Global Pigment Dispersion Market By Product Type (Inorganic Pigments and Organic Pigments), By Application (Plastics, Inks, and Coatings), By End-Use Industry (Building & Construction, Automotive, Packaging, Paper & printing, Textile, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 35249

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

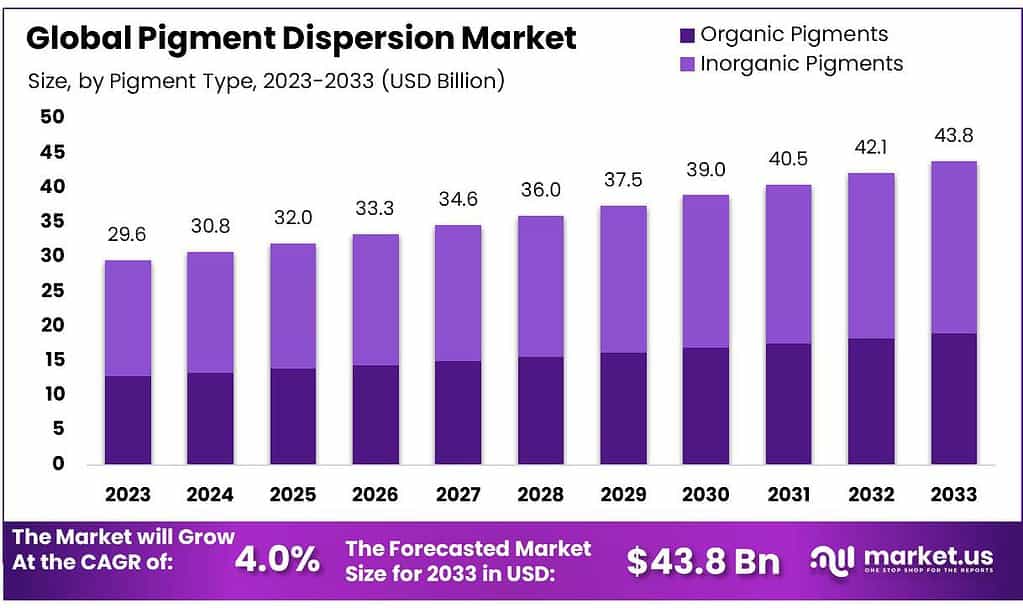

The global pigment dispersions market size is expected to be worth around USD 43.8 billion by 2033, from USD 29.6 billion in 2023, growing at a CAGR of 4.0% during the forecast period from 2023 to 2033.

The forecast period will see steady growth in the global packaging industry in terms of food and non-food packaging and printing labels. This is expected to drive demand for pigment dispersions. The pigment dispersions market involves the production and distribution of pigment particles uniformly dispersed in a liquid medium. Here’s an overview:

Purpose and Use Pigment dispersions are used to impart color to various materials like paints, coatings, inks, plastics, textiles, and cosmetics. They enhance the appearance and provide color consistency in the final product.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projections: The pigment dispersions market is set to experience robust growth, with a forecasted worth of around USD 43.8 billion by 2033, indicating a significant increase from the 2023 valuation of USD 29.6 billion.

- Drivers of Market Growth: Several factors are propelling this expansion. Emerging economies, particularly in Asia-Pacific and South America, are witnessing substantial industrialization, driving demand. Industries like construction, automotive, packaging, and textiles are crucial drivers, leveraging pigment dispersions for various applications.

- Product Type Analysis: Inorganic Pigments: Dominated the market in 2023, capturing 56.6% share due to their versatility across industries like paints, coatings, plastics, and textiles.

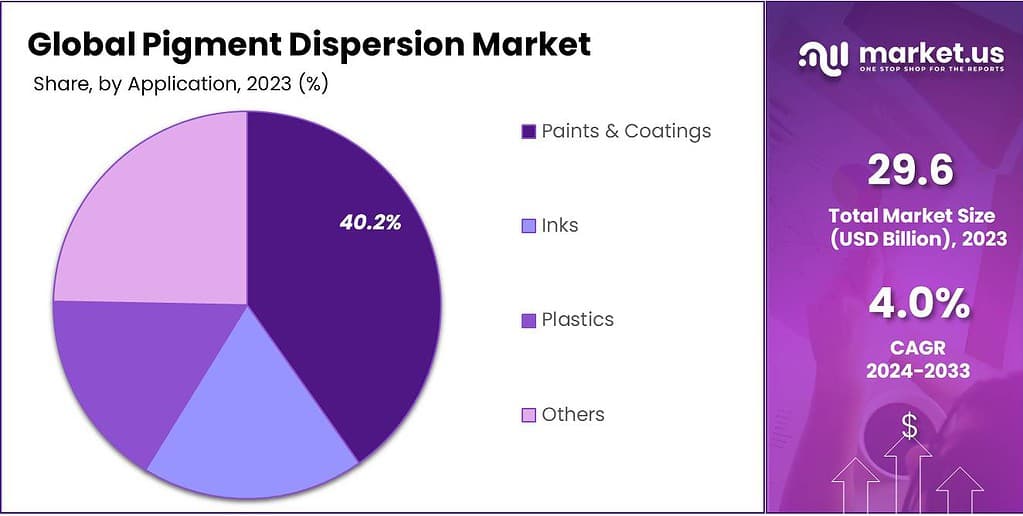

- Application Insights: Paints and Coatings Segment: Led the market in 2023 with a share of over 40.2%, utilized extensively for architectural, automotive, and industrial purposes.

- End-Use Industry Analysis: Building & Construction: Took the lead in 2023, utilizing pigments widely in paints and coatings for structures.

- Market Challenges: Stringent environmental regulations impact certain pigment types derived from elements like chromium, cadmium, lead, and mercury. Compliance requires adaptation and innovation in production methods.

- Opportunities: Escalating demand for eco-friendly organic pigments due to superior qualities, aligning with environmental concerns and regulations, presents a growth opportunity.

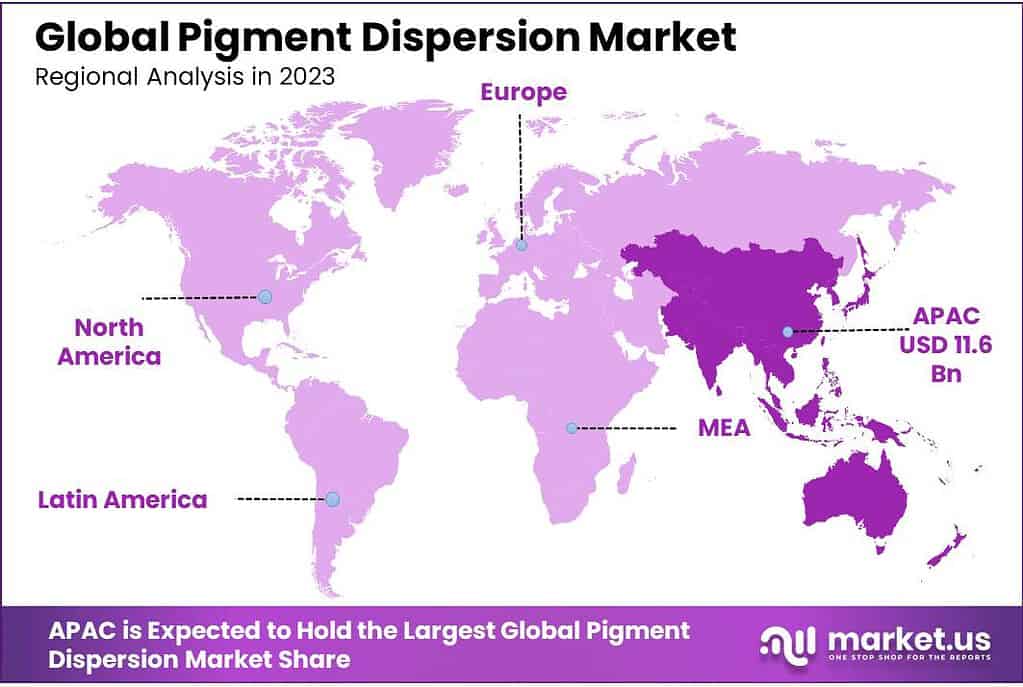

- Regional Analysis: Asia-Pacific leads the market due to abundant raw materials and low-cost labor. South Korea’s coatings application segment and the US’s QSRs drive demand in their respective regions.

- Key Players & Recent Developments: Major players like BASF SE, Clariant Ltd., and others focus on innovation, mergers, and acquisitions for market dominance. Recent developments highlight investments in new facilities and acquisitions to expand their market presence.

Product type analysis

In 2023, the pigment dispersion market witnessed a significant dominance by Inorganic pigments, capturing an impressive 56.6% share. These pigments, which encompass Titanium Dioxide, Iron Oxide, and various other compounds, displayed a remarkable versatility across industries.

Their prevalence in applications such as paints, coatings, plastics, and textiles contributed to their leading position. Their robustness in different environmental conditions and stability in various mediums fortified their market stronghold.

Inorganic pigment dispersion tends to be lighter than organic pigment dispersion. However, for applications that require greater durability, organic pigment dispersion may be preferred. Organic pigment dispersion can fade if it is exposed to the sun continuously, unlike inorganic pigment.

Inorganic pigment dispersion can be more economical than organic pigment and has better dispersion properties on different substrates due to its smaller particle sizes. Iron oxide and titanium dioxide are two of the most popular inorganic pigment dispersions.

Organic pigments are made up of carbon rings and carbon chains. They are transparent because of their large particle sizes. There are many types of organic pigments available, including azo pigments and phthalocyanine, lake, and quinacridone.

Organic pigments have a higher color strength than inorganic ones. However, high prices and poor dispersion abilities are hindering organic pigments’ growth. Printing inks, paints and coatings, rubber, and plastics all use organic pigments.

Application analysis

In 2023, the Paints and coatings segment emerged as the frontrunner in the pigment dispersion market, commanding a significant share of over 40.2%. This dominance stemmed from the widespread use of pigments in this sector to impart color, durability, and protection to various surfaces.

The versatility of pigments in paints and coatings for architectural, automotive, and industrial applications contributed to this segment’s robust position.

Because pigment dispersion is more effective at coloring printing inks than dyes, it has been widely used to replace them. The pigment dispersion-based inks are composed of dyes, which are dissolved in a carrier liquid.

However, the pigment dispersion-based inks contain fine particles that are suspended in the carrier fluid. These inks can use both organic and inorganic dispersions, but the percentage of the latter is relatively high due to their lower price and better dispersion abilities.

The forecast period will see an increase in plastic consumption in many end-use industries such as construction, automotive, medical devices, and electrical & electronic. Many plastics are used in construction, including floorings, high-performance safety windows, insulation materials, and storage tanks. They also serve as pipes, domes/skylights, cables, doors, and pipes. This market is in constant development and offers moderate growth potential.

Pigment dispersion can be used in plastics with polyolefins for food packaging and non-food packaging. It is also used in building and construction products, coverings and gutters, sheets, and films. Because of the potential for UV radiations to affect pigment dispersion properties, pigment dispersions are used in plastic applications that require direct sunlight exposure.

Pigment dispersion is used in packaging to enhance branding and improve visual design. This often attracts customers.

For flooring applications that require the use of pigment dispersion, epoxy and polyurethane are used. For coloring rubber sheets, tire sidewalls, and equipment used in surgery in the medical sector, pigment dispersion is used.

*Actual Numbers Might Vary In The Final Report

By End-Use Industry

In 2023, the Building and construction sector took the lead in the pigment dispersion market. It used pigments widely in paints and coatings for buildings, giving them color and protection.

Following closely, the Automotive industry saw significant growth, using pigments in car paints to make vehicles look good and last longer. Packaging also stood out, using pigments for colorful prints on packages, enhancing product appeal.

Paper & Printing used pigments for bright and lasting prints. Textiles used pigments for dyeing and printing fabrics, while various other industries found unique uses for pigments, showing their adaptability. Overall, the Building and construction sector led, but various industries relied on pigments for their unique needs.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Inorganic Pigments

- Organic Pigments

By Application

- Plastics

- Inks

- Coatings

By End-Use Industry

- Building & Construction

- Automotive

- Packaging

- Paper & printing

- Textile

- Others

Drivers

The pigment dispersions market is witnessing significant momentum, fueled by several driving factors. One key driver is the expanding utilization of pigment dispersions in emerging economies. Rapid industrialization across regions like APAC and South America presents substantial opportunities for market growth.

Industries such as building & construction, automotive, packaging, and textiles have experienced remarkable expansion in these areas. Countries like China, India, South Korea, Indonesia, and others in this league have seen robust growth in key manufacturing sectors.

The growth of manufacturing in these regions acts as a catalyst, propelling the pigment dispersions market. Government policies in these areas also support industry growth. Factors like low labor costs, skilled workforces, raw material availability, and urbanization have facilitated both domestic and foreign companies in establishing their production facilities in these regions.

Furthermore, the plastics industry’s surge plays a significant role in driving the consumption of pigment dispersions. Plastics have seen increasing popularity due to their exceptional properties such as durability, weather resistance, moisture resistance, insulation properties, thermal stability, abrasion resistance, and chemical resistance.

Textile manufacturers are experiencing unprecedented expansion due to the increasing use of fabric across many applications. Overall, the expanding applications of pigment dispersions in these burgeoning economies, coupled with the growth of pivotal industries like plastics and textiles, are major factors propelling the market dynamics forward.

Restrains

One significant restraint impacting the pigment dispersions market is the imposition of stringent environmental regulations. Certain pigments like metal oxide, mixed metal oxides, and metallic pigments, derived from elements such as chromium, cadmium, lead, and mercury, require certification for use across industries.

The disposal of heavy metals during the manufacturing process of these pigments poses environmental pollution risks.

Specifically, Chinese producers have encountered challenges due to inadequate treatment facilities and strict governmental regulations. Consequently, several chemical units faced closure due to non-compliance.

To navigate this regulatory landscape, companies are working on developing new products that align with government-mandated parameters.

The regulatory framework has prompted companies to modify their practices to avoid severe penalties and ensure compliance. The focus has shifted towards adopting environmentally friendly production methods and innovating new products that meet stringent regulatory standards.

These efforts are essential to mitigate environmental impact and adhere to regulatory guidelines, despite the associated challenges posed to the pigment dispersion market.

Opportunities

An opportunity knocking on the door of the pigment dispersions market is the escalating demand for organic pigments. Nowadays, most high-performance pigments are crafted from environmentally friendly materials, posing minimal to no threat to human health and safety. This trend has led to a surge in the usage of high-performance organic pigments, revered for their superior qualities.

These organic pigments exhibit heightened lightfastness, resistance to chemical exposure, weather resilience, and heat stability compared to conventional pigments. They boast exceptional color fastness and insolubility, making them especially fitting for applications in automotive and decorative coatings that demand top-notch light and weather endurance.

The ongoing development of organic pigments tailored for specific applications opens significant growth avenues for pigment dispersion manufacturers. End-users increasingly prefer products that embrace eco-friendly attributes and pose minimal health risks.

This preference aligns with the growing global concern for environmental protection, driving the demand for products that comply with regulations set by various government bodies worldwide.

The escalating preference for organic pigments signifies an advantageous opportunity for pigment dispersion manufacturers to innovate and cater to the market’s evolving needs while aligning with environmental standards and meeting the rising demand for eco-conscious products.

Challenges

The challenge in the pigment dispersion market revolves around rules for recycling plastics. When recycling plastic, clear types are preferred, followed by white and colored ones. But within colored plastics, darker shades hold more value than lighter ones.

In the EU, rules require careful pigment choices to meet specific legal needs for different products. For instance, using chrome yellow in a toy might be illegal, but it could be okay if the product is considered sports equipment. Likewise, using certain pigments in food processing products must adhere to strict rules, especially for electrical appliances.

Finding the right pigment while balancing costs, following rules, and meeting different product needs is tough. Companies must navigate these regulations while meeting diverse application demands

Regional Analysis

The Asia Pacific was the dominant market, accounting for over 39.3% of global revenue in 2023. This is due to the abundance of raw materials and low-cost labor.

It has attracted many manufacturers from different industries to establish production plants in the Asia Pacific region to reap greater benefits. The coatings application segment in South Korea is expected to have the largest share of the overall pigment dispersion industry growth over the forecast period.

South Korea’s market for pigment dispersion is expected to grow due to the increased infrastructure spending and the increasing government spending on public infrastructure. Additionally, South Korea’s low unemployment rate and high disposable income will drive the demand for pigment dispersions for packaging applications in various end-use industries such as food and beverage and consumer goods.

Germany accounted for the largest share of Europe’s pigment dispersion market in terms of both revenue and volume. The region’s growth is expected to be aided by the support of many European countries and growing industrial facilities. The region is projected to benefit from the growing popularity of green technology and strict environmental regulations.

In the US, the growing number of QSRs and quick-service restaurants (QSRs) is driving the demand for pigment dispersion. They use pigment dispersion in food packaging and printing ink applications. There are strict guidelines in the USA regarding the types of pigment dispersions that can be used in food packaging. Many inorganic pigments can become toxic when they come in contact with foods.

According to the FDA, food coloring agents and printing inks can only be made from materials that are approved by the FDA. Food packaging is not allowed to use pigments that contain polynuclear aroma hydrocarbons or benzopyrene at levels exceeding 0.5 and 5.0 parts, respectively.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global pigment dispersion market is fragmented. Major players are involved in product development, strategic partnerships, mergers and acquisitions, and joint ventures to vertically incorporate across the value chain. This reduces operational costs and allows for higher profit margins.

In March 2019, BASF SE joined forces with Landa Labs to launch its second stir-in pigment, eXpand. Blue (EH 6001) is sold under the Colors & Effects label. eXpand! Blue (EH 6001) can be used for automotive coatings as well as outdoor coating applications.

Organic Dyes and Pigments also acquired Premier Colors, Inc. in December 2020 to expand its business in Providence and serve the customers of the former. Premier Colors, Inc. is a South Carolina-based company that supplies specialty chemicals and pigment dispersions to the paper, textile, paints and coatings, and leather industries. These are the major players in the global pigment dispersion industry.

Маrkеt Кеу Рlауеrѕ

- BASF SE

- Clariant Ltd.

- Ferro Corporation

- Sun Chemical

- Sudarshan Chemical Industries Limited

- Pidilite Industries Ltd.

- DyStar Singapore Pte. Ltd.

- Solvay

- Altana

- Heubach GmbH

- Flint Group

- Avient

- Organic Dyes and Pigments

- Aum Farbenchem

- Aralon Color GmbH

Recent Developments

In March 2022, BASF SE (Germany) inaugurated a new laboratory building for the development of automotive refinish coatings and to make more paint innovations.

In March 2022, Fujifilm Imaging Colorants announced it had invested $28 Million in adding a new facility in Delaware for Inkjet Pigment Dispersions

In January 2022, a consortium of Heubach Group and SK Capital Partners completed the purchase of Clariant’s pigment business. Clariant retains a 20 % stake in the newly formed group.

Report Scope

Report Features Description Market Value (2022) USD 29.6 Bn Forecast Revenue (2032) USD 43.8 Bn CAGR (2023-2032) 4.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Inorganic Pigments and Organic Pigments), By Application (Plastics, Inks, and Coatings), By End-Use Industry (Building and construction, Automotive, Packaging, Paper & printing, Textile, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE, Clariant Ltd., Ferro Corporation, Sun Chemical, Sudarshan Chemical Industries Limited, Pidilite Industries Ltd., DyStar Singapore Pte. Ltd., Solvay, Altana, Heubach GmbH, Flint Group, Avient, Organic Dyes and Pigments, Aum Farbenchem, Aralon Color GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are pigment dispersions?Pigment dispersions are finely ground particles of pigments uniformly distributed in a liquid medium, such as water, solvent, or resin, to create a stable and easily applicable coloring solution.

What is the primary purpose of using pigment dispersions?Pigment dispersions are used to provide color, opacity, and other desired properties to a wide range of materials, including paints, coatings, inks, plastics, textiles, and cosmetics.

How are pigment dispersions different from pigments?Pigments are insoluble particles, while pigment dispersions are pigments that have been dispersed or suspended in a liquid carrier to facilitate their incorporation into various materials more effectively.

-

-

- BASF SE

- Clariant Ltd.

- Ferro Corporation

- Sun Chemical

- Sudarshan Chemical Industries Limited

- Pidilite Industries Ltd.

- DyStar Singapore Pte. Ltd.

- Solvay

- Altana

- Heubach GmbH

- Flint Group

- Avient

- Organic Dyes and Pigments

- Aum Farbenchem

- Aralon Color GmbH