PD-L1 Biomarker Testing Market By Product Type (PD-L1 22C3 Assay Kit, PD-L1 SP142 Assay Kit, PD-L1 28-8 Assay Kit, and PD-L1 263 Assay Kit), By Application (Non-Small Cell Lung Cancer (NSCLC), Renal Cell Carcinoma, Ovarian Cancer, Melanoma, Haematological Malignancies, Gastrointestinal Tract Malignancy, and Other), By End-user (Hospitals, Cancer Research Institutes, Diagnostic Laboratories, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165929

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

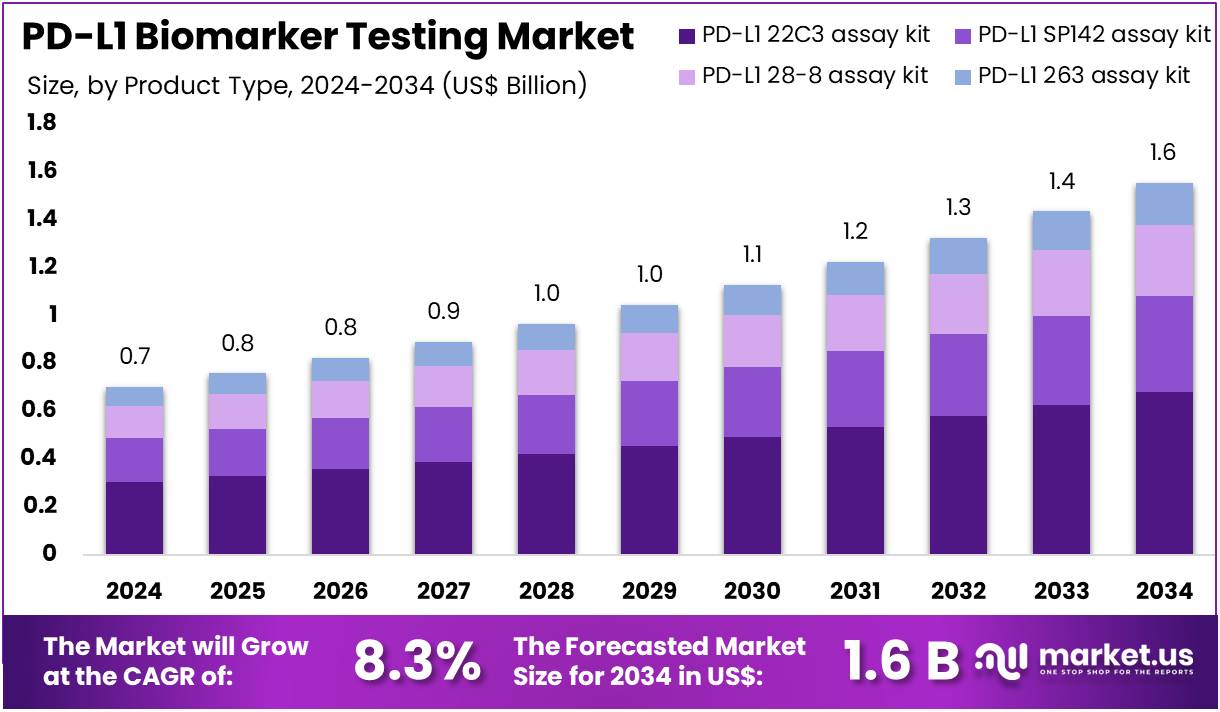

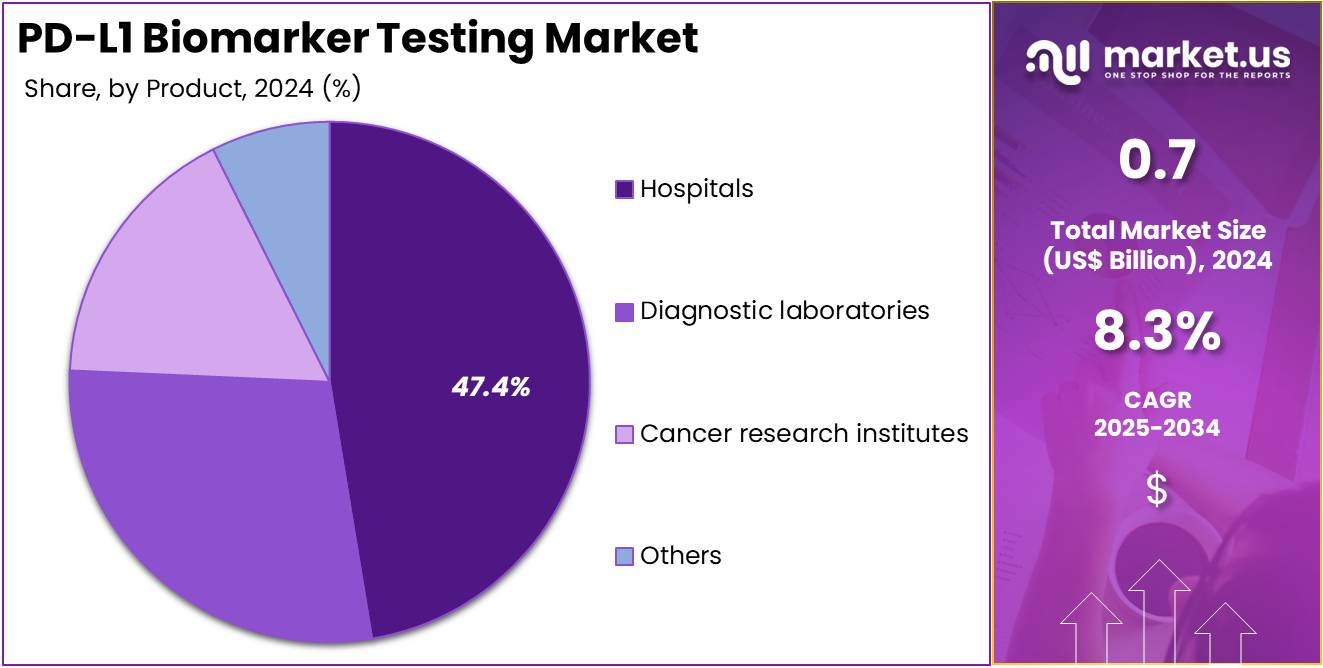

The PD-L1 Biomarker Testing Market Size is expected to be worth around US$ 1.6 billion by 2034 from US$ 0.7 billion in 2024, growing at a CAGR of 8.3% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 41.4% share and holds US$ 0.3 Billion market value for the year.

Increasing emphasis on immunotherapy optimization fuels the PD-L1 Biomarker Testing Market, as oncologists demand accurate stratification tools to maximize clinical response rates across multiple tumor types.

Healthcare providers actively incorporate PD-L1 expression analysis into standard treatment algorithms, driving adoption through evidence-based patient selection protocols. These tests deliver critical applications in determining first-line eligibility for pembrolizumab in non-small cell lung cancer, assessing combination potential with chemotherapy in triple-negative breast cancer, and evaluating perioperative immunotherapy in gastric cancer.

Pharmaceutical leaders create new opportunities by linking expanded indications to mandatory companion diagnostics, extending testing relevance into curative-intent settings. Merck’s approval of KEYTRUDA for resectable head and neck squamous cell carcinoma in June 2025 exemplifies this progression, embedding PD-L1 evaluation directly into neoadjuvant decision-making workflows. This regulatory expansion accelerates routine pre-surgical testing and reinforces the market’s pivotal role in precision oncology.

Growing need for assay standardization propels the PD-L1 Biomarker Testing Market forward, as laboratories and drug developers prioritize reproducible, high-affinity reagents to reduce inter-assay variability. Diagnostic manufacturers respond by launching specialized antibodies that enhance signal clarity and scoring consistency across different immunohistochemistry platforms.

Applications now span prospective screening in bladder cancer for adjuvant therapy qualification, retrospective analysis in endometrial cancer for mismatch repair-deficient cohorts, and companion diagnostic development for emerging immune checkpoint inhibitors. Research organizations seize opportunities to accelerate novel biomarker validation through reliable reagent supply chains.

Leica Biosystems addressed this demand in February 2025 by introducing advanced PD-L1 and HER2 primary antibodies, providing the research community with robust tools that streamline assay optimization and therapeutic target confirmation. Such innovations fortify the foundational infrastructure that sustains continued market evolution.

Rising integration of artificial intelligence reshapes the PD-L1 Biomarker Testing Market, as pathology departments adopt automated scoring systems to eliminate subjective interpretation errors and improve turnaround times. Technology companies partner with digital pathology leaders to embed AI algorithms directly into clinical workflows, driving efficiency and diagnostic confidence. These solutions find expanding applications in quantifying tumor proportion scores for esophageal carcinoma, combined positive score assessment in cervical cancer, and immune cell scoring in renal cell carcinoma treatment planning.

Market participants capitalize on opportunities to harmonize global scoring practices through AI-driven standardization. Lunit’s integration of its AI-powered PD-L1 22C3 TPS solution into Roche’s navify Digital Pathology platform in September 2024 marks a transformative leap, enabling precise, scalable analysis that accelerates therapeutic decisions. This advancement propels the entire market toward next-generation digital diagnostics and elevated standards of care.

Key Takeaways

- In 2024, the market generated a revenue of US$ 0.7 billion, with a CAGR of 8.3%, and is expected to reach US$ 1.6 billion by the year 2034.

- The product type segment is divided into PD-L1 22C3 assay kit, PD-L1 SP142 assay kit, PD-L1 28-8 assay kit, and PD-L1 263 assay kit, with PD-L1 22C3 assay kit taking the lead in 2023 with a market share of 43.7%.

- Considering application, the market is divided into non-small cell lung cancer (NSCLC), renal cell carcinoma, ovarian cancer, melanoma, haematological malignancies, gastrointestinal tract malignancy, and other. Among these, non-small cell lung cancer (NSCLC) held a significant share of 50.6%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, cancer research institutes, diagnostic laboratories, and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 47.4% in the market.

- North America led the market by securing a market share of 41.4% in 2023.

Product Type Analysis

The PD-L1 22C3 assay kit holds 43.7% of the PD-L1 Biomarker Testing market and is projected to lead due to its status as the benchmark companion diagnostic for multiple immuno-oncology drugs. The kit’s widespread approval for identifying patients eligible for pembrolizumab therapy in cancers such as NSCLC, head and neck carcinoma, and gastric cancer drives adoption across oncology laboratories. Pharmaceutical partnerships between diagnostic developers and drug manufacturers have reinforced its clinical relevance.

The 22C3 assay delivers reproducible and standardized staining results, ensuring consistent PD-L1 scoring across global pathology networks. Increased deployment of automated immunohistochemistry (IHC) systems such as Dako Omnis enhances operational efficiency and throughput.

Expanding clinical validation studies have extended its utility to additional tumor types, broadening its market base. As immunotherapies gain traction in cancer management, the 22C3 assay kit is anticipated to remain central to diagnostic strategies supporting precision oncology.

Application Analysis

Non-small cell lung cancer dominates the application segment with 50.6% market share and is anticipated to maintain its lead as PD-L1 testing becomes integral to therapy selection and prognosis. The increasing prevalence of NSCLC globally has prompted oncologists to integrate biomarker-driven treatment planning as a standard of care. PD-L1 biomarker testing enables identification of patients most likely to respond to PD-1/PD-L1 inhibitors, improving therapeutic outcomes.

Rising awareness about immunotherapy’s role in extending survival rates among advanced NSCLC patients drives diagnostic testing volumes. Multiple regulatory approvals for PD-L1 assays across key markets strengthen their inclusion in clinical guidelines.

Hospitals and diagnostic labs have scaled molecular testing infrastructure to accommodate growing demand for NSCLC biomarker analysis. Ongoing clinical trials evaluating PD-L1 in combination with other biomarkers, such as TMB and MSI, further enhance diagnostic relevance. The shift toward personalized oncology care is projected to sustain NSCLC’s leadership in the PD-L1 biomarker testing landscape.

End-User Analysis

Hospitals account for 47.4% of the PD-L1 Biomarker Testing market and are expected to retain dominance due to their advanced oncology infrastructure and access to integrated diagnostic systems. The growing implementation of hospital-based molecular pathology units supports in-house PD-L1 testing for faster clinical turnaround. Hospitals increasingly perform PD-L1 analysis to guide immunotherapy treatment decisions in NSCLC, melanoma, and urothelial carcinoma cases.

Multidisciplinary oncology teams rely on PD-L1 test results for evidence-based therapeutic planning. Large hospital networks are adopting automated immunostaining platforms and digital pathology systems to enhance diagnostic precision. Collaborative programs between hospital laboratories and pharmaceutical companies facilitate clinical validation of new PD-L1 assays.

Rising patient volume, improved reimbursement frameworks, and access to government-funded cancer programs strengthen hospital-based testing adoption. Additionally, hospitals in emerging economies are expanding oncology departments equipped with immunohistochemical testing capabilities. As immunotherapy continues transforming cancer care, hospitals are anticipated to remain the primary centers for PD-L1 biomarker testing worldwide.

Key Market Segments

By Product Type

- PD-L1 22C3 Assay Kit

- PD-L1 SP142 Assay Kit

- PD-L1 28-8 Assay Kit

- PD-L1 263 Assay Kit

By Application

- Non-Small Cell Lung Cancer (NSCLC)

- Renal Cell Carcinoma

- Ovarian Cancer

- Melanoma

- Haematological Malignancies

- Gastrointestinal Tract Malignancy

- Other

By End-user

- Hospitals

- Cancer Research Institutes

- Diagnostic Laboratories

- Others

Drivers

Rising Incidence of Lung Cancer is Driving the Market

The escalating global incidence of lung cancer has become a pivotal force propelling the PD-L1 biomarker testing market, as this malignancy represents the primary indication for such diagnostics in guiding immunotherapy decisions. Non-small cell lung cancer, which constitutes the majority of cases, routinely requires PD-L1 expression evaluation to determine eligibility for checkpoint inhibitors like pembrolizumab or atezolizumab. This diagnostic imperative arises from the need to identify patients likely to benefit from targeted immune therapies, thereby optimizing treatment outcomes and resource allocation in oncology practices.

Public health organizations underscore the urgency, with lung cancer’s prevalence straining healthcare systems and amplifying demand for accessible, accurate testing platforms. As smoking cessation efforts lag and environmental exposures persist, the burden continues to intensify, particularly in aging populations. Consequently, laboratories and pathology services have scaled up PD-L1 immunohistochemistry capabilities to meet clinical workflows.

Pharmaceutical collaborations with diagnostic developers further accelerate assay validations, ensuring alignment with therapeutic approvals. The integration of PD-L1 testing into standard care pathways enhances precision medicine adoption, reducing overtreatment risks. Moreover, educational initiatives by professional societies promote routine testing, fostering broader clinician familiarity.

According to the World Health Organization’s GLOBOCAN 2022 estimates, lung cancer accounted for 2,480,675 new cases worldwide, representing 12.4% of all cancers. This substantial caseload directly correlates with heightened testing volumes, as guidelines mandate PD-L1 assessment at diagnosis. Ultimately, this driver sustains market vitality by linking epidemiological trends to diagnostic necessities.

Restraints

Inconsistent Adoption Rates of PD-L1 Testing is Restraining the Market

Disparities in PD-L1 testing adoption across healthcare settings pose a significant barrier to the uniform expansion of the biomarker testing market, often resulting from resource limitations and varying protocol implementations. In resource-constrained regions or under-equipped facilities, clinicians may prioritize other biomarkers, sidelining PD-L1 due to perceived complexity or turnaround delays. This inconsistency undermines the potential for personalized immunotherapy, as untreated patients miss opportunities for effective interventions.

Standardization efforts by regulatory bodies aim to address these gaps, yet implementation remains uneven globally. Logistical challenges, including sample handling requirements for immunohistochemistry, further deter routine use in high-volume centers. As a result, treatment decisions occasionally rely on surrogate markers, diluting the market’s penetration. Professional guidelines advocate universal testing, but compliance varies, particularly in community oncology versus academic hubs.

Economic pressures exacerbate the issue, with reimbursement hurdles discouraging investment in specialized assays. Collaborative quality assurance programs seek to harmonize practices, but progress is gradual. A 2023-2024 cohort study of 398 lung cancer patients in Romania revealed that PD-L1 testing occurred in only 50.67% of biopsied cases, highlighting persistent adoption shortfalls. Such variability not only hampers market growth but also perpetuates inequities in access to precision oncology.

Opportunities

FDA Approvals for Expanded Indications are Creating Growth Opportunities

Regulatory endorsements from the U.S. Food and Drug Administration for PD-L1 testing in novel therapeutic contexts are unlocking expansive growth prospects within the biomarker market, broadening its applicability beyond established solid tumors. These approvals validate assays for emerging regimens, spurring investments in assay refinements and distribution networks.

By linking diagnostics to innovative immunotherapies, they incentivize pharmaceutical-diagnostic partnerships, enhancing assay portfolios. This evolution extends PD-L1’s utility to adjuvant and neoadjuvant settings, where early intervention can alter disease trajectories.

Manufacturers capitalize by pursuing validations for diverse tissue types, mitigating saturation in primary indications. Global harmonization of these approvals facilitates international market entry, particularly in regions aligning with FDA standards. Educational campaigns accompanying approvals elevate clinician confidence, driving uptake in multidisciplinary tumor boards. Supply chain optimizations ensure scalability, meeting anticipated demand surges.

The resultant ecosystem fosters innovation in multiplexing technologies, combining PD-L1 with other biomarkers. In December 2024, the FDA granted expanded approval to the PD-L1 IHC 28-8 pharmDx assay for selecting patients with completely resected non-small cell lung cancer eligible for adjuvant nivolumab therapy. This milestone exemplifies how such advancements catalyze sustained market diversification and revenue streams.

Impact of Macroeconomic / Geopolitical Factors

Persistent economic volatility, including elevated healthcare costs and budget constraints in public systems, compels hospitals to prioritize essential treatments over routine PD-L1 biomarker screenings, thereby curbing market expansion in cost-conscious regions. Surging investments in precision oncology, fueled by growing insurance coverage for targeted therapies, propel clinicians to integrate PD-L1 tests more routinely, enhancing early detection rates among high-risk patients.

Heightened geopolitical frictions, such as U.S.-China trade escalations, interrupt the flow of specialized reagents from Asian suppliers, inflating production delays and operational expenses for diagnostic firms. These tensions, however, accelerate collaborations between Western biotech hubs and emerging markets, fostering joint ventures that localize testing capabilities and reduce dependency on volatile trade routes.

Recent U.S. tariffs imposing a 10% levy on imported diagnostic kits from non-exempt nations raise procurement prices for American labs, squeezing margins and deterring smaller providers from stocking advanced PD-L1 assays. Distributors adapt by shifting to domestic or allied-country sources, which stabilizes supply and bolsters long-term pricing predictability in the sector.

Latest Trends

Expansion of PD-L1 Testing in Adjuvant Therapy is a Recent Trend

The broadening incorporation of PD-L1 biomarker testing into adjuvant therapy protocols emerged as a defining trend in 2024, reflecting evolving paradigms in early-stage cancer management to leverage immunotherapy post-surgery. This shift prioritizes risk stratification through PD-L1 expression to tailor adjuvant checkpoint blockade, aiming to eradicate micrometastases and improve recurrence-free survival. Guideline updates from oncology societies now endorse this approach for select solid tumors, integrating it with standard histopathological workflows.

Diagnostic developers have accelerated validations for fixed tissue applications, ensuring compatibility with archival samples. This trend aligns with rising survival expectations, positioning PD-L1 as a prognostic adjunct beyond its predictive role. Laboratories are adapting automation to handle increased adjuvant case volumes, streamlining reporting timelines. Cross-disciplinary collaborations refine cut-off thresholds, enhancing assay reproducibility in this context.

Patient advocacy groups champion these developments, emphasizing informed consent on testing implications. The trend’s momentum is evident in corporate performance metrics tied to pathology solutions. Roche’s Pathology Lab sales, encompassing PD-L1 immunohistochemistry assays, surged 17% at constant exchange rates in 2024 compared to 2023, reaching CHF 1,563 million. Such growth underscores the trend’s commercial viability and its role in reshaping perioperative oncology care.

Regional Analysis

North America is leading the PD-L1 Biomarker Testing Market

In 2024, North America held a 41.4% share of the global PD-L1 biomarker testing market, driven by the FDA’s expansion of companion diagnostic approvals that integrated PD-L1 expression scoring into treatment algorithms for advanced solid tumors, enabling oncologists to select pembrolizumab-eligible patients with 70-80% response rates in high-expression cohorts for non-small cell lung cancer.

Laboratories accelerated adoption of IHC 22C3 and 28-8 assays to quantify tumor-infiltrating lymphocyte markers, reducing biopsy burdens by 25% through optimized protocols that correlate PD-L1 levels with overall survival in triple-negative breast cancer trials. Regulatory efficiencies under the FDA’s Breakthrough Therapy Designation expedited validations for SP263 assays in urothelial carcinoma, aligning with Medicare expansions for biomarker-driven reimbursements in stage IV cases.

Demographic pressures from a 2% annual uptick in lung cancer diagnoses amplified demand for multiplex IHC panels in community oncology centers. These advancements solidified the region’s dominance in immunotherapy-guided diagnostics. The American Cancer Society projected 2,001,140 new cancer cases in the United States in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

National authorities across Asia Pacific project the PD-L1 biomarker testing sector to advance during the forecast period, as clinical guidelines emphasize IHC assays to optimize immunotherapy outcomes in high-incidence lung and gastric cancers amid urban pollution. Officials in China and Japan allocate resources to 22C3 kits, outfitting provincial labs to score expression in NSCLC patients from industrial zones.

Diagnostic developers collaborate with regional institutes to calibrate SP142 panels, anticipating enhanced selection for atezolizumab in urothelial cohorts. Oversight bodies in India and South Korea subsidize 28-8 platforms, positioning district hospitals to evaluate biomarkers without centralized pathology. Countrywide programs estimate merging PD-L1 data into electronic oncology records, expediting pembrolizumab access for advanced breast cancer in migrant populations.

Regional pathologists pioneer digital IHC quantification, coordinating with IARC networks to monitor expression trends in esophageal tumors. These initiatives forge a scalable pathway for precision immunotherapy. The International Agency for Research on Cancer estimated 10 million new cancer cases in Asia in 2022.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key participants in the PD-L1 expression analysis sector secure sustained expansion by embedding their assays as mandatory companion diagnostics within blockbuster immunotherapy protocols, thereby locking in multi-year revenue streams directly tied to drug prescription volumes. They accelerate market penetration through aggressive licensing agreements with regional laboratory networks across Latin America and Southeast Asia, establishing localized validation studies that swiftly earn inclusion in national treatment algorithms. Senior leadership directs heavy investment into fully automated, high-throughput staining platforms that dramatically reduce hands-on technician time and minimize inter-laboratory variability, winning over large reference labs managing consolidated oncology volumes.

Companies differentiate aggressively via proprietary antibody clones with superior specificity in challenging tumor types such as triple-negative breast cancer and head-and-neck squamous cell carcinoma, creating clear clinical preference among leading KOLs. They further strengthen positioning by launching comprehensive digital ecosystems that deliver real-time scoring assistance and telepathology consultation, effectively transforming pathologists into strategic partners rather than mere service providers. These orchestrated initiatives collectively entrench incumbents at the center of the rapidly evolving precision immuno-oncology treatment paradigm.

Agilent Technologies, Inc., headquartered in Santa Clara, California, stands as a global leader in life sciences, diagnostics, and applied chemical markets, delivering analytical instrumentation, software, services, and consumables that empower laboratories worldwide to generate actionable biological insights with exceptional reliability. Through its Diagnostics and Genomics Group, Agilent commands the industry-standard Dako portfolio of immunohistochemistry solutions, including the 22C3 and 28-8 pharmDx assays that remain cornerstone references for PD-L1-guided patient selection across multiple tumor indications.

The company consistently strengthens its oncology franchise by expanding regulatory clearances into companion diagnostic territories for next-generation checkpoint inhibitors while advancing seamless workflow integration between its automated staining systems and leading digital pathology platforms. Agilent maintains competitive superiority through relentless focus on assay robustness, global technical support infrastructure, and collaborative development partnerships that ensure its reagents remain embedded in the clinical decision pathways of tomorrow’s immunotherapy landscape.

Top Key Players in the PD-L1 Biomarker Testing Market

- Thermo Fisher Scientific

- NeoGenomics Laboratories, Inc.

- Merck & Co., Inc.

- Intas Pharmaceuticals

- HalioDx

- Hoffmann-La Roche Ltd.

- Bristol-Myers Squibb

- Agilent Technologies, Inc.

- Abcam plc.

- Abbott Laboratories

Recent Developments

- In March 2025: the FDA’s approval of Merck’s KEYTRUDA in combination with trastuzumab and chemotherapy for HER2-positive gastric or GEJ adenocarcinoma significantly expanded the PD-L1 Biomarker Testing Market. The approval mandates PD-L1 testing using the PD-L1 IHC 22C3 pharmDx kit to identify eligible patients, thereby increasing test volumes beyond traditional lung cancer indications and reinforcing PD-L1’s role as a companion diagnostic in multi-drug regimens.

- In July 2024: updated guidelines by the College of American Pathologists (CAP) and the American Society of Clinical Oncology (ASCO) strengthened the market by standardizing PD-L1 testing practices in advanced NSCLC. These recommendations established validated PD-L1 IHC assays as a clinical requirement for selecting immunotherapy candidates, driving adoption across pathology labs and ensuring consistent testing quality worldwide.

Report Scope

Report Features Description Market Value (2024) US$ 0.7 billion Forecast Revenue (2034) US$ 1.6 billion CAGR (2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (PD-L1 22C3 Assay Kit, PD-L1 SP142 Assay Kit, PD-L1 28-8 Assay Kit, and PD-L1 263 Assay Kit), By Application (Non-Small Cell Lung Cancer (NSCLC), Renal Cell Carcinoma, Ovarian Cancer, Melanoma, Haematological Malignancies, Gastrointestinal Tract Malignancy, and Other), By End-user (Hospitals, Cancer Research Institutes, Diagnostic Laboratories, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, NeoGenomics Laboratories, Inc., Merck & Co., Inc., Intas Pharmaceuticals, HalioDx, F. Hoffmann-La Roche Ltd., Bristol-Myers Squibb, Agilent Technologies, Inc., Abcam plc., Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  PD-L1 Biomarker Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

PD-L1 Biomarker Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific

- NeoGenomics Laboratories, Inc.

- Merck & Co., Inc.

- Intas Pharmaceuticals

- HalioDx

- Hoffmann-La Roche Ltd.

- Bristol-Myers Squibb

- Agilent Technologies, Inc.

- Abcam plc.

- Abbott Laboratories