Global Pharmacy Information Systems Market By Component (Software, Services, Hardware) By Deployment Model (Cloud-Based, On-Premise, Web-Based) By Application (Medication therapy management, Inventory management, Compound pricing and billing, ePrescribing, Billing) By End-User (Inpatient Pharmacies, Outpatient Pharmacies(Retail Pharmacies, Specialty Pharmacies, Online Pharmacies)) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Sep 2024

- Report ID: 157627

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

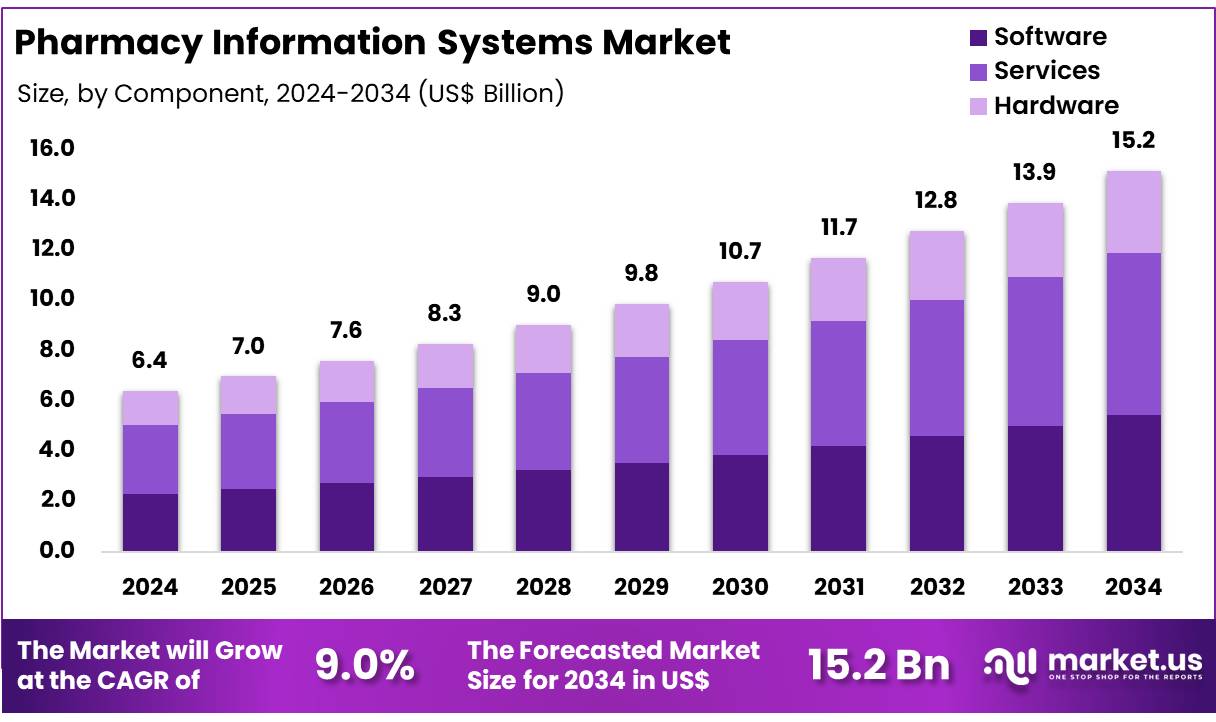

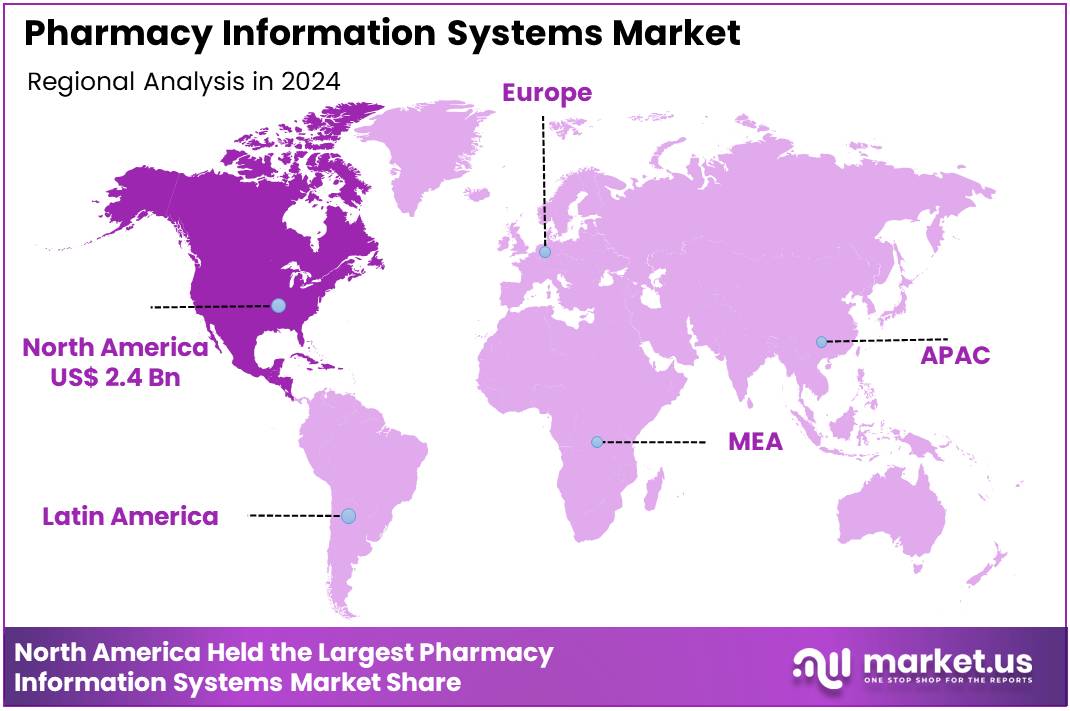

Global Pharmacy Information Systems Market size is expected to be worth around US$ 15.2 Billion by 2034 from US$ 6.4 Billion in 2024, growing at a CAGR of 9.0% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 37.7% share with a revenue of US$ 2.4 Billion.

Pharmacy Information Systems (PIS) have become integral to modern healthcare, streamlining medication management and enhancing patient safety. These systems facilitate the electronic recording, tracking, and management of medication orders, inventory, and patient profiles, thereby reducing human errors and improving workflow efficiency.

Key functionalities of PIS include computerized provider order entry (CPOE), which allows healthcare providers to electronically enter medication orders, and clinical decision support systems (CDSS), which provide alerts for potential drug interactions, allergies, and dosage errors. Additionally, PIS supports medication therapy management by consolidating patient data from various sources, enabling pharmacists to offer personalized care and counseling.

The implementation of PIS has shown significant improvements in medication safety. A study evaluating PIS in teaching hospitals revealed that systems with integrated clinical decision support features effectively reduced medication errors and adverse drug events. Furthermore, automated inventory management within PIS ensures optimal stock levels, reducing the risk of shortages and overstocking.

As healthcare continues to evolve, the adoption of advanced Pharmacy Information Systems is crucial for enhancing patient outcomes and operational efficiency. Healthcare institutions are encouraged to invest in robust PIS solutions to meet the growing demands of modern medicine.

Key Takeaways

- Market Size: Global Pharmacy Information Systems Market size is expected to be worth around US$ 15.2 Billion by 2034 from US$ 6.4 Billion in 2024.

- Market Growth: The market growing at a CAGR of 9.0% during the forecast period from 2025 to 2034.

- Component Analysis: The services segment, which is projected to capture 42.6% of the total market share by 2024.

- Deployment Model Analysis: In 2024, the Deployment Model segment is expected to dominate the market, accounting for 39.8% of the overall share.

- Application Analysis: Inventory management emerging as the leading segment in 2024, holding a 25.4% share of the total market.

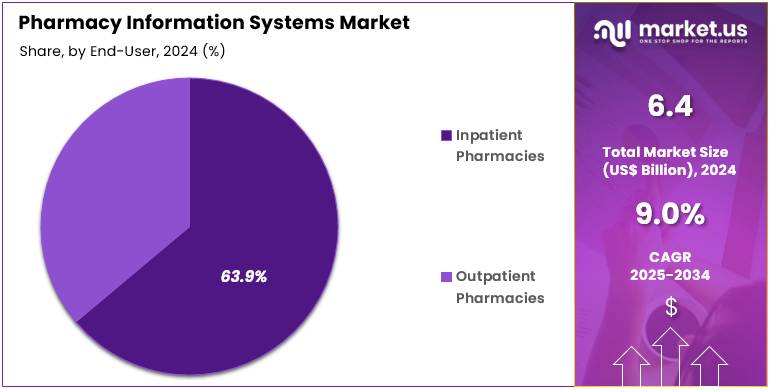

- End-Use Analysis: In 2024, inpatient pharmacies accounted for the dominant share, representing 63.9% of the total market.

- Regional Analysis: In 2024, North America held a dominant market position, capturing more than 37.7% share and holding a market value of US$ 2.4 billion for the year.

Component Analysis

In the Pharmacy Information Systems (PIS) market, the component size segmentation reveals a notable dominance of the services segment, which is projected to capture 42.6% of the total market share by 2024. This segment includes services such as system integration, support and maintenance, training, and consulting, which are critical for the successful deployment, operation, and optimization of PIS solutions in pharmacies and healthcare settings.

Following the services segment, the software segment is expected to maintain a substantial share of the market. Software solutions are integral to PIS, providing essential functionalities such as medication management, prescription processing, and inventory control. These systems enable pharmacies to enhance operational efficiency, reduce errors, and improve patient care. With the increasing demand for digitization and automation within the healthcare sector, software is anticipated to experience continued growth.

The hardware segment, while important, holds a comparatively smaller portion of the market. Hardware components, such as computers, servers, barcode scanners, and other devices, are necessary for the functioning of PIS but are typically regarded as supplementary to the software and services. However, the rise in adoption of integrated PIS solutions is expected to drive incremental growth in hardware demand.

In summary, while services lead the market, both software and hardware components play critical roles in the overall functionality and success of Pharmacy Information Systems.

Deployment Model Analysis

The Pharmacy Information Systems (PIS) market is witnessing significant growth, driven by the increasing adoption of advanced technologies in healthcare settings. In 2024, the Deployment Model segment is expected to dominate the market, accounting for 39.8% of the overall share. This growth can be attributed to the increasing preference for Cloud-Based and Web-Based solutions, which offer distinct advantages in terms of flexibility, cost-effectiveness, and scalability.

Cloud-Based Pharmacy Information Systems are anticipated to experience the highest demand due to their ability to provide real-time access to data, seamless updates, and enhanced collaboration across multiple locations. These systems are also preferred for their minimal upfront infrastructure costs and lower maintenance requirements. Healthcare providers increasingly recognize the potential of cloud solutions to streamline operations, improve data security, and ensure regulatory compliance.

Web-Based Pharmacy Information Systems, while similar to cloud-based solutions, are typically hosted on private or public servers and accessed through web browsers. These systems are gaining traction for their ability to be easily integrated with existing systems and their user-friendly interface. Web-based solutions are particularly attractive to smaller or mid-sized healthcare facilities due to their affordability and ease of deployment.

Both deployment models enable pharmacy professionals to enhance operational efficiency, reduce errors, and improve patient outcomes, contributing to the ongoing growth of the market. The shift towards digitalization within the pharmaceutical sector is expected to further boost the adoption of these deployment models in the coming years.

Application Analysis

The Pharmacy Information Systems (PIS) market is segmented by application, with inventory management emerging as the leading segment in 2024, holding a 25.4% share of the total market. The dominance of this segment is largely attributed to the growing need for efficient stock control, demand forecasting, and automated replenishment in pharmacies. Rising prescription volumes and the increasing complexity of drug distribution processes have made inventory management solutions critical to reducing waste, preventing stockouts, and ensuring timely availability of medications.

Medication Therapy Management (MTM) is also witnessing steady growth. The increasing emphasis on personalized care and the need to optimize therapeutic outcomes have resulted in wider adoption of MTM modules within PIS platforms. These solutions support pharmacists in monitoring drug interactions, improving adherence, and enhancing patient safety.

Compound Pricing and Billing solutions are gaining traction as compounding pharmacies expand, particularly in specialty medicine. The ability to automate pricing calculations, manage regulatory compliance, and streamline billing processes is contributing to segment expansion.

ePrescribing is expected to continue its strong adoption, driven by regulatory mandates and the growing preference for digital prescriptions to minimize errors and streamline communication between healthcare providers and pharmacies.

Billing Applications also remain integral, ensuring seamless claim submission, insurance reimbursement, and financial reporting. Together, these applications are enabling pharmacies to enhance operational efficiency, reduce administrative burdens, and improve patient care delivery, thereby supporting overall market growth.

End-User Analysis

The pharmacy information systems (PIS) market demonstrates significant variation in adoption between inpatient and outpatient pharmacy settings. In 2024, inpatient pharmacies accounted for the dominant share, representing 63.9% of the total market. This dominance can be attributed to the increasing integration of PIS solutions in hospital-based settings where patient volumes are high and medication management requires stringent control.

The growing need for advanced clinical decision support, error reduction in medication dispensing, and compliance with regulatory requirements have further accelerated adoption within inpatient environments. Additionally, the shift toward value-based healthcare and the demand for enhanced patient safety are supporting the sustained growth of PIS across hospitals and large healthcare facilities.

Conversely, outpatient pharmacies, encompassing retail, specialty, and online pharmacies, represent a comparatively smaller but rapidly expanding segment. The growth in outpatient adoption is driven by rising consumer demand for convenient medication access, the expansion of e-prescriptions, and the proliferation of specialty pharmacy services catering to chronic and complex diseases.

Online pharmacies, in particular, are expected to contribute strongly, supported by the global rise in e-commerce penetration and digital health initiatives. While this segment currently lags inpatient pharmacies in market share, it is forecasted to witness robust growth rates, as technological advancements and patient-centric models transform outpatient service delivery.

Overall, inpatient pharmacies dominate the current market landscape; however, outpatient segments are anticipated to provide substantial growth opportunities in the coming years.

Key Market Segments

By Component

- Software

- Services

- Hardware

By Deployment Model

- Cloud-Based

- On-Premise

- Web-Based

By Application

- Medication therapy management

- Inventory management

- Compound pricing and billing

- ePrescribing

- Billing

By End-User

- Inpatient Pharmacies

- Outpatient Pharmacies

- Retail Pharmacies

- Specialty Pharmacies

- Online Pharmacies

Driving Factors

The growth of the pharmacy information systems (PIS) market is primarily driven by the rising need for efficient data management in healthcare facilities. Increasing prescription volumes, medication errors, and the demand for accurate drug information have accelerated adoption. The integration of PIS with electronic health records (EHRs) enhances workflow automation, improves patient safety, and reduces operational costs.

Moreover, growing emphasis on regulatory compliance, particularly in developed economies, compels healthcare providers to invest in advanced systems. The rise in healthcare spending and digital transformation initiatives further support market expansion. Consequently, the growing burden of chronic diseases and the need for seamless patient care coordination continue to fuel adoption of pharmacy information systems worldwide.

Trending Factors

A notable trend in the pharmacy information systems market is the integration of artificial intelligence (AI) and cloud-based solutions. AI-driven systems are increasingly applied to automate drug dispensing, predict medication interactions, and support clinical decision-making. Cloud-based platforms are gaining traction due to their scalability, remote accessibility, and cost-effectiveness, enabling smaller pharmacies and healthcare facilities to adopt advanced technologies without heavy infrastructure investment.

Another emerging trend is interoperability, with systems being designed to seamlessly connect across hospitals, pharmacies, and healthcare providers, ensuring real-time information sharing. Additionally, the focus on mobile-friendly solutions for pharmacists and clinicians is rising, aligning with broader digital health initiatives and the need for on-the-go access to patient and drug data.

Restraining Factors

Despite promising growth, the pharmacy information systems market faces restraints related to high implementation costs and data security concerns. The initial investment for software, hardware, and staff training is substantial, making adoption challenging for small and medium-sized healthcare facilities, especially in developing regions.

Furthermore, integration with legacy systems is often complex, leading to operational disruptions during the transition phase. Concerns over cybersecurity and patient data breaches act as significant barriers, as healthcare providers handle sensitive medical information subject to strict compliance standards. In addition, a shortage of skilled IT professionals in healthcare creates further difficulties in managing and maintaining such systems, slowing down the pace of widespread adoption.

Opportunity

The pharmacy information systems market presents strong opportunities through the expansion of telepharmacy and personalized medicine. Rising demand for remote consultations and medication management, particularly in rural or underserved regions, is expected to accelerate PIS adoption. Moreover, the increasing emphasis on precision medicine and customized drug therapies generates demand for advanced systems capable of handling complex datasets.

Emerging markets, particularly in Asia-Pacific, offer significant growth potential due to healthcare infrastructure modernization and rising investments in digital health technologies. Additionally, government initiatives promoting e-prescriptions and digital health records are creating favorable conditions for vendors. Vendors offering affordable, interoperable, and cloud-based solutions are well positioned to capture these untapped opportunities in the coming years.

Regional Analysis

North America

In 2024, North America held a dominant market position, capturing more than 37.7% share and holding a market value of US$ 2.4 billion for the year. The dominance of this region can be attributed to the early adoption of advanced healthcare IT systems. Strong digital infrastructure and high healthcare spending further supported the widespread use of pharmacy information systems. The United States contributed the largest share due to its well-established hospital networks and strict regulatory compliance requirements.The focus on reducing medication errors and improving patient safety encouraged healthcare providers to invest in advanced systems. A robust presence of skilled healthcare IT professionals also supported effective implementation and integration. Moreover, government programs promoting electronic health records strengthened the market demand. Canada also showed strong adoption trends, supported by public health initiatives and growing awareness of digital healthcare benefits.

Europe

Europe followed as the second-largest regional market. Growth was driven by favorable government policies and strong emphasis on interoperability between healthcare systems. The increasing use of e-prescriptions and standardized patient data exchange created a supportive environment for system adoption. Western European countries led the region due to advanced healthcare facilities and strict compliance frameworks. Eastern Europe showed gradual progress with ongoing investments in digital healthcare infrastructure.Asia-Pacific

Asia-Pacific is projected to register the fastest growth rate over the coming years. Expansion is driven by rapid digitalization in healthcare, rising patient volumes, and investments in hospital IT infrastructure. Countries such as China, India, and Japan are key growth engines. Increasing focus on telemedicine and digital pharmacies is creating new opportunities for adoption. Government initiatives supporting healthcare modernization further fuel market growth.Rest of the World

The rest of the world, including Latin America, the Middle East, and Africa, shows emerging potential. Market growth is supported by gradual improvements in healthcare infrastructure and increased awareness of medication safety. However, limited financial resources and lack of skilled IT professionals present challenges. Adoption is expected to rise as governments invest in healthcare reforms and digital health projects.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The pharmacy information systems market is characterized by the presence of a mix of global vendors, regional providers, and emerging technology firms. Key participants are focusing on innovation, offering cloud-based platforms and artificial intelligence-driven solutions to strengthen their competitive positions.

Continuous investment in research and development enables the delivery of systems with enhanced interoperability, real-time analytics, and improved user interfaces. Strategic alliances with healthcare institutions are commonly adopted to expand market penetration and enhance product credibility.

Players are also emphasizing regulatory compliance, ensuring their solutions align with stringent healthcare data protection and safety standards. The competitive environment is further shaped by mergers and acquisitions, as established vendors seek to broaden service portfolios and enter new geographic markets.

Pricing flexibility and scalable deployment models are being used to attract small and medium healthcare facilities. Overall, competition remains intense, with differentiation driven by technological innovation and service reliability.

Market Key Players

- McKesson Corporation

- Oracle

- Epic Systems Corporation

- QS/1 Data Systems

- PioneerRx

- Liberty Software

- Omnicell, Inc.

- Micro Merchant Systems

- Veradigm

- Alphabet Inc.

- Datascan

- Intel Corporation

- Clanwilliam Health

Recent Developments

- McKesson Corporation (February 2025): In February 2025, a controlling interest (approximately 80%) was acquired in an ophthalmology and retina management services provider for about US$ 850 million, with the original physicians retaining a 20% stake.

- Oracle (June 2022): The acquisition of a prominent electronic health record provider was completed for US$ 28.3 billion, marking a significant expansion into clinical IT systems.

- Epic Systems Corporation: In April 2025, an industry commentary highlighted the continued commitment to in-house development and close engagement with users, reinforcing long-term software strategy without external mergers or acquisitions.

- PioneerRx: In May 2025, an internal “Smart Chat” tool was introduced, enabling technical support staff to resolve pharmacy-related queries more rapidly by navigating to relevant resources via AI-assisted responses

Report Scope

Report Features Description Market Value (2024) US$ 6.4 Billion Forecast Revenue (2034) US$ 15.2 Billion CAGR (2025-2034) 9.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Services, Hardware) By Deployment Model (Cloud-Based, On-Premise, Web-Based) By Application (Medication therapy management, Inventory management, Compound pricing and billing, ePrescribing, Billing) By End-User (Inpatient Pharmacies, Outpatient Pharmacies(Retail Pharmacies, Specialty Pharmacies, Online Pharmacies)) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape McKesson Corporation, Oracle, Epic Systems Corporation, QS/1 Data Systems, PioneerRx, Liberty Software, Omnicell, Inc., Micro Merchant Systems, Veradigm, Alphabet Inc., Datascan, Intel Corporation, Clanwilliam Health Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pharmacy Information Systems MarketPublished date: Sep 2024add_shopping_cartBuy Now get_appDownload Sample

Pharmacy Information Systems MarketPublished date: Sep 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- McKesson Corporation

- Oracle

- Epic Systems Corporation

- QS/1 Data Systems

- PioneerRx

- Liberty Software

- Omnicell, Inc.

- Micro Merchant Systems

- Veradigm

- Alphabet Inc.

- Datascan

- Intel Corporation

- Clanwilliam Health