Global Plasma-Derived Drugs Market By Product Type (Immunoglobin, Albumin, Coagulation Factors and Others), By Application (Bleeding Disorders, Alpha-1 Antitrypsin Deficiency (AATD), Pelvic Inflammatory Disease (PID), Liver Disease, Infections and Others), By Distribution Channel (Hospital Pharmacies, Online Pharmacies, Retail Pharmacies and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173869

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

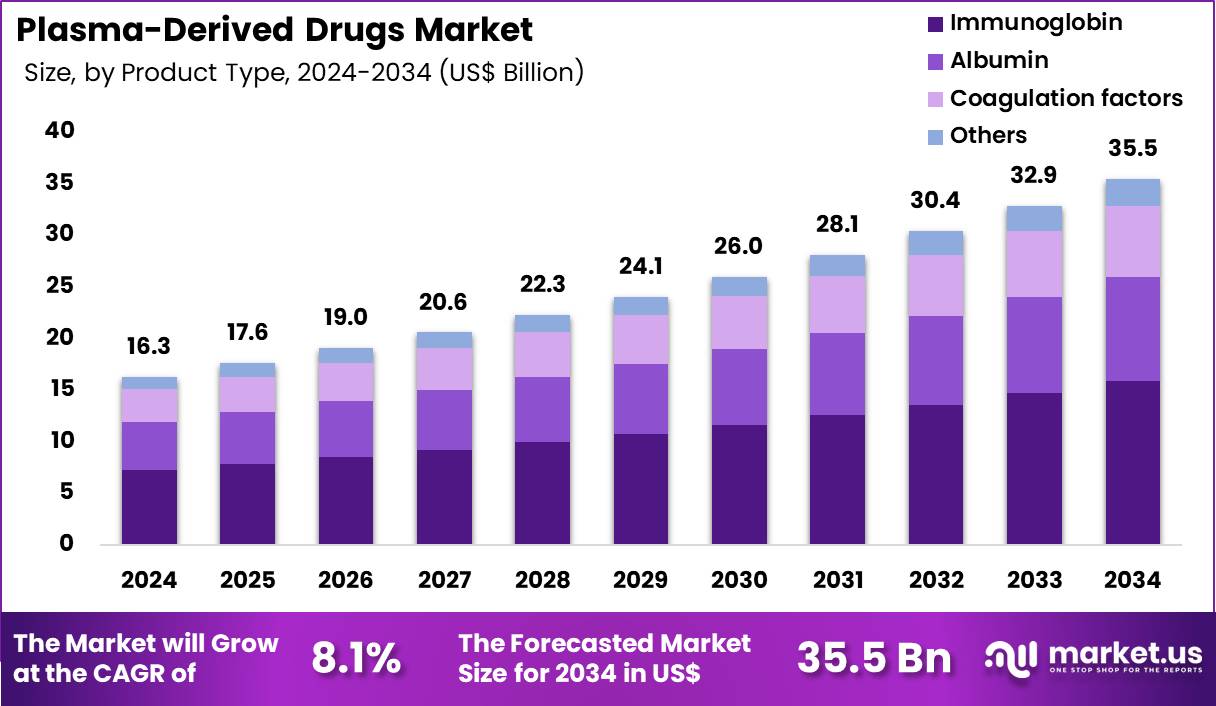

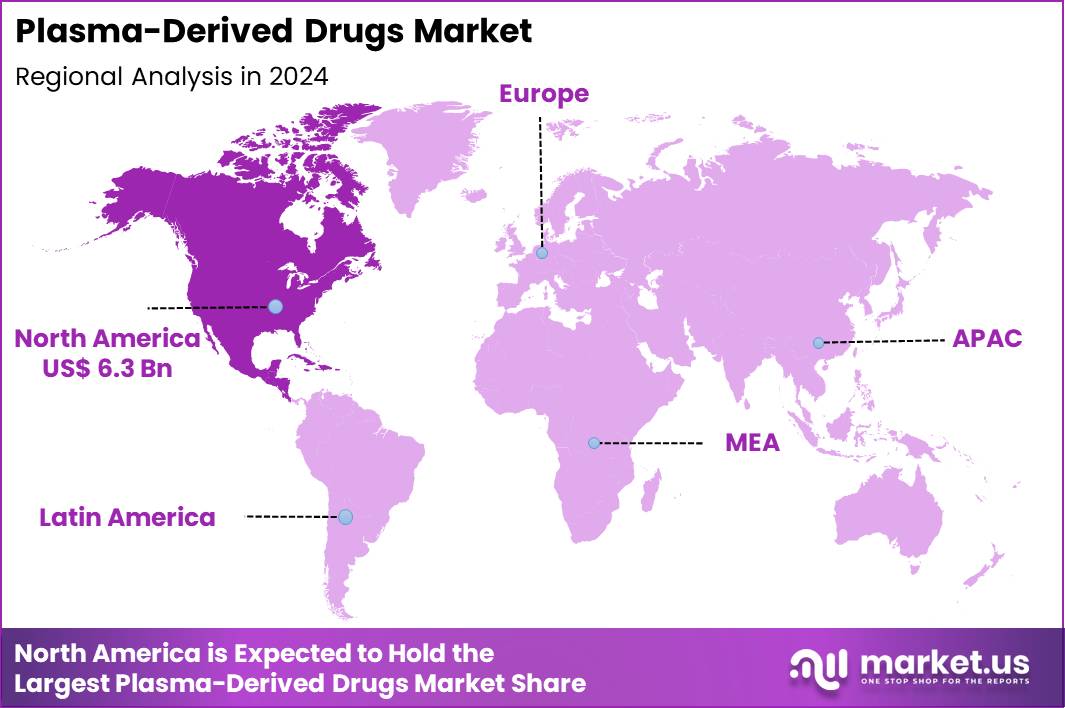

The Global Plasma-Derived Drugs Market size is expected to be worth around US$ 35.5 Billion by 2034 from US$ 16.3 Billion in 2024, growing at a CAGR of 8.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.9% share with a revenue of US$ 6.3 Billion.

Rising demand for plasma-derived therapies propels manufacturers to expand collection and fractionation processes that yield essential immunoglobulins and clotting factors for patients with rare and life-threatening conditions.

Hematologists administer intravenous immunoglobulin products to patients with primary immunodeficiency disorders, restoring antibody levels that prevent recurrent infections and improve quality of life. These therapies support treatment of autoimmune diseases by modulating immune responses in conditions such as chronic inflammatory demyelinating polyneuropathy and immune thrombocytopenia.

Clinicians utilize plasma-derived coagulation factors to manage hemophilia A and B, enabling patients to maintain hemostasis during routine activities and surgical interventions. Providers apply alpha-1 proteinase inhibitor concentrates to slow progression of emphysema in individuals with alpha-1 antitrypsin deficiency, preserving lung function over extended periods.

In March 2025, NHS Blood and Transplant, working alongside NHS England, successfully supplied domestically sourced plasma to the first NHS patient under a new national program. This initiative is intended to benefit up to 17,000 patients across the UK while rebuilding a self-sufficient plasma supply chain. By reducing dependence on imported plasma products, the program is expected to deliver annual cost savings of between £5 million and £10 million and improve long-term resilience of the UK healthcare system.

Manufacturers pursue opportunities to develop higher-purity immunoglobulin preparations that enhance tolerability and reduce infusion-related adverse events, broadening applications in neurologic and dermatologic autoimmune disorders. Developers advance subcutaneous formulations of immunoglobulins, enabling self-administration at home for patients with primary immunodeficiencies and facilitating consistent dosing in long-term management.

These innovations support expanded use in transplant medicine, where plasma-derived products prevent graft-versus-host disease and manage post-transplant infections. Opportunities emerge in creating specialized concentrates for rare bleeding disorders, such as factor XIII deficiency, addressing unmet needs in niche hematologic conditions.

Companies invest in pathogen inactivation technologies that strengthen safety profiles while preserving therapeutic activity across all plasma-derived products. Firms explore combination therapies that integrate immunoglobulins with emerging biologics, optimizing outcomes in refractory autoimmune and inflammatory diseases.

Industry specialists refine large-scale fractionation methods to increase yield efficiency, ensuring reliable supply of critical plasma proteins for chronic replacement therapies. Developers prioritize patient-centric delivery systems that simplify administration of coagulation factors in hemophilia care, improving adherence and joint health preservation.

Market participants advance real-world evidence generation to demonstrate long-term efficacy of immunoglobulins in secondary immunodeficiencies, supporting guideline updates and broader reimbursement. Innovators incorporate advanced purification techniques that minimize aggregate formation, enhancing safety during high-dose intravenous immunoglobulin treatments.

Companies emphasize sustainable sourcing practices that maintain plasma quality while addressing ethical considerations in donor recruitment. Ongoing advancements focus on next-generation plasma-derived therapies that target emerging indications, sustaining relevance in precision medicine for immune and hemostatic disorders.

Key Takeaways

- In 2024, the market generated a revenue of US$ 16.3 Billion, with a CAGR of 8.1%, and is expected to reach US$ 35.5 Billion by the year 2034.

- The product type segment is divided into immunoglobin, albumin, coagulation factors and others, with immunoglobin taking the lead in 2024 with a market share of 44.7%.

- Considering application, the market is divided into bleeding disorders, alpha-1 antitrypsin deficiency (AATD), pelvic inflammatory disease (PID), liver disease, infections and others. Among these, bleeding disorders held a significant share of 41.8%.

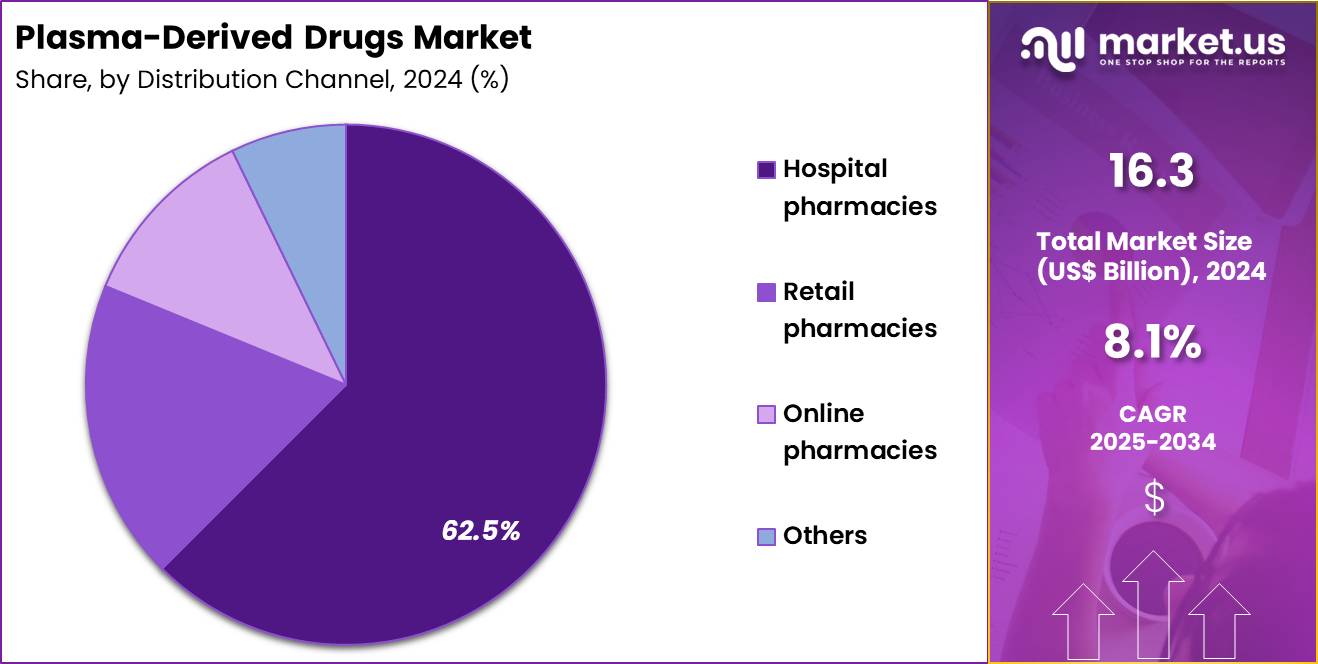

- Furthermore, concerning the distribution channel segment, the market is segregated into hospital pharmacies, online pharmacies, retail pharmacies and others. The hospital pharmacies sector stands out as the dominant player, holding the largest revenue share of 62.5% in the market.

- North America led the market by securing a market share of 38.9% in 2024.

Product Type Analysis

Immunoglobin accounted for 44.7% of growth within the product type category and represents the largest revenue contributor in the Plasma-Derived Drugs market. Rising prevalence of primary and secondary immunodeficiency disorders drives sustained demand. Clinicians increasingly rely on immunoglobin for immune modulation and infection prevention. Expanding indications across neurology, hematology, and autoimmune diseases support broader utilization.

Aging populations contribute to higher immune dysfunction incidence. Improved diagnostic awareness increases treatment initiation rates. Immunoglobin therapy supports both acute and chronic disease management. Substitution limitations reinforce dependence on plasma-derived sources. Advances in fractionation improve product purity and safety.

Hospitals prioritize immunoglobin for high-risk patient populations. Long-term therapy requirements increase cumulative consumption. Clinical guidelines reinforce immunoglobin use in standard care pathways. Expanding access in emerging markets supports volume growth. Increased survival rates among immunodeficient patients extend therapy duration. Supply chain investments stabilize availability.

Patient outcomes improve with regular immunoglobin administration. Physicians favor established efficacy and safety profiles. Pricing frameworks support sustained market value. Research continues to expand therapeutic indications. The segment is projected to remain dominant due to broad clinical applicability and chronic demand.

Application Analysis

Bleeding disorders captured 41.8% of growth within the application category and stand as the primary clinical driver of the Plasma-Derived Drugs market. Hemophilia and related coagulation deficiencies require lifelong management. Plasma-derived coagulation therapies remain essential in many treatment protocols. Surgical interventions increase episodic demand for clotting support. Trauma and emergency care contribute to acute usage. Early diagnosis improves long-term treatment adherence.

Prophylactic therapy adoption expands consumption volumes. Limited alternatives in certain patient groups sustain reliance on plasma-derived products. Hospitals manage severe bleeding cases with rapid infusion protocols. Treatment guidelines emphasize timely factor replacement. Pediatric-to-adult transition care sustains lifetime demand. Improved survival rates increase cumulative therapy exposure. Developing regions report rising diagnosis rates.

Access programs improve treatment continuity. Specialized care centers concentrate patient volumes. Plasma-derived therapies support inhibitor management strategies. Product familiarity strengthens clinician confidence. Stable reimbursement supports consistent utilization. Clinical outcomes reinforce therapy necessity. The segment is anticipated to maintain leadership due to disease chronicity and therapeutic indispensability.

Distribution Channel Analysis

Hospital pharmacies represented 62.5% of growth within the distribution channel category and dominate the Plasma-Derived Drugs market. Plasma-derived therapies require controlled storage and handling conditions. Hospitals maintain infrastructure for cold-chain management. Acute administration frequently occurs in inpatient settings. Complex dosing and monitoring favor hospital-based dispensing. Emergency bleeding and immune crises concentrate usage in hospitals.

Multidisciplinary teams coordinate therapy initiation. Hospital pharmacies support rapid access during critical care. Formularies prioritize plasma-derived drugs for specialized indications. Teaching hospitals drive adoption through standardized protocols. Centralized procurement improves supply reliability. Patient monitoring requirements align with hospital care models. Regulatory oversight strengthens hospital distribution dominance. Infusion services support high-volume administration.

Hospitals manage patients with comorbid conditions effectively. Transition-of-care programs reinforce hospital initiation. Clinical pharmacists guide dose optimization. Referral networks funnel complex cases to hospitals. Reimbursement workflows operate efficiently in hospital settings. Infrastructure investments expand plasma therapy capacity. The segment is expected to retain dominance due to safety requirements and clinical complexity.

Key Market Segments

By Product Type

- Immunoglobin

- Albumin

- Coagulation Factors

- Others

By Application

- Bleeding Disorders

- Alpha-1 Antitrypsin Deficiency (AATD)

- Pelvic Inflammatory Disease (PID)

- Liver Disease

- Infections

- Others

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

- Others

Drivers

Increasing demand for immunoglobulin products is driving the market

The plasma-derived drugs market is significantly driven by the increasing demand for immunoglobulin products, which are essential for treating immune deficiencies and autoimmune diseases through substitution therapy. Healthcare providers rely on these drugs to manage conditions like primary immunodeficiency, where patient numbers are growing due to better diagnosis. Regulatory agencies prioritize immunoglobulin approvals to address global shortages and support public health needs.

Pharmaceutical companies expand production capacities to meet rising clinical requirements in both adult and pediatric populations. Clinical protocols integrate immunoglobulins into standard care for chronic inflammatory disorders, enhancing treatment efficacy. Global health organizations advocate for plasma collection to sustain supply for these life-saving therapies. Academic research validates the role of immunoglobulins in preventing infections in immunocompromised patients.

Patient care improves with reliable access to plasma-derived immunoglobulins for long-term management. Economic factors, including the high cost of untreated immune conditions, further justify market expansion. Grifols reported a 15.3% growth at constant currency for its immunoglobulin franchise in fiscal year 2024. This growth reflects sustained demand for key plasma-derived products like IVIG and SCIG.

The trend aligns with broader plasma supply increases to support manufacturing. Immunoglobulin shortages in previous years have spurred investment in fractionation technologies. Healthcare systems in developed regions prioritize these drugs for vulnerable populations. Pharmaceutical innovations focus on high-concentration formulations to reduce administration volumes.

Global plasma donation campaigns contribute to raw material availability for immunoglobulin production. Patient advocacy groups push for equitable distribution of these therapies. Economic analyses highlight the cost-effectiveness of preventive immunoglobulin use. Overall, this driver maintains momentum in the plasma-derived segment.

Restraints

Increased prevalence of contaminants in plasma donors is restraining the market

The plasma-derived drugs market is restrained by the increased prevalence of contaminants in plasma donors, which poses risks to product safety and requires enhanced testing protocols to mitigate transmission. Healthcare manufacturers must implement nucleic acid testing for viruses like parvovirus B19, adding to operational costs and supply chain complexities. Regulatory agencies mandate screening of plasma pools, leading to potential discard of contaminated units and reduced yield.

Pharmaceutical firms face delays in fractionation processes due to heightened quality controls for derived products. Clinical use of plasma drugs is impacted by concerns over viral inactivation efficacy in contaminated batches. Global donation centers experience challenges in maintaining donor pools with low contaminant rates. Academic studies highlight the epidemiological trends affecting plasma safety.

Patient safety is prioritized through voluntary recalls or holds on potentially affected products. Economic implications include higher insurance premiums for manufacturers due to contamination risks. The Centers for Disease Control and Prevention reported that the prevalence of pooled plasma samples with parvovirus B19 DNA >10^4 IU/mL increased from 1.5% in December 2023 to 19.9% in June 2024. This rise necessitates additional minipool testing strategies.

Plasma processors adjust protocols to comply with FDA recommendations on B19V limits. Donation screening programs are intensified to exclude high-titer donors. Pharmaceutical supply is strained by the need for pathogen-reduced plasma. Clinical guidelines recommend monitoring recipients of plasma-derived products for viral infections.

Global health alerts emphasize the importance of vigilant donor selection. Academic collaborations focus on developing rapid detection methods for contaminants. Patient advocacy calls for transparency in plasma safety measures. Overall, this restraint limits efficient market operations.

Opportunities

Expansion into new markets for self-sufficiency programs is creating growth opportunities

The plasma-derived drugs market offers growth opportunities through expansion into new markets for self-sufficiency programs, enabling countries to produce their own therapies and reduce dependence on imports. Healthcare systems in emerging regions can build local plasma collection and fractionation capabilities, fostering domestic manufacturing. Regulatory partnerships facilitate technology transfer for safe production of immunoglobulins and albumin.

Pharmaceutical companies like Grifols collaborate with governments to establish integrated value chains, opening avenues for long-term contracts. Clinical access improves in areas with previously limited supply, addressing unmet needs in immune deficiencies. Global health initiatives support these programs to enhance equity in plasma drug availability. Academic training programs build local expertise in plasma processing technologies.

Patient populations benefit from affordable, locally produced therapies reducing treatment delays. Economic contributions from these programs include job creation and GDP growth. Grifols Egypt operates 16 donation centers and has produced over one million vials with Egyptian plasma as of 2024. This initiative demonstrates scalable models for self-sufficiency. Plasma testing laboratories are established to ensure quality standards. Fractionation plants are planned for full chain completion by 2026.

Donation campaigns increase local plasma volumes for processing. Clinical distribution to public hospitals strengthens healthcare infrastructure. Global models like Egypt’s can be replicated in other regions. Academic evaluations assess the impact on disease management. Patient registries track outcomes from locally derived products. Overall, this opportunity diversifies supply sources globally.

Impact of Macroeconomic / Geopolitical Factors

Flourishing international economies funnel capital into immunology advancements, elevating the plasma-derived drugs market by intensifying orders for therapies like factor VIII concentrates amid growing chronic disease burdens. Leaders harness stable fiscal policies to forge acquisitions in biotech, which amplifies production scales for albumin and immunoglobulin solutions. Sadly, explosive global inflation catapults donor compensation and fractionation fees skyward, eroding viability for providers in austerity-hit zones.

Deepening superpower animosities in donor-rich continents thwart plasma collections, stalling export quotas for essential blood products. Trailblazers parry these disruptions with blockchain-tracked supply partnerships, which fortifies transparency and expedites cross-border flows. Today’s US tariffs, mandating 100% premiums on imported patented biologics since October 2025, saddle global entrants with daunting fiscal hurdles.

American innovators counter by surging investments in plasma centers nationwide, which galvanizes research synergies and elevates self-sufficiency metrics. State-of-the-art purification breakthroughs relentlessly invigorate the landscape, guaranteeing amplified therapeutic reach and shareholder optimism enduringly.

Latest Trends

Growing plasma supply through increased collections is a recent trend

In 2024, the plasma-derived drugs market has exhibited a prominent trend toward growing plasma supply through increased collections, enabling higher production volumes for therapies like immunoglobulins and clotting factors. Healthcare manufacturers optimize donation centers to boost raw material availability, supporting expanded fractionation capacities. Regulatory incentives encourage voluntary donations to address previous shortages. Pharmaceutical firms report improved supply chains, facilitating consistent drug delivery to patients.

Clinical demands for plasma products in immune therapies are met with enhanced inventories. Global collaborations focus on sustainable collection practices to maintain donor participation. Academic studies evaluate the impact of increased supply on treatment accessibility. Patient therapies benefit from reduced wait times for essential plasma-derived medications. Ethical protocols emphasize donor safety in expanded collection efforts.

Grifols reported an 8% increase in plasma supply in the first quarter of 2024. This trend reflects recovery from prior disruptions. Donation volumes are tracked to ensure quality standards. Fractionation efficiencies are improved with higher input. Clinical distribution networks adapt to larger supplies. Global plasma markets stabilize with consistent growth.

Academic partnerships refine collection technologies for efficiency. Patient advocacy promotes awareness of donation benefits. Economic analyses project sustained revenue from increased output. Overall, this trend strengthens the supply foundation for plasma-derived drugs.

Regional Analysis

North America is leading the Plasma-Derived Drugs Market

In 2024, North America held a 38.9% share of the global plasma-derived drugs market, advanced by the growing demand for immunoglobulins and clotting factors to treat primary immunodeficiencies and hemophilia, where shortages in donor plasma have prompted innovations in fractionation techniques to improve yield and purity.

Clinicians expanded prescriptions for albumin in critical care for volume expansion and liver disease support, driven by guideline updates emphasizing its role in sepsis and hypovolemia management. Regulatory frameworks facilitated faster approvals for recombinant alternatives with plasma-derived components, addressing safety concerns in transfusion medicine.

Rising incidences of autoimmune disorders amplified usage for intravenous immunoglobulin therapies, while aging populations intensified needs for anti-inhibitor coagulant complexes in bleeding disorders. Pharmaceutical firms refined pathogen inactivation methods, ensuring product safety for neonatal and pediatric applications.

Collaborative collection drives boosted plasma donations, bridging supply gaps in high-demand urban centers. Supply optimizations guaranteed cold-chain integrity for biologics, aligning with biosecurity norms in specialty pharmacies. The U.S. Food and Drug Administration reported that CBER approved 14 biological license applications in 2023, including several for plasma-derived therapeutics.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders anticipate robust progression in plasma-derived drugs within Asia Pacific over the forecast period, as healthcare expansions confront escalating immune and coagulation disorder burdens from infectious disease legacies. Specialists integrate immunoglobulins into treatment regimens for Kawasaki disease, adapting protocols to pediatric cohorts in high-density populations.

Governments subsidize fractionation facilities through public investments, equipping them to produce albumin for burn care in disaster-prone regions. Biotech enterprises customize clotting factor concentrates with extended half-lives, tailoring them to genetic variants prevalent in hemophilia A and B. Regional health organizations validate pathogen-reduced products through surveillance, fostering efficacy for viral hemorrhagic fevers.

Pharmaceutical manufacturers localize albumin production through technology transfers, ensuring affordability for hepatic encephalopathy management in rural areas. Policy initiatives promote donor recruitment campaigns, extending coverage to underserved provinces facing transfusion shortages. The World Health Organization estimates that the South-East Asia Region accounted for 26% of global hemophilia A cases in 2022.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Plasma-Derived Drugs market drive growth by expanding plasma collection networks, improving fractionation yields, and prioritizing therapies for immunology, hematology, and rare diseases with durable demand. Companies strengthen scale through vertical integration that links donor centers, manufacturing, and distribution to secure supply continuity and cost control.

Commercial strategies emphasize long-term payer agreements, indication expansion, and physician education to reinforce guideline-based use and adherence. Innovation priorities focus on process intensification, viral safety enhancements, and higher-concentration formulations that improve dosing efficiency and patient convenience.

Market expansion targets regions increasing diagnosis rates and reimbursement access for rare and chronic conditions. CSL Behring exemplifies leadership through its global plasma collection footprint, advanced manufacturing capabilities, and a broad portfolio of immunoglobulins and specialty products that support sustained growth and reliable patient access.

Top Key Players

- CSL Limited

- Grifols, S.A.

- Takeda Pharmaceutical Company Limited

- Octapharma AG

- Baxter International Inc.

- Kedrion S.p.A.

- Biotest AG

- Sanquin Plasma Products

- Bio Products Laboratory (BPL)

- LFB S.A.

Recent Developments

- In June 2024, CSL Behring strengthened its presence in the Indian plasma therapeutics landscape through the local introduction of Haemocomplettan P, a human fibrinogen concentrate. The product was brought to market by Bengaluru-based Plasmagen Biosciences, a company focused exclusively on plasma protein and specialty care therapies. This development reflects growing efforts to improve access to critical plasma-derived medicines in emerging healthcare markets, particularly for the management of bleeding disorders and complex surgical indications.

- In February 2024, Grifols disclosed plans to release Phase III clinical data in 2024 for its long-term albumin treatment program, as outlined by its chief scientific innovations officer, Jörg Schüttrumpf. The therapy targets patients with decompensated cirrhosis and ascites and is designed to extend survival by addressing complications associated with chronic liver disease. Progress at this late clinical stage highlights sustained innovation in albumin-based therapies and reinforces the role of plasma-derived products in managing advanced hepatic conditions.

Report Scope

Report Features Description Market Value (2024) US$ 16.3 Billion Forecast Revenue (2034) US$ 35.5 Billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Immunoglobin, Albumin, Coagulation Factors and Others), By Application (Bleeding Disorders, Alpha-1 Antitrypsin Deficiency (AATD), Pelvic Inflammatory Disease (PID), Liver Disease, Infections and Others), By Distribution Channel (Hospital Pharmacies, Online Pharmacies, Retail Pharmacies and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape CSL Limited, Grifols, S.A., Takeda Pharmaceutical Company Limited, Octapharma AG, Baxter International Inc., Kedrion S.p.A., Biotest AG, Sanquin Plasma Products, Bio Products Laboratory (BPL), LFB S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Plasma-Derived Drugs MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Plasma-Derived Drugs MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- CSL Limited

- Grifols, S.A.

- Takeda Pharmaceutical Company Limited

- Octapharma AG

- Baxter International Inc.

- Kedrion S.p.A.

- Biotest AG

- Sanquin Plasma Products

- Bio Products Laboratory (BPL)

- LFB S.A.