Global Overprint Varnish Market Type(UV curable Overprint Varnish, Water-based Overprint Varnish, Solvent-based Overprint Varnish), Application(Commercial prints, Labels, Pharmaceuticals, Packaging), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 31555

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

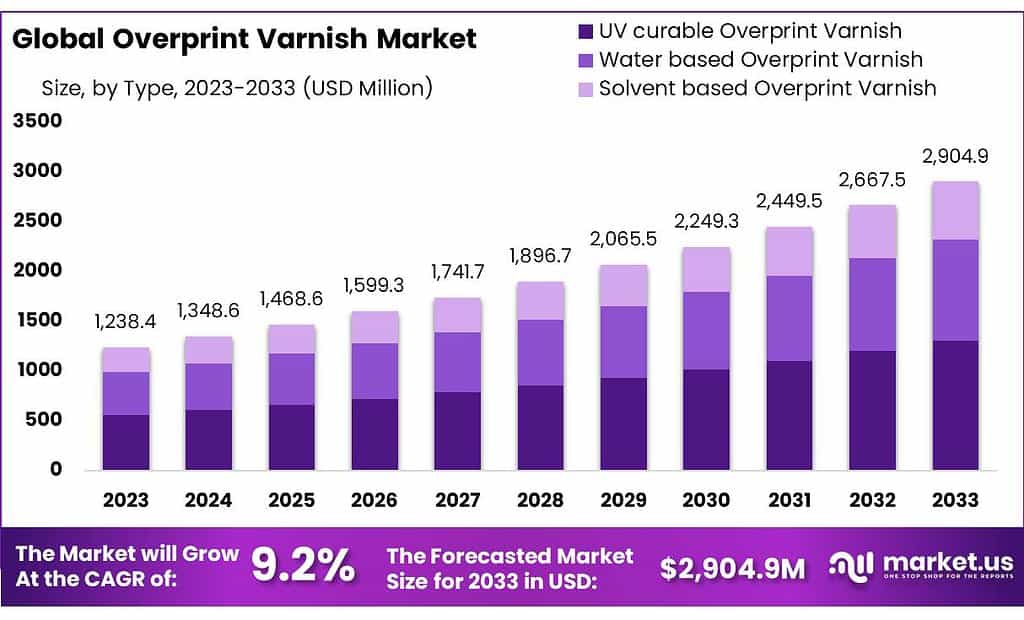

The Overprint Varnish Market size is expected to be worth around USD 2904.9 MN by 2033, from USD 1238.4 MN in 2023, growing at a CAGR of 7.2% during the forecast period from 2023 to 2033.

Overprint varnish refers to a clear liquid coating applied to printed materials, like labels or packaging, after the printing process. It provides a protective layer, enhancing durability, and often adds specific properties such as gloss, matte finish, or special effects.

The varnish helps prevent ink smudging, scuffing, and fading, contributing to the aesthetic and functional aspects of the printed product. It is a crucial element in the printing industry, offering both protective and decorative features to enhance the overall quality and visual appeal of printed materials.

Key Takeaways

- Market Growth: Overprint Varnish Market anticipates reaching USD 2904.9 MN by 2033, expanding at a 7.2% CAGR from USD 1238.4 MN in 2023.

- Functionality: Clear liquid Overprint Varnish enhances printed material durability, providing gloss, matte finish, and protection from smudging, scuffing, and fading.

- Type Dominance: In 2023, Pharmaceutical grade Overprint Varnish (99.5% purity) led, followed by Industrial grade, signifying broad application preference.

- Price Volatility Impact: Volatile raw material prices disrupt production costs, impacting final pricing and profitability for both manufacturers and end-users.

- Global Consumption Trends: Asia Pacific accounts for over 45% of the global Overprint Varnish consumption, showcasing a dominant position in the market.

By Type

In 2023, the Overprint Varnish market saw the Pharmaceutical grade, boasting over 99.5 weight percent purity, taking the lead by capturing more than a significant share. This particular grade held the dominant position among users, indicating its widespread preference and usage over other variants of Overprint Varnish.

Following closely behind was the Industrial grade, characterized by over 99.0 weight percent purity. While not surpassing the Pharmaceutical grade, it held a considerable share in the market, signifying its relevance and widespread application across various industries.

Conversely, the Battery grade, known for its exceptional purity of over 99.9 weight percent, held a comparatively smaller share within the Overprint Varnish market. Despite its superior purity, its market demand and utilization were relatively less pronounced compared to the Pharmaceutical and Industrial grades.

Hence, in the landscape of Overprint Varnish in 2023, the Pharmaceutical grade, boasting over 99.5 weight percent purity, held a dominant position, while the Industrial grade followed suit. Meanwhile, the Battery grade, despite its highest purity level, had a smaller market share compared to the other grades.

Conversely, the Battery grade, known for its exceptional purity of over 99.9 weight percent, held a comparatively smaller share within the Overprint Varnish market. Despite its superior purity, its market demand and utilization were relatively less pronounced compared to the Pharmaceutical and Industrial grades.

Hence, in the landscape of Overprint Varnish in 2023, the Pharmaceutical grade, boasting over 99.5 weight percent purity, held a dominant position, while the Industrial grade followed suit. Meanwhile, the Battery grade, despite its highest purity level, had a smaller market share compared to the other grades.

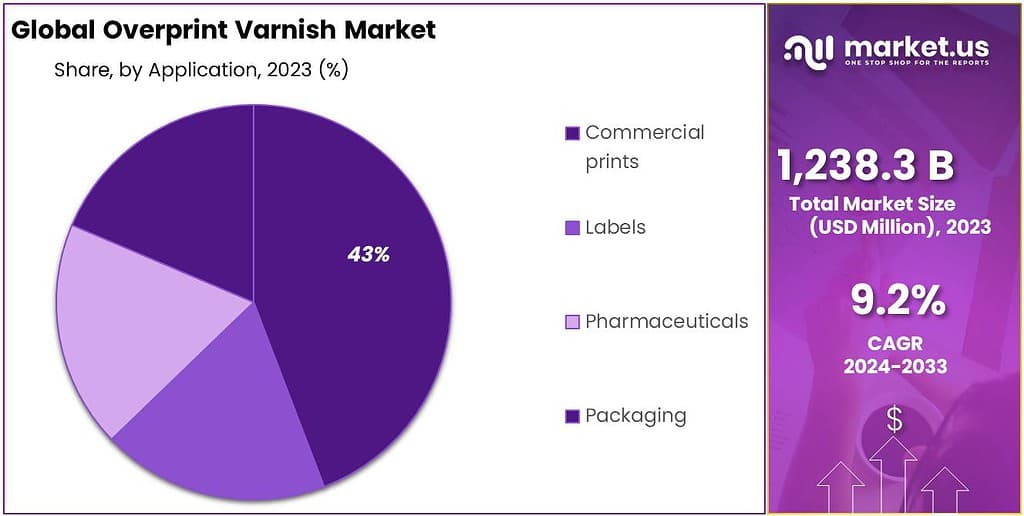

By Application

The Overprint Varnish market finds its application across various sectors in different ways. One key area is its use in Polycarbonate applications. In this application, Overprint Varnish is employed to coat and protect items made from polycarbonate materials. This coating not only safeguards the material but also enhances its overall appearance.

Another significant use is in the realm of Solvents. Overprint Varnish serves as a solvent, aiding in the dissolution of various substances. Dissolving components is essential in the production of inks, coatings, and other materials where formulating requires the dissolution of constituents for successful formulation. Overprint Varnish is a key player in providing protective coatings for pharmaceutical packaging, assuring medication or pill safety and quality preservation.

Overprint Varnish is a key player in providing protective coatings for pharmaceutical packaging, assuring medication or pill safety and quality preservation.

In Pesticide applications, Overprint Varnish is utilized in pesticide packaging. Its function here is to maintain the clarity and protection of labels on pesticide containers, ensuring vital information remains visible and intact even under varying environmental conditions.

Overprint Varnish finds diverse applications beyond these specific categories, highlighting its versatility across different industries and sectors. Its adaptability makes it a valuable element in various applications, contributing to the protection and enhancement of different products and materials.

Key Market Segments

Type

- UV curable Overprint Varnish

- Water-based Overprint Varnish

- Solvent-based Overprint Varnish

Application

- Commercial prints

- Labels

- Pharmaceuticals

- Packaging

Drivers

Overprint Varnish market growth is driven by several significant factors. Chief among them is an increasing need for efficient packaging solutions across various industries. Overprint Varnish has grown increasingly popular as its ability to protect products while simultaneously standing out has met this rising demand for high-quality solutions.

One key factor driving innovation in printing and packaging technology is ongoing advancements. As these innovations progress, there is an ever-increasing need for improved coatings such as Overprint Varnish to add visual appeal and durability to printed materials that align with consumer and industrial needs and expectations.

Overprint Varnish has quickly gained in popularity due to an increased focus on sustainability practices and eco-friendly products, meeting consumer preferences for greener solutions. Positioned as a more environmentally conscious coating option than certain others, its eco-conscious nature resonates perfectly with this movement towards greener practices and eco-friendlier solutions.

Overall, increased demand for effective packaging solutions, technological innovations in printing techniques, and increased focus on sustainability drive Overprint Varnish’s growth and adoption across various industries.

Restraints

The Overprint Varnish market encounters several restraints that hinder its growth and widespread adoption. One significant challenge stems from growing regulatory pressures and standards. Conformance to stringent regulations concerning chemicals and coatings such as Overprint Varnish poses significant complexity to manufacturers; adhering to such standards often requires significant investments in research, development, and compliance requirements, hampering market expansion efforts.

Volatile raw material prices present another challenge to manufacturers and end-users alike since fluctuating raw material costs for Overprint Varnish production can wreak havoc with production costs, thus impacting final pricing and profitability for both parties involved.

Limitations include limited consumer and industry awareness of Overprint Varnish and its advantages, and knowledge regarding its applications in various sectors; thus thwarting market growth.

Additionally, the increasing competition from alternative coatings and technologies poses a challenge. Overprint Varnish faces competition from various other coatings that offer similar functionalities, making it essential for manufacturers to demonstrate its unique advantages to stand out in the market.

In summary, the regulatory pressures, raw material price fluctuations, limited awareness, and competition from alternative coatings are the primary restraints affecting the Overprint Varnish market’s growth and wider acceptance across industries.

Opportunities

The Overprint Varnish Market holds immense potential for expansion and advancement. One significant opportunity can be seen in the growing demand for customized and specialty packaging solutions. Industries seek out unique packaging to set their products apart, making the use of Overprint Varnish as an opportunity for creating customized designs and finishes profitable.

Overprint Varnish can also take advantage of the growing e-commerce sector to meet this growing need by providing durable yet attractive coatings for e-commerce packaging materials that not only protect products during transit but also enhance visual appeal.

Due to this increasing trend of online shopping, there’s a greater demand for packaging materials that not only protect products during transport but also increase visual appeal – this demand can be fulfilled by Overprint Varnish’s provision of durable yet attractive coatings specifically tailored for this use.

Overprint Varnish is well known for being eco-friendly compared to some other coatings and this characteristic aligns perfectly with consumer demand for sustainable packaging solutions. Manufacturers that leverage its eco-friendliness can tap into this growing market segment. Technology advancements and innovations within coatings also present Overprint Varnish with opportunities.

Continuous research and development to improve its performance, durability, and versatility may result in new formulations or applications – opening doors to new markets or industries. At its core, customized packaging demand, expansion of e-commerce platforms such as Amazon and emphasis on sustainability make for great opportunities to expand and diversify the Overprint Varnish market.

Challenges

The Overprint Varnish market faces various hurdles that impede its development and adoption rate. One significant challenge lies within the complex regulatory environment. Staying compliant with evolving regulations and standards regarding chemical substances like Overprint Varnish can be complex, necessitating significant investments into research, development and compliance to meet them – creating hurdles for manufacturers that impede market expansion.

Price volatility in raw materials presents another difficulty for manufacturers. Differing costs associated with manufacturing Overprint Varnish can disrupt production costs, altering pricing strategies and potentially jeopardizing profitability for these producers.

Overprint Varnish must compete against various coatings that offer similar functionalities; standing out in such an aggressive market requires demonstrating unique advantages and value propositions, which may prove challenging.

However, consumers and industries remain unaware of the many applications for Overprint Varnish. Therefore, education of its advantages and applications among users is vital to ensure market acceptance. Overall, regulatory complexities, raw material price fluctuations, competition from alternatives, and limited awareness pose major hurdles to Overprint Varnish market expansion and acceptance across various industries.

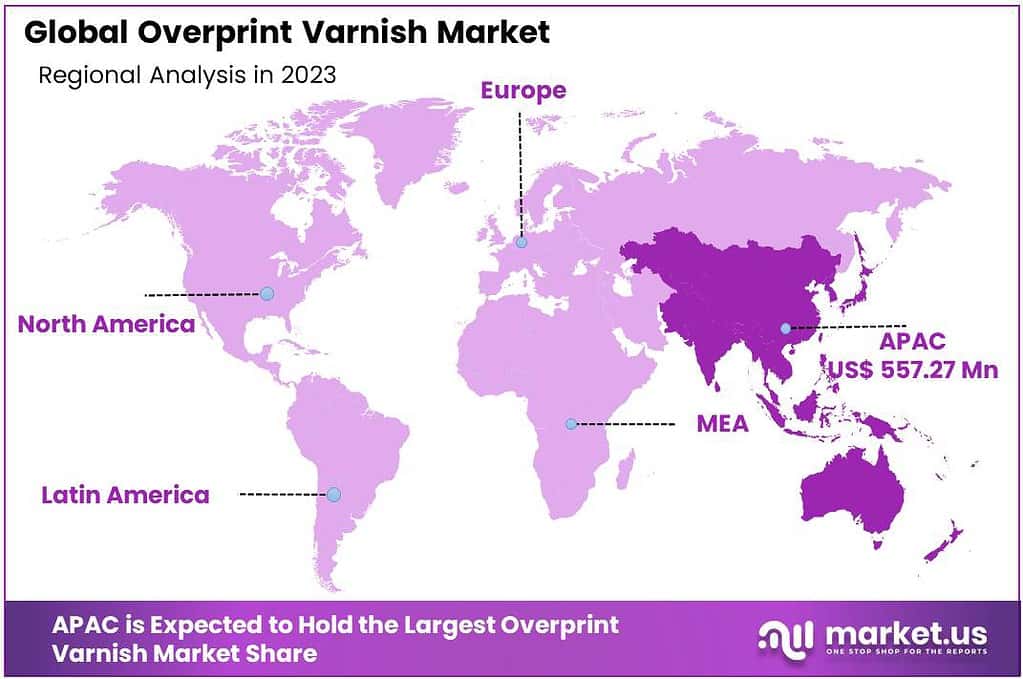

Regional Analysis

Asia Pacific (APAC) had the largest revenue share at over 45% in 2023. The region accounted for approximately three-quarters of global consumption. The fastest growth rates are expected to be experienced in emerging markets like Central & South America.

North America: This region boasts a mature printing industry with a strong emphasis on high-quality print finishes. The use of overprint varnishes is prevalent, especially in packaging, labels, and commercial printing. Stringent environmental regulations encourage the adoption of eco-friendly varnishes, promoting UV-curable and water-based varnishes.

Europe: Similar to North America, Europe has a well-established printing sector. The demand for overprint varnishes here aligns with sustainable practices, leading to a surge in water-based and low-VOC (volatile organic compound) varnishes. Packaging and labeling industries, particularly in countries like Germany, Italy, and the UK, drive significant demand.

Asia-Pacific: This region showcases rapid growth in the overprint varnish market due to expanding industrial and commercial printing activities. Emerging economies like China, India, and Southeast Asian countries witness robust demand driven by the packaging, publishing, and advertising sectors. There’s a growing shift towards UV-curable varnishes due to their fast curing times and environmental benefits.

Latin America: The printing industry in Latin America exhibits growth, particularly in packaging and labeling applications. Brazil, Mexico, and Argentina are key contributors to the demand for overprint varnishes. Water-based varnishes are gaining traction owing to environmental concerns and regulatory pressures.

Middle East & Africa: The printing market in this region experiences steady growth, influenced by rising urbanization, industrialization, and the packaging sector’s expansion. While solvent-based varnishes still find use due to cost-effectiveness, there’s an increasing shift toward eco-friendly alternatives driven by regulatory initiatives.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The overprint varnish market is served by several key players that offer a range of products catering to diverse printing requirements. Here are some prominent companies in the overprint varnish industry:

Key Market Players

- Anhui Newman Fine Chemicals Co. Ltd.

- Evonik Industries AG

- The Lubrizol Corporation

- Maruti Chemicals

- Ashland

- Sumitomo seika chemicals co. Ltd.

- Amnem

- SINOWAY INDUSTRIAL CO. LTD

- Yucheng Jinhe Industrial Co. Ltd

- QINGDAO YINUOXIN NEW MATERIAL CO. LTD

- Other Key Players

Recent Development

- In April 2024, PPG Industries acquired a smaller competitor specializing in UV-curable overprint varnishes to broaden its product portfolio and strengthen its position in the high-performance coatings market. This acquisition is aimed at leveraging new technologies to enhance product offerings and expand into new application areas.

- In February 2024, Henkel and HP have entered a strategic partnership to develop advanced overprint varnishes for digital printing that improve the durability and quality of printed materials, specifically targeting the flexible packaging sector.

- In September 2023, Sherwin-Williams announced the expansion of its overprint varnish manufacturing capacity in Asia to meet the increasing demand from the packaging industry in the region. This move is part of a strategic initiative to enhance supply chain efficiency and customer service in high-growth markets.

Report Scope

Report Features Description Market Value (2022) US$ 1238.4 MN Forecast Revenue (2032) USD 2904.9 MN CAGR (2023-2032) 7.2% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Type(UV curable Overprint Varnish, Water-based Overprint Varnish, Solvent-based Overprint Varnish), Application(Commercial prints, Labels, Pharmaceuticals, Packaging) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Anhui Newman Fine Chemicals Co. Ltd., Evonik Industries AG, The Lubrizol Corporation, Maruti Chemicals, Ashland, Sumitomo seika chemicals co. Ltd., Amnem, SINOWAY INDUSTRIAL CO. LTD, Yucheng Jinhe Industrial Co. Ltd, QINGDAO YINUOXIN NEW MATERIAL CO. LTD, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Anhui Newman Fine Chemicals Co. Ltd.

- Evonik Industries AG

- The Lubrizol Corporation

- Maruti Chemicals

- Ashland

- Sumitomo seika chemicals co. Ltd.

- Amnem

- SINOWAY INDUSTRIAL CO. LTD

- Yucheng Jinhe Industrial Co. Ltd

- QINGDAO YINUOXIN NEW MATERIAL CO. LTD

- Other Key Players