Global Plasma Bottle Market Size, Share, Growth Analysis By Raw Material (Glass, Plastics), By Raw Material - Glass Type (Type I, Type II), By Capacity (Up to 250ml, 250ml to 500ml, Above 500ml), By End Use (Healthcare, Defense, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155875

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

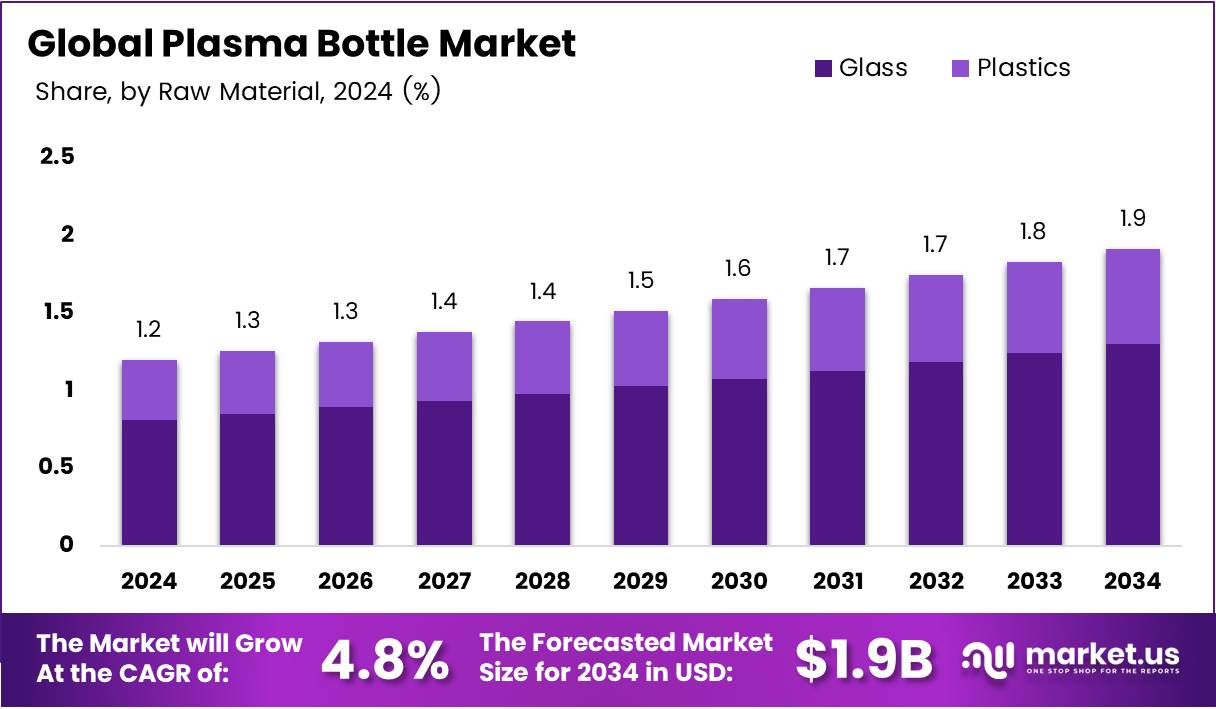

The Global Plasma Bottle Market size is expected to be worth around USD 1.9 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

The plasma bottle market plays a critical role in the healthcare and biotechnology sectors. Plasma bottles are primarily used to store and transport blood plasma, a key component in the production of life-saving medical treatments such as immunoglobulins and clotting factors. This market is driven by advancements in healthcare infrastructure and the increasing demand for blood plasma-based products.

The growth of the plasma bottle market is influenced by rising global healthcare needs and an increasing focus on the treatment of chronic diseases. As the global population ages, the demand for plasma-derived therapies, such as those used in immune deficiencies and bleeding disorders, is projected to grow. Additionally, the surge in healthcare investments globally is further accelerating market development.

One of the major opportunities within the plasma bottle market lies in expanding the use of plasma for fractionation. For example, in 2023, Korea imported 61% of its plasma for fractionation, primarily sourced from the United States. This highlights a growing dependence on global plasma sources, creating opportunities for market players to innovate in storage solutions and distribution networks.

Moreover, government investments and regulations are playing an essential role in shaping the market. Many countries are incentivizing plasma donation through policies that support voluntary donation programs. According to a survey, Germany and the U.S. saw voluntary plasma donation rates increase by 20% and 13% from 2021 to 2023, respectively. This demonstrates the growing importance of plasma collection and the need for efficient, secure storage solutions.

Furthermore, as the plasma bottle market grows, regulatory frameworks surrounding plasma collection and storage are becoming more stringent. Governments are introducing more robust regulations to ensure plasma quality and safety. These regulations are likely to enhance the demand for high-quality, secure plasma bottles that meet industry standards, providing a steady market for manufacturers.

Key Takeaways

- The global Plasma Bottle Market is projected to reach USD 1.9 Billion by 2034, growing at a CAGR of 4.8% from 2025 to 2034.

- In 2024, the Glass segment held 67.8% of the market share in the Raw Material Analysis category.

- The 250ml to 500ml capacity range accounted for 49.6% of the Plasma Bottle Market in 2024.

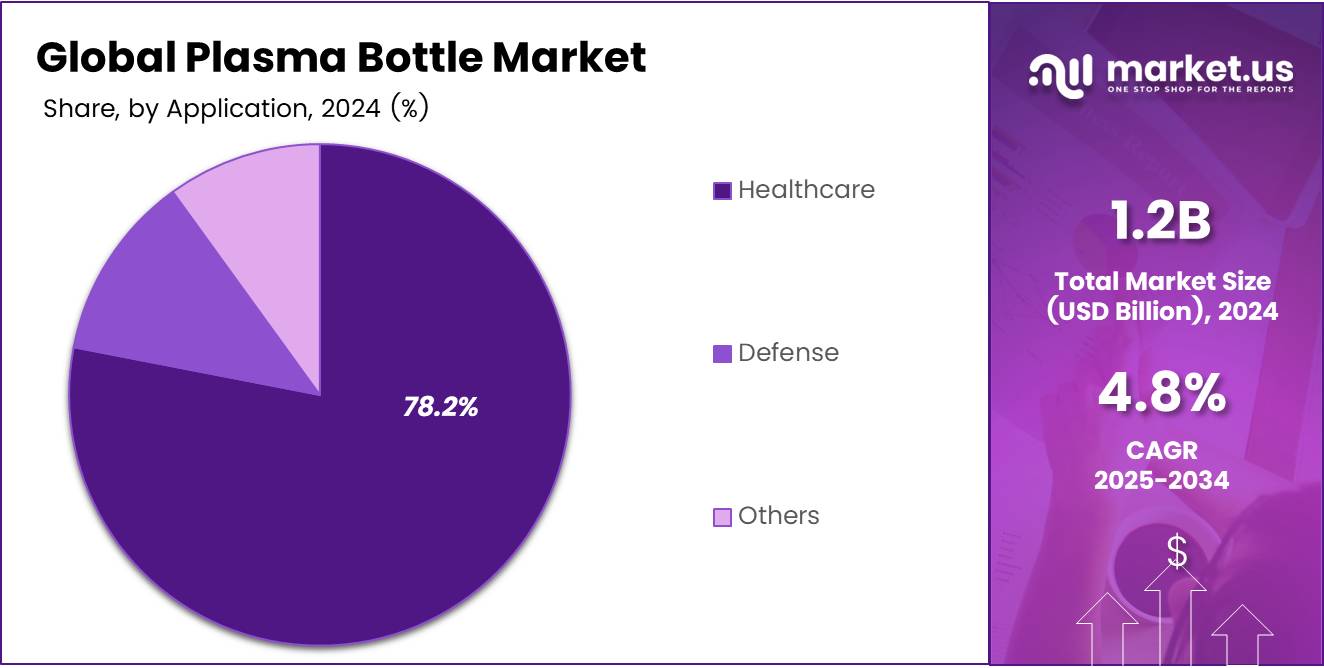

- The Healthcare segment dominated the market in the End Use Analysis category, capturing 78.2% of the market share in 2024.

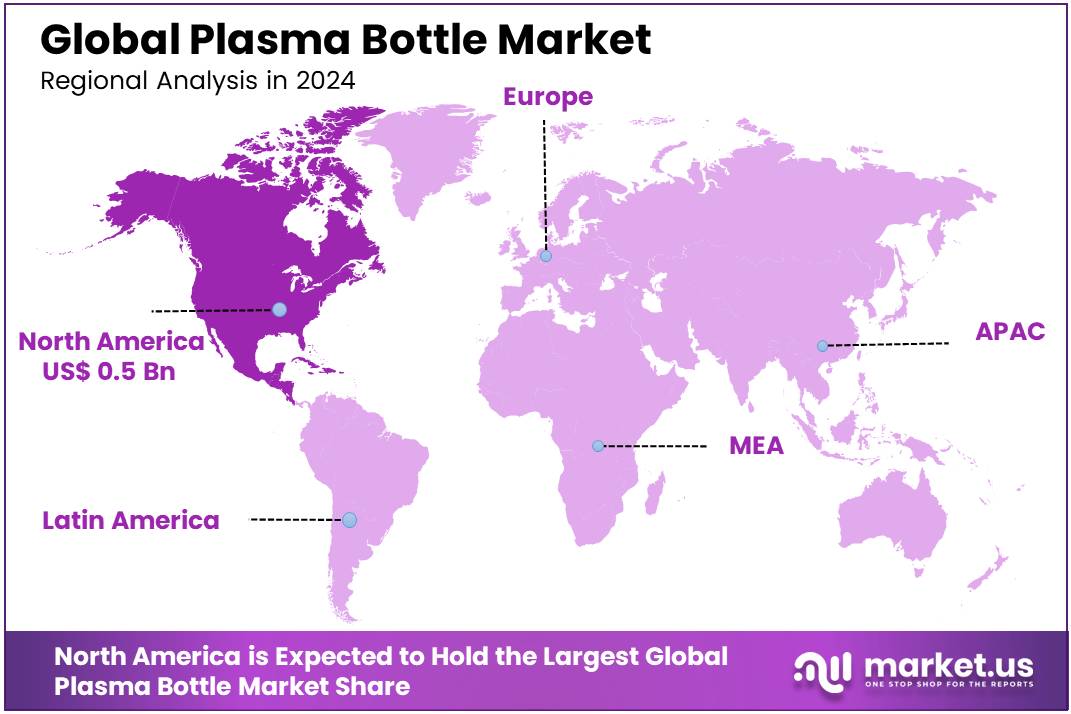

- North America leads the global Plasma Bottle Market with a share of 48.4%, valued at USD 0.5 Billion in 2024.

Raw Material Analysis

Glass holds a dominant market position with a 67.8% share in 2024 due to its strength and versatility.

In 2024, the Glass segment dominated the Plasma Bottle Market in the Raw Material Analysis category, securing a significant market share of 67.8%. Glass is preferred for its strength, durability, and ability to maintain the integrity of the plasma during storage and transportation. The material’s transparency also enables easy monitoring of the contents, adding to its popularity.

On the other hand, Plastics made up the remaining share of the market. Though plastics are increasingly being considered for their lightweight and cost-effective properties, they are less favored compared to glass in the medical field due to concerns over chemical stability and the risk of contamination. However, plastics are still used in certain applications, especially in regions where cost constraints play a significant role.

The growth of the glass segment is largely attributed to its established use in the healthcare industry, especially for products requiring high levels of sterilization and safety. As the demand for plasma bottles continues to rise, Glass is expected to remain the material of choice for its superior performance and reliability.

Capacity Analysis

250ml to 500ml holds a dominant market position with a 49.6% share in 2024, driven by its balanced size for most applications.

In 2024, the 250ml to 500ml capacity range held the largest market share in the Plasma Bottle Market, accounting for 49.6% of the market. This capacity is ideal for a wide range of medical and industrial applications, making it the most preferred choice for plasma storage and transportation. Its balanced volume allows for optimal storage, minimizing both space wastage and overfill risks.

The Up to 250ml and Above 500ml segments hold smaller shares in comparison. The Up to 250ml category is mainly used for small plasma samples or applications requiring minimal volume, capturing a smaller portion of the market. Meanwhile, the Above 500ml category is typically used for bulk storage but faces limitations due to its larger size, which may not be necessary for most plasma usage.

The preference for the 250ml to 500ml category reflects the balance it offers between compactness and capacity, meeting the majority of plasma storage needs in various healthcare settings.

End Use Analysis

Healthcare dominates with a 78.2% share in 2024 due to its critical need for plasma bottles in medical applications.

In 2024, the Healthcare segment led the Plasma Bottle Market in the End Use Analysis category, capturing a dominant share of 78.2%. The healthcare industry is the primary consumer of plasma bottles, driven by the need for safe and effective plasma storage and transportation. As plasma plays a crucial role in various medical treatments, particularly in blood and immune therapy, the demand for reliable and durable plasma bottles in this sector remains high.

The Defense sector, while important, holds a smaller share of the market, as plasma storage for military purposes is relatively limited compared to healthcare applications. The Others category also makes up a minimal portion, including non-medical uses for plasma storage, further supporting the strong dominance of healthcare in the market.

With the growing global healthcare demand, particularly in plasma-based treatments, the healthcare segment is anticipated to continue its growth and maintain its leading position in the plasma bottle market.

Key Market Segments

By Raw Material

- Glass

- Type I

- Type II

- Plastics

By Capacity

- Up to 250ml

- 250ml to 500ml

- Above 500ml

By End Use

- Healthcare

- Defense

- Others

Drivers

Increasing Demand for Healthcare and Pharmaceutical Applications Drives Market Growth

The plasma bottle market is experiencing significant growth due to the expanding healthcare sector’s need for safe blood plasma storage solutions. Hospitals and medical facilities require specialized containers to maintain plasma quality during collection, storage, and transportation processes. The pharmaceutical industry’s growing focus on plasma-derived medicines has created substantial demand for reliable bottling systems.

Manufacturing improvements have revolutionized plasma bottle production, making containers more durable and cost-effective. New technologies enable better sterilization processes and enhanced material properties, ensuring plasma remains uncontaminated during storage. These innovations help manufacturers meet strict medical standards while reducing production costs.

Consumer awareness about environmental impact has shifted preferences toward sustainable packaging solutions. Healthcare providers increasingly choose eco-friendly plasma bottles made from recyclable materials. This trend supports both environmental responsibility and regulatory compliance, as many regions now mandate sustainable packaging practices in medical applications.

Restraints

Regulatory Challenges and Compliance Issues Limit Market Expansion

Strict regulatory requirements pose significant challenges for plasma bottle manufacturers. Medical device regulations vary across countries, requiring extensive testing and certification processes that increase development time and costs. Companies must navigate complex approval procedures, often delaying product launches and market entry.

Specialized raw materials for high-quality plasma bottles face supply constraints, particularly for materials meeting medical-grade standards. Limited suppliers and fluctuating prices create production challenges for manufacturers. The scarcity of FDA-approved materials further restricts options, forcing companies to rely on expensive specialized sources.

Growing concerns about packaging sustainability create pressure on traditional plastic bottle manufacturers. Environmental regulations increasingly restrict certain materials, forcing companies to invest in alternative solutions. The transition to sustainable materials often requires significant research and development investments, impacting profitability and market competitiveness.

Growth Factors

Expansion of Plasma Collection and Storage Facilities Creates Market Opportunities

The global expansion of plasma collection centers presents significant growth opportunities for bottle manufacturers. New facilities require extensive inventory of specialized containers, creating steady demand streams. Blood banks and donation centers worldwide are modernizing their storage capabilities, driving market expansion.

Technological innovations in bottle design offer competitive advantages through improved durability and user-friendly features. Smart bottle technologies with tracking capabilities and enhanced material properties attract premium pricing. These innovations help manufacturers differentiate their products in competitive markets.

Increasing plasma donation programs worldwide, supported by government initiatives and awareness campaigns, boost demand for collection containers. Rising investments in biotechnology research, particularly in plasma-based treatments, create new market segments requiring specialized bottling solutions.

Emerging Trends

Adoption of Smart and Interactive Packaging Solutions Shapes Market Trends

Smart packaging technologies are transforming the plasma bottle industry through integrated sensors and tracking systems. These innovations enable real-time monitoring of storage conditions and inventory management, improving operational efficiency for healthcare providers. Interactive packaging solutions help ensure proper handling and reduce contamination risks.

Sustainable and recyclable packaging materials are becoming industry standards rather than optional features. Manufacturers increasingly adopt bio-based plastics and recyclable materials to meet environmental regulations and consumer expectations. This shift toward sustainability drives innovation in material science and production processes.

Automated filling and capping processes are revolutionizing production efficiency while maintaining sterility standards. Advanced manufacturing technologies reduce human error and contamination risks, making plasma bottles safer and more reliable. The growing focus on plasma-based therapeutic products continues expanding market applications beyond traditional blood banking.

Regional Analysis

North America Dominates the Plasma Bottle Market with a Market Share of 48.4%, Valued at USD 0.5 Billion

North America holds the dominant position in the plasma bottle market, accounting for 48.4% of the global share, valued at USD 0.5 Billion. This region’s significant market share can be attributed to the advanced healthcare infrastructure, high demand for medical and pharmaceutical applications, and continuous technological advancements in plasma bottle manufacturing.

Europe Plasma Bottle Market Trends

Europe follows closely with a strong presence in the plasma bottle market. The region is experiencing steady growth due to the increasing adoption of advanced healthcare solutions and rising voluntary plasma donation rates. The European market is expected to continue expanding as a result of government initiatives supporting healthcare advancements and plasma donation programs.

Asia Pacific Plasma Bottle Market Trends

The Asia Pacific region shows significant potential for market growth, driven by the growing healthcare needs of emerging economies. Countries in this region are expected to increase their plasma collection and storage capacities, offering opportunities for market expansion. Government support and rising demand for eco-friendly packaging further contribute to market growth in Asia Pacific.

Middle East and Africa Plasma Bottle Market Insights

The Middle East and Africa region is witnessing moderate growth in the plasma bottle market, primarily due to increasing healthcare investments and rising demand for medical supplies. However, the region’s growth potential is hindered by regulatory challenges and limited raw material availability for specialized bottles, which may slow the pace of market expansion.

Latin America Plasma Bottle Market Overview

Latin America’s plasma bottle market is expected to grow at a moderate pace, with increasing awareness and adoption of medical treatments. While the region faces challenges such as economic instability and regulatory hurdles, the rise in healthcare infrastructure investment is expected to drive growth in the long term.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Plasma Bottle Company Insights

In 2024, SGD Pharma continues to strengthen its position in the global Plasma Bottle Market with its innovative glass packaging solutions, catering to the pharmaceutical sector’s demand for high-quality plasma storage. The company’s expertise in the production of Type I and Type II glass bottles positions it as a leading player, meeting stringent regulatory standards.

Adelphi Group leverages its strong manufacturing capabilities to produce high-quality plastic and glass bottles for plasma storage. By focusing on customized solutions and incorporating advanced safety features in their products, the company remains a key contributor to the market’s growth, especially in emerging regions where demand is increasing.

Amcor Limited, with its vast experience in packaging and global reach, remains a dominant force in the Plasma Bottle Market. The company’s adoption of sustainable practices and focus on eco-friendly packaging solutions aligns with the increasing demand for environmentally responsible products. Amcor’s continuous innovation in material science enhances the durability and efficiency of plasma bottles.

Ball Corporation, known for its advanced aluminum and plastic packaging, has diversified into the plasma bottle market with a strong emphasis on reducing carbon footprint. The company is focusing on the development of lightweight, recyclable bottles, addressing both sustainability and cost-efficiency demands in the industry, positioning itself for substantial growth in the years to come.

Top Key Players in the Market

- SGD Pharma

- Adelphi Group

- Amcor Limited

- Ball Corporation

- Graham Packaging Company Inc

- Alpha Packaging

Recent Developments

- In May 2025, Realta Fusion secured $36M in fresh funding to advance its fusion-in-a-bottle reactor technology, aiming to revolutionize energy production with compact fusion solutions.

- In July 2025, Numan raised $60M to drive the future of preventative digital healthcare, focusing on innovative platforms for enhancing personalized health and wellness.

- In September 2024, Zap Energy attracted investments in a $130M funding round, with backers including Soros Fund and Laurene Powell Jobs’ Emerson Collective, advancing its mission to develop clean, sustainable fusion energy.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Billion Forecast Revenue (2034) USD 1.9 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material (Glass, Plastics), By Raw Material – Glass Type (Type I, Type II), By Capacity (Up to 250ml, 250ml to 500ml, Above 500ml), By End Use (Healthcare, Defense, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape SGD Pharma, Adelphi Group, Amcor Limited, Ball Corporation, Graham Packaging Company Inc, Alpha Packaging Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SGD Pharma

- Adelphi Group

- Amcor Limited

- Ball Corporation

- Graham Packaging Company Inc

- Alpha Packaging