Global Opioids Market By Product Type (Codeine, Methadone, Morphine, Oxycodone, Others), By Application (Pain Management, Diarrhea Treatment, Cough Treatment, Anesthesia), By Route of Administration (Oral, Injectable, Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: July 2024

- Report ID: 55944

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

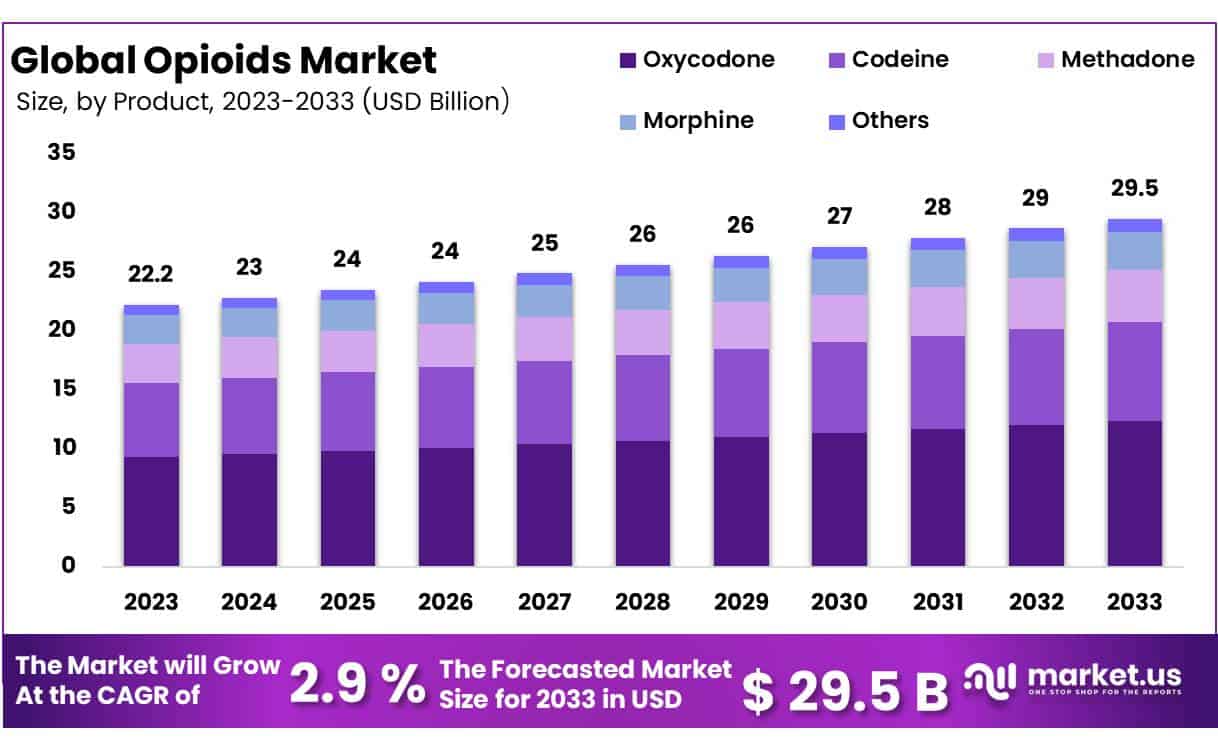

The Global Opioids Market size is expected to be worth around USD 29.5 Billion by 2033 from USD 22.2 Billion in 2023, growing at a CAGR of 2.9 % during the forecast period from 2024 to 2033.

Opioids are a class of drugs that act on the nervous system to relieve pain. They are derived from opium or synthetic versions that mimic the effects of natural opium compounds. Opioids are commonly prescribed for the treatment of acute and chronic pain, as well as for managing pain after surgery. They can also be used to relieve severe coughing or diarrhea.

Opioids market growth can be attributed to factors like increasing incidence of orthopedic diseases and prevalence of chronic conditions like cancer. Furthermore, disposable income rises and elderly populations grow. However, emerging cannabis markets and legalization pose potential threats during this forecast period.

The global opioids market refers to the market for pharmaceutical opioids, which includes both prescription opioids and illicitly manufactured opioids. This market has grown significantly over the past few decades, driven primarily by increasing demand for pain management medications.

Key Takeaways

- Market Size: Global Opioids Market size is expected to be worth around USD 29.5 Billion by 2033 from USD 22.2 Billion in 2023.

- Market Growth: The market growing at a CAGR of 2.9 % during the forecast period from 2024 to 2033.

- Product Analysis: The oxycodone segment leads with 41.8% market share in the global opioid market.

- Application Analysis: The pain management segment was dominate 39.5% market share of the global opioid market by 2023.

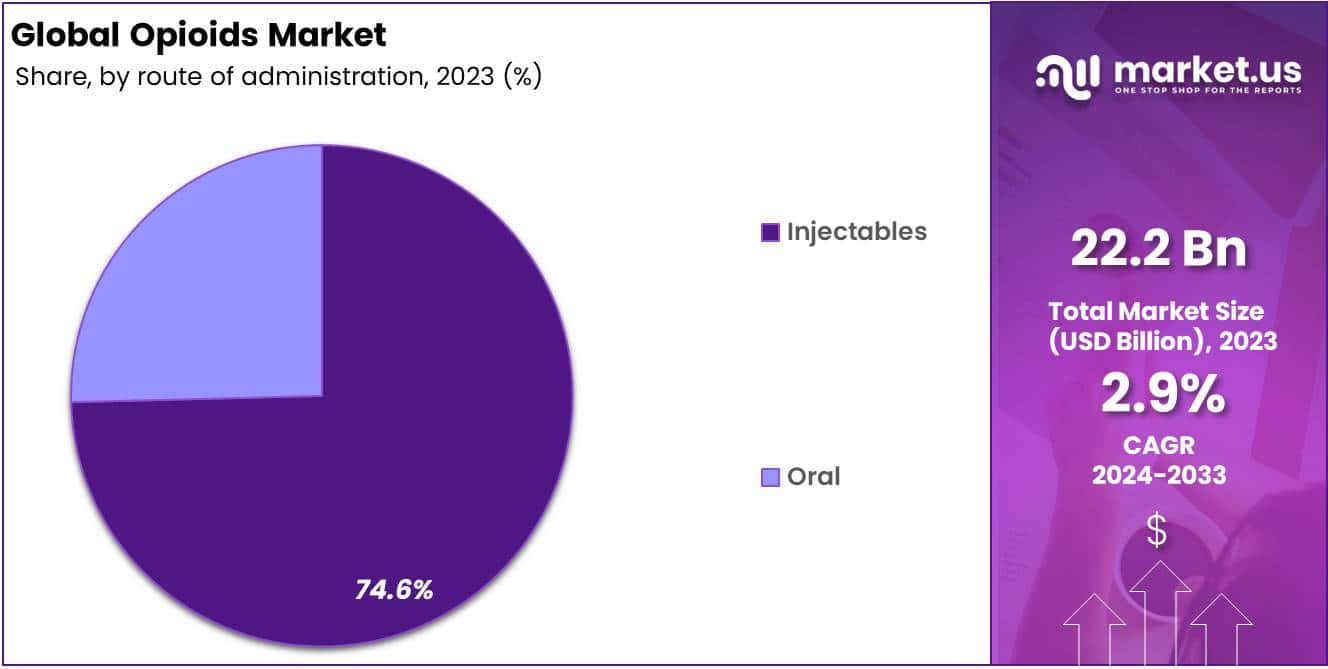

- Route of Administration Analysis: The injectables segment dominated the global opioid market by 74.6% due to the growing approval of new opioid injectables.

- Distribution Channel Analysis: The retail pharmacy segment dominated 61.4% the market in 2023.

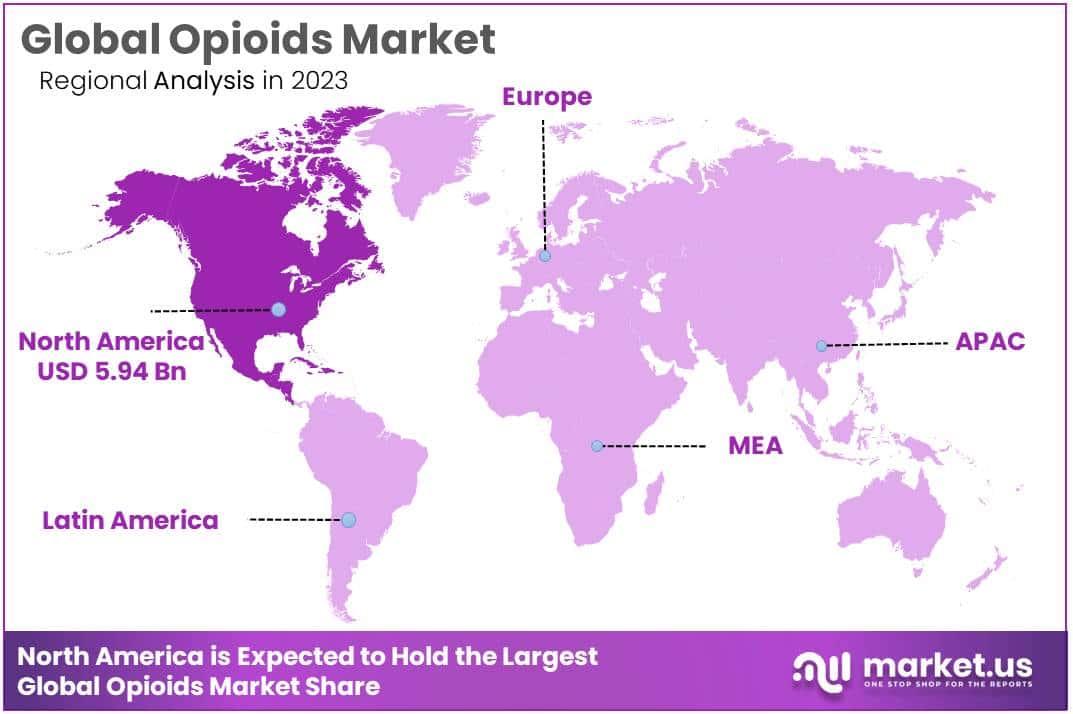

- Regional Analysis: Due to its large number of pharmaceutical companies and well-developed healthcare industry, North America held the largest share 26.8%.

- Overuse and Prescription Opioids: Over the years, opioid prescriptions have seen an unprecedented resurgence and this trend is fuelling concerns about misuse, addiction and overdoses.

- Opioid Epidemic: Many regions, particularly in the US, have witnessed an opioid epidemic marked by sharply rising overdose deaths and related regulatory scrutiny as well as public health initiatives.

By Product Analysis

The global opioid market is segmented based on products such as Codeine, Methadone, Morphine, Oxycodone, and Others. The oxycodone segment leads with 41.8% market share in the global opioid market. The availability of long-acting, extended-release opioids is a major reason for this dominance. Oxycodone and Hydrocodone are the most commonly prescribed ER/long-acting opioids.

Fentanyl, a synthetic opioid, is approved to treat severe chronic pain in patients with advanced-stage cancer. The global opioid market segment growth is expected to be fueled by the increasing incidence of chronic diseases.

By Application Analysis

The market is segmented per applications such as Pain Management, Diarrhea Treatment, Cough Treatment, and anesthesia. The pain management segment was dominate 39.5% market share of the global opioid market by 2023 and is projected to maintain this position during the forecast period (2023-2032).

Thus, increasing surgical operations augment the demand for medicines to manage post-operative pain. Anesthesia is estimated to be the fastest-growing segment during the forecast period. Intravenous opioids are used to provide analgesia and supplement sedation during general anesthesia. Thus, increasing anesthesia practices are anticipated to boost demand for intravenous opioids, driving the market growth.

By Route of Administration

By route of administration type, the global opioids market is segmented into injectables, oral, and others. The injectables segment dominated the global opioid market by 74.6% due to the growing approval of new opioid injectables. The United States FDA approved morphine sulfate injectable in April 2021. This opioid analgesic is used to manage severe pain arising from different conditions. The segment growth is expected to be driven by this approval. Due to the approval of opioid tablets, oral growth is expected to be the fastest during the forecast period.

By Distribution Channel

Based on distribution channels, the global opioids market is segmented into retail pharmacies, hospital pharmacies, and others. The retail pharmacy segment dominated 61.4% the market in 2023 and is also anticipated to grow the fastest during the forecast period (2024-2033). Owing to the easy availability of medicines and the high opioid dispensing rate.

Key Market Segments

By Product Type

- Codeine

- Methadone

- Morphine

- Oxycodone

- Others

By Application

- Pain Management

- Diarrhea Treatment

- Cough Treatment

- Anesthesia

By Route of Administration

- Oral

- Injectable

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Others

Driver

The primary driver of the opioids market is the increasing prevalence of chronic pain conditions globally. Chronic pain affects an estimated 20% of the global population, with conditions such as arthritis, cancer, and lower back pain contributing to the growing demand for effective pain management solutions. Opioids, known for their potent analgesic properties, are frequently prescribed to manage severe and persistent pain.

Additionally, the aging population is contributing to the increased incidence of chronic pain, thereby driving the demand for opioid analgesics. The ability of opioids to provide rapid and significant pain relief makes them a critical component in pain management, further fueling market growth.

Trend

A significant trend in the opioids market is the development and adoption of abuse-deterrent formulations (ADFs). With the rising concern over opioid misuse and addiction, pharmaceutical companies are focusing on creating formulations that reduce the potential for abuse. These ADFs incorporate technologies designed to prevent manipulation for illicit use, such as making it difficult to crush, snort, or inject the medication.

Innovations in this area are aimed at balancing the need for effective pain relief with the imperative to reduce the risk of addiction and overdose. This trend reflects the industry’s response to the opioid crisis and regulatory pressures to ensure safer opioid use.

Restraint

Despite their efficacy in pain management, opioids face significant restraints due to the high potential for abuse and addiction. The opioid crisis has led to increased scrutiny and regulatory restrictions on opioid prescribing practices. Governments and healthcare organizations are implementing stringent guidelines to curb misuse, which can limit the availability and use of opioid medications.

Additionally, the stigma associated with opioid use can deter patients and healthcare providers from considering these medications, despite their therapeutic benefits. These factors collectively hinder the market’s growth potential and necessitate careful balancing of pain management needs and addiction risks.

Opportunity

The opioids market presents substantial growth opportunities in the development of novel, safer opioid formulations. Pharmaceutical companies are investing in research and development to create opioids that offer effective pain relief with a reduced risk of abuse and side effects. Furthermore, the increasing adoption of personalized medicine approaches allows for more tailored opioid therapies, optimizing efficacy and minimizing risks.

Emerging markets, with their growing healthcare infrastructure and rising prevalence of chronic pain conditions, also offer significant potential for market expansion. By focusing on innovation and safety, companies can address the ongoing challenges and meet the unmet needs in pain management, driving future growth in the opioids market.

Regional Analysis

North America Dominates the Global Opioid Market During the Forecast Period

Due to its large number of pharmaceutical companies and well-developed healthcare industry, North America held the largest share 26.8% in the global market for sepsis diagnostics in 2023. The increasing acceptance of opioid-based medications to address the growing unmet medical need in the region can explain this dominance.

The COVID-19 pandemic in the United States forced healthcare systems to shift resources toward COVID-19-designated sites and intensive care units. To reduce the risk of the virus spreading, non-urgent and emergency outpatient chronic pain services were cut or discontinued during the COVID-19 Pandemic 2020.

Chronic pain sufferers remain isolated, with a consequent psychological and social impact. Chronic pain management was affected by the US government’s lockdown during the COVID-19 pandemic. According to the Canadian government, 7.9 million people, or one in five, will suffer from chronic pain in 2022. Chronic pain in Canada significantly affected the country’s mental, physical, and family health and the economy. These factors will result in significant market growth during the forecast period.

Hikma Pharmaceuticals, for instance, launched a generic version of Buprenorphine injection in May 2020. Buprenex is a prescription opioid that treats moderate to severe pain. This injection is helpful for severe pain management. A 5mL intravenously administered injection costs USD 89. Asia Pacific will be the fastest-growing region in the forecast period. The government’s efforts to curb opioid misuse in the region are responsible for the region’s growth. The prescription rate of high-quality opioids for pain management should be increased to drive the opioid market growth.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

For greater market share and regional expansion, major players are using strategies like mergers & acquisitions. Adalvo purchased Onsolis, a brand-named opioid product, from a well-respected U.S.-based specialty pharmacist company in August 2022. This opioid is used to manage chronic pain in patients with cancer. The acquisition will increase the company’s portfolio of opioid products and provide a great opportunity for growth.

Below are some of the most prominent global opioid market key industry players.

Market Key Players

- Purdue Pharma L.P.

- Hikma Pharmaceuticals PLC

- Johnson & Johnson Services, Inc.

- Pfizer, Inc.

- Sanofi

- AbbVie Inc.

- Sun Pharmaceutical Industries Ltd

- Grünenthal

- Other Key Players

Recent Developments

- Hikma Pharmaceuticals PLC (April 2024): Hikma Pharmaceuticals PLC acquired a portfolio of opioid analgesics from a smaller competitor. This acquisition is expected to strengthen Hikma’s market position and expand its offerings in pain management solutions.

- Johnson & Johnson Services, Inc. (February 2024): Johnson & Johnson Services, Inc. introduced a novel opioid analgesic patch designed for chronic pain management. The new patch offers sustained pain relief over 72 hours, aiming to improve patient compliance and comfort.

- Pfizer, Inc. (May 2024): Pfizer, Inc. announced the launch of a new opioid medication, Oxenta XR, which features extended-release properties for managing severe pain. This product is part of Pfizer’s strategy to address the growing demand for effective pain management solutions.

- Sanofi (January 2024): Sanofi acquired PainTech, a company specializing in innovative pain management solutions. This acquisition aims to enhance Sanofi’s portfolio of opioid and non-opioid pain treatments, expanding its reach in the global pain management market.

- AbbVie Inc. (June 2024): AbbVie Inc. introduced a new opioid combination therapy, PainRelief Duo, targeting severe pain conditions. This combination therapy is designed to provide enhanced pain relief while minimizing the risk of opioid dependency and side effects.

- Sun Pharmaceutical Industries Ltd. (April 2024): Sun Pharmaceutical Industries Ltd. launched a generic version of a popular opioid analgesic, expanding its product line in the opioids market. This launch aims to provide a cost-effective alternative for pain management.

Report Scope

Report Features Description Market Value (2023) USD 22.2 Billion Forecast Revenue (2033) USD 29.5 Billion CAGR (2024-2033) 2.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Codeine, Methadone, Morphine, Oxycodone, Others), By Application (Pain Management, Diarrhea Treatment, Cough Treatment, Anesthesia), By Route Of Administration (Oral, Injectable, Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Purdue Pharma L.P., Hikma Pharmaceuticals PLC, Johnson & Johnson Services, Inc., Pfizer, Inc., Sanofi, AbbVie Inc., Sun Pharmaceutical Industries Ltd, Grünenthal, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Purdue Pharma L.P.

- Hikma Pharmaceuticals PLC

- Johnson & Johnson Services, Inc.

- Pfizer, Inc.

- Sanofi

- AbbVie Inc.

- Sun Pharmaceutical Industries Ltd

- Grünenthal

- Other Key Players