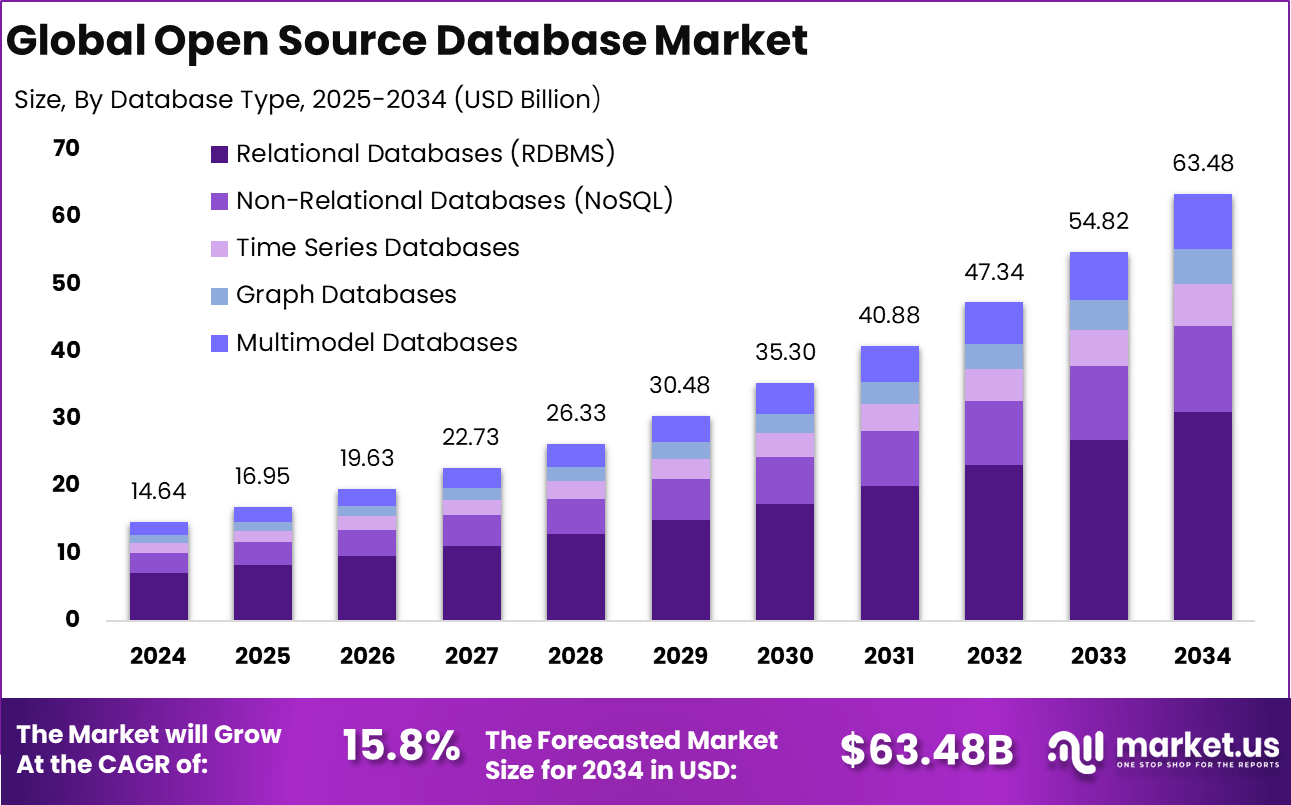

Global Open Source Database Market Size, Share Analysis Report By Database Type (Relational Databases (RDBMS), Non-Relational Databases (NoSQL), Time Series Databases, Graph Databases, Multimodel Databases), By Deployment (On-premises, Cloud-based), By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Application (Web Applications, Mobile Applications, IoT & Sensor Data, Financial Services, E-commerce Platforms, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153036

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Open Source Database Market size is expected to be worth around USD 63.48 billion by 2034, from USD 14.64 billion in 2024, growing at a CAGR of 15.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38% share, holding USD 5.56 billion in revenue.

The Open Source Database market is driven by the demand for cost-effective, flexible, and scalable solutions. The absence of licensing fees helps organizations reduce operational costs while avoiding vendor lock-in. As businesses seek customizable and adaptable systems, the rise of cloud computing, big data analytics, AI, and IoT further accelerates adoption. Open-source databases offer the flexibility to manage large, complex datasets in real-time, making them ideal for modern applications.

Widespread adoption of open source databases is fueled by the drive for agility and the quest to lower IT expenses. Flexibility is a huge pull here: having the source code open means organizations can customize solutions to fit their precise needs. There is no feeling of constraint from vendor lock-in. As more companies seek digital resilience, the scalability and support for new tech such as cloud and distributed systems strengthen the position of open source databases.

For instance, In March 2025, key players in the voluntary carbon market launched a significant open-source data initiative to improve transparency and efficiency. This collaboration focuses on developing a centralized platform to track carbon credits and verify sustainability claims. The goal is to enhance the credibility of the market, providing stakeholders with reliable, real-time data to support businesses and governments in achieving their environmental targets.

Key Takeaway

- The global Open Source Database Market is projected to reach USD 63.48 billion by 2034, up from USD 14.64 billion in 2024.

- This growth will occur at a CAGR of 15.8% between 2025 and 2034.

- In 2024, North America led the market, securing over 38% share with revenue worth USD 5.56 billion.

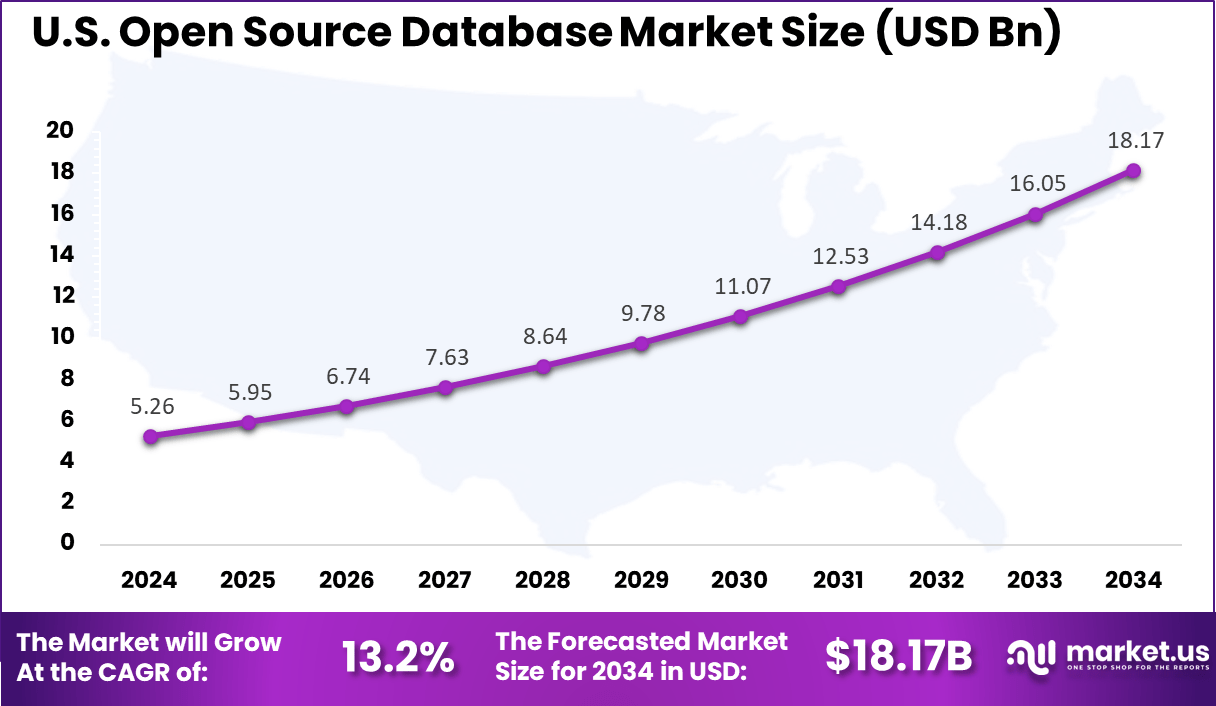

- The United States alone contributed USD 5.26 billion, with a growth rate of 13.2% CAGR.

- By Database Type, Relational Databases (RDBMS) accounted for a dominant 49% share in 2024.

- Cloud-Based deployments made up 58% of the overall market.

- Large Enterprises emerged as key adopters, representing a 61% share of market usage.

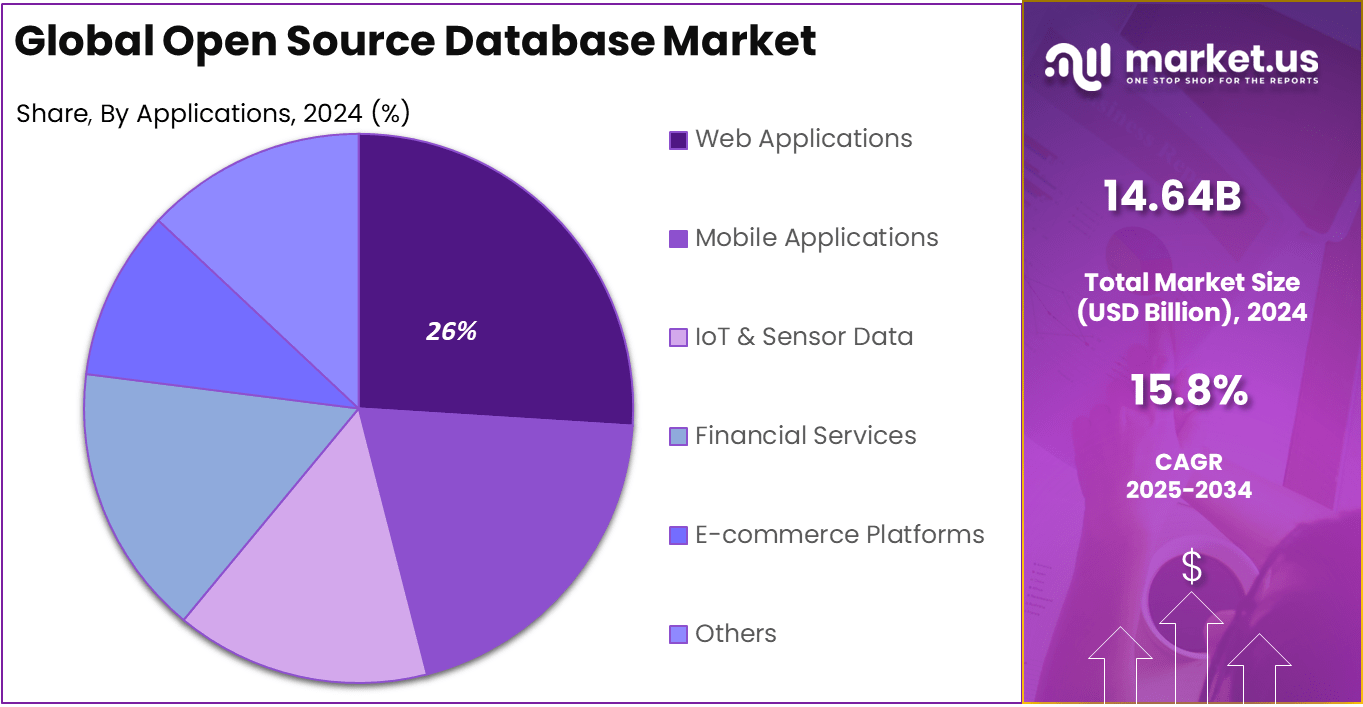

- Web Applications remained the top application area, holding a 26% share in 2024.

U.S. Market Size

The market for Open Source Database within the U.S. is growing tremendously and is currently valued at USD 5.26 billion, the market has a projected CAGR of 13.2%. The open source database market is experiencing rapid growth in the United States as businesses seek affordable, scalable alternatives in various industries.

The emergence of cloud technology, big data analysis, AI (the Internet of Things), and IoT has quickened this progression as enterprises seek flexible, tailored database solutions. Furthermore, the rise of startups and technology innovation centers in the region is generating interest in agile, open-source solutions that can handle complex data and accelerate development without high licensing costs.

For instance, in November 2024, Meta (formerly Facebook) announced a major initiative to support open-source AI development in the U.S., aimed at enhancing global security. The company’s efforts to promote open-source AI technologies focus on improving transparency, collaboration, and innovation, positioning the U.S. as a leader in responsible AI development.

In 2024, North America held a dominant market position in the Global Open Source Database Market, capturing more than a 38% share, holding USD 5.56 billion in revenue. North America leads the Global Open Source Database Market due to its strong technological infrastructure, high cloud computing adoption, and extensive use of big data, AI, and IoT.

In addition, significant investment in digital transformation has encouraged growth in the region. By leveraging open-source databases, North American companies can benefit from their robust economic strategies, expansive creative business sector (particularly in the US), and well-established regulatory frameworks, which offer greater flexibility and scalability at a lower cost than traditional databases.

For instance, In March 2025, Block became the first company in North America to reach a key milestone in open-source blockchain adoption. This move underscores the growing integration of blockchain technologies into mainstream financial services. By utilizing open-source blockchain frameworks, Block aims to enhance transparency, security, and scalability in its offerings, solidifying its position as a leader in the financial technology sector.

Database Type Analysis

In 2024, The Relational Databases (RDBMS) segment held a dominant market position, capturing a 49% share of the Global Open Source Database Market. This dominance is due to the widespread adoption of RDBMS for managing structured data, its strong support for transaction-based applications, and its established reliability.

Popular open-source RDBMS platforms, including MySQL and PostgreSQL, offer superior performance, scalability, and uncomplicated integration, making them the preferred choice for businesses and developers seeking economical solutions to crucial tasks.

For instance, in April 2025, Supabase secured $200 million in funding to further develop its open-source relational database platform. This investment will help accelerate the growth of Supabase’s capabilities, enabling businesses to build scalable, secure, and cost-effective applications with an open-source database solution.

Deployment Analysis

In 2024, the Cloud-Based segment held a dominant market position, capturing a 58% share of the Global Open Source Database Market. The demand for cloud-based open-source databases has surged due to their scalability, flexibility, and cost-efficiency.

The cloud is a cost-effective option for infrastructure, provides seamless integration with other clouds, and offers global accessibility, which is advantageous for companies that are expanding quickly and dealing with massive datasets. The rise of remote work, cloud-based devices, and the shift to hybrid and multi-cloud systems have contributed to the growth of this movement.

For instance, in September 2024, Percona launched Percona Everest, the world’s first open-source public DBaaS alternative, redefining cloud-native database management. This new platform offers businesses a cost-effective, open-source solution for managing databases in the cloud, eliminating the need for proprietary database-as-a-service (DBaaS) offerings.

Organization Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 61% share of the Global Open Source Database Market. This dominance is due to the demand for affordable, scalable databases capable of handling complex and high-volume data processing.

The availability of open-source databases enables users to customize them as needed, avoid dependence on vendors, and offer greater flexibility. The increasing adoption of cloud computing and efforts to transform IT systems contribute to the need for open-source databases that enhance performance, security, integration, and collaboration.

For Instance, in February 2025, IBM announced its acquisition of the open-source data platform and AI vendor, DataStax. This acquisition aims to enhance IBM’s capabilities in managing real-time data and AI-powered applications. By integrating DataStax’s advanced open-source technology, IBM plans to expand its cloud and data offerings, further strengthening its position in the rapidly growing market for AI-driven data solutions.

Application Analysis

In 2024, The Web Applications segment held a dominant market position, capturing a 26% share of the Global Open Source Database Market. The dominance is due to growing reliance on web-based platforms that require scalable, cost-effective database solutions.

Due to their high performance, easy integration with other databases, and ability to handle large amounts of data in dynamic and high-traffic environments, open-source alternatives such as MySQL and PostgreSQL are the preferred choices. With the growing need for e-commerce, social media, and online services, open-source databases are well-suited to handling complex transactions and real-time data, which can help expand the growth of the web applications domain.

For instance, in March 2025, Microsoft launched NLWeb, an open-source tool that brings conversational interfaces to websites. This solution lets developers easily embed AI-powered chatbots for real-time interaction. By offering it as open-source, Microsoft supports broader adoption, helping businesses improve user engagement and deliver instant support.

Key Market Segments

By Database Type

- Relational Databases (RDBMS)

- Non-Relational Databases (NoSQL)

- Time Series Databases

- Graph Databases

- Multimodel Databases

By Deployment

- On-premises

- Cloud-based

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Application

- Web Applications

- Mobile Applications

- IoT & Sensor Data

- Financial Services

- E-commerce Platforms

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend Analysis

Deeper Integration of AI and Automation

A prominent trend in the open source database landscape is the growing integration of artificial intelligence and automation. Modern open source databases are rapidly embracing AI-powered features, such as performance tuning, automated backups, anomaly detection and advanced query optimization.

These enhancements allow users to perform sophisticated data analysis and optimize operations with less manual intervention, making databases smarter and more responsive to real-world business needs. By blending AI tools directly into database environments, organizations can unlock deeper insights, improve efficiency, and enhance overall user experience, setting a new standard for data management practices.

Driver Analysis

Rising Demand for Transparency and Customization

One of the strongest driving forces behind the adoption of open source databases is the desire for greater transparency and customization. Companies are moving away from restrictive proprietary systems and opting for open source alternatives that give them more control over their data.

This shift is also propelled by the ongoing push for cost-effectiveness, as open source solutions help organizations avoid expensive licensing arrangements. In addition, the rise of real-time analytics needs and the popularity of hybrid and multi-cloud environments make open source databases a flexible and scalable choice for businesses of all sizes.

Restraint Analysis

Shortage of Skilled Personnel

Despite the many benefits, a significant restraint in the open source database market is the shortage of skilled professionals. Many organizations struggle to find or retain staff with the right expertise to manage complex, large-scale open source database deployments.

When a key specialist leaves, replacing them can be both challenging and costly. This skill gap can slow down innovation and make it hard for businesses to fully leverage the capabilities of open source technologies, especially as databases become more sophisticated and require specialized management.

Opportunity Analysis

Community-Driven Innovation and Customization

The open source ethos gives organizations a unique opportunity to be part of a dynamic community that propels innovation. Open source databases thrive because developers, engineers, and businesses worldwide are collaboratively improving software, sharing best practices, and contributing new features. This environment encourages faster iteration, allowing organizations to tap into the collective intelligence and creativity of a global network.

For companies willing to engage, they can influence the direction of the technology by submitting feature requests, contributing code, or shaping priorities through active participation. Customization is another powerful opportunity. Organizations are not limited to predefined features or roadmaps set by commercial interests.

Instead, they can tailor the database exactly to their operational needs and workflows. Whether it’s integrating with specialized analytics tools or developing unique enhancements, open source software lets organizations mold the technology to their vision, giving them a competitive edge and enabling them to quickly respond to changing business needs.

Challenge Analysis

Scalability and Performance Bottlenecks

As data volumes skyrocket, scalability emerges as a central challenge for open source databases. These databases must efficiently handle the pressures of growing user bases, diverse query demands, and real-time analytics, all without sacrificing performance or reliability.

Achieving seamless scaling is complex, requiring careful architectural decisions and sometimes leading organizations to encounter bottlenecks that slow down their operations as workload intensifies. Performance tuning becomes an ongoing effort, demanding skilled professionals who can optimize configurations and troubleshoot issues across a distributed and multi-developer codebase.

The burden to ensure consistent performance – especially during peak loads or unexpected traffic spikes – rests heavily on the adopting organization. Addressing scalability requires both technical expertise and a long-term strategy for resource management, which can be a daunting prospect for teams used to more conventional, pre-optimized commercial systems.

Key Players Analysis

Oracle Corporation, MongoDB, Inc., and EnterpriseDB (EDB) are leading players in the Open Source Database market, offering scalable and secure solutions. Oracle focuses on enterprise-grade databases, while MongoDB provides a flexible, document-based database. EDB specializes in PostgreSQL for cloud environments.

MariaDB, Percona, and Redis Ltd. drive innovation with MariaDB’s relational database management, Percona’s optimization services for MySQL and MongoDB, and Redis’ real-time data processing capabilities.

Neo4j, Apache Software Foundation, Cockroach Labs, Timescale, and ClickHouse are also key players. Neo4j leads in graph databases, while Apache Software Foundation manages diverse projects. Cockroach Labs, Timescale, and ClickHouse offer distributed databases for high-performance, large-scale applications.

Top Key Players in the Market

- Oracle Corporation

- MongoDB, Inc.

- EnterpriseDB (EDB)

- MariaDB Corporation

- Percona

- Redis Ltd.

- Neo4j, Inc.

- Apache Software Foundation

- Cockroach Labs

- Timescale, Inc.

- ClickHouse, Inc.

- Others

Recent Developments

- In March 2025, MongoDB announced plans to introduce full-text and vector search capabilities for the MongoDB Community Edition. This feature aims to enhance the database’s search functionalities, supporting a wider range of use cases in AI and machine learning applications. By offering these advanced search capabilities, MongoDB further strengthens its position as a versatile, open-source database solution.

- In June 2024, Oracle announced the launch of in-database large language models (LLMs) and an automated in-database vector store with HeatWave GenAI. This innovation allows enterprises to leverage generative AI capabilities directly within their databases, eliminating the need to move data to separate systems.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Database Type (Relational Databases (RDBMS), Non-Relational Databases (NoSQL), Time Series Databases, Graph Databases, Multimodel Databases), By Deployment (On-premises, Cloud-based), By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs), By Application (Web Applications, Mobile Applications, IoT & Sensor Data, Financial Services, E-commerce Platforms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Oracle Corporation, MongoDB, Inc., EnterpriseDB (EDB), MariaDB Corporation, Percona, Redis Ltd., Neo4j, Inc., Apache Software Foundation, Cockroach Labs, Timescale, Inc., ClickHouse, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Open Source Database MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Open Source Database MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Oracle Corporation

- MongoDB, Inc.

- EnterpriseDB (EDB)

- MariaDB Corporation

- Percona

- Redis Ltd.

- Neo4j, Inc.

- Apache Software Foundation

- Cockroach Labs

- Timescale, Inc.

- ClickHouse, Inc.

- Others