Global Physical Vapor Deposition Market By Product Type (Thermal Evaporation, Sputter Deposition and Arc Vapor Deposition) By Component (PVD Equipment, PVD Materials and PVD Services) By Application (Semiconductor & Electronics, Solar Products, Cutting Tools, Medical Equipment and Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 16940

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

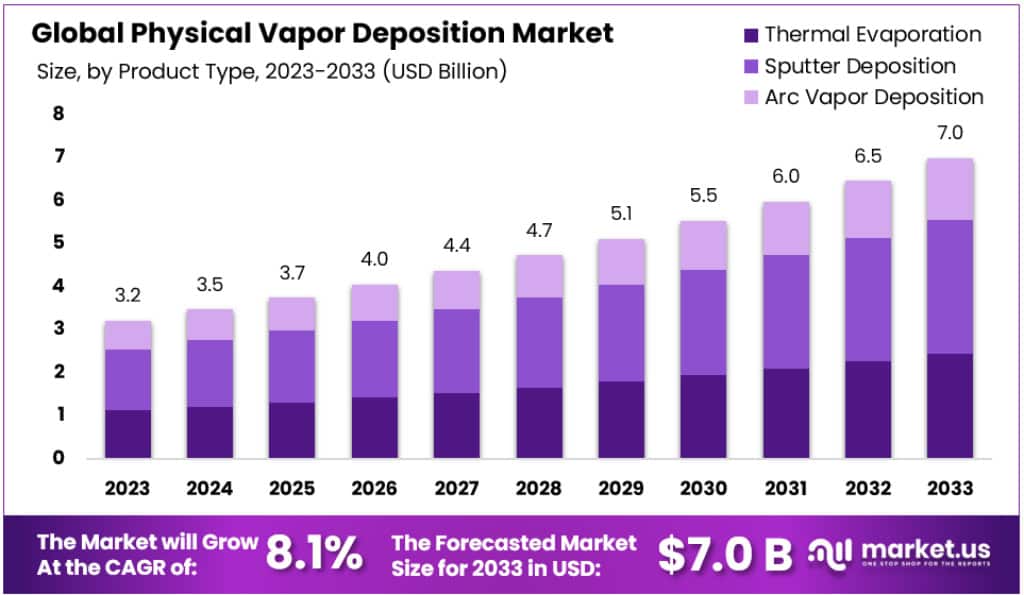

The Global Physical Vapor Deposition Market size is expected to be worth around USD 7 Billion by 2033, from USD 3.2 Billion in 2023, growing at a CAGR of 8.1% during the forecast period from 2024 to 2033.

This expansion is largely driven by the dynamic semiconductor industry, which consistently seeks advanced thin-film deposition techniques. Additionally, the escalating demand in the medical device manufacturing sector, particularly for products with enhanced durability and biocompatibility, marks a notable contribution to this upward trend. PVD’s application in improving the functionality and aesthetics of automotive industry products, coupled with its role in solar energy applications and energy-efficient building designs, further accelerates market growth.

Sputtering, a key technique within the PVD spectrum, facilitates the deposition of various metallic films, including aluminum, gold, platinum, and tungsten alloys, on wafers. This process is expected to see heightened demand in the upcoming years. Reflecting on healthcare expenditures, U.S. Medicare spending witnessed an 8.4% increase to USD 900 billion in 2021, while Medicaid expenditures rose by 9.2% to USD 734 billion compared to the previous year. The U.S. also saw a 12% rise in medicine spending in 2021, driven by the high demand for COVID-19 vaccines, boosters, treatments, and a record usage of 194 billion daily doses of prescription medications. These healthcare-related factors are anticipated to boost PVD demand in the medical sector, particularly given the growing need for medical equipment in the U.S., propelled by an aging population.

In the realm of medical applications, PVD coatings are increasingly adopted for enhancing the performance and biocompatibility of medical devices and implants, offering improved wear resistance, reduced friction, and anti-corrosive properties. These advancements contribute significantly to the longevity and functionality of various medical instruments and implants.

Turning to the semiconductor industry, regions such as Taiwan, South Korea, Japan, and China collectively accounted for 72% of global semiconductor production in 2022. The U.S. and Japan, previously dominant manufacturing hubs, now focus on exporting to high-profit countries. In 2022, Asia Pacific, led by China, emerged as the largest semiconductor market worldwide. Taiwan Semiconductor Manufacturing Co.’s decision in December 2022 to increase investments in the U.S. manufacturing capacity highlights a shift in geographic market dynamics. Consequently, the burgeoning global semiconductor industry is forecasted to stimulate PVD demand, essential for depositing thin films on silicon wafers and fabricating advanced integrated circuits and microelectronic devices.

Key Takeaways

- The Global Physical Vapor Deposition Market is expected to reach approximately USD 7 billion by 2033.

- It was valued at USD 3.2 billion in 2023.

- The market is projected to grow at a CAGR of 8.1% from 2024 to 2033.

- In 2023, Sputter Deposition held a dominant market position with a 47.6% market share.

- PVD Equipment emerged as the leading segment, holding over 35% market share in 2023.

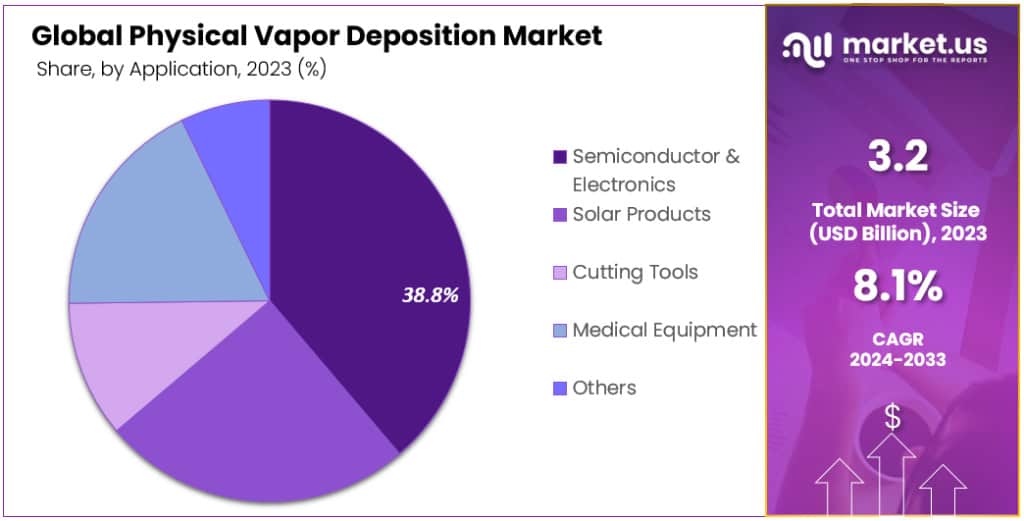

- In 2023, the Semiconductor & Electronics application segment led the market with a 38.8% share.

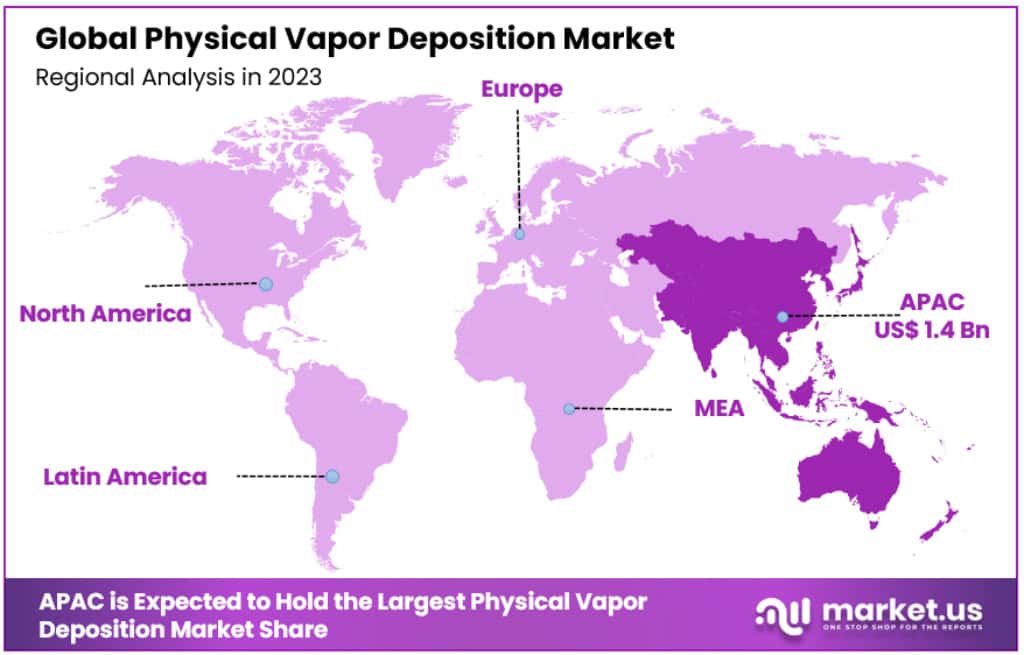

- Asia Pacific dominated the market in 2023 with a 43.1% share.

Product Type Analysis

In 2023, Sputter Deposition held a dominant market position in the Physical Vapor Deposition (PVD) sector, capturing an impressive 47.6% market share. This method, renowned for its precision and versatility, has become integral in various industries, particularly in the manufacturing of advanced electronic and optical devices. Sputter deposition’s ability to deposit thin films uniformly across diverse substrates, including metals, alloys, and ceramics, underscores its industry-wide appeal. Its operational efficiency at low temperatures is particularly advantageous for temperature-sensitive materials, enhancing its compatibility with a broad spectrum of substrates.

The technological superiority of sputter deposition is not just limited to its application versatility. It also offers higher packing densities and improved adhesion compared to other PVD methods. The adaptability to work with a wide range of metals, including alloys and mixtures, positions sputter deposition as a preferred choice for industries seeking high-quality, performance-oriented coatings. This adaptability is anticipated to drive an increased demand for sputtering systems, with projections indicating a ~6.2% CAGR growth in the sputter deposition segment over the 2024-2033 forecast period.

A notable development highlighting the segment’s advancements is the introduction of BALIQ TISINOS PRO by Oerlikon Balzers on July 4, 2023. This PVD coating, tailored for machining hardened steel with hardness up to 70 HRC, set a new industry benchmark by reducing tool loading and markedly improving wear resistance. Such innovations reinforce the segment’s leading position and its potential for increased usage, particularly in the semiconductor industry for depositing films in integrated circuit processing. The sputter deposition segment, with its diverse applications and technological advancements, is poised to sustain its market dominance and drive growth in the global PVD market.

Component Analysis

In 2023, PVD Equipment emerged as the leading segment in the Physical Vapor Deposition (PVD) market, securing a substantial share of over 35%. This dominance is largely attributed to the growing demand for advanced PVD systems across various industries. The significant share of PVD equipment in the market underscores its essential role in the PVD process, where precision and efficiency are paramount.

PVD Equipment’s prominence is driven by its integral role in enabling high-quality thin-film coatings, which are crucial in numerous applications. The equipment’s capability to offer uniform, durable, and high-purity coatings makes it indispensable in sectors such as electronics, automotive, and aerospace. In the semiconductor industry, PVD equipment is vital for depositing thin films on silicon wafers, contributing to the manufacturing of advanced integrated circuits and microelectronic devices. This equipment’s versatility in handling a variety of materials, including metals, alloys, and ceramics, further enhances its market appeal.

Technological advancements in PVD equipment, aiming to improve efficiency and reduce operational costs, also contribute to its market dominance. These advancements include the development of systems that can operate under lower temperatures, making them suitable for a wider range of temperature-sensitive materials. Moreover, the push towards more environmentally friendly and energy-efficient solutions in industrial processes has increased the adoption of advanced PVD equipment.

The demand for PVD equipment is also fueled by the rising trend of thin-film solar cells in the renewable energy sector. As the world moves towards sustainable energy solutions, the requirement for efficient and reliable PVD equipment for producing solar cells has become more pronounced.

Application Analysis

In 2023, the Semiconductor & Electronics application segment led the Physical Vapor Deposition (PVD) market, capturing an impressive 38.8% share. This segment’s dominance is primarily attributed to the crucial role PVD plays in the semiconductor industry. PVD is extensively utilized for depositing thin films on semiconductor wafers, a critical step in the fabrication of integrated circuits and microelectronic devices. Common materials deposited include metals and dielectrics, and PVD techniques such as sputtering are employed to metalize semiconductor devices.

This process is vital for creating conductive paths, interconnects, and contacts within semiconductor components, which are essential for the flow of electrical signals. Advanced semiconductor devices particularly benefit from the precise deposition capabilities of PVD, essential for forming intricate interconnect structures on semiconductor wafers.

The microelectronics segment, a subfield of electronics, also significantly contributes to the market’s growth. In 2023, it accounted for more than one-third of the global PVD market value. PVD processes in microelectronics are utilized for device fabrication and seed layers for plating. The coatings produced are known for their hardness, homogeneity, high-temperature durability, and excellent abrasion strength, thereby enhancing the performance of microelectronic devices. The growing microelectronics market, especially in key economies like China, India, Japan, the United States, Germany, and Brazil, is expected to augment the growth of this segment further.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Thermal Evaporation

- Sputter Deposition

- Arc Vapor Deposition

By Component

- PVD Equipment

- PVD Materials

- PVD Services

By Application

- Semiconductor & Electronics

- Solar Products

- Cutting Tools

- Medical Equipment

- Others

Drivers

- Growth in Semiconductor Manufacturing: A key driver is the sustained expansion of the semiconductor manufacturing sector. The PVD process is integral in producing microelectronic devices, which are foundational to mainstream electronics like cell phones, tablets, and laptops. This sector’s growth is fueled by advancements in connectivity, communications, automotive technologies, and data centers. The semiconductor industry’s global market share in 2022 demonstrates this with the U.S. holding ~45%, Korea ~20%, Japan ~8%, Europe ~9%, Taiwan ~8%, and China ~9%.

- Medical Applications Rise: The medical sector is increasingly utilizing PVD coatings for medical devices, enhancing their efficiency and lifespan. This growth is linked to healthcare expenditure and the proliferation of healthcare facilities, especially in North America and emerging economies. In 2021, U.S. Medicare spending increased by 8.5% to USD 900 billion, and Medicaid spending rose by 9.2% to USD 735 billion, indicating a growing market for medical applications of PVD.

- Microelectronics Penetration: The expansion of the microelectronics industry, particularly in the automotive, defense, and healthcare sectors, is significantly driving the PVD market. The CHIPS and Science Act, with its USD 52.70 billion funding in the U.S. for semiconductor R&D and production, underscores this growth.

Restraints

- High Capital Costs: The growth of PVD technology is constrained by its high capital costs, including raw material prices, equipment costs, and skilled labor. The need for specialized systems for high-temperature operations increases these costs. Fluctuating prices of materials like titanium, essential in aerospace and aircraft applications, also contribute to this challenge.

Opportunities

- Eco-Friendly Coating Processes: The environmentally safe nature of PVD, which produces no harmful waste, presents significant opportunities. This aspect is increasingly important as both consumers and manufacturers shift towards eco-friendly materials and methods. PVD’s use of materials like chromium nitride (CrN) and titanium nitride (TiN) supports this trend.

- Digital Solutions Adoption: The rise in digitization across sectors like media, banking, and healthcare boosts the PVD market. The growing Electronics System Design & Manufacturing (ESDM) industry, driven by machine learning and artificial intelligence, is creating a high demand for electronic products, which in turn increases the need for PVD-enhanced components.

Challenges

- High Service Costs and Material Price Fluctuations: The technical complexity of PVD processes requires skilled labor and high operating temperatures, leading to increased service costs. Furthermore, the fluctuating prices of raw materials directly affect the profitability of suppliers, posing a significant challenge.

Trends

- Focus on Eco-Friendly Processes: Companies are increasingly adopting PVD for its lower environmental impact. For example, Kloeckner Metals has implemented PVD processes to reduce their environmental footprint.

- Increasing Importance of Aesthetics and Durability: PVD is gaining popularity for enhancing the appearance and durability of products in various industries, including automotive and packaging. This trend is driven by its ability to provide coatings that are not only protective but also aesthetically pleasing.

- Rising Demand for Energy-Efficient Solutions: The shift towards sustainable energy sources like solar power is propelling the demand for PVD in solar panel production. PVD coatings increase the efficiency and lifespan of solar panels, making them more attractive for renewable energy applications.

Regional Analysis

In the Physical Vapor Deposition (PVD) market, Asia Pacific emerged as the dominant region in 2023, holding a significant 43.1% share. This dominance is driven by the region’s burgeoning electronics and semiconductor industries, key contributors to the demand for PVD in advanced microelectronic component and semiconductor device fabrication. The region’s rapid expansion in solar energy projects and focus on renewable energy sources further amplify the demand for PVD in solar panel production.

The automotive sector in Asia Pacific also plays a crucial role in this growth, with an increasing emphasis on enhancing automotive component performance and longevity through PVD coatings. In 2023, the market value in Asia Pacific was approximately USD 1.4 billion.

Countries like India, Japan, and South Korea are witnessing significant growth due to rising demand in medical equipment and expansion in industrial sectors. The demand for PVD coatings in these regions is growing rapidly, driven by the need for decorative coatings across various industries and the environmental benefits of PVD.

The recent USMCA (the United States Mexico Canada Agreement), and the push by the U.S. government to encourage domestic manufacturing will likely increase demand for PVD coatings in North America, mainly in medical equipment and microelectronics applications. The market will also be boosted by the increased use of physical vapor deposition coatings in Mexico’s automotive industry.

In Spain, the CAGR for PVD coatings will be 6.1% over the forecast period. Factors like a high number of hospitals, increasing prevalence of chronic diseases, higher purchasing power, and higher expectations of the population regarding healthcare will drive growth in the medical equipment market and, in turn, the PVD marketplace.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

In the competitive landscape of the Physical Vapor Deposition (PVD) market, several key players are making significant strides, contributing to the market’s growth and shaping its future trajectory.

Oerlikon Group stands as a prominent name in the PVD market. Established in 1946 and headquartered in Pfäffikon SZ, Switzerland, the company specializes in manufacturing PVD coating equipment. Oerlikon Group’s products cater to a wide range of applications, including batch and inline systems, metallization for mobile phones, laptops, consumer goods, and notebook housing. The company prides itself on its ISO-9001 and ISO/TS 16949 certified manufacturing facilities, a testament to its commitment to quality. As of 2022, Oerlikon Group has expanded its global reach, boasting 182 locations across 37 countries.

IHI Corporation, known earlier as Ishikawajima-Harima Heavy Industries Co., Ltd., is a key Japanese player in the industry. Founded in 1853, IHI Corporation has evolved into a diverse heavy industry manufacturer, impacting numerous sectors globally.

Emerging players like Intevac, Inc., Impact Coatings AB, and Denton Vacuum are also shaping the market landscape. Intevac, Inc., founded in 1991 and headquartered in California, operates in two segments: thin film equipment and photonics. The company has manufacturing facilities in California and Asia and manages direct sales through its sales force and indirect sales through distributors in Japan and China.

Impact Coatings AB, established in 1997 and based in Linkoping, Sweden, specializes in PVD technology for the automotive, fuel cells, and fashion industries. Its products, marketed under the brand names MAXPHASE and INLINECOATER, cater to both equipment and coating services.

Маrkеt Кеу Рlауеrѕ

- AJA International, Inc.

- CHA Industries

- IHI HAUZER B.V.

- Denton Vacuum

- Applied Materials, Inc.

- Intevac, Inc.

- Angstrom Engineering, Inc.

- OC Oerlikon Management AG

- Advanced Energy Industries, Inc.

- Kobe Steel Ltd.

- Inorcoat

- KOLZER SRL

- Advanced Coating Service

- Impact Coatings AB

- Oerlikon Group

- IHI Corporation

- HEF Groupe

- Kurt J. Lesker Company

- Voestalpine AG

- NISSIN ELECTRIC Co., Ltd

- Other Key Players

Report Scope

Report Features Description Market Value (2023) USD 3.2 Billion Forecast Revenue (2033) USD 7 Billion CAGR (2023-2032) 8.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Thermal Evaporation, Sputter Deposition and Arc Vapor Deposition) By Component (PVD Equipment, PVD Materials and PVD Services) By Application (Semiconductor & Electronics, Solar Products, Cutting Tools, Medical Equipment and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AJA International, Inc., CHA Industries, IHI HAUZER B.V., Denton Vacuum, Applied Materials, Inc., Intevac, Inc., Angstrom Engineering, Inc., OC Oerlikon Management AG, Advanced Energy Industries, Inc., Kobe Steel Ltd., Inorcoat, KOLZER SRL, Advanced Coating Service, Impact Coatings AB, Oerlikon Group, IHI Corporation, HEF Groupe, Kurt J. Lesker Company, Voestalpine AG, NISSIN ELECTRIC Co. Ltd, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the size of the physical vapor deposition market in 2023?A: The Physical Vapor Deposition market size is USD 3.2 Billion in 2023

Q: What is the projected CAGR at which the physical vapor deposition market is expected to grow at?A: The Physical Vapor Deposition market is expected to grow at a CAGR of 8.1% (2024-2033).

Q: List the key industry players of the Physical Vapor Deposition market?A: AJA International, Inc., CHA Industries, IHI HAUZER B.V., Denton Vacuum, Applied Materials, Inc., Intevac, Inc., Angstrom Engineering, Inc., OC Oerlikon Management AG, Advanced Energy Industries, Inc., Kobe Steel Ltd., Inorcoat, KOLZER SRL, Advanced Coating Service, Impact Coatings AB, Oerlikon Group, IHI Corporation, HEF Groupe, Kurt J. Lesker Company, Voestalpine AG, NISSIN ELECTRIC Co. Ltd and Other Key Players engaged in the Physical Vapor Deposition market.

Physical Vapor Deposition MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Physical Vapor Deposition MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- AJA International, Inc.

- CHA Industries

- IHI HAUZER B.V.

- Denton Vacuum

- Applied Materials, Inc.

- Intevac, Inc.

- Angstrom Engineering, Inc.

- OC Oerlikon Management AG

- Advanced Energy Industries, Inc.

- Kobe Steel Ltd.

- Inorcoat

- KOLZER SRL

- Advanced Coating Service

- Impact Coatings AB

- Oerlikon Group

- IHI Corporation

- HEF Groupe

- Kurt J. Lesker Company

- Voestalpine AG

- NISSIN ELECTRIC Co., Ltd

- Other Key Players