Global Plasma Separation Tubes Market By Product (EDTA tubes, Lithium heparin tubes and Sodium heparin tubes), By Material (Glass and Plastic), By Application (Diagnostic procedures, Biochemical tests, Blood routine examination, Coagulation testing and Others), By End-User (Hospitals, Ambulatory surgical centres, Diagnostic centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169516

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

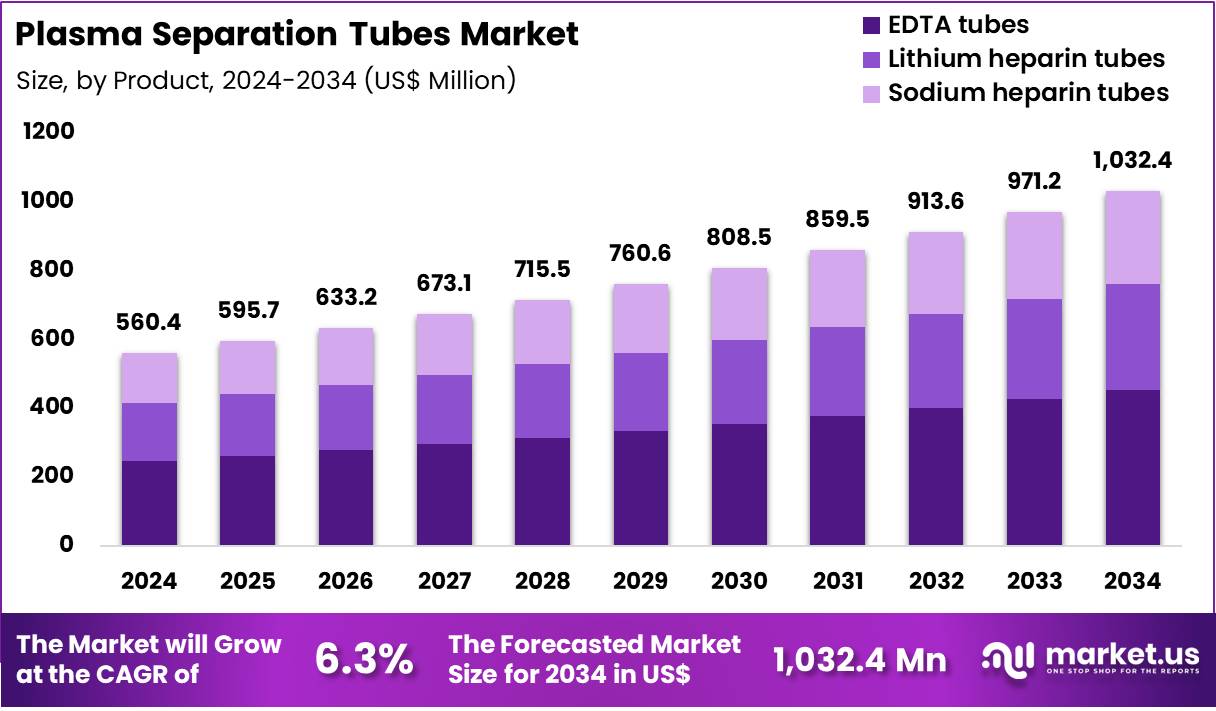

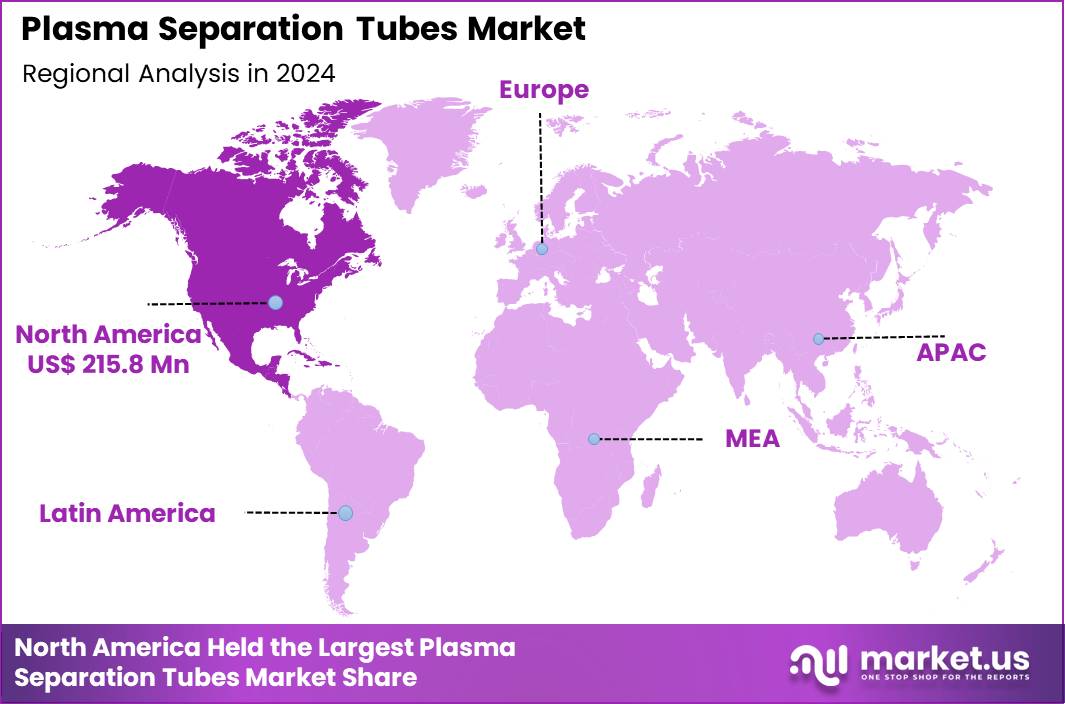

The Global Plasma Separation Tubes Market size is expected to be worth around US$ 1,032.4 Million by 2034 from US$ 560.4 Million in 2024, growing at a CAGR of 6.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.5% share with a revenue of US$ 215.8 Million.

The Plasma Separation Tubes Market is expected to grow at a steady pace driven by the rising demand for high-quality plasma samples across diagnostic laboratories, hospitals, and molecular testing facilities. Plasma separation tubes equipped with anticoagulants such as EDTA or heparin—enable rapid separation of plasma after centrifugation, supporting biochemistry, immunology, hematology, and coagulation workflows.

The expanding burden of chronic diseases, global adoption of preventive diagnostic screening, and increasing automation in sample-collection workflows accelerate demand for these tubes across healthcare systems. Growth is also supported by the increasing global volume of blood tests. WHO estimates that more than 1.5 billion diagnostic tests are performed annually across major health systems for infectious diseases alone, many requiring plasma as the primary specimen.

Manufacturers such as BD, Greiner Bio-One, Terumo, and Sarstedt continue to introduce improved polymer formulations, gel-separation technologies, and additive coatings to ensure stability, anti-hemolysis performance, and consistent plasma yield.

Key Takeaways

- In 2024, the market generated a revenue of US$ 560.4 million, with a CAGR of 6.3%, and is expected to reach US$ 1,032.4 million by the year 2034.

- The Product segment is divided into EDTA tubes, Lithium heparin tubes, and Sodium heparin tubes, with EDTA tubes taking the lead in 2024 with a market share of 43.9%

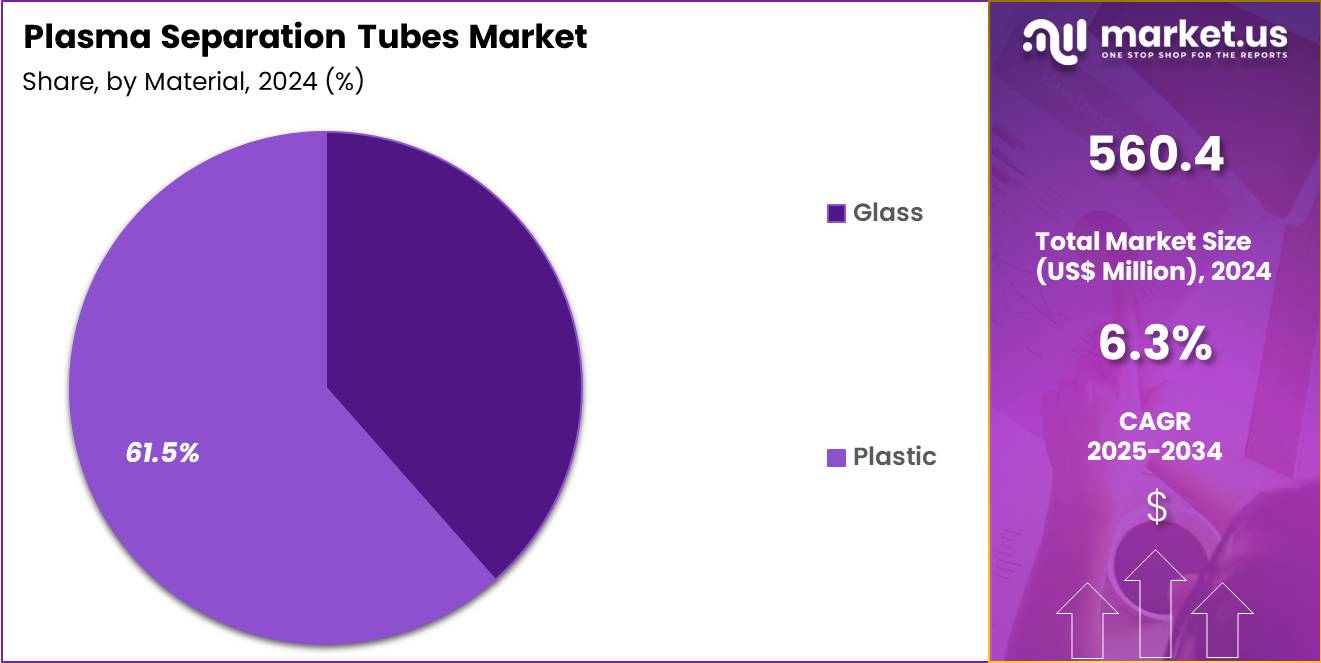

- The Material segment is divided into Glass, and Plastic, with Plastic testing taking the lead in 2024 with a market share of 61.5%

- The Application segment is divided into Diagnostic procedures, Biochemical tests, Blood routine examination, Coagulation testing, and Others, with Diagnostic procedures taking the lead in 2024 with a market share of 47.2%

- The End-User segment is divided into Hospitals, Ambulatory surgical centres, Diagnostic centers, and Others, with Hospitals taking the lead in 2024 with a market share of 40.8%

- North America led the market by securing a market share of 38.5% in 2024.

Product Analysis

EDTA tubes held the highest market share of 43.9% as they are the standard for hematology, molecular diagnostics, and routine plasma-based testing. EDTA provides optimal anticoagulation by chelating calcium, supporting plasma-based CBC tests, HbA1c screening, infectious disease PCR assays, and immunoassays. Globally, more than 900 million CBC tests are estimated to be performed each year, strongly supporting EDTA tube consumption. Hospitals prefer these tubes for stability, anti-hemolysis properties, and rapid separation when used with barrier gels.

With cardiovascular diseases responsible for over 17.9 million deaths annually (WHO), demand for biochemical testing—and thus lithium heparin tubes—continues to grow. These tubes are essential for stat chemistries and are compatible with automated plasma analyzers used in tertiary hospitals and national labs. Sodium heparin tubes remain important for specialized tests, particularly in blood gas analysis, trace-element testing, and certain therapeutic-drug monitoring assays.

Some popular examples include Sinymedical EDTA Plasma Tubes: Purple-top vacuum PET tubes with K2/K3-EDTA and separator gel; used for hematology and nucleic acid preservation. Greiner Bio-One VACUETTE EDTA/Gel Tubes: High-quality polymer tubes for precise plasma isolation in labs; supports analyzer compatibility.

Material Analysis

Plastic tubes dominated the market with 61.5% market share due to their safety, break-resistant design, lower transportation weight, and compatibility with automated processing. Plastic plasma separation tubes (PSTs) are evacuated, sterile polyethylene terephthalate (PET) tubes containing lithium heparin anticoagulant and a polymer gel barrier that, post-centrifugation, separates plasma from blood cells for rapid chemistry, therapeutic drug monitoring, and STAT testing.

The shatter-resistant plastic enhances safety over glass, with spray-coated additives ensuring quick anticoagulation without clotting delays. Healthcare facilities increasingly adopt polymer tubes for high-throughput analyzers, minimizing contamination risks. PET tubes also offer better barrier-gel adhesion and consistent plasma separation. Many large-scale blood-collection programs—including national disease-surveillance networks—prefer polymer tubes due to reduced breakage and safer disposal.

Some examples include BD Vacutainer PST Lithium Heparin Tubes 3.5 mL PET with gel for plasma chemistry; ideal for anticoagulated patients and Greiner Bio-One VACUETTE Plasma Tubes: Light green, polymer gel/heparin for molecular diagnostics like PCR.

Glass tubes continue to serve niche applications requiring enhanced chemical inertness, especially in specialized biochemical or toxicology assays. Some European and Asian laboratories still use glass for historical compatibility with centrifuges or analyzers. However, rising occupational safety standards and transport handling risks continue to push the shift toward PET/polymer alternatives.

Application Analysis

Diagnostic procedures represent the largest application category covering 47.2% market share in 2024 due to the heavy global burden of chronic and infectious diseases. Plasma samples are essential for liver tests, renal profiles, cardiac markers, infectious disease ELISAs, and molecular assays. With over 3 billion diagnostic blood tests performed globally each year, plasma tubes play a central role in providing clean, cell-free plasma necessary for accurate laboratory results.

Plasma separation tubes (PSTs) serve as the major application in diagnostic procedures by enabling rapid isolation of cell-free plasma for biochemical, molecular, and biomarker assays, outperforming serum tubes in speed and stability. The lithium heparin anticoagulant and thixotropic gel barrier facilitate centrifugation to yield high-purity plasma suitable for high-throughput testing, reducing interference from cells and hemolysis.

Biochemical testing—covering liver enzymes, lipid panels, metabolic screening, and electrolyte studies relies heavily on heparin tubes for rapid plasma processing. Rising incidence of metabolic disorders (e.g., diabetes affecting over 540 million adults globally) expands the demand for biochemical assays and corresponding plasma-separation tubes.

End-User Analysis

Hospitals remain the biggest users which accounted for over 40.8% market share due to high volumes of emergency testing, inpatient diagnostics, pre-operative plasma assessment, and critical-care monitoring. Large tertiary hospitals may consume thousands of plasma tubes daily, particularly in ICUs, trauma centers, and surgical units. Hospitals perform comprehensive chemistries, electrolytes, cardiac markers, and infectious disease tests, driving consistently high usage. For instance, Daily tube usage averages 8-30 per ICU patient, with an 8% rise over recent years amid growing diagnostics demand.

Diagnostic laboratories—particularly high-throughput reference labs are the second-largest segment. National chains in the US, India, Japan, and Europe process millions of plasma samples annually, driving bulk procurement of EDTA and heparin tubes. These labs rely heavily on automated analyzers and thus prefer PET tubes with strong mechanical stability.

Key Market Segments

By Product

- EDTA tubes

- Lithium heparin tubes

- Sodium heparin tubes

By Material

- Glass

- Plastic

By Application

- Diagnostic procedures

- Biochemical tests

- Blood routine examination

- Coagulation testing

- Others

By End-User

- Hospitals

- Ambulatory surgical centres

- Diagnostic centers

- Others

Drivers

Increasing diagnostic testing volumes, driven by chronic disease prevalence

The Plasma Separation Tubes Market is driven by increasing diagnostic testing volumes, driven by chronic disease prevalence, infectious disease surveillance, and preventive healthcare programs. Rising global cases of cardiovascular diseases, diabetes, liver disorders, and respiratory illnesses require millions of biochemical and hematology tests performed using plasma, strengthening demand for EDTA and heparin-based separation tubes.

For example, the global diabetic population reached 540 million adults in 2023, and each individual requires routine HbA1c, lipid profile, and metabolic monitoring—all dependent on plasma testing. Growth in emergency-care diagnostics further boosts adoption, as lithium heparin tubes are essential for cardiac marker testing, stat chemistries, and rapid plasma separation in critical settings.

Increasing molecular diagnostics and PCR-based viral screening also indirectly support tube consumption due to the heavy reliance on plasma samples for pre-screening and secondary biochemical assays. Automation in clinical laboratories accelerates demand for polymer-based tubes compatible with high-throughput centrifugation systems.

Restraints

Rising concerns about variability in plasma yield, pre-analytical errors, and the need for stringent quality control

Key restraints include rising concerns about variability in plasma yield, pre-analytical errors, and the need for stringent quality control. Hemolysis during sample handling remains a major challenge, as even a 1% rise in hemolysis rate significantly reduces diagnostic accuracy in electrolytes and biochemical markers. Smaller laboratories in low- and middle-income countries face difficulties adopting high-quality polymer tubes due to cost constraints and dependence on imported materials.

Glass tubes, while preferred in some chemistry applications, pose breakage risks and are gradually being phased out due to safety concerns, yet replacement costs for polymer tubes create affordability issues in public hospitals. Supply chain fluctuations such as shortages in PET resin, rubber stoppers, and gel-separator materials—also impact availability and pricing.

Geopolitical disruptions, freight delays, and rising transportation costs increase procurement challenges for diagnostic centers dependent on global suppliers. Variability in regional regulatory standards complicates product certification and import timelines, especially for heparin-coated tubes. Waste-disposal and biohazard-management regulations impose additional operational burden on laboratories with high daily tube usage.

Opportunities

Rising adoption of automated, high-throughput clinical chemistry systems

Significant opportunities emerge from the rising adoption of automated, high-throughput clinical chemistry systems that require standardized, automation-friendly plasma separation tubes. As developing regions expand healthcare infrastructure, demand for gel-barrier tubes and advanced polymer tubes will grow rapidly. The shift toward decentralized testing—including mobile clinics, rural healthcare centers, and near-patient diagnostics creates new markets for lightweight, break-resistant PET tubes.

Increasing investment in public health programs, such as national metabolic-screening and infectious-disease surveillance initiatives, expands procurement volumes for hospitals and diagnostic networks. For example, large-scale hepatitis, HIV, and dengue screening programs across Asia and Africa rely heavily on plasma-based analysis.

Another growth opportunity lies in pharmaceutical and biotechnology research, where plasma samples are essential for pharmacokinetic studies, biomarker discovery, and clinical trials. As global clinical trials exceed ~450,000 registered studies, demand for standardized plasma-collection tubes continues rising.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical forces significantly influence the Plasma Separation Tubes Market by affecting supply chains, production costs, healthcare spending, and availability of raw materials. Economic slowdowns often shift national healthcare budgets toward essential diagnostics, which sustains baseline demand for plasma tubes used in routine biochemistry, hematology, and infectious-disease testing.

However, inflationary pressures increase the cost of PET resin, rubber stoppers, silica coatings, and gel-separation materials—directly raising manufacturing and procurement expenses for hospitals and diagnostic laboratories. Geopolitical tensions can disrupt cross-border movement of medical consumables, delaying shipments of anticoagulants such as EDTA or heparin and impacting inventory levels, especially in developing regions dependent on imports.

Global conflicts, trade restrictions, and port congestions also elevate freight charges, making bulk procurement more challenging for diagnostic centers and public hospitals. Currency volatility in emerging markets reduces purchasing power and can push laboratories toward lower-cost alternatives, affecting premium polymer tubes adoption.

Public-health expenditures tend to rise during geopolitical crises due to increased disease-surveillance activities, temporarily boosting demand for plasma collection supplies. Meanwhile, stronger national regulations on medical waste and biosafety introduced in response to geopolitical or environmental priorities increase operational burdens for facilities handling large daily test volumes.

Latest Trends

Shift toward lightweight, shatter-proof PET tubes

A key trend shaping the Plasma Separation Tubes Market is the shift toward lightweight, shatter-proof PET tubes, replacing traditional glass in both hospital and diagnostic-lab settings. Automation compatibility has become a major procurement criterion, with laboratories adopting tubes designed for robotic decappers, automated centrifugation, and integrated chemistry analyzers. Gel-separation technologies are evolving, with manufacturers introducing improved thixotropic gels that yield cleaner plasma layers, reduce fibrin contamination, and ensure consistent separation within minutes.

Another emerging trend is the increasing adoption of pre-analytical quality control systems, where tubes include improved coatings, shelf-life stability, and better additive distribution. Point-of-care and near-patient diagnostics especially in emergency rooms and ambulatory surgical centers—drive demand for tubes supporting rapid turnaround testing. Growing awareness about biosafety and needle-stick injury prevention contributes to polymer tube preference due to reduced breakage. Sustainability trends are pushing manufacturers toward recyclable materials and reduced-plastic designs to meet environmental compliance.

Regional Analysis

North America is leading the Plasma Separation Tubes Market

North America represents the largest regional market due to its advanced healthcare infrastructure, high diagnostic testing volumes, and widespread adoption of automated clinical chemistry analyzers. Hospitals across the US and Canada perform millions of CBCs, metabolic panels, lipid profiles, and cardiac marker tests annually, driving high consumption of EDTA and lithium heparin tubes.

The region’s strong emphasis on preventive healthcare supported by programs for diabetes, cardiovascular screening, and oncology diagnostics further accelerates tube usage. High healthcare spending, mature laboratory networks, and consistent regulatory standards make it a stable, high-volume procurement market.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is the fastest-growing region owing to expanding healthcare infrastructure, rising chronic disease prevalence, and increased investment in diagnostic laboratory networks. Countries such as China, India, and Indonesia are experiencing rapid growth in clinical chemistry and hematology testing due to larger population bases and expanding access to primary care.

National programs for infectious disease surveillance including dengue, tuberculosis, HIV, and hepatitis significantly increase plasma-based testing volumes. The region is witnessing fast adoption of automated analyzers, especially in urban hospitals and private diagnostic chains. Growing medical tourism, expanding insurance coverage, and increasing investment in clinical research further boost demand for high-quality plasma separation tubes.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Becton, Dickinson and Company (BD), Greiner Bio-One International GmbH, Terumo Corporation, Sekisui Chemical Co., Ltd., Sarstedt AG & Co. KG, FL Medical, Narang Medical Limited, Cardinal Health, Hindustan Syringes & Medical Devices Ltd, Nipro Corporation, Bio-X Diagnostics, and Other key players.

Becton, Dickinson and Company (BD) holds a leading position in the plasma separation tubes segment through its BD Vacutainer product line, offering EDTA, lithium heparin, and gel-separation tubes widely adopted in hospitals, diagnostic chains, and clinical chemistry laboratories. BD’s strong global distribution network, automation-compatible designs, and standardized additive formulations ensure high plasma purity and consistent performance in high-throughput workflows.

Greiner Bio-One International GmbH is another major player, recognized for its VACUETTE plasma separation tubes made with high-quality PET and advanced separation gels. The company supplies a broad range of EDTA and heparin tubes used extensively across Europe and Asia, with strong focus on safety engineering, color-coded closures, and improved pre-analytical reliability to support central laboratories and molecular diagnostic units.

Terumo Corporation contributes to the market with its VENOSAFE and VENOJET tubes, emphasizing precision additive dosing, robust polymer construction, and compatibility with automated analyzers. Terumo’s strong presence in Asia and expanding international footprint reinforce its influence in plasma-collection consumables.

Top Key Players

- Becton, Dickinson and Company (BD)

- Greiner Bio-One International GmbH

- Terumo Corporation

- Sekisui Chemical Co., Ltd.

- Sarstedt AG & Co. KG

- FL Medical

- Narang Medical Limited

- Cardinal Health

- Hindustan Syringes & Medical Devices Ltd

- Nipro Corporation

- Bio-X Diagnostics

- Other key players

Recent Developments

- In March 2025, Terumo Corporation announced a restructuring (renaming) of some of its blood-and-cell-technology business units, which include blood-collection & separation activities.

- In April 2024, Becton, Dickinson and Company (BD) India launched BD Vacutainer UltraTouch Push Button Blood Collection Set in India to improve patient comfort & safety during blood collection.

- In May 2023, Greiner Bio-One launched a faster serum-separator tube: VACUETTE CAT Serum Fast Separator Tube though serum rather than plasma, this reflects innovation in their blood-collection/separation product development.

Report Scope

Report Features Description Market Value (2024) US$ 560.4 Million Forecast Revenue (2034) US$ 1,032.4 Million CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (EDTA tubes, Lithium heparin tubes and Sodium heparin tubes), By Material (Glass and Plastic), By Application (Diagnostic procedures, Biochemical tests, Blood routine examination, Coagulation testing and Others), By End-User (Hospitals, Ambulatory surgical centres, Diagnostic centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Becton, Dickinson and Company; Greiner Bio-One International GmbH; Terumo Corporation; Sekisui Chemical Co., Ltd.; Sarstedt AG & Co. KG; FL Medical; Narang Medical Limited; Cardinal Health; Hindustan Syringes & Medical Devices Ltd; Nipro Corporation and other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Plasma Separation Tubes MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Plasma Separation Tubes MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Becton, Dickinson and Company (BD)

- Greiner Bio-One International GmbH

- Terumo Corporation

- Sekisui Chemical Co., Ltd.

- Sarstedt AG & Co. KG

- FL Medical

- Narang Medical Limited

- Cardinal Health

- Hindustan Syringes & Medical Devices Ltd

- Nipro Corporation

- Bio-X Diagnostics

- Other key players