Global Open Gear Lubricants Market Size, Share, And Business Benefits By Base Oil (Synthetic Lubricants, Mineral Oil-based Lubricants, Bio-based Lubricants), By End-use (Mining, Cement, Construction, Power Generation, Oil and Gas, Marine, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154045

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

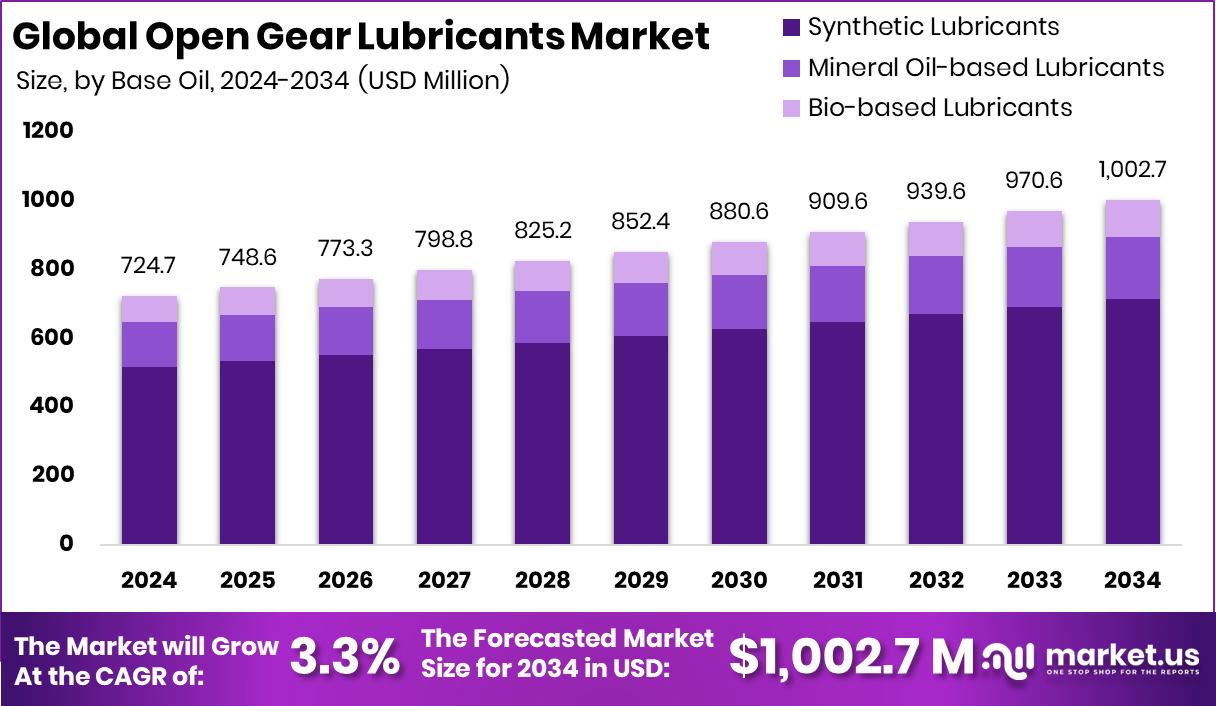

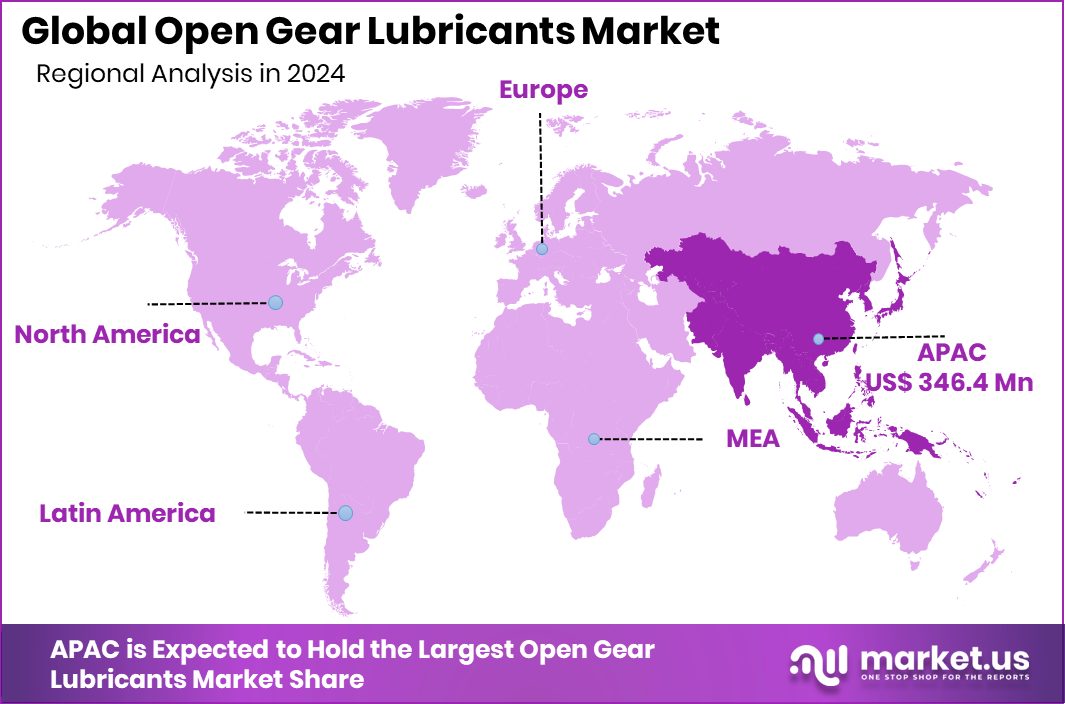

The Global Open Gear Lubricants Market is expected to be worth around USD 1,002.7 million by 2034, up from USD 724.7 million in 2024, and is projected to grow at a CAGR of 3.3% from 2025 to 2034. Strong industrial growth in Asia-Pacific supported the USD 346.4 Mn market value.

Open gear lubricants are specially formulated heavy-duty lubricants used to protect large, slow-moving open gears typically found in industrial machinery. These gears are exposed, meaning they are not enclosed in a gearbox, and are commonly used in applications such as mining equipment, cement kilns, mills, and power plants. Open gear lubricants are designed to withstand extreme pressures, high loads, and harsh operating environments.

The open gear lubricants market refers to the global demand, production, and supply of lubricants specifically used for open gear applications in heavy industrial operations. This market includes various lubricant types such as greases, semi-fluid lubricants, and synthetic or mineral-based oils formulated for use in mining, cement, steel, and power generation sectors. It plays a vital role in supporting the efficiency and durability of large-scale mechanical systems, especially in industries where equipment downtime can lead to significant financial losses.

The growth of the open gear lubricants market is primarily driven by rising investments in heavy industries such as mining, construction, and cement production. As developing economies expand their infrastructure projects, the demand for large machinery that requires open gear systems is increasing. In this context, funding activity is gaining pace — Terra CO₂ raises US$124.5 million in Series B to support sustainable cement solutions, and Queens Carbon secures US$10 million seed round for low-carbon cement technology. These investments reflect the broader industrial momentum supporting lubricant demand.

A significant opportunity exists in developing environmentally acceptable lubricants that comply with stricter environmental and safety standards. Industries are gradually shifting towards cleaner and safer lubrication options without compromising on performance. Additionally, as emerging markets increase their manufacturing and mining activities, the demand for modern lubrication technologies is expected to rise.

The transition is further supported by innovations in materials—Fiber Elements receives €2.6 million funding to advance basalt-based construction materials and Boral awarded AUD$24.5 million federal grant for carbon-cutting cement kiln upgrades—indicating a parallel trend toward sustainability and modernization in industrial operations.

Key Takeaways

- The Global Open Gear Lubricants Market is expected to be worth around USD 1,002.7 million by 2034, up from USD 724.7 million in 2024, and is projected to grow at a CAGR of 3.3% from 2025 to 2034.

- Synthetic lubricants dominate the Open Gear Lubricants Market with a 71.3% share due to superior performance.

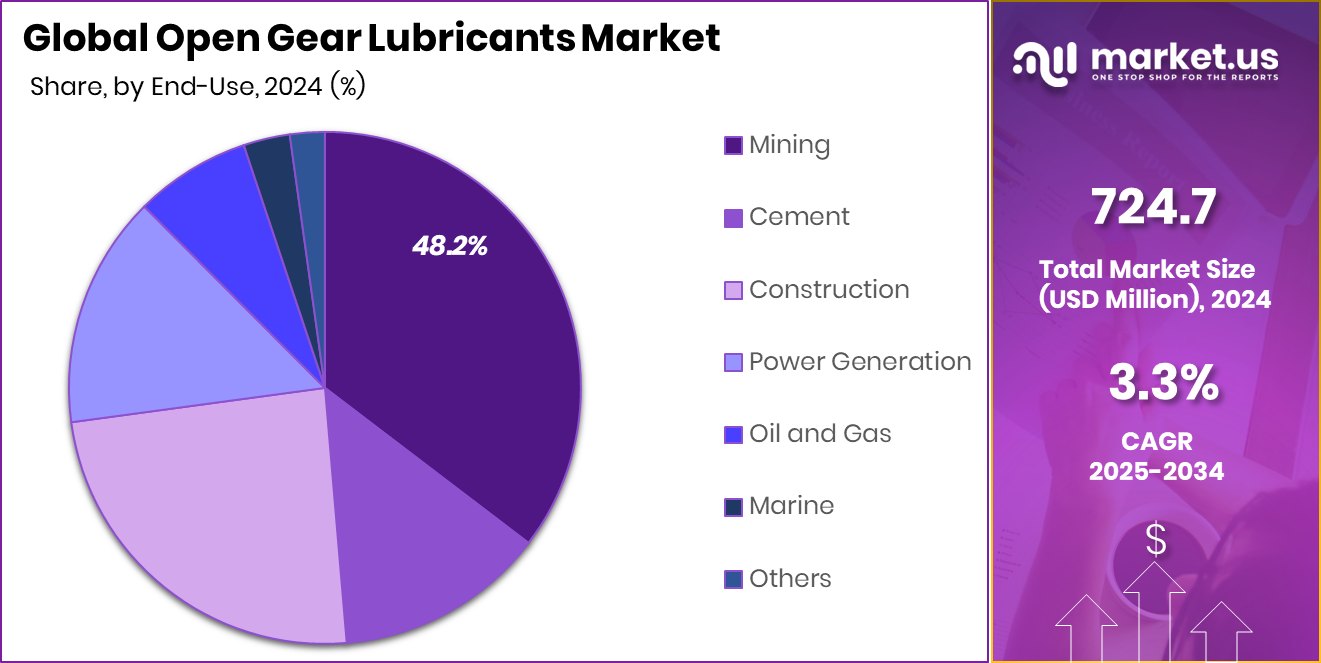

- Mining leads the Open Gear Lubricants Market with a 48.2% share, driven by heavy machinery operations.

- The Asia-Pacific market was valued at USD 346.4 million during the year 2024.

By Base Oil Analysis

Synthetic lubricants lead the Open Gear Lubricants Market with 71.3%.

In 2024, Synthetic Lubricants held a dominant market position in the By Base Oil segment of the Open Gear Lubricants Market, with a 71.3% share. This leading position can be attributed to the superior performance characteristics of synthetic formulations, especially in harsh and demanding industrial conditions. Synthetic lubricants are known for their high thermal stability, excellent load-carrying capacity, and extended service intervals, making them ideal for open gear applications where equipment operates under extreme pressures and varying temperatures.

Industries such as mining, cement, and power generation rely heavily on open gear systems that must function efficiently for long durations. The use of synthetic base oils helps reduce wear and friction, ensuring better protection for heavily loaded and exposed gear teeth. Additionally, the lower volatility and higher oxidation resistance of synthetic lubricants reduce the frequency of re-application, translating to lower maintenance costs and longer equipment lifespan.

The preference for synthetic options also reflects an increasing emphasis on equipment reliability and operational efficiency. As plant operators continue to prioritize performance, uptime, and cost-effectiveness, the demand for synthetic open gear lubricants remains strong.

By End-use Analysis

Mining dominates the Open Gear Lubricants Market with a 48.2% share.

In 2024, Mining held a dominant market position in the end-use segment of the Open Gear Lubricants Market, with a 48.2% share. This significant share is driven by the extensive use of open gear systems in mining operations, where large grinding mills, rotary kilns, and draglines require robust lubrication to function reliably under intense mechanical stress. The harsh environments typical of mining—dust, moisture, and heavy loads—make the use of high-performance open gear lubricants essential for maintaining operational efficiency and equipment longevity.

The continuous operation of mining equipment demands consistent lubrication performance to minimize unplanned downtime and reduce wear on expensive components. Open gear lubricants used in this sector must withstand extreme pressure, temperature variations, and exposure to contaminants, making them critical for sustaining productivity in high-value mining activities. The mining industry’s focus on preventive maintenance and reducing operational costs has further boosted the preference for durable, high-load-carrying lubricants.

The 48.2% market share held by the mining segment in 2024 reflects the critical role open gear lubrication plays in this sector’s day-to-day operations. As mining activities remain a cornerstone of industrial production worldwide, the demand for specialized lubricants tailored to these challenging conditions remains consistently high.

Key Market Segments

By Base Oil

- Synthetic Lubricants

- Mineral Oil-based Lubricants

- Bio-based Lubricants

By End-use

- Mining

- Cement

- Construction

- Power Generation

- Oil and Gas

- Marine

- Others

Driving Factors

Heavy Equipment Use Drives Lubricant Demand Growth

The biggest factor driving the open gear lubricants market is the growing use of heavy-duty machinery across key industries such as mining, cement, and power generation. These machines rely on exposed gear systems that operate under high loads and extreme environmental conditions. To ensure smooth and reliable performance, open gear lubricants are used to protect gears from wear, corrosion, and overheating.

As industrial activities continue to expand globally—especially in developing countries—there is a rising demand for large mechanical systems, which directly increases the need for efficient and long-lasting lubrication. Companies are also investing more in preventive maintenance to avoid costly downtime, further boosting the demand for advanced open gear lubricants across these high-impact sectors.

Restraining Factors

Environmental Concerns Limit Conventional Lubricant Usage

One of the main challenges for the open gear lubricants market is the rising concern over environmental safety and regulations. Traditional lubricants often contain harmful chemicals that can pose risks to soil and water when exposed to open environments. Since open gear systems are not enclosed, there is a higher chance of lubricant leakage or spillage during operation or maintenance.

Governments and environmental agencies are enforcing stricter regulations on the use and disposal of such lubricants, pushing industries to shift toward eco-friendly alternatives. However, these bio-based or environmentally acceptable lubricants tend to be more expensive and may not always match the performance of conventional products, making it harder for some users to adopt them immediately.

Growth Opportunity

Eco‑Friendly Lubricants Offer Growth in Demand

One of the most promising opportunities in the open gear lubricants market lies in the development and adoption of eco-friendly lubrication solutions. Industries that use large open gear systems—such as mining, cement, and power generation—are increasingly pressured by regulations and stakeholders to reduce environmental impact. Bio-based and biodegradable lubricants provide a compelling alternative, as they minimize soil and water contamination in case of leaks or spillage.

Although these environmentally acceptable options may initially cost more, they permit companies to comply with stricter ecological standards and improve public perception. As process technologies advance, the performance gap between eco-friendly and traditional lubricants is narrowing.

Latest Trends

Innovative Polymers Improve Lubricant Film and Performance (7 words)

The latest trend in the open gear lubricants market is the integration of advanced polymers and viscosity modifiers into lubricant formulations. New high‑viscosity synthetic oils, such as those using polyisobutylene (PIB) or unique performance polymers (UPPs), are being introduced to enhance film adhesion under heavy loads and reduce lubricant run‑off during operation. These polymers help open‑gear lubricants maintain a thicker, more resilient protection layer over exposed gear teeth, even in high‑pressure and high‑temperature environments.

As a result, wear is reduced and the interval between applications can be extended, improving uptime and lowering maintenance costs. This polymer-based approach represents a notable shift in formulation design, focusing on increased dwell time on gear surfaces, improved energy efficiency through reduced friction and cooler gear operation, and overall enhanced durability in extreme industrial settings

Regional Analysis

Asia-Pacific led the Open Gear Lubricants Market with 47.8% share in 2024.

In 2024, Asia-Pacific emerged as the dominant region in the Open Gear Lubricants Market, capturing a substantial 47.8% share, equivalent to a market value of USD 346.4 million. This leadership is attributed to the region’s strong base of heavy industries, including mining, cement, and power generation, which rely heavily on open gear systems for continuous operations. The demand for high-performance lubricants in this region is driven by the large-scale industrialization taking place across countries such as China, India, and Southeast Asia.

In North America and Europe, the market maintained steady performance, supported by the presence of advanced infrastructure and well-established industrial sectors. Meanwhile, the Middle East & Africa and Latin America represented emerging regions, where industrial expansion and increasing investments in infrastructure projects are gradually boosting the consumption of open gear lubricants.

The regional distribution of the market highlights Asia-Pacific as the key growth hub, with its large machinery fleets and high lubricant consumption volumes. The ongoing industrial development in this region is expected to sustain its leading position over the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Klüber Lubrication reaffirmed its position as a technology-driven leader in specialty lubricants. The company continued to emphasize bespoke solutions tailored for heavy‑duty open gear applications, highlighting its deep expertise in synthetic formulation and high‑performance base oils. Its strong application engineering support and focus on operational reliability helped clients reduce downtime and extend equipment life. Klüber’s investment in laboratory testing and customer collaboration reinforced its reputation among end‑users seeking customized lubrication strategies.

Carl Bechem GmbH, a Germany‑based specialist in industrial lubrication, maintained a clear focus on product innovation and service responsiveness. The firm’s strength lies in its engineering consultancy model—supplying not just lubricant products but also support in selection, monitoring, and maintenance protocols. This consultative approach enabled Carl Bechem to secure partnerships in critical industries, such as mining and cement, where tailored lubrication regimes are crucial for ensuring open gear reliability.

FUCHS SE, the global lubrication group, leveraged its scale and comprehensive product portfolio in 2024 to support open gear markets worldwide. FUCHS’s capacity to offer integrated lubricant systems, logistics, and global distribution enabled broad regional reach and consistent product availability. The company’s investment in synthetic formulations and extended service intervals helped it appeal to customers prioritizing efficiency gains and maintenance savings.

Top Key Players in the Market

- Kluber Lubrications

- Carl Bechem GmbH

- FUCHS SE

- Exxon Mobil Corporation

- Chevron Corporation

- BP P.L.C.

- CWS Industrials, Inc.

- Shell plc

- TotalEnergies SE

- Petron Corporation

- Specialty Lubricants Corporation

Recent Developments

- In March 2025, Klüber Lubrication was awarded the EcoVadis Gold medal—its fourth consecutive award—placing it in the top 3% of companies globally in sustainability performance. This recognition underscores its strong commitment to sustainable lubricant technologies that include eco-friendly open gear solutions.

- In March 2025, Carl Bechem unveiled its Nexus Technology, a new lubricant formulation that entirely avoids PFAS chemicals such as PTFE. This PFAS‑free solution delivers high load-carrying ability across varied temperatures and matches or exceeds the performance of traditional PTFE‑based products. The innovation also cuts carbon emissions to around 3 kg CO₂ equivalent per kilogram, compared to typical 7–10 kg levels.

Report Scope

Report Features Description Market Value (2024) USD 724.7 Million Forecast Revenue (2034) USD 1,002.7 Million CAGR (2025-2034) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Base Oil (Synthetic Lubricants, Mineral Oil-based Lubricants, Bio-based Lubricants), By End-use (Mining, Cement, Construction, Power Generation, Oil and Gas, Marine, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kluber Lubrications, Carl Bechem GmbH, FUCHS SE, Exxon Mobil Corporation, Chevron Corporation, BP P.L.C., CWS Industrials, Inc., Shell plc, TotalEnergies SE, Petron Corporation, Specialty Lubricants Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Open Gear Lubricants MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Open Gear Lubricants MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kluber Lubrications

- Carl Bechem GmbH

- FUCHS SE

- Exxon Mobil Corporation

- Chevron Corporation

- BP P.L.C.

- CWS Industrials, Inc.

- Shell plc

- TotalEnergies SE

- Petron Corporation

- Specialty Lubricants Corporation