Global Payment Devices Market Size, Share, Growth Analysis By Type (POS Terminals, ATMs & Cash Dispensers, Payment Kiosks, Card Readers, Wearable Payment Devices, Others), By Technology (Contactless/NFC, Contact-based, Hybrid/Multimode, Biometric-enabled), By Deployment Mode (On-premise, Cloud-based), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168163

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

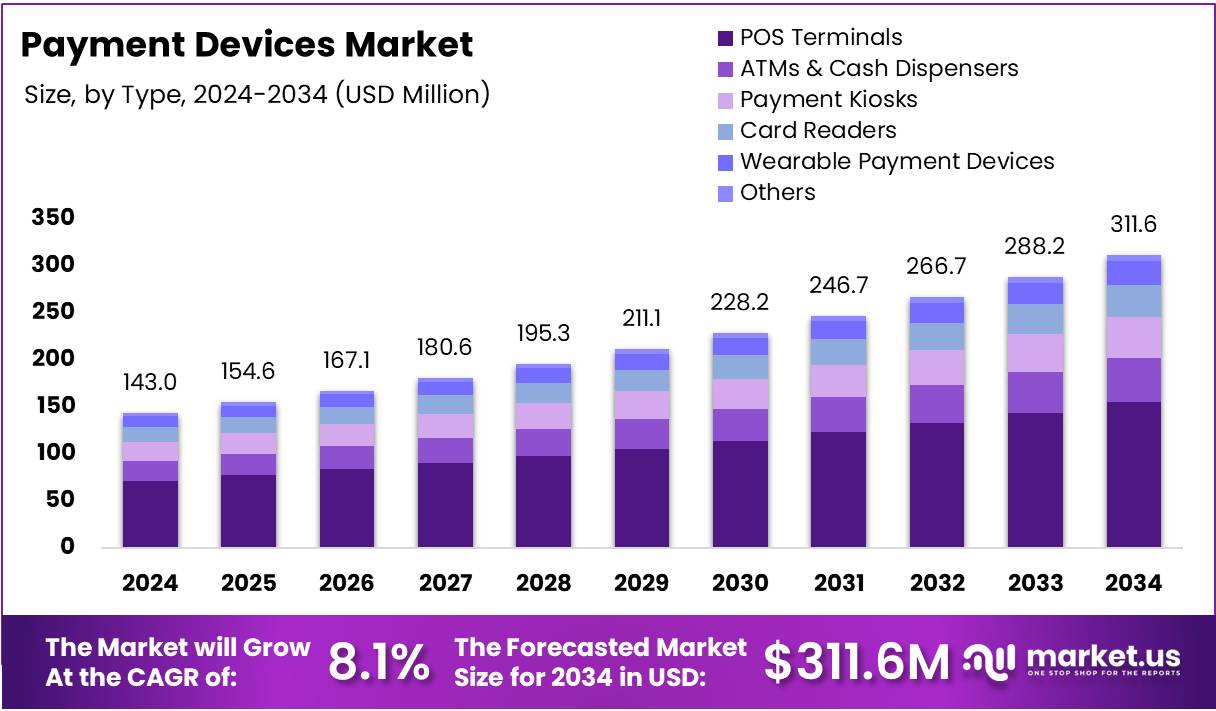

The Global Payment Devices Market size is expected to be worth around USD 311.6 Million by 2034, from USD 143.0 Million in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034.

The Payment Devices Market represents a wide ecosystem of digital tools enabling electronic transactions across retail, banking, hospitality, and mobility sectors. It includes POS terminals, payment kiosks, card readers, wearable payment tools, and biometric-enabled systems, all designed to improve transaction efficiency and strengthen secure payment experiences for consumers and businesses.

Moreover, the market continues expanding as enterprises modernize payment infrastructures to meet rising expectations for convenience and speed. This shift accelerates digital adoption and encourages retailers and service providers to deploy integrated payment device solutions that support contactless, omnichannel, and automated workflows, especially in fast-moving consumer environments.

Furthermore, growing digital commerce, mobile-first shopping behavior, and rapid fintech innovation create strong growth opportunities for manufacturers and service providers. Businesses increasingly invest in cloud-based payment device management, enabling better scalability, remote updates, and cost-effective deployment models across different industry applications and high-volume transaction environments.

In addition, government initiatives promoting digital payments, financial inclusion, and cashless economies contribute to broader market expansion. Many countries introduce incentives, compliance frameworks, and regulatory upgrades that encourage businesses to adopt certified, secure, and interoperable payment device solutions across retail, transportation, healthcare, and public service segments.

Consequently, opportunities emerge around biometric authentication, real-time data integration, fraud prevention, and enhanced customer experiences. Companies deploying secure and user-friendly devices are better positioned to support seamless digital transactions, reduce manual dependencies, and align with evolving regulatory requirements regarding data protection, transaction security, and device standardization.

According to a research, 79% of consumers now use contactless payments, highlighting the strong preference toward touch-free transactions. This shift encourages rapid deployment of NFC-enabled payment devices across multiple industries, supporting faster checkout processes and improved operational efficiencies in high-traffic locations.

Similarly, a consumer retail survey reports that 65% of users prefer self-service kiosks for ordering fast food or retail items due to convenience and reduced wait times. This trend strengthens demand for automated payment devices, reinforcing steady market growth and creating ongoing opportunities for digital transformation across physical retail and service environments.

Key Takeaways

- Global Payment Devices Market is projected to reach USD 311.6 Million by 2034 from USD 143.0 Million in 2024, growing at a CAGR of 8.1%.

- By Type, POS Terminals dominated with a 49.80% share in 2024.

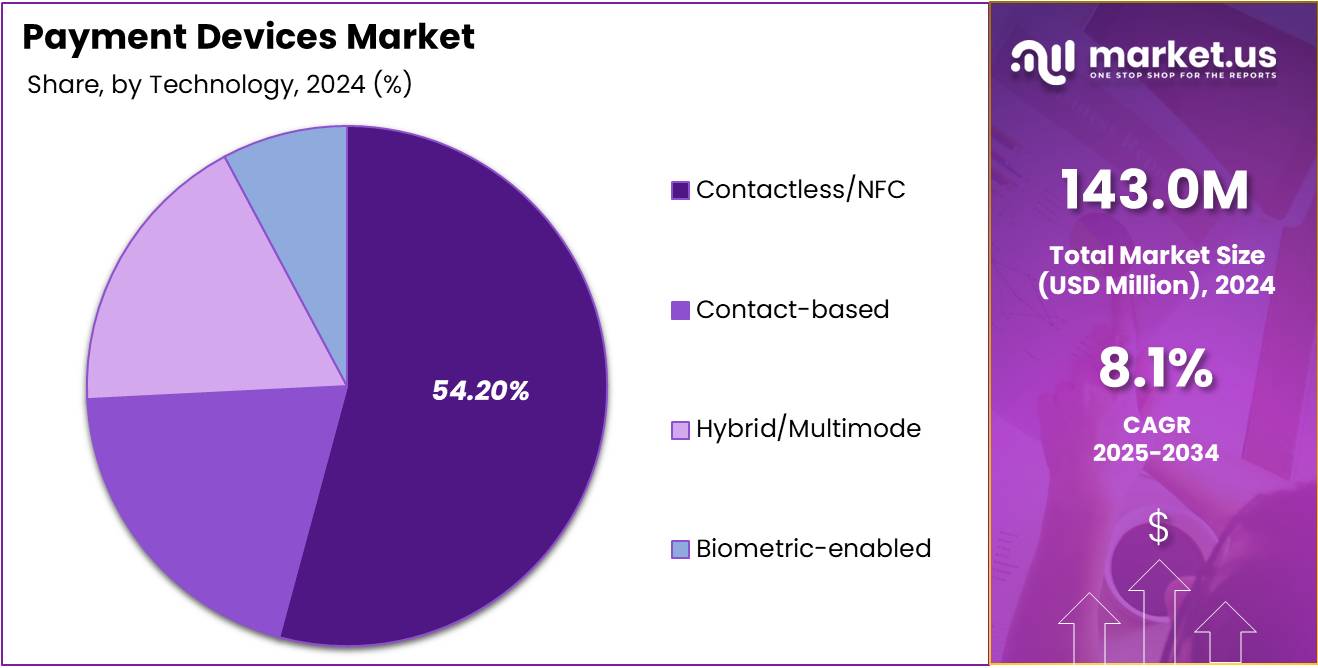

- By Technology, Contactless/NFC led the market with a 54.20% share in 2024.

- By Deployment Mode, On-premise accounted for 67.30% of the market in 2024.

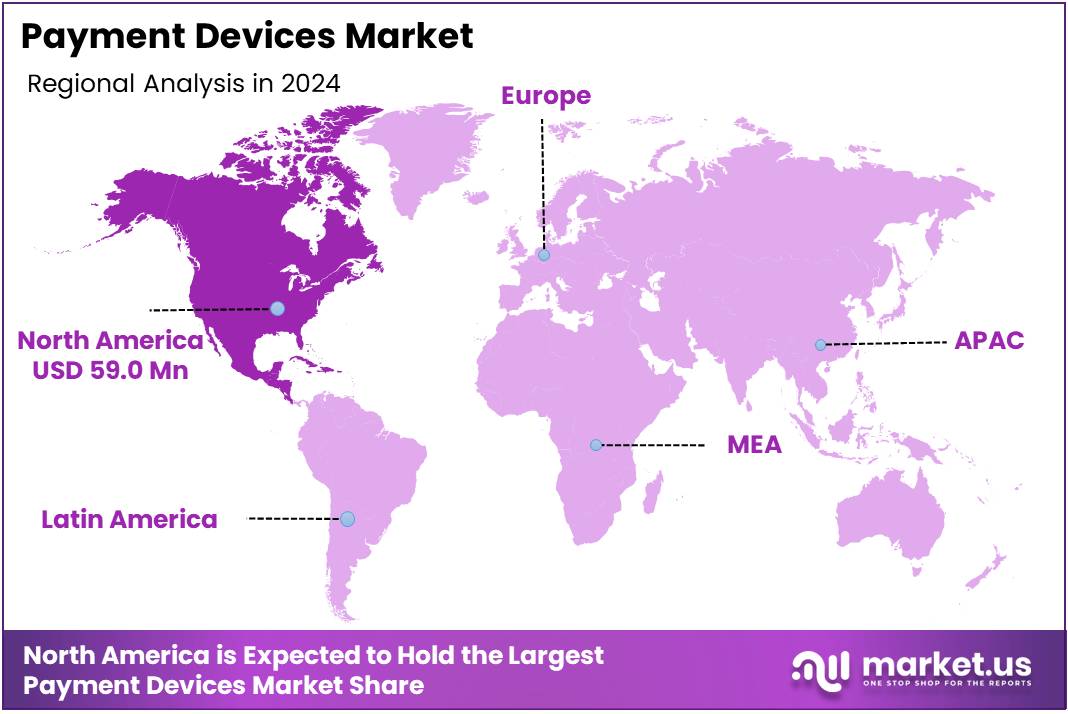

- North America dominated the market with a 41.3% share, valued at USD 59.0 Million in 2024.

By Type Analysis

POS Terminals dominate with 49.80% due to strong retail adoption and faster digital checkout experiences.

In 2024, POS Terminals held a dominant market position in the By Type Analysis segment of the Payment Devices Market, with a 49.80% share. Growing retail modernization, faster billing needs, and enhanced customer engagement tools continued to boost adoption. Additionally, expanding omnichannel commerce reinforced steady device integration.

In 2024, ATMs & Cash Dispensers gained relevance as banks upgraded infrastructure. Although cash usage declined globally, financial inclusion programs sustained hardware deployments. Moreover, rising emphasis on secure withdrawals and remote-service capabilities strengthened ATM market presence across emerging regions.

In 2024, Payment Kiosks advanced as self-service formats gained popularity. Retailers, transport hubs, and QSR chains increasingly adopted kiosks to reduce wait times. Furthermore, improved software interfaces and multi-payment options enhanced consumer convenience and operational efficiencies.

In 2024, Card Readers remained vital due to affordability and flexible integration. SMBs widely deployed compact card readers for mobile billing. Additionally, rising digital-wallet acceptance ensured steady usage, supported by simple onboarding and scalable connectivity.

In 2024, Wearable Payment Devices expanded with rising health-tech convergence. Smartwatches and fitness bands enabled tap-to-pay experiences. Moreover, demand grew due to contactless convenience, seamless pairing, and lifestyle-driven adoption among younger consumers.

In 2024, Others included hybrid and emerging payment tools gaining steady attention. These devices addressed niche use cases and enhanced business flexibility. Additionally, customizable interfaces and cross-platform compatibility promoted adoption across specialized commercial applications.

By Technology Analysis

Contactless/NFC leads with 54.20% driven by fast, secure, tap-to-pay experiences.

In 2024, Contactless/NFC held a dominant position in the By Technology segment with a 54.20% share. Growing tap-to-pay adoption, hygiene concerns, and rapid checkout requirements accelerated usage. Additionally, expanding NFC-enabled wearables and smartphones reinforced ecosystem strength.

In 2024, Contact-based technologies remained relevant for secure PIN-based transactions. Sectors such as banking and retail relied on them for legacy compatibility. Moreover, consistent performance and low upgrade requirements supported continued deployment.

In 2024, Hybrid/Multimode systems grew as businesses sought versatile solutions. These technologies combined NFC, EMV, and QR-based features to enable multi-format acceptance. Additionally, rising merchant demand for flexibility encouraged sustained adoption.

In 2024, Biometric-enabled payment devices progressed due to advanced authentication. Fingerprint and facial recognition improved transaction security. Furthermore, rising financial fraud concerns motivated enterprises to integrate biometric validation workflows.

By Deployment Mode Analysis

On-premise dominates with 67.30% supported by strong control, security, and regulatory compliance.

In 2024, On-premise deployment held a dominant position in the By Deployment Mode segment with a 67.30% share. Enterprises favored on-premise models for data governance and compliance. Moreover, industries with high-security protocols continued to invest in controlled infrastructure.

In 2024, Cloud-based deployment increased as businesses embraced scalability. Its subscription pricing model appealed to SMEs seeking cost efficiency. Additionally, frequent software updates and remote accessibility strengthened overall adoption across digital-first enterprises.

Key Market Segments

By Type

- POS Terminals

- ATMs & Cash Dispensers

- Payment Kiosks

- Card Readers

- Wearable Payment Devices

- Others

By Technology

- Contactless/NFC

- Contact-based

- Hybrid/Multimode

- Biometric-enabled

By Deployment Mode

- On-premise

- Cloud-based

Drivers

Rising Consumer Preference for Cashless Transactions Drives Market Growth

The Payment Devices Market is expanding as more consumers prefer cashless transactions for everyday purchases. People now rely heavily on digital payments because they offer speed, convenience, and improved security. This shift encourages retailers and service providers to adopt advanced payment devices to meet evolving customer expectations.

Additionally, the strong rise of e-commerce and omnichannel retail platforms is fueling the demand for modern payment technologies. As shoppers move between online and offline channels, businesses need reliable devices such as POS systems, digital kiosks, and mobile payment tools to enable smooth and consistent transactions. This integration supports better customer experiences and boosts operational efficiency.

Furthermore, growing digitalization in the banking and financial services sector is accelerating market adoption. Banks are upgrading their infrastructure with innovative payment solutions, including biometric-enabled devices, mobile POS terminals, and cloud-based payment systems. These advancements help financial institutions improve transaction security, enhance customer engagement, and simplify banking processes.

Restraints

Security Vulnerabilities in Legacy Payment Processing Systems Limit Market Expansion

The Payment Devices Market faces notable restraints due to outdated and vulnerable legacy systems still used across many financial institutions. These older systems create security gaps that increase the risk of fraud, data breaches, and unauthorized access. As cyberthreats grow more advanced, these systems struggle to handle modern encryption and authentication needs. This slows adoption, as businesses hesitate to upgrade when integration is complicated or expensive.

Moreover, maintaining legacy systems requires specialized skills and continuous patching, which adds to operational costs. Many small retailers delay modernization because they fear disruptions to daily transactions. This dependence on aging infrastructure ultimately restricts the industry’s ability to move toward more secure and flexible payment devices, creating long-term challenges for market growth.

Additionally, the market is restrained by complex regulatory compliance requirements across different regions. Payment device providers must align with strict security standards, data protection laws, and certification procedures that vary widely across countries. Navigating these rules is time-consuming and costly, especially for global players.

As regulations evolve rapidly, companies must continuously update hardware and software to stay compliant. This adds pressure on product development cycles and slows market expansion, particularly in regions with stringent financial guidelines.

Growth Factors

Expansion of Contactless Payment Solutions in Emerging Economies Drives Market Growth

The Payment Devices Market is witnessing strong growth as emerging economies rapidly shift toward contactless payment solutions. This transition is driven by rising smartphone use, improving digital infrastructure, and a growing preference for faster transactions. As more consumers adopt tap-and-pay methods, device makers gain wider opportunities to enter new regions and expand their customer base.

Additionally, the integration of AI and machine learning is creating new growth avenues by strengthening fraud detection. These technologies help payment devices identify suspicious activity in real time, reducing financial risks for merchants and users. This boost in security enhances trust, encouraging more businesses to invest in modern payment systems.

Another major opportunity emerges from the development of multi-functional payment terminals equipped with IoT capabilities. These advanced devices allow retailers to combine payments, inventory tracking, customer insights, and remote monitoring in one platform. Such multi-use systems improve operational efficiency and support smarter retail environments, especially for small and medium businesses looking to modernize.

Emerging Trends

Rising Adoption of Biometric Authentication Drives Market Expansion

The payment devices market is witnessing strong momentum as biometric authentication becomes more popular. Businesses are increasingly adopting fingerprint, facial, and iris recognition features to offer faster and more secure transactions. This trend is gaining attention because it reduces fraud risks and builds higher user confidence during digital payments.

At the same time, mobile POS solutions are expanding quickly, especially among small retailers, delivery services, and pop-up businesses. These portable systems allow companies to accept payments on the go, improving flexibility and customer convenience. The growth of mobile commerce and rising demand for instant checkout experiences continue to push this trend forward.

Cloud-based payment processing is also becoming a major factor shaping the industry. Companies are shifting to cloud platforms to simplify operations, lower infrastructure costs, and enable real-time data access. This technology helps businesses scale faster while improving system reliability and transaction security. As more enterprises adopt digital-first approaches, cloud-enabled payment devices are expected to see strong adoption.

Regional Analysis

North America Dominates the Payment Devices Market with a Market Share of 41.3%, Valued at USD 59.0 Million

North America led the global Payment Devices Market in 2024, supported by strong digital payment adoption and advanced financial infrastructure. The region maintained a dominant 41.3% market share valued at USD 59.0 Million, driven by increasing use of contactless and mobile-based transactions. Continuous upgrades in payment security standards also reinforce its leadership position.

Europe Payment Devices Market Trends

Europe shows steady growth, supported by high digital banking usage and rapid expansion of secure payment technologies. Regulatory initiatives encouraging safer transactions continue to influence device modernization. The region benefits from strong adoption of NFC, EMV, and self-service payment systems across retail and service industries.

Asia Pacific Payment Devices Market Trends

Asia Pacific is expanding rapidly due to rising mobile wallet penetration and increasing smartphone connectivity. Growing e-commerce activity and financial inclusion programs are accelerating payment device deployment. Government initiatives promoting digital transactions further strengthen market growth across emerging economies.

Middle East & Africa Payment Devices Market Trends

The Middle East & Africa region is progressing as digital payment frameworks expand and consumers shift toward cashless methods. Investments in fintech and banking modernization support wider adoption of POS and contactless systems. Retail and hospitality sectors are also upgrading payment technologies to improve customer experience.

Latin America Payment Devices Market Trends

Latin America is witnessing steady adoption of payment devices driven by digital commerce growth and rising preference for secure electronic payments. Financial reforms and inclusion efforts are supporting modern payment infrastructure expansion. Increasing merchant acceptance of POS and mobile payment systems is further boosting market penetration.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Payment Devices Company Insights

In 2024, the global Payment Devices Market saw steady growth driven by rising digital transactions, secure payment adoption, and the expansion of omnichannel retail networks. Key players continued to strengthen their portfolios through enhanced device performance, improved security layers, and wider integration capabilities.

Verifone Inc. remained a major force in the market, supported by its strong global footprint and broad device ecosystem. The company focused on improving cloud-enabled payment solutions, helping merchants manage transactions more efficiently across diverse environments.

Ingenico maintained its leadership by advancing its smart terminal portfolio and strengthening its presence in both mature and emerging markets. Its focus on security and flexible integration options positioned the brand strongly among enterprise customers transitioning to omnichannel models.

PAX Technology continued to expand rapidly, driven by competitively priced smart POS devices and growing demand from SMEs. The company leveraged its Android-based terminals to deliver customizable and user-friendly payment experiences across retail and service sectors.

Square gained further traction through its simplified payment ecosystem designed for small and micro businesses. Its compact, software-driven devices supported frictionless onboarding, making it a preferred choice for entrepreneurs seeking flexible and low-cost payment acceptance.

Sunmi, Newland, NCR, myPOS, Diebold Nixdorf, and Castles Technology also contributed to the market’s competitive landscape by enhancing their device capabilities and focusing on innovation across POS terminals, kiosks, and mobile payment platforms. Together, these companies accelerated market modernization through improved usability, stronger security frameworks, and consistent technological upgrades.

Top Key Players in the Market

- Verifone Inc.

- Ingenico

- PAX Technology

- Square

- Sunmi

- Newland

- NCR

- myPOS

- Diebold Nixdorf

- Castles Technology

Recent Developments

- In October 2025, the Reserve Bank of India (RBI) introduced IoT Payments with UPI, enabling connected devices to conduct secure UPI transactions directly. This expansion strengthened the payment device ecosystem by moving beyond traditional smartphones and POS terminals, supporting automation-driven digital payments.

- In October 2025, FiatPe launched the FiatPe Next 3-in-1 PoS device, integrating a card reader, UPI acceptance through static and dynamic QR codes, and a soundbox in one compact hardware. This innovation enhanced merchant convenience by offering multi-mode payment acceptance in a single device.

- In January 2024, Ingenico introduced the advanced iSC-M802 terminal, designed to improve transaction security and user experience for retail environments. The device offered enhanced processing power and modern connectivity features, supporting the evolving needs of digital commerce.

Report Scope

Report Features Description Market Value (2024) USD 143.0 Million Forecast Revenue (2034) USD 311.6 Million CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (POS Terminals, ATMs & Cash Dispensers, Payment Kiosks, Card Readers, Wearable Payment Devices, Others), By Technology (Contactless/NFC, Contact-based, Hybrid/Multimode, Biometric-enabled), By Deployment Mode (On-premise, Cloud-based) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Verifone Inc., Ingenico, PAX Technology, Square, Sunmi, Newland, NCR, myPOS, Diebold Nixdorf, Castles Technology Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Verifone Inc.

- Ingenico

- PAX Technology

- Square

- Sunmi

- Newland

- NCR

- myPOS

- Diebold Nixdorf

- Castles Technology