Global Peptide Therapeutics Market By Type (Generic and Beanded), By Application (Gastrointestinal Disorders, Neurological Disorders, Metabolic Disorders, Cancer, and Other Applications), By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 29056

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

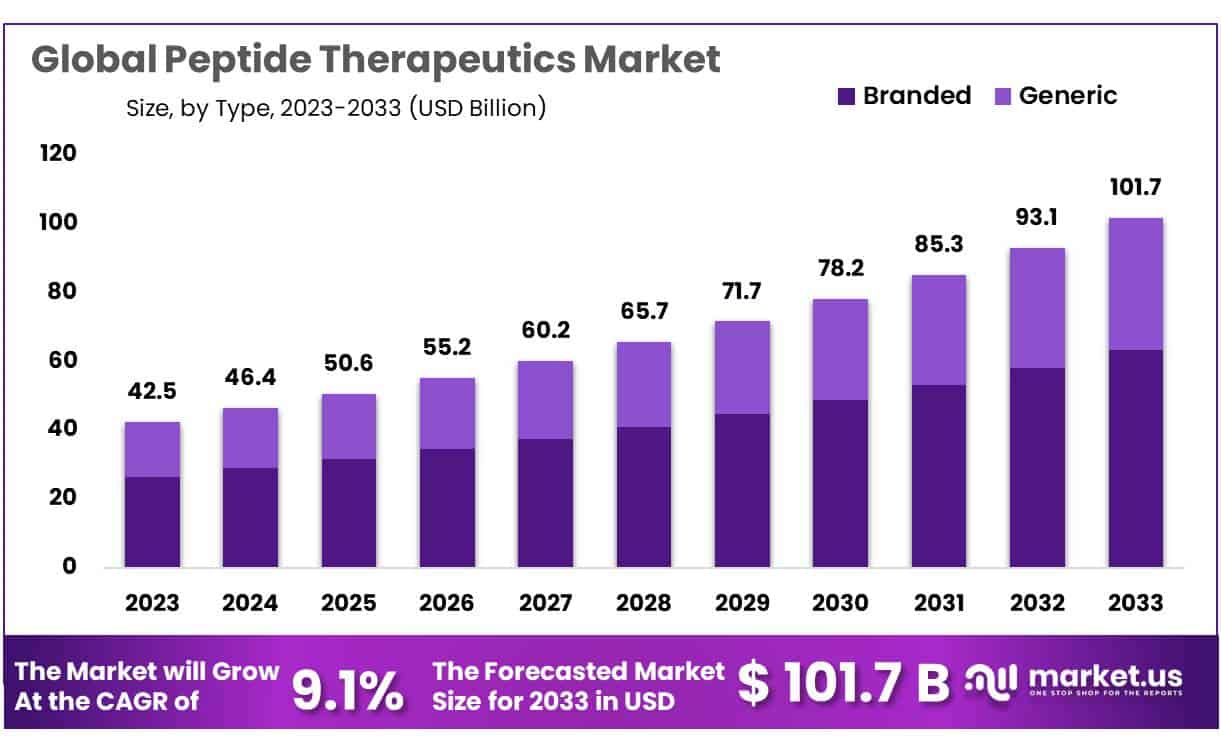

The Global Peptide Therapeutics Market size is expected to be worth around USD 101.7 Billion by 2033 from USD 42.5 Billion in 2023, growing at a CAGR of 9.1% during the forecast period from 2024 to 2033.

The global peptide therapeutics market is a growing segment within the pharmaceutical industry. Peptide therapeutics are drugs that are composed of short chains of amino acids, which can be designed to target specific disease states. They have several advantages over traditional small-molecule drugs, including high selectivity and specificity, low toxicity, and favorable pharmacokinetics.

Moreover, the increasing R&D investments by pharmaceutical companies, rising demand for biologics, and the emergence of new technologies for peptide synthesis and drug delivery are also contributing to the growth of the market. However, high development costs and stringent regulatory requirements may pose a challenge to the growth of the market.

Key Takeaways

- Market Size: Peptide Therapeutics Market size is expected to be worth around USD 101.7 Billion by 2033 from USD 42.5 Billion in 2023.

- Market Growth: The market growing at a CAGR of 9.1% during the forecast period from 2024 to 2033.

- Type Analysis:The total revenue share of branded-type peptide therapeutics is 62.4%.

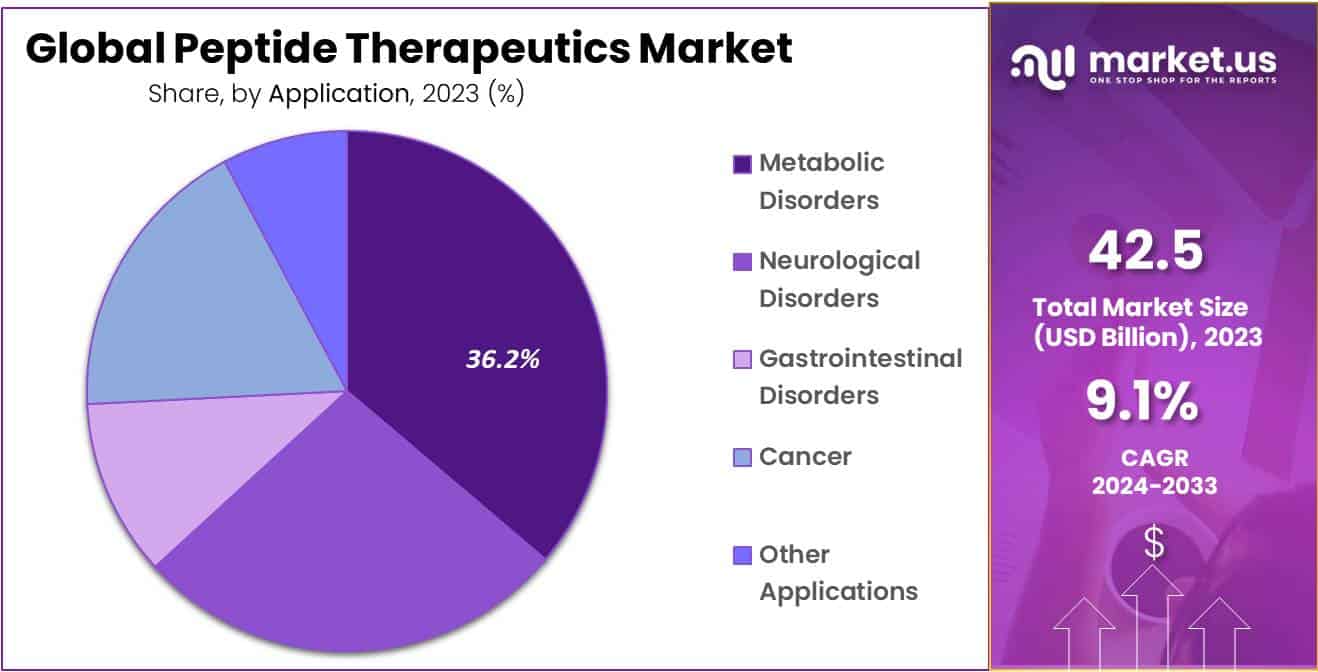

- Application Analysis: Metabolic disorders segment is dominate 36.2% market share in 2023.

- Route of Administration: The parenteral segment account with the largest revenue share of 66.7%.

- Distribution Channel: Hospital segment is register to be the most lucrative segment accounted 60.1% share in 2023.

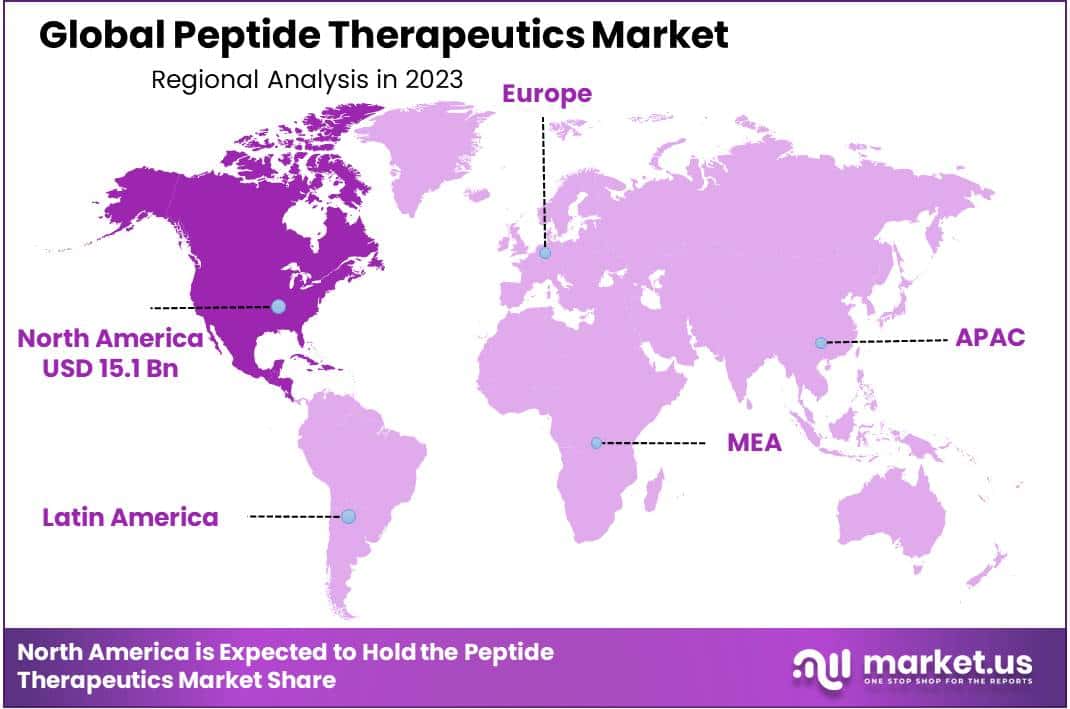

- Regional Analysis: North America the largest market share of 35.7% in 2023.

- Chronic Diseases: Rising prevalence of chronic diseases like cancer and diabetes drives peptide therapeutics adoption.

- R&D Investments: Heavy investments in research and development by pharmaceutical companies fuel market growth.

- Biologics Adoption: Growing use of biologics, including peptide therapeutics, due to their specificity and effectiveness.

Driving Factors

Rising Prevalence of Chronic Diseases to Augment Market Growth

One of the key drivers of the global peptide therapeutics market is the increasing prevalence of chronic diseases. Peptide therapeutics are used to treat a wide range of chronic diseases, such as cancer, diabetes, and cardiovascular disorders, which are on the rise worldwide. Peptide therapeutics have several advantages over traditional small-molecule drugs in the treatment of chronic diseases. They are highly specific and can be designed to target specific receptors or pathways, which can improve efficacy and reduce side effects. Additionally, they can be formulated for sustained release, which can improve patient compliance and reduce the need for frequent dosing. Another driver of the global peptide therapeutics market is the increasing investment in research and development.

The biopharmaceutical industry is investing heavily in the development of new peptide-based drugs, and several new products are expected to enter the market in the coming years. Additionally, advances in technology, such as peptide synthesis and formulation, are making it easier and more cost-effective to develop and manufacture peptide therapeutics. the growing adoption of biologics in healthcare is also driving the growth of the peptide therapeutics market. Biologics, including peptide therapeutics, are increasingly being used to treat a wide range of diseases due to their high specificity and effectiveness. The increasing availability of biologics and the growing awareness among healthcare providers and patients about their benefits are expected to drive the growth of the peptide therapeutics market in the coming years.

Restraining Factors

Complex Manufacturing Process and Higher Development Cost Restrict Growth in Emerging Countries

Peptide therapeutics are generally more expensive than small molecule drugs due to their complex manufacturing process and higher development costs. This can limit patient access to these therapies and result in lower market penetration. The development and approval process for peptide therapeutics can be lengthy and expensive due to regulatory requirements for safety and efficacy. This can result in delays in bringing new products to market and limit the growth of the market.

thus, the high cost, regulatory challenges, limited oral availability, side effects, and competition from other biologics are some of the key restraints to the global peptide therapeutics market. However, ongoing advances in technology and research are expected to address some of these challenges and drive the growth of the market in the coming years.

Growth Opportunities

Demand Opportunities from Personalized Medicines

Peptide therapeutics are highly specific and can be designed to target specific receptors or pathways. This makes them ideal for the development of personalized medicines, which can tailor treatment to the individual needs of each patient. As demand for personalized medicine continues to grow, the use of peptide therapeutics is expected to increase. the increasing demand for personalized medicine, expansion into new therapeutic areas, advancements in technology, growing focus on rare diseases, and emerging markets are some of the key opportunities in the global peptide therapeutics market. As the market continues to evolve, it is expected that these opportunities will drive the growth of the market in the coming years.

Trending Factors

Growing Usage of Peptides in the Treatment of Diabetes and Cancer

Peptides were once only employed for hormone therapy and diagnostic purposes, but thanks to technical advances, they are now very frequently utilized to treat cancer and other chronic metabolic diseases. Chemotherapy, the most popular kind of cancer treatment, has a number of issues since it can’t get the proper dosage of medication to the right patient at the right time. The natural cells of the body are also impacted. A promising new path for the peptide therapeutics market’s future development has been made possible by the use of peptide-based therapies in the treatment of cancer.

In addition, peptide therapies are frequently used in injections for diabetic patients as a result of new synthetic methods that lessen the need for frequent injections while also enhancing stability and other physical characteristics. The rising prevalence of diabetes and the growing need for quick and effective treatment methods are both factors that are pushing the use of peptide treatments rather than oral medications.

Type Analysis

Branded Type Expected to Witness Significant Growth

Based on type, the market for peptide therapeutics is segmented into generic and branded. Among these types, the branded segment is the most lucrative in the global peptide therapeutics market. The total revenue share of branded-type peptide therapeutics is 62.4% in 2023. During the forecast period, a significant rate of growth for the generic segment is anticipated. The use of generic drugs is anticipated to expand along with healthcare spending by the federal government.

Another major element influencing the generic market is thought to be the loss of patent protection for many branded medications. When a patent expires, generic medicine manufacturers have a big chance to join the market with less expensive versions of popular prescription medications. Nonetheless, brand loyalty may affect sector growth in the case of some novel drugs.

Application Analysis

Metabolic Disorders Expected to Witness Significant Growth

By application, the market is further divided into gastrointestinal disorders, neurological disorders, metabolic disorders, cancer, and other applications. The metabolic disorders segment is estimated to be the most lucrative segment in the global peptide therapeutics market, with a market share of over 36.2% in 2023. Also, the second-largest segment was discovered to be cancer.

Rising cancer incidence rates around the world and an increase in the prescription of peptide therapies for cancer therapy are the key factors driving this market’s expansion. Growth is anticipated to be fueled over the forecast period by a rise in the need for effective and quick-acting medicines.

Route of Administration Analysis

Parenteral Route of Administration Expected to Witness Significant Growth

Based on the route of administration, the market is segmented into parenteral, oral, and other routes of administration. Among these routes of administration, the parenteral segment is estimated to be the most lucrative segment in the global peptide therapeutics market, with the largest revenue share of 66.7% during the forecast period. The most popular method of administration is parenteral since it guarantees improved absorption, a quicker start time, and better treatment results. The trend for administering therapeutic peptides has changed as a result of improvements in drug delivery methods.

Distribution Channel Analysis

Hospitals Expected to Witness Significant Growth

Based on distribution channels, the market is segmented into hospitals, retail and drug stores, online pharmacies, and other distribution channels. Among these channels, the hospital segment is estimated to be the most lucrative segment accounted 60.1% share in the global peptide therapeutics market due to the infrastructure, equipment, and expertise required to administer and monitor the use of peptide therapeutics, which are often complex and require specialized handling and administration.

While other distribution channels, such as retail stores, and online pharmacies may play a role in the distribution of peptide therapeutics, they are not as dominant as hospitals. These channels are often used for medications that are less complex and require less specialized handling and administration.

Key Market Segments

Based on Type

- Generic

- Branded

Based on Applications

- Gastrointestinal Disorders

- Neurological Disorders

- Metabolic Disorders

- Cancer

- Other Applications

Based on the Route of Administration

- Parenteral

- Oral

- Other Routes of Administration

Based on Distribution Channel

- Hospitals

- Retail and Drug Stores

- Online Pharmacies

- Other Distribution Channels

Regional Analysis

North America is estimated to be the most lucrative market in the global peptide therapeutics market, with the largest market share of 35.7% in 2023. The region’s peptide therapeutics market is expanding due to strengthened healthcare infrastructure, expensive peptide therapeutics medications, and advantageous reimbursement regulations. Because infectious diseases are becoming more common in the region, analysts predict that the market in the Asia Pacific will expand at a rapid CAGR during the course of the forecast.

The market in the Asia Pacific is being driven by an increase in the number of elderly people and a rise in healthcare spending. The market for peptide therapeutics in Asia Pacific is also expected to grow as a result of the region’s vast patient base and strong desire for more modern, advanced therapies.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Ipsen, Sanofi, Pfizer, Lonza Group, Merck KGaA, and Sandoz International are just a few of the key companies that operate in the highly competitive worldwide peptide therapeutics market. These businesses are continuously working to create cutting-edge and efficient peptide-based medicines, and it is anticipated that their efforts will fuel the expansion of the worldwide peptide therapeutics market in the years to come.

Listed below are some of the most prominent peptide therapeutics industry players.

Market Key Players

- Eli Lilly and Company

- Pfizer, Inc.

- Amgen, Inc.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceuticals Industries Ltd.

- Lonza Inc.

- Sanofi

- Bristol-Myers Squibb (BMS)

- AstraZeneca PLC

- GlaxoSmithKline plc (GSK)

- Novartis AG

- Novo Nordisk A/S

- Other Key Players

Recent Developments

- October 2023: Eli Lilly and Company Announced positive Phase 3 results for LY3819459, a novel peptide drug, in treating moderate-to-severe atopic dermatitis.

- August 2023: Teva Pharmaceuticals Industries Ltd. Acquired Auspex Pharmaceuticals, gaining access to Auspex’s late-stage peptide candidate for the treatment of Huntington’s disease.

- June 2023: GlaxoSmithKline plc (GSK) Discontinued development of its late-stage peptide candidate for chronic obstructive pulmonary disease (COPD) due to safety concerns.

Report Scope

Report Features Description Market Value (2023) USD 45.5 Billion Forecast Revenue (2033) USD 101.7 Billion CAGR (2024-2033) 9.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Generic and Branded), By Application (Gastrointestinal Disorders, Neurological Disorders, Metabolic Disorders, Cancer, and Other Applications), By Route of Administration(Parenteral, Oral, and Other Routes of Administration), By Distribution Channel (Hospitals, Retail and Drug Store, Online Pharmacies, and Other Distribution Channels) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Eli Lilly and Company, Pfizer, Inc., Amgen, Inc., Takeda Pharmaceutical Company Limited, Teva Pharmaceuticals Industries Ltd., Lonza Inc., Sanofi, Bristol-Myers Squibb (BMS), AstraZeneca PLC, GlaxoSmithKline plc (GSK), Novartis AG, Novo Nordisk A/S, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are peptide therapeutics?Peptide therapeutics are drugs made from short chains of amino acids, designed to treat specific medical conditions by targeting biological processes in the body.

How big is the Peptide Therapeutics Market?The global Peptide Therapeutics Market is expected to grow at a compound annual growth rate of 9.1%. From 2024 To 2033

Who are the key companies/players in the Peptide Therapeutics Market?Some of the key players in the Peptide Therapeutics Markets are Eli Lilly and Company, Pfizer, Inc., Amgen, Inc., Takeda Pharmaceutical Company Limited, Teva Pharmaceuticals Industries Ltd., Lonza Inc., Sanofi, Bristol-Myers Squibb (BMS), AstraZeneca PLC, GlaxoSmithKline plc (GSK), Novartis AG, Novo Nordisk A/S, and Other Key Players.

What medical conditions do peptide therapeutics address?Peptide therapeutics can be used to treat a wide range of conditions, including cancer, diabetes, cardiovascular diseases, and more.

How fast is the peptide therapeutics market growing?The market has been experiencing steady growth, with a compound annual growth rate (CAGR) of X% in recent years.

What are the regulatory challenges in developing peptide drugs?Regulatory agencies like the FDA play a crucial role in approving and overseeing peptide therapeutics, which can involve rigorous testing and evaluation.

Are there investment opportunities in the peptide therapeutics market?Yes, investors interested in the pharmaceutical sector may find opportunities in supporting the development and commercialization of peptide-based drugs.

Peptide Therapeutics MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Peptide Therapeutics MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Eli Lilly and Company

- Pfizer, Inc.

- Amgen, Inc.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceuticals Industries Ltd.

- Lonza Inc.

- Sanofi

- Bristol-Myers Squibb (BMS)

- AstraZeneca PLC

- GlaxoSmithKline plc (GSK)

- Novartis AG

- Novo Nordisk A/S

- Other Key Players