Pharmaceutical Glass Packaging Market Report By Product (Vials & Ampoules, Bottles, Cartridges, Syringes), By Drug Type (Generic, Branded, Biologic)By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 17977

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

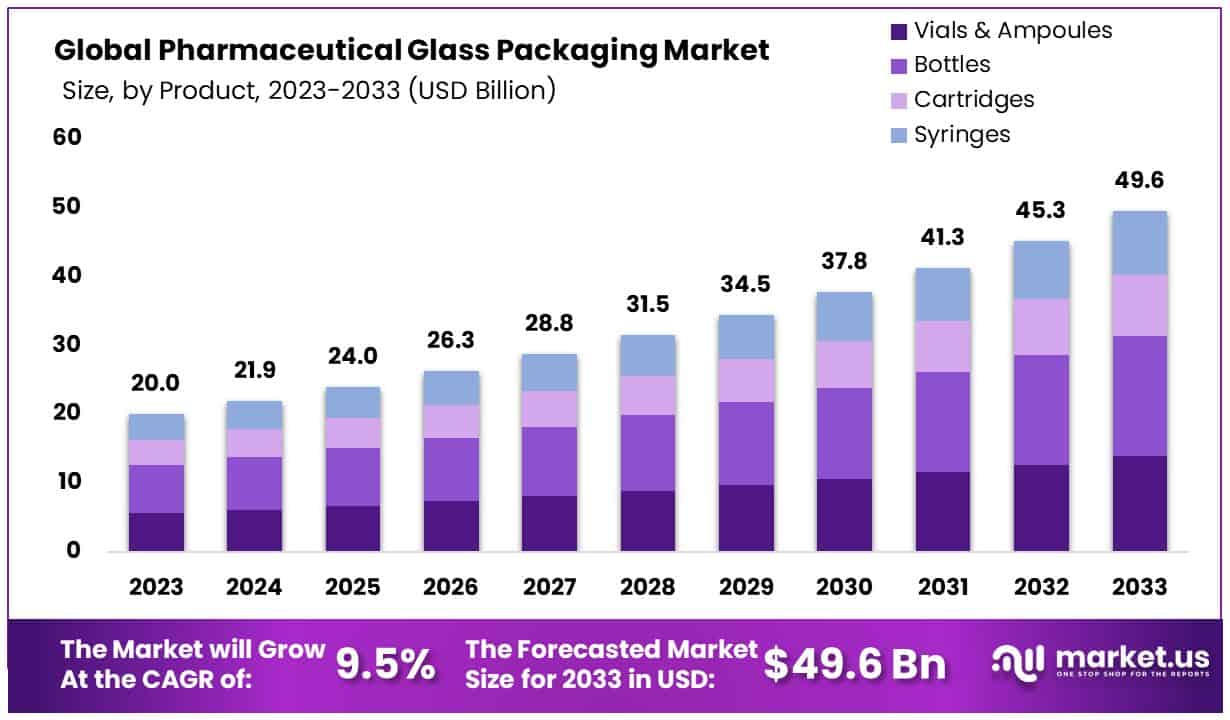

The Global Pharmaceutical Glass Packaging Market size is expected to be worth around USD 49.6 Billion by 2033, from USD 20.0 Billion in 2023, growing at a CAGR of 9.50% during the forecast period from 2024 to 2033.

The Pharmaceutical Glass Packaging Market encompasses the production and supply of glass containers specifically designed for pharmaceutical products. These include vials, ampoules, bottles, and syringes, crucial for ensuring the safety, stability, and integrity of medications.

This market caters to pharmaceutical companies’ need for reliable packaging solutions that comply with stringent regulatory standards for product quality and safety. The demand in this sector is driven by the global increase in pharmaceutical production, the shift towards sustainable packaging, and innovations in glass technology.

In the evolving landscape of the pharmaceutical industry, the Pharmaceutical Glass Packaging Market is poised for substantial growth, underpinned by significant trends in healthcare expenditure and technological advancements.

The projected increase in National Health Expenditure (NHE) by an average annual rate of 5.4% over the period from 2022 to 2031, as forecasted by the Centers for Medicare & Medicaid Services, is set to outstrip the growth in gross domestic product (GDP) which stands at 4.6%.

This discrepancy underscores a rapid demand for healthcare services, translating into an expanded requirement for pharmaceutical products and, by extension, their packaging solutions. The shift in health spending’s share of GDP from 18.3% in 2021 to an anticipated 19.6% by 2031 further highlights the increasing importance of efficient and reliable packaging within the healthcare continuum.

Innovation remains a critical driver for the market’s expansion. The introduction of SGD Pharma’s new range of Type I injectable vials, developed in collaboration with Corning on February 8, 2024, exemplifies the industry’s move towards enhancing operational efficiencies and product safety.

The integration of an external low-friction coating not only facilitates smoother processing on pharmaceutical filling lines but also aims to mitigate the risk of glass particulate contamination. Such advancements are pivotal in addressing key industry challenges, including production disruptions and the necessity for recall minimization, thereby underscoring the market’s adaptability and responsiveness to evolving pharmaceutical manufacturing demands.

Key Takeaways

- Market Value: The Pharmaceutical Glass Packaging Market is projected to reach approximately USD 49.6 Billion by 2033, indicating robust growth from USD 20.0 Billion in 2023, with a CAGR of 9.50% during the forecast period from 2024 to 2033.

- Dominant Segments:

- Product Analysis: Bottles dominate the market with a 35.2% share due to their versatility, widespread use, and sustainability advantages in pharmaceutical packaging. Other segments like vials & ampoules, cartridges, and syringes also play crucial roles in catering to specific pharmaceutical needs.

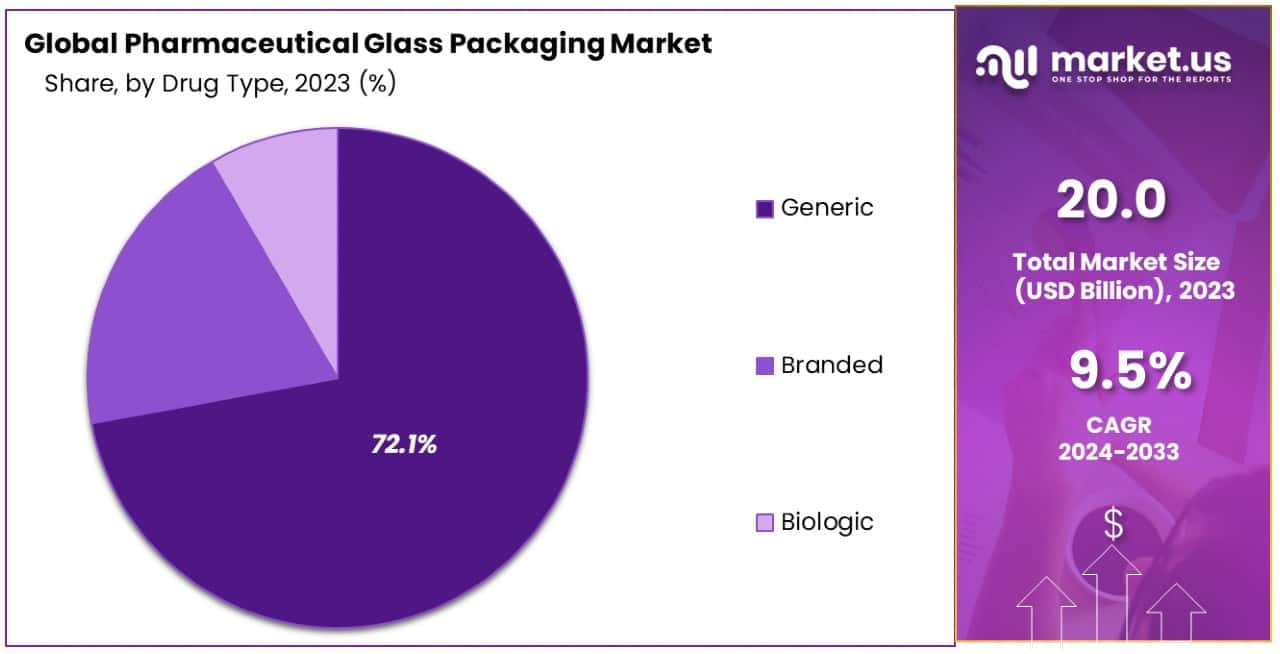

- Drug Type Analysis: Generic drugs command the largest market share of 72.1%, driven by their cost-effectiveness and increasing global demand, which directly influences the demand for glass packaging solutions. Branded and biologic drugs contribute to the market’s dynamics, requiring specialized glass packaging solutions to maintain stability and integrity.

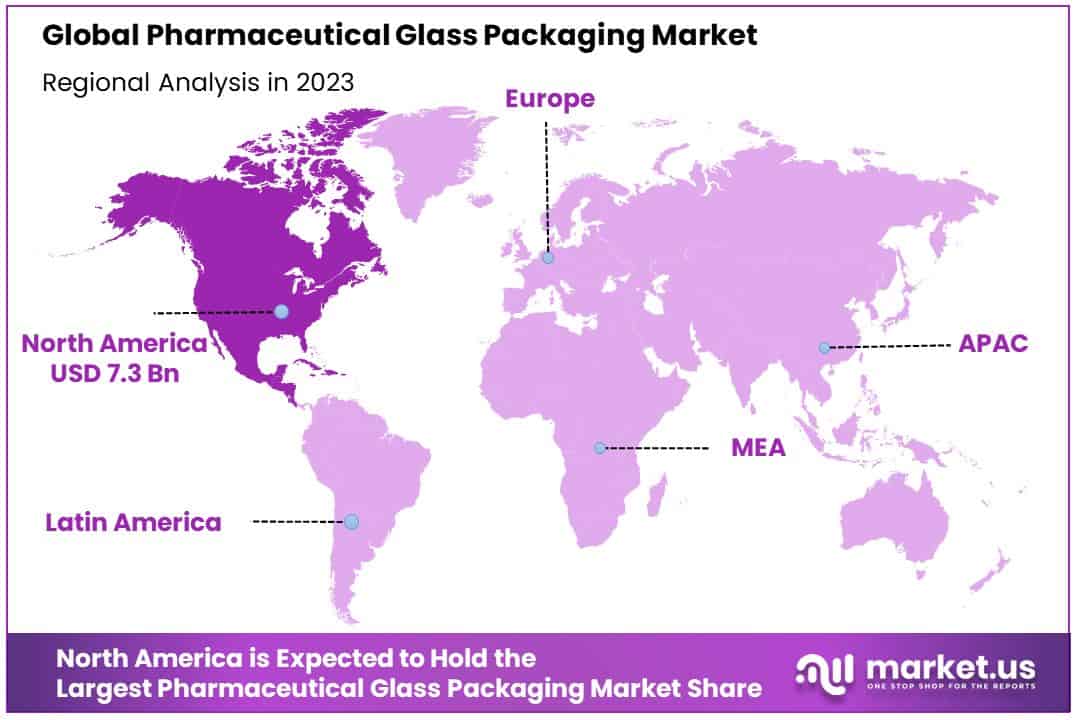

- Regional Analysis: North America dominates the market with a 36.4% market share, reflecting its significant influence and advanced pharmaceutical industry infrastructure.

- Key Players: Leading companies such as Corning Incorporated, Nipro Corporation, and SGD S.A. drive market innovation and provide a broad range of glass packaging solutions tailored to diverse pharmaceutical needs. Schott AG, Gerresheimer AG, and other global players expand their reach and product portfolios, emphasizing quality, patient safety, and sustainable practices.

- Analyst Viewpoint: The Pharmaceutical Glass Packaging Market is evolving through strategic innovation, market influence, and geographical expansion, with a focus on meeting stringent regulatory standards, enhancing patient safety, and adopting sustainable practices.

- Growth Opportunities: Opportunities lie in leveraging technological advancements for enhanced packaging safety, addressing evolving regulatory requirements, and expanding market presence through strategic partnerships and innovative product offerings. Additionally, the increasing demand for sustainable packaging solutions presents avenues for growth and differentiation in the market.

Driving Factors

Increasing Demand for Safe and Inert Packaging Drives Market Growth

The pharmaceutical industry’s pursuit of safety and efficacy in drug delivery underscores the vital role of glass packaging. Glass, inherently inert, ensures that pharmaceuticals are stored and transported without risk of chemical reactions that could compromise their integrity. This characteristic is paramount in maintaining drug stability, particularly for sensitive formulations. The escalating demand for pharmaceutical glass packaging is a direct response to this need for secure containment solutions.

As healthcare providers and patients alike grow increasingly aware of the potential risks associated with packaging materials, the preference for glass, known for its safety profile, has surged. This trend is further supported by the global increase in healthcare expenditure, signaling a broader demand for pharmaceutical products and, consequently, their reliable packaging. The interplay between safety requirements and market expectations shapes a robust growth trajectory for the pharmaceutical glass packaging industry.

Growth in Biologics and Parenteral Drugs Accelerates Market Expansion

The pharmaceutical landscape is witnessing a significant shift towards biologics and parenteral drugs, categories that require stringent packaging standards to preserve their complex biological structures. Glass packaging, particularly prefillable syringes, emerges as a solution of choice, offering both sterility and compatibility with these formulations.

The rise in chronic diseases and subsequent demand for biologics and injectables propels the need for glass containers that can maintain the efficacy and safety of these drugs from production to administration. This sector’s growth is further catalyzed by advancements in pharmaceutical technologies and the increasing prevalence of self-administration practices in chronic disease management. Together, these dynamics underscore the critical role of glass packaging in facilitating the global distribution and administration of biologics and parenteral drugs, thereby driving market growth.

Stringent Regulatory Requirements Bolster Market Adoption

Regulatory oversight plays a pivotal role in shaping the pharmaceutical glass packaging market. With organizations like the United States Pharmacopeia (USP) setting rigorous standards for packaging materials, glass emerges as a compliant and preferred option. These regulations are designed to ensure the highest levels of product safety and quality, mandating the use of materials that preserve drug integrity.

The strict regulatory landscape encourages pharmaceutical manufacturers to prioritize glass packaging, recognized for its ability to meet these stringent criteria. This regulatory environment not only drives the adoption of glass packaging but also fosters innovation within the sector, as manufacturers and suppliers strive to develop glass solutions that address both regulatory demands and market needs. The symbiosis between regulatory standards and market requirements catalyzes the growth of the pharmaceutical glass packaging market, reinforcing its importance in the pharmaceutical supply chain.

Restraining Factors

High Cost of Production and Raw Materials Restrains Market Growth

The manufacturing of pharmaceutical glass packaging is notably resource-intensive, requiring high temperatures and specialized machinery, which escalates production costs significantly. The use of premium materials, such as borosilicate glass, further inflates expenses, with raw materials accounting for up to half of the total production cost.

This high cost structure makes glass packaging a less economically viable option for some pharmaceutical companies, especially when compared to cheaper alternatives like plastic. As a result, the market’s growth is hampered by these financial barriers, particularly for smaller players with limited budgets, leading to a constrained adoption rate of glass packaging solutions across the industry.

Fragility and Potential for Breakage Restrains Market Growth

The inherent fragility of glass poses significant challenges to the pharmaceutical glass packaging market. Despite its advantages in safety and inertness, glass’s susceptibility to breakage during transport, handling, and usage presents a risk of product loss, contamination, and safety hazards.

These issues not only incur additional costs for pharmaceutical companies in terms of wasted products and replacement but also raise concerns about patient safety and drug efficacy. The potential for breakage necessitates rigorous packaging standards and enhanced handling procedures, which can complicate logistics and increase operational costs, thus limiting the market’s growth potential and the broader adoption of glass packaging in the pharmaceutical industry.

Product Analysis

In the Pharmaceutical Glass Packaging Market, bottles emerge as the dominant sub-segment, accounting for 35.2% of the market share. This prominence can be attributed to the versatility and widespread use of glass bottles in the pharmaceutical industry. Glass bottles offer an ideal solution for the packaging of various pharmaceutical formulations, including liquid drugs, syrups, and oral suspensions.

Their inert nature ensures that the packaged contents are not compromised, maintaining the efficacy and safety of the pharmaceutical products. Furthermore, glass bottles are highly customizable, capable of accommodating a range of volumes and closures, which makes them suitable for a wide array of pharmaceutical needs.

The dominance of bottles in the pharmaceutical glass packaging market is further bolstered by their sustainability advantages. Glass is 100% recyclable, with the ability to be reused multiple times without loss of quality or purity. This environmental benefit aligns with the increasing emphasis on sustainable packaging solutions within the pharmaceutical industry and beyond, driving the demand for glass bottles.

While bottles lead the product segment, other sub-segments like vials & ampoules, cartridges, and syringes also play crucial roles in the market’s growth. Vials and ampoules are essential for the packaging of injectable drugs, offering precise dosage capabilities and sterility. Cartridges and syringes, particularly prefilled variants, are gaining traction for their convenience and safety in drug administration, especially in home care settings.

Drug Type Analysis

Within the drug type segment, generic drugs command the largest market share, accounting for 72.1%. The dominance of generic drugs is primarily due to their cost-effectiveness compared to branded counterparts.

As patents for many blockbuster drugs expire, the market sees a surge in the production of generic versions, which are chemically identical to their branded equivalents but are available at a lower cost. This affordability makes generic drugs a critical component of global healthcare, especially in developing countries where access to medicines is a significant challenge.

The demand for generic drugs directly influences the Pharmaceutical Glass Packaging Market, as these drugs require reliable and safe packaging solutions that meet regulatory standards. Glass packaging, with its inert properties and compatibility with a wide range of drug formulations, is perfectly suited to meet these needs. The increasing volume of generic drugs being produced and distributed globally sustains the demand for glass packaging solutions, reinforcing the segment’s significance in the market.

Branded and biologic drugs also contribute to the market’s dynamics. Branded drugs, while more expensive, are essential for new therapeutic advancements and treatments. Biologic drugs, which are based on complex molecules and living organisms, require specialized glass packaging solutions that can maintain the stability and integrity of these sensitive formulations. Each of these drug types supports the diverse needs of the pharmaceutical industry, underlining the importance of tailored glass packaging solutions.

Key Market Segments

By Product

- Vials & Ampoules

- Bottles

- Cartridges

- Syringes

By Drug Type

- Generic

- Branded

- Biologic

Growth Opportunities

Development of Advanced Glass Packaging Solutions Offers Growth Opportunity

The push towards innovation within the Pharmaceutical Glass Packaging Market is unlocking significant growth opportunities. Companies like Gerresheimer and Schott are at the forefront, developing glass containers that feature integrated dosing systems and advanced coatings. These innovations are designed to meet the pharmaceutical industry’s evolving needs, focusing on enhancing drug stability, shelf life, and patient safety.

For instance, specialized coatings can minimize drug interaction with the packaging, while integrated delivery systems simplify medication administration, ensuring accurate dosages. Such advancements not only cater to current market demands but also set the stage for future growth by offering solutions that address the complexities of new pharmaceutical formulations. The development of these advanced packaging options reflects the industry’s commitment to innovation, improving the efficacy and safety of drug delivery.

Expansion in Emerging Markets Offers Growth Opportunity

Emerging markets represent a burgeoning frontier for the Pharmaceutical Glass Packaging Market, driven by the rapid expansion of their pharmaceutical sectors. Countries in regions like Asia-Pacific and Latin America are witnessing significant growth in their healthcare sectors, propelled by increasing population health awareness and government healthcare expenditures. For example, India’s pharmaceutical industry growth has led to a surge in demand for high-quality glass packaging solutions, prompting companies such as Hindustan National Glass & Industries Ltd. to ramp up their production capacities.

This surge in demand is not just limited to India; many countries within these regions are experiencing similar trends. The expansion into these markets offers glass packaging manufacturers considerable opportunities to scale operations, diversify product offerings, and establish a foothold in fast-growing economies. The strategic focus on emerging markets could potentially catalyze global market expansion and innovation, highlighting the interconnectedness of global health demands and packaging solutions.

Trending Factors

Focus on Sustainability and Recyclability Are Trending Factors

The shift towards environmental consciousness within the pharmaceutical industry has significantly elevated the demand for sustainable and eco-friendly packaging options. This trend has positioned recyclable and reusable glass packaging as a preferred choice for many pharmaceutical companies. Glass, with its inherent recyclability and non-reactive nature, offers an eco-friendly alternative to other packaging materials, aligning with the industry’s growing commitment to sustainability.

This focus not only supports environmental preservation efforts but also resonates with consumers’ increasing preference for green packaging solutions. As a result, the adoption of glass packaging is witnessing an uptrend, with companies actively exploring and integrating recyclable glass options into their product lines, signaling a positive shift towards more sustainable packaging practices in the pharmaceutical sector.

Serialization and Traceability Are Trending Factors

The pharmaceutical industry is increasingly grappling with the challenges of counterfeit drugs, which compromise patient safety and brand integrity. In response, serialization and traceability regulations have become more stringent, necessitating advanced packaging solutions capable of integrating tracking and authentication features.

Glass packaging is evolving to meet these requirements, with innovations that allow for the serialization of vials, bottles, and other containers. These developments enable manufacturers to track the movement of pharmaceutical products through the supply chain, enhancing safety and regulatory compliance. The trend towards incorporating serialization and traceability into glass packaging is driven by the need to secure the pharmaceutical supply chain from counterfeit threats, showcasing how regulatory demands are shaping packaging innovations and trends within the market.

Regional Analysis

North America Dominates with 36.4% Market Share

North America’s commanding 36.4% share in the Pharmaceutical Glass Packaging Market is a testament to the region’s advanced pharmaceutical industry and stringent regulatory standards. The high market share can be attributed to several key factors, including robust healthcare infrastructure, significant investment in pharmaceutical R&D, and stringent FDA regulations that demand high-quality, safe packaging solutions.

The presence of leading pharmaceutical companies in the U.S. and Canada, coupled with a strong emphasis on innovative and sustainable packaging solutions, further contributes to the region’s dominance.

The market dynamics in North America are characterized by a high degree of innovation and a growing focus on sustainability, driving the adoption of advanced glass packaging solutions. The region’s healthcare system, with its extensive coverage and high drug consumption rates, supports a steady demand for pharmaceutical packaging.

Looking ahead, North America is expected to maintain its influential position in the global market, spurred by ongoing advancements in biotechnology and personalized medicine. These trends are likely to drive the need for specialized glass packaging that caters to the evolving requirements of these sectors.

Europe’s Strategic Position in Pharmaceutical Glass Packaging

Europe holds a substantial position in the global Pharmaceutical Glass Packaging Market, characterized by its advanced pharmaceutical industry, stringent regulatory frameworks, and emphasis on sustainability and innovation. The region’s commitment to high-quality healthcare and pharmaceutical products drives the demand for reliable glass packaging solutions.

Asia Pacific: A Rapidly Growing Market

The Asia Pacific region is experiencing the fastest growth in the Pharmaceutical Glass Packaging Market, driven by increasing healthcare expenditure, rising awareness of health issues, and expanding pharmaceutical manufacturing. Countries like China and India are pivotal, with their large populations and growing middle class, which increases access to healthcare services and medications.

Middle East & Africa: Emerging Opportunities

The Middle East & Africa region, while holding a smaller share of the global Pharmaceutical Glass Packaging Market, is showing signs of accelerated growth. Improvements in healthcare infrastructure, increased healthcare spending, and a growing focus on regulatory frameworks to ensure drug safety and quality are key drivers.

Latin America: Growth Amidst Challenges

Latin America’s Pharmaceutical Glass Packaging Market is witnessing growth, driven by improving access to healthcare, regulatory enhancements, and an increasing focus on quality and safety in pharmaceutical products. Countries like Brazil and Mexico are leading the market, with their large populations and growing pharmaceutical industries.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the Pharmaceutical Glass Packaging Market, several key players are defining the industry’s trajectory through strategic innovation, market influence, and geographical expansion.

Corning Incorporated leads with its cutting-edge glass technologies, enhancing packaging safety and durability, while Nipro Corporation and SGD S.A. specialize in providing a broad range of glass packaging solutions, catering to diverse pharmaceutical needs. Companies like Stoelzle Oberglas GmbH, Bormioli Pharma S.p.A., and West Pharmaceutical Services, Inc., further enrich the market with their specialized offerings and focus on quality and patient safety.

Schott AG and Gerresheimer AG stand out for their global reach and extensive product portfolios, driving advancements in drug storage and delivery. Shandong Medicinal Glass Co., Ltd., and Beatson Clark focus on meeting the specific demands of their regional markets while contributing to the global supply chain. Meanwhile, Ardagh Group S.A., Arab Pharmaceutical Glass Co., and Piramal Enterprises Ltd. diversify the market with their unique strengths in manufacturing capabilities and market penetration.

Collectively, these companies shape the Pharmaceutical Glass Packaging Market through innovation, quality assurance, and responsive strategies to evolving pharmaceutical demands. Their impact extends beyond product offerings to include the advancement of sustainable practices and the adoption of new technologies, ensuring the market’s continued growth and adaptation to global healthcare needs.

Market Key Players

- Corning Incorporated

- Nipro Corporation

- SGD S.A.

- Stoelzle Oberglas GmbH

- Bormioli Pharma S.p.A.

- West Pharmaceutical Services, Inc.

- Schott AG

- Gerresheimer AG

- Shandong Medicinal Glass Co., Ltd.

- Beatson Clark

- Ardagh Group S.A.

- Arab Pharmaceutical Glass Co.

- Piramal Enterprises Ltd.

Recent Developments

- On February 2024, SGD Pharma launched a new range of Type I injectable vials in tubular glass, featuring an external low-friction coating developed by Corning.

- On January 2024, SGD Pharma announced the opening of a new siliconisation operation at its Saint-Quentin Lamotte (SQLM) plant in France, expanding its capacity for siliconised glass vials used in pharmaceutical packaging.

- On January 2024, SCHOTT Glass India commenced the production of amber pharma glass in Gujarat, India, expanding its local footprint to meet the increasing demand in the healthcare industry.

- On January 2024, Corning Incorporated and SGD Pharma announced a collaboration to establish a pharmaceutical glass packaging facility in Telangana state, India. This joint venture involves a significant investment of INRs 500 crore to set up the facility, with the first production expected in Q1 2025.

- On October 2023, Stoelzle Pharma launched the PharmaCos packaging line at CPHI Barcelona 2023, introducing a new range of packaging solutions designed for wellbeing and healthcare products.

Report Scope

Report Features Description Market Value (2023) USD 20.0 Billion Forecast Revenue (2033) USD 49.6 Billion CAGR (2024-2033) 9.50% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Vials & Ampoules, Bottles, Cartridges, Syringes), By Drug Type (Generic, Branded, Biologic) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Corning Incorporated, Nipro Corporation, SGD S.A., Stoelzle Oberglas GmbH, Bormioli Pharma S.p.A., West Pharmaceutical Services, Inc., Schott AG, Gerresheimer AG, Shandong Medicinal Glass Co., Ltd., Beatson Clark, Ardagh Group S.A., Arab Pharmaceutical Glass Co., Piramal Enterprises Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected value of the Global Pharmaceutical Glass Packaging Market?The Global Pharmaceutical Glass Packaging Market is anticipated to be worth approximately USD 49.6 Billion by 2033, indicating robust growth from USD 20.0 Billion in 2023, with a CAGR of 9.50% during the forecast period from 2024 to 2033.

What products are included in the Pharmaceutical Glass Packaging Market?The Pharmaceutical Glass Packaging Market encompasses the production and supply of glass containers specifically designed for pharmaceutical products. These include vials, ampoules, bottles, and syringes, crucial for ensuring the safety, stability, and integrity of medications.

What are the driving factors behind the growth of the Pharmaceutical Glass Packaging Market?The growth of the Pharmaceutical Glass Packaging Market is driven by factors such as the increasing demand for safe and inert packaging, the expansion of biologics and parenteral drugs, and stringent regulatory requirements mandating high-quality packaging materials.

Which region dominates the Pharmaceutical Glass Packaging Market?North America dominates the Pharmaceutical Glass Packaging Market with a 36.4% market share, attributed to its advanced pharmaceutical industry infrastructure and stringent regulatory standards.

Who are the key players in the Pharmaceutical Glass Packaging Market?Leading companies such as Corning Incorporated, Nipro Corporation, and SGD S.A. are key players in the Pharmaceutical Glass Packaging Market, driving market innovation and providing a broad range of glass packaging solutions tailored to diverse pharmaceutical needs.

Pharmaceutical Glass Packaging MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Pharmaceutical Glass Packaging MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Corning Incorporated

- West Pharmaceutical Services, Inc.

- Ardagh Group S.A.

- Gerresheimer AG

- Bormioli Pharma S.r.l

- Arab Pharmaceutical Glass Co.

- Schott AG

- Nipro Corporation

- Other Key Players