Global Polyhydroxyalkanoate (PHA) Market By Type(Short Chain Length, Medium Chain Length, Long Chain Length), By Production Method(Vegetable Oil Fermentation, Methane Fermentation), By Form(Co-polymerized PHA, Linear PHA), By Application(Packaging & Food Services, Biomedical, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 119291

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

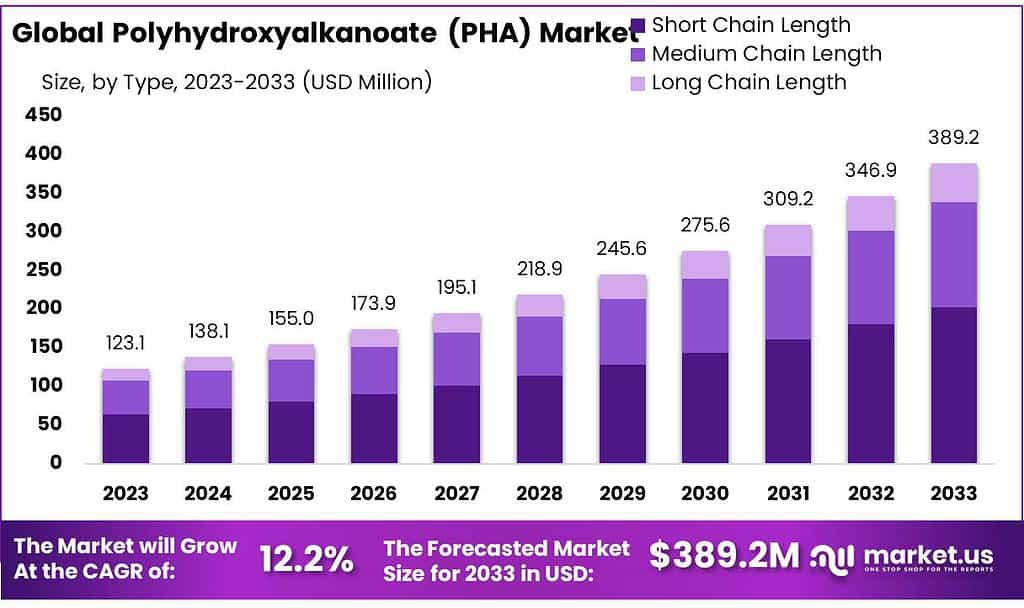

The global Polyhydroxyalkanoate (PHA) Market size is expected to be worth around USD 389.2 Million by 2033, from USD 123.1 Million in 2023, growing at a CAGR of 12.2% during the forecast period from 2023 to 2033.

The Polyhydroxyalkanoate (PHA) Market refers to the commercial landscape surrounding the production, distribution, and sale of PHAs, which are biodegradable polymers produced naturally by bacterial fermentation of sugars or lipids. PHAs are gaining attention as sustainable alternatives to conventional petroleum-based plastics due to their biodegradability and biocompatibility.

This market encompasses a wide range of industries including packaging, agriculture, biomedical, and more, where PHAs are utilized for their environmentally friendly properties.

The growth of the PHA market is driven by increasing environmental concerns, government regulations against plastic pollution, and a growing demand for sustainable materials. PHAs offer a promising solution to reducing plastic waste in environments ranging from oceanic and soil to industrial compost settings.

Additionally, advancements in biotechnological methods have improved the cost-effectiveness and efficiency of PHA production, further boosting their market adoption. The PHA market is also propelled by innovations in application sectors such as biomedicine, where PHAs are used for making sutures, drug delivery devices, and implants due to their biocompatibility and harmless degradation byproducts.

Key Takeaways

- Market Growth: PHA market to reach USD 389.2 million by 2033, growing at 12.2% CAGR from 2023.

- Short Chain Length Dominance: Holds over 52.1% market share in 2023, favored for fast biodegradability.

- Niche Applications for Long Chain Length PHA: Specialized uses like automotive and medical sectors due to unique properties.

- Vegetable Oil Fermentation Method Leads Over 53.5% market share in 2023, known for efficiency and renewable sources.

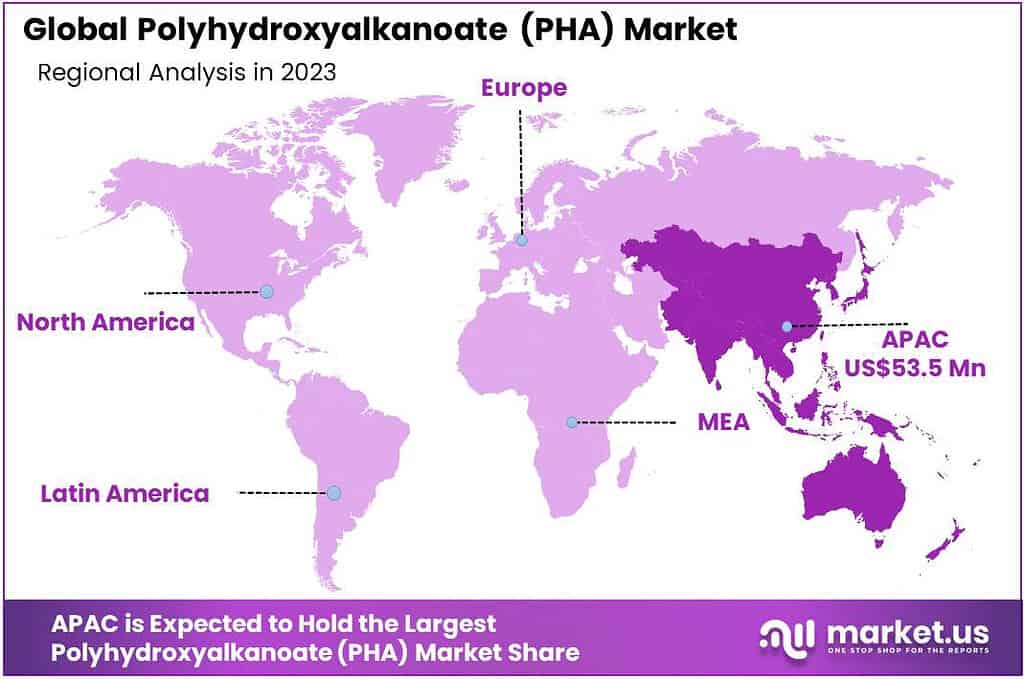

- Asia Pacific region emerged as the most lucrative market for industrial air compressors, securing the largest market share of 43.5%.

By Type

In 2023, the Short Chain Length PHA segment held a dominant market position in the Polyhydroxyalkanoate (PHA) market, capturing more than a 52.1% share. This type of PHA is highly favored due to its faster biodegradability and ease of processing, which make it particularly suitable for use in packaging and disposable items. The dominance of this segment is driven by the increasing demand for eco-friendly packaging solutions that can reduce the environmental impact of plastic waste.

The Medium Chain Length PHA segment also plays a significant role in the market. These PHAs are valued for their enhanced mechanical strength and flexibility, making them ideal for applications requiring more durable materials, such as agricultural mulches and biodegradable bags. While this segment holds a smaller share compared to short chain-length PHAs, it is crucial for applications where higher resilience and flexibility are needed.

Long Chain Length PHAs are used in niche applications that require specific material properties like UV resistance and high thermal stability. These PHAs are typically used in more specialized fields such as automotive parts, electronics, and medical devices. The market share for long-chain length PHAs is smaller but growing, as research continues to expand their applicability and cost-effectiveness. Each of these segments highlights the versatility and adaptability of PHAs to meet diverse market needs and environmental goals.

By Production Method

In 2023, the Vegetable Oil Fermentation method held a dominant market position in the Polyhydroxyalkanoate (PHA) market, capturing more than a 53.5% share. This production method is highly popular due to its efficiency and the availability of renewable resources as feedstock.

Vegetable oils, which are readily obtainable and cost-effective, serve as a rich carbon source for the microbial production of PHA, making this method both sustainable and scalable. The large share of this segment reflects its widespread adoption in producing PHAs for applications ranging from biodegradable packaging to agricultural films.

Methane Fermentation is another significant method used for PHA production. It involves using methane as a feedstock, which can be derived from natural or biogas, making it a viable option for recycling waste gases into valuable bioplastics.

While this segment holds a smaller share than vegetable oil fermentation, it is recognized for its potential to contribute to waste reduction and energy recovery, aligning with global sustainability goals. This method is particularly advantageous in settings where methane is readily available from waste treatment facilities or landfill sites, presenting a unique opportunity to convert waste into biodegradable plastic products.

By Form

In 2023, Co-polymerized PHA held a dominant market position in the Polyhydroxyalkanoate (PHA) market, capturing more than a 54% share. This form of PHA is particularly valued for its versatility and enhanced material properties, such as improved flexibility and impact resistance, which are achieved by combining different monomers during production.

The popularity of co-polymerized PHA is driven by its broad applicability in industries requiring robust and durable biodegradable materials, such as medical devices, packaging, and agricultural applications.

Linear PHA, on the other hand, represents a simpler form of PHA with a straightforward polymer structure. Although it captures a smaller market share compared to co-polymerized PHA, linear PHA is important for applications where uniformity and predictability in degradation rates are critical.

Its use is essential in specific niches within the biomedical and packaging sectors, where precise material performance is required. The distinct properties of linear PHA make it suitable for specialized applications, complementing the versatility of co-polymerized PHA in the market.

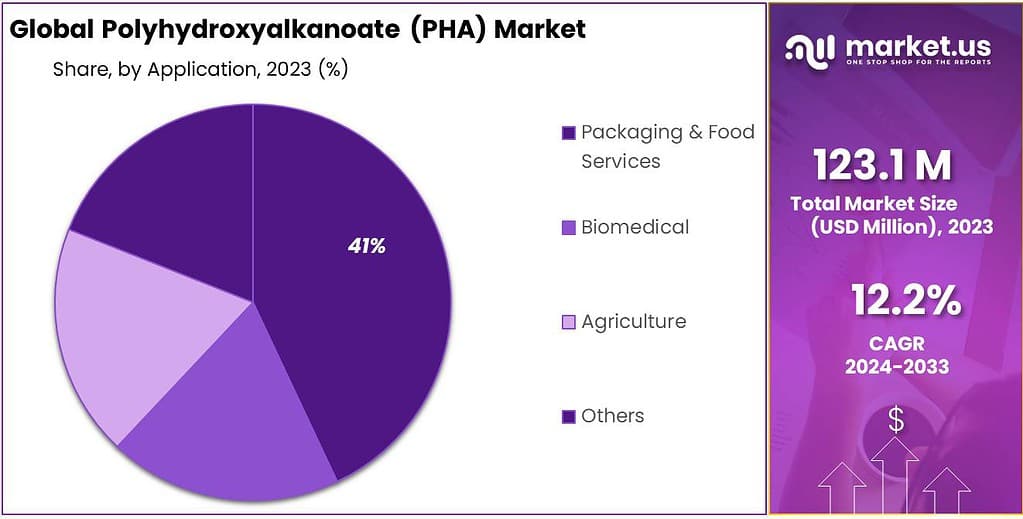

By Application

In 2023, the Packaging & Food Services sector held a dominant market position in the Polyhydroxyalkanoate (PHA) market, capturing more than a 41.1% share. This segment benefits significantly from the increasing demand for biodegradable packaging solutions that reduce environmental impact and meet consumer and regulatory demands for sustainability.

PHA’s biodegradability and food-safe properties make it highly suitable for a variety of packaging applications, including containers, wraps, and utensils used in the food service industry.

The Biomedical segment also plays a crucial role in the PHA market. PHA is valued in this sector for its biocompatibility and biodegradability, which are essential for medical applications such as sutures, implants, and drug delivery systems. While this segment holds a smaller share compared to Packaging & Food Services, its impact is significant in advancing medical materials that align with the body’s natural processes.

Agriculture is another important application area for PHA, where it is used in mulch films, controlled-release fertilizers, and biodegradable planters. The demand in this segment is driven by the need for sustainable farming practices that reduce plastic waste and chemical runoff. PHA’s ability to degrade naturally in the soil without leaving harmful residues supports its adoption in agricultural applications.

Key Market Segments

By Type

- Short Chain Length

- Medium Chain Length

- Long Chain Length

By Production Method

- Vegetable Oil Fermentation

- Methane Fermentation

By Form

- Co-polymerized PHA

- Linear PHA

By Application

- Packaging & Food Services

- Biomedical

- Agriculture

- Others

Drivers

Stringent Environmental Regulations Driving Adoption of Sustainable Materials

A major driver propelling the Polyhydroxyalkanoate (PHA) market is the implementation of stringent environmental regulations worldwide, aimed at reducing plastic pollution and promoting the use of sustainable materials.

Governments across the globe are increasingly aware of the environmental impacts caused by synthetic plastics, which are typically non-biodegradable and contribute significantly to oceanic and terrestrial pollution. In response, these governments are enacting policies that mandate reductions in plastic waste and encourage or even require the use of biodegradable alternatives like PHA.

PHA stands out in the bioplastics market due to its fully biodegradable nature, which allows it to break down in natural environments—including marine settings—without leaving toxic residues. This characteristic aligns perfectly with global regulatory trends aiming to minimize the environmental footprint of plastic products.

For instance, the European Union’s ban on single-use plastics directly supports the growth of the PHA market by creating a demand for alternative materials that can replace traditional plastics in applications such as packaging, agricultural films, and disposable consumer products.

Moreover, the push for sustainability is not only limited to regulatory measures but is also influenced by changing consumer preferences. Modern consumers are increasingly conscious of the environmental impact of their purchases and are demanding products that are not only effective but also sustainable.

This shift in consumer behavior is compelling companies to rethink their product lines and packaging solutions, leading to a greater market demand for PHA-based products. Companies are motivated to adopt PHA to enhance their brand image, meet consumer expectations, and comply with environmental guidelines, which often translate to competitive advantages in eco-conscious markets.

The adoption of PHA is also facilitated by advancements in biotechnology that have made the production of PHA more cost-effective and scalable. Recent developments in genetic engineering and microbial processing have enabled more efficient synthesis of PHA from renewable resources, reducing production costs and thus lowering the barriers to entry for its wider commercial use.

This technological progress is crucial in making PHA a viable alternative to petrochemical-based plastics, particularly in high-volume industries such as packaging and agriculture.

Additionally, the global movement towards a circular economy, where waste is minimized and materials are continuously reused, provides a robust framework for integrating PHA. In this model, PHA’s biodegradability ensures that it can be composted or broken down naturally at the end of its lifecycle, thereby reducing waste and facilitating the reuse of biological materials.

This compatibility with circular economic principles further drives the PHA market, as industries and economies strive to reduce their reliance on finite resources and minimize waste.

Restraints

High Production Costs Limiting Widespread Adoption of PHA

A significant restraint impacting the growth of the Polyhydroxyalkanoate (PHA) market is the high cost of production associated with these biopolymers. While PHA offers substantial environmental benefits as a biodegradable and sustainable alternative to traditional plastics, its production costs are considerably higher, making it less competitive against conventional plastics in terms of price. This economic barrier is a critical issue for many industries considering the switch from cheaper, petrochemical-derived plastics to PHA.

The production of PHA typically involves the fermentation of raw materials such as sugars or vegetable oils using specific strains of bacteria. The cost factors in this process are multifaceted, including the price of the raw materials, the maintenance of microbial cultures, the energy consumption during fermentation, and the downstream processing needed to extract and purify the PHA.

These steps are not only resource-intensive but also require specialized equipment and technology, which add to the overall expenses. Furthermore, the yield of PHA from these processes is often lower compared to the yields of traditional plastics manufacturing, which further escalates the cost per unit of production.

Another economic challenge is the scalability of PHA production. Although technological advancements have led to improvements in production efficiency and cost-effectiveness, scaling up to levels comparable with petrochemical plastic production remains financially and logistically daunting.

The biotechnology-based nature of PHA production involves biological risks and variabilities, such as the potential for contamination or the sensitivity of bacterial cultures to operational conditions, which can affect the consistency and volume of output.

Regulatory factors also play a role in the cost dynamics. The certification and compliance costs for ensuring that PHA products meet various safety and environmental standards can be high. Additionally, the investment in research and development to enhance the properties of PHA for specific applications or to develop more cost-effective production methods requires substantial funding, which may not always promise immediate returns, thus deterring investment.

Market dynamics further complicate the economic viability of PHA. The current market for PHA is much smaller compared to that for conventional plastics, leading to a lower economy of scale. The relative novelty of PHA also means that market penetration is gradual, dependent on awareness and acceptance among manufacturers and consumers alike. Moreover, the price volatility of raw materials and competition from other bioplastics that might offer similar benefits at lower costs can limit the market potential for PHA.

Opportunity

Expansion into Biomedical Applications: A Lucrative Opportunity for PHA Market Growth

A significant opportunity for the Polyhydroxyalkanoate (PHA) market lies in its potential expansion into biomedical applications. PHA’s biocompatibility and biodegradability make it an ideal candidate for a variety of medical uses, ranging from surgical sutures to drug delivery systems and tissue engineering.

As the global healthcare industry continues to grow and evolve, the demand for sustainable and safe biomedical materials is increasing, presenting a substantial market opportunity for PHA.

PHA polymers are particularly valued in the biomedical field for their ability to naturally break down in the body into non-toxic by-products. This feature is crucial for temporary implants, such as screws and pins used in bone surgery, which can be made from PHA to eventually degrade within the body, eliminating the need for a second surgery to remove them. Additionally, PHA’s versatility allows for the adjustment of its degradation rate through copolymerization, making it suitable for various medical applications where controlled degradation is necessary.

The application of PHA in drug delivery systems also presents a notable opportunity. PHA can be engineered to encapsulate medications, releasing them at controlled rates over extended periods. This property is especially beneficial for treatments requiring consistent drug levels within the body, such as in the case of chronic diseases. The ability to fine-tune PHA’s physical and chemical properties allows for the customization of delivery systems tailored to specific drugs and therapeutic conditions, enhancing treatment efficacy and patient compliance.

Moreover, the field of tissue engineering can greatly benefit from the use of PHA. The material’s compatibility with human tissue supports its use in creating scaffolds that facilitate cell growth and tissue regeneration. These scaffolds provide a temporary matrix for cells to adhere to, proliferate, and eventually form new tissue structures, which is essential for organ repair or replacement therapies.

The growing awareness and stringent regulations regarding the use of synthetic, non-degradable materials in the medical field further amplify the potential for PHA. As hospitals and healthcare providers increasingly seek out eco-friendly and safe alternatives, PHA stands out as a sustainable choice that meets both environmental and health safety standards.

Furthermore, advancements in genetic engineering and microbial fermentation technology are making the production of medical-grade PHA more efficient and cost-effective. These technological improvements not only enhance the quality and suitability of PHA for complex medical applications but also help in scaling up production to meet industry demands.

However, tapping into the biomedical market requires PHA producers to navigate a series of regulatory approvals and clinical trials to ensure product safety and efficacy. The process is rigorous and costly, but the potential for high returns on investment is substantial due to the critical nature of medical products and the premium they command in the healthcare market.

Trends

Sustainable Packaging Solutions Fueling PHA Market Growth

One of the major trends in the Polyhydroxyalkanoate (PHA) market is the surge in demand for sustainable packaging solutions. As global awareness of environmental issues increases, particularly concerning plastic pollution and its long-term impacts on ecosystems, consumers and corporations are shifting towards more sustainable practices.

This shift is prominently reflected in the packaging industry, where there is a growing preference for materials that are both sustainable and biodegradable. PHA, with its fully biodegradable properties, is emerging as a preferred choice for eco-friendly packaging solutions, driving a significant trend in the market.

The transition to sustainable packaging is supported by a combination of consumer demand, corporate social responsibility (CSR) policies, and stringent governmental regulations aimed at reducing plastic waste.

Consumers are increasingly opting for products that use environmentally friendly packaging, influencing companies across various sectors—such as food and beverage, personal care, and retail—to adopt greener packaging materials. PHA stands out as an ideal material in this regard due to its ability to degrade completely in natural environments, including both terrestrial and marine settings, without leaving toxic residue.

Additionally, PHA’s versatility in form and function allows it to be used in a variety of packaging formats, from flexible films to rigid containers. This adaptability is crucial as it enables PHA to meet the diverse needs of the packaging industry, encompassing everything from single-use bags and wraps to durable, reusable containers. Moreover, ongoing advancements in PHA production technology are improving the material’s properties, such as its barrier resistance, mechanical strength, and clarity, making it even more competitive with traditional plastics used in packaging.

Governments worldwide are also playing a pivotal role in this trend by implementing policies that encourage the use of biodegradable materials. For instance, bans on single-use plastics in numerous countries have created a regulated demand for alternative materials that can perform similar functions without harming the environment. PHA is benefiting from these regulations as it is positioned as a compliant, sustainable alternative.

The trend towards sustainable packaging is not only limited to consumer products. It also extends to industries such as pharmaceuticals and electronics, where packaging integrity and safety are paramount. PHA’s biocompatibility makes it suitable for sensitive applications, adding another layer of value to its use in sustainable packaging solutions.

However, despite its growing popularity, the challenge remains in scaling up the production of PHA to meet the increasing demand while keeping costs competitive. The industry is responding by investing in new production facilities and enhancing microbial fermentation techniques to increase yield and reduce production costs. These efforts are crucial for maintaining the momentum of this trend and ensuring that PHA can be a viable long-term solution for the global shift toward sustainable packaging.

Regional Analysis

In 2023, the Asia Pacific region emerged as the most lucrative market for industrial air compressors, securing the largest market share of 43.5%. This significant market dominance is primarily attributed to rapid industrialization in countries such as China, India, and Japan, which has amplified the demand for industrial air compressors across various sectors including manufacturing, construction, and automotive.

The growth in this region is further bolstered by extensive infrastructure development projects that heavily rely on compressed air for a myriad of applications, such as operating pneumatic tools and machinery. Additionally, there is a growing emphasis on energy efficiency and the adoption of sustainable technologies, which has accelerated the integration of advanced air compressor technologies in the region.

Moreover, supportive government policies and substantial investments in infrastructure development are continuously driving the market forward. These initiatives not only enhance the operational capabilities of industries but also support the overall growth of the industrial air compressor market in the Asia Pacific.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Polyhydroxyalkanoate (PHA) market features several key players contributing to its growth and development. These players are involved in various aspects of the PHA value chain, including production, research and development, distribution, and application. Some of the prominent companies in the PHA market

Market Key Players

- Danimer Scientific

- TianAn Biologic Materials Co., Ltd.

- Biomer

- Kaneka Corporation

- Bio-on S.p.A.

- Shenzhen Ecomann Biotechnology Co., Ltd.

- Newlight Technologies LLC

- Metabolix Inc.

- Tepha, Inc.

- Meredian Holdings Group Inc.

- Bioplus Life Sciences Pvt. Ltd.

- Mango Materials Inc.

- Yield10 Bioscience, Inc.

- P&G Chemicals

- PHB Industrial S.A

Recent Development

In 2023 Danimer Scientific, the company continued its commitment to sustainable solutions, with its PHA-based products gaining traction in various applications such as packaging, foodservice products, and films.

In 2023 TianAn Biologic Materials Co., Ltd, the company demonstrated steady growth, with its PHA-based products gaining traction in various industries such as packaging, agriculture, and medical devices.

Report Scope

Report Features Description Market Value (2023) USD 123.1 Mn Forecast Revenue (2033) US$ 389.2 Mn CAGR (2024-2033) 12.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Short Chain Length, Medium Chain Length, Long Chain Length), By Production Method(Vegetable Oil Fermentation, Methane Fermentation), By Form(Co-polymerized PHA, Linear PHA), By Application(Packaging & Food Services, Biomedical, Agriculture, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Danimer Scientific, TianAn Biologic Materials Co., Ltd., Biomer, Kaneka Corporation, Bio-on S.p.A., Shenzhen Ecomann Biotechnology Co., Ltd., Newlight Technologies LLC, Metabolix Inc., Tepha, Inc., Meredian Holdings Group Inc., Bioplus Life Sciences Pvt. Ltd., Mango Materials Inc., Yield10 Bioscience, Inc., P&G Chemicals, PHB Industrial S.A Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Polyhydroxyalkanoate (PHA) Market?Polyhydroxyalkanoate (PHA) Market size is expected to be worth around USD 389.2 Million by 2033, from USD 123.1 Million in 2023

What CAGR is projected for the Polyhydroxyalkanoate (PHA) Market?The Polyhydroxyalkanoate (PHA) Market is expected to grow at 12.2% CAGR (2023-2033).Name the major industry players in the Polyhydroxyalkanoate (PHA) Market?Danimer Scientific, TianAn Biologic Materials Co., Ltd., Biomer, Kaneka Corporation, Bio-on S.p.A., Shenzhen Ecomann Biotechnology Co., Ltd., Newlight Technologies LLC, Metabolix Inc., Tepha, Inc., Meredian Holdings Group Inc., Bioplus Life Sciences Pvt. Ltd., Mango Materials Inc., Yield10 Bioscience, Inc., P&G Chemicals, PHB Industrial S.A

Polyhydroxyalkanoate (PHA) MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Polyhydroxyalkanoate (PHA) MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Danimer Scientific

- TianAn Biologic Materials Co., Ltd.

- Biomer

- Kaneka Corporation

- Bio-on S.p.A.

- Shenzhen Ecomann Biotechnology Co., Ltd.

- Newlight Technologies LLC

- Metabolix Inc.

- Tepha, Inc.

- Meredian Holdings Group Inc.

- Bioplus Life Sciences Pvt. Ltd.

- Mango Materials Inc.

- Yield10 Bioscience, Inc.

- P&G Chemicals

- PHB Industrial S.A