Global Organic Milk Powder Market By Type (Whole Milk Powder, Skimmed Milk Powder, Buttermilk and Whey), By Source (Dairy-based, Non-dairy based), By Application (Bakery And Confectionery, Infant Formula, Nutritional Products, Dairy Desserts, Beverages, Others), By Distribution Channel (B2B, B2C, Supermarkets/Hypermarkets (Specialty Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150788

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

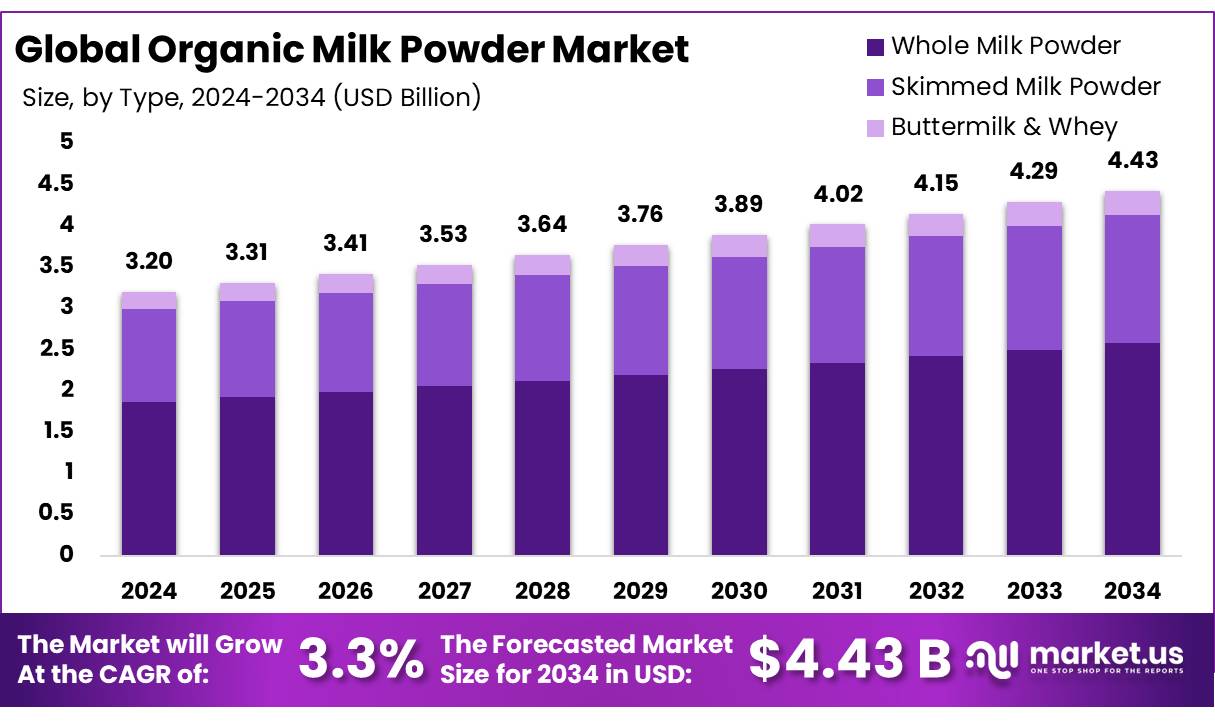

The Global Organic Milk Powder Market size is expected to be worth around USD 4.0 Billion by 2034, from USD 3.2 Billion in 2024, growing at a CAGR of 3.3% during the forecast period from 2025 to 2034.

Milk powder is a dried form of milk obtained by removing most of the water content from fluid milk, resulting in a shelf-stable product that retains the nutritional and functional qualities of fresh milk. Common types include skimmed milk powder, whole milk powder, and buttermilk powder.

This transformation not only extends the product’s shelf life to 12-18 months but also makes it easier to transport, store, and incorporate into various food formulations. Milk powder serves as a versatile ingredient in a wide range of applications, including baked goods, confections, dairy products, recombined milk, nutritional beverages, and prepared foods, offering both nutritional value and functional benefits such as improved texture and flavor.

The global organic milk powder market is witnessing steady growth, driven by rising consumer demand for organic and natural products motivated by health concerns, environmental awareness, and animal welfare considerations. Increasing product diversification, such as flavored organic milk beverages, along with growing preferences for clean-label and additive-free foods, is further fueling this expansion.

Additionally, organic whole milk powder is gaining popularity as a key ingredient in food and beverage applications, including dietary supplements, due to its superior nutritional profile. Overall, the organic milk powder market is expected to continue growing as consumers increasingly prioritize health, sustainability, and quality in their dietary choices.

Key Takeaways

- The global organic milk powder market was valued at USD 3.2 billion in 2024.

- The global organic milk powder market is projected to grow at a CAGR of 3.3 % and is estimated to reach USD 4.0 billion by 2034.

- Among types, whole milk powder accounted for the largest market share 58.3%.

- Among sources, dairy-based accounted for the majority of the market share at 87.4%.

- By application, bakery & confectionery accounted for the largest market share of 38.4%.

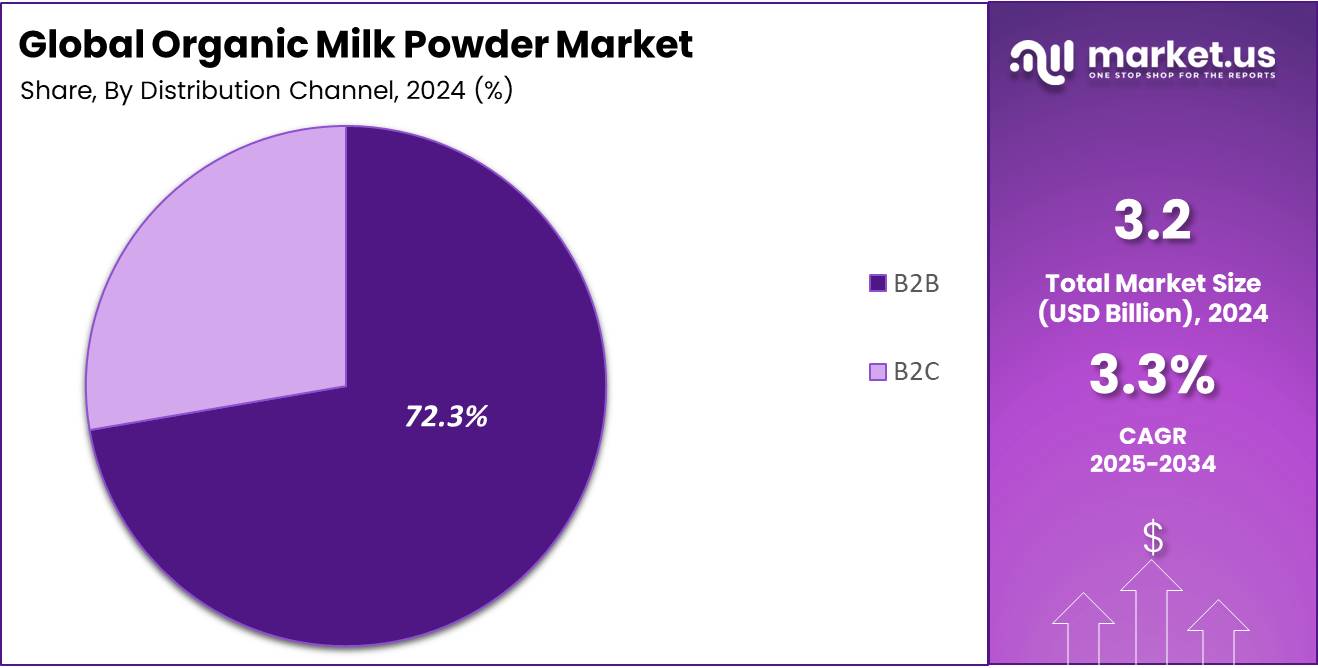

- By distribution channel, B2B accounted for the majority of the market share at 72.3%.

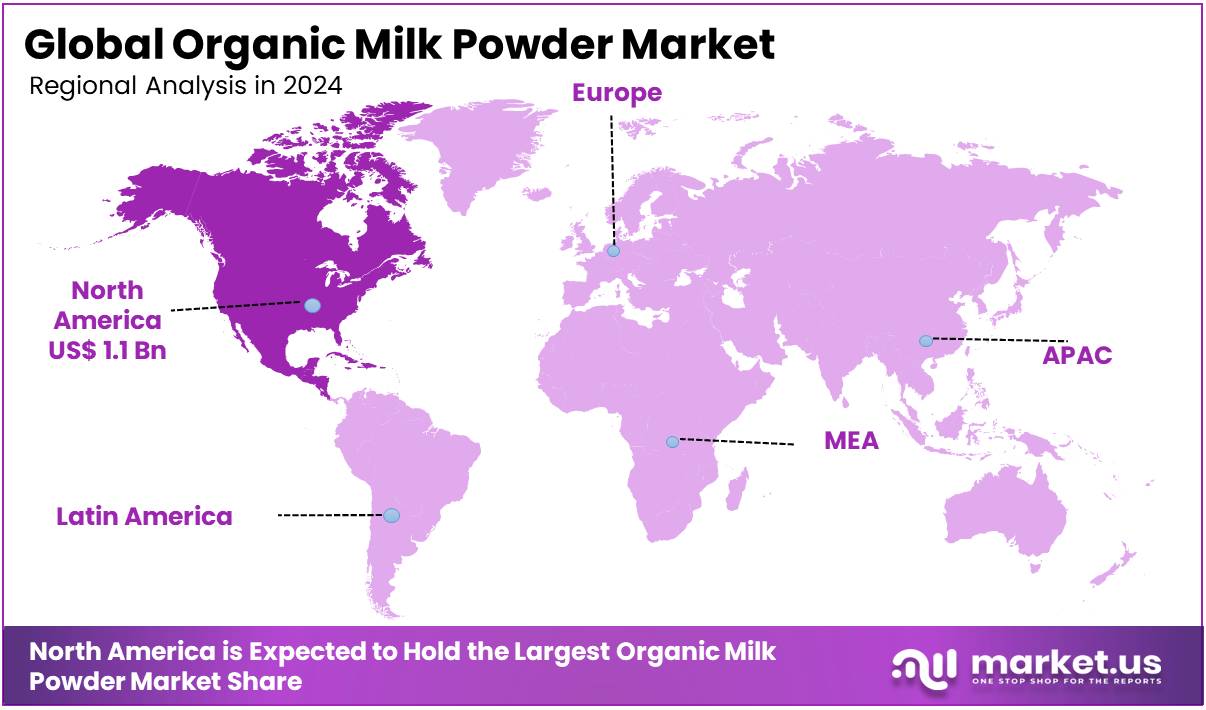

- North America is estimated as the largest market for organic milk powder with a share of 36.3% of the market share.

Type Analysis

Whole Milk Powder Dominated Segment Type In Global Organic Milk Powder Market

The organic milk powder market is segmented based type into whole milk powder, skimmed milk powder, buttermilk & whey. In 2024, the whole milk powder segment held a significant revenue share of 58.3%. Due to its rich nutritional profile and growing use in infant formula, bakery, confectionery, and dairy-based food products.

Whole milk powder retains natural milk fat, which enhances flavor and texture, making it a preferred choice for both consumers and manufacturers seeking clean-label, full-fat dairy alternatives. Additionally, increased demand for organic, high-calorie nutrition particularly in emerging markets and health-conscious demographics has further driven growth in this segment.

Source Analysis

Dairy-Based Led The Source Segment In Global Organic Milk Powder Market

Based on source, the market is further divided into dairy-based, and non-dairy-based. The predominance of the dairy-based, commanding a substantial 87.4% market share in 2024. Due to the strong consumer preference for traditional dairy nutrition and the established trust in cow milk as a reliable source of protein, calcium, and essential vitamins.

Dairy-based organic milk powder is widely used in infant nutrition, functional foods, and dietary supplements, where its bioavailability and compatibility with human digestion offer significant advantages. Furthermore, the robust dairy infrastructure, especially in North America and Europe, supports large-scale production and distribution of certified organic dairy products, reinforcing the segment’s dominance in the global market.

Application Analysis

The Bakery & Confectionery Application Segment holds the Major Share Of the Global Organic Milk Powder Market.

Among applications, the organic milk powder market is classified into bakery & confectionery, infant formula, nutritional products, dairy desserts, beverages, and others. In 2024, bakery & confectionery held a dominant position with a 38.4% share. Due to the growing demand for clean-label, organic ingredients in baked goods and sweets.

Consumers are increasingly seeking healthier alternatives without artificial additives or preservatives, prompting manufacturers tso incorporate organic milk powder for its natural richness, extended shelf life, and functional properties like texture improvement and flavor enhancement. Additionally, the rising trend of premium and artisanal bakery products, especially in North America and Europe, has fueled the use of organic dairy components, further strengthening this segment’s market position.

Distribution Channel Analysis

B2B Distribution Channel commands the Largest Share In the Global Organic Milk Powder Market.

By distribution channel, the market is categorized into B2B and B2C with the B2B segment emerging as the dominant channel, holding 72.3% of the total market share in 2024. Driven by strong demand from food and beverage manufacturers, including bakeries, confectionery producers, infant formula companies, and nutritional product developers.

These businesses rely on organic milk powder as a key ingredient due to its long shelf life, consistent quality, and functional versatility in product formulations. Additionally, the B2B channel benefits from bulk purchasing, streamlined logistics, and stable supply agreements, which make it a more efficient and cost-effective distribution route compared to direct-to-consumer sales.

Key Market Segments

By Type

- Whole Milk Powder

- Skimmed Milk Powder

- Buttermilk & Whey

By Source

- Dairy-based

- Non-dairy based

By Application

- Bakery & Confectionery

- Infant Formula

- Nutritional Products

- Dairy Desserts

- Beverages

- Others

By Distribution Channel

- B2B

- B2C

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Others

Drivers

Rising Awareness Regarding Nutritional Benefits of Organic Dairy Products

Growing awareness of the health benefits of organic dairy products is a key driver of the global organic milk powder market. Consumers are increasingly concerned about the harmful effects of synthetic chemicals, additives, and GMOs in conventional food. Organic milk powder, produced without antibiotics or growth hormones, is seen as a safer and more nutritious option.

The COVID-19 pandemic has further intensified consumer demand for clean-label, immune-boosting, and chemical-free food options. This rising preference for organic products highlights a broader shift toward sustainable, health-conscious lifestyle. These factors make organic milk powder increasingly seen as a staple in both household and commercial food sectors.

- According to the Organic Trade Association (OTA), organic food sales in 2023 surpassed $63 billion in the United States.

Moreover, organic milk powder is gaining popularity due to its rich nutritional profile and health benefits. It contains higher levels of omega-3 fatty acids, CLA, antioxidants like vitamin E and beta-carotene, as well as essential minerals such as calcium and phosphorus. These nutrients support immunity, bone strength, heart health, and cognitive development. Its clean-label nature and superior quality appeal strongly to health-conscious consumers, particularly families with young children. This aligns with the growing demand for sustainable and wellness-focused food choices.

- For instance, According to the U.S. Dairy Export Council, just 100g of skimmed milk powder provides approximately 1,300mg of calcium—meeting the daily recommended intake for adults over 50.

- Additionally, the USDA highlights that organic milk contains 16 vital nutrients, including protein, calcium, phosphorus, and key vitamins such as A, B12, and D. These highlights make organic milk powder a highly beneficial choice for maintaining bone health, supporting immunity, and meeting daily nutritional needs.

Furthermore, generations Y and Z are driving demand for organic milk powder, prioritizing products that offer both health benefits and align with ethical and environmental values. For these consumers, organic milk powder is more than a dietary supplement it represents a conscious lifestyle choice. Their focus on quality over price, along with increased awareness of food sourcing and sustainability, is fueling market growth. This shift is positioning organic milk powder as a key product in both homes and health-focused products globally.

Restraints

Higher Cost

High costs are one of the major factors restraining the growth of the global organic milk powder market. Organic dairy farming requires adherence to strict standards, including the use of certified organic feed and sustainable farming methods, which increase input costs compared to conventional dairy production. Additionally, rising prices for feed and labor, along with the need for specialized handling and storage to maintain product quality, further drive up overall production expenses. These higher costs are often passed on to consumers, limiting affordability and restricting market expansion, especially in price-sensitive regions.

- According to the USDA National Agricultural Statistics Service (NASS), the average price of milk powder in the United States has risen by over 20% in the past year. These factors highlight the high cost of organic milk powder limiting demand and slowing the growth of the global organic milk powder market.

Moreover, supply chain disruptions and inefficiencies also add to the financial challenges faced by organic milk powder producers. Factors such as transportation delays, increased shipping costs, and logistical complexities have intensified in recent years due to global events like geopolitical trade policies. These issues not only raise operational costs but also affect timely market supply, making it difficult for producers to scale and compete globally. To foster market growth, stakeholders must focus on enhancing production efficiencies, streamlining supply chains, and implementing supportive policies that reduce the financial burden on organic dairy farmers.

- According to the U.S. Department of Agriculture, the price of non-fat dry milk in the United States has risen to $1.24 per pound, significantly exceeding the global average of $1.00 per pound. This price gap reflects differences in production costs, supply chain efficiencies, and varying market conditions across countries.

Opportunity

Expansion into the food industry

The expansion of the global food industry is driving significant growth opportunities for the organic milk powder market. With increasing consumer demand for healthier, sustainable, and convenient food options, organic milk powder is becoming a popular ingredient across various applications such as bakery goods, dairy desserts, beverages, and nutritional products. Its natural appeal, versatility, and long shelf life make it ideal for both traditional dishes and innovative culinary creations. Food manufacturers and service providers are increasingly adopting organic milk powder to cater to the rising preference for clean-label and nutrient-rich ingredients.

Furthermore, the growing popularity of international cuisines and home baking trends is further boosting demand for organic milk powder. As quick-service restaurants, cafes, and ready-to-eat meal providers diversify their menus, organic milk powder is used to create a wide range of products from traditional sweets to modern cakes, cookies, and beverages. This product diversification, coupled with urbanization and a rising middle class with higher disposable income, is fueling continuous growth and innovation in the food sector, solidifying organic milk powder’s position as a key ingredient in the evolving, health-focused global food market.

Trends

Rise of Farm-to-Scoop Dairy Branding

The “Farm to Scoop” dairy branding trend is gaining significant momentum in the global organic milk powder market, driven by growing consumer demand for transparency, authenticity, and quality. This approach highlights the entire supply chain journey—from the local farm where the milk is produced to the final powdered product—emphasizing freshness and ethical sourcing.

By showcasing specific farms or cooperatives and sharing stories about farming practices and farmer profiles, brands build deeper trust and connection with consumers who increasingly prioritize knowing the origin of their food. In the organic milk powder industry, the Farm to Scoop trend helps differentiate products in a crowded market by aligning with consumer values around sustainability, animal welfare, and clean production methods.

This transparency fosters loyalty and supports premium pricing, which is critical given the higher production costs associated with organic dairy. As a result, the rise of Farm to Scoop branding is not only reshaping marketing strategies but also contributing positively to the growth and development of the global organic milk powder market.

Geopolitical Impact Analysis

Impact of Geopolitical Trade Tariffs on the Global Organic Milk Powder Market

Recent geopolitical trade tariffs are reshaping the global organic milk powder market by creating new challenges for exporters and limiting market accessibility. These tariffs increase costs and reduce competitiveness, forcing producers to adapt their strategies while disrupting established trade flows and supply chains.

- For instance, is Colombia’s imposition of a 4.86% countervailing duty on U.S. milk powder imports, introduced in September 2024.

As the U.S. is a major producer and consumer of organic milk powder, trade tariffs, and geopolitical tensions significantly influence both its domestic market and export potential. Furthermore, rising trade tensions between major global economies have escalated after the U.S. imposed baseline tariffs on more than 120 countries, including key players such as China, the European Union, and India.

Intended as a response to what the U.S. views as unfair trade practices, these tariffs have triggered retaliatory actions from several nations. This back-and-forth has created instability in global trade networks, increasing costs and uncertainty for exporters. Among the sectors affected is the organic dairy industry, where products like organic milk powder now face greater challenges in maintaining competitive access to international markets.

- For instance, in April 2025, the U.S. introduced a 10% universal tariff on imports from over 180 countries, excluding only pharmaceuticals. In response, China imposed its own 10% tariff on a wide range of U.S. agricultural goods, including dairy. Meanwhile, Canada’s steep 250% tariff on U.S. dairy exports has further strained trade relations, with the U.S. signaling it may impose similar tariffs in return.

- In addition, In May 2025, the U.S. imposed a 26% tariff on milk powder and other dairy products imported from India. This move was p intensifying trade tensions between the two countries and impacting the global dairy trade landscape.

The recent tariffs imposed by key trading partners such as China and India create barriers that limit U.S. exporters’ access to important international markets. These trade restrictions not only affect U.S. dairy farmers and manufacturers but also disrupt global supply chains, prompting shifts in sourcing and pricing. Consequently, the U.S. market’s dynamics play a crucial role in shaping trends, availability, and competitiveness in the global organic milk powder industry.

On a global level, these trade restrictions disrupt supply chains and create uncertainty for producers and buyers alike. Exporters are forced to explore new markets or adjust their pricing strategies to maintain demand, which can slow overall market growth. Additionally, countries imposing tariffs may encourage local production or sourcing from alternative suppliers, reducing reliance on U.S. imports. This shifting trade dynamics underscores new geopolitical tensions and protectionist policies ultimately affecting the availability, pricing, and growth of organic milk powder worldwide.

Regional Analysis

North America Dominate the Global Organic Milk Powder Market in 2024, Driven By the Well-Established Dairy Industry, Health-Conscious Consumers, and Strong Government Support

In 2024, North America dominated the global organic milk powder market, accounting for 36.3% of the total market share, driven by its well-established dairy industry, which employs advanced farming techniques and follows strict organic certification standards. These standards ensure that the products are of high quality and meet consumer expectations for safety and purity. In addition, growing consumer awareness about health, nutrition, and sustainable food choices has driven strong demand for organic dairy products throughout the region. This demand is supported by the presence of major organic milk powder producers and a reliable supply chain infrastructure, which ensures consistent production and efficient distribution.

- According to the Organic Trade Association, 82% of U.S. households reported purchasing organic products at least occasionally in 2022. This high level of consumer engagement reflects the growing preference for organic options, driven by increasing awareness of health, environmental, and quality benefits associated with organic foods.

Moreover, regions’ favorable government initiatives promoting organic farming and increased investment in organic agriculture have further strengthened the market in North America. In the United States, processors and manufacturers are committed to continuous improvement and sustainability. The Innovation Center for U.S. Dairy, a collaborative consortium involving dairy farmers, companies, government representatives, academic institutions, and NGOs, works together to enhance food safety by improving pathogen control, tightening audit protocols, and reducing risks in the supply chain. These combined efforts help maintain high standards and support the region’s dominance in the global organic milk powder market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players in the Organic Milk Powder Market Dominate the Market Through Product Innovation, Sustainable Practices, And Strong Supply Chain Management.

Major players such as Fonterra Co-operative Group and Arla Foods amba are leveraging their extensive scale, robust research and development capabilities, and strong compliance with quality and regulatory standards to maintain a competitive edge in the global organic milk powder market. These companies are widely recognized for their continuous innovation and ability to adapt to shifting consumer preferences toward organic and sustainably sourced dairy products.

Furthermore, companies such as GMP Dairy Limited, Bayerische Milchindustrie eG, and NOW Foods strengthen their market position by focusing on innovation to the rising global demand for clean-label, sustainable, and health-focused dairy offerings. Their strategic emphasis on product transparency and nutritional value aligns with the evolving expectations of health-conscious consumers worldwide.

The Major Players in The Industry

- Fonterra Co-Operative Group Limited

- Lactalis Ingredients

- Horizon Organic Dairy, LLC

- AGRANA Group

- NOW Foods

- Essona Organics

- GMP Dairy

- Organic Valley

- Bayerische Milchindustrie eG

- Castle Dairy

- Pāmu

- Vreugdenhil Dairy Foods

- Open Country Dairy

- Valfoo

- Arla Foods amba

- Bobbie

- Other Key Players

Recent Development

- In April 2025 – Bobbie launched the first and only USDA Organic whole milk infant formula manufactured in the U.S., offering a breast milk-inspired recipe with premium brain-supporting ingredients and no palm or soy oils.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Bn Forecast Revenue (2034) USD 4.4 Bn CAGR (2025-2034) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Whole Milk Powder, Skimmed Milk Powder, Buttermilk & Whey), By Source (Dairy-based, Non-dairy based), By Application (Bakery & Confectionery, Infant Formula, Nutritional Products, Dairy Desserts, Beverages, Others), By Distribution Channel (B2B, B2C, Supermarkets/Hypermarkets (Specialty Stores, Online Retail, Others), Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Fonterra Co-Operative Group Limited, Lactalis Ingredients, Horizon Organic Dairy, LLC, AGRANA Group, NOW Foods, Essona Organics, GMP Dairy, Organic Valley, Bayerische Milchindustrie eG (BMI), Castle Dairy, Pāmu, Vreugdenhil Dairy Foods, Open Country Dairy, Valfoo, Arla Foods amba, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Organic Milk Powder MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Organic Milk Powder MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Fonterra Co-Operative Group Limited

- Lactalis Ingredients

- Horizon Organic Dairy, LLC

- AGRANA Group

- NOW Foods

- Essona Organics

- GMP Dairy

- Organic Valley

- Bayerische Milchindustrie eG

- Castle Dairy

- Pāmu

- Vreugdenhil Dairy Foods

- Open Country Dairy

- Valfoo

- Arla Foods amba

- Bobbie

- Other Key Players