Global Personalized Skin Care Products Market Size, Share, Growth Analysis By Product (Face Care, Body Care), By Gender (Male, Female), By Type (Mass, Premium), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170550

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

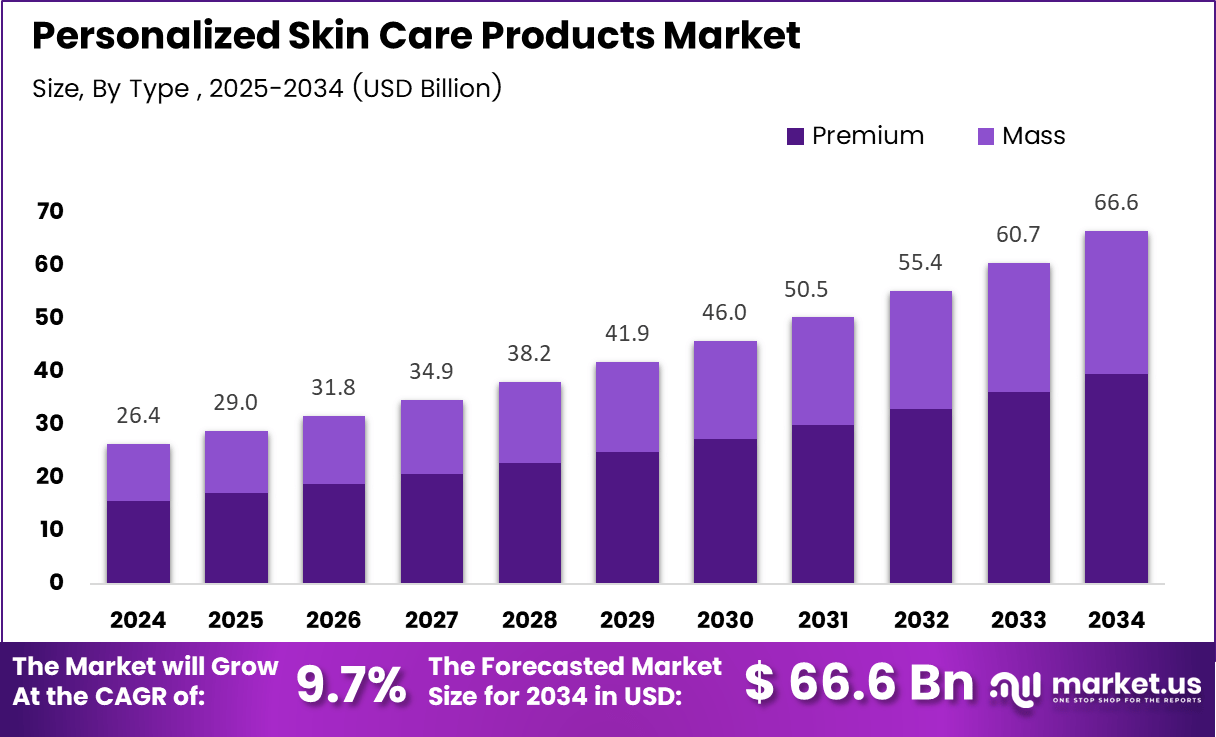

The Global Personalized Skin Care Products Market size is expected to be worth around USD 66.6 billion by 2034, from USD 26.4 billion in 2024, growing at a CAGR of 9.7% during the forecast period from 2025 to 2034.

The personalized skin care products market refers to solutions tailored to individual skin type, lifestyle, genetics, and environmental exposure. It combines data-driven diagnostics, custom formulations, and direct-to-consumer delivery models. This market addresses growing demand for efficacy-focused beauty, transparency, and measurable skin health outcomes across diverse consumer segments.

From a growth perspective, personalized skin care is expanding as consumers shift from generic products toward targeted routines. Moreover, rising digital literacy and smartphone penetration accelerate the adoption of AI-based skin analysis tools. Consequently, brands integrating personalization, subscription models, and clean formulations are expected to strengthen customer retention and long-term value creation.

In terms of opportunity, increasing acceptance of tele-dermatology and virtual consultations supports market scalability. Additionally, government investments in digital health infrastructure and data-driven wellness platforms indirectly benefit personalized beauty ecosystems. Regulatory frameworks emphasizing ingredient safety, labeling accuracy, and consumer data protection are anticipated to improve trust and standardization across customized skin care offerings.

From a demand standpoint, evolving lifestyle patterns strongly influence routine-based consumption. According to a consumer survey, 50% of Americans report a very or somewhat consistent skin care routine, including 20% who describe it as very consistent. This behavior underlines a stable base for personalized regimens anchored in daily usage habits.

Gender based usage trends further shape market design strategies. The same data shows women 60% are more likely than men 39% to maintain consistent routines, while 18% of women and 36% of men report no routine at all. These gaps create whitespace opportunities for simplified, personalized entry-level solutions targeting male consumers.

Product usage frequency highlights monetization potential across core categories. According to the Beauty survey, lip balm leads daily usage, with 35% of women and 10% of men applying it multiple times daily. Cleanser and moisturizer also show strong engagement, as 46% of women and 17% of men use moisturizer at least once daily.

Pricing sensitivity remains diverse, influencing premium and mass personalization strategies. Study Report 15% of Americans cap spending at $10 or less per product, while 16% are willing to spend $41 or more. Notably, 9% of women would spend above $60, compared with 2% of men, supporting tiered personalized pricing models.

Key Takeaways

- The Global Personalized Skin Care Products Market is projected to grow from USD 26.4 billion in 2024 to USD 66.6 billion by 2034, registering a CAGR of 9.7%.

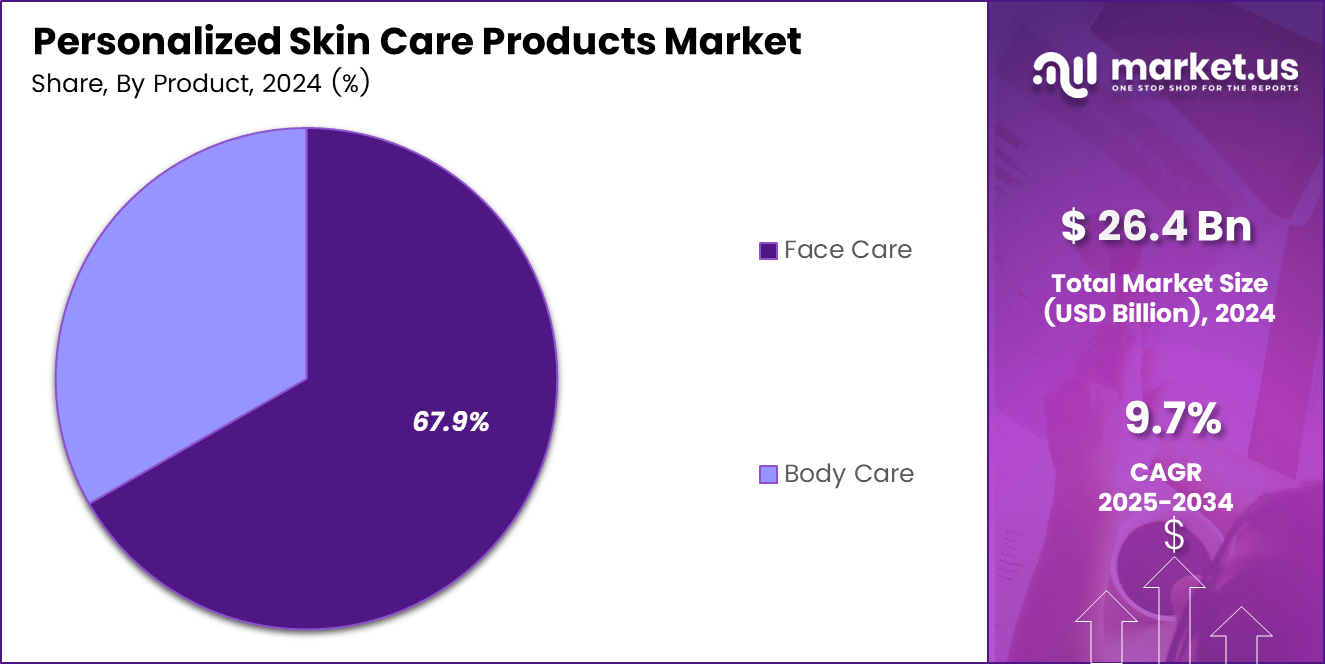

- By product, Face Care dominates the market with a share of 67.9%, reflecting strong consumer focus on daily facial skin health routines.

- By gender, Female consumers lead adoption with a market share of 71.3%, driven by higher routine consistency and customization demand.

- By type, the Mass segment accounts for the largest share at 59.7%, supported by affordability and wider accessibility of personalized solutions.

- By distribution channel, Offline sales dominate with 61.8%, benefiting from in-store consultations and professional guidance.

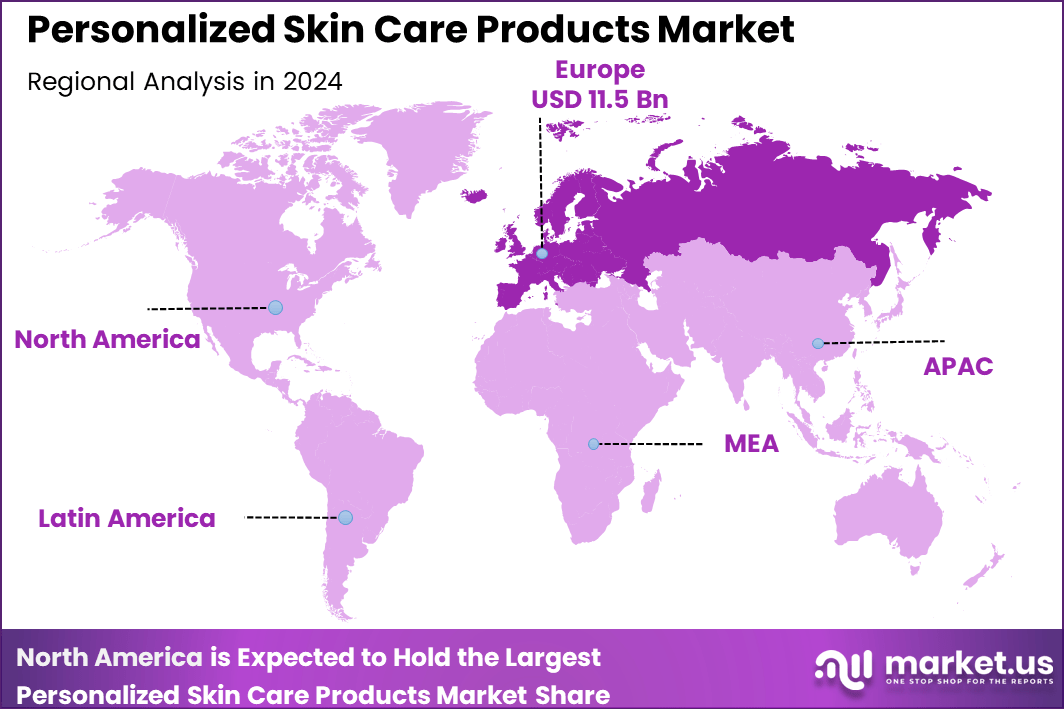

- Regionally, Europe leads the global market with a share of 43.9%, valued at USD 11.5 billion.

By Product Analysis

Face Care dominates with 67.9% due to its higher consumer focus on facial appearance and daily skin health routines.

In 2024, Face Care held a dominant market position in the By Product Analysis segment of the Personalized Skin Care Products Market, with a 67.9% share. This dominance is supported by rising demand for customized facial solutions addressing acne, pigmentation, aging, and sensitivity, while enabling brands to leverage AI diagnostics and ingredient personalization effectively.

Body Care represents the remaining share within the By Product segment and continues to expand steadily. Consumers increasingly seek tailored solutions for hydration, body acne, and uneven skin tone. Although adoption is slower than face care, personalization technologies and subscription models are gradually strengthening engagement across body-focused skin routines.

By Gender Analysis

Female dominates with 71.3% driven by higher awareness, routine consistency, and demand for customized beauty solutions.

In 2024, females held a dominant market position in the By Gender Analysis segment of the Personalized Skin Care Products Market, with a 71.3% share. Women demonstrate stronger engagement with personalized regimens, supported by higher product experimentation, digital consultations, and willingness to invest in data-driven skin assessments.

Male skincare continues to gain momentum as grooming norms evolve and awareness increases. Personalized offerings targeting oil control, sensitivity, and environmental damage are encouraging adoption. Although the share remains lower, simplified routines and targeted formulations are helping brands gradually expand male participation in customized skincare solutions.

By Type Analysis

Mass dominates with 59.7% due to affordability and wider accessibility of personalized solutions.

In 2024, Mass held a dominant market position in the By Type Analysis segment of the Personalized Skin Care Products Market, with a 59.7% share. This segment benefits from scalable personalization models, affordable pricing, and integration with online skin analysis tools that appeal to cost-conscious consumers seeking customized yet accessible products.

Premium personalized skincare targets consumers seeking advanced formulations, high-quality ingredients, and deeper customization. While smaller in share, this segment benefits from brand loyalty, dermatologist-backed solutions, and luxury positioning. Premium players focus on efficacy and exclusivity to justify higher price points.

By Distribution Channel Analysis

Offline dominates with 61.8% supported by in-store consultations and professional guidance.

In 2024, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Personalized Skin Care Products Market, with a 61.8% share. Physical stores enable skin assessments, expert recommendations, and product trials, which strengthen consumer trust and enhance the personalization experience.

Online channels are expanding rapidly as digital diagnostics, virtual consultations, and subscription services improve convenience. Consumers increasingly prefer online platforms for reorders and customized formulations. Although currently smaller in share, continuous technology integration is expected to support long-term online channel growth.

Key Market Segments

By Product

- Face Care

- Body Care

By Gender

- Male

- Female

By Type

- Mass

- Premium

By Distribution Channel

- Online

- Offline

Drivers

Rising Consumer Preference for Customized Formulations Drives Market Growth

The personalized skin care products market is strongly driven by consumers seeking solutions that match their unique skin needs. Many users no longer trust one-size-fits-all all products and prefer formulas designed around skin type, lifestyle, climate, and daily habits. This shift supports steady demand for customized routines.

At the same time, awareness around ingredient transparency continues to rise. Consumers increasingly read labels and value dermatologist-guided and data-backed solutions. Personalized skin care brands benefit from this trend by clearly explaining why specific ingredients are selected for individual concerns. This improves confidence and repeat usage.

Digital penetration further strengthens market momentum. AI-based skin diagnostics, mobile apps, and online consultations make personalization easier and more accessible. These tools help users understand skin conditions quickly and receive tailored product recommendations without visiting clinics.

Additionally, demand for targeted solutions addressing acne, aging, pigmentation, and sensitivity is increasing across age groups. Personalized approaches allow brands to focus on precise concerns, improving outcomes and user satisfaction while supporting long-term market growth.

Restraints

High Product Pricing Limits Wider Adoption of Personalized Skin Care

One major restraint in the personalized skin care products market is high pricing. Small batch production, advanced formulations, and customized packaging increase overall costs. As a result, price-sensitive consumers may hesitate to adopt personalized solutions despite interest.

Another challenge is limited consumer trust in algorithm-driven recommendations. Some users remain unsure whether AI-based diagnostics can fully replace professional dermatology advice. Without clear clinical validation, adoption rates may slow, especially among first-time users.

Regulatory complexity also restrains market expansion. Claims related to personalization, efficacy, and data usage are closely monitored. Brands must comply with strict labeling rules, data protection laws, and transparency standards, which can delay product launches.

Together, pricing pressure, trust gaps, and regulatory hurdles create barriers for rapid scaling, particularly in emerging markets with lower awareness of personalized skin care benefits.

Growth Factors

Expansion of AI-Powered Skin Analysis Tools Creates New Growth Opportunities

The expansion of AI-powered skin analysis tools presents strong growth opportunities. Integration with mobile apps and smart devices allows real-time skin assessment and continuous personalization. This enhances user engagement and supports recurring product demand.

Rising interest in personalized men’s grooming and gender neutral skin care also opens new avenues. Men increasingly seek simple, effective routines, while gender neutral positioning appeals to broader audiences. This diversification helps brands reach untapped consumer segments.

Partnerships between dermatology clinics and direct-to-consumer brands further strengthen credibility. Clinical involvement improves trust, supports data accuracy, and helps bridge the gap between medical advice and personalized beauty solutions.

These opportunities collectively support market expansion by combining technology, inclusivity, and professional validation.

Emerging Trends

Use of Genetic and Microbiome Profiling Shapes Market Trends

A key trend in the personalized skin care products market is genetic and microbiome-based profiling. These approaches allow a deeper understanding of skin behavior and enable hyper-personalized formulations designed for long-term skin health.

Sustainability is also becoming central to personalization strategies. Brands increasingly integrate eco-friendly ingredients, reduced waste packaging, and ethical sourcing within customized offerings. This aligns personalization with environmental responsibility.

Omni-channel personalization is gaining traction, combining online diagnostics with in-store consultations. This hybrid approach improves accuracy and consumer confidence while enhancing the buying experience.

Additionally, demand for made-to-order, clean-label, and fragrance-free products continues to grow. These trends reflect consumer focus on safety, simplicity, and transparency within personalized skin care solutions.

Regional Analysis

Europe Dominates the Personalized Skin Care Products Market with a Market Share of 43.9%, Valued at USD 11.5 Billion

Europe represents the leading regional market for personalized skin care products, accounting for a dominant share of 43.9% and reaching a value of USD 11.5 billion. Growth in this region is supported by high consumer awareness around ingredient safety, dermatology-backed formulations, and sustainability-driven personalization trends. Advanced digital health adoption and strong demand for customized anti-aging and sensitive skin solutions further strengthen Europe’s leadership position.

North America Personalized Skin Care Products Market Trends

North America demonstrates strong adoption of personalized skin care solutions due to widespread use of AI-based skin diagnostics and data-driven beauty platforms. Consumers in this region show a high willingness to invest in premium, subscription-based, and clinically guided products. The presence of advanced digital infrastructure and a strong focus on preventive skin health continue to support market expansion.

Asia Pacific Personalized Skin Care Products Market Trends

Asia Pacific is emerging as a high-growth region, supported by a large population base, rising disposable income, and increasing beauty consciousness among younger consumers. Demand is driven by personalized acne Treatment, pigmentation, and uneven skin tone, particularly in urban areas. Rapid expansion of e-commerce and mobile-based skin analysis tools further accelerates regional growth.

Middle East and Africa Personalized Skin Care Products Market Trends

The Middle East and Africa market is developing steadily, supported by growing awareness of customized skin solutions for climate-specific concerns such as dryness and hyperpigmentation. Urbanization and rising penetration of premium beauty products are contributing to gradual adoption. Dermatologist-recommended and targeted treatment products are gaining visibility across key markets.

Latin America Personalized Skin Care Products Market Trends

Latin America shows moderate growth, driven by increasing interest in personalized beauty routines and expanding online beauty retail channels. Consumers are gradually shifting from mass market products toward tailored formulations addressing oil control and sun-related skin issues. Growing digital engagement and influencer-driven education continue to support market development.

U.S. Personalized Skin Care Products Market Trends

The US market remains a key contributor within North America, characterized by early adoption of AI-enabled skin diagnostics and customized formulation platforms. High demand for science-backed, transparent, and data-supported products strengthens market momentum. Subscription models and direct-to-consumer personalization strategies are expected to support sustained growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Personalized Skin Care Products Company Insights

The competitive landscape of the global Personalized Skin Care Products Market in 2024 is shaped by established beauty conglomerates and emerging digital-first brands that focus on customization, data-driven formulation, and direct consumer engagement. The first four companies demonstrate different but complementary approaches to personalization, innovation, and market penetration.

The Estée Lauder Companies Inc. leverages its strong R and D capabilities and premium brand portfolio to integrate personalization through advanced skin diagnostics, AI-powered consultations, and bespoke product recommendations. Its strategy is centered on combining luxury positioning with science-based personalization, allowing the company to address diverse skin concerns while maintaining high brand trust and consumer loyalty across global markets.

Amway Corp approaches personalized skin care through a wellness-oriented and consumer-centric model, supported by its direct selling network and Nutrilite-backed research ecosystem. The company emphasizes customized regimens linked to lifestyle, nutrition, and skin health, enabling deeper consumer relationships and repeat purchases through long-term skin care programs rather than single product sales.

Coty Inc. focuses on digital transformation and data-enabled beauty experiences to strengthen its presence in personalized skin care. By integrating AI-driven skin analysis tools and flexible formulation platforms, Coty aims to modernize its brand portfolio and attract younger, tech-savvy consumers seeking tailored solutions that align with individual skin profiles and aesthetic preferences.

AUGUST SKINCARE represents a new generation of personalization-led brands that prioritize clean formulations, transparency, and algorithm-based product matching. Its growth strategy is driven by online-first distribution, rapid feedback loops, and simplified personalization models, appealing to consumers looking for effective, minimalistic, and highly individualized skin care solutions without the complexity of traditional beauty routines.

Top Key Players in the Market

- The Estée Lauder Companies Inc.

- Amway Corp

- Coty Inc.

- AUGUST SKINCARE

- PROVEN

- Function of Beauty

- L’Oréal Groupe

- Curology

Recent Developments

- In Aug 2025, Magic Science Corporation announced a strategic partnership with NexPhase Capital alongside the acquisition of a leading hypochlorous acid manufacturer. This move strengthens Magic Science’s production scale and accelerates growth across healthcare, hygiene, and antimicrobial solution markets.

- In Dec 2024, L’Oréal Groupe signed an agreement with Migros to acquire its subsidiary Gowoonsesang Cosmetics Co., Ltd., including the Korean skincare brand Dr.G, founded in 2003 and headquartered in Seoul. The acquisition integrates Dr.G into L’Oréal’s Consumer Products Division (CPD), positioning the brand to capture rising global demand for K-Beauty and science-driven, affordable skincare solutions.

Report Scope

Report Features Description Market Value (2024) USD 26.4 billion Forecast Revenue (2034) USD 66.6 billion CAGR (2025-2034) 9.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Face Care, Body Care), By Gender (Male, Female), By Type (Mass, Premium), By Distribution Channel (Online, Offline) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape The Estée Lauder Companies Inc., Amway Corp, Coty Inc., AUGUST SKINCARE, PROVEN, Function of Beauty, L’Oréal Groupe, Curology Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Personalized Skin Care Products MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Personalized Skin Care Products MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- The Estée Lauder Companies Inc.

- Amway Corp

- Coty Inc.

- AUGUST SKINCARE

- PROVEN

- Function of Beauty

- L’Oréal Groupe

- Curology