Global Painting Machines Market By Type(Paint Sprayers, Automatic Spraying Machine), By End User(Automotive, Industrial, Construction, Manufacturing, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: May 2024

- Report ID: 21695

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

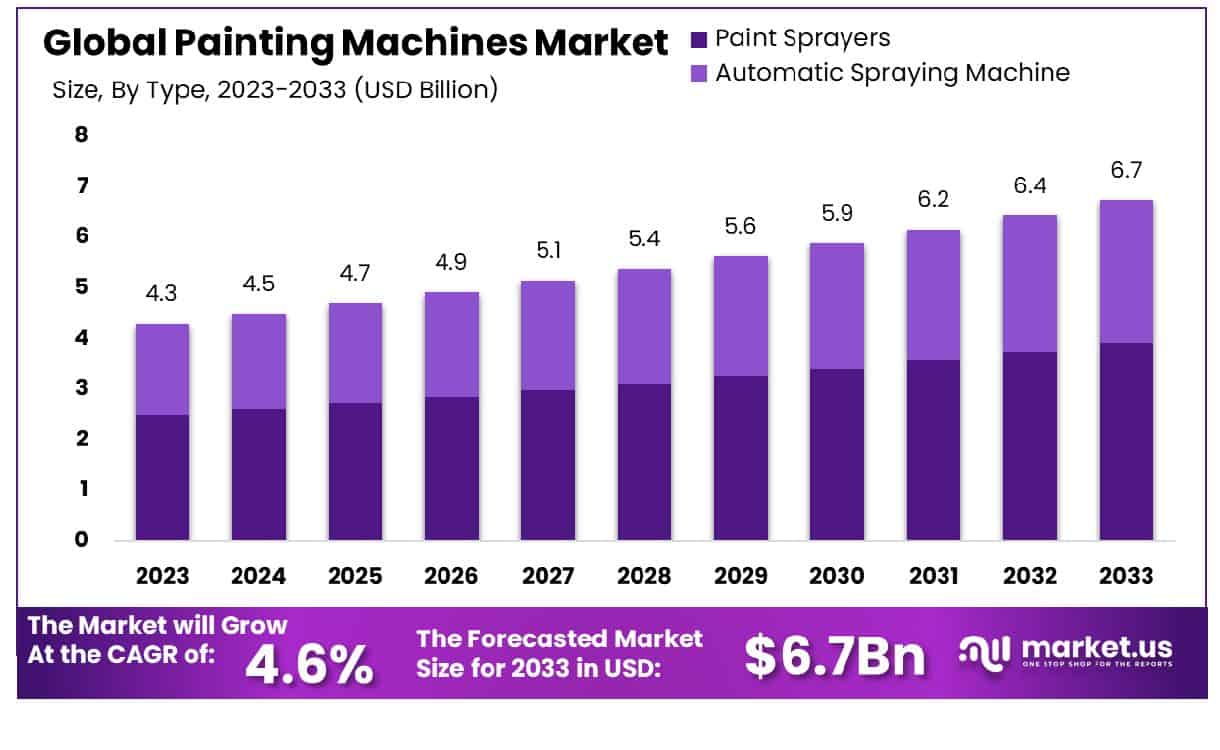

The Global Painting Machines Market size is expected to be worth around USD 6.7 Billion by 2033, From USD 4.3 Billion by 2023, growing at a CAGR of 4.60% during the forecast period from 2024 to 2033.

The Painting Machines Market encompasses automated systems designed for applying paint or coatings to various surfaces, primarily in the industrial and automotive sectors. These machines enhance productivity, ensure consistent quality, and reduce labor costs. Advanced technologies such as robotics, machine learning, and AI integration are driving innovation in this market, enabling precision and efficiency.

Key applications include automotive painting, industrial equipment coating, and consumer goods finishing. The market is characterized by increasing demand for automation, environmental regulations promoting eco-friendly coatings, and the need for high-quality, durable finishes across diverse industries.

The Painting Machines Market is poised for substantial growth, driven by advancements in automation and precision technologies. The integration of robotics, AI, and machine learning is revolutionizing the painting process, enabling superior quality and efficiency across various applications. In the industrial and automotive sectors, the demand for consistent, high-quality finishes and cost-effective production methods is accelerating the adoption of automated painting systems. This trend is further supported by stringent environmental regulations promoting eco-friendly coatings and sustainable practices.

The market’s expansion is not limited to industrial applications. The US market size for house painting and decorating contractors reached $18.6 billion in 2022, underscoring the significant demand for residential painting services. This sector is increasingly recognizing the benefits of automated painting machines for their ability to deliver consistent results and reduce labor costs. Furthermore, with 41% of individuals preferring to hire professional painters, there is a clear emphasis on expertise and efficiency, which automated systems can enhance.

Additionally, the global art auction turnover, which reached $14.9 billion in 2023 despite a 14% slowdown from the previous year, indicates sustained interest and investment in high-quality finishes and artistic coatings. This aspect of the market highlights the versatility of painting machines, which can cater to both mass production and bespoke, high-end applications.

Key Takeaways

- Market Growth: The Global Painting Machines Market size is expected to be worth around USD 6.7 Billion by 2033, From USD 4.3 Billion by 2023, growing at a CAGR of 4.60% during the forecast period from 2024 to 2033.

- Regional Dominance: In North America, the painting machines market is expected to grow by 32% due to increased demand for automated solutions.

- Segmentation Insights:

- By Type: Paint sprayers are favored for automotive applications, offering precision.

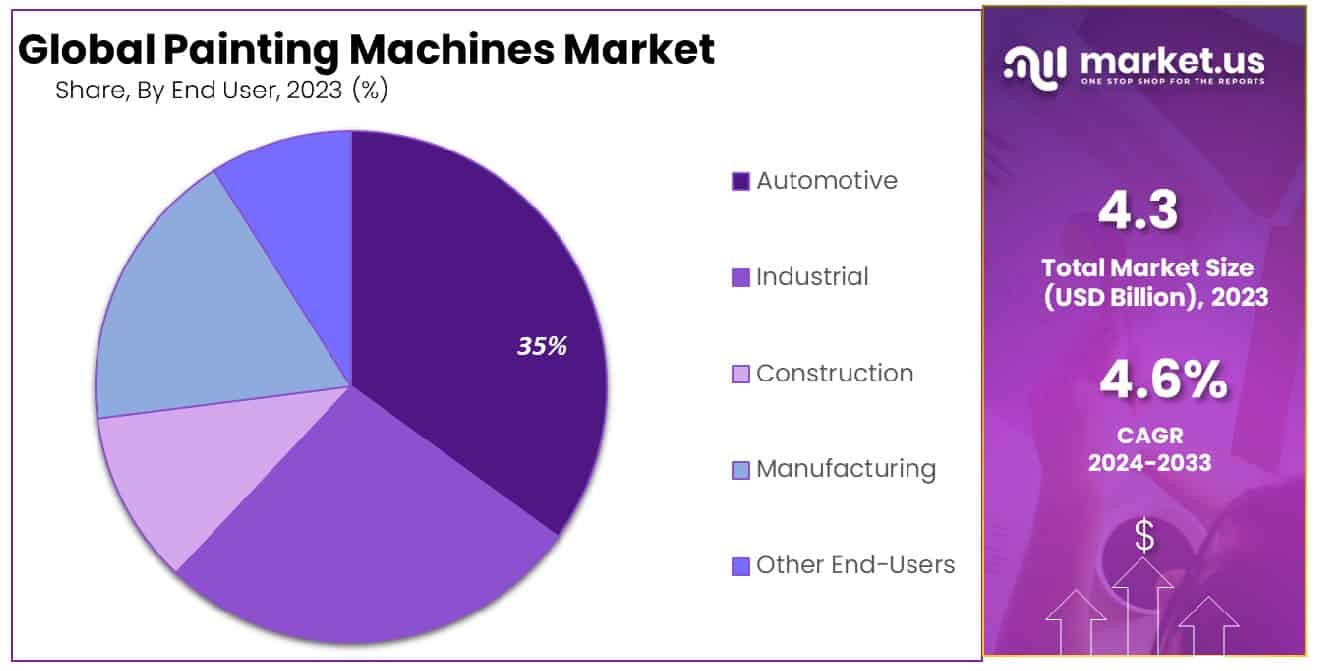

- By End User: The automotive sector accounts for 35% of paint sprayer usage.

- Growth Opportunities: In 2023, the global painting machines market saw growth opportunities driven by increasing demand for personalized printing solutions and rising e-commerce, necessitating efficient packaging solutions.

Driving Factors

Rising Necessity for Adoption of Flexible Manufacturing Practices

The increasing need for flexible manufacturing practices is significantly driving the growth of the painting machines market. As manufacturers face dynamic market demands and shorter product lifecycles, there is a critical need for adaptable production processes. Flexible manufacturing systems (FMS) enable companies to quickly adjust to changes in production volume and product type, which enhances their competitiveness.

Painting machines that are easily programmable and can handle various sizes and shapes of products without extensive reconfiguration are becoming essential in this context. This adaptability reduces downtime and increases efficiency, leading to higher productivity. The ability of painting machines to integrate with existing manufacturing lines and accommodate diverse product requirements positions them as a pivotal component in modern flexible manufacturing setups.

Growing Potential of Manufacturing Infrastructure Worldwide

The global expansion of manufacturing infrastructure is another key factor propelling the painting machines market. Emerging economies are investing heavily in industrial development, establishing new manufacturing plants, and upgrading existing facilities. According to recent data, the global manufacturing sector’s output has been steadily increasing, with significant contributions from countries like China, India, and Brazil.

This growth in manufacturing activities necessitates advanced automation solutions, including state-of-the-art painting machines. These machines enhance production efficiency, ensure high-quality finishes, and minimize waste, aligning with the increasing quality standards and output expectations of modern manufacturing infrastructure. As a result, the demand for advanced painting machines is expected to rise, supported by the robust expansion of the manufacturing sector globally.

Implementation of Government Schemes and Regulatory Frameworks for Quality Assurance

Government initiatives and regulatory frameworks aimed at ensuring quality assurance are crucial drivers of the painting machines market. Many governments are implementing stringent regulations to improve product quality and environmental standards. For instance, regulations on emissions and waste management compel manufacturers to adopt eco-friendly and efficient painting solutions.

Government schemes that offer incentives for the adoption of advanced manufacturing technologies also play a significant role. These policies encourage companies to invest in high-quality painting machines that comply with regulatory standards and contribute to sustainable manufacturing practices. The alignment of government regulations with industry needs not only ensures compliance but also promotes the adoption of innovative painting technologies, thereby driving market growth.

Restraining Factors

High Initial Investment and Maintenance Costs

The high initial investment and maintenance costs associated with painting machines are significant restraining factors impacting market growth. Advanced painting machines, particularly those equipped with cutting-edge technologies and automation capabilities, require substantial capital outlay. The initial investment includes not only the purchase price but also costs related to installation, integration with existing manufacturing systems, and operator training.

Additionally, the sophisticated nature of these machines demands regular maintenance and occasional upgrades, which further escalates the total cost of ownership. For many small and medium-sized enterprises (SMEs), these financial burdens are prohibitive, limiting their ability to adopt advanced painting solutions. Consequently, the market growth is hindered as potential buyers are deterred by the high upfront and ongoing expenses, slowing the overall adoption rate of painting machines.

Lack of Skilled Labor and Technical Expertise

The shortage of skilled labor and technical expertise poses another significant challenge to the growth of the painting machine market. Operating and maintaining advanced painting machines require specialized knowledge and skills. However, there is a notable gap in the availability of trained personnel capable of handling these sophisticated systems. According to industry reports, a considerable portion of the workforce lacks the necessary technical proficiency, which impedes the efficient utilization of printing machines.

This skills gap not only affects the operational efficiency of manufacturing processes but also increases the risk of errors and downtime. Manufacturers are often compelled to invest additional resources in training programs, which adds to their operational costs and further exacerbates the challenge posed by high initial investments. The combined effect of high costs and the skills shortage creates a significant barrier to market growth, as companies struggle to maximize the potential benefits of advanced painting technologies.

By Type Analysis

Paint sprayers dominate the market, driven by efficiency and precision in coating applications.

In 2023, paint sprayers held a dominant market position in the “By Type” segment of the painting machines market. This segment is primarily driven by the efficiency and precision offered by paint sprayers in various industrial and commercial applications. The increased demand for automation in painting processes, particularly in the automotive and construction industries, has significantly bolstered the adoption of paint sprayers. These machines enable a uniform and high-quality finish, reducing labor costs and time associated with manual painting.

Paint sprayers are further categorized into different types, including airless sprayers, HVLP (High Volume Low Pressure) sprayers, and compressed air sprayers. Among these, airless sprayers are the most widely used due to their ability to handle a variety of coatings and deliver a consistent finish. The versatility and adaptability of paint sprayers make them suitable for both small-scale and large-scale projects, contributing to their widespread adoption.

Additionally, the market for automatic spraying machines has also seen significant growth. Automatic spraying machines are extensively utilized in industries where precision and consistency are paramount, such as in the manufacturing of electronics, furniture, and automotive components. These machines are equipped with advanced technologies, including robotic arms and programmable control systems, which enhance their accuracy and efficiency. The integration of IoT (Internet of Things) and AI (Artificial Intelligence) technologies in automatic spraying machines has further propelled their demand, as these advancements enable real-time monitoring and optimization of the spraying process.

The growing emphasis on improving operational efficiency and product quality in various industries is expected to sustain the demand for paint sprayers and automatic spraying machines. As companies continue to invest in advanced painting technologies, the “By Type” segment of the painting machines market is poised for substantial growth in the coming years.

By End User Analysis

Within automotive sectors, they hold a substantial share, constituting approximately 35% of the market.

In 2023, the automotive sector held a dominant market position in the “By End User” segment of the painting machines market, capturing more than a 35% share. The substantial demand for high-quality finishes and coatings in automotive manufacturing and repair has significantly contributed to this dominance. The automotive industry’s focus on enhancing vehicle aesthetics and durability has led to the increased adoption of advanced painting machines, which provide precision and efficiency in coating applications.

The industrial sector also represents a significant portion of the painting machines market. This sector benefits from the deployment of painting machines for machinery, equipment, and infrastructure, where uniform and durable coatings are essential. Automated painting solutions in the industrial segment help improve productivity and ensure consistent quality, driving their market penetration.

In the construction industry, painting machines are extensively used for both residential and commercial projects. The demand for aesthetic appeal and protective coatings in buildings has spurred the adoption of painting machines. These machines are particularly valued for their ability to apply coatings efficiently over large surfaces, reducing labor costs and time.

The manufacturing sector, encompassing a diverse range of products such as electronics, furniture, and consumer goods, has also shown significant utilization of painting machines. The need for precision and high-quality finishes in manufacturing processes drives the adoption of advanced printing technologies. Automatic spraying machines equipped with robotic arms and programmable systems are increasingly favored for their accuracy and ability to handle complex tasks.

Other end-users, including the aerospace, marine, and energy sectors, contribute to the painting machines market. These industries require specialized coatings for durability and protection against harsh environments, further driving the demand for advanced painting solutions.

Overall, the dominance of the automotive sector in the “By End User” segment highlights the critical role of painting machines in achieving superior quality and efficiency across various industries. The continued advancements in painting technologies are expected to further enhance their adoption in the coming years.

Key Market Segments

By Type

- Paint Sprayers

- Automatic Spraying Machine

By End User

- Automotive

- Industrial

- Construction

- Manufacturing

- Other End-Users

Growth Opportunities

Growing Demand for Personalized and Customized Printing Solutions

The global painting machines market witnessed a significant surge in demand in 2023, primarily fueled by the escalating need for personalized and customized printing solutions. As consumers increasingly seek unique and tailor-made products, manufacturers are under pressure to deliver highly customized items efficiently and cost-effectively. This trend has propelled the adoption of advanced painting machines capable of producing intricate designs and patterns with precision.

Industries such as textiles, automotive, and consumer goods have been at the forefront of embracing these technologies to meet evolving consumer preferences. Furthermore, the integration of digital printing technologies with painting machines has expanded the scope of customization, allowing for on-demand production and rapid prototyping. This convergence of traditional manufacturing processes with digital innovation has unlocked new avenues for growth and differentiation in the painting machines market.

Rising Popularity of Online Shopping Leading to Higher Demand for Packaging and Labeling Solutions

In tandem with the exponential growth of e-commerce, the global painting machines market experienced a surge in demand for packaging and labeling solutions in 2023. The shift towards online shopping has necessitated efficient packaging processes to meet the escalating volume of orders and ensure timely delivery to consumers. Painting machines equipped with advanced labeling and packaging capabilities have emerged as indispensable assets for e-commerce companies seeking to streamline their operations and enhance brand visibility.

Moreover, the growing emphasis on sustainable packaging solutions has driven the adoption of eco-friendly painting machines that minimize environmental impact without compromising performance. This trend is expected to persist as companies strive to align with evolving consumer preferences and regulatory mandates regarding sustainable practices in packaging.

Latest Trends

Surge in Demand Driven by Widespread Use of Plastic Film and Foil

The year 2023 witnessed a notable surge in demand for painting machines globally, largely propelled by the widespread adoption of plastic film and foil across various industries such as packaging and labeling. The growing preference for plastic materials stems from their versatility, durability, and cost-effectiveness, driving manufacturers to invest in advanced painting technologies to ensure superior surface finish and product aesthetics.

As industries continue to transition towards sustainable packaging solutions, painting machines play a pivotal role in enhancing the visual appeal and functionality of plastic-based products, thereby driving market growth.

Adoption of Innovative Technologies like Robotics and AI-Driven Systems

The global painting machines market experienced a paradigm shift in 2023 with the increasing adoption of innovative technologies such as robotics and AI-driven systems. Manufacturers across industries recognized the potential of automation in optimizing painting processes, improving efficiency, and reducing operational costs. Robotics-enabled painting machines offer precision, consistency, and flexibility, allowing for intricate designs and customized coatings.

Furthermore, AI-driven systems enable predictive maintenance, real-time monitoring, and adaptive control, enhancing overall productivity and quality assurance. As companies prioritize digital transformation and Industry 4.0 initiatives, the integration of robotics and AI in painting machines emerges as a key trend driving market evolution in 2023.

Regional Analysis

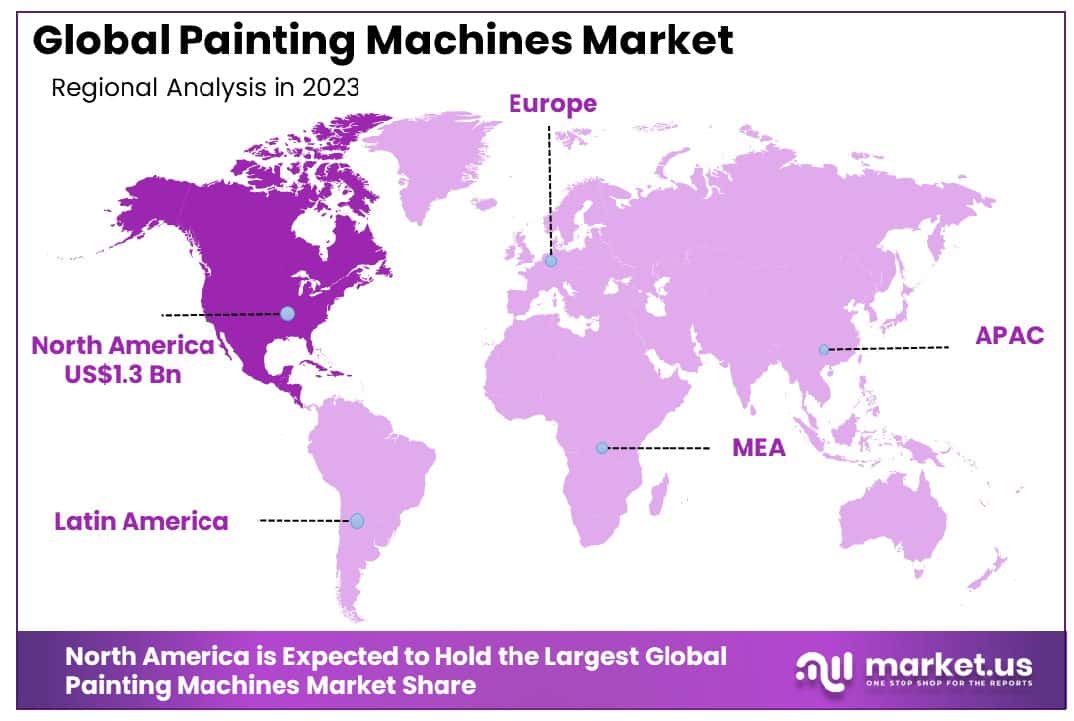

In North America, the painting machines market is projected to grow by 32% in 2024.

The global painting machines market demonstrates a diverse landscape across regions, each exhibiting unique dynamics driven by factors such as technological advancements, industrialization levels, and infrastructure development.

In North America, the painting machines market commands a significant share, capturing approximately 32% of the global market. The region’s dominance can be attributed to the robust presence of key industries such as automotive, aerospace, and construction, which extensively utilize painting machines for surface finishing applications. Moreover, stringent regulations pertaining to environmental sustainability and quality control drive the adoption of advanced painting technologies, bolstering market growth.

According to recent industry reports, the automotive sector in North America witnessed steady growth, with a notable increase in vehicle production, thereby amplifying the demand for painting machines. Additionally, the presence of major players in the region, coupled with ongoing investments in research and development initiatives, further accentuates market expansion prospects.

In Europe, the painting machines market exhibits resilience, buoyed by a mature industrial landscape and a strong emphasis on automation across various sectors. With a focus on enhancing operational efficiency and reducing production costs, manufacturers in Europe increasingly deploy painting machines to streamline coating processes and ensure superior finish quality. According to industry insights, the automotive industry in Europe remains a key contributor to market growth, driven by the region’s reputation for innovation and high-quality manufacturing standards.

Additionally, stringent regulatory frameworks aimed at promoting eco-friendly practices and reducing VOC emissions fuel the adoption of advanced painting technologies, propelling market advancement. Furthermore, the presence of established market players and strategic collaborations with technology providers bolster the competitive landscape in Europe, fostering sustained market expansion.

Overall, while North America maintains its dominance with a 32% market share, Europe emerges as a formidable contender in the global printing machines market, driven by technological innovation and stringent regulatory frameworks. These regions, along with burgeoning markets in Asia Pacific and Latin America, collectively shape the trajectory of the painting machines market, offering lucrative opportunities for industry stakeholders.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2023, the global painting machines market showcased notable dynamism, propelled by innovative technologies and a burgeoning demand for automated solutions across various industries. Among the key players driving this landscape were stalwarts such as J. Wagner GmbH, Graco Inc., Exel Industries Société Anonyme, Cefla s.c., ABB Ltd., Dürr Group, Eisenmann LacTec GmbH, RIGO S.R.L., and SPMA.

J. Wagner GmbH, renowned for its cutting-edge coating technologies, continued to assert its dominance by offering high-performance painting machines tailored to diverse applications. Graco Inc. stood out for its unwavering commitment to product innovation and customer-centric solutions, solidifying its position as a market leader.

Exel Industries Société Anonyme maintained its competitive edge through strategic acquisitions and a comprehensive product portfolio catering to both industrial and agricultural sectors. Cefla s.c., with its focus on sustainability and efficiency, witnessed significant traction, particularly in the woodworking and automotive segments.

ABB Ltd.’s expertise in robotics and automation brought forth groundbreaking solutions, enhancing productivity and precision in painting operations. The Dürr Group’s holistic approach to surface finishing, coupled with its advanced digitalization initiatives, underscored its significance in the market.

Eisenmann LacTec GmbH, RIGO S.R.L., and SPMA demonstrated resilience and adaptability, catering to evolving industry needs with their innovative offerings and commitment to quality.

Market Key Players

- J. Wagner GmbH

- Graco Inc.

- Exel Industries Société Anonyme

- Cefla s.c.

- ABB Ltd.

- Dürr Group

- Eisenmann LacTec GmbH

- RIGO S.R.L.

- SPMA

Recent Development

- In May 2024, Renowned Ukrainian artist, Aram Manukyan, presents rescued artworks and hosts a live painting masterclass at Wirral Met College, funded by Liverpool City Region’s Test and Learn program. Integration of creativity in education enhances community engagement.

- In May 2024, PPG Industries introduces innovative digital paint mixing tools like PPG MoonWalk® and PPG LINQ™ ecosystem, enhancing color-matching accuracy and shop efficiency. Over 2,000 shops globally benefit from the automated system.

- In April 2024, Yanmar CE embraces customer-centricity with a shift to Premium Red machinery, reflecting a broader transformation in branding and business approach. Focused on holistic solutions, they prioritize partnerships for mutual growth.

Report Scope

Report Features Description Market Value (2023) USD 4.3 Billion Forecast Revenue (2033) USD 6.7 Billion CAGR (2024-2033) 4.60% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Paint Sprayers, Automatic Spraying Machine), By End User(Automotive, Industrial, Construction, Manufacturing, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape J. Wagner GmbH, Graco Inc., Exel Industries Société Anonyme, Cefla s.c., ABB Ltd., Dürr Group, Eisenmann LacTec GmbH, RIGO S.R.L., SPMA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Painting Machines Market Size in 2023?The Global Painting Machines Market Size is USD 4.3 Billion in 2023.

What is the projected CAGR at which the Global Painting Machines Market is expected to grow at?The Global Painting Machines Market is expected to grow at a CAGR of 4.60% (2024-2033).

List the key industry players of the Global Painting Machines Market?J. Wagner GmbH, Graco Inc., Exel Industries Société Anonyme, Cefla s.c., ABB Ltd., Dürr Group, Eisenmann LacTec GmbH, RIGO S.R.L., SPMA

Name the key areas of business for Global Painting Machines Market?The US, Canada, Mexico are leading key areas of operation for Global Painting Machines Market.

List the segments encompassed in this report on the Global Painting Machines Market?Market.US has segmented the Global Painting Machines Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type(Paint Sprayers, Automatic Spraying Machine), By End User(Automotive, Industrial, Construction, Manufacturing, Other End-Users)

-

-

- J. Wagner GmbH

- Graco Inc.

- Exel Industries Société Anonyme

- Cefla s.c.

- ABB Ltd.

- Dürr Group

- Eisenmann LacTec GmbH

- RIGO S.R.L.

- SPMA