Global Optical Fiber In-Vehicle Network Market Size, Share, Industry Analysis Report By Material Type (Plastic Optical Fiber (POF), Glass Optical Fiber (GOF)), By Mode (Multi-Mode Fiber (MMF), Single-Mode Fiber (SMF)), By Communication Method (MOST (Media Oriented Systems Transport), Ethernet (Ethernet Over Plastic Optical Fiber (POF), Ethernet Over Glass Optical Fiber (GOF)), Others (CAN, LIN, FlexRay, etc.)), By Communication Speed (≤ 1 Gbps, >1 Gbps to ≤ 10 Gbps, > 10 Gbps), By Application (Lighting Devices, Safety Systems, Infotainment, Communication Devices, Internal and External Sensing, Others), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 160646

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Analysts’ Viewpoint

- Role of Generative AI

- Investment and Business Benefits

- China Market Size

- By Material Type

- By Mode

- By Communication Method

- By Communication Speed

- By Application

- By Vehicle Type

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

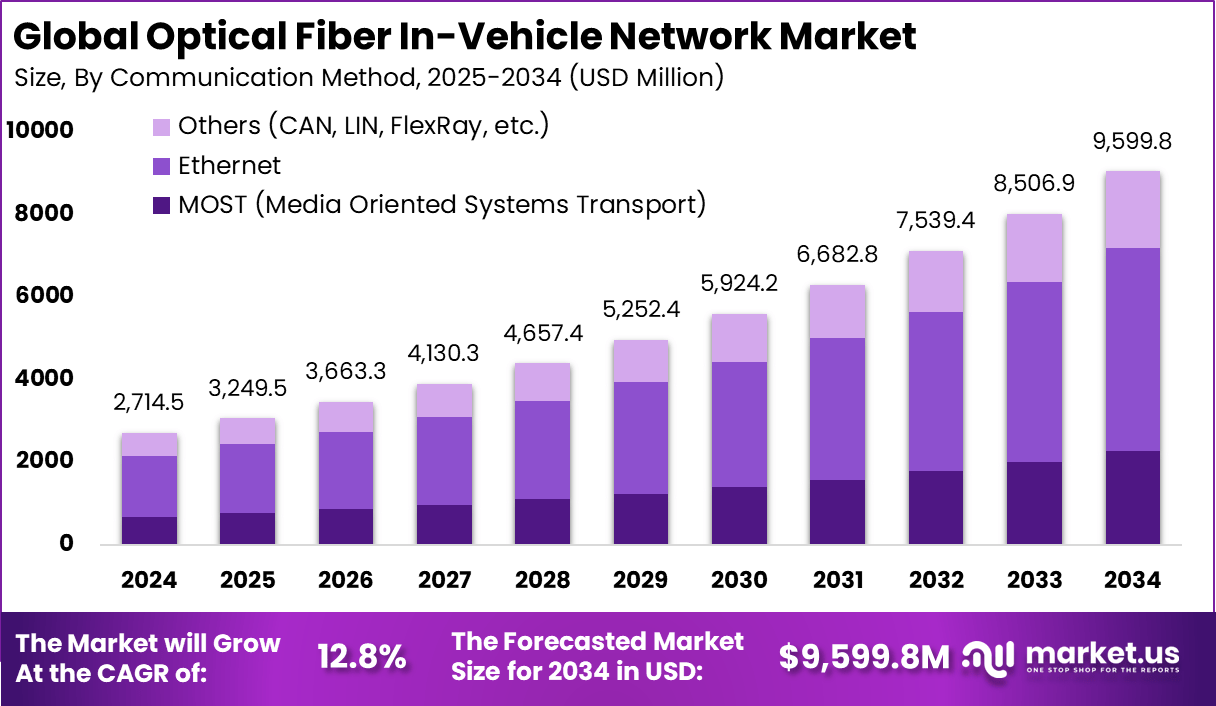

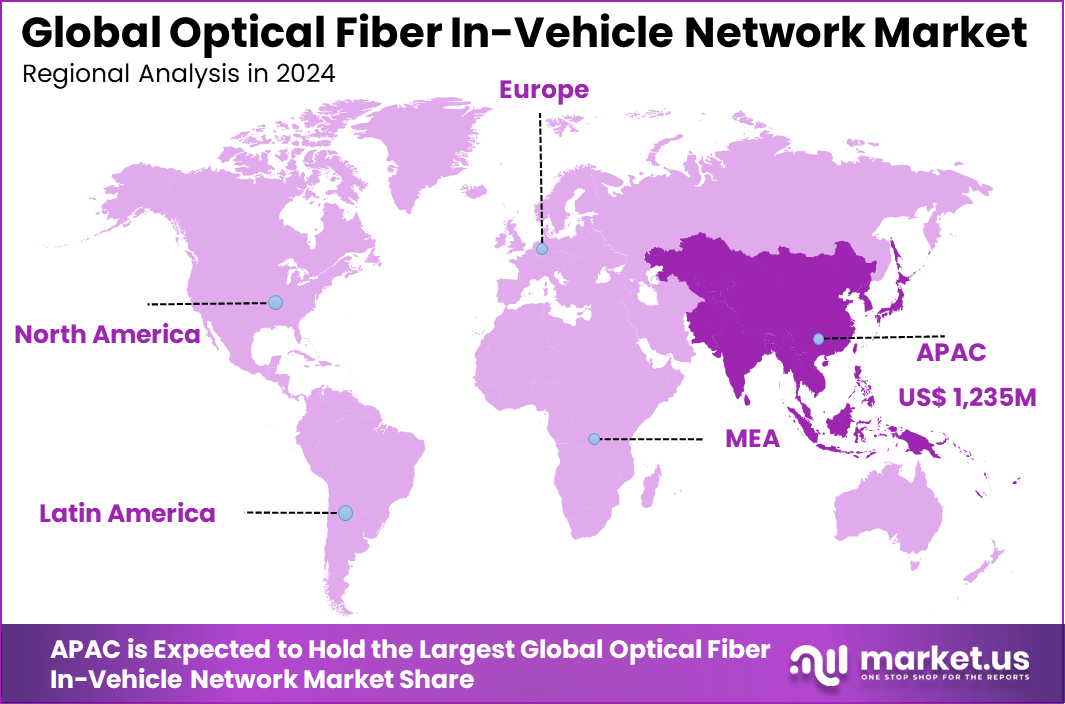

The Global Optical Fiber In-Vehicle Network Market generated USD 2,714.5 Million in 2024 and is predicted to register growth from USD 3,249.5 Million in 2025 to about USD 9,599.8 Million by 2034, recording a CAGR of 12.8% throughout the forecast span. In 2024, APAC held a dominan market position, capturing more than a 45.5% share, holding USD 1,235 Million revenue.

The Optical Fiber In-Vehicle Network Market is evolving rapidly as modern vehicles increasingly rely on high-speed, reliable data transmission to support complex electrical and communication systems. Optical fibers enable fast, interference-free data transfer within vehicles, essential for infotainment, navigation, safety features, and autonomous driving systems. The lightweight nature of optical fibers also contributes to vehicle efficiency by reducing weight, which is vital in electric and hybrid vehicles.

Top driving factors include the growing demand for bandwidth-intensive applications such as advanced driver-assistance systems (ADAS), vehicle-to-vehicle (V2V) communication, and in-car entertainment systems. Optical fibers provide immunity to electromagnetic interference, which is crucial as vehicles incorporate more sensors and electronic control units.

The shift towards electric vehicles (EVs) accelerates optical fiber adoption because these vehicles require lightweight and energy-efficient communication solutions that optimize battery performance. Additionally, government regulations and industry standards promoting vehicle safety and emissions reduction indirectly boost optical fiber integration.

Top Market Takeaways

- By material type, Plastic Optical Fiber (POF) dominates with 70.6%, favored for flexibility, lightweight design, and cost efficiency in vehicles.

- By mode, Multi-Mode Fiber (MMF) holds a strong 89.8%, driven by its suitability for short-distance, high-capacity in-vehicle communication.

- By communication method, Ethernet leads with 54.4%, reflecting the shift toward standardized, high-speed automotive networking.

- By communication speed, ≤ 1 Gbps accounts for 75.3%, showing current reliance on sub-gigabit systems while preparing for faster networks.

- By application, infotainment systems represent 33.0%, driven by consumer demand for connected entertainment experiences.

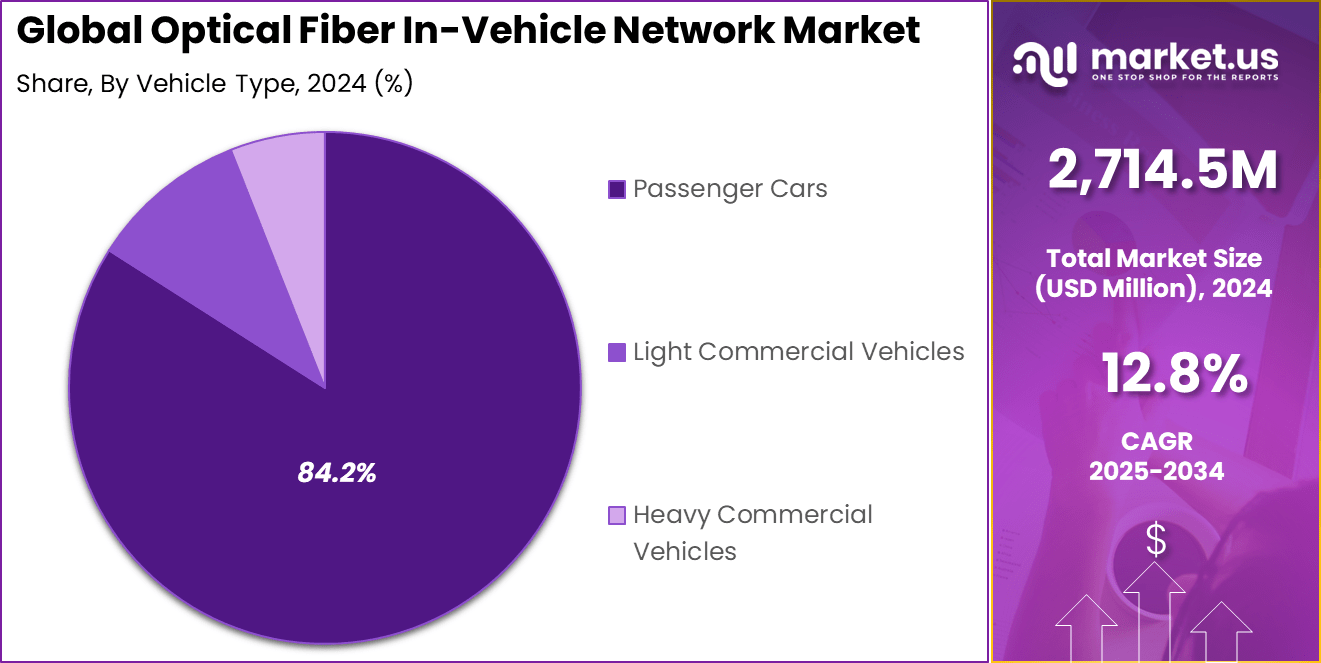

- By vehicle type, passenger cars dominate with 84.2%, as automakers integrate advanced networking to enhance connectivity and safety features.

- Asia-Pacific leads with 45.5%, supported by automotive manufacturing hubs and rising adoption of smart mobility.

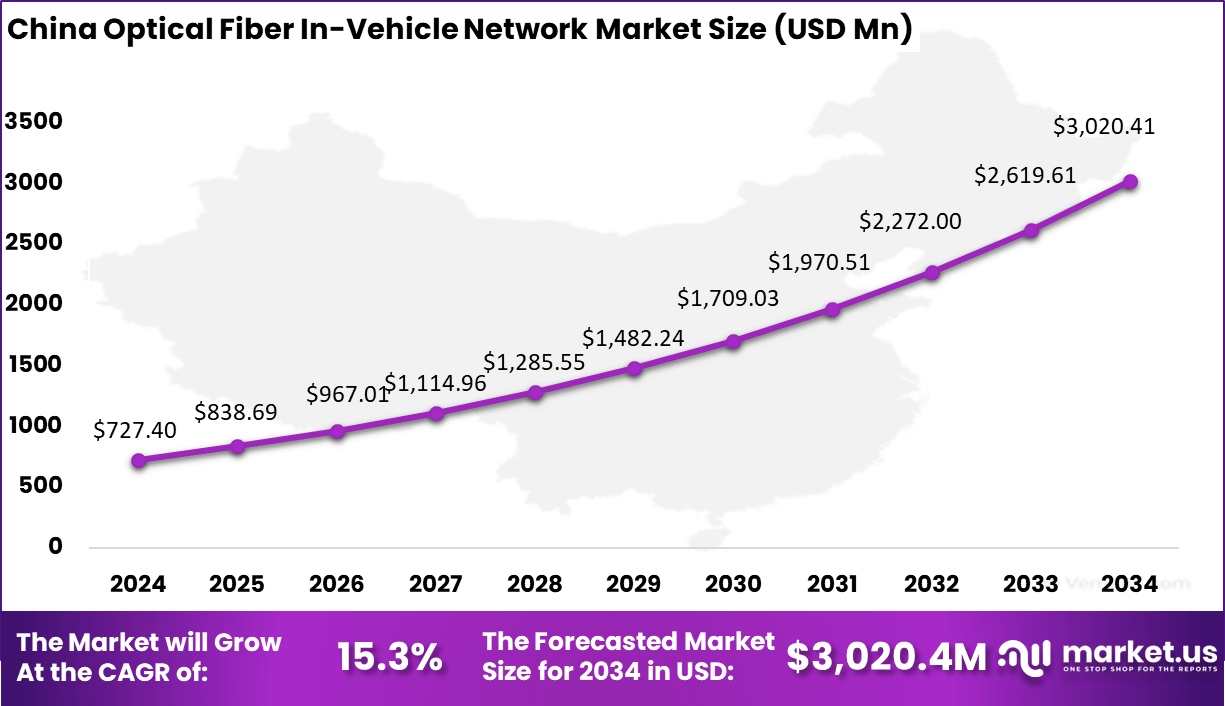

- The China market reached USD 727.4 million and is expanding at a strong CAGR of 15.3%, highlighting its leadership in connected vehicle technologies.

Analysts’ Viewpoint

Demand analysis reveals that passenger vehicles dominate the adoption due to consumer preference for connectivity and enhanced in-car experiences. Commercial vehicles also increasingly use optical fibers for fleet management and telematics due to durability in harsh environments. The electric vehicle segment is a significant growth area, with optical fiber networks supporting complex battery management and autonomous functions.

Growing integration of AI and IoT in vehicles further fuels this demand, as real-time data exchange becomes critical for vehicle performance and safety. Increasing adoption technologies include plastic optical fiber (POF) for cost-efficiency and flexibility in vehicle interiors and glass optical fiber for higher bandwidth applications. Technologies like optical multi-gigabit Ethernet are being integrated to achieve data rates up to 50 Gbit/s over distances within vehicle architectures.

These solutions provide scalable, interference-free communication supporting future software-defined vehicles. The adoption of IoT-enabled vehicle ecosystems and AI-powered analytics in autonomous and connected vehicles is pushing the need for robust optical networks. Key reasons for adopting optical fiber include superior bandwidth and speed, immunity to electromagnetic interference (EMI), lighter weight compared to copper wiring, and enhanced reliability over long distances inside vehicles.

Role of Generative AI

The role of generative AI in optical fiber in-vehicle networks is becoming increasingly significant as it supports the management and analysis of the massive data generated within modern vehicles. Generative AI enhances the capability to process raw data from fiber optic sensors and networks, allowing real-time fault detection, optimization of network pathways, and predictive maintenance.

This AI-driven automation improves the efficiency and reliability of these networks, crucial for supporting autonomous driving and advanced driver assistance systems (ADAS). Studies show that generative AI can automate design and operational workflows, leading to improved network planning and maintenance efficiency by up to 30%, demonstrating its critical contribution to the future of in-vehicle fiber optic networks.

Investment and Business Benefits

Investment opportunities in the market are driven by growing demand for EVs, autonomous vehicles, and connected infrastructure. Automotive manufacturers and technology providers are investing in research and development to improve optical fiber durability, reduce installation costs, and develop industry-wide standards.

Investments also focus on integrating optical fiber with next-generation vehicle computing platforms, including high-performance optical transceivers and connectors designed for automotive environments. The ongoing global push for smart mobility and connected transportation networks opens further avenues for optical fiber use.

Business benefits of implementing optical fiber in in-vehicle networks include enhanced data transmission reliability, reduced electromagnetic interference risks, and support for increasing vehicle electronic complexity. Optical fibers contribute to enhanced safety through faster and more accurate sensor data transfer. They offer lower maintenance costs over vehicle lifetimes due to durability and reduced susceptibility to wear compared to traditional wiring.

China Market Size

In 2024, China stands out with notable market activity, marked by a 15.3% CAGR and a market size around USD 727.4 million. The country’s large automotive production base and aggressive push toward electrification and connectivity drive optical fiber adoption in vehicles. Chinese automakers are increasingly integrating high-speed in-vehicle networks, making China a critical market for fiber optic technologies.

Technological advancements, combined with growing consumer expectations for vehicle safety, infotainment, and autonomous features, underpin this growth. Government policies supporting new energy vehicles and smart mobility also catalyze demand, making China central to the expansion of the optical fiber in-vehicle network market globally.

Asia-Pacific holds a commanding 45.5% share of the optical fiber in-vehicle network market, supported by rapid growth in automotive production and technology adoption in countries like Japan, South Korea, India, and China. The region’s expanding automotive industry, paired with increasing demand for connected car features and smart vehicle technologies, accelerates optical fiber use in vehicle networks.

By Countrywise Share Analysis (%), 2020-2024

Country 2020 2021 2022 2023 2024 China 57.0% 57.7% 58.4% 59.1% 60.2% Japan 10.0% 9.9% 9.7% 9.6% 9.4% South Korea 3.2% 3.2% 3.2% 3.2% 3.1% India 12.0% 11.9% 11.9% 11.8% 11.6% Australia & New Zealand 4.0% 3.9% 3.9% 3.8% 3.7% ASEAN 7.6% 7.4% 7.2% 7.0% 6.8% Rest of Asia-Pacific 6.2% 6.0% 5.7% 5.5% 5.2% Infrastructure investments, digitalization initiatives, and growing consumer demand for infotainment and safety systems contribute to the region’s leadership. Asia-Pacific’s robust manufacturing ecosystem and government support for electric and autonomous vehicles further strengthen its market position and growth potential.

By Material Type

In 2024, Plastic Optical Fiber (POF) dominates the optical fiber in-vehicle network market, accounting for 70.6% share. This dominance is driven by POF’s distinct advantages, including its flexibility, ease of installation, and resistance to harsh automotive environments such as high temperatures and vibrations. POF’s mechanical strength and ability to maintain performance over the lifespan of a vehicle make it preferable for infotainment and sensor networks within cars.

Market Share by Material Type (%), 2020-2024

Material Type 2020 2021 2022 2023 2024 Plastic Optical Fiber (POF) 72.8% 72.7% 72.5% 72.4% 72.3% Glass Optical Fiber (GOF) 27.2% 27.3% 27.5% 27.6% 27.7% Furthermore, POF supports shorter-distance high-data-rate communication efficiently, making it suitable for the intricate wiring systems inside vehicles. Its adaptability to complex vehicle architectures and compatibility with standards like MOST (Media Oriented Systems Transport) underscores why POF remains the preferred material over glass fiber in in-car networks.

By Mode

In 2024, Multi-Mode Fiber (MMF) leads the market with a significant 89.8% share. MMF’s ability to carry multiple light signals simultaneously is particularly beneficial for in-vehicle networks needing high bandwidth over relatively short distances. The large core size of MMF compared to single-mode fiber enables effective transmission within the confined spaces of a vehicle without excessive signal loss or attenuation.

Market Share by Mode (%), 2020-2024

Mode 2020 2021 2022 2023 2024 Multi-Mode Fiber (MMF) 92.1% 91.8% 91.4% 91.1% 90.8% Single-Mode Fiber (SMF) 7.9% 8.2% 8.6% 8.9% 9.2% This type of fiber is well suited for Ethernet-based communication systems in vehicles, especially for data-intensive applications such as infotainment and driver assistance systems. As automotive networks become more complex, MMF’s capacity for high-speed data transfer while handling multiple communication paths makes it the backbone for in-car fiber optic networks.

By Communication Method

In 2024, Ethernet is the preferred communication method with 54.4% share in in-vehicle networks. It provides high-speed, reliable data transmission essential for supporting connected car features such as real-time infotainment streaming, navigation, and advanced driver-assistance systems (ADAS). Ethernet’s widespread adoption in automotive networking is driven by its standardized protocols and compatibility with IT network infrastructure.

Market Share by Communication Method (%), 2020-2024

Communication Method 2020 2021 2022 2023 2024 MOST (Media Oriented Systems Transport) 5.2% 5.2% 5.2% 5.2% 5.1% Ethernet 47.9% 48.8% 49.7% 50.6% 52.0% – Ethernet Over Plastic Optical Fiber (POF) 73.9% 73.7% 73.6% 73.4% 73.3% – Ethernet Over Glass Optical Fiber (GOF) 26.1% 26.3% 26.4% 26.6% 26.7% Others (CAN, LIN, FlexRay, etc.) 46.8% 45.9% 45.1% 44.2% 42.9% Additionally, Ethernet supports speeds up to 1 Gbps or higher, which is crucial as vehicles integrate more sensors and consumer electronics that demand fast data exchange. The automotive industry is embracing Ethernet to replace older, slower communication buses, paving the way for smarter and more connected vehicles.

By Communication Speed

In 2024, Communication speeds up to 1 Gbps account for 75.3% of the market, reflecting the current technological standard in most in-vehicle networks. This speed range supports a wide range of vehicle systems, from infotainment to sensor networks, without the need for the higher bandwidths that some cutting-edge autonomous driving applications may require.

Market Share by Communication Speed (%), 2020-2024

Communication Speed 2020 2021 2022 2023 2024 ≤ 1 Gbps 78.1% 77.9% 77.7% 77.5% 77.3% > 1 Gbps to ≤ 10 Gbps 18.6% 18.7% 18.9% 19.0% 19.2% > 10 Gbps 3.3% 3.3% 3.4% 3.5% 3.5% This standard speed balances cost and performance effectively, making it the backbone for many passenger car networks. As automotive connectivity needs grow, this segment maintains strong demand due to ongoing integration of multimedia and telematics features requiring reliable but cost-efficient data rates.

By Application

In 2024, Infotainment applications form the largest segment at 33.0% share. Increasing consumer demand for seamless multimedia, navigation, and connectivity features is pushing automakers to enhance in-car infotainment systems. Optical fiber in these systems enables high-quality audio and video streaming with low interference, ensuring a superior passenger experience.

Market Share by Application (%), 2020-2024

Application 2020 2021 2022 2023 2024 Lighting Devices 10.8% 10.7% 10.7% 10.6% 10.5% Safety Systems 26.5% 26.9% 27.4% 27.8% 28.5% Infotainment 37.7% 37.1% 36.5% 35.9% 35.0% Communication Devices 7.3% 7.3% 7.4% 7.5% 7.5% Internal and External Sensing 11.7% 12.0% 12.3% 12.6% 13.0% Others 6.0% 5.9% 5.8% 5.7% 5.5% Integrating infotainment with other vehicle systems necessitates robust data networks. Optical fibers, especially POF combined with Ethernet communication, provide the bandwidth and reliability needed to support real-time media transfer and system control within passenger cars, thereby making infotainment the dominant application driving fiber adoption.

By Vehicle Type

In 2024, Passenger cars represent the majority of demand in this market with 84.2% share. The high penetration of advanced features like connected infotainment, safety sensors, and driver assistance in passenger vehicles fuels the need for reliable, high-speed network connections. Passenger cars tend to adopt optical fiber technology rapidly to support these systems’ data requirements while optimizing weight and cabling complexity.

Market Share by Vehicle Type (%), 2020-2024

Vehicle Type 2020 2021 2022 2023 2024 Passenger Cars 86.4% 86.5% 86.5% 86.5% 86.5% Light Commercial Vehicles 10.7% 10.6% 10.5% 10.4% 10.3% Heavy Commercial Vehicles 2.8% 2.9% 3.0% 3.1% 3.2% Moreover, the diversity of passenger car models and market competition to offer enhanced technology drives continuous upgrading of in-vehicle network architectures. Optical fiber networks in these vehicles help improve performance and user experience, solidifying passenger cars’ position as the key vehicle segment in this market.

Emerging Trends

Emerging trends in optical fiber in-vehicle networks reveal a shift towards integrating multi-gigabit Ethernet over fiber optics, adhering to new standards like IEEE 802.3cz to enable data rates up to 50 Gbit/s with low latency and electromagnetic interference immunity. Such innovations are driven by the need to support software-defined vehicles with complex electrical architectures that traditional copper wiring cannot handle effectively.

The industry is also witnessing a move toward hybrid fiber solutions optimized for various sensor types, which support the integration of high-bandwidth infotainment, V2X communication, and safety systems. In the newer models, the adoption of automotive-grade optical fibers has increased by over 40% in the last two years, reflecting the rapid pace of adoption tied to connected and autonomous vehicle development.

Growth Factors

Growth factors supporting the optical fiber in-vehicle network market include the rapid expansion of electric vehicles that require robust, high-bandwidth internal communication networks to manage battery systems, propulsion controls, and onboard sensors. Additionally, increasing regulatory focus on vehicle safety and the implementation of ADAS have made the real-time transfer of large data volumes essential.

The lightweight nature of fiber optics compared to copper leads to vehicle weight reduction, enhancing fuel efficiency, which is another growth driver. It is observed that vehicles incorporating optical fiber networks experience up to 25% improvements in data transmission stability and up to 15% reductions in overall wiring weight, supporting higher efficiency and performance.

Key Market Segments

By Material Type

- Plastic Optical Fiber (POF)

- Glass Optical Fiber (GOF)

By Mode

- Multi-Mode Fiber (MMF)

- Single-Mode Fiber (SMF)

By Communication Method

- MOST (Media Oriented Systems Transport)

- Ethernet

- Ethernet Over Plastic Optical Fiber (POF)

- Ethernet Over Glass Optical Fiber (GOF)

- Others (CAN, LIN, FlexRay, etc.)

By Communication Speed

- ≤ 1 Gbps

- >1 Gbps to ≤ 10 Gbps

- > 10 Gbps

By Application

- Lighting Devices

- Safety Systems

- Infotainment

- Communication Devices

- Internal and External Sensing

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

High-Speed Data Demand in Modern Vehicles

The increasing demand for high-speed data transmission within vehicles is a key driver for the adoption of optical fiber networks. Modern vehicles, particularly electric and autonomous models, require rapid and reliable communication among sensors, cameras, ADAS (advanced driver-assistance systems), and infotainment systems.

Optical fiber technology offers significantly higher bandwidth than traditional copper wiring and provides immunity to electromagnetic interference, making it ideal for handling the heavy data loads involved in these applications. This results in improved vehicle safety, connectivity, and user experience. As vehicles become more connected and software-defined, the need for faster data transfer only grows.

Optical fiber allows seamless communication across various vehicle systems, supporting not only present-day requirements but also future innovations like vehicle-to-everything (V2X) connectivity. This technology is becoming critical for automakers aiming to meet consumer expectations for advanced functionality and safety features while managing the increasing network complexity within vehicles.

Restraint

High Implementation Cost and Integration Complexity

One major restraint in expanding optical fiber networks in vehicles is the relatively high cost and complexity of implementation compared to conventional wiring. The integration of optical fiber into existing vehicle architectures often requires substantial redesign and specialized components such as connectors, transceivers, and protective housings.

These factors elevate the initial investment needed by automakers, especially for mass-market or lower-priced vehicles. Additionally, the automotive environment poses challenges for optical fiber durability and reliability because of vibrations, temperature extremes, and mechanical stresses.

Ensuring that optical fiber networks meet stringent automotive standards demands careful engineering and testing, which can slow down adoption. This combination of cost and integration challenges makes manufacturers cautious, limiting rapid widespread deployment despite growing market interest.

Opportunity

Growing Electric Vehicle Market

The expanding electric vehicle (EV) market represents a significant growth opportunity for optical fiber in-vehicle networks. EVs increasingly depend on complex electronic control units that manage battery systems, propulsion, and safety features.

These systems require extensive data communication capabilities that optical fibers can provide through their high speed and electromagnetic interference immunity. As governments push for cleaner transportation, and consumer demand for EVs rises, automakers are forced to adopt technologies that optimize vehicle performance and safety.

Optical fiber networks align well with this trend, enabling efficient data transfer while reducing the weight of wiring harnesses, which can improve EV range. This presents a substantial opportunity for the optical fiber market to grow alongside the electrification of transportation.

Challenge

Standardization and Scalability Issues

A significant challenge for the optical fiber in-vehicle network market is the ongoing effort to develop universal standards and scalable solutions. The automotive industry requires reliable and interoperable technology to ensure compatibility across various vehicle makes and models.

However, the optical fiber network standards for automotive applications are still evolving, which can slow down adoption and increase uncertainty for manufacturers and suppliers. Scalability also poses a challenge, as networks need to support varying data rates – from hundreds of Mbps to multi-gigabit speeds – across different vehicle architectures.

Delivering solutions that balance cost, reliability, and performance at scale demands continued innovation and coordination among industry players. Overcoming these standardization and scalability hurdles is crucial for optical fiber to become a mainstream in-vehicle communication technology.

Competitive Analysis

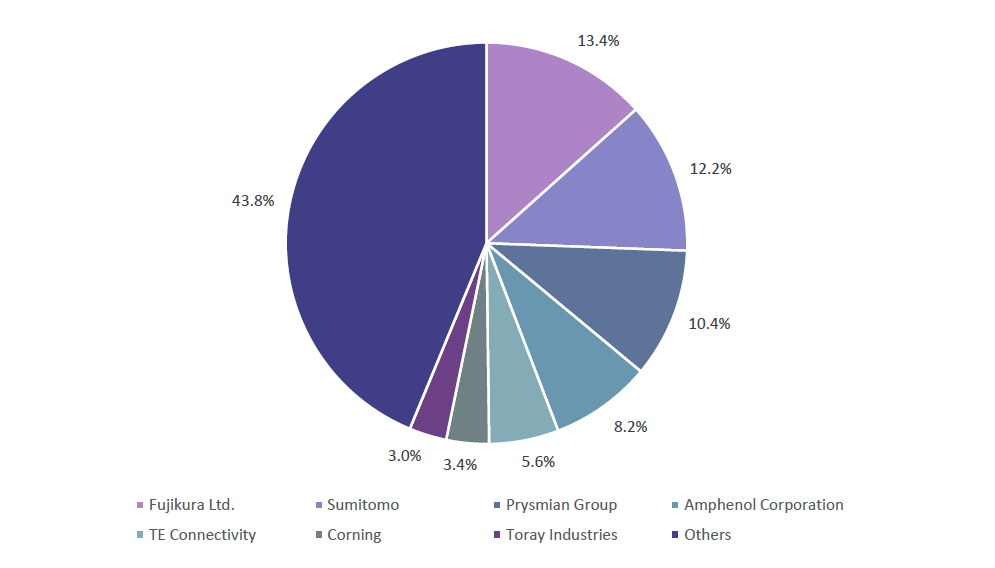

The Optical Fiber In-Vehicle Network Market is led by major fiber and cabling manufacturers such as Fujikura Ltd., Sumitomo, and Prysmian Group. These companies supply high-performance optical fiber solutions designed to support data-heavy automotive applications, including ADAS, infotainment, and autonomous driving systems. Their strong manufacturing capabilities and partnerships with OEMs position them as primary suppliers for next-generation vehicle networks.

Connectivity and component providers including Amphenol Corporation and TE Connectivity play a key role in integrating optical fiber into vehicle architectures. They deliver connectors, harnesses, and transceiver modules that ensure signal integrity, durability, and electromagnetic resistance. Their offerings support vehicle-to-everything (V2X) communication, high-speed data transmission, and low-latency networking across electric and connected vehicles.

Material and fiber technology leaders such as Corning and Toray Industries contribute through advancements in lightweight, heat-resistant, and flexible optical fibers tailored for harsh automotive environments. Their innovations help automakers replace traditional copper cabling with optical alternatives to reduce weight and increase bandwidth. A range of other participants continues to expand the market through specialized fiber components and custom in-vehicle networking solutions.

Key Player Analysis (%)

Company Market Share (%) Fujikura Ltd. 13.4% Sumitomo 12.2% Prysmian Group 10.4% Amphenol Corporation 8.2% TE Connectivity 5.6% Corning 3.4% Toray Industries 3.0% Others 43.8% Top Key Players in the Market

- Fujikura Ltd.

- Sumitomo

- Prysmian Group

- Amphenol Corporation

- TE Connectivity

- Corning

- Toray Industries

- Others

Recent Developments

- Fujikura Ltd., September 2025: Fujikura showcased its advanced fiber optic technologies at Connected Britain 2025, highlighting innovations aimed at accelerating network deployment and improving infrastructure efficiency. Their solutions focus on future-ready optical networks designed for durability and scalability, supporting high-speed communication needs in automotive and telecom sectors.

- Prysmian Group, March 2025: Prysmian entered a strategic long-term partnership and investment agreement with Relativity Networks to industrialize the production of hollow-core optical fiber (HCF) at scale. This next-generation fiber technology is designed for ultra-low latency and improved transmission performance, targeting high-growth markets such as AI-powered data centers, which align with in-vehicle network demands for high bandwidth and low delay.

Report Scope

Report Features Description Market Value (2024) USD 2,714.5 Mn Forecast Revenue (2034) USD 9,599.8 Mn CAGR(2025-2034) 12.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Material Type (Plastic Optical Fiber (POF), Glass Optical Fiber (GOF)), By Mode (Multi-Mode Fiber (MMF), Single-Mode Fiber (SMF)), By Communication Method (MOST (Media Oriented Systems Transport), Ethernet (Ethernet Over Plastic Optical Fiber (POF), Ethernet Over Glass Optical Fiber (GOF)), Others (CAN, LIN, FlexRay, etc.)), By Communication Speed (≤ 1 Gbps, >1 Gbps to ≤ 10 Gbps, > 10 Gbps), By Application (Lighting Devices, Safety Systems, Infotainment, Communication Devices, Internal and External Sensing, Others), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Fujikura Ltd., Sumitomo, Prysmian Group, Amphenol Corporation, TE Connectivity, Corning, Toray Industries, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Optical Fiber In-Vehicle Network MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Optical Fiber In-Vehicle Network MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Fujikura Ltd.

- Sumitomo

- Prysmian Group

- Amphenol Corporation

- TE Connectivity

- Corning

- Toray Industries

- Others