Global Polyimides (PI) Market Size, Share, Growth Analysis By Form (Film, Resin, Fiber, Others), By Application (Electrical & Electronics, Aerospace & Defense, Automotive & Transportation, Medical, Energy & Power, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176392

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

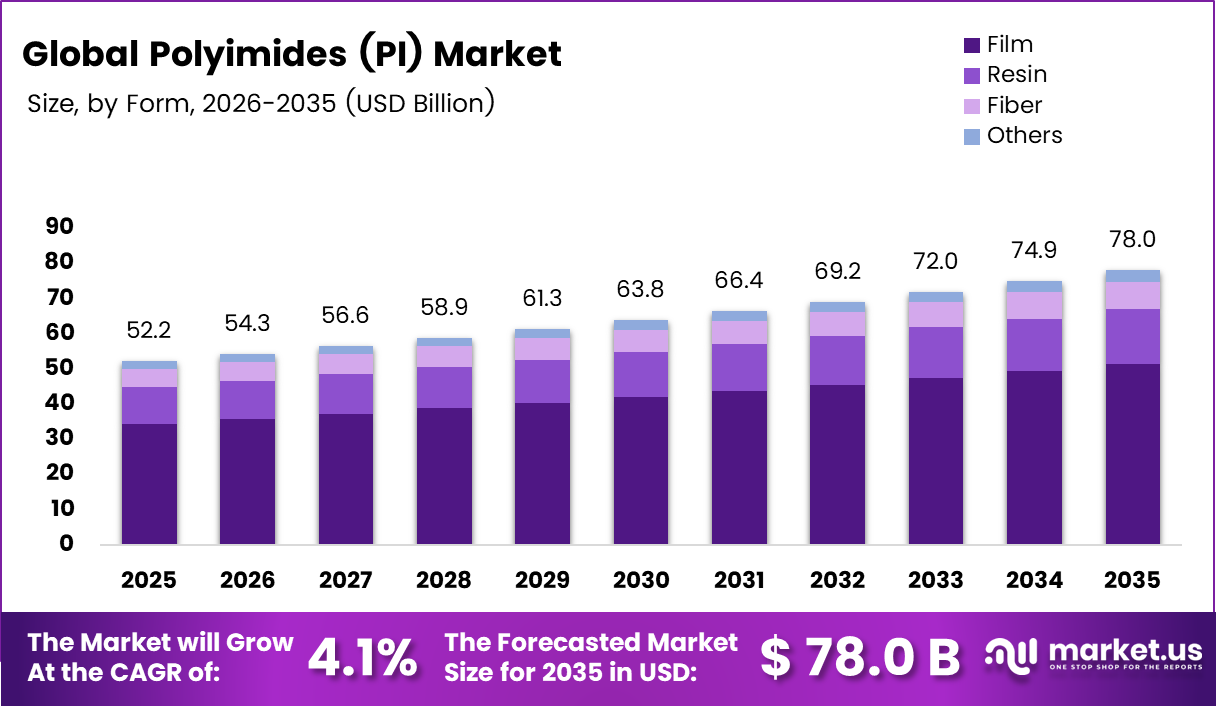

Global Polyimides (PI) Market size is expected to be worth around USD 78.0 Billion by 2035 from USD 52.2 Billion in 2025, growing at a CAGR of 4.1% during the forecast period 2026 to 2035.

Polyimides represent a class of high-performance polymers distinguished by exceptional thermal stability and mechanical properties. These advanced materials maintain structural integrity across extreme temperature ranges, from -200°C to +280°C. Moreover, they exhibit superior chemical resistance and electrical insulation capabilities essential for demanding industrial applications.

The market demonstrates robust growth driven by expanding electronics manufacturing and aerospace innovation. Polyimide films serve critical roles in flexible circuits, semiconductor packaging, and satellite components. Additionally, automotive electrification accelerates demand for lightweight, heat-resistant insulation materials in electric vehicle batteries and power systems.

Industrial adoption continues expanding across diverse sectors requiring extreme performance characteristics. Polyimides offer unique advantages including self-extinguishing properties rated UL94 V-0 and excellent dielectric strength exceeding 300KV/mm. Consequently, applications span medical devices, energy storage systems, and advanced manufacturing processes demanding thermal and chemical stability.

Government investments in aerospace exploration and defense technologies create substantial growth opportunities. Space programs require materials withstanding harsh conditions including radiation exposure and thermal cycling. Therefore, polyimides remain indispensable for satellite construction, spacecraft components, and next-generation communication systems supporting 5G infrastructure deployment.

Technological advancements drive innovation in transparent and colorless polyimide films for display applications. Manufacturers increasingly focus on developing bio-based alternatives addressing environmental sustainability concerns. However, production complexity and high costs currently limit broader market penetration across price-sensitive applications requiring similar performance characteristics.

According to Stasskol, polyimides can briefly withstand short-term application temperatures up to 400°C. According to GTEEK, polyimide film maintains thermal class C rating with temperature index exceeding 240°C. These exceptional properties enable usage from -269°C to +400°C, supporting applications requiring extreme thermal resistance and mechanical reliability.

According to Arkema, the company launched Zenimid brand in July 2025 for flagship high-performance polyimide products targeting aerospace, automotive, electronics and industrial sectors. This strategic branding initiative reflects growing market opportunities and expanding global demand for advanced polyimide solutions across multiple high-value applications.

Key Takeaways

- Global Polyimides (PI) Market projected to reach USD 78.0 Billion by 2035 from USD 52.2 Billion in 2025

- Market growing at CAGR of 4.1% during forecast period 2026-2035

- Film segment dominates with 65.8% market share in form category

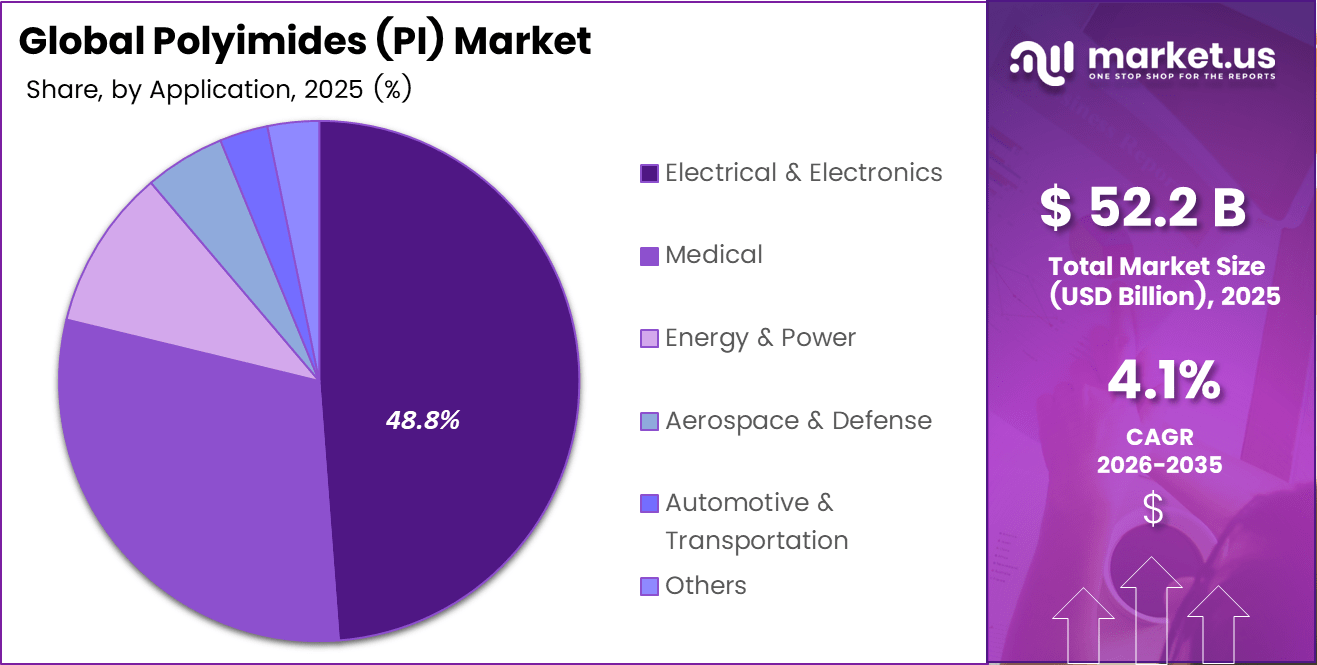

- Electrical and Electronics application leads with 48.8% market share

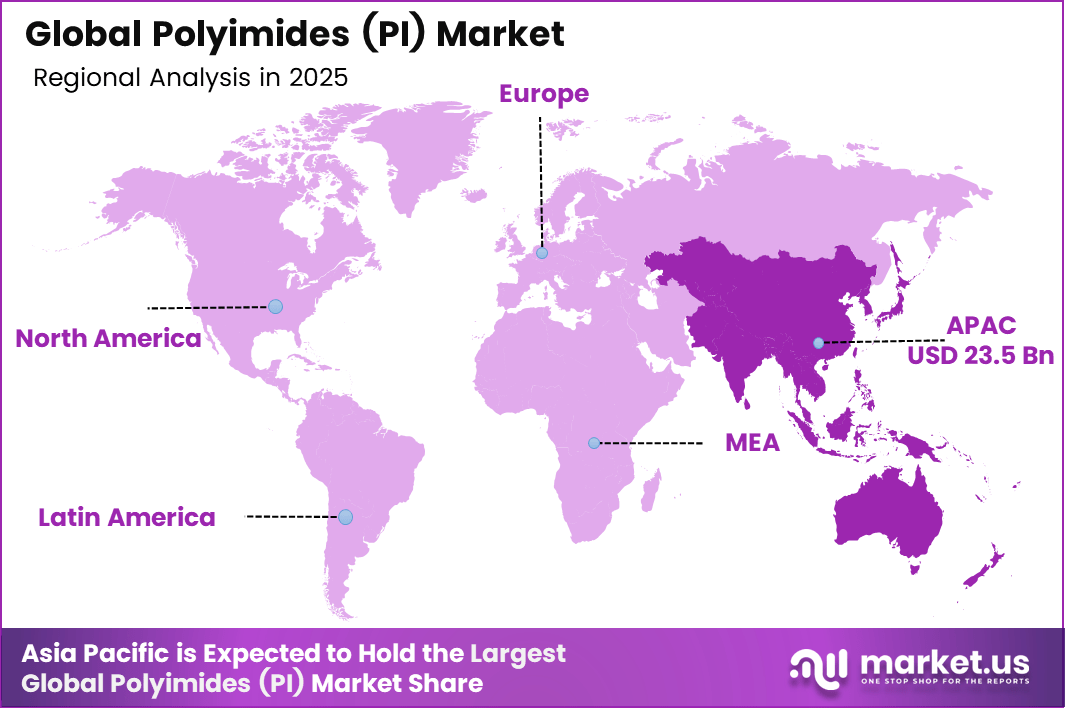

- Asia Pacific region holds dominant position with 45.1% share valued at USD 23.5 Billion

- Temperature resistance ranges from -269°C to +400°C enabling extreme condition applications

Form Analysis

Film dominates with 65.8% due to superior flexibility and thermal stability for electronics applications.

In 2025, Film held a dominant market position in the By Form segment of Polyimides (PI) Market, with a 65.8% share. Film products offer exceptional flexibility combined with outstanding thermal resistance, making them ideal for flexible printed circuits and display technologies. Additionally, ultra-thin polyimide films enable miniaturization in electronic devices while maintaining excellent dielectric properties and mechanical strength.

Resin formulations provide versatile solutions for composite materials and coating applications across aerospace and automotive industries. These materials deliver superior adhesion properties and chemical resistance essential for structural components. Moreover, resin-based polyimides facilitate custom molding processes enabling complex geometries for specialized industrial applications requiring high-temperature performance.

Fiber variants contribute significantly to reinforced composite structures in aerospace and defense applications. These high-strength fibers enhance mechanical properties while reducing overall component weight. Consequently, fiber polyimides support advanced manufacturing of aircraft components and satellite structures demanding exceptional strength-to-weight ratios and thermal stability.

Others category encompasses specialty polyimide formulations including powders, coatings, and custom-engineered variants. These products address niche applications requiring specific processing characteristics or performance attributes. Therefore, specialized polyimide forms continue gaining traction in emerging sectors including medical devices and energy storage systems.

Application Analysis

Electrical and Electronics dominates with 48.8% driven by semiconductor fabrication and flexible circuit demand.

In 2025, Electrical and Electronics held a dominant market position in the By Application segment of Polyimides (PI) Market, with a 48.8% share. This sector relies heavily on polyimide films for semiconductor packaging, flexible printed circuits, and microelectronics manufacturing. Additionally, integration in 5G communication systems and high-frequency electronics drives sustained growth across telecommunications infrastructure.

Aerospace and Defense applications require materials withstanding extreme thermal cycling and radiation exposure. Polyimides serve critical roles in satellite components, spacecraft insulation, and aircraft engine parts. Moreover, space exploration initiatives and defense modernization programs create continuous demand for high-performance materials capable of operating in harsh environmental conditions.

Automotive and Transportation sectors increasingly adopt polyimides for electric vehicle battery insulation and power electronics. These materials provide lightweight alternatives to traditional insulators while maintaining superior thermal management capabilities. Consequently, automotive electrification trends accelerate polyimide consumption in next-generation vehicle systems and charging infrastructure.

Medical Applications leverage polyimide materials due to their proven biocompatibility and resistance to repeated sterilization processes. These properties make them suitable for surgical instruments, catheters, and minimally invasive tools. Polyimides are also increasingly used in implantable devices where long-term stability and safety are critical.

Energy and Power sectors utilize polyimides in battery separators, insulation films, and advanced energy storage systems. Their high thermal stability and electrical insulation performance enhance battery safety and efficiency. These materials support the growing demand for reliable components in electric vehicles and renewable energy systems.

Others category includes industrial machinery, consumer electronics, and specialized equipment applications. Polyimides are preferred where extreme temperature resistance and strong chemical stability are required. Their durability supports long service life in harsh operating and manufacturing environments.

Key Market Segments

By Form

- Film

- Resin

- Fiber

- Others

By Application

- Electrical & Electronics

- Aerospace & Defense

- Automotive & Transportation

- Medical

- Energy & Power

- Others

Drivers

Rising Adoption of High-Temperature-Resistant Materials Drives Aerospace and Electronics Growth

Polyimides offer exceptional thermal stability enabling continuous operation from -200°C to +280°C with short-term resistance reaching 400°C. Aerospace manufacturers increasingly specify these materials for satellite components and aircraft systems requiring extreme temperature performance. Moreover, semiconductor fabrication processes demand insulation materials maintaining properties under thermal cycling and chemical exposure conditions.

Electric vehicle proliferation accelerates demand for lightweight, heat-stable insulation in battery systems and power electronics. Polyimide films provide superior dielectric strength exceeding 300KV/mm while reducing overall component weight. Additionally, automotive electrification trends require materials withstanding high operating temperatures in motor controllers, inverters, and charging systems supporting sustainable transportation initiatives.

Advanced electronics manufacturing relies on flexible polyimide substrates for printed circuits and microelectronics packaging. Miniaturization trends necessitate ultra-thin films maintaining mechanical integrity and electrical properties. Consequently, flexible displays, wearable devices, and 5G infrastructure deployment drive sustained growth across telecommunications and consumer electronics sectors requiring high-performance flexible materials.

Restraints

High Production Costs and Environmental Concerns Limit Market Expansion

Complex manufacturing processes involving specialized chemical synthesis and controlled polymerization conditions elevate polyimide production costs significantly. Capital-intensive equipment and stringent quality control requirements create barriers for new market entrants. Moreover, extended processing cycles and multi-step fabrication procedures increase overall production expenses compared to conventional polymer alternatives limiting adoption in price-sensitive applications.

Limited recyclability poses environmental challenges as polyimides resist degradation by known organic solvents and maintain stability at temperatures exceeding 800°C. End-of-life disposal options remain constrained due to material durability and chemical resistance properties. Additionally, carbonization during thermal decomposition rather than melting complicates recycling efforts addressing sustainability concerns.

Environmental regulations increasingly scrutinize synthetic polymer production processes and lifecycle impacts. Growing emphasis on circular economy principles and sustainable material alternatives challenges traditional polyimide manufacturing approaches. Therefore, industry faces pressure developing bio-based formulations and improving recyclability while maintaining performance characteristics essential for demanding applications across aerospace, electronics, and automotive sectors.

Growth Factors

Expanding Electronics Applications and Energy Storage Systems Accelerate Market Growth

Flexible printed circuits and electronic wearable devices create substantial growth opportunities for ultra-thin polyimide films. Consumer demand for compact, lightweight electronics drives miniaturization trends requiring flexible substrates maintaining performance. Moreover, integration in foldable displays, flexible sensors, and bendable electronics supports innovation across consumer technology and medical monitoring devices.

Next-generation battery technologies and energy storage systems increasingly utilize polyimide separators and insulation materials. Electric vehicle batteries require thermal management solutions preventing short circuits while withstanding operational temperatures. Additionally, grid-scale energy storage installations demand materials offering long-term stability and safety characteristics essential for reliable power infrastructure supporting renewable energy integration.

Medical device manufacturers increasingly specify polyimides for biocompatible applications requiring sterilization resistance and chemical stability. Surgical instruments, catheter components, and implantable devices benefit from material properties enabling repeated sterilization cycles. Consequently, healthcare innovation and minimally invasive surgical techniques drive demand for high-performance polymers meeting stringent regulatory standards and biocompatibility requirements.

Emerging Trends

Innovation in Transparent Films and Sustainable Materials Reshapes Industry Landscape

Development of colorless and transparent polyimide films enables new applications in display technologies and optical devices. Transparent substrates maintain thermal and mechanical properties while offering optical clarity essential for touchscreens and flexible displays. Moreover, advancements in molecular design reduce inherent yellowish coloration expanding addressable markets across consumer electronics and automotive display applications.

Bio-based polyimide innovations address environmental sustainability concerns while maintaining performance characteristics. Researchers explore renewable feedstocks and green chemistry approaches reducing carbon footprint associated with traditional synthesis methods. Additionally, industry collaborations focus on developing recyclable formulations supporting circular economy initiatives without compromising thermal stability and mechanical properties.

Integration in 5G communication infrastructure and high-frequency electronic systems drives technical innovation in low-loss dielectric materials. Polyimides offer excellent signal integrity at microwave frequencies essential for telecommunications equipment. Consequently, space exploration initiatives requiring extreme thermal stability and radiation resistance create emerging opportunities for advanced polyimide formulations supporting satellite components and deep-space missions.

Regional Analysis

Asia Pacific Dominates the Polyimides (PI) Market with a Market Share of 45.1%, Valued at USD 23.5 Billion

Asia Pacific leads global polyimide consumption driven by robust electronics manufacturing in China, Japan, and South Korea. Semiconductor fabrication facilities and flexible circuit production concentrate in this region supporting consumer electronics and telecommunications infrastructure. Moreover, regional automotive electrification initiatives and government investments in advanced manufacturing capabilities sustain strong demand growth across multiple industrial applications.

North America Polyimides (PI) Market Trends

North America demonstrates steady growth supported by aerospace and defense sectors requiring high-performance materials. United States space exploration programs and military modernization initiatives drive polyimide adoption in satellite systems and aircraft components. Additionally, medical device manufacturing and electric vehicle production contribute to regional market expansion.

Europe Polyimides (PI) Market Trends

Europe maintains significant market presence with strong automotive and aerospace industries. German automotive manufacturers increasingly adopt polyimides for electric vehicle components and advanced driver assistance systems. Moreover, stringent environmental regulations encourage sustainable material development and bio-based polyimide innovations across European manufacturing sectors.

Latin America Polyimides (PI) Market Trends

Latin America experiences moderate growth driven by expanding electronics manufacturing and automotive production in Brazil and Mexico. Regional investments in renewable energy infrastructure create opportunities for energy storage applications. Additionally, medical device manufacturing and industrial automation support gradual market development across the region.

Middle East & Africa Polyimides (PI) Market Trends

Middle East and Africa represent emerging markets with growth potential in aerospace and energy sectors. Gulf Cooperation Council countries invest in space programs and defense technologies requiring advanced materials. Moreover, renewable energy projects and industrial diversification initiatives create new applications for high-performance polyimides across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

DuPont maintains leadership position through extensive polyimide portfolio serving aerospace, electronics, and industrial applications. The company leverages decades of material science expertise developing innovative formulations meeting evolving industry requirements. Moreover, global manufacturing capabilities and strong customer relationships support sustained market presence across diverse geographic regions and application sectors.

Toray Industries Inc. demonstrates significant capabilities in polyimide film production for electronics and automotive applications. The company invests heavily in research and development advancing transparent polyimide technologies and ultra-thin film manufacturing. Additionally, strategic partnerships with electronics manufacturers strengthen market position supporting flexible display and semiconductor packaging applications requiring advanced material solutions.

Arkema recently launched Zenimid brand positioning flagship high-performance polyimide products across aerospace, automotive, electronics, and industrial markets. This strategic branding initiative reflects commitment to global expansion and product range development. Consequently, the company strengthens competitive positioning through innovation and market-focused product differentiation strategies addressing specialized application requirements.

Kaneka Corporation contributes substantial expertise in polyimide resin and film technologies serving electronics and energy sectors. The company focuses on developing specialized formulations for semiconductor applications and flexible circuits. Moreover, investments in production capacity expansion and technical service capabilities enhance customer support delivering customized solutions for demanding high-performance applications.

Key players

- Arakawa Chemical Industries, Ltd.

- Arkema

- China Wanda Group

- DUNMORE

- DuPont

- JIAOZUO TIANYI TECHNOLOGY CO., LTD

- Kaneka Corporation

- Kolon Industries Inc.

- Mitsui Chemicals Inc.

- PI Advanced Materials Co., Ltd.

- Shenzhen Ruihuatai Film Technology Co., Ltd.

- SKC

- Taimide Tech. Inc.

- Toray Industries Inc.

- UBE Corporation

- Other Key Players

Recent Developments

- July 2025 – Arkema and PI Advanced Materials announced the launch of Zenimid brand name for flagship high-performance polyimide products. This strategic initiative marks significant milestone expanding global reach across aerospace, automotive, electronics and industrial sectors with enhanced market positioning.

- September 2024 – Foxhole Group partnered with Faldu family adding Accutron to Foxtronics EMS platform portfolio. This acquisition adds significant depth in life science and aerospace defense capabilities strengthening the company’s electronic manufacturing services offerings across specialized high-performance sectors.

Report Scope

Report Features Description Market Value (2025) USD 52.2 Billion Forecast Revenue (2035) USD 78.0 Billion CAGR (2026-2035) 4.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Film, Resin, Fiber, Others), By Application (Electrical & Electronics, Aerospace & Defense, Automotive & Transportation, Medical, Energy & Power, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Arakawa Chemical Industries, Ltd., Arkema, China Wanda Group, DUNMORE, DuPont, JIAOZUO TIANYI TECHNOLOGY CO., LTD, Kaneka Corporation, Kolon Industries Inc., Mitsui Chemicals Inc., PI Advanced Materials Co., Ltd., Shenzhen Ruihuatai Film Technology Co., Ltd., SKC, Taimide Tech. Inc., Toray Industries Inc., UBE Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Arakawa Chemical Industries, Ltd.

- Arkema

- China Wanda Group

- DUNMORE

- DuPont

- JIAOZUO TIANYI TECHNOLOGY CO., LTD

- Kaneka Corporation

- Kolon Industries Inc.

- Mitsui Chemicals Inc.

- PI Advanced Materials Co., Ltd.

- Shenzhen Ruihuatai Film Technology Co., Ltd.

- SKC

- Taimide Tech. Inc.

- Toray Industries Inc.

- UBE Corporation

- Other Key Players