Global Parabens Market Size, Share, And Enhanced Productivity By Product Type (Methylparaben, Propylparaben, Butylparaben, Ethylparaben, Others), By End Use (Pharmaceutical, Cosmetics and Personal Care, Food, Chemical Industry, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175003

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

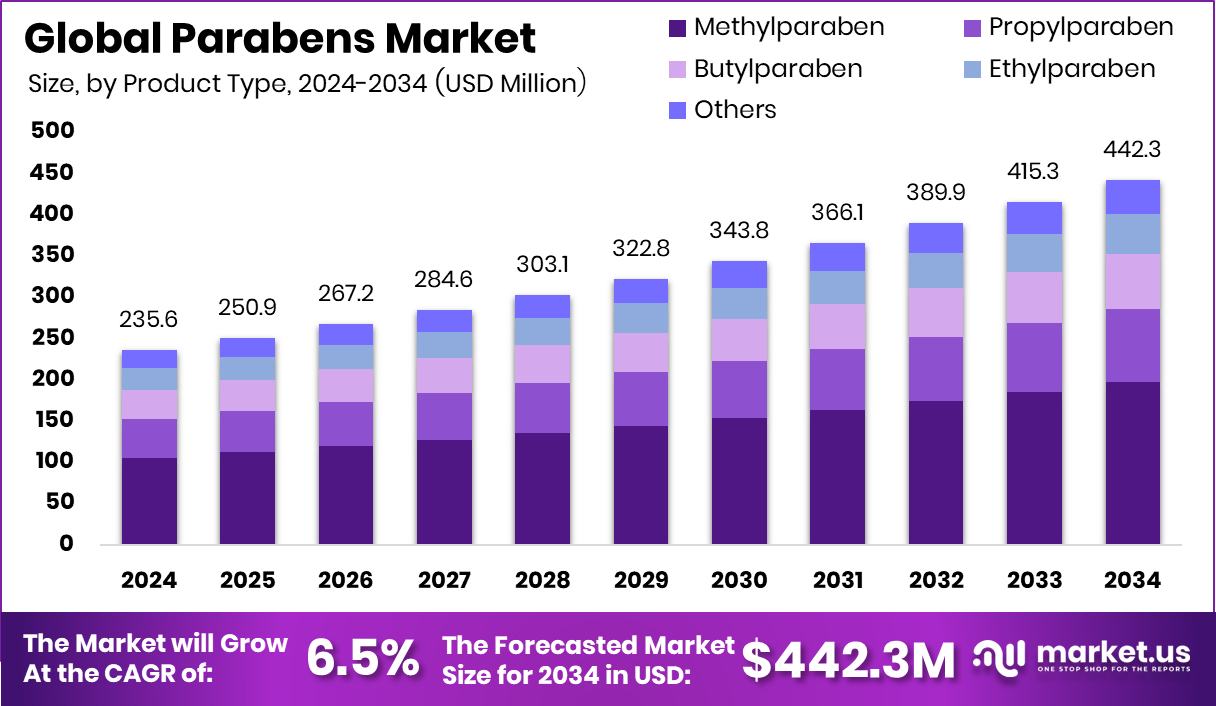

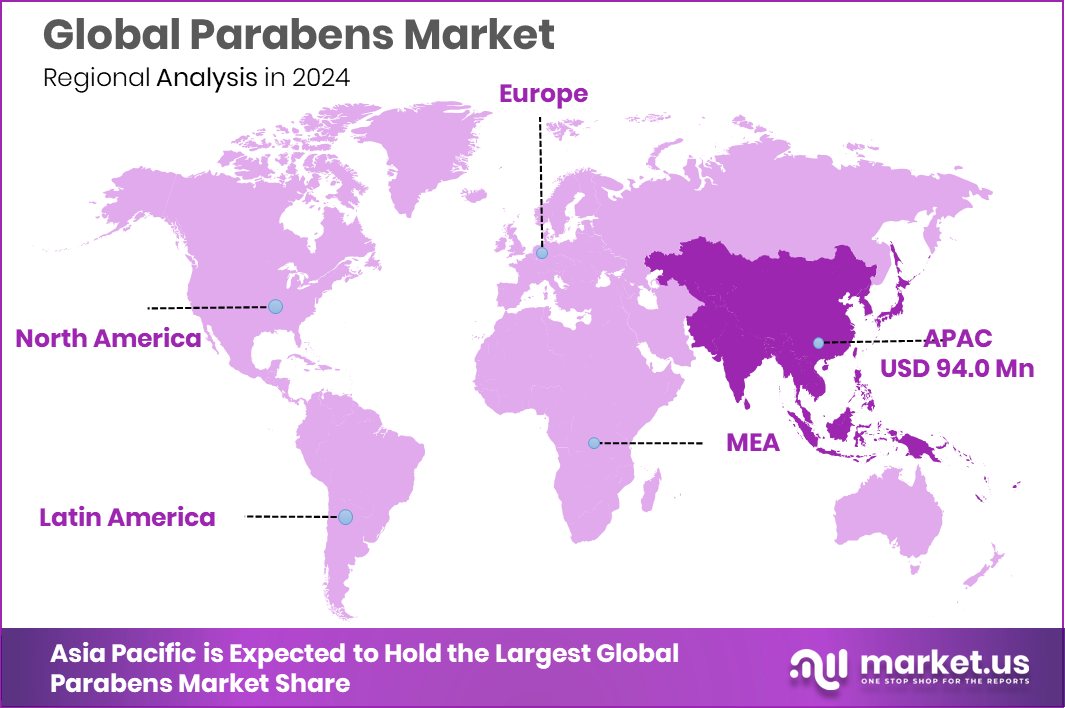

The Global Parabens Market is expected to be worth around USD 442.3 million by 2034, up from USD 235.6 million in 2024, and is projected to grow at a CAGR of 6.5% from 2025 to 2034. Asia Pacific 39.9% maintained leadership due to expanding cosmetics use across diverse consumer markets.

Parabens are a group of widely used preservatives that help stop the growth of bacteria, yeast, and mold in everyday products. They keep lotions, creams, shampoos, and household items safe for longer use by protecting them from spoilage. Their stability, low cost, and long history in formulations make them a common choice for ensuring product freshness throughout storage and repeated consumer handling.

The Parabens Market refers to the overall demand, production, and use of these preservatives across personal care, cosmetics, pharmaceuticals, and household products. It includes manufacturers, suppliers, and formulators who rely on parabens to extend product shelf life and maintain quality. As more brands expand globally, the market continues evolving with new formulations and regulatory awareness.

Growth in the parabens market is supported by rising consumer demand for reliable and long-lasting personal care products. At the same time, innovation in preservation creates new interest. For example, Chinova Bioworks raised $6 million in Series A funding, signaling momentum toward natural shelf-life technologies that influence broader preservative strategies.

Demand remains steady as beauty and wellness brands scale operations. Investments such as Owl’s Brew securing $9 million in Series A funding and an industry alum raising $8 million for a natural perfume startup reflect expanding product portfolios that still depend on stable preservation systems.

Opportunities emerge as companies grow their retail presence. Madison Reed’s $33 million expansion funding and its additional $51 million round to support store growth indicate rising production volumes, which also increase the need for consistent, safe preservation across large product lines.

Key Takeaways

- The Global Parabens Market is expected to be worth around USD 442.3 million by 2034, up from USD 235.6 million in 2024, and is projected to grow at a CAGR of 6.5% from 2025 to 2034.

- In the Parabens Market, methylparaben dominates product types, holding a 44.7% share due to formulation use.

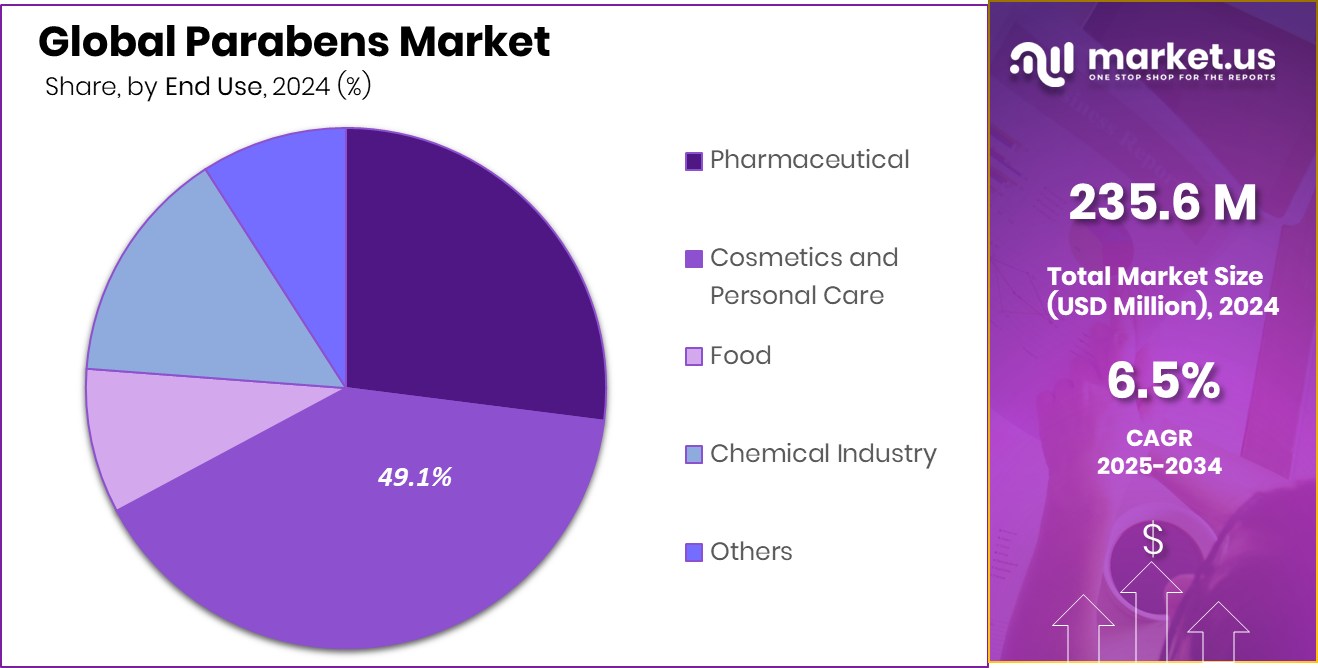

- Cosmetics and personal care lead the Parabens Market end-use segment, accounting for 49.1% of consumption.

- The Asia Pacific reported a total market valuation of USD 94.0 Mn that year.

By Product Type Analysis

Methylparaben leads the Parabens Market with a strong 44.7% share.

In 2024, the Parabens Market by product type was led by Methylparaben, holding a 44.7% share due to its wide acceptance and cost efficiency. Methylparaben remains one of the most commonly used preservatives because it offers strong protection against bacteria and fungi while maintaining product stability over long shelf lives. Its compatibility with water-based formulations makes it especially suitable for lotions, creams, shampoos, and pharmaceutical preparations.

Manufacturers prefer methylparaben as it performs consistently across varying temperature and pH conditions. Additionally, its long history of use and well-documented performance support continued demand from large-scale producers. Despite rising interest in alternative preservatives, methylparaben’s reliability, low dosage requirement, and affordability continue to reinforce its dominant position within the Parabens Market.

By End Use Analysis

Cosmetics and personal care dominate the Parabens Market with 49.1% share today.

In 2024, the Cosmetics and Personal Care segment dominated the Parabens Market by end use, accounting for 49.1% of total demand. This dominance is closely linked to the growing consumption of everyday beauty and hygiene products such as moisturizers, makeup, haircare items, deodorants, and sunscreens. Parabens play a critical role in preventing microbial growth in these products, ensuring safety throughout repeated consumer use.

Cosmetic manufacturers rely on parabens to extend shelf life while maintaining product texture, fragrance, and performance. Rising urbanization, increasing beauty awareness, and frequent product launches further strengthen this segment’s demand. Even as clean-label trends influence formulations, cosmetics and personal care remain the largest and most stable end-use market for parabens globally.

Key Market Segments

By Product Type

- Methylparaben

- Propylparaben

- Butylparaben

- Ethylparaben

- Others

By End Use

- Pharmaceutical

- Cosmetics and Personal Care

- Food

- Chemical Industry

- Others

Driving Factors

Rising Beauty Brands Increase Preservative Usage Needs

The Parabens Market is strongly driven by the rapid growth of beauty and personal care brands that require safe and stable formulations. As new cosmetic products enter the market, manufacturers rely on effective preservatives to protect products from bacteria and spoilage during storage and repeated use. This demand grows further as brands scale production and expand distribution.

For instance, Secret Alchemist raised US$3 million in funding led by Unilever Ventures, highlighting rising activity among emerging beauty brands that need dependable preservation systems. Similarly, Renee Cosmetics raised $30 million in fresh funding, supporting product expansion and wider market reach. As these companies increase product volumes and diversify offerings, the need for proven preservatives such as parabens remains high, directly supporting market growth.

Restraining Factors

Clean Label Concerns Limit Traditional Preservative Acceptance

One key restraining factor in the Parabens Market is growing consumer concern around ingredient transparency and clean-label formulations. As beauty brands respond to demand for “natural” or simplified ingredient lists, some reduce or reformulate preservative choices. This shift affects traditional preservatives, including parabens, especially in premium segments. Renee Cosmetics raised $30 million to target offline growth and technology investment, signaling brand evolution that may include formulation changes.

In addition, SUGAR Cosmetics secured $5 million from Anicut Capital and others, supporting brand positioning and product development strategies aligned with consumer preferences. As companies invest in branding, retail presence, and formulation innovation, pressure increases to limit certain preservatives, which can restrain broader parabens usage.

Growth Opportunity

Premium Beauty Expansion Creates Stable Preservation Demand

Growth opportunities in the Parabens Market are emerging from premium and celebrity-led beauty brands scaling production. These brands often balance clean positioning with product safety and shelf stability, creating selective opportunities for well-regulated preservatives. YSE Beauty closed a $15 million Series A funding round, supporting expansion of its skincare portfolio and production capacity.

At the same time, SUGAR Cosmetics secured $4.5 million in Series D funding from existing investors, reinforcing product innovation and market expansion. As premium brands grow and enter new channels, maintaining consistent product quality becomes critical. This opens opportunities for parabens where performance, safety testing, and regulatory acceptance align with brand and consumer expectations.

Latest Trends

Hybrid Formulations Balance Safety And Consumer Expectations

A major trend shaping the Parabens Market is the rise of hybrid formulations that combine performance-driven preservation with evolving consumer preferences. Brands increasingly seek balanced solutions that ensure product safety without compromising brand image. YSE Beauty secured $15 million in Series A funding, reinforcing investment in formulation development and product scaling.

Meanwhile, FAE Beauty raised ₹17 crore in fresh funding led by Spring Marketing Capital, enabling portfolio expansion and faster market penetration. These funding activities reflect a broader trend where growing brands reassess ingredient strategies while maintaining shelf life and safety. As innovation continues, parabens remain part of formulation discussions, especially where reliability and cost efficiency are essential.

Regional Analysis

Asia Pacific held a strong parabens market share of 39.9% in 2024.

Asia Pacific emerged as the dominant region in the Parabens Market, holding a 39.9% share valued at USD 94.0 million, driven by its expanding cosmetics and personal care consumption across major economies. The region’s strong manufacturing base and rising product usage in daily hygiene items continue to reinforce its lead.

North America follows with steady demand supported by high consumer reliance on personal care formulations and well-established product safety regulations that maintain consistent preservative usage.

Europe remains another key market, influenced by widespread utilization of skincare, haircare, and pharmaceutical products that depend on stable preservation systems. Meanwhile, the Middle East & Africa show gradual growth, supported by increasing urban lifestyles and rising beauty product adoption.

Latin America maintains a moderate share, with consumption shaped by local manufacturing activities and expanding retail channels offering paraben-based products across diverse consumer categories.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Clariant continued to strengthen its position in the global Parabens Market by focusing on high-quality preservative solutions tailored for personal care and industrial applications. The company’s strategy remained centered on consistent product performance, regulatory compliance, and supplying ingredients that enhance formulation stability. Clariant’s strong global distribution network supported reliable delivery to cosmetic and pharmaceutical manufacturers, enabling the company to maintain steady demand for its paraben offerings despite rising interest in alternative preservatives.

Acme-Hardesty sustained its role as an important supplier within the market, leveraging its long-standing expertise in sourcing and distributing specialty chemicals. In 2024, the company emphasized dependable supply, customer-specific solutions, and efficient logistics, which reinforced its relevance across personal care and industrial formulations containing parabens. Acme-Hardesty’s ability to meet varied formulation needs allowed it to serve small and large manufacturers seeking consistent preservative performance.

Alta Laboratories Ltd remained a key contributor through its established production capabilities and technical know-how in manufacturing parabens for global use. The company’s focus on product purity, controlled processing, and meeting international quality standards helped maintain customer trust. In 2024, Alta Laboratories continued supporting growing demand by providing stable, cost-effective preservative ingredients widely used in cosmetics and pharmaceutical products worldwide.

Top Key Players in the Market

- Clariant

- Acme-Hardesty

- Alta Laboratories Ltd

- Kosnature

- Muby Chemicals

- UNICORN PETROLEUM INDUSTRIES PVT. LTD.

- UENO FINE CHEMICALS INDUSTRY, LTD.

- Hefei TNJ Chemical Industry Co., Ltd.

- Ashland

- Nebula Healthcare Limited

Recent Developments

- In April 2024, Clariant announced it had completed the acquisition of Lucas Meyer Cosmetics, a well-known provider of high-value ingredients for cosmetics and personal care. This deal enhances Clariant’s portfolio and strengthens its capabilities in supplying ingredients used in beauty products and preservatives globally.

- In January 2024, Acme-Hardesty became the first company in the United States to earn SUCCESS certification from the Sustainable Castor Association. This certification highlights the company’s commitment to sustainable and ethical sourcing of castor products used in personal care, cosmetics, and other ingredient supply chains.

Report Scope

Report Features Description Market Value (2024) USD 235.6 Million Forecast Revenue (2034) USD 442.3 Million CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Methylparaben, Propylparaben, Butylparaben, Ethylparaben, Others), By End Use (Pharmaceutical, Cosmetics and Personal Care, Food, Chemical Industry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Clariant, Acme-Hardesty, Alta Laboratories Ltd, Kosnature, Muby Chemicals, UNICORN PETROLEUM INDUSTRIES PVT. LTD., UENO FINE CHEMICALS INDUSTRY, LTD., Hefei TNJ Chemical Industry Co., Ltd., Ashland, Nebula Healthcare Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Clariant

- Acme-Hardesty

- Alta Laboratories Ltd

- Kosnature

- Muby Chemicals

- UNICORN PETROLEUM INDUSTRIES PVT. LTD.

- UENO FINE CHEMICALS INDUSTRY, LTD.

- Hefei TNJ Chemical Industry Co., Ltd.

- Ashland

- Nebula Healthcare Limited