Global Polyaluminum Chloride Market Size, Share and Future Trends Analysis Report By Form (Solid, Liquid), By Basicity (Low, Medium, High), By End-Use (Water Treatment, Oil and Gas, Cosmetic and Personal Care, Paper and Pulp, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149726

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

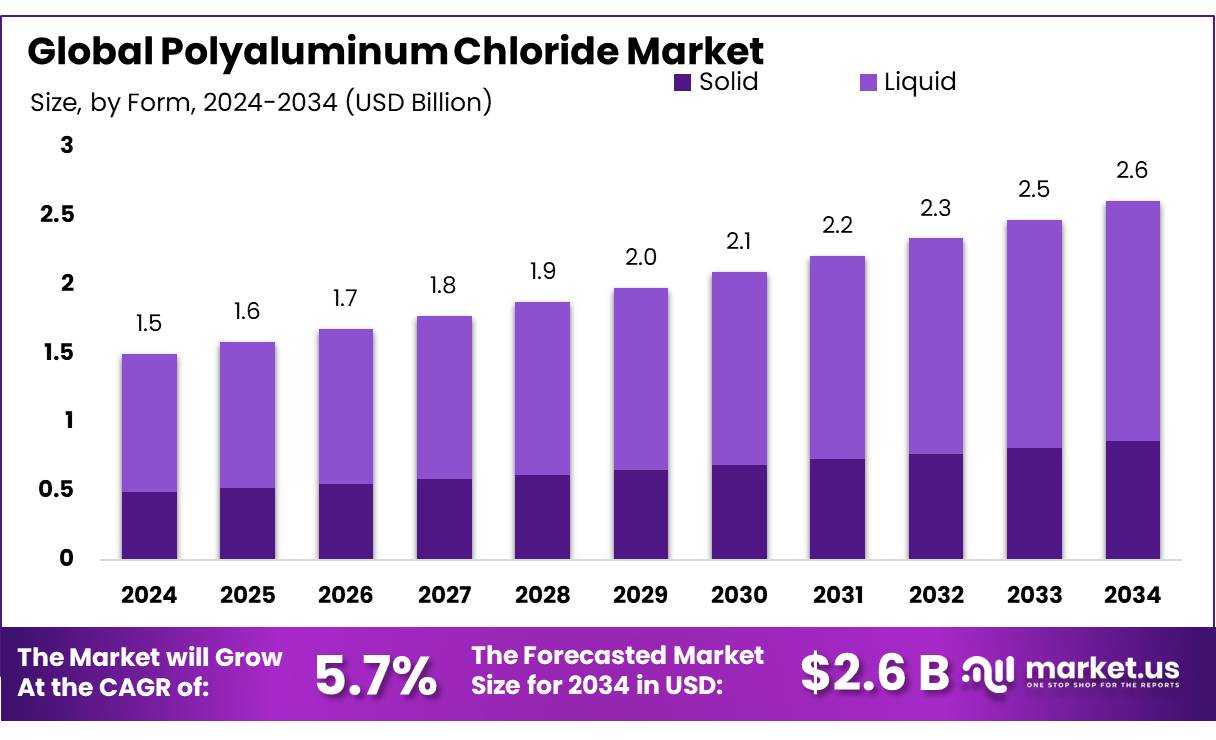

The Global Polyaluminum Chloride Market size is expected to be worth around USD 2.6 Billion by 2034, from USD 1.5 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

The global polyaluminum chloride (PAC) market is experiencing significant growth, driven by increasing demand for efficient water treatment solutions across municipal and industrial sectors. PAC, an inorganic polymer coagulant, is widely utilized for its superior performance in coagulating and flocculating suspended particles, making it indispensable in water purification processes.

Government initiatives play a pivotal role in propelling the PAC market. For instance, India’s Jal Jeevan Mission aims to provide safe and adequate drinking water through individual household tap connections by 2024, thereby increasing the demand for water treatment chemicals like PAC. Similarly, the U.S. Environmental Protection Agency’s Effluent Guidelines Program Plan 15, announced in January 2023, regulates the amount of effluent discharge from industrial sources, necessitating the use of effective coagulants in wastewater treatment.

In the United States, the Environmental Protection Agency (EPA) reported a domestic production of approximately 66 million kilograms of PAC in 2019. The same year saw imports and exports of 7 million kilograms each, indicating a balanced trade scenario.

The versatility of PAC extends beyond water treatment. In the paper and pulp industry, PAC is employed to enhance paper quality and processing efficiency. According to the European Association representing the paper industry, the demand for paper increased by 3.6% in 2021, indicating a growing need for PAC in this sector. Additionally, the cosmetics and personal care industry utilizes PAC in the formulation of deodorants and antiperspirants, capitalizing on its properties to reduce perspiration.

Key Takeaways

- Polyaluminum Chloride Market size is expected to be worth around USD 2.6 Billion by 2034, from USD 1.5 Billion in 2024, growing at a CAGR of 5.7%.

- Liquid held a dominant market position, capturing more than a 67.4% share in the polyaluminum chloride market.

- High held a dominant market position, capturing more than a 47.7% share in the polyaluminum chloride market.

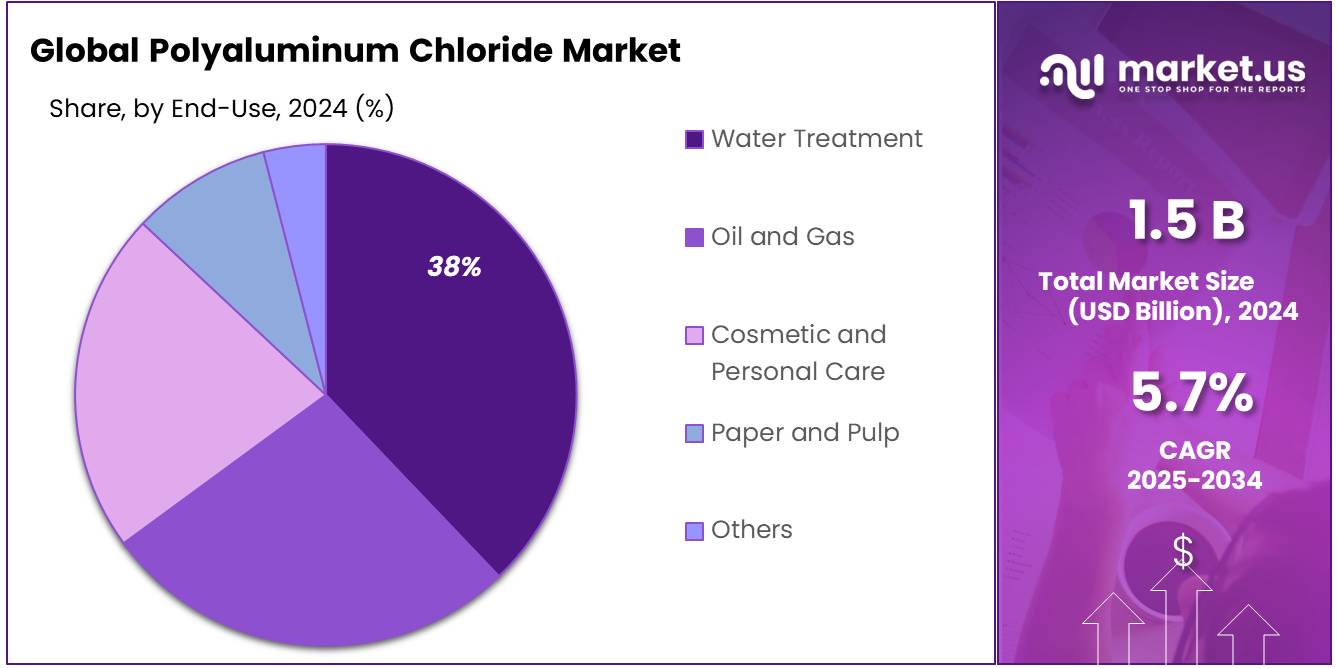

- Water Treatment held a dominant market position, capturing more than a 37.8% share in the global polyaluminum chloride market.

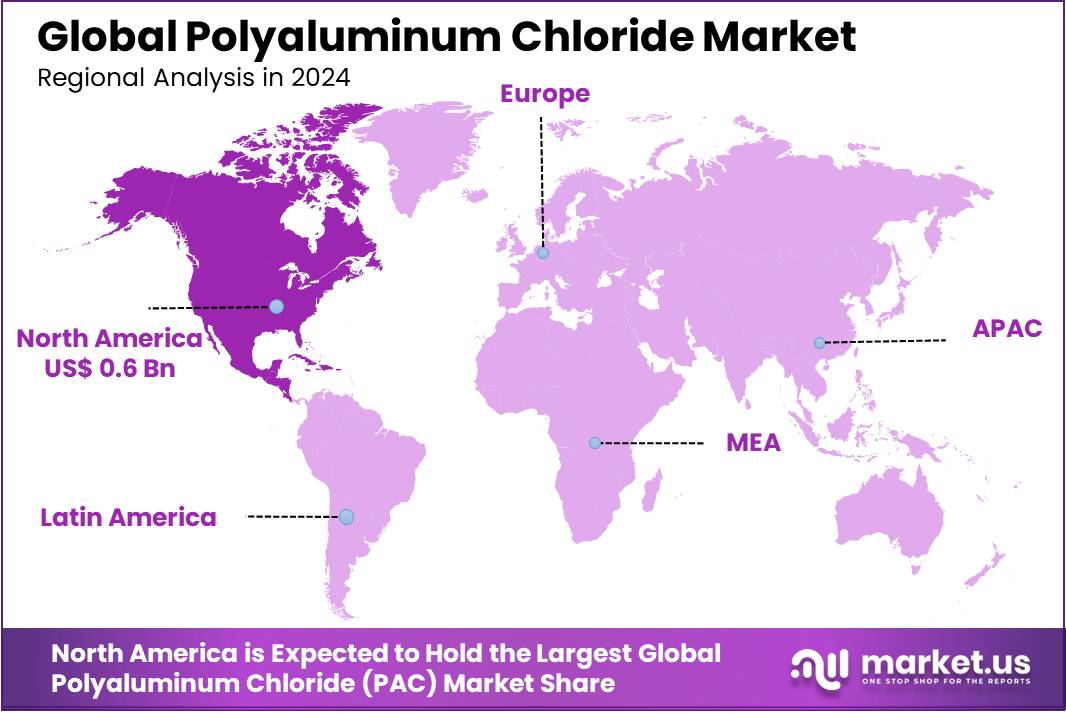

- North America emerged as the leading region in the global polyaluminum chloride (PAC) market, securing a commanding 46.4% share and achieving a market valuation of approximately USD 0.6 billion.

Analysts Viewpoint

From an investment perspective, PAC offers promising opportunities. The shift towards liquid PAC formulations is notable, driven by their ease of handling and precise dosing capabilities. Moreover, advancements in production technologies, including automation and improved polymerization techniques, are enhancing efficiency and reducing costs.

However, investors should be aware of potential risks. Fluctuating raw material prices can impact profitability, and the market faces competition from alternative coagulants like alum and ferric chloride. Additionally, stringent environmental regulations necessitate continuous innovation and compliance, which may require significant investment.

Consumer insights reveal a growing preference for eco-friendly and efficient water treatment solutions. PAC’s lower sludge production and effectiveness across various pH levels align with these preferences. Technological advancements are further enhancing PAC’s appeal, with manufacturers focusing on developing sustainable and high-performance formulations.

Regulatory frameworks, particularly in developed regions, are becoming more stringent, emphasizing the need for effective water treatment solutions, thereby positively influencing PAC demand. Overall, while the PAC market presents lucrative opportunities, stakeholders must navigate the challenges of raw material volatility and regulatory compliance to capitalize on its growth potential.

By Form

Liquid Form Leads with 67.4% Share in 2024 Owing to High Demand in Water Treatment Applications

In 2024, Liquid held a dominant market position, capturing more than a 67.4% share in the global polyaluminum chloride (PAC) market by form. This significant lead can be attributed to its superior solubility and ease of dosing in large-scale municipal and industrial water treatment plants. Liquid PAC is preferred due to its rapid mixing capabilities, consistent performance, and lower production of sludge compared to powdered alternatives.

The form’s popularity has grown steadily as governments and utilities prioritize efficient water purification systems. With rising investments in water infrastructure across Asia and North America, the demand for liquid PAC is expected to remain strong through 2025, further solidifying its lead in the market.

By Basicity

High Basicity PAC Leads with 47.7% Share in 2024 Driven by Strong Coagulation Efficiency and Lower Sludge Generation

In 2024, High held a dominant market position, capturing more than a 47.7% share in the polyaluminum chloride (PAC) market by basicity. This preference is largely due to its strong coagulation efficiency, especially in drinking water and industrial wastewater treatment. High basicity PAC produces less residual aluminum and reduces sludge volume, making it more economical for long-term operations.

As more water treatment facilities move toward sustainable and cost-efficient practices, the demand for high basicity PAC has remained steady. Going into 2025, this segment is expected to retain its lead, supported by regulatory emphasis on cleaner water output and minimized chemical residuals.

By End-Use

Water Treatment Leads with 37.8% Share in 2024 as Demand for Clean Water Rises Globally

In 2024, Water Treatment held a dominant market position, capturing more than a 37.8% share in the global polyaluminum chloride (PAC) market by end-use. The strong uptake in this segment is driven by increasing urbanization, stricter environmental norms, and growing concerns over access to safe drinking water.Municipal bodies and industries are relying more on PAC due to its effective coagulating properties and ability to remove turbidity, organic matter, and heavy metals from water sources. This trend has been especially strong in regions like Asia-Pacific and the Middle East, where water scarcity and pollution are pressing challenges. By 2025, the water treatment sector is expected to further boost PAC consumption, backed by infrastructure upgrades and rising global awareness about water quality.

Key Market Segments

By Form

-

- Solid

- Liquid

By Basicity

- Low

- Medium

- High

By End-Use

- Water Treatment

- Oil and Gas

- Cosmetic and Personal Care

- Paper and Pulp

- Others

Drivers

Rising Global Demand for Clean Water Fuels Growth in Polyaluminum Chloride (PAC) Market

The escalating global demand for clean and safe water is a significant driver for the growth of the polyaluminum chloride (PAC) market. PAC is extensively utilized in water treatment processes due to its efficiency in coagulating and removing impurities.

The surge in water treatment requirements is not only due to population growth and urbanization but also because of the rising industrial activities that contribute to water pollution. Industries such as food and beverage, pharmaceuticals, and textiles discharge significant amounts of wastewater, necessitating effective treatment solutions. PAC, with its superior coagulating properties, is instrumental in treating such industrial effluents, thereby ensuring compliance with environmental regulations and safeguarding public health.

Government initiatives worldwide are also propelling the demand for PAC. For instance, the Indian government’s Jal Jeevan Mission aims to provide safe and adequate drinking water to all rural households by 2024. Such programs require robust water treatment solutions, thereby increasing the reliance on PAC.

Furthermore, the growing concerns over water scarcity have led to the adoption of advanced water treatment technologies, including desalination and wastewater recycling, where PAC is a critical component. The integration of PAC in these processes enhances the efficiency of contaminant removal, making it indispensable in achieving sustainable water management goals.

Restraints

Environmental Regulations Pose Challenges to Polyaluminum Chloride (PAC) Market Growth

The growth of the polyaluminum chloride (PAC) market is increasingly influenced by stringent environmental regulations aimed at safeguarding ecosystems and public health. While PAC is widely used in water treatment for its efficiency in coagulating impurities, concerns have been raised about its environmental impact, particularly regarding the discharge of untreated wastewater.

A notable instance highlighting these concerns occurred in Ludhiana, India, where the Buddha Dariya Action Front conducted an inspection near the Tajpur dairy complex. The team discovered significant environmental violations, including the direct discharge of untreated wastewater from effluent treatment plants and nearby dairies into the Buddha Dariya river. This not only contravenes environmental regulations but also poses serious risks to aquatic life and public health.

Such incidents underscore the challenges faced by the PAC industry in adhering to environmental standards. Regulatory bodies worldwide are tightening controls on industrial discharges, necessitating investments in advanced treatment technologies and stricter compliance measures. These requirements can increase operational costs for PAC manufacturers and users, potentially affecting market dynamics.

Moreover, the environmental implications of PAC usage extend beyond wastewater discharge. Improper application or accidental releases of concentrated PAC can pose risks to aquatic ecosystems, particularly in sensitive habitats. Therefore, regulatory compliance and proper handling protocols are essential to ensure environmental benefits without compromising ecosystem health.

Opportunity

Government-Led Water Infrastructure Projects Open New Avenues for PAC Market Growth

The expansion of government-led water infrastructure initiatives presents significant growth opportunities for the polyaluminum chloride (PAC) market. PAC is a key coagulant used in water treatment processes, and its demand is closely tied to the development of water supply and sanitation infrastructure.

In India, the Jal Jeevan Mission (JJM) aims to provide tap water to every rural household. As of March 31, 2025, approximately 14.56 crore rural households, representing about 73% coverage, have been connected under this mission. Thirteen states and Union Territories, including Goa, Haryana, Gujarat, and Telangana, have achieved 100% coverage. Additionally, 2.12 lakh villages have been declared “Har Ghar Jal certified,” indicating that every household has a functional tap water connection. To ensure local involvement and monitoring, 6.2 lakh village-level water and sanitation committees have been formed.

These developments underscore the significant role that government initiatives and infrastructure investments play in driving the demand for PAC. As countries continue to prioritize access to clean water, the PAC market is poised for sustained growth.

Trends

Embracing Sustainability: The Shift Towards Eco-Friendly PAC Formulations

A notable trend in the polyaluminum chloride (PAC) market is the increasing emphasis on developing eco-friendly and sustainable formulations. This shift is driven by growing environmental concerns and stringent regulations aimed at reducing the ecological footprint of water treatment processes.

In India, for instance, the Uttar Pradesh Pollution Control Board (UPPCB) reported a 68.8% improvement in water quality across rivers and reservoirs in 2024, compared to the previous year. This improvement is attributed to sustained initiatives, strict monitoring, and environmental campaigns like the Namami Gange Mission and Swachh Bharat Abhiyan.

The state enhanced wastewater treatment infrastructure by establishing 152 sewage treatment plants (STPs), with 141 currently operational and 126 meeting environmental standards. These efforts underscore the importance of effective and environmentally friendly water treatment solutions, such as PAC, in achieving significant water quality improvements.

Furthermore, the global PAC market is experiencing growth due to its superior performance compared to traditional coagulants like alum. PAC’s effectiveness in water and wastewater treatment processes, coupled with increasing urbanization and government initiatives supporting water management projects, is bolstering market expansion.

Regional Analysis

North America Commands 46.4% of the Global PAC Market in 2024, Valued at $0.6 Billion

In 2024, North America emerged as the leading region in the global polyaluminum chloride (PAC) market, securing a commanding 46.4% share and achieving a market valuation of approximately USD 0.6 billion. This dominance is primarily attributed to the region’s stringent environmental regulations and the pressing need to upgrade aging water infrastructure. Municipal water treatment facilities are increasingly adopting PAC due to its superior coagulation efficiency and reduced sludge production, which are essential for meeting the United States Environmental Protection Agency’s (EPA) rigorous water quality standards.

The United States, accounting for about 28% of the global PAC consumption, has been at the forefront of this demand surge. The country’s focus on enhancing water treatment processes, especially in response to emerging contaminants like microplastics and pharmaceutical residues, has further propelled the adoption of advanced PAC formulations. Innovations such as hybrid PAC variants, which combine the benefits of aluminum and iron-based coagulants, are gaining traction for their enhanced impurity removal capabilities.

Moreover, the industrial sector, encompassing pulp and paper, textiles, and food and beverage industries, significantly contributes to the regional PAC demand. These industries rely on PAC for efficient wastewater treatment to comply with environmental discharge regulations. The consistent industrial activities, coupled with the region’s proactive approach to environmental sustainability, have solidified North America’s position in the PAC market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Aditya Birla Chemicals is a key player in the global PAC market, offering high-quality polyaluminum chloride for municipal and industrial water treatment. The company operates under the flagship of Grasim Industries and has a strong presence across Asia and Africa. In 2024, the firm focused on sustainability by optimizing energy-efficient production technologies. With India’s growing water infrastructure demands, Aditya Birla continues to expand its supply footprint through public sector partnerships and export contracts in emerging markets.

Airedale Chemical, based in the United Kingdom, plays a prominent role in the PAC market, particularly in Europe. The company specializes in the manufacture of liquid PAC solutions used in water treatment and process industries. In 2024, Airedale emphasized the development of more environmentally friendly coagulants to meet rising EU regulations. Its flexible packaging and tailored PAC formulations have strengthened its position in industrial wastewater treatment and food processing sectors across the UK and neighboring countries.

Headquartered in Japan, Central Glass Co., Ltd. is actively engaged in the production of high-purity PAC products for municipal water treatment and semiconductor manufacturing. The company’s PAC offerings are known for low residual aluminum content, meeting Japan’s strict water quality regulations. In 2024, it invested in process automation to improve output and reduce chemical waste. With an expanding distribution network in Southeast Asia, Central Glass is positioning itself as a reliable supplier of premium-grade PAC in the region.

Top Key Players in the Market

- Aditya Birla Chemicals (India) Limited

- Airedale Chemical

- Central Glass Co., Ltd.

- Coyne Chemicals

- De Dietrich Process Systems

- Feralco AB Ltd

- GEO Specialty Chemicals, Inc

- Gongyi Filter Industry Co. Ltd.

- Grasim Industries Ltd.

- Gujarat Alkalies and Chemicals

- Henan Aierfuke Chemicals Co. Ltd

- Kanoria Chemicals & Industries Limited

- Kemira Oyj

- Lvyuan Chem

- NALCO

- Summit Chemical Specialty Products, LLC.

Recent Developments

In 2024, Central Glass Co., Ltd. chemical segment, which includes PAC production, reported sales of approximately ¥102 billion.

In 2024, Airedale Chemical, a UK-based company, has solidified its position in the polyaluminium chloride (PAC) market by supplying a wide range of PAC products in various quantities, including 25L, 200L, 1000L, and bulk transfers.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Bn Forecast Revenue (2034) USD 2.6 Bn CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Solid, Liquid), By Basicity (Low, Medium, High), By End-Use (Water Treatment, Oil and Gas, Cosmetic and Personal Care, Paper and Pulp, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aditya Birla Chemicals (India) Limited, Airedale Chemical, Central Glass Co., Ltd., Coyne Chemicals, De Dietrich Process Systems, Feralco AB Ltd, GEO Specialty Chemicals, Inc, Gongyi Filter Industry Co. Ltd., Grasim Industries Ltd., Gujarat Alkalies and Chemicals, Henan Aierfuke Chemicals Co. Ltd, Kanoria Chemicals & Industries Limited, Kemira Oyj, Lvyuan Chem, NALCO, Summit Chemical Specialty Products, LLC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Polyaluminum Chloride MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Polyaluminum Chloride MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aditya Birla Chemicals (India) Limited

- Airedale Chemical

- Central Glass Co., Ltd.

- Coyne Chemicals

- De Dietrich Process Systems

- Feralco AB Ltd

- GEO Specialty Chemicals, Inc

- Gongyi Filter Industry Co. Ltd.

- Grasim Industries Ltd.

- Gujarat Alkalies and Chemicals

- Henan Aierfuke Chemicals Co. Ltd

- Kanoria Chemicals & Industries Limited

- Kemira Oyj

- Lvyuan Chem

- NALCO

- Summit Chemical Specialty Products, LLC.