Global Open-Source AI Model Market Size, Share, Industry Analysis Report By Model Type (Foundational Models, Computer Vision Models, Multimodal Models, Others), By Application (Natural Language Processing, Content Generation, Code Generation, Others), By Licensing (Permissive Licenses, Restricted Licenses, Copyleft Licenses), By End-User (Enterprises, Academia, Developers, Individuals), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165051

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Statistics and Adoption Trends

- Leading Open-Source AI Models

- Analysts’ Viewpoint

- Investment and Business Benefits

- Role of Generative AI

- U.S. Market Size

- Model Type Analysis

- Application Analysis

- Licensing Analysis

- End-User Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

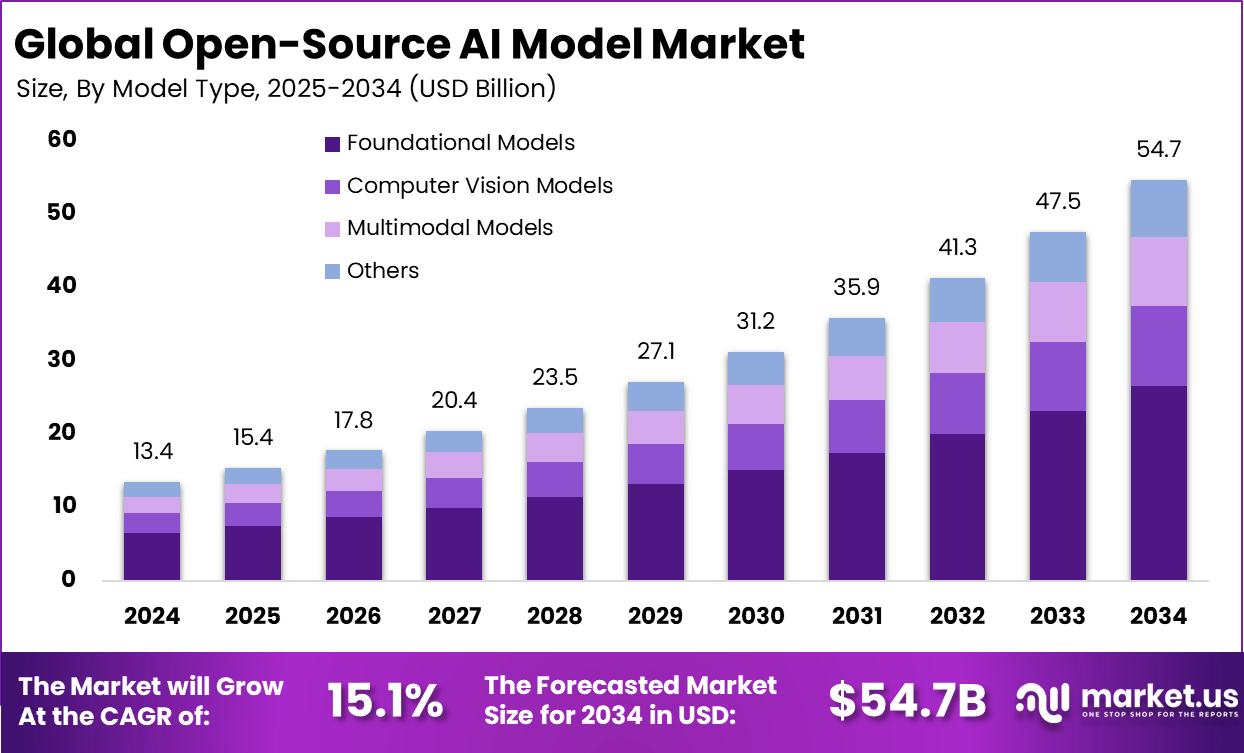

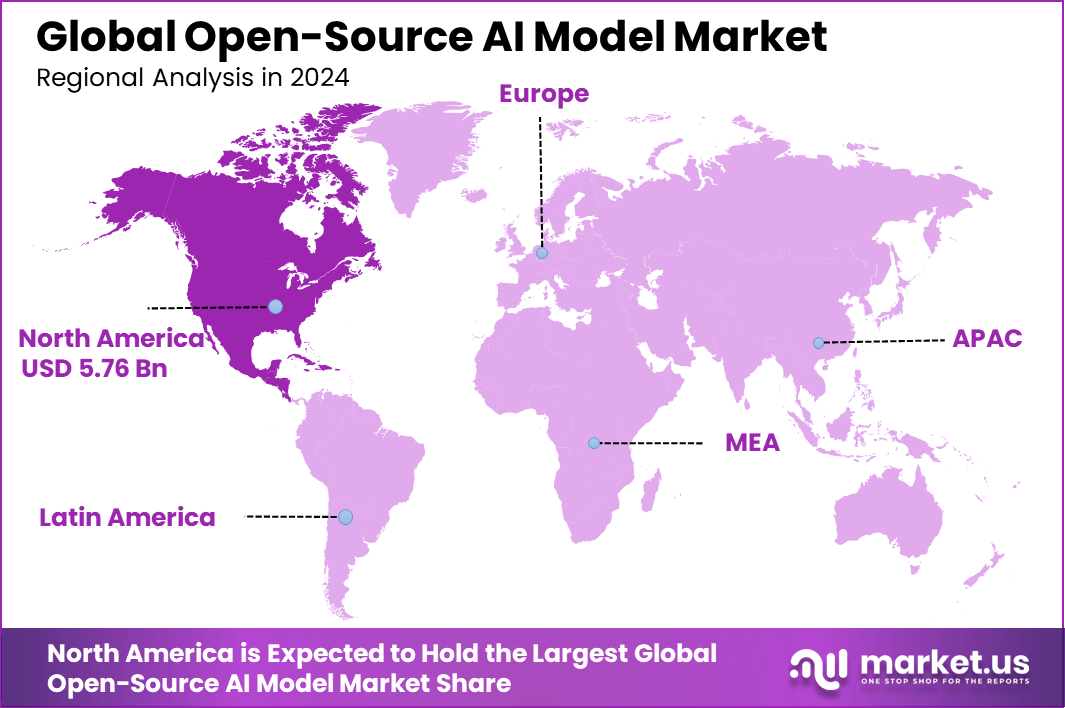

The Global Open-Source AI Model Market size is expected to be worth around USD 54.7 billion by 2034, from USD 13.4 billion in 2024, growing at a CAGR of 15.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 43% share, holding USD 5.76 billion in revenue.

The open-source AI models market revolves around AI systems whose code and training data are publicly available for anyone to use and modify. This market showcases fast growth fueled by the rising AI adoption worldwide. As of 2025, over 60% of AI projects integrate open-source models in their development, signaling widespread acceptance. The ability to customize and reduce dependency on costly proprietary software is crucial for many organizations embracing open-source AI solutions.

Top driving factors behind the adoption of open-source AI include cost efficiency, flexibility, and rapid innovation. About 63% of companies actively use open-source AI, with 89% of AI-equipped organizations incorporating it somewhere in their infrastructure. Significant cost savings emerge, as deploying open-source tools is often three and a half times cheaper than relying on proprietary software.

Demand is strong across sectors with 68% of tech companies reporting open-source AI as part of their core AI strategy in 2025. Startups and mid-sized firms drive approximately 45% of this uptake, attracted by low entry costs. Key applications include automation, NLP, and computer vision, with businesses reporting an average 30% improvement in deployment speed. Geographic demand is highest in North America, Europe, and parts of Asia, where digital infrastructure supports AI integration.

For instance, in October 2025, Meta released new Llama tools to protect and enhance open-source AI community efforts. The newest Llama iteration, expected in 2025, shows competitive performance with high efficiency, positioning Meta’s Llama models as a cornerstone in open AI innovation while fostering developer adoption globally.

Key Takeaway

- The Foundational Models segment held the largest share at 48.6%, reflecting widespread adoption of open-source large-scale models for training and fine-tuning across industries.

- The Content Generation segment accounted for 38.4%, driven by strong demand for open AI tools in creative and marketing workflows.

- Permissive Licenses dominated with 42.3%, as enterprises favored flexible licensing frameworks that support commercial adaptation and collaboration.

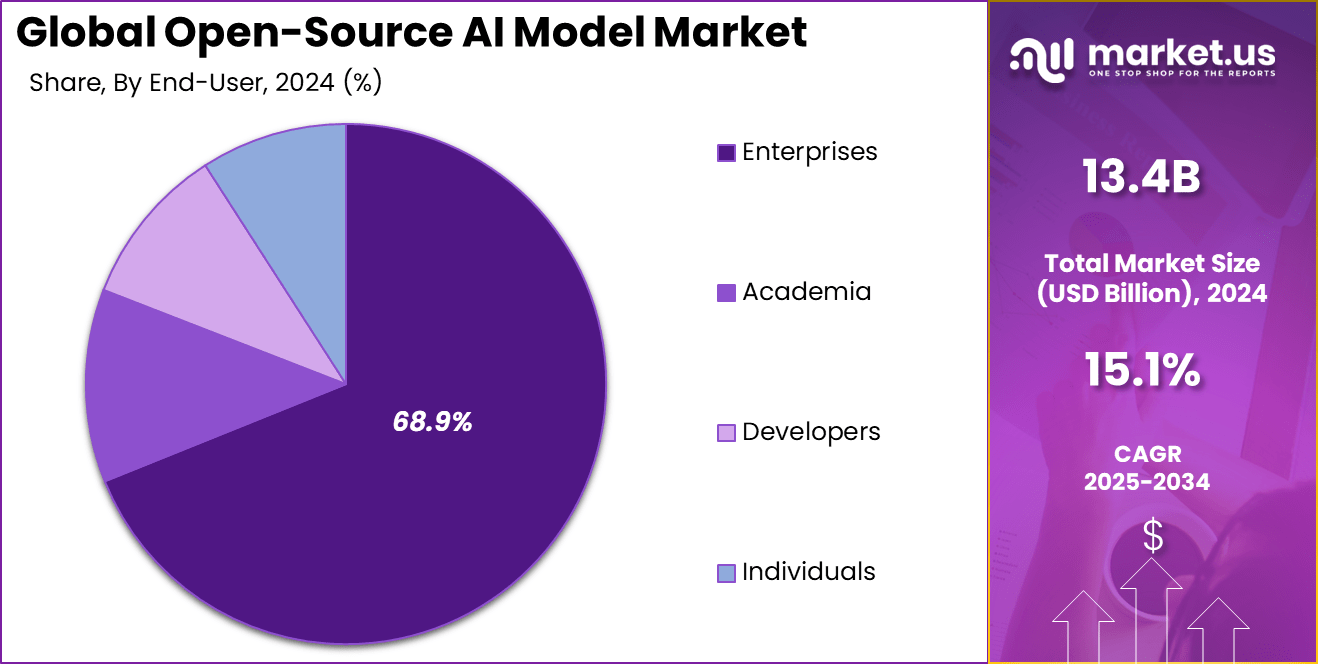

- The Enterprises segment led with 68.9%, highlighting growing interest from organizations seeking transparency, control, and customization in AI model deployment.

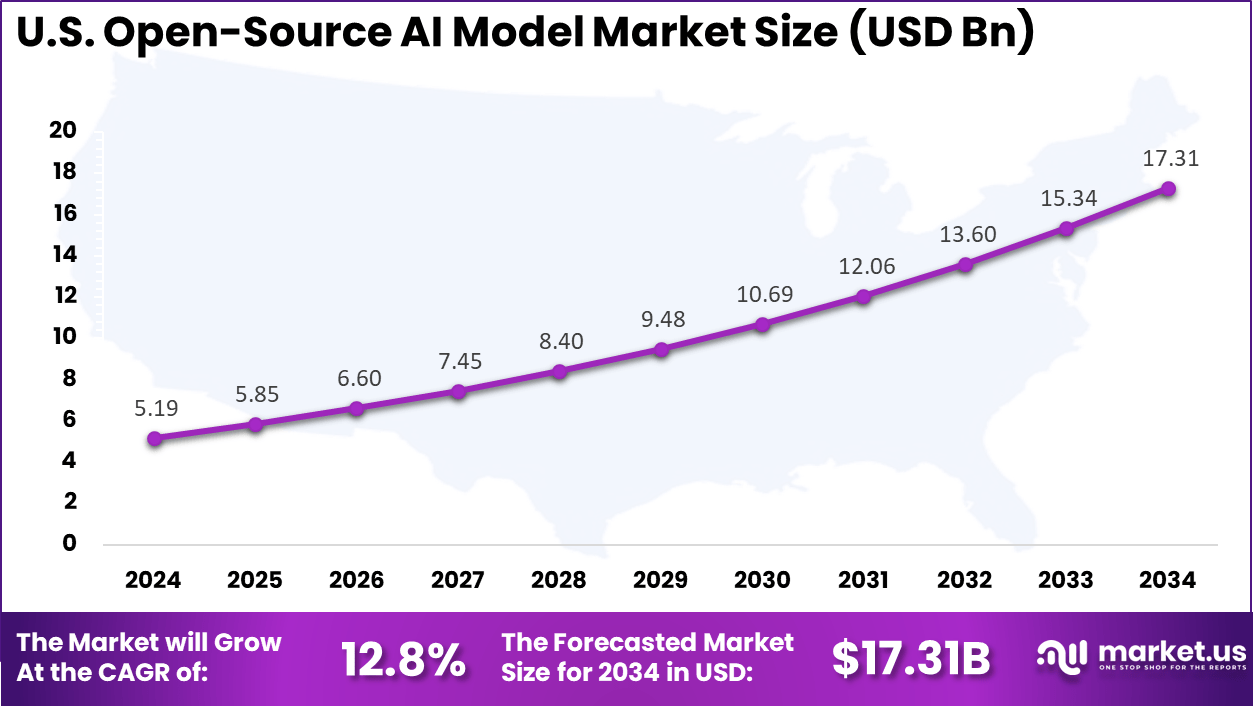

- The U.S. market reached USD 5.19 billion in 2024, expanding at a steady 12.8% CAGR, supported by open-AI infrastructure investments and community innovation.

- North America captured over 43% of global revenue, maintaining leadership through active developer ecosystems, policy support, and early enterprise integration of open-source AI models.

Key Statistics and Adoption Trends

- Widespread usage: More than half of organizations now use open-source solutions for AI development and deployment. Some studies indicate that up to 89% of AI-enabled organizations have integrated open-source components into their infrastructure.

- Growing adoption: Interest in open-source AI continues to rise. Around 75% of surveyed companies plan to expand their use of open-source AI technologies over the next few years, driven by flexibility and rapid innovation cycles.

- Developer preference: Approximately 66% of developers use open-source AI models. The main reasons include greater transparency, the ability to customize models, and strong community support that accelerates problem-solving and model improvement.

- Cost efficiency: Open-source AI significantly reduces expenses related to implementation and maintenance. Research shows up to a 35% lower total cost of ownership compared with proprietary AI platforms, making it a preferred option for cost-conscious organizations.

- Performance: The performance gap between open-source and proprietary AI models is narrowing. Models such as Meta’s Llama 3 and Alibaba’s Qwen 2.5-72B-Instruct have achieved competitive benchmark results, indicating that open-source AI is increasingly viable for enterprise-grade applications.

Leading Open-Source AI Models

Model Family Developer Key Features & Performance Notes Llama 3 Meta AI Highly competitive performance, available in 8B and 70B parameter versions, with a 405B version in development/release. Known for strong general-purpose reasoning and wide adoption for fine-tuning. Mistral / Mixtral Mistral AI Known for efficiency and strong performance relative to size. The Mixtral 8×7B (45B total parameters, 13B active) model uses a Mixture-of-Experts (MoE) architecture for speed and efficiency. Gemma Google DeepMind A family of lightweight models (e.g., 2B, 7B, 9B) inspired by Gemini research. Optimized for research and responsible AI development, performing well in resource-constrained environments. Qwen 2 Alibaba Cloud Offers strong multilingual capabilities (supporting 29 languages) and competitive benchmark performance, with models ranging up to 72B parameters. Phi 3 Microsoft A series of small language models (e.g., 3.8B, 7B, 14B) designed for local, hardware-constrained deployments while maintaining strong reasoning and programming performance. Analysts’ Viewpoint

Innovations such as model quantization and transfer learning have seen adoption rates exceeding 50% among open-source AI users. Quantization enables running models on edge devices, increasing accessibility and reducing latency. Transfer learning reduces training time by over 60%, making AI productization faster. Edge AI adoption from open-source models is growing at roughly 35% annually, expanding real-time AI use in IoT, healthcare, and more.

Firms highlight a 25% cost reduction linked to transfer learning and quantization. Speed to market is up to 40% faster due to reusable models and smaller training data needs. Privacy regulations push 30% of adopters to edge computing to keep sensitive data local. These technologies offer versatile deployment options, catering to diverse business needs and regulatory requirements.

Investment and Business Benefits

Investment in open-source AI-related startups rose by 45% from 2023 to 2025, reflecting strong financial interest. Domain-specific model development attracted around 30% of total AI investments in the past year. Platforms enabling deployment and management of open-source AI solutions are expected to capture increasing attention as enterprises scale adoption. Consultancies and tooling services supporting this ecosystem also benefit from rapid market growth.

Firms using open-source AI report a 35% reduction in total cost of ownership compared to full proprietary solutions. Customization leads to a 20% increase in user satisfaction due to better alignment with unique demands. Transparency improves regulatory acceptance, as 40% of businesses emphasize audit-readiness when selecting AI models. Community collaboration accelerates feature updates and security patches, shortening the innovation cycle significantly.

Role of Generative AI

Generative AI plays a central role in the open-source AI ecosystem by enabling the creation of content such as text, images, and audio through models known as large language models (LLMs) and visual language models (VLMs). These models, which are often openly available with their architecture, weights, and training code, allow developers and businesses to customize and deploy AI solutions suited to their specific needs.

Roughly 40% of organizations that see AI as key to their strategy prefer open-source AI tools because these models offer transparency and control, allowing local hosting and fine-tuning without heavy licensing fees. These generative models have been crucial in advancing multiple sectors, including healthcare, where open-source AI assists with clinical data analysis and personalized treatment plans by processing extensive medical records and literature.

The open-source community has fostered innovations such as multilingual models and speech-to-text transcription, making AI more accessible and adaptable to real-world applications. This openness accelerates both innovation and practical deployment across industries by providing models that anyone can tailor for specialized tasks.

U.S. Market Size

The market for Open-Source AI models within the U.S. is growing tremendously and is currently valued at USD 5.19 billion, the market has a projected CAGR of 12.8%. This growth is driven by increasing demand from enterprises seeking cost-effective and customizable AI solutions to enhance automation, decision-making, and operational efficiency.

The country’s advanced technology infrastructure, strong community support, and emphasis on transparency are significant factors encouraging adoption across multiple industries, including healthcare, finance, and retail. Additionally, huge research institutions and active investment in AI development fuel innovation and deployment of open-source AI models.

For instance, In October 2025, Microsoft expanded its partnership with OpenAI through a USD 250 billion Azure contract, ensuring Azure exclusivity for OpenAI’s models. The deal strengthens U.S. leadership in AI by combining cloud integration, compute power, and support for open-weight model development.

In 2024, North America held a dominant market position in the Global Open-Source AI Model Market, capturing more than a 43% share, holding USD 5.76 billion in revenue. This dominance is driven by the presence of leading technology companies and extensive investments in AI research and infrastructure.

The region benefits from a mature digital ecosystem with strong government support, advanced IT infrastructure, and high AI adoption rates across industries such as healthcare, finance, and defense. Furthermore, North America’s leadership is supported by the growing demand for open-source AI solutions that offer flexibility, transparency, and scalability.

The active participation of startups, corporations, and research institutions accelerates innovation and commercialization. These factors combine to make North America a critical hub for AI development and deployment globally.

For instance, in September 2025, Databricks partnered with OpenAI in a $100 million deal to embed OpenAI models within its own AI and data platforms. This partnership cements its position in the U.S. market as a powerhouse, enabling enterprises to build scalable open-source AI applications, reinforcing North America’s leadership in AI infrastructure.

Model Type Analysis

In 2024, The Foundational Models segment held a dominant market position, capturing a 48.6% share of the Global Open-Source AI Model Market. These models serve as versatile bases that can be adapted and fine-tuned for a variety of AI applications. Their widespread use reflects a growing preference for scalable and reusable AI architectures that support innovation across sectors.

Foundational models often enable developers and enterprises to accelerate AI deployment without starting from scratch, contributing greatly to efficiency and customization. Developers and organizations appreciate foundational models for their broad applicability and ability to underpin multiple AI services. This segment’s leadership indicates a shift towards more modular AI development approaches, where core capabilities are established in advance and specialized functions can be added later.

For Instance, in August 2025, Meta released the LLaMA 3 family of foundational large language models, which represent a core development in open-source AI. These models provide a base for researchers and developers and are designed to support broad customization and innovation. Meta continues to invest heavily in AI infrastructure to support such models, including a $600 billion commitment announced in November 2025 to expand AI data centers in the U.S.

Application Analysis

In 2024, the Content Generation segment held a dominant market position, capturing a 38.4% share of the Global Open-Source AI Model Market. This application area focuses on AI’s ability to create textual, visual, audio, or multimedia content quickly and at scale. It appeals widely to industries seeking to automate creative workflows, improve marketing outreach, and enhance personalized communications.

The adoption of content generation tools is boosted by the flexibility and extensibility of open-source models, which allow firms to tailor AI outputs to specific needs such as brand voice or style consistency. As content demand surges across digital platforms, this segment supports efficient content marketing, automated news generation, and creative design, making it a critical growth area in open-source AI applications.

For instance, in July 2025, Stability AI expanded its text-to-image generation offerings with Stable Diffusion 3 and introduced Stable Audio Open, an open-source model for audio content generation. These products target enterprises seeking to automate creative production, showcasing the rise of AI in content generation. Stability AI also optimized its models for faster performance and enterprise deployment in collaboration with NVIDIA, signaling commercial readiness of content generation models.

Licensing Analysis

In 2024, The Permissive Licenses segment held a dominant market position, capturing a 42.3% share of the Global Open-Source AI Model Market. These licenses grant users broad freedoms to modify, integrate, and redistribute AI models with minimal restrictions, encouraging innovation and rapid adoption. Such licensing models attract businesses looking to leverage AI without heavy legal constraints, fostering a collaborative and flexible technology environment.

The preference for permissive licenses reflects a market trend toward openness and shared development, reducing barriers for enterprises to experiment and deploy AI across various use cases. This type of licensing supports an ecosystem where improvements and new developments can flow more freely among organizations and independent developers alike.

For Instance, in May 2025, Microsoft exemplifies leadership in promoting open standards and permissive licensing through initiatives like the Model Context Protocol and the open agentic web framework. These frameworks encourage broad usage and integration of AI models with fewer restrictions, making it easier for enterprises and developers to adopt and customize AI technology safely.

End-User Analysis

In 2024, The Enterprises segment held a dominant market position, capturing a 68.9% share of the Global Open-Source AI Model Market. This indicates that large organizations find significant value in adopting open-source AI for their operational and strategic needs. Enterprises leverage these models to enhance automation, improve decision-making, and stay competitive by integrating advanced AI capabilities.

The dominance of enterprises underscores a broader digital transformation trend where companies seek cost-effective, customizable AI solutions to drive efficiency and innovation. The open-source approach gives enterprises flexibility to adapt AI models to specific corporate requirements while benefiting from community-driven advancements and transparency.

For Instance, in August 2025, Databricks is investing heavily in delivering AI-ready data platforms to enterprises. Their partnerships and investments in collaboration with OpenAI highlight how enterprises are embedding AI deeply into business operations, from analytics to intelligent workflows. This demonstrates the strong enterprise demand for customizable, scalable open-source AI solutions.

Emerging trends

One major emerging trend is the increasing focus on smaller, more efficient AI models that perform well while reducing energy use and computational needs. These compact models are becoming more capable of running on edge devices and personal computers, opening AI to a broader range of users and use cases.

Alongside this, multimodal models that understand and generate interconnected text, images, and audio are advancing rapidly, with predictions that native integration of multiple media types in single models will unlock new interactive and creative applications.

Another trend is the growing collaborative innovation within the open-source AI community. Platforms with vast developer participation, with over 100,000 contributors in some projects, are driving faster improvements. This collective effort is expanding AI capabilities while making them more transparent and accessible.

Growth Factors

A key growth factor is the strong community-driven development that allows continuous refinement and extension of open-source models. Contributions from thousands of organizations and individual developers enable rapid iteration and adaptation to new domains, increasing the usefulness and trustworthiness of these models.

Additionally, open-source AI reduces barriers to entry by lowering costs compared to proprietary alternatives, making advanced AI technology accessible to startups and smaller companies that might otherwise be excluded.

Another growth driver is the increasing demand for localized and customizable AI solutions. Organizations prefer open-source models so they can address specific language, cultural, or industry needs without relying on external vendors. This trend supports diverse applications from personalized healthcare to region-specific language processing. As more industries recognize the value of adaptable AI workflows, adoption of open-source models is expected to broaden, further accelerating development and deployment.

Key Market Segments

By Model Type

- Foundational Models

- Computer Vision Models

- Multimodal Models

- Others

By Application

- Natural Language Processing

- Content Generation

- Code Generation

- Others

By Licensing

- Permissive Licenses

- Restricted Licenses

- Copyleft Licenses

By End-User

- Enterprises

- Academia

- Developers

- Individuals

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Demand for Transparent and Customizable AI

A key factor driving the open-source AI model market is the increasing need for transparency and customization in AI solutions. Organizations want AI systems that they can fully understand and modify to fit their unique needs. Open-source AI models provide access to the core code, enabling users to adapt the technology rather than relying on one-size-fits-all proprietary solutions. This openness builds trust and encourages developers to innovate through shared improvements.

Another aspect fueling growth is cost efficiency. Open-source models lower barriers for businesses by eliminating licensing fees, which is especially helpful for startups and smaller companies. This accessibility accelerates AI adoption across various industries, where flexibility and openness are essential for integration with existing systems and industry-specific requirements.

For instance, in April 2025, Meta released its Llama 4 series of open-source large language models with significant advancements in multimodality. These models, including Scout and Maverick, allow the seamless combination of text, image, and video data, enabling richer AI applications. Meta emphasized openness by making these models publicly available, providing developers and enterprises the flexibility to build customized AI solutions transparently.

Restraint

Security and Data Privacy Concerns

Security and data privacy present significant challenges for adopting open-source AI models. Because these models are publicly accessible, organizations worry about potential exposure of sensitive information and vulnerability to cyber threats. The open nature means less centralized control over how models are secured, creating hesitation among companies with strict compliance obligations and confidential data.

Additionally, the variable quality of open-source models can discourage use in critical applications. Without consistent standards or guaranteed support, businesses sometimes doubt whether open-source solutions can provide reliable and secure performance. This uncertainty pushes many organizations toward proprietary AI tools that offer dedicated security measures and customer assistance.

For instance, in October 2025, Microsoft announced an extension of its partnership with OpenAI, focusing on responsible AI development balanced with intellectual property (IP) protections and secure deployment options. While supporting model openness through API access, Microsoft carefully controls IP rights and access to certain advanced technologies, reinforcing enterprise concerns over security and proprietary safeguards.

Opportunities

Industry-Specific Custom AI Solutions

The open-source AI market holds considerable potential for creating tailored AI applications in industries with specialized needs. Fields like healthcare, financial services, and manufacturing benefit from customized models that handle specific data types and business processes. Open-source frameworks support this by providing the flexibility to build solutions fine-tuned for distinct requirements, improving AI’s usefulness and effectiveness.

Collaboration across academia, startups, and enterprise players also boosts the market’s opportunity. Shared research, resources, and knowledge help develop more sophisticated models and foster a vibrant ecosystem. This collaborative environment encourages innovation, making it easier for users worldwide to adopt and adapt open-source AI technology for local and niche uses.

For instance, in September 2025, Mistral AI formed a strategic partnership with semiconductor equipment manufacturer ASML to integrate open-source AI models into advanced lithography systems. This collaboration aims to accelerate innovation in semiconductor manufacturing by providing AI solutions tailored to ASML’s technology and customers.

Challenges

Scaling and Maintaining Open-Source Models

Maintaining and scaling open-source AI models is a major hurdle for organizations. These models require ongoing updates to stay secure, performant, and compatible with other software. Without sufficient technical expertise and resources, companies struggle to keep their AI systems current and effective over time.

Moreover, fragmented tools and inconsistent standards complicate model deployment in enterprise settings. This creates additional demands on skilled staff to integrate and manage these models within existing IT infrastructures. The shortage of trained professionals capable of handling these challenges limits the wider adoption of open-source AI solutions at scale.

For instance, in November 2025, Databricks expanded its AI development platform with new open-source tools designed to improve the quality, governance, and production-readiness of AI agents. These tools, like Agent Bricks, help enterprises overcome difficulties in scaling and maintaining AI models by automating steps such as accuracy checks and compliance.

Key Players Analysis

The Open-Source AI Model Market is driven by leading technology firms promoting transparency, collaboration, and accessibility in AI development. Meta, Google, and Microsoft play central roles with open frameworks and foundation models that enable developers to build customized AI solutions efficiently. Their contributions, such as transformer-based architectures and multimodal models, have accelerated innovation across language, vision, and generative AI domains.

Mistral AI, Hugging Face, Stability AI, and EleutherAI represent the new wave of independent organizations fueling decentralization in the AI space. They emphasize community-driven development and open model weights, making state-of-the-art generative and large language models (LLMs) accessible to startups, researchers, and enterprises.

Nvidia, IBM, Databricks, Snowflake, Alibaba, Apple, and Amazon are expanding open-source AI capabilities through advanced hardware acceleration, data pipelines, and integration platforms. Their focus lies in enabling efficient AI model training and deployment at scale using GPUs, cloud infrastructure, and MLOps tools.

Top Key Players in the Market

- Meta

- Microsoft

- Mistral AI

- Hugging Face

- Databricks

- Stability AI

- EleutherAI

- Technology Innovation Institute

- Nvidia

- IBM

- Snowflake

- Alibaba

- Apple

- Amazon

- Others

Recent Developments

- In October 2025, Meta and Hugging Face launched OpenEnv, an open-source platform for standardizing AI agentic environments. This platform embraces secure sandboxes for safer and predictable AI operation, promoting collaborative environment development in open-source reinforcement learning ecosystems. This development enhances scalable AI agent development opportunities for developers worldwide.

- In October 2025, Stability AI entered a strategic alliance with Universal Music Group to co-develop AI-powered professional music creation tools. This collaboration focuses on responsibly trained generative AI that supports artists’ creative workflows and aims to integrate licensed, commercially safe AI tools into the music production process.

Report Scope

Report Features Description Market Value (2024) USD 13.4 Bn Forecast Revenue (2034) USD 54.7 Bn CAGR(2025-2034) 15.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Model Type (Foundational Models, Computer Vision Models, Multimodal Models, Others), By Application (Natural Language Processing, Content Generation, Code Generation, Others), By Licensing (Permissive Licenses, Restricted Licenses, Copyleft Licenses), By End-User (Enterprises, Academia, Developers, Individuals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Meta, Microsoft, Mistral AI, Google, Hugging Face, Databricks, Stability AI

EleutherAI, Technology Innovation Institute, Nvidia, IBM, Snowflake, Alibaba, Apple, Amazon, OthersCustomization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Open-Source AI Model MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Open-Source AI Model MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Meta

- Microsoft

- Mistral AI

- Hugging Face

- Databricks

- Stability AI

- EleutherAI

- Technology Innovation Institute

- Nvidia

- IBM

- Snowflake

- Alibaba

- Apple

- Amazon

- Others