Global Phototransistor Market Size, Share, Industry Analysis Report By Type (Bipolar phototransistor, Field-Effect Phototransistor (PhotoFET), Avalanche phototransistor),By Material (Silicon, Gallium Arsenide (GaAs), Germanium, Indium Gallium Arsenide (InGaAs), Others),By Wavelength (Ultraviolet (UV), Visible, Infrared (IR)),By Application (Light detection, Optical switching, Position sensing, Optical communication, Others),By End Use Industry Vertical (Consumer electronics, Automotive, Healthcare, Telecommunications, Aerospace and defense, Industrial automation, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov 2025

- Report ID: 165689

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

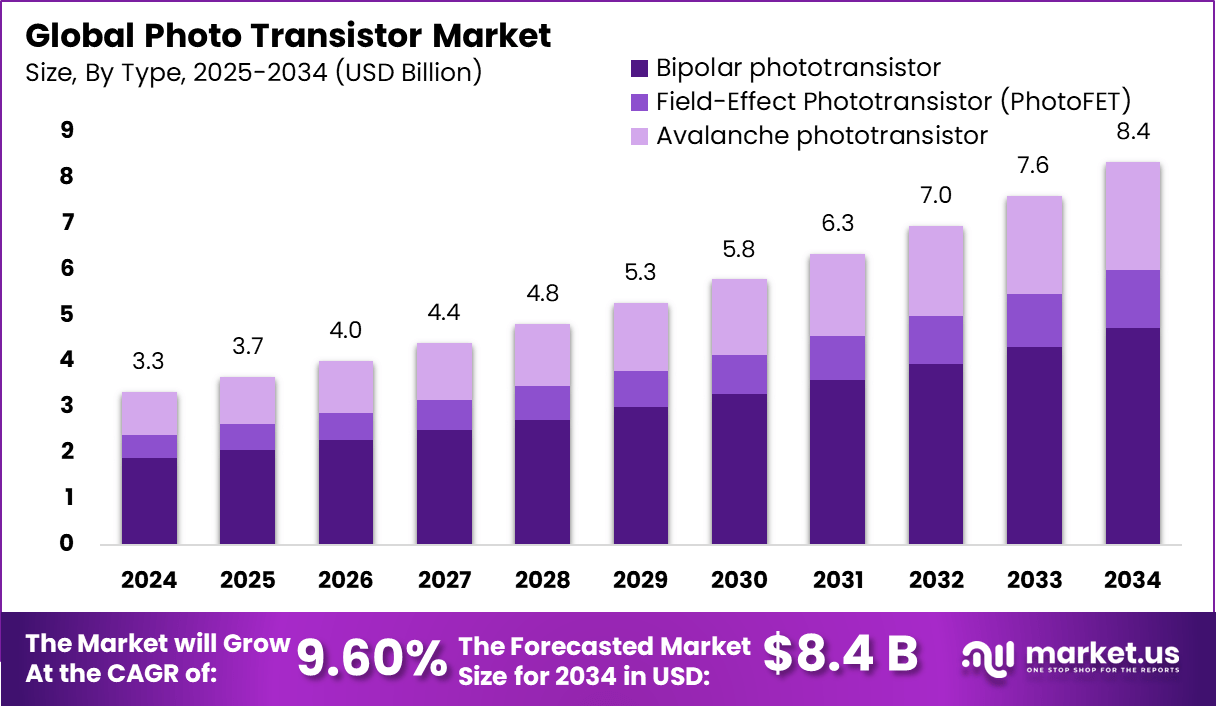

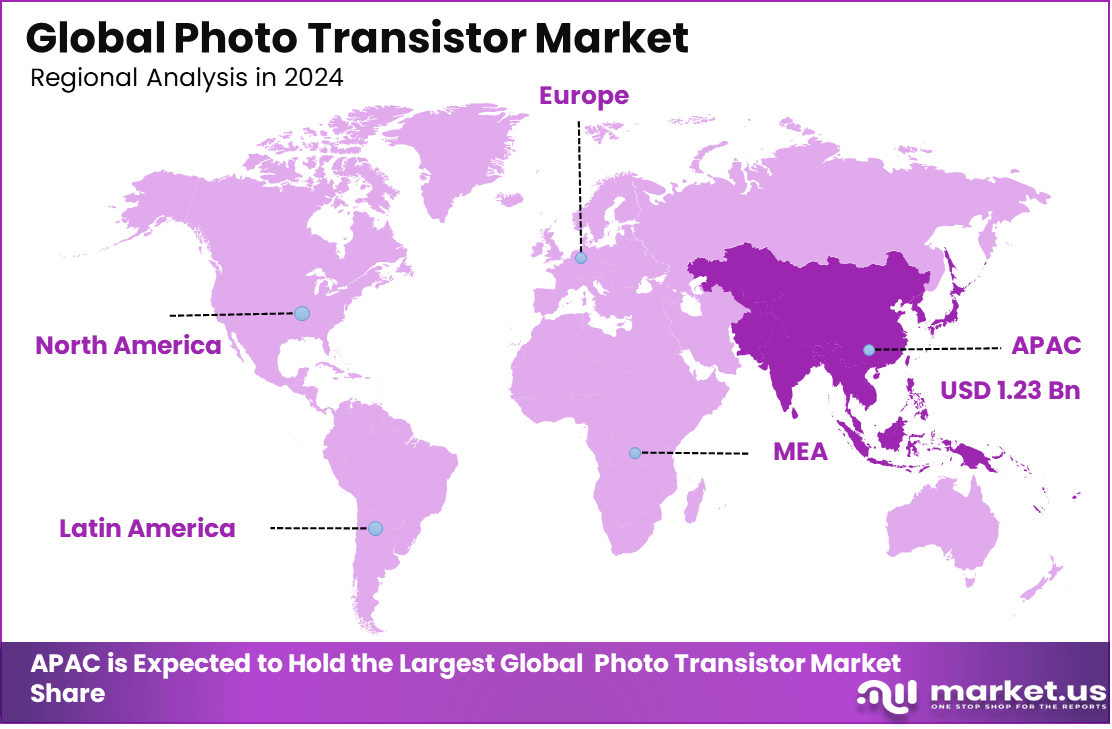

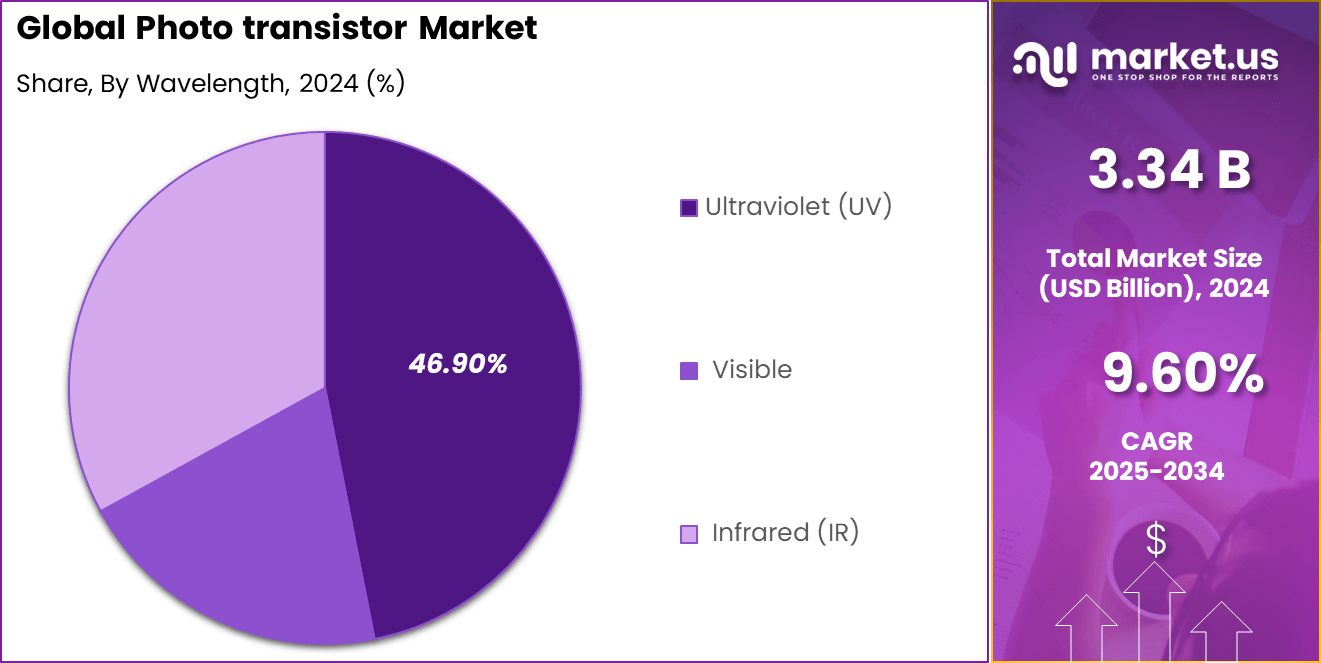

The Global Photo Transistor Market generated USD 3.34 billion in 2024 and is predicted to register growth to about USD 8.4 billion by 2034, recording a CAGR of 9.60% throughout the forecast span.In 2024, Asia Pacific held a dominan market position, capturing more than a 37.1% share, holding USD 1.2 Billion revenue.

The photo transistor market has grown steadily as demand for light sensing components increases across consumer electronics, automotive systems, industrial automation and communication devices. The market has become a key part of the broader optoelectronics ecosystem because photo transistors convert light signals into electrical output with high sensitivity and fast response. Growth reflects wider adoption of optical sensing in both everyday devices and specialized applications.

The growth of the market can be attributed to expanding use of optical sensors in smartphones, wearable devices, display systems and ambient light measurement functions. Automotive applications such as safety systems, interior lighting control and driver monitoring also drive consistent demand. Industrial automation relies heavily on optical detection for robotics, motion tracking and equipment monitoring. Advancements in semiconductor materials and miniaturization techniques further strengthen adoption.

Demand is rising across sectors that require accurate light detection and stable performance under varied conditions. Consumer electronics generate significant demand due to high production volumes and constant need for improved sensor accuracy. Automotive manufacturers integrate photo transistors into lighting, positioning and sensing modules. Industrial users require reliable detectors for factory automation, inspection systems and environmental monitoring.

Key technologies driving adoption include advanced silicon and compound semiconductor materials, surface mount packaging, integrated light filtering and high gain amplification designs. Improvements in noise reduction, response time and wavelength sensitivity support applications from ultraviolet to infrared ranges. Integration with microcontrollers, display drivers and embedded systems enables more compact and power efficient solutions.

Key Takeaways

- Bipolar Photo transistor drones represent the majority in this segment, holding around 56.7% share by type.

- Drones using silicon-based components account for about 35.8% of the market.

- Ultraviolet (UV) wavelength detection represents approximately 46.9% of drone sensor applications.

- Light detection constitutes about 38.7% of drone applications in mining.

- The consumer electronics industry represents around 32.9% of the end-use market for these drones.

- The Asia Pacific region controls roughly 37.1% of the phototransistor market share, reflecting strong industrialization and electronics manufacturing growth.

China Market Size

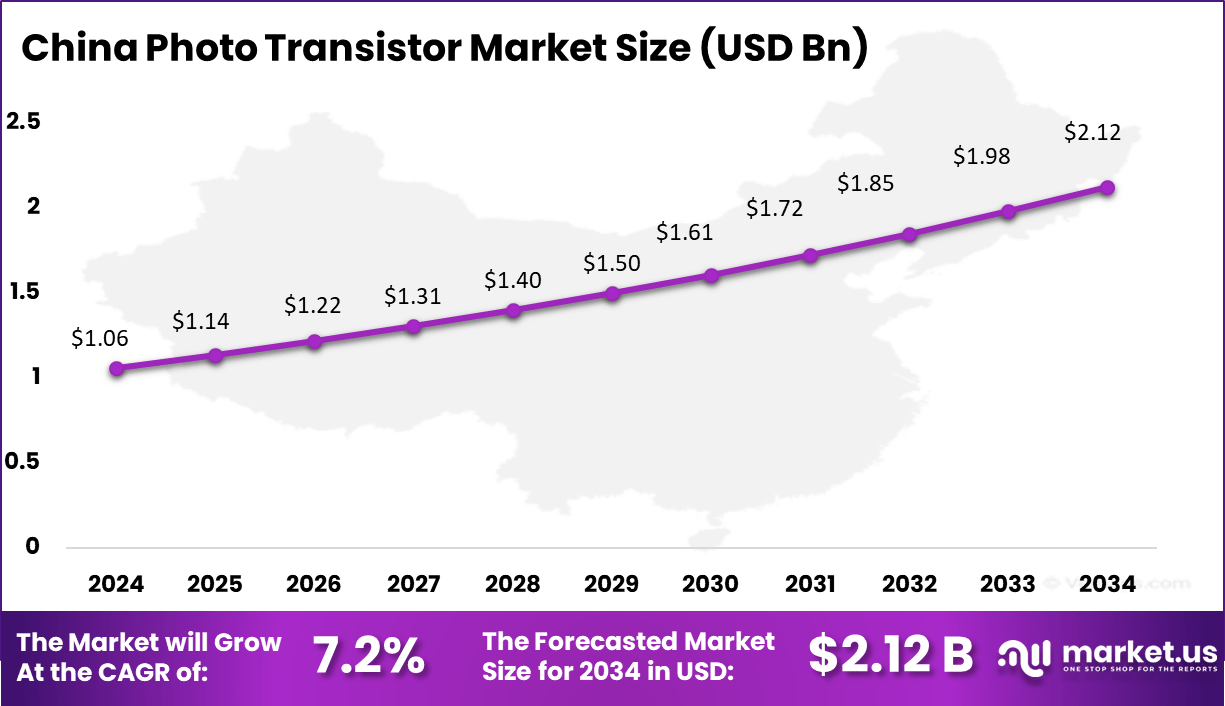

In 2024, China dominates the regional market, with its mining drone sector valued at USD 1.06 billion. The country’s strong industrial base, alongside government priorities to boost smart mining, supports widespread drone adoption for exploration, surveying, and environmental monitoring. Advanced manufacturing and technology ecosystems in China enable rapid scaling and deployment of drones tailored to mining needs.

China’s market growth at around 7.2% CAGR reflects increased digital mining investments and expanding mining projects requiring efficient data capture and analysis. The government’s focus on integrating AI and digital tools in mining fosters a favorable environment for autonomous drone technologies to flourish.

The Asia Pacific region holds a commanding share of approximately 37.1% in the autonomous mining drones market. The region benefits from rapid industrial growth, extensive mining activity, and supportive technology policies. Countries like China spearhead this market, with China alone valued at about USD 1.06 billion and exhibiting a growth rate of 7.2% CAGR.

This growth is driven by substantial investments in mining infrastructure, digitalization efforts, and government initiatives promoting automation and sustainability in mining. Asia Pacific stands out for innovative drone applications in both surface and underground mining, supported by a growing ecosystem of drone manufacturers and service providers.

By Type

In 2024, Bipolar phototransistors hold a dominant position in the phototransistor market, covering about 56.7% of the segment by type. These devices are favored for their reliability, simplicity, and ability to amplify light signals efficiently. Their long-standing use in analog amplification and switching applications across various electronic devices establishes them as a foundation of phototransistor technology.

Bipolar types are particularly well-suited for environments where stable and consistent light detection is required without complex control circuitry.This type is widely implemented in applications that demand rapid response times and strong signal gain, contributing to their continued preference in consumer electronics and industrial systems.

By Material

In 2024, Silicon is the leading semiconductor material used for phototransistors, accounting for roughly 35.8% of the market by material. Its widespread adoption is driven by mature fabrication technology, affordable cost, and reliable electrical characteristics.

Silicon-based phototransistors deliver effective performance in various spectral ranges, making them versatile for multiple light detection applications.The material supports extensive integration with existing electronics, especially in consumer products and industrial sensors.

By Wavelength

In 2024, Phototransistors that operate in the ultraviolet (UV) wavelength spectrum represent about 46.9% of the market. These devices are specialized for detecting UV light, which is crucial in fields like environmental monitoring, flame detection, and UV curing processes. UV-sensitive phototransistors enable precise identification of UV radiation levels, facilitating safety and quality controls.

Their adoption is increasing in industries where exposure to UV light needs careful management or monitoring. The UV wavelength phototransistor applications benefit from improved material engineering that enhances selectivity and durability against UV degradation.

Application

In 2024, Light detection is the principal application segment, accounting for approximately 38.7% of phototransistor use. These components convert light intensity into measurable electrical signals, serving essential roles in cameras, automatic lighting controls, and presence sensors. The accuracy and quick response of phototransistors make them key in sensing ambient light and facilitating automated systems.

The application is expanding with the rise of smart consumer devices, where light detection plays a role in enhancing user interaction and energy efficiency.

End-Use Industry Vertical

In 2024, Consumer electronics dominate as the largest end-use sector, representing about 32.9% of the phototransistor market. Smartphones, tablets, wearable devices, and smart home systems extensively use phototransistors for features like ambient light sensing, proximity detection, and biometric monitoring.

The rising demand for compact, energy-efficient, and cost-effective sensors drives this sector’s growth.Phototransistors in consumer electronics enable intuitive device behavior, contributing to better power management and user experiences.

Key Market Segments

- By Type

- Bipolar phototransistor

- Field-Effect Phototransistor (PhotoFET)

- Avalanche phototransistor

- By Material

- Silicon

- Gallium Arsenide (GaAs)

- Germanium

- Indium Gallium Arsenide (InGaAs)

- Others

- By Wavelength

- Ultraviolet (UV)

- Visible

- Infrared (IR)

- By Application

- Light detection

- Optical switching

- Position sensing

- Optical communication

- Others

- By End Use Industry Vertical

- Consumer electronics

- Automotive

- Healthcare

- Telecommunications

- Aerospace and defense

- Industrial automation

- Others

Driver Analysis

The rising adoption of smart devices and Internet of Things (IoT) applications is a key driver fueling the phototransistor market expansion. Phototransistors serve critical roles in these technologies by providing reliable light detection, ambient sensing, and automated control functions. As industries and consumers increasingly rely on smart home devices, industrial automation, and wearable electronics, the demand for phototransistors is growing steadily.

This trend creates enhanced opportunities for phototransistors to be integrated into connected systems that require energy-efficient and precise optical sensing.IoT and smart devices are becoming more pervasive across both developed and emerging regions, amplifying the market’s growth trajectory. Key sectors such as automotive, healthcare, and consumer electronics are embedding Phototransistors to improve device functionality and user experience.

Restraint Analysis

One notable restraint for Phototransistors lies in their comparatively slower response time versus alternative optical sensors like Photodiodes. In applications that demand rapid and precise light detection changes such as certain industrial sensing or high-speed communication systems this limitation can reduce their effectiveness.

As a result, photodiodes are often preferred where ultra-fast response and higher sensitivity are critical, limiting phototransistor usage in these niche segments.This slower switching speed is a technical challenge that restricts phototransistors mainly to applications with moderate response requirements. It can restrain market growth where speed and timing are decisive performance parameters.

Opportunity Analysis

The ongoing rise of automotive safety technologies, including advanced driver-assistance systems (ADAS) and autonomous vehicles, offers a significant opportunity for phototransistors. These components are essential for optical sensing in LiDAR, proximity detection, and environmental monitoring modules used in modern vehicles. The shift toward smarter and safer cars drives demand for phototransistors that can offer reliable performance under varied lighting and environmental conditions.

Similarly, expanding industrial automation and smart manufacturing further open avenues for phototransistor use, with applications in process control, robotic vision, and environmental sensing. Governments and industries worldwide are investing in smart infrastructure and factory upgrades, spurring demand for precise and durable optical sensors.

Challenges

The phototransistor market faces challenges from increasing production costs linked to advanced material and fabrication needs. Developing high-performance phototransistors with enhanced sensitivity and miniaturization requires expensive semiconductor manufacturing processes. The rising cost of raw materials and complex assembly also impacts pricing and profit margins, making it harder to compete with lower-cost alternative sensors.

Alongside cost pressures, global supply chain disruptions create uncertainties in timely component availability. Dependence on specialized materials and semiconductor fabrication infrastructure makes the market vulnerable to logistics delays, geopolitical tensions, and fluctuating energy prices.

Key Players Analysis

The phototransistor market is influenced by a wide group of global manufacturers that continue to improve sensing performance and reliability. Companies such as AMS AG, Electro Optical Components, Everlight Electronics, and Excelitas Technologies are focusing on miniaturized designs and improved light-sensitivity levels. Their innovations support higher accuracy in consumer electronics and industrial systems.

Leading semiconductor and optoelectronic companies including Hamamatsu Photonics, Honeywell International, Infineon Technologies, Kodenshi AUK, Kingbright Electronic, LITE-ON Technology, and ON Semiconductor remain central to the market. Their strategies are driven by investments in advanced packaging, thermal stability improvements, and expanded infrared capabilities. These players benefit from strong manufacturing ecosystems that support consistent product quality.

A broader set of participants such as Osram Opto Semiconductors, Panasonic Corporation, ROHM Semiconductor, Sharp Corporation, and others contribute to market depth through high-performance product portfolios. These companies focus on cost-efficient solutions, enhanced durability, and customization options for end-use industries. Their technologies support widespread use in optical communication, detection systems, and automation equipment.

Top Key Players in the Market

- AMS AG

- Electro Optical Components

- Everlight Electronics

- Excelitas Technologies

- Hamamatsu Photonics K.K.

- Honeywell International

- Infineon Technologies

- Kodenshi AUK

- Kingbright Electronic

- LITE-ON Technology Corporation

- ON Semiconductor

- Osram Opto Semiconductors

- Panasonic Corporation

- ROHM Semiconductor

- Sharp Corporation

- Others

Recent Developments

- May, 2025, Infineon Technologies introduced a new family of radiation-hardened Gallium Nitride (GaN) transistors, including phototransistor variants for mission-critical aerospace and defense applications. These devices are designed for high reliability in space vehicles and deep space probes, with a drain-source on resistance of 4 mΩ and total gate charge of 8.8 nC.

- January, 2025, Kodenshi AUK showcased its ultra-compact RGB laser light source module and advanced photodetector solutions at CES 2025. The company highlighted its new KIT Series and KEITS Series transmission photo interrupters, which combine high-power infrared LEDs and high-sensitivity phototransistors for improved productivity and surface-mount compatibility.

Report Scope

Report Features Description Market Value (2024) USD 3.34 Bn Forecast Revenue (2034) USD 8.4 Bn CAGR(2025-2034) 9.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Bipolar phototransistor, Field-Effect Phototransistor (PhotoFET), Avalanche phototransistor), By Material (Silicon, Gallium Arsenide (GaAs), Germanium, Indium Gallium Arsenide (InGaAs), Others), By Wavelength (Ultraviolet (UV), Visible, Infrared (IR)), By Application (Light detection, Optical switching, Position sensing, Optical communication, Others), By End Use Industry Vertical (Consumer electronics, Automotive, Healthcare, Telecommunications, Aerospace and defense, Industrial automation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AMS AG, Electro Optical Components, Everlight Electronics, Excelitas Technologies, Hamamatsu Photonics K.K., Honeywell International, Infineon Technologies, Kodenshi AUK, Kingbright Electronic, LITE-ON Technology Corporation, ON Semiconductor, Osram Opto Semiconductors, Panasonic Corporation, ROHM Semiconductor, Sharp Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AMS AG

- Electro Optical Components

- Everlight Electronics

- Excelitas Technologies

- Hamamatsu Photonics K.K.

- Honeywell International

- Infineon Technologies

- Kodenshi AUK

- Kingbright Electronic

- LITE-ON Technology Corporation

- ON Semiconductor

- Osram Opto Semiconductors

- Panasonic Corporation

- ROHM Semiconductor

- Sharp Corporation

- Others