Global Orthopedic Software Market By Product (Digital Templating/ Preoperative Planning Software, Orthopedic EHR, Orthopedic PACS, Orthopedic Practice Management Software, Orthopedic RCM, Robotic Integration Software, Others) By Mode of Delivery (Web/Cloud Based, On-Premise) By Patient Type (Pediatric, Adult, Geriatric) By Application (Joint Replacement, Spine Surgery, Trauma Surgery, Sports Medicine, Others) By End-User (Hospitals and Clinics, Ambulatory Surgical Centers, Orthopedic Specialty Centers, Physical Therapy Centers, Others) By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161548

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

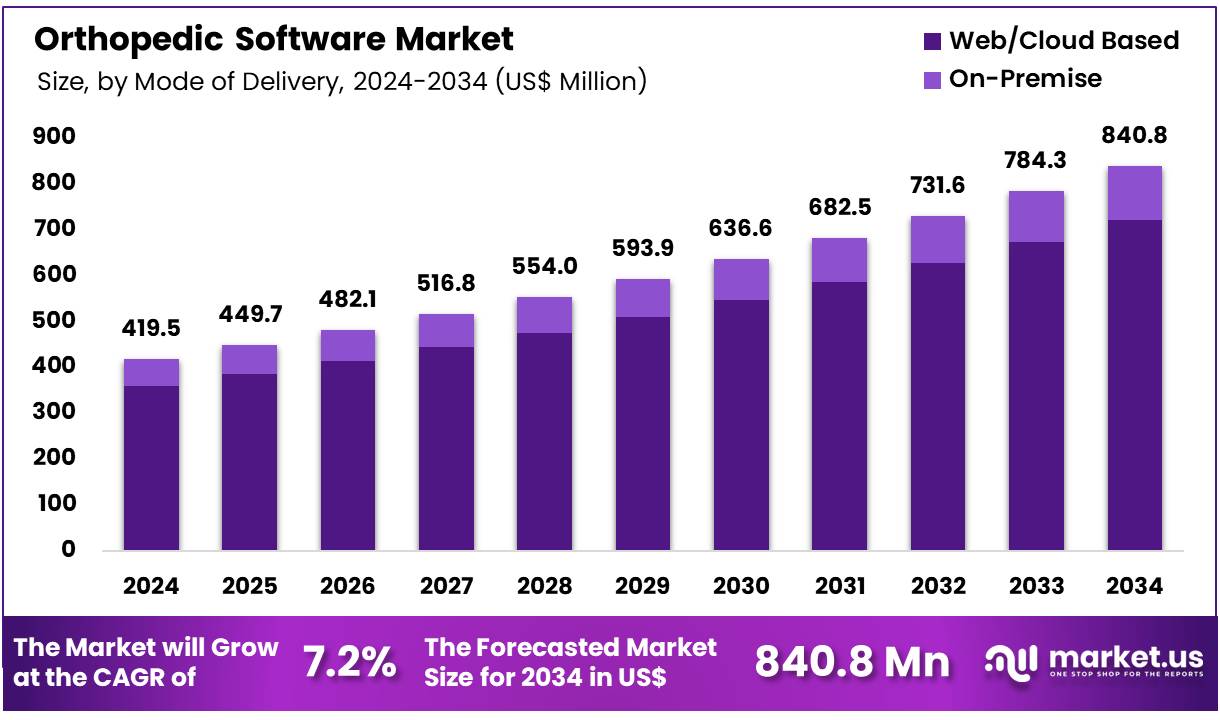

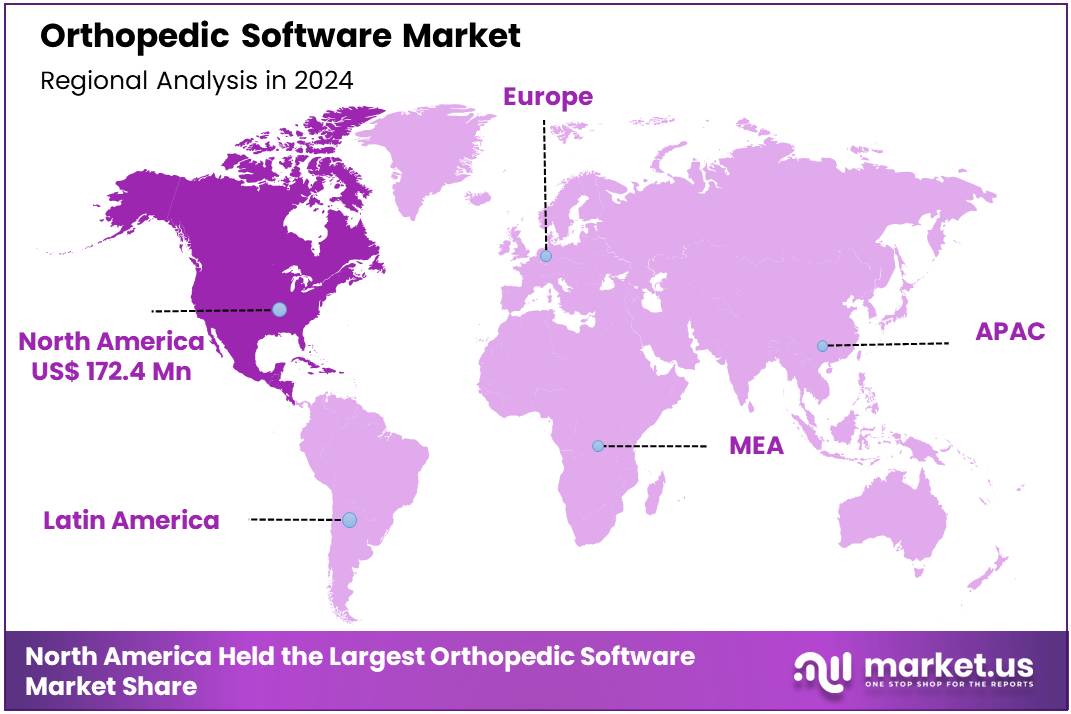

Global Orthopedic Software Market size is expected to be worth around US$ 840.8 Million by 2034 from US$ 419.5 Million in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 41.1% share with a revenue of US$ 172.4 Million.

The demand for orthopedic software is rising due to the growing prevalence of musculoskeletal (MSK) diseases and the global ageing population. The World Health Organization (WHO) estimates that approximately 1.71 billion people live with MSK conditions, with low back pain being the leading cause of disability worldwide. This increasing disease burden has driven healthcare providers to adopt digital tools that enhance productivity, accuracy, and care coordination across orthopedic services, including imaging, surgical planning, triage, and outcomes tracking.

Ageing demographics are a major catalyst for software adoption. WHO projects that by 2030, one in six individuals will be aged 60 or older, with this cohort expanding from 1 billion in 2020 to 1.4 billion, and doubling by 2050. Older adults face higher risks of osteoarthritis, fractures, and joint degeneration, which necessitate software-driven clinical decision support and perioperative management to handle increasing caseloads effectively.

High surgical volumes further sustain software demand. OECD data indicate average rates of 172 hip and 119 knee replacements per 100,000 population, demonstrating consistent procedural demand. These operations rely on digital scheduling, surgical planning, and implant registries to improve efficiency and standardize outcomes. Positive patient-reported outcomes after such procedures have reinforced continued investment in software solutions that optimize recovery and enhance care pathways.

Policy initiatives promoting interoperability are another driver. In the U.S., about 70% of hospitals now participate in all major information-exchange activities. Regulatory programs such as “Promoting Interoperability” by the Centers for Medicare & Medicaid Services require electronic clinical quality reporting, thereby encouraging hospitals to deploy orthopedic software that automates data submission, order sets, and reporting workflows.

The COVID-19 pandemic created elective surgery backlogs, prompting adoption of digital solutions to streamline preoperative and postoperative processes. For instance, NHS England has emphasized efficient referral-to-treatment management through tools supporting early screening, digital consent, and perioperative optimization. These solutions reduce cancellations and improve operating-room utilization, offering tangible cost and throughput benefits.

Public-health focus on MSK conditions is intensifying. WHO’s 2024 initiative calls for enhanced surveillance and integrated, data-driven care models. Vendors providing analytics, registry integration, and outcome benchmarking are positioned for growth as governments demand real-world performance data.

Finally, patient-access requirements have accelerated the market. Hospitals increasingly enable patients to access and share their records through secure, interoperable apps based on FHIR standards. Orthopedic portals and rehabilitation applications benefit from these trends. Overall, orthopedic software growth is driven by demographic shifts, interoperability mandates, procedural consistency, and a focus on efficient, patient-centered digital care.

Key Takeaways

- Market Size: Global Orthopedic Software Market size is expected to be worth around US$ 840.8 Million by 2034 from US$ 419.5 Million in 2024.

- Market Growth: The market growing at a CAGR of 7.2% during the forecast period from 2025 to 2034.

- Product Analysis: In 2024, the Orthopedic Electronic Health Record (EHR) segment dominates the market, accounting for 26.7% of the total share.

- Mode of Delivery Analysis: In 2024, the Web/Cloud-Based segment dominates the market with an 85.9% share.

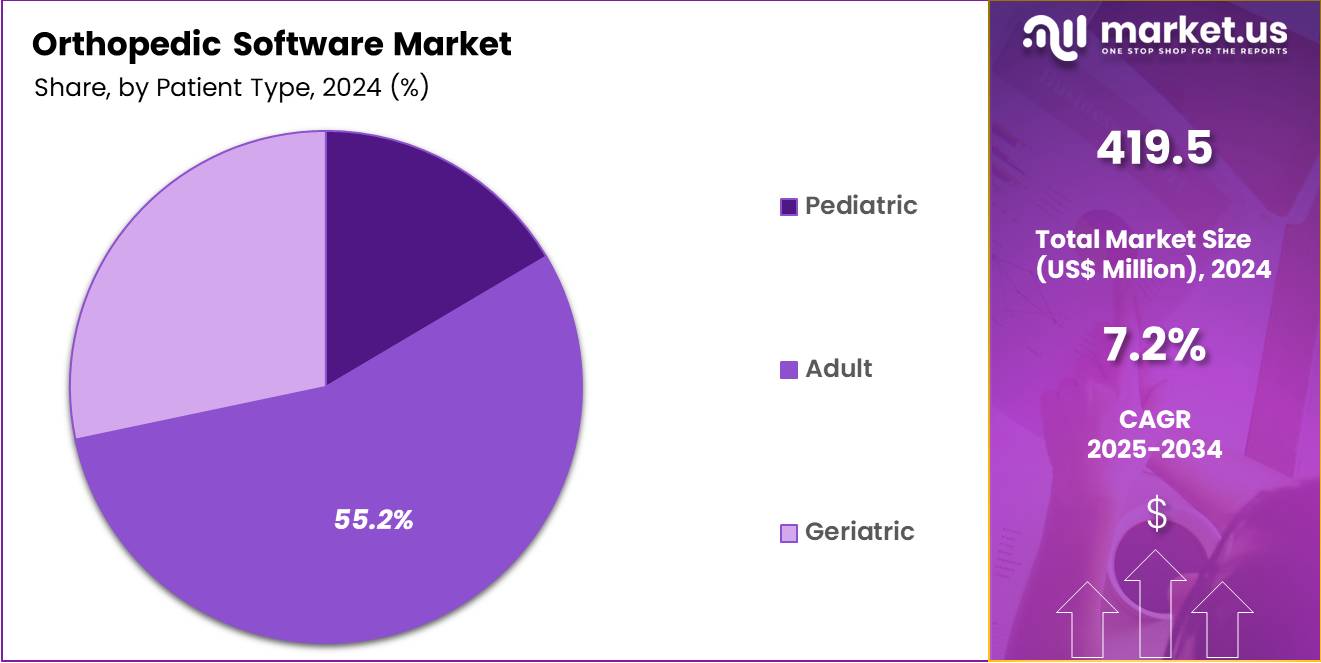

- Patient Type Analysis: The Adult segment dominates the market with a 55.2% share in 2024.

- Application Analysis: In 2024, the joint replacement segment dominates the market, accounting for approximately 23.6% of the total market share.

- End-Use Analysis: Hospitals and clinics dominate the market, accounting for approximately 57.0% of the total market share.

- Regional Analysis: In 2024, North America led the market, achieving over 41.1% share with a revenue of US$ 172.4 Million.

Product Analysis

The orthopedic software market comprises a diverse portfolio of digital solutions designed to enhance clinical efficiency, diagnostic accuracy, and surgical outcomes across orthopedic practices. In 2024, the Orthopedic Electronic Health Record (EHR) segment dominates the market, accounting for 26.7% of the total share. This dominance is attributed to the growing adoption of integrated digital health systems, regulatory emphasis on data interoperability, and the rising need for real-time patient data access in orthopedic care.

Digital Templating and Preoperative Planning Software play a critical role in improving surgical precision through advanced imaging and simulation tools. Orthopedic Picture Archiving and Communication Systems (PACS) enable efficient management and retrieval of diagnostic imaging data. Orthopedic Practice Management Software supports administrative efficiency through appointment scheduling and billing automation, while Orthopedic Revenue Cycle Management (RCM) solutions streamline financial operations.

Additionally, Robotic Integration Software is witnessing rapid growth due to increased deployment of robotic-assisted orthopedic surgeries, enhancing procedural accuracy and reducing recovery times. Other niche software solutions focus on clinical decision support, patient engagement, and teleorthopedics, collectively contributing to the digital transformation of orthopedic practices globally.

Mode of Delivery Analysis

In 2024, the Web/Cloud-Based segment dominates the market with an 85.9% share, driven by its scalability, cost efficiency, and ease of integration across healthcare systems. The widespread adoption of cloud computing in healthcare and the increasing demand for remote access to patient data have accelerated the shift toward web-based platforms. These solutions facilitate seamless data sharing between hospitals, clinics, and surgical centers, thereby enhancing collaboration, clinical outcomes, and workflow efficiency.

Cloud-based orthopedic software also supports automatic updates, enhanced cybersecurity measures, and interoperability with electronic health records, making it the preferred choice among healthcare providers. Furthermore, the growing trend of telehealth and digital patient monitoring has strengthened this segment’s dominance.

Conversely, On-Premise solutions retain a niche market presence, primarily favored by large hospitals and institutions with strict data control policies. Although offering higher customization and localized data security, on-premise systems involve significant installation and maintenance costs, limiting their adoption in small and medium orthopedic practices.

Patient Type Analysis

The Adult segment dominates the market with a 55.2% share, primarily due to the high prevalence of sports injuries, trauma cases, and musculoskeletal disorders among the working-age population.

The growing adoption of orthopedic software in adult orthopedic care is driven by the demand for efficient diagnosis, treatment planning, and post-surgical monitoring solutions. Additionally, the increasing number of elective orthopedic procedures such as joint replacements and arthroscopic surgeries further strengthens the segment’s dominance.

The Pediatric segment is expanding steadily, supported by technological advancements in orthopedic imaging and treatment planning tools for congenital deformities and growth-related conditions. Meanwhile, the Geriatric segment represents a rapidly growing market niche due to the rising aging population and the increasing incidence of osteoporosis, arthritis, and degenerative bone diseases.

Orthopedic software solutions in this category are increasingly utilized to manage chronic conditions, optimize surgical outcomes, and facilitate rehabilitation programs. Overall, the adult patient base remains the key revenue generator, with continuous innovation enhancing patient care across all age groups.

Application Analysis

The orthopedic software market is segmented by application into joint replacement, spine surgery, trauma surgery, sports medicine, and others. In 2024, the joint replacement segment dominates the market, accounting for approximately 23.6% of the total market share.

The dominance of this segment can be attributed to the increasing prevalence of osteoarthritis and rheumatoid arthritis, coupled with the rising adoption of robotic-assisted and computer-navigated joint replacement surgeries. The use of orthopedic software in this field facilitates precise implant positioning, preoperative planning, and postoperative assessment, thereby improving patient outcomes.

The spine surgery segment is projected to witness notable growth due to the growing incidence of spinal disorders and the demand for minimally invasive procedures. Trauma surgery applications are expanding with the integration of 3D visualization tools that enhance fracture management accuracy.

Sports medicine is also emerging as a significant area due to the rising number of sports-related injuries and advanced rehabilitation tracking systems. The others category, including pediatric and orthopedic oncology software, continues to gain traction as hospitals increasingly adopt digital solutions for comprehensive orthopedic care.

End User Analysis

The orthopedic software market is segmented by end user into hospitals and clinics, ambulatory surgical centers, orthopedic specialty centers, physical therapy centers, and others. In 2024, hospitals and clinics dominate the market, accounting for approximately 57.0% of the total market share.

This dominance is attributed to the high patient inflow, extensive use of integrated healthcare IT systems, and the growing adoption of advanced orthopedic software for diagnosis, surgical planning, and postoperative management. Hospitals and clinics also benefit from substantial financial resources, enabling the implementation of electronic health records (EHR) and surgical navigation systems to enhance workflow efficiency and patient outcomes.

Ambulatory surgical centers represent a rapidly growing segment driven by the increasing preference for same-day orthopedic procedures and cost-effective care models. Orthopedic specialty centers are gaining traction as they adopt customized software platforms tailored to specific orthopedic procedures.

Physical therapy centers utilize orthopedic software for rehabilitation planning, progress tracking, and patient data management. The others segment, which includes research institutions and academic centers, is expanding steadily as digital solutions become essential for clinical training, research data integration, and outcome-based orthopedic studies.

Key Market Segments

By Product

- Digital Templating/ Preoperative Planning Software

- Orthopedic EHR

- Orthopedic PACS

- Orthopedic Practice Management Software

- Orthopedic RCM

- Robotic Integration Software

- Others

By Mode of Delivery

- Web/Cloud Based

- On-Premise

By Patient Type

- Pediatric

- Adult

- Geriatric

By Application

- Joint Replacement

- Spine Surgery

- Trauma Surgery

- Sports Medicine

- Others

By End-User

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Orthopedic Specialty Centers

- Physical Therapy Centers

- Others

Market Drivers

The primary driver of the orthopedic software market is the increasing prevalence of musculoskeletal disorders combined with the aging global population. The rising incidence of degenerative joint diseases, osteoporosis, fractures, and trauma cases has heightened the need for orthopedic interventions, consequently boosting demand for digital solutions that support diagnosis, planning, and patient monitoring.

Additionally, healthcare systems’ transition toward value-based care has accelerated the adoption of software that facilitates outcome tracking, resource optimization, and reduced readmissions. The integration of digital templating, electronic health records (EHR), and imaging solutions has become essential to improving surgical precision and workflow efficiency. Overall, these factors are expected to sustain a compound annual growth rate (CAGR) of approximately 5–7% over the next decade.

Market Trends

A key trend shaping the orthopedic software market is the rapid adoption of cloud-based and AI-enabled platforms. Healthcare providers increasingly favor cloud deployments for their scalability, accessibility, and seamless interoperability across multiple clinical environments. Simultaneously, artificial intelligence (AI) and machine learning (ML) are being integrated into orthopedic software to enhance diagnostic accuracy, predict surgical risks, optimize implant sizing, and refine surgical planning.

The emergence of Explainable AI (XAI) is becoming critical to ensure transparency and clinical trust in algorithm-driven decisions. Furthermore, regulatory bodies such as the U.S. FDA’s Digital Health Center of Excellence are actively developing frameworks for Software as a Medical Device (SaMD) and setting interoperability standards, guiding innovation within a compliant ecosystem.

Market Restraints

Regulatory and compliance challenges represent significant restraints in the orthopedic software market. Software solutions used for diagnostic or therapeutic support are classified as medical devices, thereby requiring rigorous approval processes from regulatory agencies such as the U.S. Food and Drug Administration (FDA). These processes are often time-intensive and costly.

Additionally, concerns surrounding data privacy, cybersecurity, and algorithmic bias complicate validation and monitoring processes. A shortage of skilled healthcare IT professionals capable of deploying, maintaining, and interpreting advanced software systems further limits adoption, particularly in low- and middle-income regions.

Market Opportunities

Substantial opportunities exist within the orthopedic software market through the integration of emerging technologies and expansion into underserved geographies. Advancements such as robotic-assisted surgery, augmented reality (AR), 3D printing, and wearable sensors are enhancing preoperative and postoperative workflows. The growing adoption of telemedicine and remote patient monitoring is also extending orthopedic care to rural and remote populations.

Developing markets in Asia-Pacific, Latin America, and Africa are expected to offer high growth potential, driven by rising orthopedic disease burdens and strengthening digital health infrastructures. Collaborations with government health initiatives and participation in national digital health programs for musculoskeletal care can further open avenues for large-scale software deployment and integration.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 41.1% share and recording a market value of US$ 172.4 million in the global orthopedic software market. The dominance of this region can be attributed to several key factors that have reinforced its leadership in healthcare technology and digital medical solutions.

Advanced Healthcare Infrastructure

The strong presence of advanced healthcare facilities and well-established hospital networks has been instrumental in driving adoption. Hospitals and orthopedic clinics in the U.S. and Canada have integrated orthopedic software for workflow optimization, imaging analysis, and patient data management. The high penetration of electronic health records (EHR) and the integration of artificial intelligence (AI) in clinical settings have supported this growth.High Incidence of Musculoskeletal Disorders

An increasing prevalence of musculoskeletal conditions, such as osteoarthritis and fractures, has led to greater demand for efficient orthopedic management tools. The rising elderly population in North America, combined with a sedentary lifestyle, has created a strong demand for orthopedic treatment and digital monitoring systems.Favorable Regulatory and Reimbursement Environment

Supportive government policies and reimbursement frameworks for digital health solutions have accelerated the adoption of orthopedic software. The U.S. Food and Drug Administration (FDA) and Health Canada have implemented favorable guidelines for the approval and use of medical software, ensuring faster market access and higher trust among end users.Technological Advancements and Key Market Players

The region’s dominance is further supported by the presence of major technology developers and healthcare IT companies. These firms are investing in research and development to introduce advanced orthopedic planning and navigation software. Continuous product innovation, cloud-based deployment models, and interoperability features have enhanced market competitiveness.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The orthopedic software market is characterized by the presence of several well-established technology developers and specialized healthcare IT providers. These companies focus on developing advanced solutions for orthopedic practice management, surgical planning, digital templating, and patient data integration. Their competitive advantage is driven by strong research capabilities, partnerships with hospitals, and continuous innovation in artificial intelligence, 3D imaging, and cloud-based platforms.

Also, market participants are increasingly investing in interoperable systems that enhance surgical precision and patient outcomes. Furthermore, strategic collaborations, mergers, and acquisitions are common to expand product portfolios and geographic presence. The competitive landscape is also witnessing the emergence of startups introducing niche solutions, such as AI-driven diagnostics and robotic-assisted surgery modules.

Overall, the market is moderately consolidated, with leading players maintaining dominance through technological leadership and long-term relationships with healthcare institutions.

Market Key Players

- IBM

- CureMD Healthcare

- NextGen Healthcare LLC

- Smith & Nephew

- GE Healthcare

- GreenWay Health LLC

- Materialise

- Brainlab AG

- athenahealth

- DrChrono, Inc

- Stryker

- Allscripts Healthcare, LLC

- OPIE Software

- OrthoGrid Systems, Inc.

- PEEK HEALTH S.A.

- Exactech, Inc.

- eClinicalWorks

- Medstrat

Recent Developments

- IBM (Apr 2025): IBM announced a new AI-clinical initiative to embed generative intelligence into point-of-care clinical workflows and expand enterprise intelligence services.

- Smith & Nephew (Mar 2025): In March 2025, Smith & Nephew showcased its CORIOGRAPH® pre-op planning and CORI robotic system (now supporting hips) at AAOS 2025 alongside its CATALYSTEM primary hip system.

- Stryker: In January 2025, Stryker agreed to acquire Inari Medical for $4.9 billion, expanding its vascular device offerings and strengthening its medical and surgical portfolio.

- OrthoGrid Systems, Inc.: In August 2025, OrthoGrid launched an AI-driven hip replacement navigation product that uses a single intraoperative X-ray to generate real-time guidance for surgeons.

Report Scope

Report Features Description Market Value (2024) US$ 419.5 Million Forecast Revenue (2034) US$ 840.8 Million CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Digital Templating/ Preoperative Planning Software, Orthopedic EHR, Orthopedic PACS, Orthopedic Practice Management Software, Orthopedic RCM, Robotic Integration Software, Others) By Mode of Delivery (Web/Cloud Based, On-Premise) By Patient Type (Pediatric, Adult, Geriatric) By Application (Joint Replacement, Spine Surgery, Trauma Surgery, Sports Medicine, Others) By End-User (Hospitals and Clinics, Ambulatory Surgical Centers, Orthopedic Specialty Centers, Physical Therapy Centers, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape IBM, CureMD Healthcare, NextGen Healthcare LLC, Smith & Nephew, GE Healthcare, GreenWay Health LLC, Materialise, Brainlab AG, athenahealth, DrChrono, Inc, Stryker, Allscripts Healthcare, LLC, OPIE Software, OrthoGrid Systems, Inc., PEEK HEALTH S.A., Exactech, Inc., eClinicalWorks, Medstrat Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- IBM

- CureMD Healthcare

- NextGen Healthcare LLC

- Smith & Nephew

- GE Healthcare

- GreenWay Health LLC

- Materialise

- Brainlab AG

- athenahealth

- DrChrono, Inc

- Stryker

- Allscripts Healthcare, LLC

- OPIE Software

- OrthoGrid Systems, Inc.

- PEEK HEALTH S.A.

- Exactech, Inc.

- eClinicalWorks

- Medstrat