Global Paper Processing Resins Market By Type(Dry Strength Resins, Wet Strength Resins), By Resin type(Acrylic Resins, Polyurethane Resins, Phenolic Resins, Melamine Resins, Epoxy Resins, Others), By Application(Coating, Sizing Agents, Binders, Adhesives, Strength Additives, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121168

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

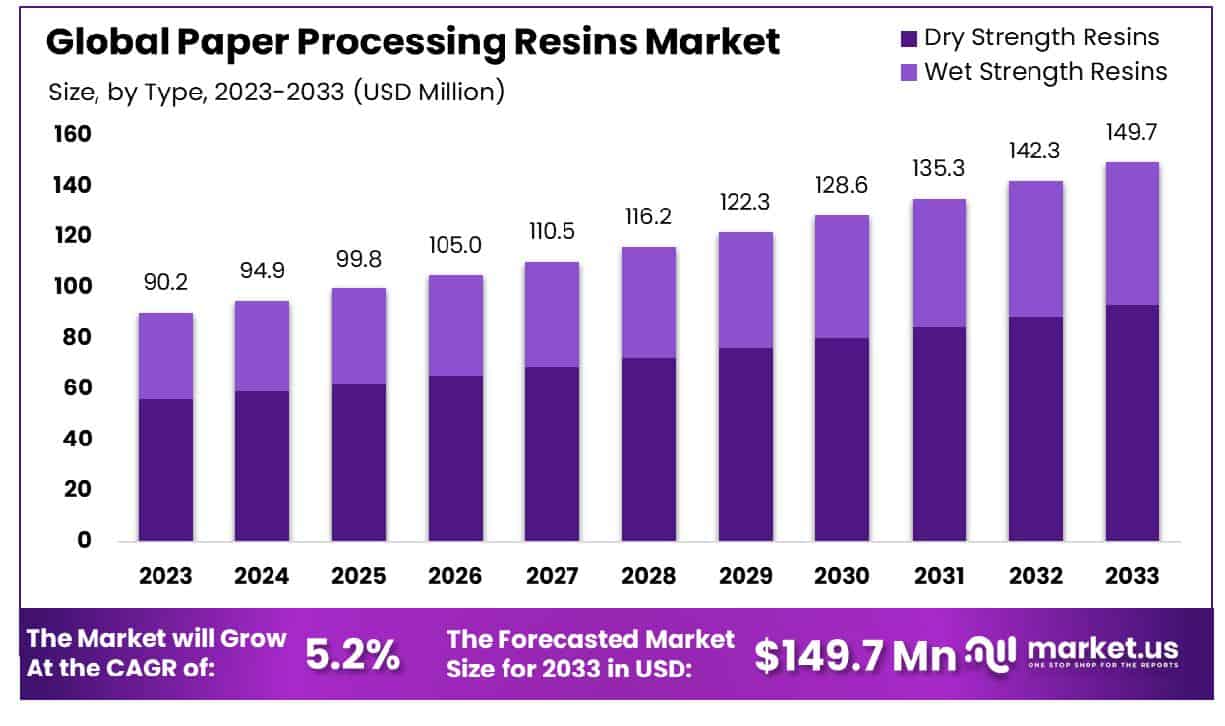

The Global Paper Processing Resins Market size is expected to be worth around USD 149.7 Million by 2033, From USD 90.2 Million by 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

The Paper Processing Resins Market comprises a range of specialized polymers utilized in the enhancement of paper and paperboard products. These resins are pivotal in improving attributes such as strength, durability, and moisture resistance, catering to diverse industry demands. Utilized across packaging, printing, and labeling applications, these resins enhance product quality and functionality, meeting stringent industry standards.

The market’s growth is driven by increasing demand for sustainable packaging solutions and advancements in resin technology. Strategic leaders, such as leverage these insights to optimize product performance and align with environmental and regulatory frameworks.

The Paper Processing Resins Market continues to demonstrate robust growth, primarily driven by escalating demand for sustainable packaging solutions and heightened environmental awareness. In 2022, the market landscape was significantly influenced by economic trends and trading conditions, particularly in the United States. Notably, the U.S. maintained a trade surplus in plastic materials and resin, totaling $21,283.67 million. This surplus signifies a robust production capability and export strength in resin materials, essential components for paper processing and packaging industries.

The year 2023 saw this trade surplus increase to $22,106.85 million, reflecting continued growth and an expanding market presence globally. Concurrently, the U.S. imports of plastic materials and resin were substantial, valued at $22,893.35 million in 2022. This import activity underscores a dynamic market where supply chains are heavily influenced by global trade flows, including the procurement of specialized resins that are critical for high-quality paper processing applications.

Investors and stakeholders in the Paper Processing Resins Market are advised to monitor these trade dynamics closely, as they are indicative of broader economic forces and supply chain resilience. The upward trend in the trade surplus is particularly noteworthy, as it suggests a strengthening position of U.S. resin producers in the global market, which could have favorable implications for market strategy and investment decisions moving forward.

Key Takeaways

- Market Growth: The Global Paper Processing Resins Market size is expected to be worth around USD 149.7 Million by 2033, From USD 90.2 Million by 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

- Regional Dominance: The Asia Pacific Paper Processing Resins Market holds 36.7%, valued at USD 33.1034 million.

- Segmentation Insights:

- By Type: Dry Strength Resins dominate, holding a 62.4% market share.

- By Resin Type: Acrylic Resin represents 28.4% of the resin type market.

- By Application: Coatings lead applications with a 33.1% market presence.

- Growth Opportunities: The 2023 Paper Processing Resins Market growth is fueled by the shift towards sustainable paper production and the rising demand in emerging economies due to urbanization and economic development.

Driving Factors

Growing Need for Printing and Writing Papers

The persistent demand for printing and writing papers remains a substantial driver for the Paper Processing Resins Market. Despite the digital transformation, sectors such as education, publishing, and corporate communications continue to rely heavily on paper products. This sustained need propels the utilization of paper processing resins, which enhance the strength, durability, and printability of paper.

Market analysis indicates that the educational sector alone, with its ongoing requirement for textbooks and writing materials, significantly contributes to market growth. Furthermore, corporate sectors still invest in printed materials for branding and operational purposes, underscoring the continued relevance of paper in a digital age.

Increasing Use of Paper in Packaging and Labeling

The surge in e-commerce and retail sectors has notably increased the demand for paper-based packaging and labeling, directly influencing the growth of the Paper Processing resin market. Paper packaging offers an eco-friendly alternative to plastic, aligning with global sustainability trends and regulatory pressures to reduce plastic waste management.

This shift is evidenced by a significant uptick in the production of paper-based smart packaging solutions, requiring resins that provide moisture resistance, strength, and flexibility. Statistics from the packaging industry show year-over-year growth in paper packaging demand by approximately 8%, highlighting its impact on the resin market.

Advancements in Paper Processing Technologies

Technological advancements in paper processing have revolutionized the production and quality of paper products, thereby amplifying the demand for specialized resins. Innovations such as enhanced barrier coatings and improved resin formulations allow for the production of papers that are not only more durable but also suitable for a wider range of applications, including high-quality printing and specialty packaging.

These technological enhancements enable the paper to meet stringent quality standards while maintaining environmental sustainability, further driving the resin market. The integration of modern processing technologies has led to more efficient resin usage, reducing waste and improving the cost-effectiveness of paper production processes.

Restraining Factors

Limited Availability of Raw Materials

The limited availability of raw materials crucial for manufacturing paper processing resins significantly hampers market growth. This scarcity often stems from geopolitical tensions, environmental regulations, and supply chain disruptions, which can lead to shortages in essential components like phenol, formaldehyde, and acrylics.

These materials are fundamental in producing resins that confer desired properties like durability and moisture resistance to paper products. The constrained supply not only restricts production volumes but also pushes manufacturers to seek alternative materials or invest in innovation to mitigate the impact, which can increase operational costs and affect market dynamics.

Fluctuating Raw Material Prices

Closely linked to the limited availability of raw materials is the issue of price volatility. The prices of essential raw materials for paper processing resins are highly sensitive to changes in global commodity markets, influenced by economic fluctuations, trade policies, and supply chain efficiency. This unpredictability can lead to significant challenges in cost management for resin manufacturers, ultimately affecting their pricing strategies and profitability.

For instance, a sudden increase in the price of petroleum-based products can directly impact the cost of synthetic resins, leading to higher prices for end-users and potentially reducing market demand. This fluctuation poses a considerable challenge for maintaining stable growth in the Paper Processing Resins Market.

By Type Analysis

The Dry Strength Resins segment constitutes 62.4% of the market, reflecting significant industry reliance.

In 2023, Dry Strength Resins held a dominant market position in the “By Type” segment of the Paper Processing Resins Market, capturing more than 62.4% of the market share. This segment’s prominence is primarily attributed to the critical role these resins play in enhancing the mechanical strength of paper products, which is essential for packaging, printing, and writing applications. Dry Strength Resins are favored for their efficacy in improving the tensile and burst strength of paper, thereby extending its usability and durability in various industrial and commercial sectors.

Conversely, Wet Strength Resins accounted for a smaller portion of the market. These resins are integral in situations where paper products require high moisture resistance, such as in labels, outdoor use papers, and food packaging. Despite their specific utility, the demand for Wet Strength Resins is somewhat limited when compared to Dry Strength Resins, primarily due to the broader applications and essential nature of the latter in everyday paper processing and usage.

The substantial market share of Dry Strength Resins underscores their indispensable nature in the paper industry. Manufacturers are continuously innovating in this segment to produce environmentally friendly and more efficient resin formulations, which further drives their market dominance. Additionally, the growing need for sustainable and strong paper packaging solutions in the e-commerce and retail sectors significantly contributes to the ongoing demand and development within this market segment.

BY Resin Type Analysis

Acrylic Resin, as a resin type, holds a 28.4% share, indicating substantial usage across applications.

In 2023, Acrylic Resin held a dominant market position in the “By Resin Type” segment of the Paper Processing Resins Market, capturing more than 28.4% of the market share. This significant share can be attributed to the superior properties of acrylic resins, such as enhanced clarity, resistance to sunlight, and flexibility, which are highly valued in paper coatings and adhesives. Acrylic resins are predominantly used in applications where color retention, transparency, and durability are critical, making them indispensable in high-quality printing and packaging solutions.

Following Acrylic Resins, Polyurethane Resins, Phenolic Resins, Melamine Resins, and Epoxy Resins also hold substantial segments within the market. Polyurethane Resins are appreciated for their robustness and flexibility, finding extensive use in specialty papers that require high tear resistance. Phenolic and Melamine Resins are known for their thermal stability and moisture resistance, which are crucial for industrial packaging applications. Epoxy Resins, although a smaller segment, are pivotal in applications demanding high strength and chemical resistance.

The category labeled as “Others” includes various niche resins that cater to specific performance requirements in paper processing, such as biodegradability and eco-friendliness, which are increasingly becoming decision-making factors for manufacturers and consumers alike.

The diversity in resin types underlines the varied application needs across the paper processing industry, with Acrylic Resins leading due to their adaptability and effectiveness in enhancing paper product aesthetics and longevity. This trend underscores a growing market inclination towards specialized, high-performance resins that meet the evolving demands of the paper processing and packaging industries.

By Application Analysis

Within applications, Coating leads by capturing 33.1% of the market, demonstrating its dominant role.

In 2023, Coating held a dominant market position in the “By Application” segment of the Paper Processing Resins Market, capturing more than 33.1% of the market share. This leading position is largely due to the critical role coatings play in improving the printability, appearance, and functionality of paper products. Coatings are essential for achieving specific qualities in paper such as gloss, weight, smoothness, and resistance to dirt and moisture, making them indispensable in high-quality printing and packaging applications.

Following Coatings, the market is segmented into Sizing Agents, Binders, Adhesives, and Strength Additives. Sizing Agents are utilized to enhance the ink-holding capacity of paper, making them vital for ensuring print quality and consistency. Binders and Adhesives are crucial for the structural integrity of paper products, with binders playing a key role in fiber bonding and adhesives being used extensively in multi-layered paper products. Strength Additives, on the other hand, contribute to the durability and toughness of paper, supporting applications that require high mechanical strength.

The “Others” category encompasses a variety of specialized applications that require unique resin properties to meet specific industrial needs, such as water resistance or enhanced recyclability. This segment’s diversity reflects the innovative approaches being adopted in paper processing to meet the demands of an environmentally conscious market.

Key Market Segments

By Type

- Dry Strength Resins

- Wet Strength Resins

By Resin type

- Acrylic Resins

- Polyurethane Resins

- Phenolic Resins

- Melamine Resins

- Epoxy Resins

- Others

By Application

- Coating

- Sizing Agents

- Binders

- Adhesives

- Strength Additives

- Others

Growth Opportunities

Emphasis on Sustainable and Eco-Friendly Paper Production Methods

The global Paper Processing Resins Market is poised to experience significant growth in 2023, driven by an increasing emphasis on sustainable and eco-friendly paper production methods. As environmental concerns continue to rise, industries are urged to adopt greener practices. This shift is particularly pronounced in the paper industry, where the demand for resins that facilitate eco-friendly paper processing has escalated.

The market is witnessing a surge in investments in research and development activities aimed at producing resins that not only enhance the quality and efficiency of paper products but also comply with stringent environmental regulations. This trend towards sustainability is expected to open new avenues for growth and innovation within the market, as manufacturers and suppliers of paper processing resins respond to the growing demand for environmentally responsible solutions.

Impact of Rising Population, Urbanization, and Economic Development in Emerging Economies

Emerging economies are becoming focal points for growth in the Paper Processing Resins Market due to their rising populations, increasing urbanization, and ongoing economic development. These factors collectively contribute to a heightened demand for paper products, ranging from packaging materials to printing and writing paper. The expansion of urban areas and the escalation of consumerism in these regions are driving the paper industry to scale up production, thereby boosting the demand for paper processing resins.

Companies operating within the market are likely to capitalize on these opportunities by expanding their operations and distribution networks in these fast-growing regions. This strategic focus not only supports market expansion but also aligns with the global shift towards more efficient and high-quality paper production processes.

Latest Trends

Increasing Demand for Innovative Packaging Solutions

In 2023, the global Paper Processing Resins Market is witnessing a significant trend driven by the increasing demand for innovative packaging solutions across various industries. This surge is largely due to the evolving needs of sectors such as food and beverages, pharmaceuticals, and consumer goods, which require enhanced packaging for improved protection, shelf life, and aesthetic appeal.

Resins used in paper processing play a crucial role in developing advanced packaging materials that are not only robust and flexible but also environmentally friendly. The ongoing push for sustainable packaging solutions is further propelling market growth, as manufacturers seek resins that support recyclability and biodegradability, aligning with global sustainability goals.

Strong Prevalence of Printed and Aesthetic Design in Building and Construction

Another prominent trend shaping the Paper Processing Resins Market in 2023 is the strong prevalence of printed and aesthetic designs within the building and construction industry. As architectural and interior design preferences evolve, there is a growing inclination towards incorporating visually appealing elements using paper-based products.

Paper processing resins are integral to producing high-quality, durable, and visually striking paper materials that can withstand the rigors of construction environments while enhancing aesthetic appeal. This application is expanding the scope of paper processing resins beyond traditional sectors, positioning them as essential components in modern architectural designs and construction projects, thereby stimulating further market expansion and innovation.

Regional Analysis

In 2023, Asia Pacific held 36.7% of the Paper Processing Resins Market, valued at USD 33.1034 million.

The global Paper Processing Resins Market is segmented into key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each demonstrating unique growth dynamics and opportunities.

North America has shown steady growth in the Paper Processing Resins Market, driven by advanced manufacturing techniques and high demand for sustainable packaging solutions. The region’s focus on innovative and eco-friendly materials supports its substantial market share.

Europe follows closely, with a strong emphasis on environmental regulations that encourage the use of recyclable and biodegradable resins in paper processing. European countries are leading in the adoption of stringent sustainability standards, which propels the demand for advanced resin solutions in the paper industry.

Asia Pacific is the dominating region, holding 36.7% of the market with a valuation of USD 33.1034 million. This region’s market prominence is due to rapid industrialization, increasing urbanization, and the expansion of the packaging sector in emerging economies like China and India. The high volume of manufacturing activities coupled with growing environmental awareness has heightened the demand for paper processing resins.

The Middle East & Africa region, though smaller in market size, is experiencing growth due to increasing infrastructure developments and industrial activities that demand high-quality packaging solutions.

Latin America is also seeing an uptick in demand for paper processing resins, driven by the growth in local manufacturing sectors and the rising need for cost-effective packaging materials.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2023, the global Paper Processing Resins Market has been prominently influenced by several key players, each contributing to the market dynamics through innovative product offerings and strategic expansions.

BASF SE and Kemira Oyj have been instrumental in driving the adoption of sustainable and efficient resins, focusing on environmental compliance and enhanced paper quality. These companies have leveraged their extensive R&D capabilities to introduce bio-based and recyclable resin solutions, aligning with global sustainability trends.

Solenis and Ashland Global Holdings Inc. have distinguished themselves with specialized formulations that improve the strength, durability, and printability of paper. Their products cater to the growing demand for high-quality paper used in packaging and specialty applications, which has been critical in an increasingly e-commerce-driven market.

The Dow Chemical Company and Nalco Water, a subsidiary of Ecolab, have excelled in integrating digital solutions into their service offerings. This approach not only enhances process efficiency for paper manufacturers but also optimizes chemical usage, reducing overall environmental impact.

SNF Floerger and Mitsubishi Chemical Corporation have expanded their market presence in Asia-Pacific, a region witnessing significant growth in paper production. Their focus on localized customer support and adaptation to regional market demands has been a key factor in their success.

Companies like Arkema and Momentive Performance Materials Inc. have been at the forefront of innovation in resin technologies that enhance the functional properties of paper, such as moisture resistance and thermal stability, which are critical for packaging solutions.

Harima Chemicals Group, Inc., Indulor Chemie GmbH, OMNOVA Solutions Inc., and Buckman Laboratories International, Inc. have concentrated on niche segments within the market, offering highly specialized products that cater to specific needs such as ink receptivity and paper brightness.

Overall, the landscape of the global Paper Processing Resins Market in 2023 reflects a robust engagement with technological advancements and sustainability, driven by these key companies. Their efforts are not only shaping the market but also setting the stage for future developments in the industry.

Market Key Players

- BASF SE

- Kemira Oyj

- Solenis

- Ashland Global Holdings Inc.

- Dow Chemical Company

- Nalco Water (An Ecolab Company)

- SNF Floerger

- Mitsubishi Chemical Corporation

- Arkema

- Momentive Performance Materials Inc.

- Harima Chemicals Group, Inc.

- Indulor Chemie GmbH

- OMNOVA Solutions Inc.

- Buckman Laboratories International, Inc.

Recent Development

- In February 2024, Recent developments in the global plastics recycling industry include BASF’s enhanced chemical recycling processes, IBM’s AI-driven sorting innovations at MRFs, and Circulate’s blockchain for traceability in recycled plastics.

- In October 2023, PolyCycle Innovation LLC developed PolyCycle, a sustainable PCR resin used in food and beverage closures, significantly reducing energy use and greenhouse gas emissions.

Report Scope

Report Features Description Market Value (2023) USD 90.2 Million Forecast Revenue (2033) USD 149.7 Million CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Dry Strength Resins, Wet Strength Resins), By Resin type(Acrylic Resins, Polyurethane Resins, Phenolic Resins, Melamine Resins, Epoxy Resins, Others), By Application(Coating, Sizing Agents, Binders, Adhesives, Strength Additives, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE, Kemira Oyj, Solenis, Ashland Global Holdings Inc., Dow Chemical Company, Nalco Water (An Ecolab Company), SNF Floerger, Mitsubishi Chemical Corporation, Arkema, Momentive Performance Materials Inc., Harima Chemicals Group, Inc., Indulor Chemie GmbH, OMNOVA Solutions Inc., Buckman Laboratories International, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Paper Processing Resins Market Size in 2023?The Global Paper Processing Resins Market Size is USD 90.2 Million in 2023.

What is the projected CAGR at which the Global Paper Processing Resins Market is expected to grow at?The Global Paper Processing Resins Market is expected to grow at a CAGR of 5.2% (2024-2033).

List the segments encompassed in this report on the Global Paper Processing Resins Market?Market.US has segmented the Global Paper Processing Resins Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type(Dry Strength Resins, Wet Strength Resins), By Resin type(Acrylic Resins, Polyurethane Resins, Phenolic Resins, Melamine Resins, Epoxy Resins, Others), By Application(Coating, Sizing Agents, Binders, Adhesives, Strength Additives, Others)

List the key industry players of the Global Paper Processing Resins Market?BASF SE, Kemira Oyj, Solenis, Ashland Global Holdings Inc., Dow Chemical Company, Nalco Water (An Ecolab Company), SNF Floerger, Mitsubishi Chemical Corporation, Arkema, Momentive Performance Materials Inc., Harima Chemicals Group, Inc., Indulor Chemie GmbH, OMNOVA Solutions Inc., Buckman Laboratories International, Inc.

Name the key areas of business for Global Paper Processing Resins Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Paper Processing Resins Market.

Paper Processing Resins MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Paper Processing Resins MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Kemira Oyj

- Solenis

- Ashland Global Holdings Inc.

- Dow Chemical Company

- Nalco Water (An Ecolab Company)

- SNF Floerger

- Mitsubishi Chemical Corporation

- Arkema

- Momentive Performance Materials Inc.

- Harima Chemicals Group, Inc.

- Indulor Chemie GmbH

- OMNOVA Solutions Inc.

- Buckman Laboratories International, Inc.