Global Pharmaceuticals Market By Product Type (Branded, Generics, Prescription, and OTC), By Route of Administration (Oral, Topical, Parenteral (Intramuscular and Intravenous), Inhalations, and Other), By Application (Cardiovascular diseases, Cancer, Diabetes, and Others), By End-user (Hospitals, Clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141310

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

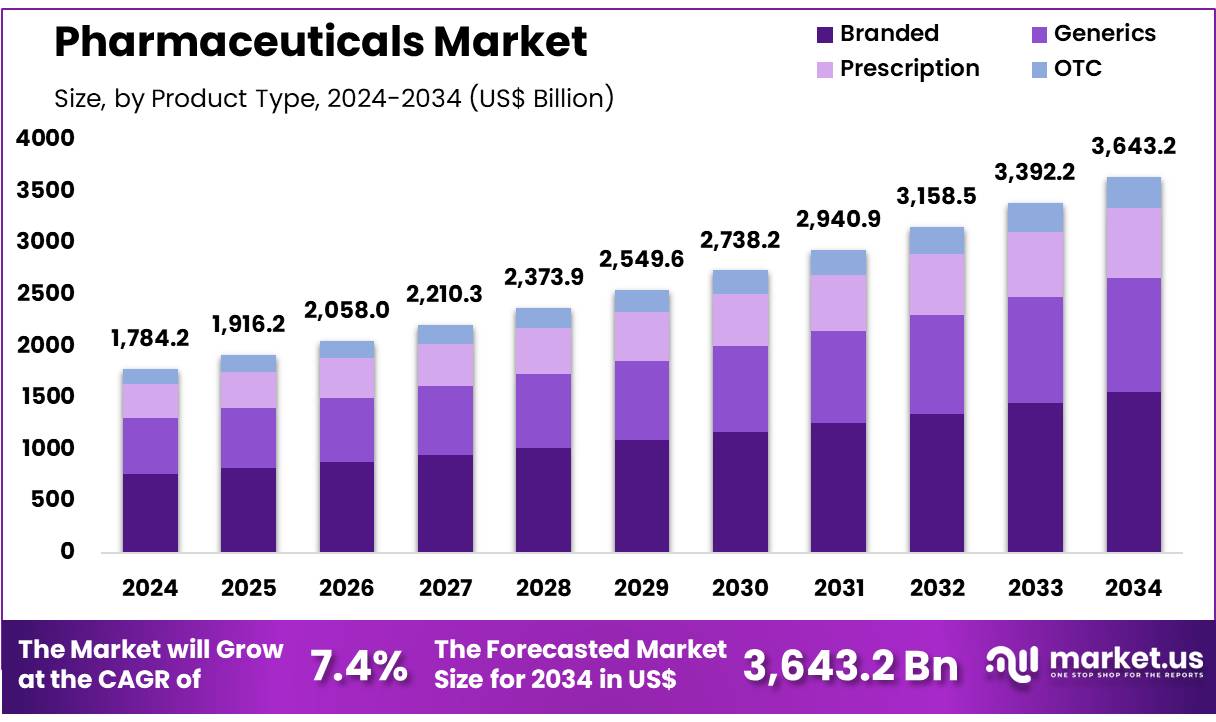

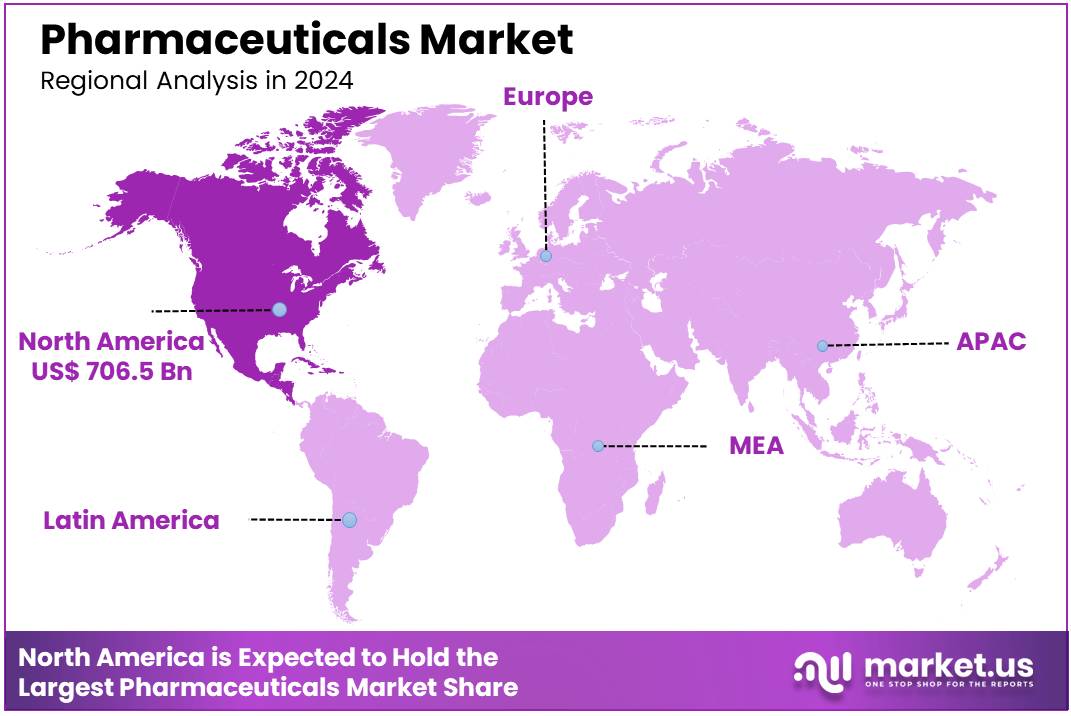

Global Pharmaceuticals Market size is expected to be worth around US$ 3643.2 Billion by 2034 from US$ 1784.2 Billion in 2024, growing at a CAGR of 7.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.6% share with a revenue of US$ 706.5 Billion.

Growing global healthcare needs and the increasing prevalence of chronic diseases are driving the expansion of the pharmaceuticals market. The pharmaceutical industry plays a vital role in developing medications and vaccines to treat a wide range of medical conditions, including infectious diseases, cancer, cardiovascular disorders, and neurological conditions.

The rising demand for effective treatments to address both acute and chronic health challenges significantly contributes to the market’s growth. In December 2021, Pfizer Inc. completed the acquisition of Arena Pharmaceuticals, a clinical-stage biotech company. This acquisition aimed to advance the development of innovative therapies targeting various immuno-inflammatory conditions, underscoring the pharmaceutical industry’s shift towards immunology and precision medicine.

Recent trends show increasing investments in research and development (R&D) for biologics, gene therapies, and personalized medicine, which offer more targeted and effective treatment options. Furthermore, the rise in aging populations globally presents substantial opportunities for pharmaceutical companies, as the demand for treatments for age-related conditions such as Alzheimer’s and osteoporosis continues to grow.

The integration of digital technologies, including AI and data analytics, into drug discovery processes also drives innovation and efficiency within the market. As regulatory frameworks evolve and new therapeutic areas emerge, the pharmaceutical market is poised for continued growth, with advancements that improve patient outcomes and expand healthcare access.

Key Takeaways

- Pharmaceuticals Market size is expected to be worth around US$ 3643.2 billion by 2034 from US$ 1784.2 billion in 2024

- The product type segment is divided into branded, generics, prescription, and OTC, with branded taking the lead in 2023 with a market share of 42.7%.

- Considering route of administration, the market is divided into oral, topical, parenteral, inhalations, and other. Among these, oral held a significant share of 48.5%.

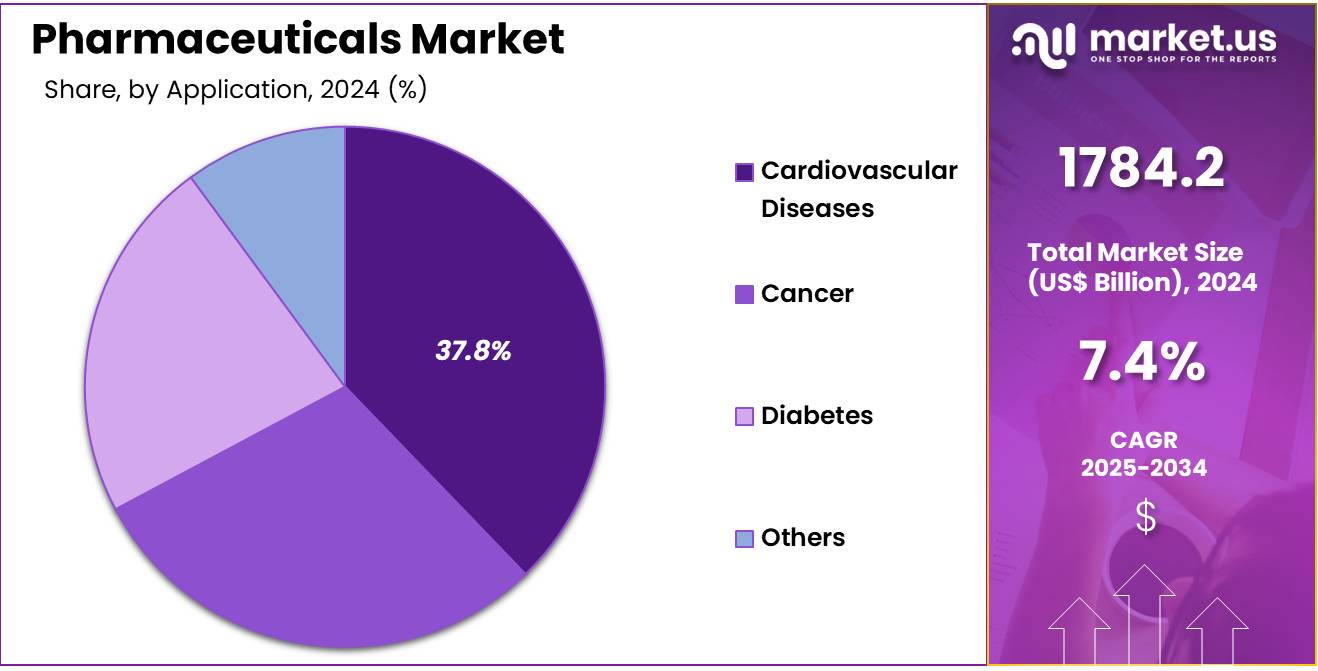

- Furthermore, concerning the application segment, the market is segregated into cardiovascular diseases, cancer, diabetes, and others. The cardiovascular diseases sector stands out as the dominant player, holding the largest revenue share of 37.8% in the pharmaceuticals market.

- The end-user segment is segregated into hospitals, clinics, and others, with the hospitals segment leading the market, holding a revenue share of 54.3%.

- North America led the market by securing a market share of 39.6% in 2024.

Product Type Analysis

The branded segment led in 2023, claiming a market share of 42.7% owing to the increasing consumer preference for well-known, trusted brands. Branded drugs often benefit from the extensive marketing efforts of pharmaceutical companies, creating strong brand recognition and consumer loyalty. This segment’s growth is anticipated to be driven by rising healthcare expenditures and the growing demand for advanced, high-quality treatments.

Additionally, branded drugs are likely to continue benefiting from exclusive patents, allowing manufacturers to set premium prices. With a focus on quality, safety, and efficacy, branded pharmaceuticals are expected to remain in high demand, particularly in therapeutic areas such as oncology, cardiology, and neurology, where specialized treatments are often needed.

Route of Administration Analysis

The oral held a significant share of 48.5% due to the widespread acceptance and convenience of oral medications. Oral administration is the preferred route for most patients, as it does not require specialized training or medical supervision, offering convenience and ease of use.

Advancements in drug formulation technologies are expected to improve the bioavailability and effectiveness of oral drugs, further boosting their demand. As a result, oral medications are likely to remain dominant in therapeutic areas such as chronic diseases, mental health, and diabetes management, contributing to the growth of this segment within the broader pharmaceutical market.

Application Analysis

The cardiovascular diseases segment had a tremendous growth rate, with a revenue share of 37.8% owing to the increasing prevalence of cardiovascular conditions worldwide. As populations age, the incidence of heart disease, hypertension, and stroke is expected to rise, leading to a higher demand for pharmaceutical treatments aimed at managing these conditions.

Ongoing advancements in drug formulations and the development of novel therapies, including those targeting specific genetic markers, will likely drive innovation in this segment. Additionally, the growing focus on preventive care, as well as government initiatives aimed at promoting heart health, are expected to contribute to the expansion of the cardiovascular diseases segment in the pharmaceuticals market.

End-user Analysis

The hospitals segment grew at a substantial rate, generating a revenue portion of 54.3% due to the rising demand for healthcare services globally. Hospitals are the primary setting for the administration of pharmaceuticals, especially for patients with critical conditions, complex treatments, or specialized care needs.

The increasing prevalence of chronic diseases, coupled with advancements in medical technology, is projected to drive higher hospital admissions and, consequently, demand for pharmaceuticals. Additionally, the growth in hospital infrastructure, especially in emerging economies, is expected to further boost the demand for pharmaceutical products used in both inpatient and outpatient settings, contributing to the growth of the hospitals segment within the broader pharmaceutical market.

Key Market Segments

Product Type

- Branded

- Generics

- Prescription

- OTC

Route of Administration

- Oral

- Topical

- Parenteral

- Intramuscular

- Intravenous

- Inhalations

- Other

Application

- Cardiovascular diseases

- Cancer

- Diabetes

- Others

End-user

- Hospitals

- Clinics

- Others

Drivers

Increasing Prevalence of Cancer Driving the Pharmaceuticals Market

Rising cancer cases are expected to drive growth in the pharmaceuticals market as demand for effective treatments continues to increase. A 2024 report from the American Cancer Society projected approximately 2 million new cancer diagnoses in the United States by the end of the year, highlighting the ongoing prevalence of the disease. The surge in cases is fueling the development of innovative oncology drugs, including targeted therapies and immunotherapies.

Pharmaceutical companies are investing heavily in research to improve chemotherapy, radiation, and precision medicine approaches. Breakthroughs in biologics and monoclonal antibodies are offering new treatment options for various cancer types. The expansion of genomic research is enabling the development of personalized cancer drugs tailored to individual genetic profiles. Regulatory agencies are expediting drug approvals for promising oncology treatments to meet urgent patient needs.

Increased collaboration between biotech firms and pharmaceutical giants is accelerating the commercialization of novel cancer therapies. Rising awareness and early cancer detection programs are driving demand for preventive medications and supportive care drugs. Governments worldwide are allocating significant funds for cancer research and treatment access initiatives.

The shift toward value-based healthcare is encouraging pharmaceutical companies to develop cost-effective yet high-efficacy treatments. With the continuous rise in cancer cases, the pharmaceuticals market is likely to witness sustained growth in oncology drug development.

Restraints

High Research and Development Costs Are Restraining the Pharmaceuticals Market

Rising research and development (R&D) expenses are limiting the growth of the pharmaceuticals market, making drug development a costly and time-consuming process. Pharmaceutical companies invest billions in clinical trials, regulatory approvals, and manufacturing, increasing the overall price of medications. The average cost of developing a new drug exceeds $2 billion, with a significant portion spent on early-stage research and lengthy clinical trials.

Regulatory requirements from agencies such as the FDA and EMA demand extensive safety and efficacy data, further extending development timelines. High failure rates in drug discovery lead to substantial financial losses, as only a small percentage of drug candidates reach commercialization. The complexity of biologics and advanced therapies adds to production costs, making affordability a concern for both healthcare providers and patients.

Intellectual property protection and patent expirations contribute to revenue losses, forcing companies to maintain high drug prices to recover R&D investments. Addressing these cost challenges through government incentives, collaborative research, and efficient trial designs could improve affordability and market expansion.

Opportunities

Growing Popularity of Decentralized Clinical Trials as an Opportunity for the Pharmaceuticals Market

The increasing adoption of decentralized clinical trials (DCTs) is expected to create new opportunities in the pharmaceuticals market by improving patient access and trial efficiency. A 2024 study by Huma, a digital health company, revealed that DCTs surged from 250 in 2012 to nearly 1,300 in 2021, demonstrating the growing adoption of remote and technology-driven trial methods. Digital platforms, telemedicine, and wearable health devices are enabling pharmaceutical companies to conduct clinical trials with reduced logistical constraints.

Patients can participate from home, eliminating the need for frequent site visits and expanding trial accessibility. Artificial intelligence and real-world data analytics are improving trial designs, accelerating drug development timelines. The flexibility of DCTs allows for more diverse patient recruitment, enhancing the generalizability of clinical outcomes. Lower operational costs compared to traditional trials are making DCTs a cost-effective alternative for pharmaceutical firms.

Regulatory agencies are recognizing the potential of virtual trials, streamlining approval processes for digital-based study models. The expansion of decentralized research is likely to enhance innovation in pharmaceuticals, bringing life-saving treatments to market faster.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a significant role in shaping the pharmaceuticals market. On the positive side, rising healthcare expenditures globally, particularly in emerging economies, contribute to the increasing demand for pharmaceutical products. The growing focus on improving healthcare infrastructure and access to essential medicines drives market growth, especially in regions with expanding middle-class populations.

Additionally, advancements in research and development, coupled with rising awareness of public health issues, fuel demand for innovative treatments. However, economic recessions, government budget cuts, or financial crises can limit healthcare spending, reducing the capacity to purchase costly medications.

Geopolitical factors such as trade restrictions, regulatory variances, and political instability may also disrupt the pharmaceutical supply chain, increasing production costs and limiting access to drugs in certain regions. Despite these challenges, the continued push for universal healthcare, alongside ongoing innovation in drug development, provides a positive long-term outlook for the industry.

Latest Trends

Surge in Mergers and Acquisitions Driving the Pharmaceuticals Market:

Rising mergers and acquisitions are driving significant growth in the pharmaceuticals market. High demand for innovation, combined with the need to strengthen product portfolios and expand market share, is expected to encourage more consolidation among pharmaceutical companies. These strategic moves enable companies to pool resources, enhance research and development efforts, and access new markets, which accelerates the introduction of new treatments.

The increasing trend of acquisitions is likely to streamline operations, reduce competition, and promote collaboration across the pharmaceutical value chain. In June 2024, EPAM Systems, Inc. completed the acquisition of Odysseus, a major health data analytics firm.

This move aims to revolutionize the life sciences industry by integrating advanced analytics, artificial intelligence (AI), and data-driven insights. As mergers and acquisitions continue to rise, the pharmaceutical market is expected to benefit from accelerated innovation, improved product offerings, and broader access to cutting-edge therapies.

Regional Analysis

North America is leading the Pharmaceuticals Market

North America dominated the market with the highest revenue share of 39.6% owing to rising demand for chronic disease treatments and advancements in drug development. A 2021 study by the US Bone and Joint Initiative revealed that arthritis affects about 7 out of every 100 individuals aged 18 to 44, with nearly half of those aged 65 and older experiencing some form of the condition.

The increasing prevalence of age-related and lifestyle diseases contributed to the expansion of treatments for conditions such as arthritis, diabetes, and cardiovascular disorders. Strong investments in research and development led to the introduction of innovative biologics and personalized medicine, improving patient outcomes. Government initiatives supporting drug accessibility and affordability, including expanded insurance coverage, further boosted market growth.

The rapid adoption of digital health technologies, including AI-driven drug discovery and telepharmacy services, enhanced efficiency in pharmaceutical distribution. Additionally, the presence of major biotechnology firms and pharmaceutical manufacturers in the region strengthened supply chains and accelerated the development of next-generation therapies, driving the market’s expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing healthcare investments and rising demand for advanced medicines. A 2023 report from the Indian Ministry of Finance highlighted that healthcare spending as a percentage of GDP rose from 1.4% in 2018 to 1.9% in 2023, reflecting increased investment in medical infrastructure and drug accessibility.

Expanding healthcare coverage in countries like China, India, and Japan is anticipated to improve access to essential medications. Government policies supporting local drug manufacturing are expected to reduce dependency on imports and lower costs. The growing burden of chronic diseases, coupled with an aging population, is likely to drive demand for innovative treatments.

Rising investments in biotechnology and precision medicine are anticipated to accelerate the development of targeted therapies. Collaborations between global pharmaceutical firms and regional companies are projected to enhance research capabilities and distribution networks. The increasing adoption of digital healthcare solutions, including e-pharmacies and AI-driven diagnostics, is expected to further strengthen market expansion across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the pharmaceuticals market focus on expanding research and development efforts to introduce innovative drugs and biologics for various therapeutic areas. Companies invest in advanced manufacturing technologies and digital transformation to improve production efficiency and streamline supply chains.

Strategic collaborations with biotech firms and academic institutions help accelerate drug discovery and regulatory approvals. Geographic expansion into emerging markets with increasing healthcare investments supports further growth. Many players also emphasize sustainability by adopting eco-friendly packaging and reducing carbon footprints in production.

Pfizer is a leading company in this market, known for its strong pipeline of innovative medicines and vaccines across multiple therapeutic segments. The company focuses on scientific advancements, strategic partnerships, and global expansion to enhance access to high-quality treatments. Pfizer’s commitment to research, healthcare innovation, and regulatory excellence positions it as a key player in the pharmaceutical industry.

Top Key Players

- Takeda Pharmaceutical Company Limited

- Sanofi

- Pfizer Inc

- Novartis AG

- McKesson Corporation

- Johnson & Johnson Services

- GSK plc

- Bristol-Myers Squibb Company

- AbbVie Inc

Recent Developments

- In October 2024, McKesson Corporation introduced InspiroGene, a new division dedicated to accelerating the commercialization of cell and gene therapies (CGTs), supporting biotech companies in bringing innovative treatments to market.

- As of March 2022, Sanofi’s research and development pipeline consisted of 91 clinical-stage candidates spanning multiple therapeutic areas, including oncology, neurology, and autoimmune diseases. Of these, 34 were in phase III trials or awaiting regulatory approval.

Report Scope

Report Features Description Market Value (2024) US$ 1784.2 billion Forecast Revenue (2034) US$ 3643.2 billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Branded, Generics, Prescription, and OTC), By Route of Administration (Oral, Topical, Parenteral (Intramuscular and Intravenous), Inhalations, and Other), By Application (Cardiovascular diseases, Cancer, Diabetes, and Others), By End-user (Hospitals, Clinics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Takeda Pharmaceutical Company Limited, Sanofi, Pfizer Inc, Novartis AG, McKesson Corporation, Johnson & Johnson Services, GSK plc, Bristol-Myers Squibb Company, and AbbVie Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Takeda Pharmaceutical Company Limited

- Sanofi

- Pfizer Inc

- Novartis AG

- McKesson Corporation

- Johnson & Johnson Services

- GSK plc

- Bristol-Myers Squibb Company

- AbbVie Inc