Global Parametric Insurance Market Size, Share, Trends Analysis Report By Type (Natural Catastrophes Insurance, Specialty Insurance, Others), By Application (Agriculture, Energy & Utilities, Real Estate, Construction, Healthcare, Marine, Travel & Tourism, Others), By Distribution Channel (Direct Sales, Brokers, Online Platforms), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2025

- Report ID: 129704

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

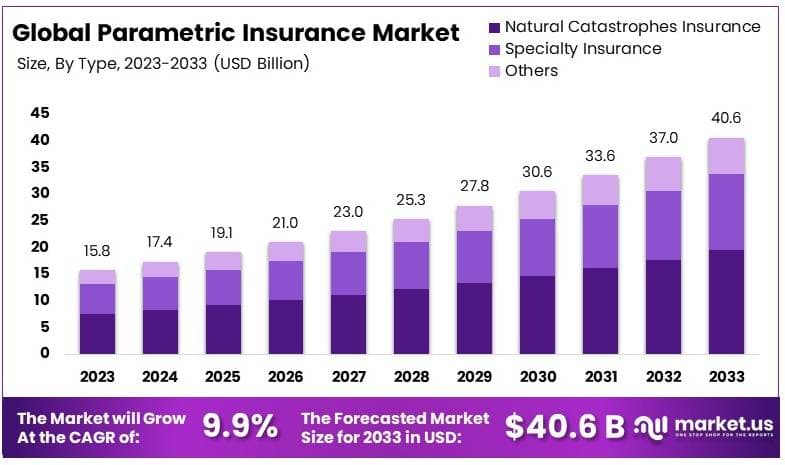

The Global Parametric Insurance Market size is expected to be worth around USD 40.6 Billion by 2033, from USD 15.8 Billion in 2023, growing at a CAGR of 9.9% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 35% share, holding USD 5.5 Billion revenue.

Parametric insurance is a specialized type of insurance policy that provides payouts based on predetermined parameters or metrics of specific events, rather than the actual damage incurred. This type of insurance is set to trigger when natural catastrophes or specific events like earthquakes, hurricanes, or heavy rainfall reach predefined thresholds that are independently verified, such as wind speeds or seismic activities.

The parametric insurance market has been expanding as businesses and individuals look for quicker, more efficient ways to manage financial risks associated with natural disasters and other measurable events. This market’s growth is propelled by its appeal in regions prone to specific types of natural disasters where traditional insurance models are less effective or more costly due to high loss experiences.

The primary driving factor of the parametric insurance market is the growing frequency and severity of climate-related disasters, which push the need for quick liquidity to recover from such events. Another driver is the enhancement of data quality and availability, allowing for more precise and reliable triggers for insurance payouts. This advancement supports the scalability of parametric insurance to various applications, from agriculture to disaster relief efforts.

Demand in the parametric insurance market is high among governments, businesses, and organizations in disaster-prone areas. These policies are particularly appealing because they provide immediate funds for recovery, helping to bridge the gap until traditional insurance claims are settled. The simplicity and speed of payouts help insured parties manage their cash flow effectively in the aftermath of a disaster.

For instance, In June 2024, African Risk Capacity Ltd. (ARC) received a substantial boost with a USD 27 million contribution from the Dutch government. This funding aims to enhance climate resilience across Africa and expand the use of parametric insurance. The contribution was funneled through the African Development Bank’s Africa Disaster Risk Financing Program (ADRiFi) Multi-Donor Trust Fund.

Technological advancements play a crucial role in the growth of the parametric insurance market. The use of satellite imagery, drones, weather stations, and IoT devices provides accurate and timely data, which is essential for the precise activation of parametric insurance policies. Advanced analytics and modeling techniques also improve the prediction and understanding of risks, making parametric insurance more reliable and applicable across different sectors.

There are significant opportunities in the parametric insurance market for developing products that cover a broader range of risks and parameters. Innovations in IoT and real-time data monitoring open new possibilities for creating insurance products that can offer more immediate and context-specific responses to various triggers, such as pollution levels or specific weather conditions.

For instance, following a 5.7 magnitude earthquake in Utah, parametric insurance provided rapid financial relief within days, demonstrating its efficiency. As climate change intensifies, more industries and governments are incorporating parametric solutions to mitigate risks and improve resilience in disaster-prone regions.

The Parametric Insurance market is poised for rapid growth, driven by increasing demand for faster and more reliable payout mechanisms. With over 400 major natural disasters recorded in 2023, causing $380 billion in global economic losses, only 31% of these damages were covered by traditional insurance. This growing “protection gap” highlights the need for parametric solutions.

Governments and organizations like the Caribbean Catastrophe Risk Insurance Facility (CCRIF) and the African Risk Capacity (ARC) are already leveraging these models to ensure quicker access to funds during recovery phases, showing the potential for widespread adoption.

Several factors are driving the rise of parametric insurance. The increasing frequency and severity of natural disasters, fueled by climate change, are creating heightened demand for rapid-response insurance solutions.

In the U.S. alone, 395 natural disasters have caused over $1 billion in damages since 1980, with 19 billion-dollar events occurring in 2024. This trend is spurring growth in parametric solutions, which offer faster payouts and more predictable risk management.

The opportunity for parametric insurance is significant. As global adoption expands, particularly in disaster-prone regions like the Philippines, customized solutions such as windstorm models are enabling quicker payouts and reducing financial strain on affected sectors.

Government initiatives and regulations that promote climate risk management are also expected to fuel further growth. For example, Swiss Re reported over $100 billion in insured losses from natural catastrophes in 2023, demonstrating the critical role parametric insurance can play in closing the protection gap.

Key Takeaways

- The Parametric Insurance Market was valued at USD 15.8 billion in 2023, and is expected to reach USD 40.6 billion by 2033, with a CAGR of 9.9%.

- In 2023, Natural Catastrophes Insurance dominated the type segment with 48%, driven by increasing climate-related risks.

- In 2023, Agriculture dominated the application segment with 27%, critical for mitigating risks in weather-dependent sectors.

- In 2023, Direct Sales dominated the distribution channel with 40%, ensuring tailored insurance solutions.

- In 2023, North America held 35%, driven by a high demand for innovative risk management solutions.

Type Analysis

In 2023, the Natural Catastrophes Insurance segment held a dominant market position within the parametric insurance market, capturing more than a 48% share. This leadership is primarily due to the growing awareness and higher incidence of natural disasters like hurricanes, earthquakes, and floods, especially in regions highly susceptible to such events.

As climate change continues to influence weather patterns, the frequency and intensity of these natural catastrophes are expected to rise, driving demand for more robust insurance solutions that can offer quick financial relief. This segment’s prominence is further bolstered by the straightforward nature of its policies.

Natural Catastrophes Insurance operates on clear, measurable triggers, such as specific wind speeds or earthquake magnitudes, making it an attractive option for those seeking transparent and efficient claims processes. This clarity is particularly valued in high-risk areas where traditional insurance might be costly or difficult to obtain due to the high likelihood of recurring claims.

Moreover, the development of sophisticated data collection and processing technologies has enhanced the accuracy with which these triggers are monitored and assessed. Improved satellite imagery, IoT devices, and advanced modeling techniques have all played a role in making Natural Catastrophes Insurance more reliable and responsive to the actual conditions during an event.

This technological edge allows insurers to offer competitively priced premiums while maintaining quick response times for payouts, enhancing customer satisfaction and trust in the product. As a result, Natural Catastrophes Insurance not only meets the urgent need for immediate post-disaster funds but also supports resilience building in vulnerable communities. By providing a financial safety net, it enables quicker recovery and rebuilding efforts, which is essential for maintaining economic stability and encouraging investment in disaster-prone regions.

Application Analysis

In 2023, the Agriculture segment held a dominant market position within the parametric insurance market, capturing more than a 27% share. This segment’s leadership stems from the critical role that weather and climatic conditions play in agricultural productivity.

Farmers face significant financial risks due to variables like rainfall, temperature, and other climate-related factors that can drastically affect crop yields. Parametric insurance offers a streamlined solution by providing payouts based on specific, measurable weather parameters, ensuring quick financial support without the need for lengthy claims processing.

The appeal of parametric insurance in agriculture is also due to its ability to cover risks that are typically excluded or difficult to manage under traditional crop insurance schemes. For example, it can provide coverage for droughts or excessive rainfall with predetermined rainfall indices that, when breached, automatically trigger a payout. This feature is particularly valuable in regions prone to such extremes, where traditional insurance might not offer adequate coverage or could be prohibitively expensive due to high risk.

Furthermore, the adoption of advanced technologies in the agriculture sector, such as IoT for precision farming, has facilitated the growth of parametric insurance. These technologies enable more accurate and timely data collection regarding weather conditions, directly feeding into the parametric insurance model. This integration allows for more tailored insurance products that better meet the specific needs of farmers, enhancing the overall attractiveness of parametric solutions in this sector.

Overall, the Agriculture segment’s prominence in the parametric insurance market is driven by its ability to provide immediate, transparent, and fair financial compensation based on objective weather data, directly addressing the unique challenges faced by the agricultural sector. This not only helps stabilize farm income but also supports broader rural economies by enabling farmers to recover and reinvest in their operations after adverse weather events.

Distribution Channel Analysis

In 2023, the Direct Sales segment held a dominant market position within the parametric insurance market, capturing more than a 40% share. This leading role is largely attributed to the direct control insurers maintain over the sales process, which allows for better customization of insurance products to meet specific client needs.

Direct sales channels enable insurers to engage closely with their customers, offering detailed explanations and tailored advice on how parametric insurance can specifically benefit them, based on their risk profiles and coverage needs. Another key advantage of the Direct Sales channel is the trust and reliability perceived in direct interactions between insurers and policyholders.

When clients purchase insurance directly from the provider, it often builds a stronger sense of security and confidence in the product. This is particularly important for parametric insurance, where the understanding of policy triggers and payouts must be clear to avoid any miscommunication at the time of a claim.

Moreover, the Direct Sales approach benefits insurers by reducing dependency on intermediaries, which can lead to lower operational costs and more competitive pricing for customers. Insurers are able to pass these savings back to the policyholders, making parametric insurance more accessible and appealing. Direct engagement also allows insurance companies to gather firsthand feedback and data, which they can use to continuously improve their offerings and customer service.

Overall, the Direct Sales segment’s success in the parametric insurance market is reinforced by its ability to offer personalized services, enhanced trust, and cost efficiency, all of which are crucial for expanding the adoption of parametric insurance solutions across various risk-prone sectors.

Key Market Segments

By Type

- Natural Catastrophes Insurance

- Specialty Insurance

- Others

By Application

- Agriculture

- Energy & Utilities

- Real Estate

- Construction

- Healthcare

- Marine

- Travel & Tourism

- Others

By Distribution Channel

- Direct Sales

- Brokers

- Online Platforms

Driver

Technological Advancements Drive Market Growth

Advancements in data analytics play a pivotal role in the expansion of the parametric insurance market. By leveraging big data as a service and machine learning, insurers can accurately assess risks and set precise triggers for payouts.

This technological progress enhances the efficiency and reliability of parametric products, making them more attractive to both consumers and businesses. Additionally, the rising frequency of natural disasters has heightened the need for swift and transparent insurance solutions, which parametric insurance effectively provides.

Coupled with the increasing demand for customized insurance solutions, these factors collectively propel the market forward. Government support and robust regulatory frameworks further facilitate this growth by creating a conducive environment for innovation and investment in the sector.

Restraint

Awareness and Data Challenges Restrain Market Growth

Limited awareness among consumers significantly restrains the growth of the parametric insurance market. Many potential customers are unfamiliar with how parametric insurance differs from traditional models, leading to hesitation in adoption.

Additionally, data privacy concerns pose a major barrier, as consumers and businesses are wary of how their data is collected and used in risk assessments. High initial setup costs associated with implementing parametric insurance solutions also deter smaller insurers and new entrants from entering the market.

Moreover, regulatory uncertainties create an unstable environment, making it challenging for insurers to navigate compliance requirements effectively. These restraining factors collectively hinder the widespread acceptance and scalability of parametric insurance.

Opportunity

Emerging Markets and Technological Integration Provide Opportunities

The parametric insurance market is poised to capitalize on several growth opportunities that can drive its expansion. Expansion into emerging markets presents a significant opportunity, as these regions often face high risks from natural disasters and have a growing need for efficient insurance solutions.

Integration with the Internet of Things (IoT) allows for real-time data collection and more accurate risk assessments, enhancing the effectiveness of parametric products. Partnerships with technology firms can lead to innovative solutions and broader market reach.

The development of new and tailored insurance products can address specific needs of different customer segments. These opportunities enable insurers to broaden their offerings, improve customer satisfaction, and tap into new revenue streams.

Challenge

Operational Complexities and Market Competition Pose Challenges

The parametric insurance market faces several challenging factors that could impede its growth. The complexity in trigger mechanisms often makes it difficult for consumers to understand when and how payouts are initiated, leading to mistrust and reluctance to adopt such products.

Limited historical data for accurate modeling hampers the ability of insurers to set appropriate parameters, increasing the risk of either underestimating or overestimating payouts. Competition from traditional insurance providers, who have established trust and extensive customer bases, further intensifies the challenges for parametric insurers.

Additionally, scalability issues in diverse regions, where varying regulatory and environmental conditions exist, make it difficult to implement standardized parametric solutions globally. These challenges require strategic solutions to ensure the parametric insurance market can overcome obstacles and achieve sustainable growth.

Growth Factors

Technological and Economic Growth Factors Propel Market Expansion

The parametric insurance market is experiencing significant growth driven by several key factors. Technological innovations, such as advanced data analytics and machine learning, enhance the efficiency and accuracy of parametric insurance products, making them more appealing to a broader audience.

Growing investor interest in insurance technology (InsurTech) fuels the development and scaling of innovative insurance solutions, providing the necessary capital and expertise for market expansion. Increasing awareness of climate change impacts underscores the need for resilient insurance products that can offer quick and reliable payouts during disasters, boosting demand for parametric solutions.

Supportive economic policies and initiatives promoting insurance adoption further facilitate market growth by creating favorable conditions for both insurers and customers. These growth factors collectively contribute to a robust and dynamic parametric insurance market.

Emerging Trends

Innovation and Sustainability Set Market Trends

Several trending factors are currently shaping the parametric insurance market, driving its evolution and adoption. The adoption of blockchain technology enhances transparency and security in parametric transactions, building trust among stakeholders.

The use of artificial intelligence in risk assessment allows for more precise and dynamic modeling of insurance products, improving their reliability and attractiveness. The growth of microinsurance products caters to underserved populations, expanding the market reach and inclusivity of parametric insurance solutions.

Additionally, an increased focus on sustainability and Environmental, Social, and Governance (ESG) factors aligns parametric insurance with global priorities. This makes it a preferred choice for socially conscious consumers and businesses.

Regional Analysis

North America Dominates with 35% Market Share

North America leads the Parametric Insurance market with a 35% share, valued at USD 5.53 billion. This dominance is driven by a well-developed insurance sector, increasing demand for innovative insurance products, and a high frequency of natural disasters like hurricanes and wildfires. Businesses and governments in the region rely on parametric insurance to quickly recover from losses triggered by predefined events.

The region’s advanced technological infrastructure supports the use of data analytics and weather modeling, key components of parametric insurance. North American insurance companies are increasingly adopting digital platforms to offer tailored policies for climate risks, enhancing market growth. Additionally, regulatory support and risk management initiatives encourage the adoption of parametric products in sectors like agriculture and energy.

Looking ahead, North America’s market presence is expected to strengthen as climate risks increase and businesses seek faster claims processing. The growing focus on technology-driven insurance products and real-time data will further fuel demand for parametric insurance across the region.

Regional Mentions:

- Europe: Europe holds a significant share in the parametric insurance market, driven by its focus on climate risk management and regulatory support. Countries like Germany and the UK are adopting parametric solutions for flood and storm risks.

- Asia Pacific: Asia Pacific is experiencing rapid growth in parametric insurance due to frequent natural disasters like typhoons and earthquakes. Countries like Japan and China are key players, leveraging data-driven solutions to mitigate financial losses.

- Middle East & Africa: The Middle East and Africa are emerging markets for parametric insurance, with a focus on addressing risks related to drought and extreme temperatures. The region’s agriculture and energy sectors are adopting parametric solutions to mitigate losses.

- Latin America: Latin America’s market is gradually growing as the region faces increasing climate risks. Parametric insurance is gaining popularity, particularly in sectors like agriculture and infrastructure, where natural disasters pose significant threats.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Parametric Insurance market is gaining traction as a solution for businesses seeking faster claims processing and coverage for specific events. The top three companies in this market – Allianz Group, AXA SA, and Zurich Insurance Group Ltd. – are driving growth and innovation with their strong market presence and advanced insurance solutions.

Allianz Group is a global leader in parametric insurance, offering tailored solutions that cover a range of events, from natural disasters to extreme weather. Allianz’s parametric insurance products are designed to provide faster payouts by using predefined triggers, such as weather data. The company’s strong global presence and its ability to cater to large-scale businesses make it a dominant player in this market. Allianz’s commitment to innovation ensures it remains at the forefront of parametric insurance development.

AXA SA is another key player, known for its wide-ranging insurance solutions, including parametric insurance for climate and weather-related risks. AXA’s focus on simplifying the claims process and providing immediate payouts based on predefined parameters has made it a preferred choice for businesses seeking quick financial recovery. AXA’s strategic partnerships and its emphasis on using data-driven technologies strengthen its market influence.

Zurich Insurance Group Ltd. is a major player in the parametric insurance market, offering solutions that address risks from natural disasters and weather events. Zurich’s parametric insurance products are widely used by industries such as agriculture, energy, and infrastructure, which rely on immediate payouts to mitigate losses. The company’s focus on providing transparent and efficient solutions, coupled with its global reach, ensures Zurich’s strong positioning in the parametric insurance market.

These top companies in the Parametric Insurance market lead through their innovative products and strong global presence. Their focus on speed, transparency, and customer-centric solutions positions them as influential players driving the future of parametric insurance.

Top Key Players in the Market

- Allianz Group

- AXA SA

- Zurich Insurance Group Ltd.

- Berkshire Hathaway Inc.

- Chubb Limited

- Munich Re Group

- FloodFlash Limited

- Neptune Flood Incorporated

- Global Parametrics Limited

- Swiss Re

- Other Key Players

Recent Developments

- AXA: In September 2023, AXA Hong Kong and Macau launched the market-first heatwave parametric insurance to protect outdoor workers from extreme heat risks. The policy provides automatic payouts or prevention kits without requiring claims forms when temperatures exceed 36°C for three consecutive days.

- Tower Insurance and CelsiusPro: In September 2023, Tower Insurance partnered with CelsiusPro to introduce parametric cyclone insurance in New Zealand. This solution offers automatic payouts based on cyclone intensity, addressing the increasing frequency of extreme weather events.

- IBISA: In September 2023, IBISA raised $3 million in seed funding to expand its parametric insurance solutions across Asia and Africa. IBISA’s technology-driven insurance products promote climate resilience by offering rapid payouts during environmental events.

- Arbol: In March 2024, Arbol secured $60 million in Series B funding to scale its parametric insurance offerings globally. Arbol’s insurance products provide swift payouts for climate-related events, addressing the growing demand for innovative solutions in mitigating financial risks from extreme weather.

Report Scope

Report Features Description Market Value (2023) USD 15.8 Billion Forecast Revenue (2033) USD 40.6 Billion CAGR (2024-2033) 9.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Natural Catastrophes Insurance, Specialty Insurance, Others), By Application (Agriculture, Energy & Utilities, Real Estate, Construction, Healthcare, Marine, Travel & Tourism, Others), By Distribution Channel (Direct Sales, Brokers, Online Platforms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz Group, AXA SA, Zurich Insurance Group Ltd., Berkshire Hathaway Inc., Chubb Limited, Munich Re Group, FloodFlash Limited, Neptune Flood Incorporated, Global Parametrics Limited, Swiss Re, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Parametric Insurance MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Parametric Insurance MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz Group

- AXA SA

- Zurich Insurance Group Ltd.

- Berkshire Hathaway Inc.

- Chubb Limited

- Munich Re Group

- FloodFlash Limited

- Neptune Flood Incorporated

- Global Parametrics Limited

- Swiss Re

- Other Key Players