Global Organic Packaged Food Market By Product(R.T.E Cereals, Bakery and Confectionery Products, Dairy Products, Sauces, Dressings And Condiments, Snacks and Nutrition Bars, Other Products), By Distribution Channel(Offline, Online), By Applications(Daily Diet, Nutrition, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 34236

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

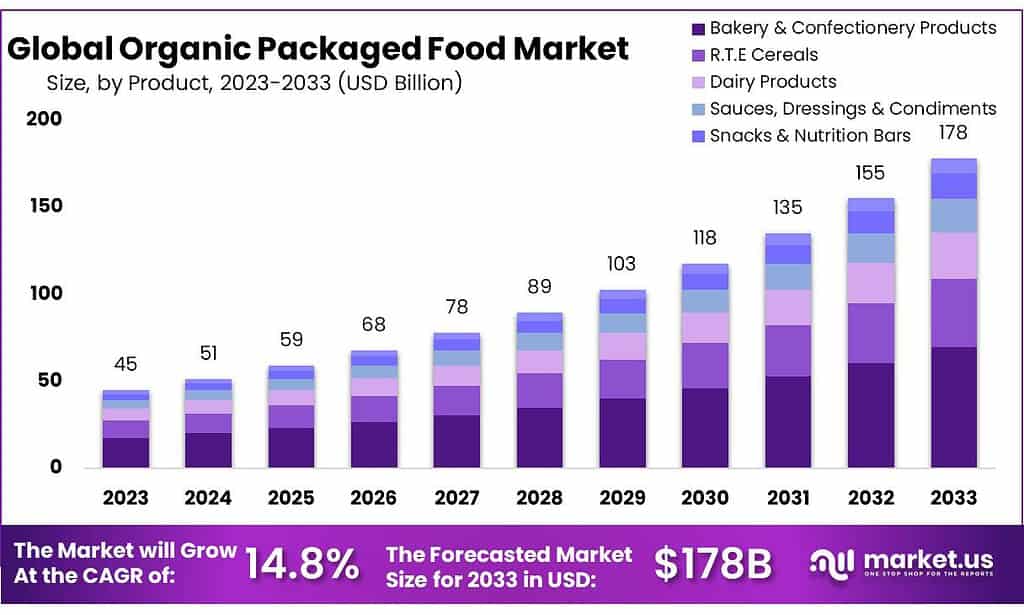

The Organic Packaged Food Market size is expected to be worth around USD 178 billion by 2033, from USD 45 Bn in 2023, growing at a CAGR of 14.8% during the forecast period from 2023 to 2033.

The Organic Packaged Food Market refers to the sector of the food industry that involves the production, distribution, and consumption of packaged food products made from organically grown ingredients. These products adhere to organic farming practices, avoiding synthetic pesticides, fertilizers, and genetically modified organisms (GMOs).

The market emphasizes sustainability, environmental consciousness, and the use of natural methods to deliver food items that meet organic certification standards. Organic packaged foods cater to consumers seeking healthier, environmentally friendly alternatives with a focus on transparency in sourcing and production methods.

The trend of changing lifestyles that have increased dependence on processed food is expected to continue to be beneficial. Additionally, the industry growth in organic packaged food is expected to benefit from the increased awareness and recommendations of dieticians at the global level regarding the health benefits associated with organic packaged food.

Key Takeaways

- Market Growth: The Organic Packaged Food Market is projected to reach USD 178 billion by 2033, growing at a significant CAGR of 14.8% from USD 45 billion in 2023.

- Bakery Dominance: In 2023, Bakery and Confectionery held over 38.3% market share, showcasing the popularity of carob powder known for its natural sweetness in products like cakes and chocolates.

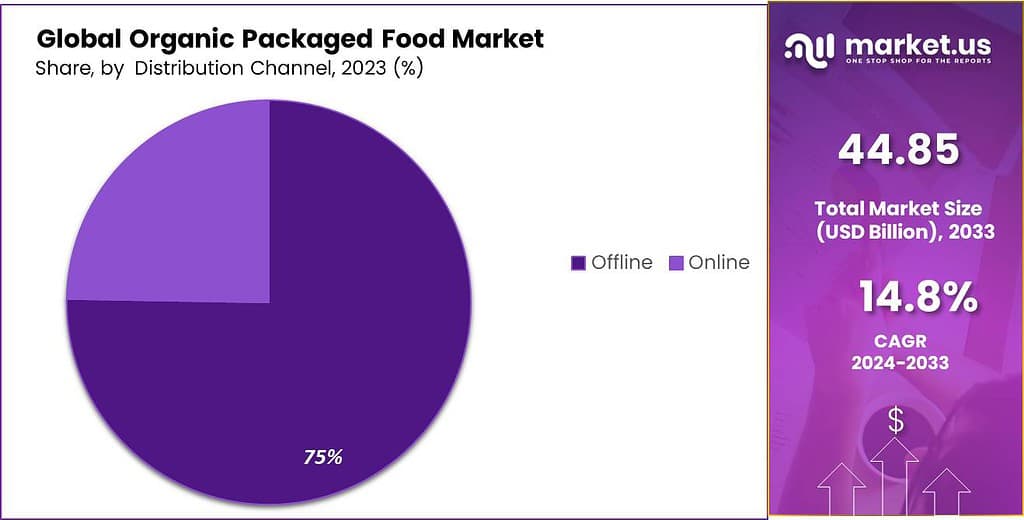

- Distribution Channel Dynamics: In 2023, offline channels dominated with a market share of 70.9%, while online channels gained significance, signifying evolving consumer preferences in purchasing organic packaged foods.

- Daily Diet Applications: Daily Diet applications led the market with a share exceeding 56.3% in 2023, indicating consumers’ preference for integrating carob powder into everyday meals for its nutritional value

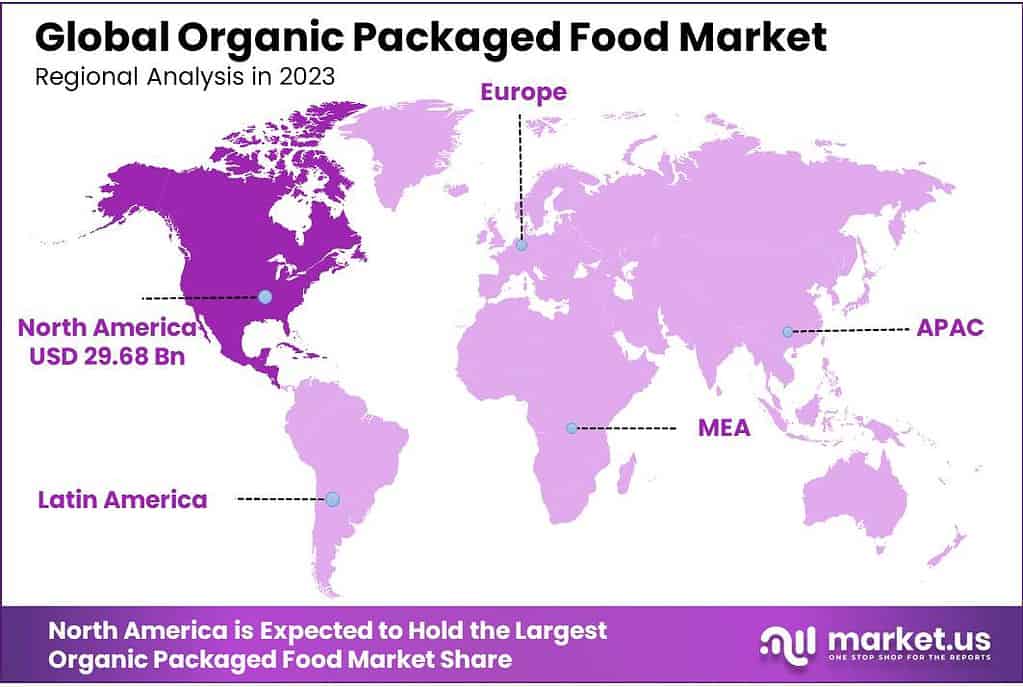

- Regional Insights: North America dominated with over 50.0% revenue share in 2023, while Asia Pacific is poised for a 15.8% CAGR, driven by an expanding middle-class population and strategic partnerships.

Product Analysis

In 2023, Bakery and Confectionery held a dominant market position, capturing more than a 38.3% share. This indicates that carob powder was most commonly used in making bakery and confectionery products like cakes, pastries, chocolates, and other treats.

People enjoy the natural sweetness and unique flavor that carob powder adds to these delicious creations. The notable market share held by Bakery and Confectionery in 2023 highlights the crucial role of carob powder in this industry.

Consumers are increasingly drawn to healthier choices, and carob powder fits well into this preference as a nutritious and naturally sweet option. As the market progresses, businesses in the bakery and confectionery sector can use the popularity of carob powder to cater to the rising demand for healthier and flavorful products. The strong presence of Bakery and Confectionery in 2023 highlights how versatile carob powder is, showing that it can be used in various types of cooking.

Because people consistently like using carob powder in these foods, there are chances to come up with new ideas and discover more ways to use it in making delicious and healthy treats. For businesses that work with bakery and confectionery products, knowing and making the most of the popularity of carob powder can help them keep succeeding in giving consumers what they want.

Distribution Channel Analysis

In 2023, offline distribution channels dominated the carob powder market, securing a significant market share of more than 70.9%. This indicates a strong consumer preference for purchasing carob powder through traditional brick-and-mortar stores, encompassing supermarkets, grocery stores, and specialty food shops.

The prominence of offline channels suggests that consumers value the tangible shopping experience offered by physical stores, where they can inspect and select products firsthand. The immediate availability of products in offline stores likely contributed to their continued popularity. The market also witnessed a substantial market share held by online distribution channels, indicating a shift in consumer behavior towards digital platforms. This shift suggests that an increasing number of consumers are opting for the convenience of purchasing carob powder online, possibly through various e-commerce platforms.

The advantages of online shopping, including home delivery, a broader product range, and the ability to easily compare options, have likely contributed to the growing preference for online purchases. For businesses operating in the carob powder market, understanding the dynamics between offline and online distribution channels is crucial.

Striking the right balance between traditional retail and e-commerce strategies will be essential to cater to the diverse preferences of consumers in this evolving marketplace. As consumer behaviors continue to change, businesses should adapt their distribution strategies to effectively reach and serve their target audience, whether through physical stores or online platforms.

By Applications

In the carob powder market, the segmental breakdown reveals fascinating insights into consumer preferences and usage patterns. Notably, in 2023, the Daily Diet segment emerged as the dominant force, capturing more than 56.3% of the market share. This highlights a significant inclination among consumers to integrate carob powder into their everyday meals, showcasing its popularity as a staple ingredient in daily dietary practices.

Using carob powder in Daily Diet applications means it’s like a flexible and natural sweetener or flavor booster in regular meals and snacks. People like it because it adds nutrition and genuine sweetness to their everyday food, matching the trend of going for healthier options in daily nutrition.

While Daily Diet takes the lead, the market encompasses other segments, including Nutrition and Others. Nutrition applications may involve targeted usage of carob powder in specialized dietary plans or as part of nutritional supplements. On the other hand, the “Others” category suggests diverse applications in the food and beverage industry, reflecting the versatility of carob powder.

Knowing that Daily Diet applications took the lead in 2023 is helpful for businesses. It shows that people widely accept carob powder as a natural and nutritious option for their everyday cooking. This sets the stage for more exploration and innovation in the carob powder market.

Key Market Segments

By Product

- R.T.E Cereals

- Bakery & Confectionery Products

- Dairy Products

- Sauces, Dressings & Condiments

- Snacks & Nutrition Bars

- Other Products

By Distribution Channel

- Offline

- Online

By Applications

- Daily Diet

- Nutrition

- Others

Drivers

The Organic Packaged Food Market is growing because people want healthier food. Many consumers are more aware of what they eat and prefer organic packaged foods, thinking they are better and don’t contain harmful chemicals. Also, there’s a trend towards caring for the environment. People are worried about how food is produced and delivered. Choosing organic packaged foods is seen as a way to support eco-friendly practices, and this is helping the market to grow.

The surge in disposable incomes and changing lifestyles is also contributing to the market’s growth. With higher purchasing power, consumers are more willing to invest in premium organic products. Busy lifestyles and a preference for convenient food options further drive the demand for organic packaged foods, which often offer ready-to-eat and on-the-go alternatives.

In summary, the key drivers behind the growth of the Organic Packaged Food Market include the emphasis on health and wellness, a focus on environmental sustainability, and the impact of changing lifestyles and increased disposable incomes. These factors collectively contribute to the expanding market for organic packaged foods.

Restraints

Another challenge is the limited availability of organic ingredients. Organic farming practices may yield lower quantities compared to conventional methods, resulting in challenges to meet the growing demand for organic packaged foods. This scarcity of supply can contribute to higher prices, affecting the affordability of these products for a broader consumer base. Additionally, there is a perception issue where organic foods are sometimes considered niche or cater only to a specific demographic.

This perception may hinder broader market acceptance, with some consumers viewing organic packaged foods as luxury items rather than everyday choices. Addressing these challenges will be essential for the Organic Packaged Food Market to broaden its appeal and ensure sustained growth.

Additionally, there is a perception issue where organic foods are sometimes considered niche or cater only to a specific demographic. This perception may hinder broader market acceptance, with some consumers viewing organic packaged foods as luxury items rather than everyday choices. Addressing these challenges will be essential for the Organic Packaged Food Market to broaden its appeal and ensure sustained growth.

One challenge for organic packaged foods is that some people think they are too expensive. This happens because the way organic foods are produced can be costlier. People might feel that choosing organic packaged foods will be heavy on their wallets, especially those who are conscious of prices. Another challenge is that there might not be enough organic ingredients available.

Organic farming practices may result in lower quantities compared to traditional methods. This scarcity of supply can lead to higher prices, making it difficult for a lot of people to afford organic packaged foods. Another thing is that some people see organic foods as only for a specific group of people. They may think it’s a luxury or something only certain folks would choose. Overcoming these challenges will be important to make organic packaged foods more accepted and affordable for everyone.\

Opportunities

The Organic Packaged Food Market has great chances for growth because of the way people are changing what they want and how companies are changing to meet those needs. One big change is in focusing more on being good for the environment and treating everyone fairly. People want organic packaged foods that not only keep them healthy but also come from sources that care about the Earth.

Companies that show they care about these things can attract more customers who want products that are good for them and the planet. Another way the market can grow is by using online shopping. More and more people are buying things online because it’s easy and convenient. Companies that sell organic packaged foods can use the internet to show their products to more people, teach them about why organic is a good choice, and make it easy for them to buy online. This can help the market grow even more and reach more people.

The Organic Packaged Food Market has a good chance to grow more by working together. When companies team up, they can make new and better organic products, make the supply chain work better, and solve problems together.

This teamwork not only brings new ideas but also makes the whole market stronger and helps it grow more. So, in the end, the Organic Packaged Food Market can make the most of the chances linked to being eco-friendly, online shopping, and working together as an industry. This way, it can meet the changing needs of mindful consumers and keep growing.

Challenges

One big challenge for organic packaged foods is that people might think they are more expensive than non-organic ones. This is because making organic food can need more resources, making it cost more. So, people who want to spend less might choose non-organic options instead. Another problem is that there might not be enough organic ingredients available.

The way organic foods are made might result in fewer products than usual. This can make it hard to meet the growing demand for organic packaged foods, and because there isn’t enough, the prices might go up. This makes it tough for more people to afford these products. Fixing these challenges needs different solutions, like teaching people about why organic foods are worth it, finding ways to make production less costly, and working together in the industry.

Solving these issues is important for the Organic Packaged Food Market to keep growing and become something that everyone likes and buys. Another challenge for organic packaged foods is that some people see them as something only for a specific group and not for everyone.

This makes it hard for more people to accept and buy organic foods. Some might think of these foods as fancy or a luxury, not something for everyday use. This makes it a challenge to reach a wider group of people and make organic choices more available to everyone. Solving these challenges needs different actions.

First, telling people why organic foods are good for them can help. Also, finding new and smart ways to make organic foods without spending too much money is important. Lastly, working together in the industry can bring more ideas and solutions. By doing these things, the Organic Packaged Food Market can overcome its challenges and become something that everyone likes and buys every day.

Regional Analysis

North America held the highest revenue share at over 50.0% in 2023. Market growth will be driven by high consumer awareness of the benefits of organic packaged food, as well as increased spending on a nutritional product that allows companies to utilize farm-grown natural ingredients in the U.S. and Canada. The availability of organic packaged foods will increase with Walmart’s expansion.

Asia Pacific is expected to expand at a 15.8% CAGR between 2023-2032. In the coming years, new avenues will open up due to the growing middle-class population in countries such as China, India, Thailand, and Bangladesh. Agro-farming land availability in India and China will likely force industry players to establish strategic partnerships in the area.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Some key players include THE WHITEWAVE FODIES COMPANY, Hain Celestial, and General Mills Inc. Sresta Natural Bio Products Pvt. Ltd. Due to the availability of many brands and rapid innovation within the product line, there will be low entry barriers.

Major manufacturers are expected to compete fiercely. There is growing competition between the various market players due to the increasing demand for organic packaged products and the attractiveness of low-priced organizations like Walmart. Innovation and new product development will remain key success factors given the competitive landscape.

Market Key Players

- Amy’s Kitchen

- Albert’s Organics, Inc.

- The Whitewave Foods Company

- Hain Celestial Group

- General Mills Inc.

- The Kellogg Company

- Campbell Soup Company

- Other Key Players

Recent Developments

In August 2022, Danone acquired organic food producer Happy Family. Happy Family produces a variety of organic products. The management of Danone revealed that the company has agreed to purchase 92% of the organic baby and baby food manufacturer Happy Family.

In July 2022, Grain Forests introduced new organic products to bring the rural farm closer to the city. Sprouted ragi for babies, Health Mix for diabetics, Moringa powder for daily nutrition, and Ragi Dosa for a nutritious breakfast are newly added products.

Report Scope

Report Features Description Market Value (2022) US$ 45 Bn Forecast Revenue (2032) US$ 178 Bn CAGR (2023-2032) 14.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(R.T.E Cereals, Bakery & Confectionery Products, Dairy Products, Sauces, Dressings & Condiments, Snacks & Nutrition Bars, Other Products), By Distribution Channel(Offline, Online), By Applications(Daily Diet, Nutrition, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Amy’s Kitchen, Albert’s Organics, Inc., The Whitewave Foods Company, Hain Celestial Group, General Mills Inc., The Kellogg Company, Campbell Soup Company, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Organic Packaged Food MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Organic Packaged Food MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Amy's Kitchen

- Albert's Organics, Inc.

- The Whitewave Foods Company

- Hain Celestial Group

- General Mills Inc.

- The Kellogg Company

- Campbell Soup Company

- Other Key Players