Global Palm Kernel Oil Market Size, Share, And Business Benefits By Product (Fractionated Palm Kernel Oil, Primary Palm Kernel Oil), By Application (Edible Oil, Cosmetics, Bio-diesel, Lubricants, Surfactants, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166686

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

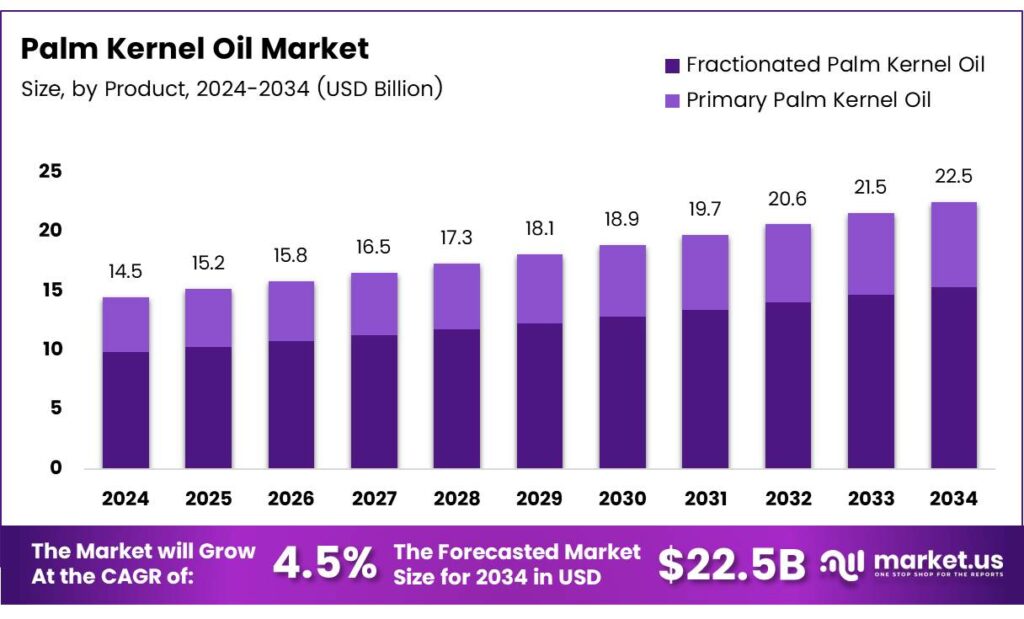

The Global Palm Kernel Oil Market size is expected to be worth around USD 22.5 billion by 2034, from USD 14.5 billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

The Palm Kernel Oil represents a dynamic segment within the global vegetable oils industry, driven by rising demand for lauric-rich oils in food, oleochemicals, and personal-care applications. The market evolves steadily as manufacturers adopt efficient extraction technologies and respond to sustainability expectations across Asia, Africa, and emerging Latin American zones. Palm kernel oil itself is a lauric-based vegetable oil obtained from the inner seed of the oil palm fruit.

It holds strong industrial relevance because its shorter-chain fatty acids enhance stability, melting behavior, and versatility across soaps, surfactants, and bakery fats. Demand continues to expand with rising consumption of plant-based formulations and specialty fats. From a processing standpoint, palm kernel oil undergoes either alkali refining or physical refining. Deodorization temperatures remain lower due to short-chain fatty acids, reaching 220 °C in alkali refining and 230–235 °C in physical refining.

- These milder conditions help maintain product quality while reducing thermally induced degradation. Production efficiency remains central to market competitiveness. Palm kernels exiting mills contain 50% oil and up to 8% moisture, requiring further size reduction to 2-mm pieces before cooking at 110–120 °C. This step lowers moisture to 2.5%, enabling high-pressure screw pressing for crude oil recovery and producing meal with 7–9% residual oil. Cold-pressing offers an alternative route, generating a meal containing 10–12% residual oil.

This flexibility supports better margins across volatile commodity cycles. Yield efficiency significantly shapes regional supply. As documented in palm agronomy references, 100 tonnes of fresh fruit bunches (FFB) generate 23 tonnes of crude palm oil and about 2.5 tonnes of palm kernel oil. Crude palm oil normally carries 4–5% FFA, though improved processing can produce oil with 2–3% FFA. Its richness in β-carotene, tocopherols, and tocotrienols enhances product value in nutrition-linked applications.

Key Takeaways

- The Global Palm Kernel Oil Market is projected to reach USD 22.5 billion by 2034, growing from USD 14.5 billion in 2024, at a steady 4.5% CAGR between 2025 and 2034.

- Fractionated Palm Kernel Oil leads the segment with a dominant 67.2% share in 2024.

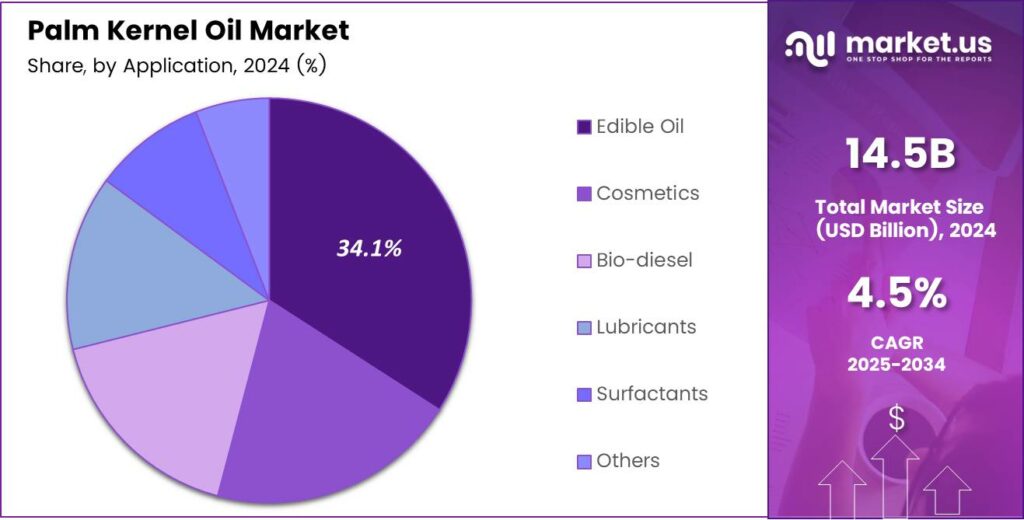

- The Edible Oil segment accounts for the largest share at 34.1%.

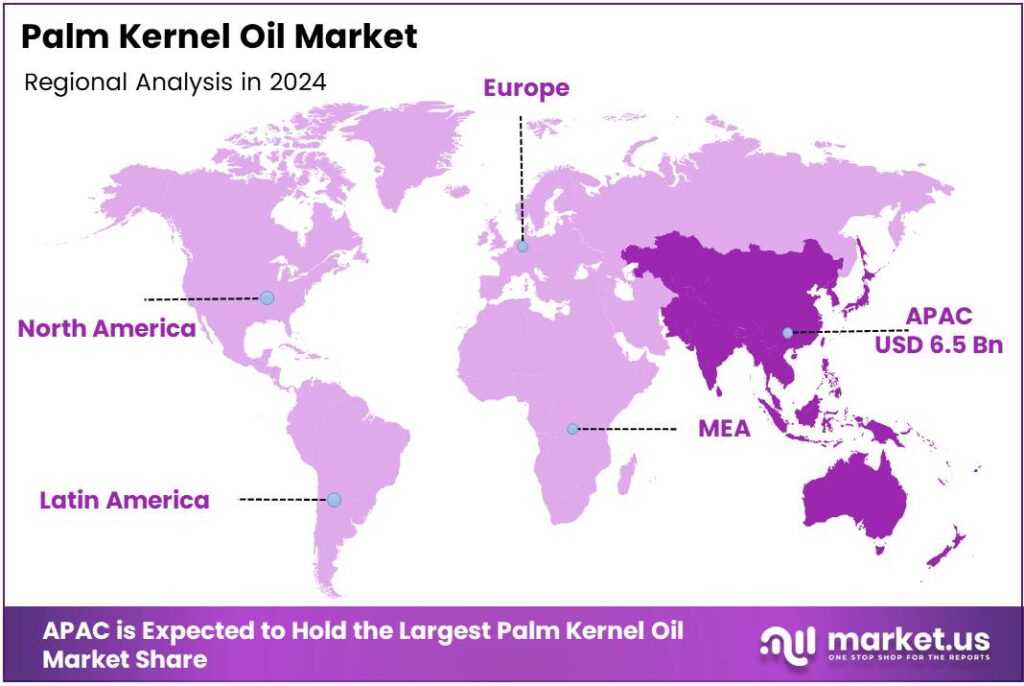

- The Asia Pacific region dominates the global landscape with a strong 45.2% share, valued at USD 6.5 billion.

By Product Analysis

Fractionated Palm Kernel Oil dominates with 67.2% due to its refined functionality and broad industrial acceptance.

In 2024, Fractionated Palm Kernel Oil held a dominant market position in the By-Product Analysis segment of the Palm Kernel Oil Market, with a 67.2% share. This grade remains widely preferred as it offers stable texture, high melting control, and better oxidative resistance, making it suitable for food, cosmetics, and pharmaceutical formulations.

The Primary Palm Kernel Oil segment continued gaining traction as manufacturers expanded processing capacities. It supports applications in confectionery, soaps, and oleochemicals due to its natural lauric content. Moreover, its cost-effectiveness encourages adoption across small and mid-scale industries seeking versatile raw materials for diversified product manufacturing.

By Application Analysis

Edible Oil dominates with 34.1% due to strong food-industry consumption and versatile cooking uses.

In 2024, Edible Oil held a dominant market position in the By Application Analysis segment of the Palm Kernel Oil Market, with a 34.1% share. Its high stability, neutral taste, and suitability for frying applications strengthened usage across household and commercial food sectors, supporting continuous product demand.

The Cosmetics segment expanded gradually as palm-derived fatty acids enriched moisturizing lotions, creams, and personal-care items. Its natural emollient properties improved texture and absorption, prompting cosmetic manufacturers to integrate palm kernel derivatives into premium and mass-market formulations.

The Bio-diesel segment advanced as industries explored alternative fuels to meet clean-energy transitions. Palm kernel oil offered a viable biodiesel feedstock, enabling enhanced blending performance. Ongoing blending mandates in several countries indirectly supported its demand, though scale variations remained region-specific.

Key Market Segments

By Product

- Fractionated Palm Kernel Oil

- Primary Palm Kernel Oil

By Application

- Edible Oil

- Cosmetics

- Bio-diesel

- Lubricants

- Surfactants

- Others

Emerging Trends

Growing Use of Plant-Based Ingredients Enhances Market Momentum

One major trending factor in the palm kernel oil market is the rising shift toward plant-based and natural ingredients. Many food, cosmetic, and personal-care brands now prefer oils that offer clean-label appeal, and palm kernel oil fits this requirement because of its stable texture and mild aroma. This trend is encouraging manufacturers to use it more frequently in processed foods, soaps, and lotions.

- The Roundtable on Sustainable Palm Oil (RSPO) reports that production of certified sustainable palm oil (which includes palm kernel oil and its derivatives) reached 13.4 million tonnes in certified supply chain operations. As a result, certified sustainable palm kernel oil is gaining popularity, pushing producers to adopt better farming practices and improve supply-chain transparency.

The rise of bio-based industrial applications is also shaping market trends. Palm kernel oil is increasingly used in bio-lubricants, biodegradable surfactants, and oleochemical products, as industries look for eco-friendly raw materials. This shift toward green alternatives is expanding the market beyond food and cosmetics.

Drivers

Rising Use of Palm Kernel Oil in Food and Personal Care Industries Drives Market Growth

The Palm Kernel Oil market is growing steadily as more food manufacturers use it in baked goods, snacks, and processed foods. Its stability during high-temperature cooking and its creamy texture make it a preferred choice for large-scale food processing. This rising industrial use continues to push overall demand upward across global markets.

In addition, the personal care and cosmetics industry is a major driver of growth. Palm kernel oil acts as a natural moisturizer, helping brands formulate soaps, lotions, and shampoos. With consumers shifting toward products containing plant-based ingredients, manufacturers increasingly rely on palm kernel oil for both quality and cost efficiency.

The biofuel sector is also contributing to the market expansion. Palm kernel oil can be converted into biodiesel, supporting energy companies seeking low-carbon alternatives. As countries strengthen policies around renewable fuels, the demand for palm-based biodiesel feedstock continues to increase.

Restraints

Environmental and Regulatory Pressures Limit Market Expansion

Environmental concerns act as one of the biggest restraints for the palm kernel oil market. Many countries are tightening rules to reduce deforestation, land misuse, and carbon emissions linked to palm plantations. These regulations increase compliance costs for producers and make expansion more difficult, especially in regions with strict sustainability laws.

Another key restraint comes from fluctuating raw material prices. Palm fruit yields depend on weather patterns, labour availability, and fertilizer costs. When plantations face poor harvest seasons, the price of palm kernel oil rises sharply. This makes it harder for manufacturers in the food, cosmetics, and industrial sectors to manage production budgets.

Competition from alternative oils further restricts growth. Coconut oil, soybean oil, and sunflower oil are widely used substitutes that attract buyers seeking stable pricing or cleaner supply chains. As more industries explore plant-based or renewable alternatives, palm kernel oil demand faces additional challenges, slowing overall market expansion.

Growth Factors

Rising Global Demand for Natural Oils Creates New Market Opportunities

Growing interest in natural and plant-based ingredients is opening strong opportunities for the palm kernel oil market. Many food and cosmetic companies are shifting toward cleaner and more sustainable inputs, and palm kernel oil fits well into this trend due to its versatility and stable performance. This shift allows producers to expand into new consumer segments and premium product lines.

- The palm oil, together with kernel oil, meets about 40% of global vegetable oil demand while occupying only about 6% of the land under oil crops. This high efficiency and high yield per hectare make PKO an attractive input for food processors seeking cost-effective and functional fats. Food-industry usage is apparent, as over 65% of the global PKO supply was consumed in food-processing industries.

Additionally, the rise of bio-based industries is creating future growth prospects. Palm kernel oil can be used to make surfactants, detergents, lubricants, and even biodiesel. As governments promote cleaner industrial inputs, companies have more room to scale production and supply specialty chemicals made from renewable feedstocks. This creates opportunities across the value chain, from plantations to chemical processors.

Regional Analysis

Asia Pacific Dominates the Palm Kernel Oil Market with a Market Share of 45.2%, Valued at USD 6.5 Billion

Asia Pacific leads the global Palm Kernel Oil market, supported by strong production bases in Southeast Asia and consistent demand from food, oleochemical, and personal care industries. The region’s large refining capacity and expanding consumer markets contributed to its dominant 45.2% share, valued at nearly USD 6.5 billion. Favorable climatic conditions and government-backed plantation programs further strengthen regional output and export competitiveness.

North America shows steady growth, driven by the rising adoption of plant-based ingredients in packaged foods and personal care formulations. Consumers’ shift toward natural oils supports consistent import demand. Additionally, expanding applications in specialty surfactants and bio-based lubricants enhance long-term market potential across the region.

Europe maintains a mature market, shaped by strong demand for sustainable and certified palm derivatives in cosmetics, detergents, and processed foods. Strict environmental regulations encourage the use of responsibly sourced palm kernel oil. Growing investments in green chemistry and bio-based manufacturing continue to support stable regional consumption.

Latin America experiences moderate growth as food processing industries integrate palm-based oils into confectionery, snacks, and specialty fats. Expanding personal care manufacturing also boosts demand. Although not a major producer, the region benefits from improving trade networks and growing consumer preference for natural and functional oil ingredients.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Golden Agri Resources Ltd. continued to strengthen its influence in the global palm kernel oil market through its extensive upstream plantations and integrated refining operations. The company’s broad supply chain allows it to maintain consistent raw-material availability, supporting stable PKO output even during fluctuating production cycles. Its focus on sustainability and operational efficiency also enhances its long-term market resilience.

Godrej Agrovet Ltd. expanded its role in the sector as part of India’s growing emphasis on domestic palm oil and kernel processing. The company benefits from strategically located mills and a rising plantation footprint, enabling it to serve local refining and downstream industries. Its diversified agribusiness model also provides risk balance against commodity volatility.

PT Astra Agro Lestari Tbk. maintained a strong competitive position through an integrated plantation-to-processing model. Its investment in kernel crushing and refining capabilities enables the company to capture higher value from the palm supply chain. Operational improvements and selective downstream expansion continue to support its market presence despite rising environmental compliance pressures.

Cargill Inc. plays a pivotal role in connecting upstream producers with food, oleochemical, and industrial buyers. Its refining expertise and broad customer networks allow it to respond quickly to shifts in demand, particularly from specialty fats and personal-care sectors. The company’s global supply chain management continues to be a major strategic strength.

Top Key Players in the Market

- Golden Agri Resources Ltd.

- Godrej Agrovet Ltd.

- PT Astra Agro Lestari Tbk.

- Cargill Inc.

- United Palm Oil Industry Public Company Ltd.

- Wilmar International Ltd.

- Sime Darby

- Kulim Bhd.

- Musim Mas Group

- Alami Group

Recent Developments

- In 2025, GAR’s net-zero roadmap for palm oil includes traceability, conservation, responsible farming, and supplier-engagement systems. GAR reported targeted capital expenditure of up to USD 350 million, mainly for replanting, expansion of downstream processing plants, and enhancement of downstream facilities, including for traceability.

- In 2025, Godrej states it is among the largest oil-palm developers in India and produces Crude Palm Oil, Crude Palm Kernel Oil, and Palm Kernel Cake from its five oil-palm mills across India. The Government of Gujarat allotted land to Godrej in Vadodara, Surat, and Tapi for oil-palm cultivation under the NMEO-OP (National Mission on Edible Oils – Oil Palm).

Report Scope

Report Features Description Market Value (2024) USD 14.5 Billion Forecast Revenue (2034) USD 22.5 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Fractionated Palm Kernel Oil, Primary Palm Kernel Oil), By Application (Edible Oil, Cosmetics, Bio-diesel, Lubricants, Surfactants, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Golden Agri Resources Ltd., Godrej Agrovet Ltd., PT Astra Agro Lestari Tbk., Cargill Inc., United Palm Oil Industry Public Company Ltd., Wilmar International Ltd., Sime Darby, Kulim Bhd., Musim Mas Group, Alami Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Palm Kernel Oil MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Palm Kernel Oil MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Golden Agri Resources Ltd.

- Godrej Agrovet Ltd.

- PT Astra Agro Lestari Tbk.

- Cargill Inc.

- United Palm Oil Industry Public Company Ltd.

- Wilmar International Ltd.

- Sime Darby

- Kulim Bhd.

- Musim Mas Group

- Alami Group