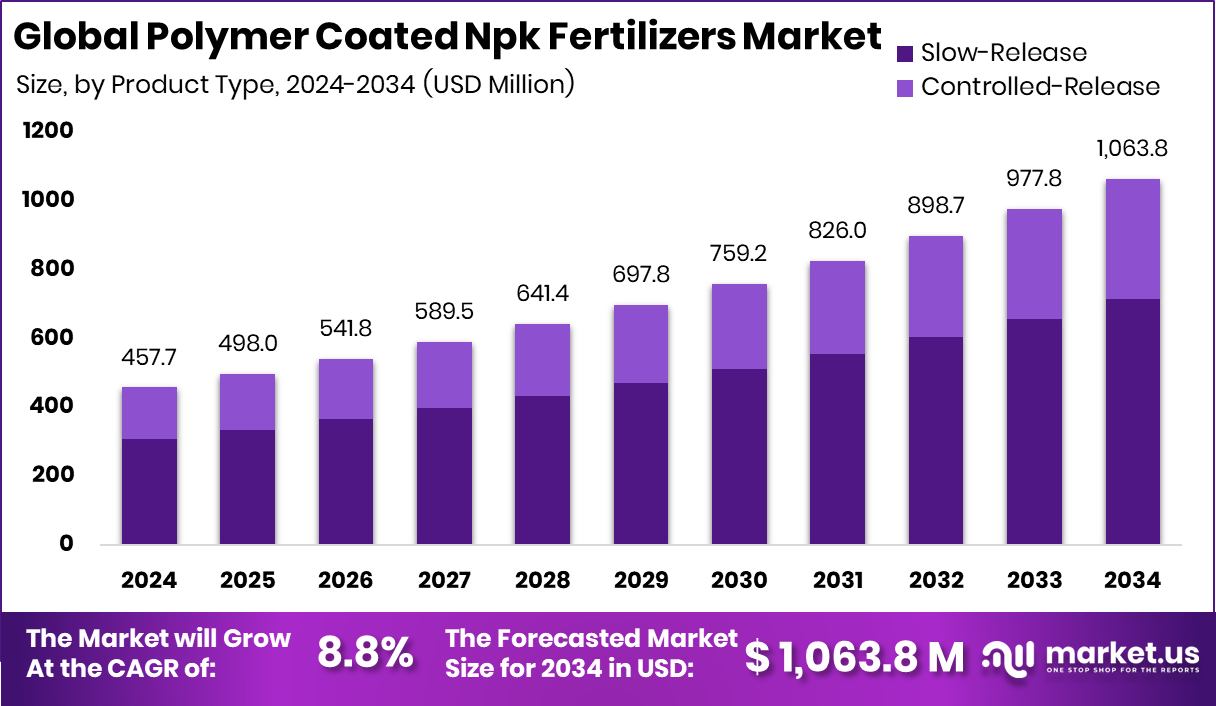

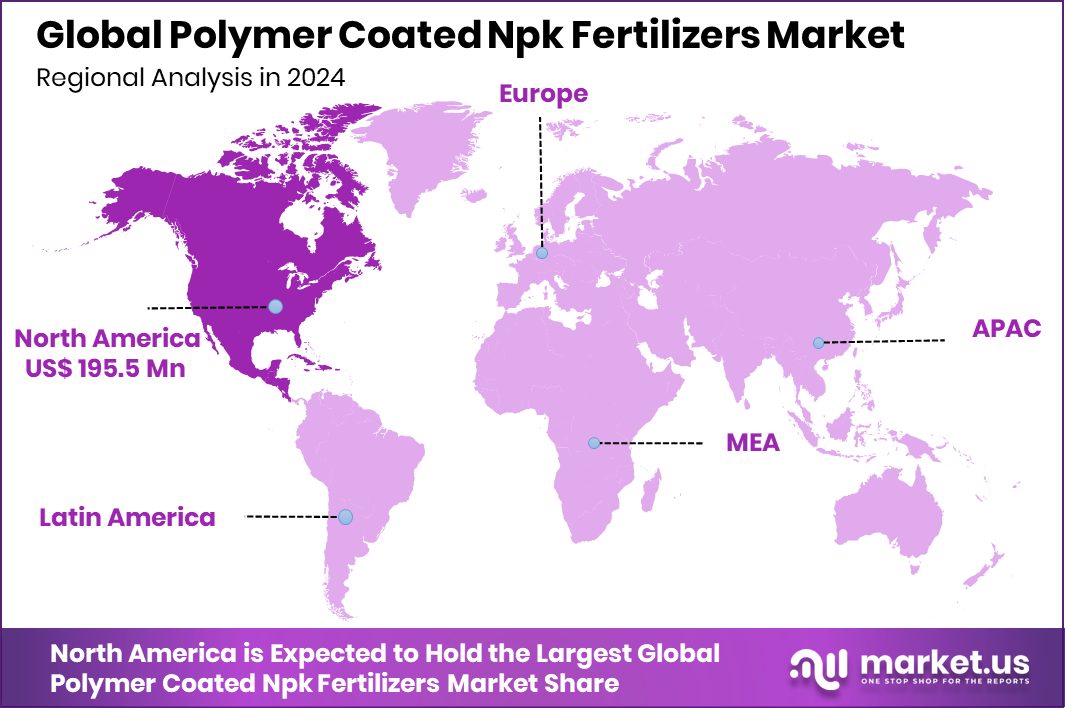

The Global Polymer Coated Npk Fertilizers Market is expected to be worth around USD 1,063.8 million by 2034, up from USD 457.7 million in 2024, and is projected to grow at a CAGR of 8.8% from 2025 to 2034. With a 42.8% share, the North America Polymer Coated NPK Fertilizers Market reached USD 195.5 Mn.

Polymer-coated NPK Fertilizers are advanced fertilizers where nitrogen, phosphorus, and potassium (NPK) nutrients are coated with a thin layer of polymer. This coating controls the release of nutrients over time, ensuring that crops receive a steady supply according to their growth needs. Unlike traditional fertilizers, these slow-release fertilizers reduce nutrient losses through leaching and volatilization, making them more efficient and environmentally friendly.

The Polymer Coated NPK Fertilizers Market refers to the global demand, production, and trade of these specialized fertilizers. It includes the adoption by agricultural sectors, distribution channels, and technological developments in coating materials. The market is driven by the increasing need for high-efficiency fertilizers that support sustainable farming practices and reduce environmental damage.

One key growth factor is the rising awareness among farmers about sustainable agriculture. With soil degradation and nutrient loss becoming major concerns, more farmers are turning to polymer-coated fertilizers to maintain soil health and achieve consistent crop output. According to an industry report, Pluckk aims to secure INR 85 crore to expand fresh fruit and vegetable sales.

The demand for these fertilizers is growing due to the shift toward high-yield crops and precision farming techniques. Controlled nutrient release helps optimize growth cycles, making it highly attractive for both large-scale and small-scale farming. According to an industry report, Origin launches operations in Bengaluru, targeting $10 million in funding.

The opportunity lies in regions facing water scarcity and poor soil fertility. By providing efficient nutrient management, polymer-coated NPK fertilizers can help improve productivity while reducing the environmental footprint, creating a strong potential for wider adoption in the future. According to an industry report, Agri-food startup Fresh From Farm raises over Rs 3.2 crore, led by Inflection Point Ventures.

Key Takeaways

- The Global Polymer Coated Npk Fertilizers Market is expected to be worth around USD 1,063.8 million by 2034, up from USD 457.7 million in 2024, and is projected to grow at a CAGR of 8.8% from 2025 to 2034.

- In the Polymer Coated NPK Fertilizers Market, slow-release types dominate with 67.3% share.

- Cereals and grains represent 36.8% of demand in the Polymer Coated NPK Fertilizers Market.

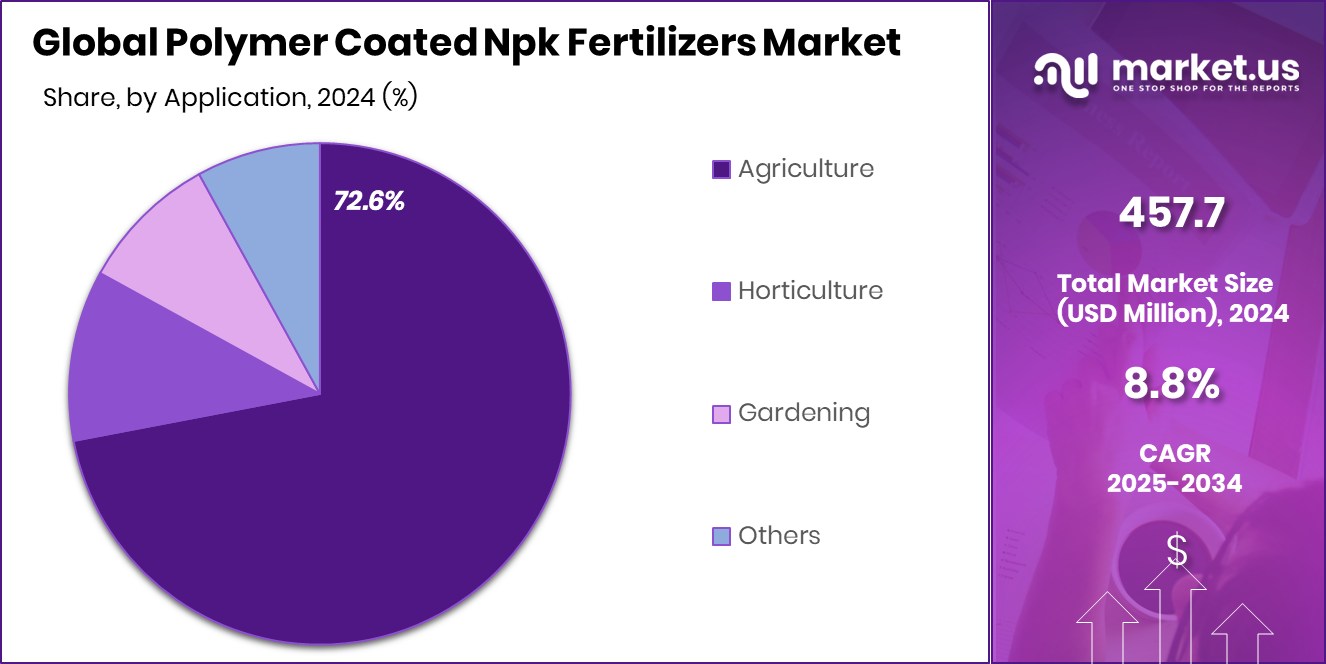

- Agriculture applications account for 72.6% of usage in the Polymer Coated NPK Fertilizers Market.

- Direct sales lead distribution with 47.1% in the Polymer Coated NPK Fertilizers Market.

- Strong adoption in North America, valued at USD 195.5 Mn, reflects 42.8% regional dominance.

By Product Type Analysis

Slow-release polymer-coated NPK fertilizers dominate the market, holding a 67.3% share.

In 2024, Slow-Release held a dominant market position in the By Product Type segment of the Polymer Coated NPK Fertilizers Market, with a 67.3% share. The strong uptake of slow-release products is largely driven by their ability to deliver nutrients gradually, aligning with crop growth cycles and reducing wastage. Farmers are increasingly preferring this type of fertilizer as it enhances nutrient efficiency, lowers input costs over time, and minimizes environmental concerns such as leaching into groundwater.Additionally, the growing focus on sustainable agricultural practices and precision farming has further supported the adoption of slow-release fertilizers. This dominance highlights the clear preference for solutions that improve productivity while ensuring soil health and long-term farm profitability.

By Crop Type Analysis

Cereals and grains drive demand strongly, accounting for 36.8% of the crop types.

In 2024, Cereals and Grains held a dominant market position in the By Crop Type segment of the Polymer Coated NPK Fertilizers Market, with a 36.8% share. This dominance is attributed to the high global demand for staple crops such as rice, wheat, and corn, which form the foundation of food security in many regions. The use of polymer-coated fertilizers in cereals and grains ensures efficient nutrient release, supporting higher yields and better quality harvests.Farmers are increasingly adopting these fertilizers to address soil nutrient depletion and enhance productivity in large-scale cultivation. The growing consumption of cereals worldwide continues to reinforce the segment’s strong market share, reflecting its vital role in sustaining agricultural output.

By Application Analysis

Agriculture applications lead usage, with 72.6% adoption in farming practices worldwide.

In 2024, Agriculture held a dominant market position in By Application segment of the Polymer Coated NPK Fertilizers Market, with a 72.6% share. The strong share is driven by the rising need to enhance crop productivity and maintain soil fertility in large-scale farming practices. Polymer-coated fertilizers are widely adopted in agriculture due to their controlled nutrient release, which supports optimal plant growth while reducing wastage and environmental impact.Farmers benefit from improved yields and cost efficiency, making these fertilizers a preferred choice in crop cultivation. The growing emphasis on sustainable farming methods and the increasing pressure to meet food demand worldwide continue to strengthen the dominance of the agriculture segment in this market.

By Distribution Channel Analysis

Direct sales distribution remains key, capturing 47.1% of overall market channels.

In 2024, Direct Sales held a dominant market position in the By Distribution Channel segment of the Polymer Coated NPK Fertilizers Market, with a 47.1% share. This strong performance is attributed to the growing preference of farmers and agricultural enterprises for purchasing directly from manufacturers or authorized dealers.

Direct sales ensure better access to product information, a reliable supply, and cost benefits by eliminating intermediaries. Farmers also value the technical guidance and after-sales support provided through this channel, which enhances trust and adoption. With rising demand for efficiency-driven fertilizers, direct sales have become a key driver in reaching end-users effectively, reinforcing their leadership in the market’s distribution landscape.

Key Market Segments

By Product Type

- Slow-Release

- Controlled-Release

By Crop Type

- Cereals And Grains

- Fruits And Vegetables

- Oilseeds And Pulses

- Turf And Ornamentals

- Others

By Application

- Agriculture

- Horticulture

- Gardening

- Others

By Distribution Channel

- Direct Sales

- Retail Stores

- Online Stores

- Others

Driving Factors

Rising Focus on Sustainable and Efficient Farming

One of the biggest driving factors for the Polymer Coated NPK Fertilizers Market is the rising focus on sustainable and efficient farming practices. Farmers today face challenges like soil degradation, water scarcity, and rising input costs. Polymer-coated fertilizers help solve these issues by slowly releasing nutrients, ensuring crops get what they need over time. This reduces wastage, improves soil health, and boosts yields with fewer applications.

Governments and agricultural organizations are also encouraging the use of eco-friendly fertilizers to reduce environmental pollution caused by nutrient leaching. As a result, farmers are adopting these fertilizers not just for better productivity but also to safeguard the long-term sustainability of their land and resources, making this trend a major growth driver. According to industry report, Tesco boosts its national Fruit & Veg for Schools initiative with an additional £4 million.

Restraining Factors

High Production Costs Limit Wider Farmer Adoption

A key restraining factor for the Polymer Coated NPK Fertilizers Market is the high production cost of these advanced fertilizers. The process of coating nutrients with polymers requires specialized technology and materials, making the final product more expensive compared to conventional fertilizers. For many farmers, especially in developing regions, the higher price creates a barrier to adoption despite the long-term benefits.

Small and medium-scale farmers often prioritize affordability over efficiency due to budget constraints. This price gap limits the widespread use of polymer-coated fertilizers and slows market growth. Unless supported by subsidies, incentives, or cost-reduction innovations, the high costs will continue to restrict accessibility for a large portion of the farming community.

Growth Opportunity

Expanding Use in Water-Scarce Farming Regions

A major growth opportunity for the Polymer Coated NPK Fertilizers Market lies in their expanding use across water-scarce farming regions. In areas where water availability is limited, farmers face difficulties in ensuring crops receive balanced nutrients. Polymer-coated fertilizers provide a solution by slowly releasing nutrients, reducing the need for frequent irrigation and minimizing nutrient losses through leaching. This makes them highly suitable for dryland and semi-arid agriculture.

As climate change intensifies and water scarcity grows, more regions are expected to adopt such efficient fertilizers. Governments and agricultural bodies promoting water-saving technologies further support this opportunity, positioning polymer-coated NPK fertilizers as a key tool in improving productivity while conserving vital water resources. According to an industry report, the USDA allocates $46 million to programs improving fruit and vegetable accessibility.

Latest Trends

Adoption of Precision Farming Boosts Fertilizer Demand

One of the latest trends in the Polymer Coated NPK Fertilizers Market is the growing adoption of precision farming techniques. Farmers are increasingly using modern tools like sensors, drones, and GPS systems to monitor soil health, crop growth, and nutrient needs in real time.

Polymer-coated fertilizers fit perfectly into this system, as their slow and controlled nutrient release matches the precision required in modern farming. This reduces waste, ensures efficient use of inputs, and supports higher yields with lower environmental impact. As more farmers turn to technology-driven practices to maximize productivity, the integration of polymer-coated fertilizers with precision farming methods is becoming a strong trend shaping the future of agriculture.

Regional Analysis

In 2024, North America held a 42.8% share of the Polymer Coated NPK Fertilizers Market, worth USD 195.5 Mn.

The Polymer Coated NPK Fertilizers Market demonstrates varied regional dynamics across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, with North America emerging as the dominant region. In 2024, North America accounted for 42.8% of the global market, valued at USD 195.5 million. This leadership is strongly supported by the region’s advanced agricultural practices, high adoption of precision farming, and government initiatives promoting sustainable crop nutrition.

Farmers in the United States and Canada are increasingly shifting toward controlled-release fertilizers to address challenges of soil degradation and to enhance productivity in staple crops such as corn and wheat. Europe also shows steady growth, driven by environmental regulations encouraging eco-friendly fertilizers, while the Asia Pacific continues to expand due to rising food demand and the modernization of farming practices.

The Middle East & Africa are gradually adopting such solutions in response to water scarcity, and Latin America benefits from the growing need for efficient fertilizers in large-scale crop cultivation. However, North America remains the leading region, reflecting its strong focus on advanced farming technologies, sustainability, and high awareness among farmers regarding the long-term benefits of polymer-coated NPK fertilizers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nutrien Ltd. continues to play a significant role through its extensive distribution network and strong portfolio in crop nutrition. With a focus on efficiency and sustainability, the company has been promoting advanced fertilizer solutions tailored to meet the rising demand for high-yield crops. Its emphasis on innovation and farmer-centric programs ensures that polymer-coated fertilizers are accessible to both large-scale and mid-size farming communities.

Yara International ASA brings forward its reputation as a pioneer in sustainable farming solutions, placing heavy focus on balanced crop nutrition and environmental responsibility. By aligning polymer-coated fertilizer production with climate-smart agriculture practices, Yara is addressing challenges such as nutrient loss and soil health degradation. Its global presence allows it to influence adoption rates across diverse markets, particularly in regions transitioning toward sustainable farming methods.

ICL Group Ltd. adds competitive strength through its specialized offerings in advanced fertilizers. Known for its research-driven approach, ICL has been enhancing nutrient efficiency and developing coatings that improve release patterns in line with crop cycles. The company’s focus on innovation and precision agriculture further supports farmers in achieving higher yields with reduced environmental impact.

Top Key Players in the Market

- Nutrien Ltd.

- Yara International ASA

- ICL Group Ltd.

- The Mosaic Company

- Kingenta Ecological Engineering Group Co., Ltd.

- Haifa Group

- Shandong Shikefeng Chemical Industry Co., Ltd.

- Compo Expert GmbH

- J.R. Simplot Company

- Helena Chemical Company

Recent Developments

- In September 2025, the company announced plans to sell its 50% stake in Argentine nitrogen fertilizer producer Profertil for $600 million. This move is part of Nutrien’s strategy to focus on core markets and operations. The transaction is expected to be completed before the end of 2025.

- In November 2024, Yara North America launched the YaraAmplix biostimulant portfolio. This portfolio is designed to enhance crop resilience, nutrient uptake, and overall crop quality while promoting healthier soils and better adaptability to environmental stressors. The YaraAmplix portfolio is backed by over five years of global and regional research and development.

Report Scope

Report Features Description Market Value (2024) USD 457.7 Million Forecast Revenue (2034) USD 1,063.8 Million CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Slow-Release, Controlled-Release), By Crop Type(Cereals And Grains, Fruits And Vegetables, Oilseeds And Pulses, Turf And Ornamentals, Others), By Application(Agriculture, Horticulture, Gardening, Others), By Distribution Channel (Direct Sales, Retail Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nutrien Ltd., Yara International ASA, ICL Group Ltd., The Mosaic Company, Kingenta Ecological Engineering Group Co., Ltd., Haifa Group, Shandong Shikefeng Chemical Industry Co., Ltd., Compo Expert GmbH, J.R. Simplot Company, Helena Chemical Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Polymer Coated Npk Fertilizers MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Polymer Coated Npk Fertilizers MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nutrien Ltd.

- Yara International ASA

- ICL Group Ltd.

- The Mosaic Company

- Kingenta Ecological Engineering Group Co., Ltd.

- Haifa Group

- Shandong Shikefeng Chemical Industry Co., Ltd.

- Compo Expert GmbH

- J.R. Simplot Company

- Helena Chemical Company