Global Packaged Salad Market Size, Share, Growth Analysis By Product (Vegetarian, Non-Vegetarian), By Processing (Organic, Conventional), By Type (Packaged Greens, Packaged Kits), By Distribution Channel (Offline, Online) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157688

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

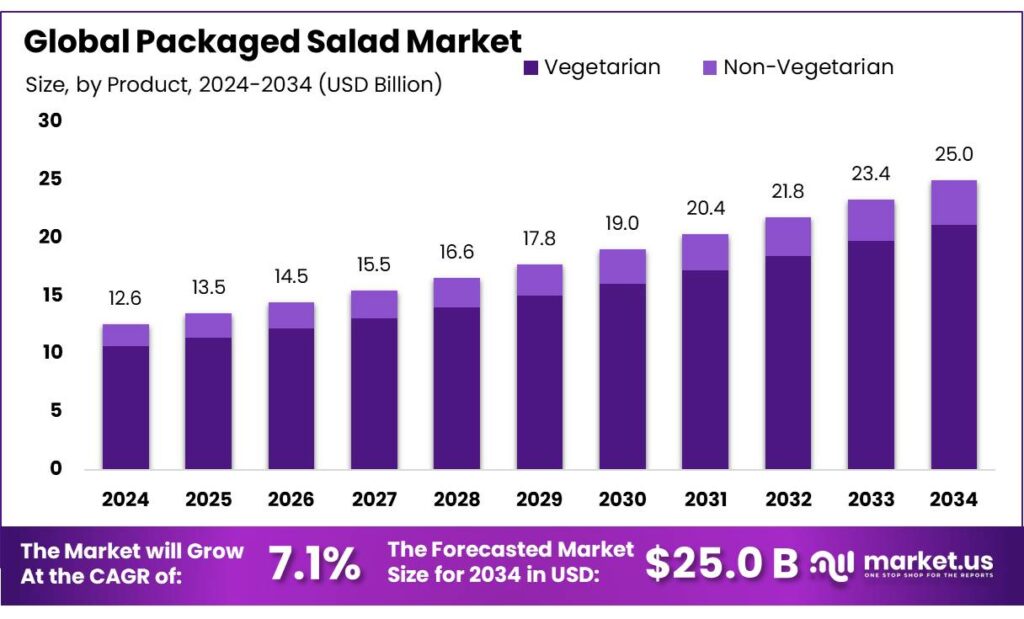

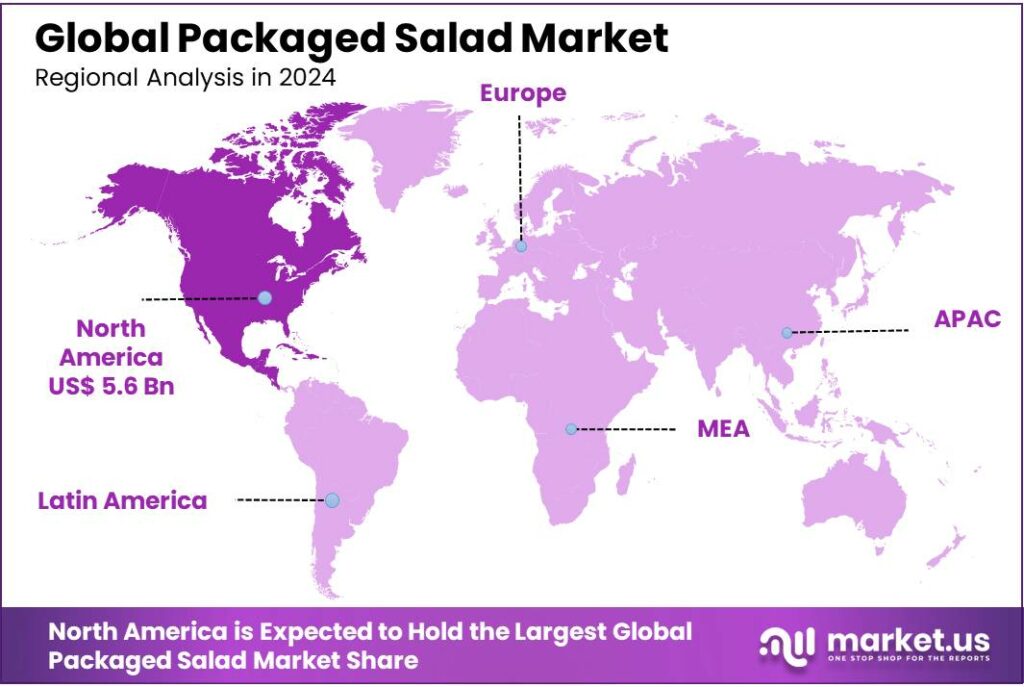

The Global Packaged Salad Market size is expected to be worth around USD 25.0 Billion by 2034, from USD 12.6 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 44.8% share, holding USD 5.6 Billion in revenue.

The packaged salad industry is experiencing significant growth, driven by the increasing demand for pre-washed and pre-cut vegetables that significantly reduce preparation time. This shift towards healthier eating, coupled with the growing popularity of plant-based diets, has led to higher salad consumption, particularly among younger generations who prioritize convenience and health.

- According to the U.S. Department of Agriculture (USDA), fresh vegetable consumption in the U.S. increased by 15.5% between 2015 and 2020, underscoring the rise in demand for fresh produce, which in turn supports the growth of packaged salads that offer a convenient way for consumers to access these healthy foods.

Government initiatives aimed at promoting healthy eating have also played a key role in bolstering the packaged salad market. For example, India’s Midday Meal Scheme (PM-POSHAN) provides free lunches to over 120 million children in government schools, emphasizing the importance of balanced nutrition from an early age.

In addition to these initiatives, the Indian government’s push for organic farming has further supported the packaged salad industry. By offering subsidies and simplifying certification processes, the government has encouraged the cultivation of organic vegetables, which are increasingly important in the packaged salad market. For instance, Sikkim has achieved 98% organic coverage of its net sown area, setting a benchmark for organic farming in the country. This growing organic supply base further supports the demand for fresh, healthy salads.

In the United States, government programs such as the Agricultural Marketing Service (AMS) provide regular updates on the retail prices of specialty crops, including packaged salads. The AMS’s National Retail Report – Specialty Crops recently showed a 27% decrease in the average price of packaged salads (10–12 oz), reflecting the impact of market dynamics and changing consumer demand. As packaged salads become more affordable, they are likely to attract a larger consumer base.

According to the U.S. Environmental Protection Agency (EPA), packaging waste in the U.S. accounts for approximately 23% of total waste generated, prompting many brands to adopt eco-friendly packaging practices. This shift towards sustainability is expected to accelerate the adoption of packaged salads, as consumers increasingly seek products that align with their environmental values.

Key Takeaways

- Packaged Salad Market size is expected to be worth around USD 25.0 Billion by 2034, from USD 12.6 Billion in 2024, growing at a CAGR of 7.1%.

- Vegetarian segment dominated the packaged salad market, capturing more than an 84.6% share.

- Conventional processing dominated the packaged salad market, capturing more than a 79.4% share.

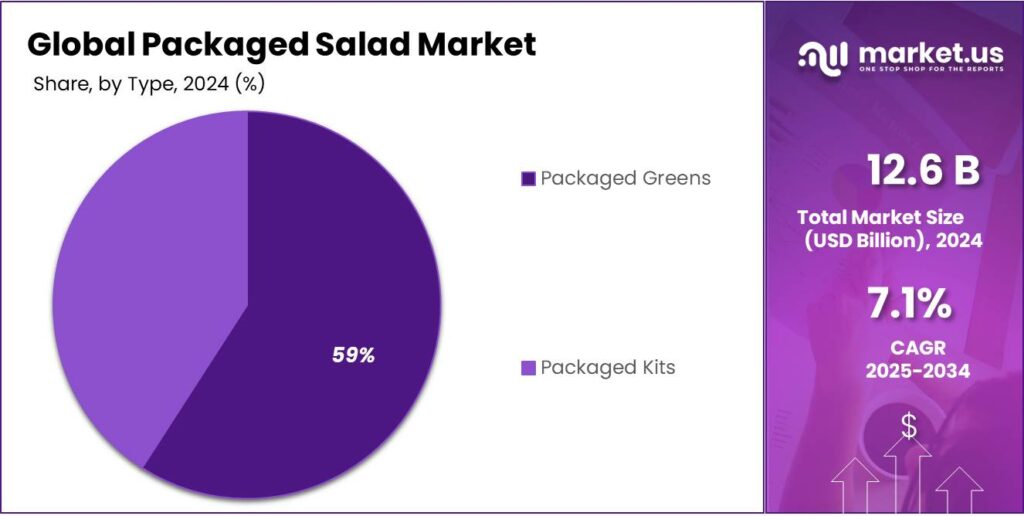

- Packaged Greens held a dominant market position, capturing more than a 59.3% share.

- Offline held a dominant market position, capturing more than a 79.8% share of the packaged salad market.

- North America led the global packaged salad market, commanding a substantial 44.8% share, equivalent to approximately USD 5.6 billion in revenue.

By Product Analysis

Vegetarian Packaged Salads Lead the Market with Over 84.6% Share in 2024

In 2024, the vegetarian segment dominated the packaged salad market, capturing more than an 84.6% share. This significant market presence is attributed to the growing consumer preference for plant-based diets, driven by health consciousness, environmental concerns, and the increasing adoption of vegetarian and vegan lifestyles. The availability of convenient, ready-to-eat vegetarian salad options has further fueled this trend, making it the preferred choice among health-conscious consumers.

The dominance of vegetarian packaged salads is also supported by their versatility and appeal to a broad consumer base. These salads typically feature a variety of fresh vegetables and greens, offering a rich source of essential vitamins, minerals, and fiber. The emphasis on clean-label ingredients and the absence of animal products make them an attractive option for individuals with dietary restrictions or those seeking to reduce their environmental footprint.

By Processing Analysis

Conventional Processing in Packaged Salads Holds Over 79.4% Market Share in 2024

In 2024, conventional processing dominated the packaged salad market, capturing more than a 79.4% share. This significant market presence is attributed to the cost-effectiveness and widespread availability of conventionally processed salads. Conventional processing methods, which include the use of synthetic pesticides and fertilizers, are generally more affordable compared to organic alternatives. This affordability makes packaged salads accessible to a broader consumer base, contributing to their dominance in the market.

The preference for conventionally processed packaged salads is also driven by their longer shelf life and robust supply chains. These salads can withstand transportation and storage conditions better than organic salads, reducing spoilage and waste. As a result, retailers and consumers alike favor conventional salads for their reliability and convenience.

By Type Analysis

Packaged Greens Lead the Market with a 59.3% Share in 2024

In 2024, Packaged Greens held a dominant market position, capturing more than a 59.3% share. This segment’s strong performance is largely due to the growing consumer demand for fresh, healthy, and ready-to-eat greens. Packaged greens, such as lettuce, spinach, and kale, are increasingly popular for their convenience and nutritional benefits. They offer consumers a quick, hassle-free way to incorporate leafy vegetables into their diets without the need for washing, cutting, or preparation.

The rise of health-conscious eating and the shift towards plant-based diets have contributed to the steady growth of packaged greens. As people become more aware of the importance of leafy greens in promoting overall health, the demand for these products has surged. Packaged greens cater to busy urban lifestyles, offering a convenient option for consumers who want fresh, nutritious food but don’t have the time to prepare it themselves. Additionally, these products are favored for their versatility, as they can be used in salads, sandwiches, wraps, and other dishes.

By Distribution Channel Analysis

Offline Distribution Dominates with 79.8% Market Share in 2024

In 2024, Offline held a dominant market position, capturing more than a 79.8% share of the packaged salad market. This significant market share reflects the continued strength of traditional retail channels, such as supermarkets, hypermarkets, and local grocery stores, which remain the primary points of sale for packaged salads. Consumers continue to prefer purchasing their food in-person, where they can inspect the freshness and quality of the products before making a purchase.

The Offline distribution channel has benefitted from well-established supply chains and the widespread availability of packaged salads in physical retail outlets. Consumers often visit brick-and-mortar stores for their grocery shopping, making it easier for them to purchase packaged salads alongside other food items. The trust in the product quality and the convenience of immediate availability have made offline purchases the go-to option for many consumers.

Key Market Segments

By Product

- Vegetarian

- Non-Vegetarian

By Processing

- Organic

- Conventional

By Type

- Packaged Greens

- Packaged Kits

By Distribution Channel

- Offline

- Online

Emerging Trends

Surge in Plant-Based and Natural Food Labels

A significant trend in the packaged salad industry is the growing consumer preference for plant-based and “natural” labeled products. This shift reflects a broader movement towards healthier eating habits, with consumers increasingly seeking foods that are perceived as more wholesome and environmentally friendly.

- According to a report by the USDA’s Economic Research Service, in 2018, 16.3% of retail food expenditures and 16.9% of all items purchased were for foods labeled as “natural.” While the term “natural” is not strictly defined by federal regulations, it is often associated with foods that are minimally processed and free from artificial ingredients, which aligns with the characteristics of many packaged salads.

This preference for natural labeling is not limited to the United States. In India, the demand for organic and natural food products is also on the rise. The Food Processing Ingredients Annual report by the USDA highlights that India’s food processing sector is experiencing growth, with increasing consumer interest in healthy snacking and natural food products. This presents an opportunity for the packaged salad industry to expand its offerings to meet the growing demand for natural and organic products.

Government initiatives are also supporting this trend. In the United States, the USDA’s Food and Nutrition Service develops dietary guidance and promotes healthier dietary behaviors based on the latest scientific research. These efforts aim to encourage consumers to make healthier food choices, which includes increasing the consumption of natural and plant-based foods.

Drivers

Increased Consumer Demand for Convenience and Health

One of the major driving factors for the packaged salad market is the increasing consumer demand for convenience coupled with a growing focus on health. In today’s fast-paced world, many consumers are looking for quick and easy meal options that don’t compromise on nutritional value. Packaged salads offer a convenient solution by providing pre-washed, pre-cut vegetables that are ready to eat, saving consumers significant time and effort in meal preparation.

- According to the U.S. Department of Agriculture (USDA), Americans have been consuming more vegetables over the past few years. Between 2015 and 2020, fresh vegetable consumption in the U.S. increased by 15.5%, signaling a shift towards healthier eating habits. This trend is not only reflected in the U.S. but also in many other developed countries where convenience, health, and sustainability are becoming important factors in food choices.

The convenience of packaged salads is also being bolstered by an increase in working professionals and busy lifestyles. Many consumers are looking for ready-to-eat meals that require minimal preparation and offer nutritional benefits. Packaged salads cater to this demand by providing a quick, easy, and healthy meal option that can be consumed on-the-go or as part of a meal at home. According to a study by the Food Marketing Institute (FMI), 48% of consumers report purchasing pre-packaged salads due to the convenience factor, particularly as an on-the-go snack or part of a quick meal.

Restraints

Concerns Over Packaging and Food Waste

One of the major restraining factors for the packaged salad industry is the growing concern over packaging waste and its environmental impact. While the convenience of pre-washed and pre-cut salads is appealing to consumers, the packaging materials used—often plastic—pose significant challenges for sustainability. As awareness about the environmental impact of plastic waste increases, many consumers and industry stakeholders are calling for more sustainable packaging solutions.

- According to the U.S. Environmental Protection Agency (EPA), packaging waste accounts for approximately 23% of the total waste generated in the U.S. alone. This highlights a critical issue that the packaged salad industry must address in order to align with the broader movement towards sustainability and waste reduction.

Government regulations and initiatives aimed at reducing packaging waste are also creating challenges for the packaged salad industry. In 2018, the European Union introduced new guidelines aimed at reducing single-use plastics, including regulations to ban plastic packaging for fruits and vegetables in some countries by 2025. These regulations are expected to influence the packaging of packaged salads, pushing manufacturers to invest in alternative packaging materials.

Similarly, in the U.S., several states, such as California, have begun implementing their own restrictions on plastic packaging, with California’s state legislature passing a law in 2022 that mandates a reduction in plastic waste by 25% by 2030. These regulations are a response to growing concerns about plastic pollution and are pushing food companies, including packaged salad producers, to adopt more sustainable practices.

Opportunity

Expansion of Organic Farming and Sustainable Practices

A significant growth opportunity for the packaged salad industry lies in the expansion of organic farming and the adoption of sustainable agricultural practices. As consumers become more health-conscious and environmentally aware, there is a growing demand for fresh, organic produce. This shift in consumer preferences presents an opportunity for the packaged salad sector to align with these trends by sourcing ingredients from organic farms and promoting sustainability throughout the supply chain.

In India, the government has implemented various initiatives to promote organic farming. The Paramparagat Krishi Vikas Yojana (PKVY) offers financial assistance to farmers adopting organic farming practices. Under this scheme, farmers receive support for organic inputs, certification, and capacity building. Additionally, the Mission Organic Value Chain Development for North Eastern Region (MOVCDNER) focuses on developing organic value chains in the northeastern states, providing subsidies for infrastructure development and organic certification.

The success of organic farming in states like Sikkim, which has achieved 98% organic coverage of its net sown area, demonstrates the viability and benefits of such practices. This success not only contributes to environmental sustainability but also enhances the quality and appeal of produce, aligning with consumer demand for healthier food options.

Regional Insights

North America Dominates the Packaged Salad Market with 44.8% Share, Valued at USD 5.6 Billion in 2024

In 2024, North America led the global packaged salad market, commanding a substantial 44.8% share, equivalent to approximately USD 5.6 billion in revenue. This dominance is primarily driven by the United States, which alone accounted for over 1.2 million metric tons of consumption in 2024. The region’s robust infrastructure, including advanced cold chain logistics and widespread retail networks, facilitates the efficient distribution and availability of packaged salads. Additionally, the prevalence of dual-income households and a growing health-conscious consumer base have significantly contributed to the increased demand for convenient, ready-to-eat salad options.

Canada also plays a pivotal role in this market, with a notable 13% year-over-year growth in organic salad consumption. The country’s emphasis on sustainable farming practices and local sourcing aligns with the rising consumer preference for organic and ethically produced food items. Furthermore, innovations in vertical farming and controlled-environment agriculture have enhanced the consistency and freshness of packaged salads, reducing spoilage rates by approximately 19%.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BrightFarms is a leading provider of locally grown, pesticide-free salad greens, operating hydroponic greenhouse farms near supermarkets to reduce transportation time and environmental impact. Their greens are delivered fresh to local grocers, ensuring long shelf life and minimal waste. Recognized for their innovative approach, BrightFarms was named #571 on the Inc. 5000 list of the fastest-growing private companies in 2018.

Fresh Express, a subsidiary of Chiquita Brands International, pioneered the ready-to-eat salad category and continues to be a market leader in value-added salads. The company produces nearly 40 million pounds of salad each month, with over 20 million servings consumed weekly. Fresh Express is known for its patented Keep-Crisp® breathable bag technology, which helps maintain the freshness of its salads without preservatives.

Earthbound Farm is the largest producer of organic salads in the United States, having pioneered prewashed, packaged salad greens on an industrial scale in 1986. The company operates over 50,000 acres of certified organic farmland, offering a variety of fresh, organic greens and vegetables. Earthbound Farm is committed to sustainability and regenerative farming practices, aiming to shape a resilient future for agriculture.

Top Key Players Outlook

- Bondvelle

- Brightfarms Inc.

- Dolle Food Company Inc.

- Fresh Express, Incorporated

- Earthbound Farm

- Mann Packing Co., Inc.

- Misionero

- Eat Smart

- Gotham Greens

Recent Industry Developments

In May 2024, Earthbound Farm introduced a line of organic salad kits featuring dressings made with 100% organic avocado oil, celebrating its 40th anniversary and honoring its original salad packaging.

In 2024, Fresh Express expanded its product line with the introduction of Hot or Cold Salad and Noodle Meal Kits, retailing at $5.99, which combine fresh vegetables, pre-cooked noodles, and gourmet dressings for versatile meal options.

Report Scope

Report Features Description Market Value (2024) USD 12.6 Bn Forecast Revenue (2034) USD 25.0 Bn CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Vegetarian, Non-Vegetarian), By Processing (Organic, Conventional), By Type (Packaged Greens, Packaged Kits), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bondvelle, Brightfarms Inc., Dolle Food Company Inc., Fresh Express, Incorporated, Earthbound Farm, Mann Packing Co., Inc., Misionero, Eat Smart, Gotham Greens Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bondvelle

- Brightfarms Inc.

- Dolle Food Company Inc.

- Fresh Express, Incorporated

- Earthbound Farm

- Mann Packing Co., Inc.

- Misionero

- Eat Smart

- Gotham Greens