Global Paper Bags Market Size, Share, Growth Analysis By Product Type (Sewn Open Mouth, Pinched Bottom Open Mouth, Pasted Valve, Pasted Open Mouth, Flat Bottom), By Material Type (Brown Kraft, White Kraft), By Thickness (1 Ply, 2 Ply, 3 Ply, More Than 3 Ply), By End Use (Food & Beverage, Agriculture, Building & Construction, Retail, Agriculture, Chemicals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155361

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

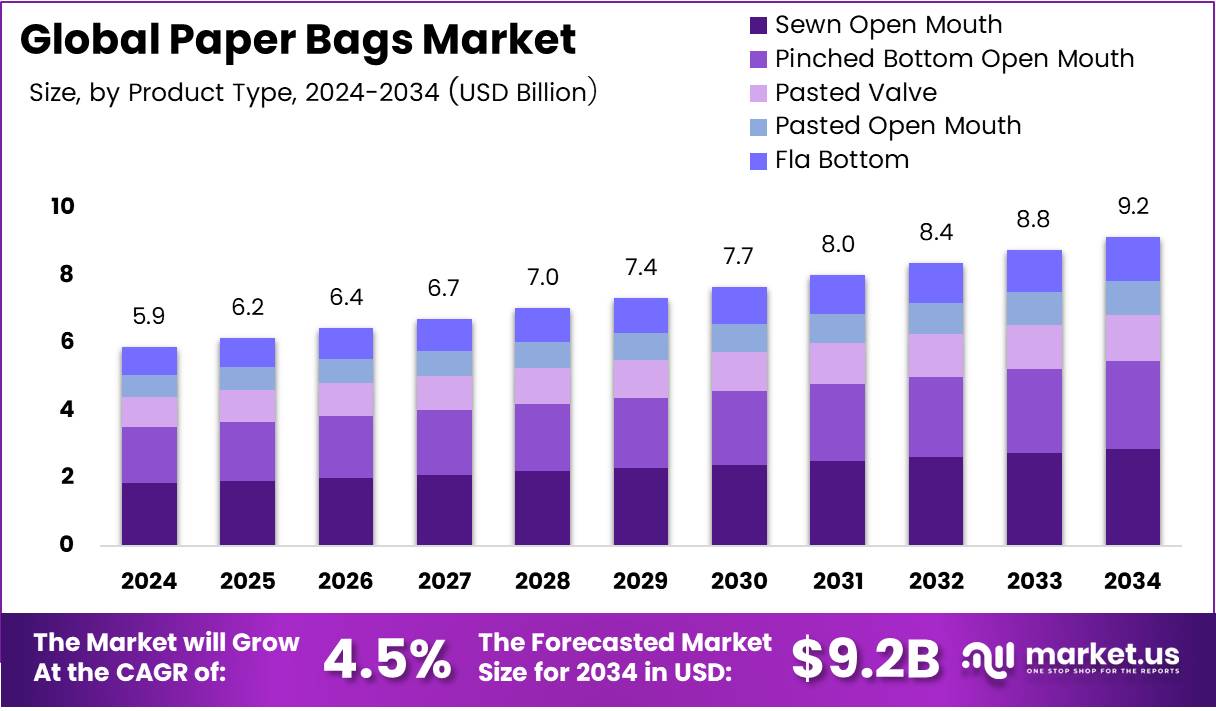

The Global Paper Bags Market size is expected to be worth around USD 9.2 Billion by 2034, from USD 5.9 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

The paper bags market is experiencing notable growth due to increasing consumer demand for sustainable packaging solutions. As consumers become more eco-conscious, companies are shifting toward alternatives to plastic. This trend is driving the expansion of the market, especially as paper bags offer a biodegradable and recyclable option that aligns with environmental goals.

There is a significant opportunity in the paper bags market, particularly for businesses looking to innovate in packaging. The increasing demand for paper-based solutions spans across various industries, including retail, food, and logistics. With consumer preferences shifting towards sustainable packaging, paper bags are poised for widespread adoption across multiple sectors.

Government investment and regulatory measures are also playing a key role in the market’s growth. Various governments have introduced policies to reduce plastic waste, encouraging the use of eco-friendly packaging alternatives. Regulations that restrict single-use plastic bags have created a favorable environment for paper bags to thrive in the market, offering businesses an incentive to switch to more sustainable options.

According to a 2023 survey by Two Sides, 55% of European consumers prefer paper-based packaging because they believe it is better for the environment. This shift in consumer behavior underscores the growing demand for eco-friendly packaging solutions. It highlights the importance of environmental responsibility in consumer purchasing decisions and the need for businesses to adapt to this trend.

In addition to consumer preference, the growth of the paper bags market is supported by the increasing awareness of environmental concerns. The rising cost of plastic waste disposal and the environmental impact of plastic are encouraging both businesses and consumers to prioritize paper-based packaging solutions. The market for paper bags is poised for steady growth as a result of these global shifts.

Key Takeaways

- The Global Paper Bags Market is expected to reach USD 9.2 Billion by 2034, growing at a CAGR of 4.5% from 2025 to 2034.

- Sewn Open Mouth bags held the largest share in 2024 with 31.3%, favored for their reliability and versatility in heavy packaging.

- Brown Kraft dominated the market in 2024 with a 67.9% share, known for its sustainability and strength in packaging.

- 2 Ply bags accounted for 38.1% of the market in 2024, offering a balance between strength and cost-effectiveness.

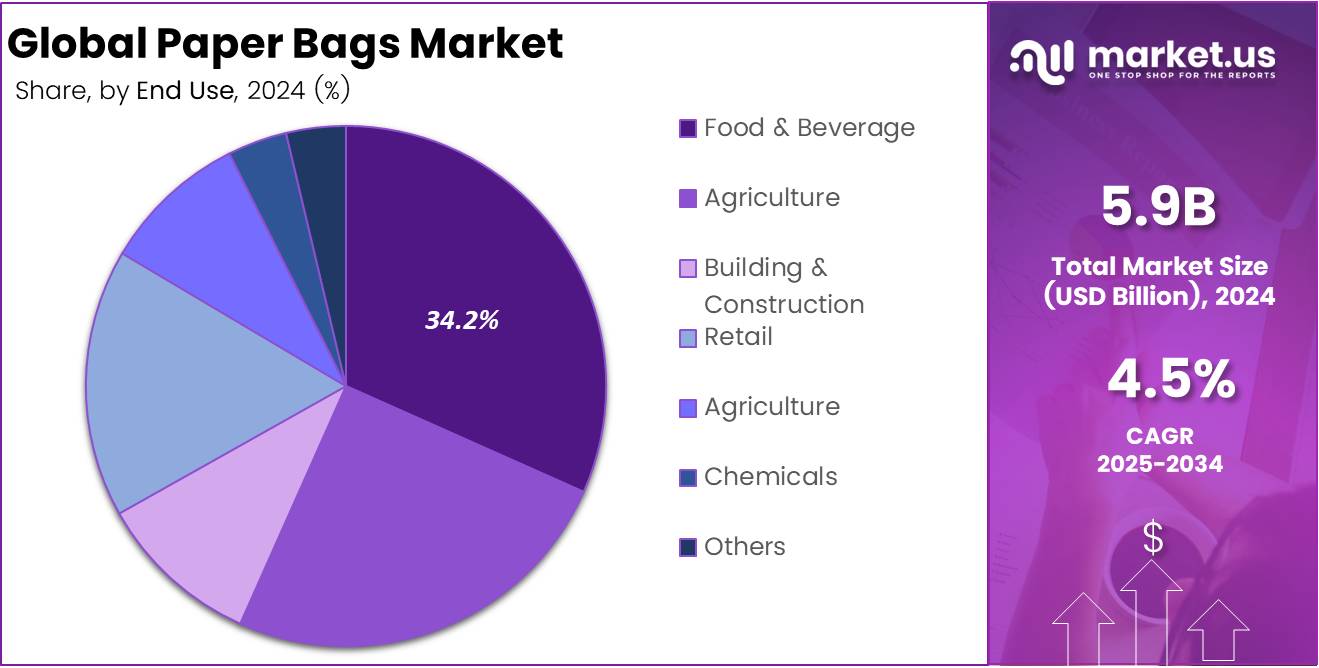

- The Food & Beverage sector led the market in 2024 with 34.2% share, driven by the demand for eco-friendly packaging.

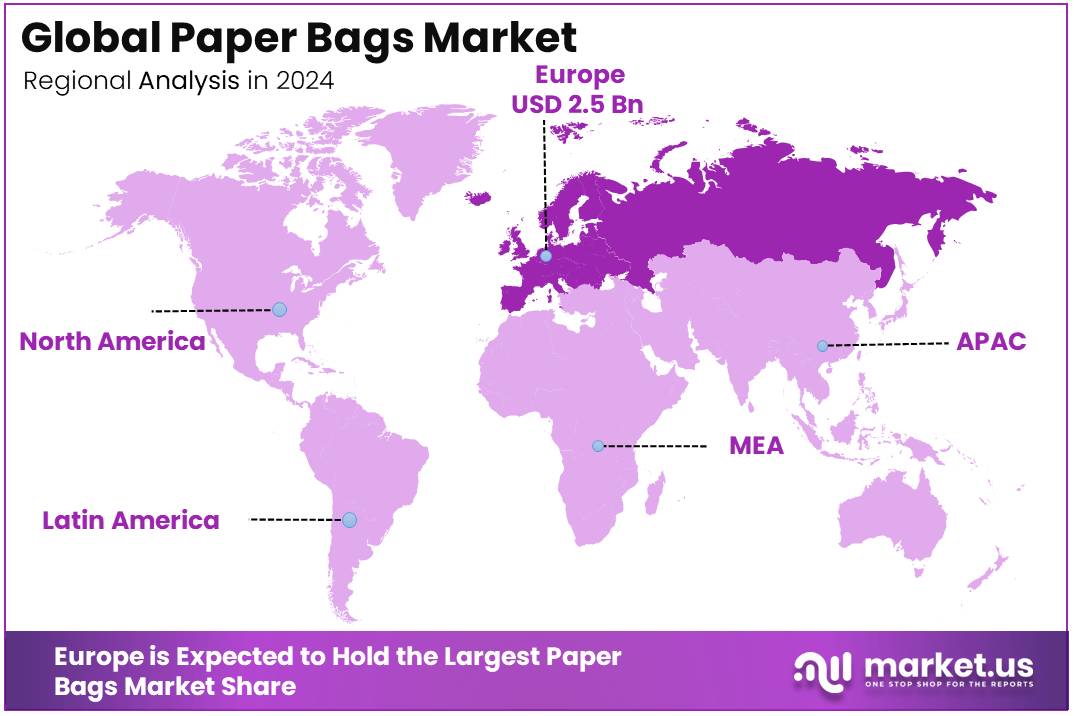

- Europe held the largest regional share of 42.9% in the paper bags market, valued at USD 2.5 billion.

Product Type Analysis

Sewn Open Mouth holds a dominant position with a 31.3% share in the Paper Bags Market in 2024.

In 2024, Sewn Open Mouth bags captured the largest share in the Paper Bags Market, accounting for 31.3%. This significant share is attributed to their widespread use in various industries due to their reliability and versatility. Sewn Open Mouth bags are particularly favored for packaging heavy and bulk materials.

Pinched Bottom Open Mouth bags hold a notable market position as well, driven by their sturdy design and ability to contain fine powders and granulated products. They continue to be a preferred choice in industries such as agriculture and chemicals.

Pasted Valve bags, with their ability to provide tight sealing, maintain a strong presence in specialized packaging applications. Their consistent performance ensures product safety, making them ideal for packaging products like cement and fertilizers.

Pasted Open Mouth bags also contribute significantly to the market. Their cost-effectiveness and ease of use in packaging lightweight items allow them to cater to a wide range of sectors.

Finally, Fla Bottom bags, though a smaller segment, offer specialized solutions, especially in industries requiring enhanced sealing capabilities.

Material Type Analysis

Brown Kraft dominates the Paper Bags Market with a 67.9% share in 2024 due to its sustainability and strength.

In 2024, Brown Kraft held a dominant position in the Paper Bags Market with a 67.9% share. Its widespread popularity is driven by its strong sustainability credentials and robust nature, making it the preferred material for packaging applications across various industries. Brown Kraft bags are widely used for packaging goods in retail, food, and consumer products due to their eco-friendly nature and strength.

White Kraft, while representing a smaller share, is favored for its premium appearance. It is commonly used in higher-end packaging solutions, where aesthetics and product presentation are crucial. Despite its lower market share compared to Brown Kraft, White Kraft bags remain a staple for brands looking to create an upscale image for their products.

Thickness Analysis

2 Ply dominates the Paper Bags Market with a 38.1% share in 2024 due to its balanced strength and cost-effectiveness.

In 2024, 2 Ply bags held the largest share in the Paper Bags Market, accounting for 38.1%. This segment is driven by the balance between strength and cost-effectiveness, making 2 Ply bags a versatile option for a variety of industries. Their durability and ability to carry a wide range of products contribute to their widespread adoption, especially in the retail and food sectors.

1 Ply bags, while providing a more economical option, represent a smaller market share. They are mainly used for lightweight applications and are typically favored for low-cost packaging needs.

3 Ply bags, offering enhanced durability, are often used for heavier or more fragile items that require additional protection. Despite their benefits, they command a smaller portion of the market compared to 2 Ply.

More Than 3 Ply bags, while effective for highly demanding applications, remain a niche product in the market, focusing on heavy-duty use cases that require maximum strength.

End Use Analysis

Food & Beverage dominates the Paper Bags Market with a 34.2% share in 2024 due to high demand for eco-friendly packaging.

In 2024, the Food & Beverage sector led the Paper Bags Market with a 34.2% share. This is largely driven by the growing demand for sustainable and eco-friendly packaging solutions in the food industry. As consumers continue to seek environmentally responsible packaging options, paper bags have become the go-to choice for food packaging, particularly in sectors like bakery goods, takeout, and grocery packaging.

The Agriculture sector holds a key role in the market as well, using paper bags for packaging grains, fertilizers, and other agricultural products. While its share is smaller compared to Food & Beverage, it remains an essential end-use segment due to its reliable and biodegradable nature.

Other sectors like Building & Construction, Retail, Chemicals, and Others also contribute to the market, but their shares are comparatively lower. These industries rely on paper bags for specific applications where strength, durability, and eco-friendliness are required for product packaging.

Key Market Segments

By Product Type

- Sewn Open Mouth

- Pinched Bottom Open Mouth

- Pasted Valve

- Pasted Open Mouth

- Flat Bottom

By Material Type

- Brown Kraft

- White Kraft

By Thickness

- 1 Ply

- 2 Ply

- 3 Ply

- More Than 3 Ply

By End Use

- Food & Beverage

- Agriculture

- Building & Construction

- Retail

- Agriculture

- Chemicals

- Others

Drivers

Increasing Consumer Preference for Eco-Friendly Packaging Solutions Drives Paper Bags Market Growth

The increasing consumer preference for eco-friendly packaging solutions is a major driver for the growth of the paper bags market. As more people become environmentally conscious, they are opting for sustainable alternatives to plastic packaging. Paper bags are seen as a responsible choice, as they are biodegradable and can be recycled easily. This shift in consumer preferences is pushing businesses to adopt paper bags to align with the demand for green products.

Government regulations are also a key factor influencing this trend. Governments worldwide are implementing stricter rules on plastic use and waste management. With bans on single-use plastic bags in many countries, businesses are turning to paper bags as a compliant alternative. These regulations are fostering the growth of the paper bags market by encouraging companies to adopt more sustainable packaging solutions.

Restraints

Challenges Hindering the Growth of Paper Bags Market

Despite their benefits, the paper bags market faces some challenges. One of the key restraints is the limited durability and strength of paper bags in certain applications. Paper bags are often less sturdy compared to plastic bags, especially when carrying heavy or wet items. This limitation restricts their use in specific industries, such as retail and grocery, where durability is crucial.

Another challenge is the dependency on raw materials like wood pulp for paper bag production. As demand for paper bags increases, the pressure on natural resources grows. This can lead to higher production costs and environmental concerns, which may slow down the widespread adoption of paper bags.

Growth Factors

Growth Opportunities in the Paper Bags Market

There are several growth opportunities for the paper bags market in the coming years. One of the key opportunities is the expansion of paper bag use in e-commerce packaging. With the growth of online shopping, e-commerce businesses are seeking sustainable packaging options to reduce their environmental impact. Paper bags are a perfect fit for this shift towards more eco-conscious packaging solutions.

Additionally, the rising consumer demand for biodegradable and compostable packaging options offers further growth prospects for the paper bags market. Paper bags are a great choice for consumers who prioritize sustainability, especially in industries like food and beverage packaging. The increasing integration of advanced printing and customization technologies also presents new opportunities for differentiation and branding in paper bag offerings.

Emerging Trends

Trending Factors Shaping the Future of Paper Bags Market

Several trends are shaping the future of the paper bags market. The incorporation of recycled paper in bag manufacturing is gaining momentum, as it helps reduce the environmental impact and supports the circular economy. This trend is aligned with growing consumer preferences for products made from sustainable materials.

The growth of eco-conscious packaging innovations in the retail sector is also driving the demand for paper bags. Many brands are now focusing on environmentally friendly packaging to meet customer expectations and boost their sustainability credentials. Additionally, the emergence of smart paper bags with integrated RFID technology is opening new possibilities in inventory management and product tracking.

Finally, paper bags are gaining popularity in fashion and luxury packaging. Luxury brands are increasingly adopting paper bags as part of their eco-friendly image, using high-quality materials and innovative designs to appeal to environmentally conscious consumers.

Regional Analysis

Europe Dominates the Paper Bags Market with a Market Share of 42.9%, Valued at USD 2.5 Billion

Europe holds the largest share of the paper bags market, accounting for 42.9% of the global market, valued at USD 2.5 billion. The growth in the region is primarily driven by the increasing environmental awareness and the shift towards sustainable packaging solutions. Additionally, stringent regulations in countries like Germany and the UK have further boosted the demand for paper bags as alternatives to plastic packaging.

North America Paper Bags Market Trends

The North American market is expected to experience significant growth due to the rising consumer preference for eco-friendly packaging. Growing concerns about plastic waste and the adoption of sustainability initiatives by various industries contribute to this trend. With increasing government support for sustainable alternatives, the North American paper bags market is poised for expansion in the coming years.

Asia Pacific Paper Bags Market Trends

The Asia Pacific region is witnessing rapid growth in the paper bags market, driven by the growing adoption of eco-friendly packaging solutions and increasing industrialization. Rising disposable incomes in countries like China and India, along with the increasing preference for environmentally responsible packaging, are expected to continue supporting market growth. Additionally, the region is home to a large consumer base, further enhancing the demand for paper bags.

Latin America Paper Bags Market Trends

Latin America is gradually increasing its share in the global paper bags market, primarily driven by the growing awareness about environmental sustainability. Countries like Brazil are adopting stricter regulations on plastic waste management, pushing industries toward more sustainable packaging options. The demand for paper bags is expected to rise as companies in the region explore more eco-friendly alternatives to conventional packaging solutions.

Middle East and Africa Paper Bags Market Trends

In the Middle East and Africa, the paper bags market is expanding as governments and industries embrace eco-friendly packaging solutions. With an increasing focus on reducing plastic consumption, the region is expected to witness steady growth. Rising consumer awareness about sustainability and a gradual shift toward environmentally responsible packaging are the key factors influencing the growth of the paper bags market in this region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Paper Bags Company Insights

In the global Paper Bags Market, Mondi Group stands out as a key player, leveraging its strong commitment to sustainable packaging solutions. The company focuses on providing innovative, eco-friendly products while expanding its production capacity to meet growing demand.

International Paper continues to be a dominant force, capitalizing on its extensive experience in the paper and packaging industry. With a focus on high-quality, recyclable paper bags, the company is well-positioned to cater to diverse market needs, especially in the retail and food industries.

Oji Holdings Corporation has made significant strides in the paper packaging sector, particularly in the production of paper bags for consumer goods. Their strong operational network across Asia and commitment to environmentally friendly solutions give them a competitive edge in the market.

Smurfit Kappa is renowned for its leadership in sustainable packaging and innovation. The company’s paper bags are gaining traction due to their strength and recyclability, positioning Smurfit Kappa as a crucial player in the global market, especially in the European and North American regions.

These companies, through their sustainability initiatives, innovation in design, and broad geographic reach, are driving the growth and transformation of the global Paper Bags Market in 2024.

Top Key Players in the Market

- Mondi Group

- International Paper

- Oji Holdings Corporation

- Smurfit Kappa

- Stora Enso

- DS Smith

- Novolex

- Wisconsin Converting Inc.

- Papier-Mettler

- Paperbags Ltd

- Welton Bibby & Baron

Recent Developments

- In April 2024, Inteplast Group acquired Brown Paper Goods, enhancing its position in the paper and packaging industry, with an increased focus on sustainable products.

- In April 2025, Reel Paper announced the acquisition of HoldOn Bags, further strengthening its portfolio of eco-friendly household brands and expanding its sustainability-driven offerings.

- In September 2024, Novolex acquired American Twisting, broadening its product range in the flexible packaging sector while reinforcing its commitment to high-quality, sustainable solutions.

Report Scope

Report Features Description Market Value (2024) USD 5.9 Billion Forecast Revenue (2034) USD 9.2 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Sewn Open Mouth, Pinched Bottom Open Mouth, Pasted Valve, Pasted Open Mouth, Flat Bottom), By Material Type (Brown Kraft, White Kraft), By Thickness (1 Ply, 2 Ply, 3 Ply, More Than 3 Ply), By End Use (Food & Beverage, Agriculture, Building & Construction, Retail, Agriculture, Chemicals, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Mondi Group, International Paper, Oji Holdings Corporation, Smurfit Kappa, Stora Enso, DS Smith, Novolex, Wisconsin Converting Inc., Papier-Mettler, Paperbags Ltd, Welton Bibby & Baron Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mondi Group

- International Paper

- Oji Holdings Corporation

- Smurfit Kappa

- Stora Enso

- DS Smith

- Novolex

- Wisconsin Converting Inc.

- Papier-Mettler

- Paperbags Ltd

- Welton Bibby & Baron