Global Parcel Delivery Logistics Market Size, Share, Growth Analysis By Mode (Road, Air, Sea, Rail), By Destination Type (Domestic, International), By Business Type (Business-to-Consumer, Business-to-Business, Consumer-to-Consumer), By End-use (Retail, Defense, Chemical, Wholesale, Logistics and Shipping, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156565

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

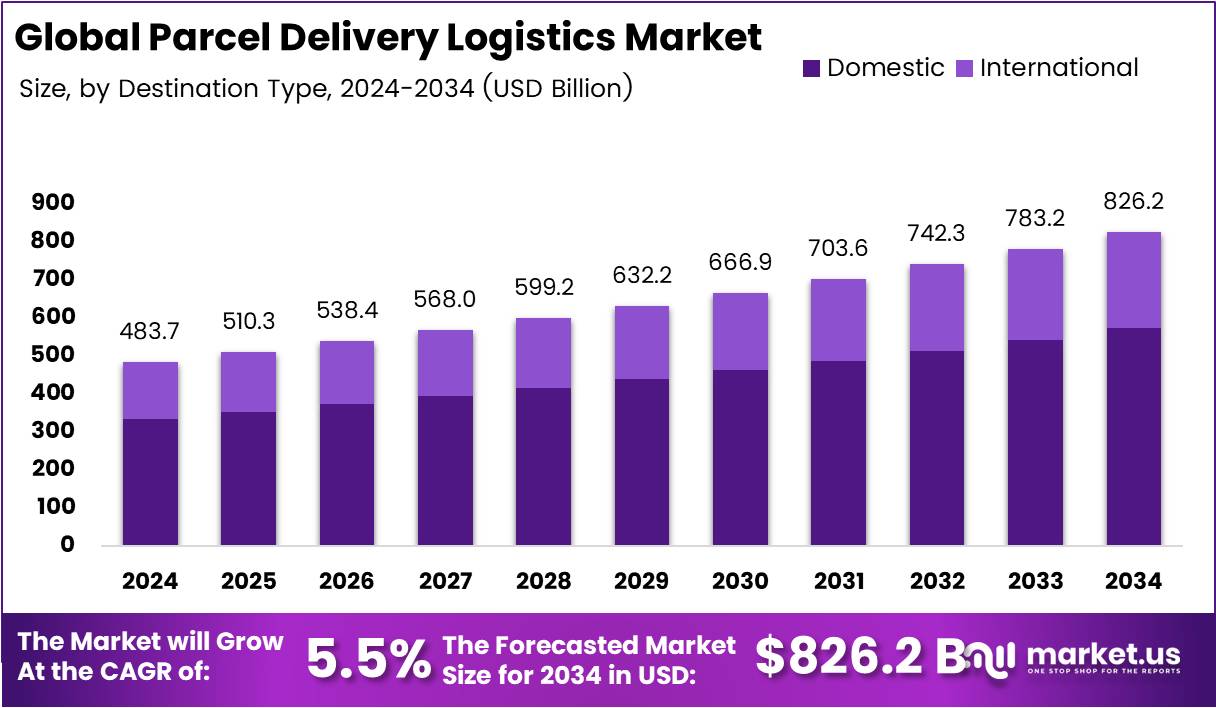

The Global Parcel Delivery Logistics Market size is expected to be worth around USD 826.2 Billion by 2034, from USD 483.7 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

The parcel delivery logistics market involves the transportation and distribution of packages, ranging from small parcels to bulk shipments. This industry has seen significant growth due to the rise of e-commerce and increased consumer demand for quick, reliable delivery services. As a result, companies are focusing on enhancing operational efficiency and adopting new technologies to streamline the supply chain.

The market is driven by the continuous rise in online shopping, leading to a surge in parcel volume. Companies are continuously investing in infrastructure to meet the growing demand for timely deliveries. Additionally, last-mile delivery solutions, powered by technology such as drones and autonomous vehicles, are gaining momentum to improve efficiency and reduce costs.

Governments globally are making substantial investments in infrastructure to support the growing logistics market. Regulations are evolving to accommodate new delivery methods and ensure safety, security, and environmental sustainability. These investments help improve the quality of service, reduce delivery times, and address logistical challenges like traffic congestion and last-mile inefficiencies.

The U.S. parcel volume reached 22.37 billion shipments in 2024, a 3.4% increase from 2023, reflecting robust market growth, as reported by a recent survey. With this increasing volume, parcel carriers are leveraging technology and innovation to enhance their operations and meet the demand for faster and more efficient delivery services.

In the U.S., 90% of online shoppers expect two- to three-day shipping, according to a survey. Moreover, nearly half of consumers state they will shop elsewhere if delivery times exceed expectations. These consumer demands are pushing companies to adopt advanced logistics technologies to stay competitive in the market.

The rise in e-commerce and the growing demand for quick deliveries are expected to continue driving market growth. Companies in the parcel delivery logistics sector are focusing on enhancing speed, improving last-mile delivery options, and optimizing their networks to stay ahead of the competition. This will lead to more opportunities for businesses to innovate and grow in the coming years.

To stay competitive, it’s critical for businesses to address these growing consumer expectations and government regulations. The market offers immense opportunities, with government investment and regulatory support paving the way for a more efficient and sustainable delivery ecosystem in the future.

Key Takeaways

- The Global Parcel Delivery Logistics Market size is expected to reach USD 826.2 Billion by 2034, up from USD 483.7 Billion in 2024, growing at a CAGR of 5.5% from 2025 to 2034.

- In 2024, Road held a dominant position in By Mode Analysis with a 61.8% market share.

- In 2024, Domestic dominated By Destination Type Analysis with a 69.3% market share.

- In 2024, Business-to-Consumer led By Business Type Analysis with a 56.4% share.

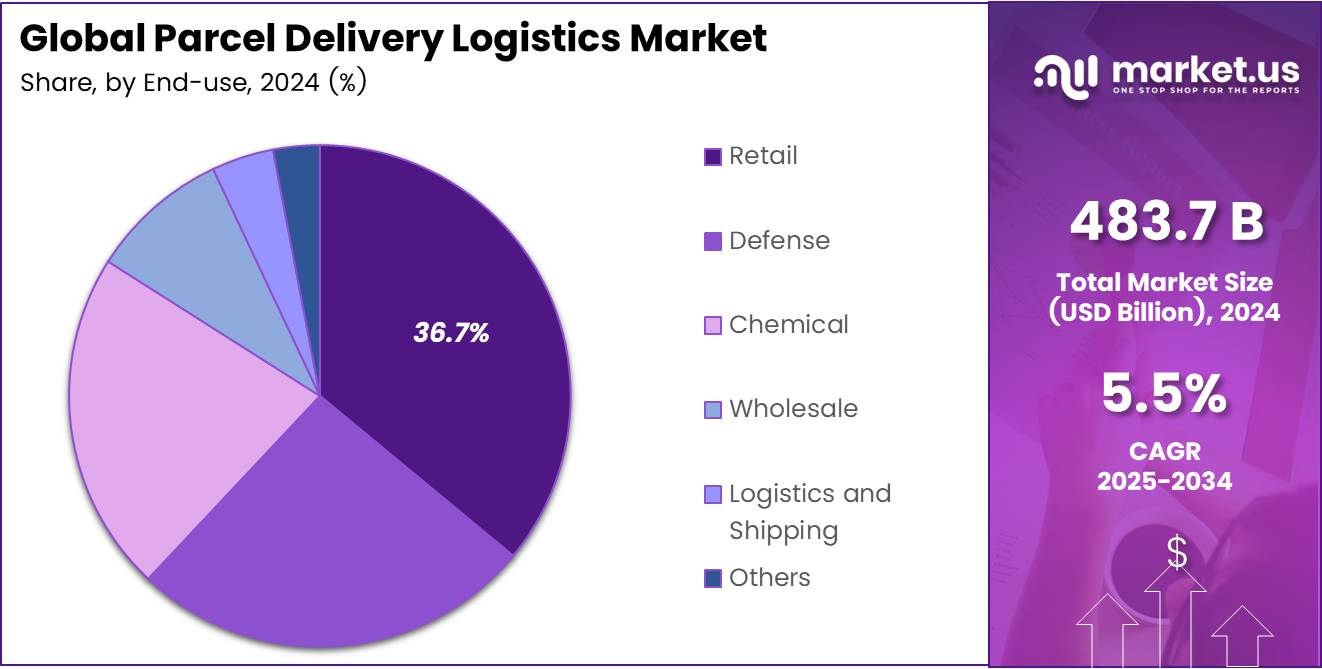

- In 2024, Retail was the leading segment in By End-use Analysis with a 36.7% market share.

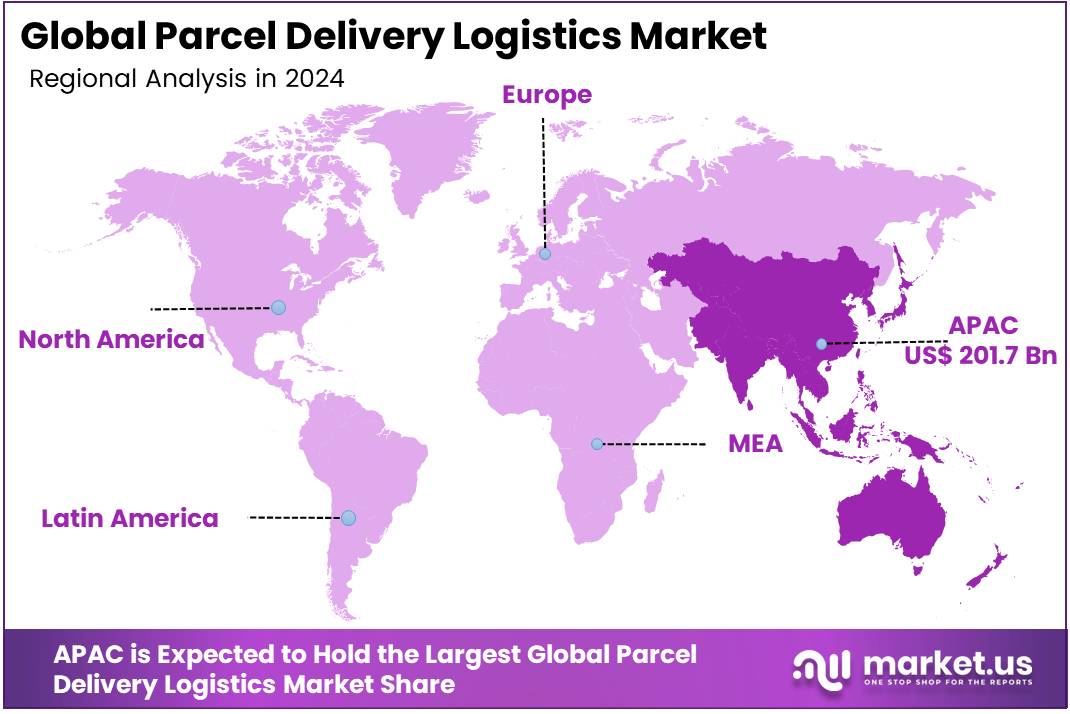

- The Asia Pacific (APAC) region holds the largest share of the Parcel Delivery Logistics Market with 41.7%, valued at USD 201.7 billion.

Mode Analysis

Road transportation dominates with 61.8% due to its extensive infrastructure network and cost-effectiveness.

In 2024, Road held a dominant market position in By Mode Analysis segment of Parcel Delivery Logistics Market, with a 61.8% share. This commanding lead reflects the comprehensive road infrastructure available across most regions, enabling last-mile delivery capabilities that other modes cannot match.

Air transport represents the second-largest segment, catering to time-sensitive deliveries and long-distance shipments where speed outweighs cost considerations. Sea freight serves bulk parcel movements for international trade, particularly for e-commerce platforms shipping non-urgent items across continents.

Rail transport maintains a niche position, primarily utilized for intercity bulk parcel movements where cost efficiency is prioritized over delivery speed. The road segment’s dominance stems from its flexibility in reaching diverse geographical locations and its ability to provide door-to-door service.

Destination Type Analysis

Domestic deliveries dominate with 69.3% due to established infrastructure and lower operational complexity.

In 2024, Domestic held a dominant market position in By Destination Type Analysis segment of Parcel Delivery Logistics Market, with a 69.3% share. This substantial market share reflects the maturity of domestic parcel delivery networks and the growing e-commerce penetration within national boundaries.

Domestic shipments benefit from streamlined processes, established distribution networks, and reduced regulatory complexities compared to international deliveries. The segment’s growth is fueled by increasing online shopping behaviors and same-day delivery expectations from consumers.

International parcel delivery represents the remaining market share, primarily driven by cross-border e-commerce and global trade activities. While growing steadily, international deliveries face challenges including customs procedures, longer transit times, and higher operational costs.

The domestic segment’s dominance is expected to continue as logistics providers invest heavily in last-mile delivery infrastructure and automation technologies to meet rising consumer demands.

Business Type Analysis

Business-to-Consumer dominates with 56.4% due to explosive e-commerce growth and changing shopping behaviors.

In 2024, Business-to-Consumer held a dominant market position in By Business Type Analysis segment of Parcel Delivery Logistics Market, with a 56.4% share. This leadership position directly correlates with the unprecedented growth of online retail and consumers’ increasing preference for home delivery services.

The B2C segment’s expansion is driven by major e-commerce platforms, direct-to-consumer brands, and traditional retailers enhancing their online presence. Consumer expectations for fast, reliable delivery have transformed this segment into the most dynamic component of the parcel delivery market.

Business-to-Business deliveries maintain significant market presence, serving inter-company logistics needs, supply chain management, and industrial shipments. Consumer-to-Consumer represents the emerging segment, fueled by peer-to-peer marketplaces and individual shipping needs.

The B2C segment’s growth trajectory continues upward, supported by mobile commerce expansion, subscription box services, and the increasing digitalization of retail experiences across various product categories.

End-use Analysis

Retail dominates with 36.7% due to massive e-commerce expansion and omnichannel strategies.

In 2024, Retail held a dominant market position in By End-use Analysis segment of Parcel Delivery Logistics Market, with a 36.7% share. This leading position reflects the retail industry’s digital transformation and the integration of online and offline shopping experiences.

The retail segment encompasses everything from fashion and electronics to household goods, driving consistent parcel volume across multiple product categories. Major retailers’ investment in fulfillment centers and distribution networks has created substantial demand for parcel delivery services.

Defense applications represent specialized logistics requirements, while the Chemical sector demands specialized handling and compliance protocols. Wholesale operations contribute to B2B parcel movements, supporting supply chain connectivity between manufacturers and retailers.

Logistics and Shipping companies generate internal demand through their own service networks, while the Others category includes healthcare, automotive, and emerging sectors. The retail segment’s dominance is reinforced by seasonal peaks, promotional events, and the continuous growth of online marketplace platforms.

Key Market Segments

By Mode

- Road

- Air

- Sea

- Rail

By Destination Type

- Domestic

- International

By Business Type

- Business-to-Consumer

- Business-to-Business

- Consumer-to-Consumer

By End-use

- Retail

- Defense

- Chemical

- Wholesale

- Logistics and Shipping

- Others

Drivers

Surge in E-commerce and Online Shopping Drives Market Growth

The parcel delivery logistics market is experiencing unprecedented growth due to the massive rise in online shopping. More people are buying products through the internet, especially after the pandemic changed shopping habits worldwide. This shift means businesses need reliable ways to deliver packages to customers’ doorsteps.

Modern delivery technologies are making the process faster and more efficient. Companies are using automated sorting systems, smart routing software, and advanced tracking methods. These improvements help reduce delivery times and cut operational costs while improving customer satisfaction.

Customers today expect their packages quickly. The demand for same-day and next-day deliveries has become a standard expectation rather than a luxury service. This pressure pushes logistics companies to innovate and expand their delivery networks to meet these tight deadlines.

International trade continues to expand, creating more opportunities for cross-border deliveries. Businesses are selling products globally, and consumers want access to international brands. This trend requires logistics companies to develop better international shipping capabilities and partnerships with global carriers.

Restraints

Rising Fuel Prices and Operational Costs Create Market Challenges

High fuel costs significantly impact the parcel delivery industry’s profitability. When gasoline and diesel prices increase, transportation expenses rise dramatically. These costs often get passed to customers through higher shipping fees, which can reduce demand for delivery services.

Meeting regulatory requirements and ensuring package security adds complexity to operations. Companies must follow strict rules about package handling, driver qualifications, and security screening. Compliance with these regulations requires additional staff training and equipment investments.

Environmental concerns are pressuring logistics companies to reduce their carbon footprint. Customers and governments want cleaner delivery methods, but switching to electric vehicles or alternative fuels requires substantial upfront investments that many companies struggle to afford.

Rural and remote areas present significant delivery challenges. Limited road infrastructure, longer distances between stops, and smaller package volumes make rural deliveries expensive and time-consuming. Many logistics companies struggle to provide cost-effective services in these regions.

Growth Factors

Integration of Artificial Intelligence for Route Optimization Creates Growth Opportunities

Artificial intelligence is revolutionizing how delivery companies plan their routes. Smart algorithms can analyze traffic patterns, weather conditions, and delivery priorities to create the most efficient paths. This technology reduces fuel consumption, improves delivery times, and increases the number of packages each driver can deliver.

Last-mile delivery solutions represent a huge growth opportunity. This final step of getting packages from distribution centers to customers’ homes is often the most expensive part of shipping. Companies are developing innovative approaches like local pickup points, smart lockers, and neighborhood delivery hubs.

Green logistics practices are becoming essential for business success. Companies adopting electric vehicles, bicycle deliveries, and carbon-neutral shipping options attract environmentally conscious customers. These sustainable practices also help reduce long-term operational costs and improve brand reputation.

Drone and autonomous delivery systems promise to transform the industry. These technologies can deliver packages to hard-to-reach locations and operate during off-peak hours. While still developing, early adopters are testing these systems for specific use cases like medical deliveries and rural areas.

Emerging Trends

Demand for Contactless Delivery Solutions Shapes Market Trends

Contactless delivery has become a permanent customer expectation. People want packages delivered without direct human interaction for health and convenience reasons. This trend drives companies to develop better drop-off procedures, secure delivery locations, and digital confirmation systems.

Real-time package tracking has evolved from a nice feature to an absolute necessity. Customers want to know exactly where their packages are and when they will arrive. Companies are investing in GPS tracking, mobile apps, and automated notification systems to provide complete delivery transparency.

Cold chain logistics for perishable goods represents a rapidly growing market segment. Online grocery shopping, meal kit deliveries, and pharmaceutical shipments require temperature-controlled transportation. Companies are expanding their refrigerated delivery capabilities to capture this lucrative market.

Subscription-based delivery services are changing customer relationships with logistics companies. Regular deliveries of groceries, household items, and specialty products create predictable revenue streams. This model helps companies plan capacity better and build stronger customer loyalty through consistent service quality.

Regional Analysis

Asia Pacific Dominates the Parcel Delivery Logistics Market with a Market Share of 41.7%, Valued at USD 201.7 Billion

In 2024, the Asia Pacific (APAC) region holds the largest share of the Parcel Delivery Logistics Market with 41.7% and is valued at USD 201.7 billion. The region benefits from robust e-commerce growth, high urbanization rates, and a rapidly expanding digital economy. These factors continue to drive the demand for parcel delivery services, particularly in countries like China and India, where logistical infrastructure is improving, thus fueling the market expansion.

North America Parcel Delivery Logistics Market Overview

North America is a key player in the global parcel delivery logistics market, driven by the growing demand for faster and more efficient delivery services. The U.S., in particular, has a significant influence on the market due to its advanced logistics infrastructure and large e-commerce sector. The region is anticipated to continue experiencing strong demand for parcel delivery services as e-commerce continues to thrive, with technological advancements improving delivery speeds.

Europe Parcel Delivery Logistics Market Insights

Europe remains an important region in the parcel delivery logistics market, with a steady demand for delivery services driven by a strong e-commerce presence. The region has also witnessed improvements in infrastructure, with an emphasis on sustainability and eco-friendly logistics solutions. The European market is expected to benefit from growing urbanization and the expansion of cross-border e-commerce, which is likely to drive further growth in parcel delivery services.

Middle East and Africa Parcel Delivery Logistics Market Dynamics

The Middle East and Africa (MEA) region is expected to see gradual growth in the parcel delivery logistics market. With an increase in e-commerce activity and improvements in logistics infrastructure, particularly in the Gulf Cooperation Council (GCC) countries, there is significant potential for expansion. However, the market remains challenged by political instability and economic fluctuations in some areas, although the region’s growth prospects are still positive.

Latin America Parcel Delivery Logistics Market Trends

Latin America is an emerging region in the parcel delivery logistics market, with increasing demand driven by a rise in e-commerce activities and improvements in logistics networks. Countries such as Brazil and Mexico are key contributors to market growth, with an increasing number of local and international e-commerce players expanding their operations. Despite challenges like fluctuating currency values and infrastructure gaps, the Latin American market is projected to grow as digital retail penetration increases.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Parcel Delivery Logistics Company Insights

In 2024, FedEx Corporation continues to lead the global parcel delivery logistics market with its strong global network and diversified service offerings, including express and freight services. The company is leveraging technological advancements to enhance operational efficiency, positioning itself as a key player in the competitive market.

United Parcel Service, Inc. (UPS) stands as a major player, particularly in North America and Europe, with a robust infrastructure supporting ground, air, and international parcel delivery. UPS focuses on expanding its sustainable delivery options and improving its last-mile delivery solutions to meet rising consumer expectations.

Deutsche Post AG, the parent company of DHL, holds a significant share in the market due to its strong presence in international express services. With an extensive logistics network across Europe and Asia, Deutsche Post is investing in automation and digital tools to further enhance the speed and efficiency of its global operations.

Yamato Holdings Co., Ltd. remains a dominant force in Japan’s parcel delivery logistics. The company focuses on providing highly customized services for both B2B and B2C sectors, capitalizing on Japan’s advanced e-commerce ecosystem. Its integration of digital solutions, including IoT-based tracking, helps maintain its competitive edge in the local and regional markets.

Top Key Players in the Market

- FedEx Corporation

- United Parcel Service, Inc.

- Deutsche Post AG

- Yamato Holdings Co., Ltd.

- Japan Post Holdings Co., Ltd.

- SF Holding Co., Ltd.

- Canada Post Corporation

- Royal Mail Group Ltd

- Aramex International LLC

Recent Developments

- In July 2025, HIVED secured $42 million to revolutionize the parcel delivery landscape, leveraging artificial intelligence and an all-electric logistics network to improve efficiency and sustainability in the sector. This investment aims to enhance their eco-friendly delivery model and disrupt traditional delivery methods.

- In February 2025, Relay raised €33.4 million to reshape parcel delivery services, focusing on innovations that meet the growing demands of e-commerce. The funds will be used to optimize their technology and infrastructure for faster, more cost-effective delivery solutions.

- In April 2025, Delhivery acquired a controlling stake in Ecom Express, signaling its expansion in the Indian logistics sector. The move will enhance Delhivery’s capabilities, integrating Ecom Express’ extensive network into their operations to strengthen last-mile delivery services.

Report Scope

Report Features Description Market Value (2024) USD 483.7 Billion Forecast Revenue (2034) USD 826.2 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Mode (Road, Air, Sea, Rail), By Destination Type (Domestic, International), By Business Type (Business-to-Consumer, Business-to-Business, Consumer-to-Consumer), By End-use (Retail, Defense, Chemical, Wholesale, Logistics and Shipping, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape FedEx Corporation, United Parcel Service, Inc., Deutsche Post AG, Yamato Holdings Co., Ltd., Japan Post Holdings Co., Ltd., SF Holding Co., Ltd., Canada Post Corporation, Royal Mail Group Ltd, Aramex International LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Parcel Delivery Logistics MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Parcel Delivery Logistics MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- FedEx Corporation

- United Parcel Service, Inc.

- Deutsche Post AG

- Yamato Holdings Co., Ltd.

- Japan Post Holdings Co., Ltd.

- SF Holding Co., Ltd.

- Canada Post Corporation

- Royal Mail Group Ltd

- Aramex International LLC