Global Polyarylsulfone Market By Type (Polyetherimide (PEI) And Polyethersulfone (PESU), Polysulfone (PSU), and Polyphenylsulfone (PPSU)), By End-Uses (Food and Beverages, Electrical And electronics , Automotive, Healthcare, Water treatment, Aerospace, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 55807

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

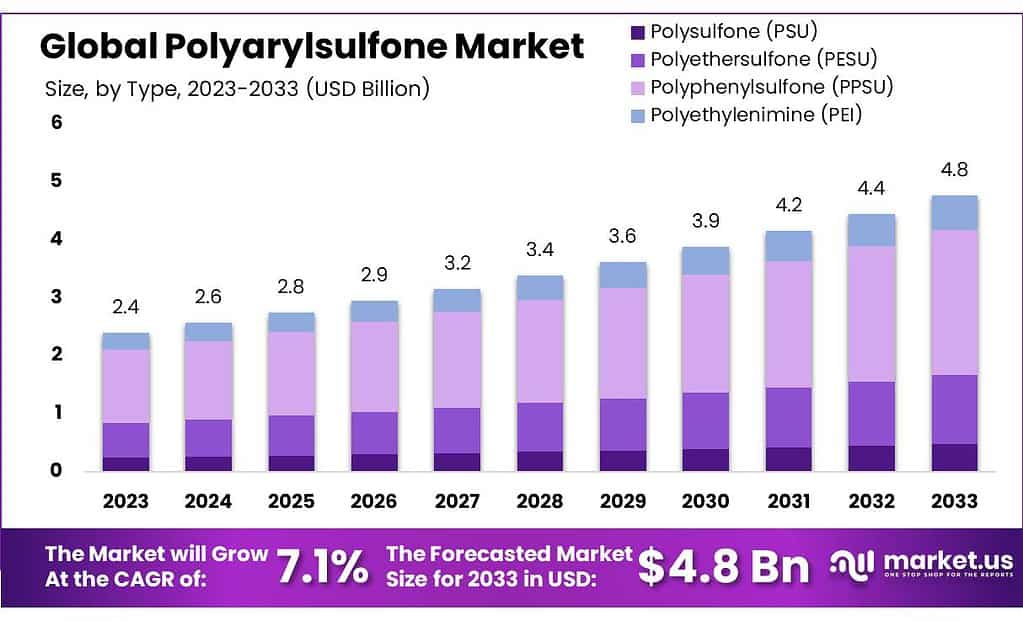

The Polyarylsulfone Market size is expected to be worth around USD 4.8 billion by 2033, from USD 2.4 Bn in 2023, growing at a CAGR of 7.1% during the forecast period from 2023 to 2033.

The polyarylsulfone market refers to the industry involved in the production, distribution, and utilization of polyarylsulfone (PAS) polymers. Polyarylsulfones are high-performance engineering thermoplastics characterized by their exceptional thermal stability, mechanical strength, chemical resistance, and electrical properties.

They find diverse applications across various industries such as automotive, aerospace, electronics, healthcare, and plumbing due to their heat resistance, toughness, and ability to withstand harsh environments. The market involves the manufacturing and sale of polyarylsulfone resins, compounds, and products, catering to the demand for durable, heat-resistant materials in specialized applications.

Key Takeaways

- Polyarylsulfone Market is anticipated to reach around USD 4.8 billion in 2033, soaring from USD 2.4 billion in 2023, At a CAGR of 7.1%.

- In 2023, polyphenylsulfone led the market, 52.6% share due to its outstanding properties.

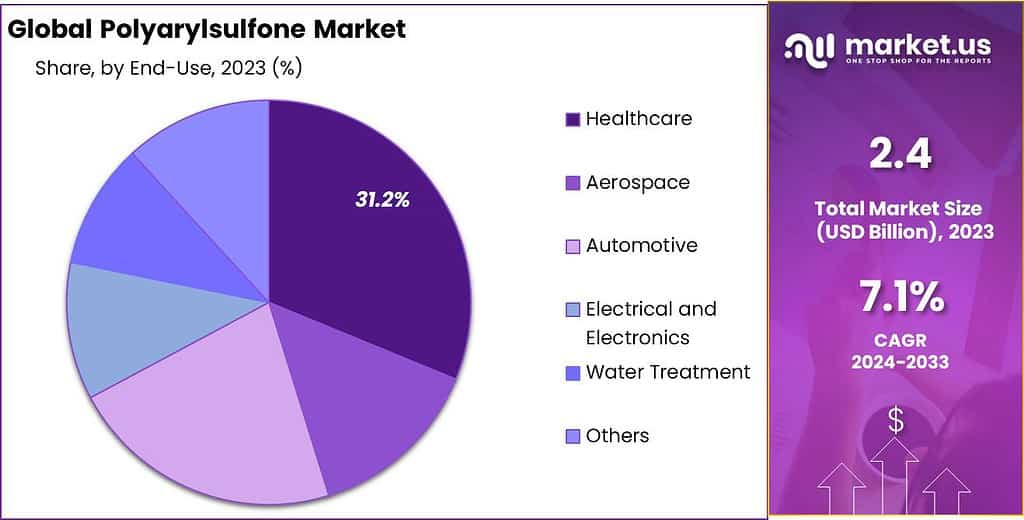

- Healthcare emerged as the primary end-user, holding over 31.2% share in 2023.

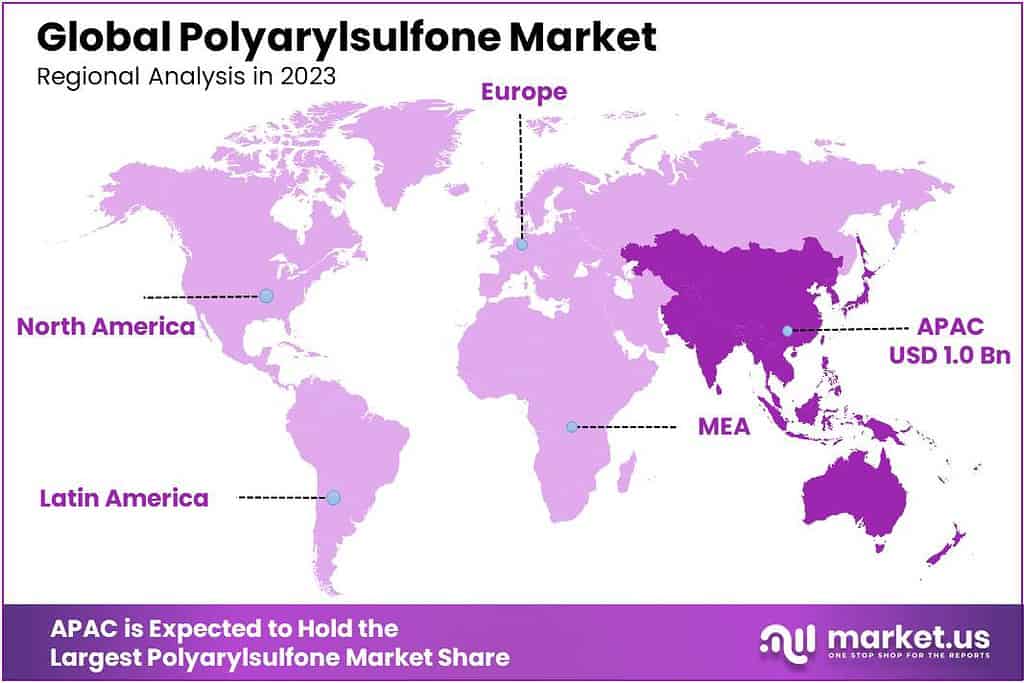

- Asia-Pacific Dominance led the market in 2023, accounting for over 42.3% share

Type Analysis

In 2023, the Polyarylsulfone market was notably led by Polyphenylsulfone (PPSU), capturing an impressive share of over 52.6%. Polyphenylsulfone (PPSU) took the Polyarylsulfone market by storm in 2023 due to its exceptional properties and diverse applications across industries.

Its high-temperature resistance, exceptional mechanical strength, and outstanding chemical durability made PPSU an indispensable choice in sectors like aerospace, automotive manufacturing, healthcare, and household goods manufacturing.

PESU is used extensively in safety shields, printed circuits, and connectors. PPSU’s ability to be sterilized by high-temperature steam easily without any feature damage makes it a very attractive product that could see increased demand for dental instruments and medical devices at the fastest rate. PPSU is a popular material for aircraft interiors.

With stringent FDA regulations, growing concerns over food safety and quality are driving demand for PSU. This will in turn drive PSU demand to manufacture membranes. PSU will likely see higher demand because of its increasing use in the oil & gas and medical industries, as well as for membrane applications in wastewater treatment and sanitation.

PAS is used primarily in beverages to produce juices and wines, while it is used in food for different cereals such as corn and dairy products. In the future, the market is expected to grow because of the growing demand for wastewater treatment.

End-Use Analysis

In 2023, the Polyarylsulfone market saw Healthcare emerge as the dominant end-user, capturing a substantial share of over 31.2%. 2023 saw Healthcare lead the Polyarylsulfone market, reflecting their indispensable presence within medical device production.

Polyphenylsulfone (PPSU) materials have become essential in many healthcare applications due to their remarkable properties that meet stringent manufacturing demands for medical device production. Polyarylsulfones exhibit an exceptional combination of characteristics that makes them suitable for medical equipment that regularly undergoes sterilization processes involving high heat.

Their exceptional high-temperature resistance ensures their structural integrity and functionality even under repeated exposure to high heat temperatures, making these materials the ideal solution.

Polyether sulfone membranes are expected to capture a large share of the market during the forecast period. This is due to their variable pore sizes, high flow, and chemical resistance. Because of its lightweight, high impact, and tensile strength as well as reduced creep tendency and high dimensional stability, Polyarylsulfone has been used in electronic applications like switch latches. Due to its high thermal stability and chemical resistance, low moisture absorption, and low thermal stability, it’s used in household appliances like espresso machines and pipe connection fittings.

Key Market Segments

By Type

- Polyetherimide (PEI) & Polyethersulfone (PESU)

- Polysulfone (PSU)

- Polyphenylsulfone (PPSU)

By End-Uses

- Food and Beverages

- Electrical & electronics

- Automotive

- Healthcare

- Water treatment

- Aerospace

- Other End-Uses

Drivers

Polyarylsulfone market growth is being propelled by several factors. First among these is its versatility across industries – especially healthcare applications. Polyphenylsulfone (PPSU), Polysulfone (PSU), Polyethersulfone (PESU) and polyethyleneimine (PEI) all possess excellent properties such as temperature resistance, mechanical strength and chemical durability; making these materials desirable components in healthcare, aerospace, automotive electronics as well as water treatment applications to meet different industrial demands.

Healthcare industry demands provide additional impetus for market growth. Polyarylsulfones (PPSU) are increasingly used in medical devices due to their sterilization capabilities and biocompatibility; they play a crucial role in providing stringent hygiene standards and patient safety requirements in healthcare environments, driving up their usage and demand within this sector.

Industries like aerospace, automotive, and electronics really like using Polyarylsulfones because these materials can handle really tough conditions. They stay strong and keep their shape even when things get really harsh, which is super important for important parts in these industries. The growth of the market is also because everyone is thinking more about taking care of the environment and following strict rules.

Companies want to use materials that are good for the environment and follow the rules. Polyarylsulfones fit into this because they’re eco-friendly and meet the rules, so companies use them more in making different things. These drivers fuel the expansion of the Polyarylsulfone market, positioning these materials as essential components in industries where durability, temperature resistance, and chemical stability are paramount.

Restraints

The Polyarylsulfone market encounters several restraints that impede its growth trajectory. Firstly, cost factors play a significant role. The production cost associated with high-performance Polyarylsulfones can be relatively high, posing a challenge for their widespread adoption. Industries might seek more budget-friendly alternatives, impacting the extensive use of these materials across various applications.

Another restraint lies in the limited compatibility of Polyarylsulfones with certain materials. Not all substances or composites are compatible with these materials, limiting their application in specific industries or applications requiring compatibility with particular materials.

Complex manufacturing processes present another challenge. The production of Polyarylsulfones involves intricate processes, specialized equipment, and expertise. This complexity can lead to longer production times and increased expenses, potentially affecting their accessibility and utilization in certain industries.

These materials face competition from alternative options that offer similar properties or are more cost-effective. This competition poses a challenge, as industries might opt for alternatives, impacting the market share and adoption of Polyarylsulfones.

Regulatory challenges present hurdles in the form of stringent standards and evolving regulations. Ensuring compliance with constantly evolving regulations demands continuous adjustments and investments, which could increase production costs and complexity, affecting the market growth of Polyarylsulfones.

To overcome these restraints, the industry needs innovations that reduce production costs, enhance material compatibility, streamline manufacturing processes, and address regulatory complexities. These efforts are crucial to encouraging broader acceptance and utilization of Polyarylsulfones across various industries, despite the existing challenges.

Opportunities

The Polyarylsulfone market showcases several promising opportunities for advancement and expansion. Firstly, ongoing innovation and research in material science offer a pathway for developing improved variants of Polyarylsulfones. These innovations might focus on enhancing properties like cost-efficiency, improved material compatibility, and broader application potentials, unlocking new market segments and diverse applications.

Emerging applications in industries such as automotive, aerospace, and electronics present significant opportunities for Polyarylsulfones. The demand for lightweight yet durable materials aligns with the inherent properties of Polyarylsulfones, like their strength, heat resistance, and structural integrity. This positions them favorably for growth in these sectors, as they cater to evolving industry requirements.

In the healthcare realm, particularly in medical devices and instruments, there exists a growing need for sterilizable and biocompatible materials. Polyarylsulfones, notably PPSU, boast properties that suit these requirements, positioning them as valuable materials in the healthcare sector, offering significant expansion opportunities.

The market benefits from the increasing global emphasis on sustainability. The eco-friendly attributes of Polyarylsulfones make them appealing to industries aiming for environmentally conscious manufacturing processes, presenting opportunities for their wider adoption.

Additionally, stringent regulatory requirements across various industries create opportunities for Polyarylsulfones. Their ability to comply with evolving standards positions them as preferred materials in industries where meeting specific regulations is critical.

Realizing these opportunities necessitates substantial investment in research and development to improve properties, identify novel applications, and ensure continuous compliance with evolving regulations. Exploring emerging sectors and aligning with sustainability goals can further propel the market for Polyarylsulfones toward growth and diversification.

Challenges

The Polyarylsulfone market confronts various challenges hindering its widespread adoption and growth. Firstly, facing competition from alternative materials offering similar properties or cost advantages poses a significant hurdle. Industries might opt for these substitutes, impacting the market share and broader acceptance of Polyarylsulfones.

Additionally, the production cost of high-performance Polyarylsulfones can be relatively high, presenting a challenge for their widespread adoption. Finding cost-effective production methods without compromising quality remains a critical challenge to address.

Another challenge lies in the limited compatibility of Polyarylsulfones with certain materials. Not all substances or composites are compatible with these materials, restricting their application in industries that necessitate compatibility with specific substances.

As noted, Polyarylsulfone manufacturing processes are complex, involving specialized equipment and expertise that may lead to longer production times and increased expenses, creating challenges when it comes to accessibility and affordability.

Meeting stringent regulatory standards and compliance requires ongoing adjustments, further adding complexity and cost to the manufacturing process. Overcoming these hurdles requires joint efforts in creating cost-effective production methods, improving material compatibility and streamlining manufacturing processes while meeting ever-evolving regulations. Innovations which address these concerns will play a pivotal role in driving wider acceptance and utilization of Polyarylsulfones across various industries.

Regional Analysis

Asia Pacific (APAC) had the largest revenue share at over 42.3% in 2023. The Asia Pacific is benefiting from the presence of a well-developed and well-organized thermoplastic industry, as well as ongoing technical development in key industries like automotive, aerospace, and medical.

The Asia Pacific, which includes China, Japan, and South Korea, was the largest market for Polyarylsulfones. It is expected to grow at the fastest rate during the forecast period. This is mainly due to the large-scale presence of the automotive industry and developing manufacturing industries primarily in India, and China.

Positive growth potential is being created by several factors, including increased automotive production, a high standard of living, a growing population, and the presence in Europe of newly developed economies. This region is seeing rapid urbanization and the presence of large-scale, reputable automakers. These factors are helping to develop the market for automotive products.

Rising demand for consumer electronics in emerging markets such as Saudi Arabia, and Qatar, and the proliferation of wearables are expected to be key trends in driving PAS demand in this region. The MEA region will continue to witness the expansion of the Polyarylsulfone industry due to the lifting of sanctions against Iran and the push for economic diversification among the oil-exporting Gulf Cooperation Council countries.

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Many of the market participants are actively involved in mergers and acquisition activities over the past few years. Key companies are looking to enhance their regional presence, particularly in unorganized markets such as India, Brazil, and China which is increasing the importance of the distribution channel in this market.

Key Market Players

- BASF

- Sabic

- Solvay

- Quadrant AG

- Sumitomo Chemicals Co., Ltd.

- Ensinger

- Polymer Industries

- Techmer PM (Polymer Modifiers)

- RTP Company

- Westlake Plastics Company, Inc.

Recent Developments

2023 Evonik: Announced the development of a new high-performance PAES grade with improved fire resistance for use in aircraft interiors.

2023 Solvay: Invested €100 million to expand its PAES production capacity in China to meet the growing demand in the Asian market.

2022 BASF: Acquired the PAES business of Quadrant Chemicals, expanding its product portfolio and geographic reach.

Report Scope

Report Features Description Market Value (2023) US$ 2.4 Bn Forecast Revenue (2033) US$ 4.8 Bn CAGR (2023-2033) 7.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Polyetherimide (PEI) & Polyethersulfone (PESU), Polysulfone (PSU), Polyphenylsulfone (PPSU)), By End-Uses(Food and Beverages, Electrical & electronics, Automotive, Healthcare, Water treatment, Aerospace, Other End-Uses) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF, Sabic, Solvay, Quadrant AG, Sumitomo Chemicals Co., Ltd., Ensinger, Polymer Industries, Techmer PM (Polymer Modifiers), RTP Company, Westlake Plastics Company, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What Is The Size Of Polyarylsulfone Market?Polyarylsulfone Market size is expected to be worth around USD 4.8 billion by 2033, from USD 2.4 Bn in 2023

What is the CAGR for the Polyarylsulfone Market?The Polyarylsulfone Market expected to grow at a CAGR of 7.1% during 2023-2032.Who are the key players in the Polyarylsulfone Market?BASF SE, Sabic, Solvay, Quadrant AG, Sumitomo Chemicals Co., Ltd., Ensinger, Polymer Industries, Techmer PM (Polymer Modifiers), RTP Company, Westlake Plastics Company, Inc.

-

-

- BASF

- Sabic

- Solvay

- Quadrant AG

- Sumitomo Chemicals Co., Ltd.

- Ensinger

- Polymer Industries

- Techmer PM (Polymer Modifiers)

- RTP Company

- Westlake Plastics Company, Inc.