Global Pharmacogenomics Market by Technology (Sequencing, Microarray, Polymerase Chain Reaction and Others), By Application (Drug Discovery, Infectious Diseases, Oncology, Cardiovascular Diseases and Other Applications), By End-User (Hospital & Clinics, Research Organizations and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 104919

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

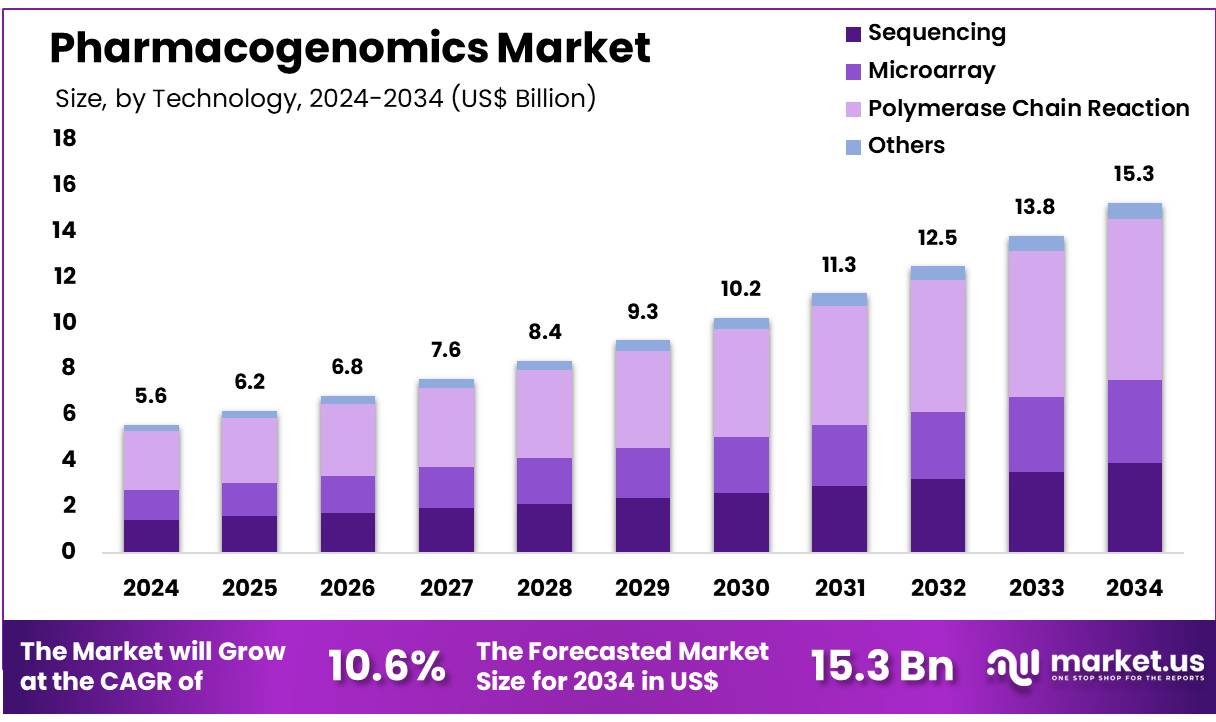

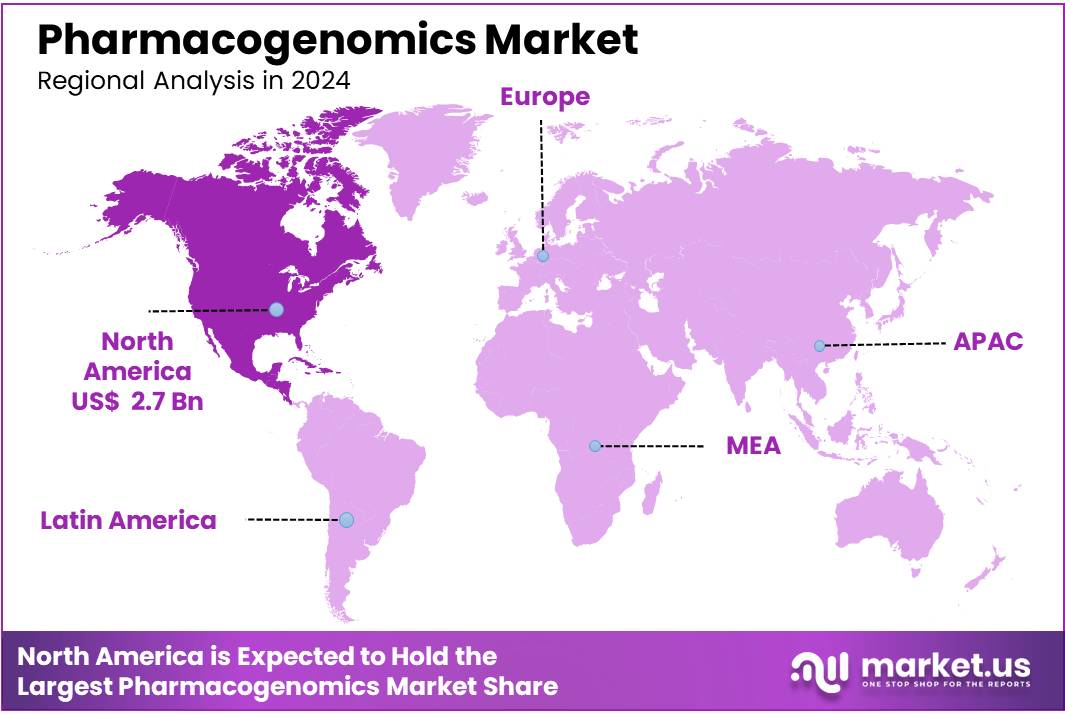

The Global Pharmacogenomics Market was valued at US$ 5.58 Billion in 2024 and is expected to grow at a CAGR of 10.6% from 2024 to 2034. In 2024, North America led the market, achieving over 48.5% share with a revenue of US$ 2.7 Billion.

Global Pharmacogenomics Market, Global Analysis, 2020-2024 (US$ Billion)

Global 2020 2021 2022 2023 2024 CAGR Revenue 3.60 4.04 4.54 5.03 5.58 9.9% The rising prevalence of chronic diseases, along with a growing emphasis on precision medicine, is accelerating the market growth. Additionally, increasing collaborations between pharmaceutical companies and research organizations is enhancing the development of pharmacogenomics solutions.

- The World Health Organization reported approximately 20 million new cancer cases and 9.7 million cancer-related deaths in 2022.

- Around one in five individuals will develop cancer during their lifetime, with about one in nine men and one in twelve women succumbing to the disease.

- The International Diabetes Federation estimated that 537 million adults aged 20 to 79 were living with diabetes in 2021, a figure expected to rise to 783 million by 2045.

- Additionally, the Institute for Health Metrics and Evaluation noted that over half a billion people worldwide were living with diabetes as of 2023.

Advancements in genomics have significantly improved our understanding of genetic variations and their influence on drug efficacy and safety. Pharmacogenomics focuses on the study of how an individual’s genetic makeup affects their response to medications, enabling personalized treatment plans. This approach minimizes adverse drug reactions and optimizes therapeutic outcomes, driving the growing adoption of pharmacogenomics technologies.

Recent technological innovations, such as next-generation sequencing (NGS) and CRISPR-based gene editing, have made genetic testing faster, more accurate, and cost-effective. These advancements allow researchers to identify biomarkers associated with drug response, paving the way for tailored treatments.

- According to the report of ACCP, the first FDA approval for a direct-to-consumer genetic test to evaluate cancer risk was granted to 23andMe. This test from 23andMe incorporates analysis of three variants of the BRCA1 and BRCA2 genes, which are linked to breast and ovarian cancer.

Key Takeaways

- The Pharmacogenomics market generated a revenue of US$ 5.6 Billion and is predicted to reach US$ 15.3 Billion, with a CAGR of 10.6%.

- Based on the Technology, the Polymerase Chain Reaction segment generated the most revenue for the market with a market share of 45.9%.

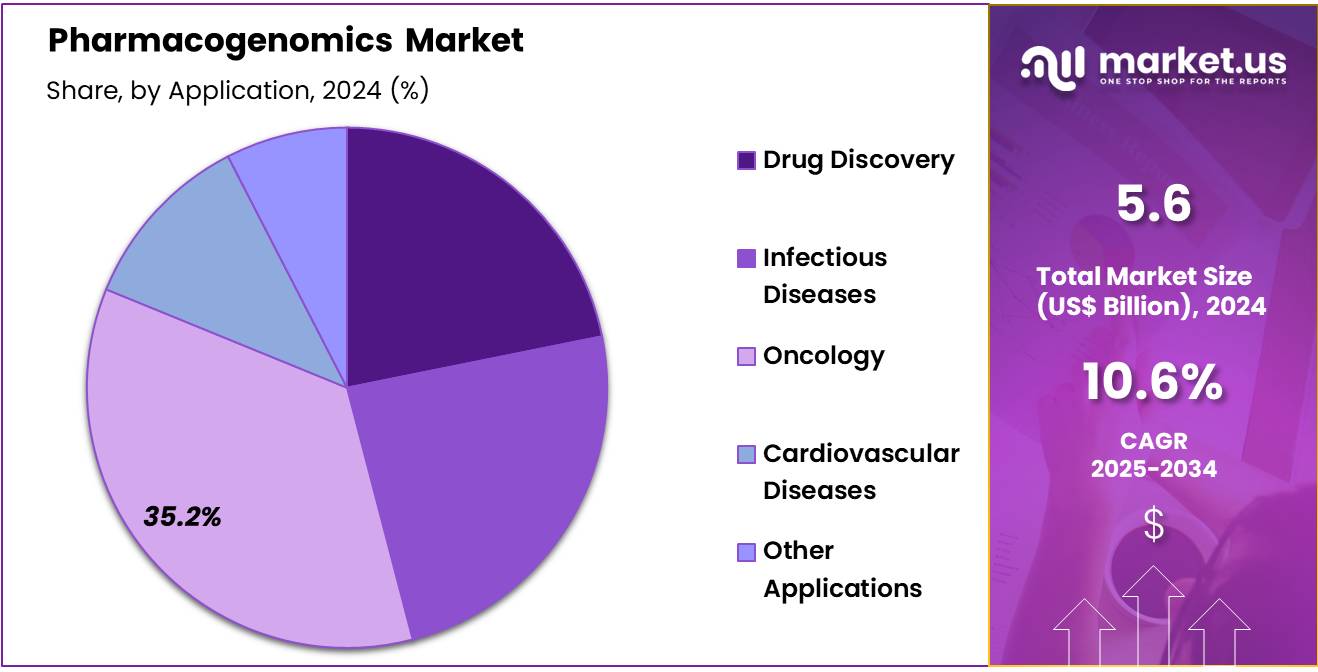

- Based on the application, the Oncology segment generated the most revenue for the market with a market share of 35.2%.

- Based on the End-User, the Hospital & Clinics segment generated the most revenue for the market with a market share of 48.7%.

- Region-wise, North America remained the lead contributor to the market, by claiming the highest market share, amounting to 48.5%.

Technology Analysis

The Polymerase Chain Reaction (PCR) segment dominated the technology segment and has attained the market share of 45.9% in 2024. PCR plays a critical role in advancing personalized medicine due to its ability to amplify specific DNA segments. This capability has established it as an essential tool in genetic research and diagnostics, enabling detailed analysis of genetic variations that influence drug responses. Its versatility and sensitivity make PCR particularly effective in detecting and quantifying small amounts of DNA, laying the groundwork for understanding the genetic factors underlying individual responses to medications.

The advent of Real-Time PCR (qPCR) has further enhanced the utility of PCR in pharmacogenomics by allowing real-time DNA quantification. This innovation provides valuable insights into gene expression levels, which are key to understanding how individuals metabolize drugs or respond to treatments. qPCR’s ability to identify genetic variations affecting drug metabolism and transport is critical for optimizing pharmaceutical efficacy and safety.

PCR’s widespread adoption in pharmacogenomics is driven by its specificity, speed, and cost-efficiency, making it a preferred technology for applications such as identifying genetic markers linked to drug responses. Its prominent role in clinical laboratories underscores its importance in transitioning pharmacogenomics from research to practical clinical applications, thereby contributing to market growth.

Advancements in PCR technology, including improved sensitivity, higher throughput, and automation, continue to create new opportunities for pharmacogenomic research and personalized medicine. As the pharmacogenomics market expands, PCR remains central to the development of genetically informed drug prescriptions and treatments, solidifying its role in the future of healthcare.

The Roche Digital LightCycler® System exemplifies innovation in digital PCR instruments. With three nanowell plate configurations, six advanced optical channels, and concentrated DNA and RNA master mixes, this system supports the progression from research findings to the creation of clinically applicable assays.

Global Pharmacogenomics Market, by Technology, 2020-2024 (US$ Billion)

Technology 2020 2021 2022 2023 2024 Sequencing 0.91 1.02 1.15 1.28 1.43 Microarray 0.84 0.95 1.07 1.19 1.32 Polymerase Chain Reaction 1.66 1.86 2.09 2.31 2.56 Others 0.19 0.21 0.23 0.25 0.27 Application Analysis

The oncology segment has led the pharmacogenomics market, driven by the capability of pharmacogenomic tests to unravel the genetic basis of various cancers, thereby enabling highly personalized treatments. By identifying specific genetic mutations within tumors, such as the BRAF V600E mutation commonly found in melanoma, pharmacogenomics facilitates the use of targeted therapies designed to inhibit the growth of cancer cells with these mutations. This precision-driven approach significantly enhances treatment effectiveness by ensuring patients receive therapies tailored to their tumor’s genetic profile.

For example, in breast cancer, the identification of HER2/neu gene amplification through pharmacogenomic testing has been transformative. Patients with HER2-positive tumors are routinely treated with trastuzumab (Herceptin), a targeted therapy that has markedly improved outcomes for this subgroup. Similarly, in lung cancer, testing for EGFR mutations guides the use of EGFR inhibitors like erlotinib or gefitinib, yielding significantly better responses compared to traditional chemotherapy.

Beyond selecting targeted therapies, pharmacogenomics also plays a critical role in predicting potential side effects, ensuring treatments are both effective and safe. For instance, testing for TPMT or NUDT15 gene variants before prescribing thiopurines in leukemia patients helps prevent severe myelosuppression, a potentially life-threatening complication.

The oncology segment’s dominance is further supported by substantial investments in research and development to identify new genetic targets for cancer therapies. A growing pipeline of targeted agents, combined with ongoing advancements in genetic testing technologies, highlights the vital role of pharmacogenomics in advancing cancer treatment. This continuous innovation underscores the segment’s central position in driving the future of personalized cancer care.

Global Pharmacogenomics Market, by Application, 2020-2024 (US$ Billion)

Application 2020 2021 2022 2023 2024 Drug Discovery 0.79 0.88 0.99 1.10 1.22 Infectious Diseases 0.86 0.97 1.09 1.21 1.34 Oncology 1.25 1.41 1.59 1.77 1.97 Cardiovascular Diseases 0.41 0.46 0.52 0.57 0.63 Other Applications 0.29 0.32 0.35 0.39 0.42 End-User Analysis

Hospitals and clinics dominated the pharmacogenomics market, reflecting their essential role in translating genetic insights into improved patient outcomes. As primary adopters of pharmacogenomic technologies, these healthcare settings are instrumental in driving the integration of personalized medicine into routine clinical practice.

The application of pharmacogenomics in hospitals and clinics is most evident in oncology, where genetic testing is routinely used to guide treatment decisions. This precision medicine approach tailors therapies based on the genetic profiles of patients and their tumors. For instance, in breast cancer treatment, pharmacogenomic tests can identify patients whose tumors overexpress the HER2 protein, making them suitable candidates for trastuzumab. This targeted therapy enhances treatment efficacy by focusing on those most likely to benefit while reducing unnecessary exposure to ineffective or harmful treatments. Beyond oncology, pharmacogenomics plays a vital role in other medical fields, such as cardiology, where genetic testing informs optimal warfarin dosing by accounting for variations in drug metabolism. Similarly, in psychiatry, pharmacogenomic tests help predict patient responses to antidepressants, streamlining the process of finding effective treatments.

The leadership of hospitals and clinics in the pharmacogenomics market is further reinforced by their role in research and development. These healthcare institutions collect and analyze genetic data, contributing to advancements in pharmacogenomic applications and therapies. By incorporating genetic testing into routine care, hospitals and clinics not only enhance immediate patient outcomes but also generate valuable insights that drive the evolution of personalized medicine and future pharmacogenomic innovations.

Global Pharmacogenomics Market, by End-User, 2020-2024 (US$ Billion)

End-User 2020 2021 2022 2023 2024 Hospital & Clinics 1.74 1.95 2.20 2.44 2.71 Research Organizations 1.16 1.31 1.47 1.63 1.80 Others 0.70 0.78 0.88 0.96 1.06

Key Market Segments

By Technology

- Sequencing

- Microarray

- Polymerase Chain Reaction

- Others

By Application

- Drug Discovery

- Infectious Diseases

- Oncology

- Cardiovascular Diseases

- Other Applications

By End-User

- Hospital & Clinics

- Research Organizations

- Others

Drivers

Increasing Prevalence of Chronic Diseases and Genetic Disorders

The increasing prevalence of chronic diseases such as cancer, cardiovascular conditions, diabetes, and various genetic disorders is a major driver of the pharmacogenomics market. This global rise in chronic illnesses highlights the growing need for personalized healthcare solutions to improve treatment outcomes, manage healthcare costs more efficiently, and enhance patients’ quality of life.

As healthcare systems and patients increasingly acknowledge the benefits of personalized medicine, the demand for pharmacogenomic testing is accelerating. This surge in interest is driving advancements and investments in the field, facilitating the development of innovative pharmacogenomic applications and services.

The shift toward a patient-centric healthcare model, where treatments are tailored to the genetic profiles of individuals rather than following a generalized approach, underscores the transformative potential of pharmacogenomics. Consequently, the rising incidence of chronic and genetic diseases is directly contributing to the growth of the pharmacogenomics market, reinforcing its importance in the advancement of modern medicine.

According to NCBI, the population aged 50 and older with at least one chronic condition is projected to nearly double by 2050, increasing by approximately 99.5% (ranging from 95.1% to 107.9%). This demographic is expected to grow from 71.5 million (with a range of 69.065 million to 73.781 million) in 2020 to 142.66 million (estimated to range between 134.74 million and 153.39 million) by 2050.

Restrains

Complexity in Test Interpretation and Integration into Clinical Practice

The complex nature of pharmacogenomic test results presents a significant challenge to their interpretation and integration into clinical practice, acting as a key restraint on the growth of the pharmacogenomics market. Healthcare providers must navigate intricate genetic information, requiring a deep understanding of pharmacogenomics and its implications for patient care. This creates a pressing need for extensive education and training to ensure medical professionals are equipped to make informed, data-driven decisions.

In addition to expertise, the effective use of pharmacogenomic insights in clinical settings relies heavily on robust infrastructure. This includes access to advanced laboratory equipment and sophisticated data management systems capable of analyzing and interpreting genetic information accurately. Together, these requirements for specialized knowledge, training, and infrastructure pose significant challenges for healthcare systems striving to incorporate pharmacogenomics into routine patient care.

These barriers can slow the adoption of pharmacogenomic testing, limiting its integration into clinical workflows despite its potential to revolutionize treatment outcomes through personalized medicine. Addressing these obstacles is crucial for unlocking the full potential of pharmacogenomics and fostering its widespread acceptance in modern healthcare.

Opportunities

Advancements in Genomic Technologies

The pharmacogenomics market presents promising opportunities, driven by the rapid advancements in genomic sequencing technologies and bioinformatics. The continuous evolution and refinement of these technologies offer the potential for more affordable, accurate, and comprehensive pharmacogenomic testing solutions.

For instance, the emergence of next-generation sequencing (NGS) platforms has revolutionized genomic analysis by enabling high-throughput sequencing at reduced costs and faster turnaround times compared to traditional methods. This technological breakthrough opens avenues for the development of multi-gene panels or whole-genome approaches within the pharmacogenomics landscape.

Illumina’s next-generation sequencing technology boasts several breakthroughs. The iSeq 100 System merges semiconductor sequencing with one-channel SBS, delivering precise data in a compact setup. Patterned flow cell technology enhances throughput for diverse sequencing tasks. The NextSeq 1000 and 2000 Systems feature 75 innovations, offering flexibility and rapid data analysis. Lastly, the NovaSeq X series provides up to 16 Tb of sequencing power, catering to data-intensive applications.

Moreover, advancements in bioinformatics tools and computational algorithms enhance the interpretation and analysis of genomic data, further optimizing the accuracy and efficiency of pharmacogenomic testing. These tools enable researchers and clinicians to identify relevant genetic variations associated with drug response or adverse reactions with greater precision, facilitating personalized treatment decisions. For eg., sophisticated algorithms can integrate genomic data with clinical parameters to generate actionable insights tailored to individual patient profiles, thereby enhancing therapeutic outcomes and minimizing adverse events.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the global pharmacogenomics market, shaping its growth trajectory and adoption rates. Economic stability and healthcare funding play pivotal roles in determining the affordability and accessibility of pharmacogenomic testing.

In high-income countries, robust healthcare infrastructure and government support for personalized medicine foster market growth. Conversely, in low- and middle-income regions, limited healthcare budgets and inadequate infrastructure hinder the adoption of pharmacogenomics.

Geopolitical factors, such as trade policies, international collaborations, and regulatory harmonization, also impact market dynamics. Favorable policies promoting cross-border research partnerships and streamlined regulatory processes can accelerate innovation and market penetration. However, geopolitical tensions, such as trade restrictions or political instability, can disrupt global supply chains, delay the approval of novel technologies, and limit access to essential reagents and equipment.

Additionally, macroeconomic challenges like inflation and currency fluctuations affect the pricing of pharmacogenomic tests, potentially constraining their affordability. Conversely, increased investment in healthcare and advancements in genomic research, often influenced by government initiatives or international organizations, can drive the market forward.

Latest Trends

The global pharmacogenomics market is experiencing several key trends that are shaping its growth and future direction. One prominent trend is the increasing adoption of personalized medicine, driven by advances in genetic research. As healthcare providers recognize the value of tailoring treatments based on an individual’s genetic makeup, pharmacogenomic testing is becoming more integrated into clinical practice. This shift is enhancing treatment efficacy and reducing adverse drug reactions, which is fueling demand for genetic testing services.

Another significant trend is the growing emphasis on oncology pharmacogenomics. With the rise of targeted therapies and precision medicine in cancer treatment, pharmacogenomic tests are being used to identify genetic mutations and biomarkers that guide therapy decisions. This trend is expanding beyond oncology, with pharmacogenomics gaining traction in fields such as cardiology, psychiatry, and infectious diseases.

Technological advancements, such as the development of more efficient and cost-effective genomic sequencing technologies, are also driving market growth. The increased accessibility of next-generation sequencing (NGS) is enabling more widespread use of pharmacogenomic tests.

Additionally, regulatory frameworks and government initiatives supporting personalized medicine are fostering market growth. As pharmacogenomics continues to evolve, collaboration between research institutions, healthcare providers, and technology developers will be crucial in advancing the field and ensuring its integration into mainstream healthcare systems.

Regional Analysis

North America Dominates the Global Pharmacogenomics Market

The North American region leads the global pharmacogenomics market, holding a market share of 48.5%, and is expected to maintain its dominant position throughout the forecast period. This growth is driven by the rising prevalence of chronic diseases, including cancer, cardiovascular diseases, and neurological disorders.

Pharmacogenomics, a genetic testing approach used to identify genetic mutations, enables oncologists to choose the most effective targeted therapies and predict individual patient responses to treatment. This has resulted in increased demand for pharmacogenomic testing in healthcare settings.

For example, according to the International Agency for Research on Cancer, the cancer incidence rate in North America was 364.7 per 100,000 individuals in 2022, driving the demand for pharmacogenomics testing in countries like the US and Canada.

Additionally, advancements in genomic technology are fueling market growth in the region. The development of more affordable, scalable, and portable nucleic acid sequencing technologies, along with the growth of platforms like PacBio and Oxford Nanopore, is expected to be transformative over the next five years.

The rising adoption of pharmacogenomics in drug discovery and clinical research further supports the market expansion. Furthermore, initiatives by various agencies to promote pharmacogenomic testing are contributing to market growth. For example, the Canadian Pharmacogenomics Network for Drug Safety focuses on reducing adverse drug reactions in both children and adults.

Global Pharmacogenomics Market, by Region, 2020-2024 (US$ Billion)

Region 2020 2021 2022 2023 2024 North America 1.76 1.97 2.20 2.43 2.69 APAC 0.76 0.86 0.97 1.09 1.22 Latin America 0.12 0.13 0.15 0.17 0.19

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global pharmacogenomics market is highly competitive, with key players focused on advancing genetic testing technologies, expanding their product portfolios, and forging strategic partnerships to drive growth. Leading companies include Illumina, Thermo Fisher Scientific, Roche, and Abbott, which offer a range of products such as next-generation sequencing (NGS) platforms, genetic testing kits, and bioinformatics solutions. These companies are heavily investing in research and development to enhance the accuracy, affordability, and scalability of pharmacogenomic tests.

Moreover, partnerships between healthcare providers, pharmaceutical companies, and research institutions are fostering innovation and accelerating the adoption of pharmacogenomics in clinical practice. Smaller, specialized firms are also emerging, offering niche solutions in specific therapeutic areas such as oncology and cardiology.

Regulatory bodies, such as the FDA, are playing an active role in shaping the competitive landscape by setting standards and approvals for pharmacogenomic tests, which influences market entry and growth strategies of competitors.

Top Key Players

- Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific, Inc.

- Abbott Laboratories

- Illumina, Inc.

- Myriad Genetics Inc.

- Qiagen NV

- Bio-Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Golden Helix, Inc.

- OneOme, LLC

Recent Developments

- In February 2024, Golden Helix, Inc. announced the release of VSPGx, a pharmacogenomics solution tailored for hospitals and testing labs.

- In February 2024, QIAGEN introduced QIAGEN Biomedical KB-AI, a novel generative AI-driven knowledge base aimed at advancing drug discovery in the pharmaceutical and biotechnology sectors.

- In January 2023, QIAGEN and Helix initiated an exclusive partnership aimed at advancing next-generation sequencing companion diagnostics for hereditary diseases.

- In September 2023, Bio-Rad Laboratories, Inc. announced the launch of the PTC Tempo 48/48 and PTC Tempo 384 Thermal Cyclers, designed to facilitate PCR applications in basic and translational research, process development, and quality control.

Report Scope

Report Features Description Market Value (2024) US$ 5.58 Billion Forecast Revenue (2034) US$ 15.3 Billion CAGR (2025-2035) 10.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology- Sequencing, Microarray, Polymerase Chain Reaction and Others, By Application- Drug Discovery, Infectious Diseases, Oncology, Cardiovascular Diseases and Other Applications, By End-User- Hospital & Clinics, Research Organizations and Others Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific, Inc., Abbott Laboratories, Illumina, Inc., Myriad Genetics Inc., Qiagen NV, Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., Golden Helix, Inc. and OneOme, LLC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific, Inc.

- Abbott Laboratories

- Illumina, Inc.

- Myriad Genetics Inc.

- Qiagen NV

- Bio-Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Golden Helix, Inc.

- OneOme, LLC