Global Online Travel Agencies Software Market Size, Share Analysis By Type of Software (Booking Engine Software, Customer Relationship Management (CRM) Software, Payment Gateway Solutions, Tour Operator Software, Others), By Deployment Type (Cloud-based, On-premises), By Pricing Model (Subscription-based Pricing, Transaction-based Pricing), By Application (Airline Booking, Hotel Booking, Car Rental Booking, Tour & Activities Booking, Vacation Packages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155065

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of AI

- U.S. Market Size

- Top 5 Growth Factors

- Top 5 Trends and Innovations

- Type of Software Analysis

- Deployment Type Analysis

- Pricing Model Analysis

- Application Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

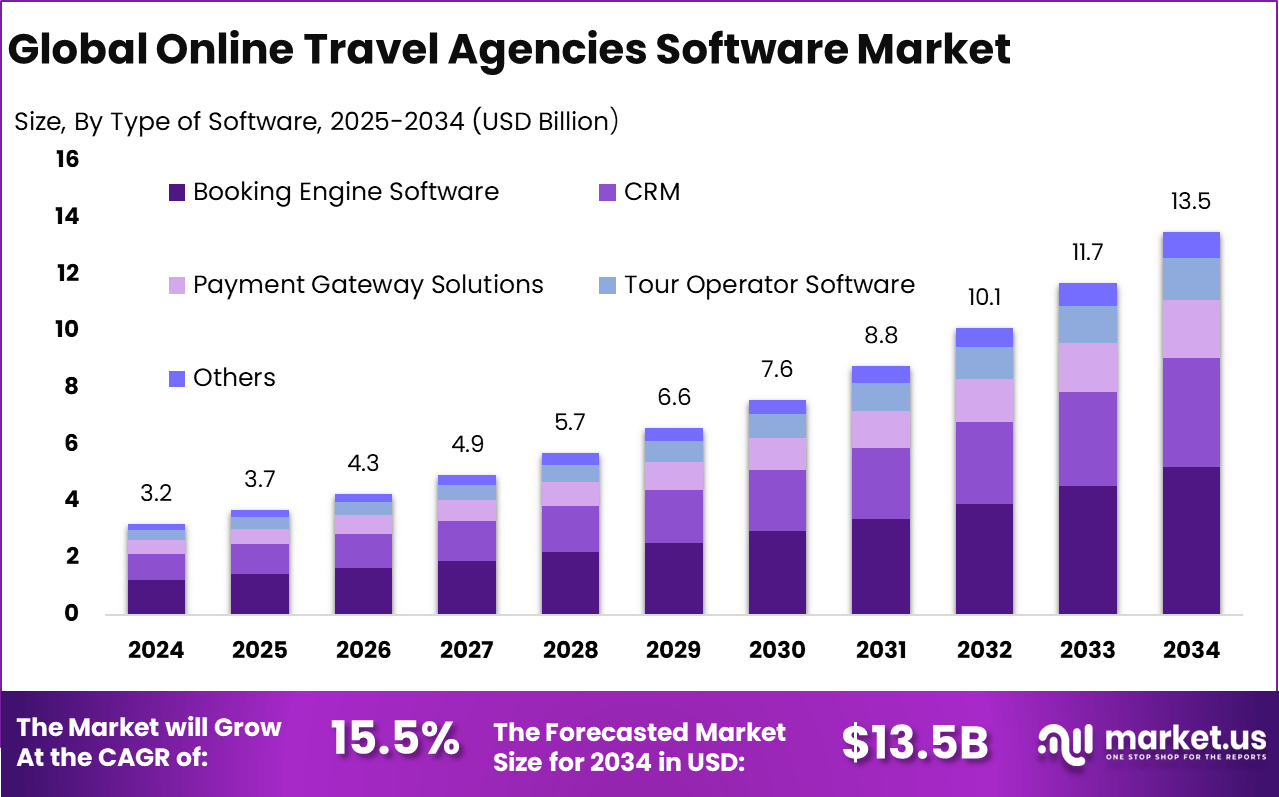

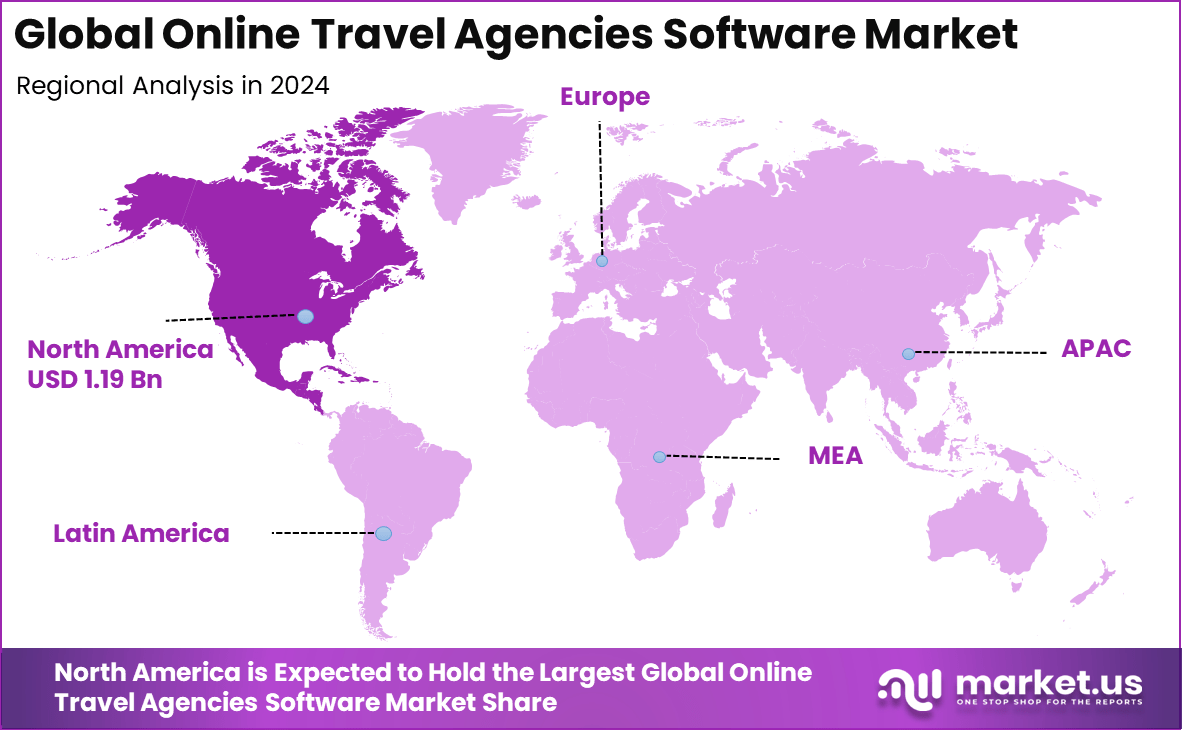

The Global Online Travel Agencies Software Market size is expected to be worth around USD 13.5 billion by 2034, from USD 3.2 billion in 2024, growing at a CAGR of 15.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.2% share, holding USD 1.19 billion in revenue.

The Online Travel Agencies (OTA) Software Market is witnessing steady transformation driven by the evolving demands of the travel and tourism industry. This market revolves around software solutions that help OTAs manage bookings, optimize itineraries, engage customers, and streamline overall travel operations. It encompasses various tools such as booking engines, customer relationship management, payment processing, and analytics platforms tailored to the unique needs of travel agencies and service providers.

Top driving factors fueling the market include the widespread adoption of digital technologies, growth in global travel and tourism, and shifting consumer behavior towards online booking platforms. The availability of personalized, seamless experiences appeals strongly to tech-savvy travelers who prefer convenience and flexibility. Additionally, increasing smartphone penetration and internet connectivity have made it easier for travelers to access OTA services anytime, anywhere.

Market Size and Growth

Metric Statistic / Value Market Value (2024) USD 3.2 Bn Forecast Revenue (2034) USD 13.5 Bn CAGR(2025-2034) 15.5% Leading Segment Subscription-based Pricing: 72.5% Leading Region Share North America [37.2% Market Share] Largest Country U.S. [USD 1.01 Billion Market Revenue], CAGR: 13.7% Based on data from llcbuddy, most travel agency software is priced between $49 and $99 per month, with advanced platforms like Tourplan and Softrip serving global tour operators and DMCs. Traveler behavior shows high last-minute activity, as 72% of mobile bookings occur within 48 hours of travel. In 2025, Booking.com’s app led the OTA market with 80 million downloads, while Delta Air Lines achieved over 80% on-time arrivals, making it the most punctual carrier of the year.

According to ET TravelWorld, India’s total Travel & Tourism GDP contribution in 2024 stood at ₹20.9 trillion (USD 249.3 billion), a 20% jump over 2019, accounting for approximately 6.6% of the national economy. WTTC forecasts a further rise to ₹22.5 trillion (USD 268.7 billion) in 2025. By 2035, the sector is expected to nearly double to ₹41.9 trillion (USD 501.1 billion), contributing an estimated 10.9% to the national GDP.

For instance, in May 2024, Collett’s Travel partnered with Dolphin Dynamics to enhance its digital infrastructure by integrating a new reservation module. This collaboration allows Collett’s Travel to streamline its booking process and offer more advanced and flexible travel solutions. The new technology from Dolphin Dynamics improves the overall customer experience by providing real-time availability, dynamic pricing, and easier management of bookings.

Investment opportunities in the OTA software sector are huge owing to rising digital adoption and the expansion of travel markets globally, particularly in emerging regions with growing middle-class populations. Innovation in AI, mobile technologies, and API integrations presents fertile ground for new entrants and established players alike. Governments supporting tourism infrastructure and digital initiatives further incentivize investments.

Key Takeaway

- The Booking Engine Software segment led the market with a 38.7% share, reflecting strong demand for integrated platforms that streamline reservations and improve conversion rates for travel service providers.

- On-premises deployment held a 64.4% share, driven by operators seeking greater control over data, customization, and security in high-volume booking environments.

- The Subscription-based Pricing model dominated with 72.5%, as OTAs and travel businesses increasingly adopt predictable, scalable payment structures to manage operational costs.

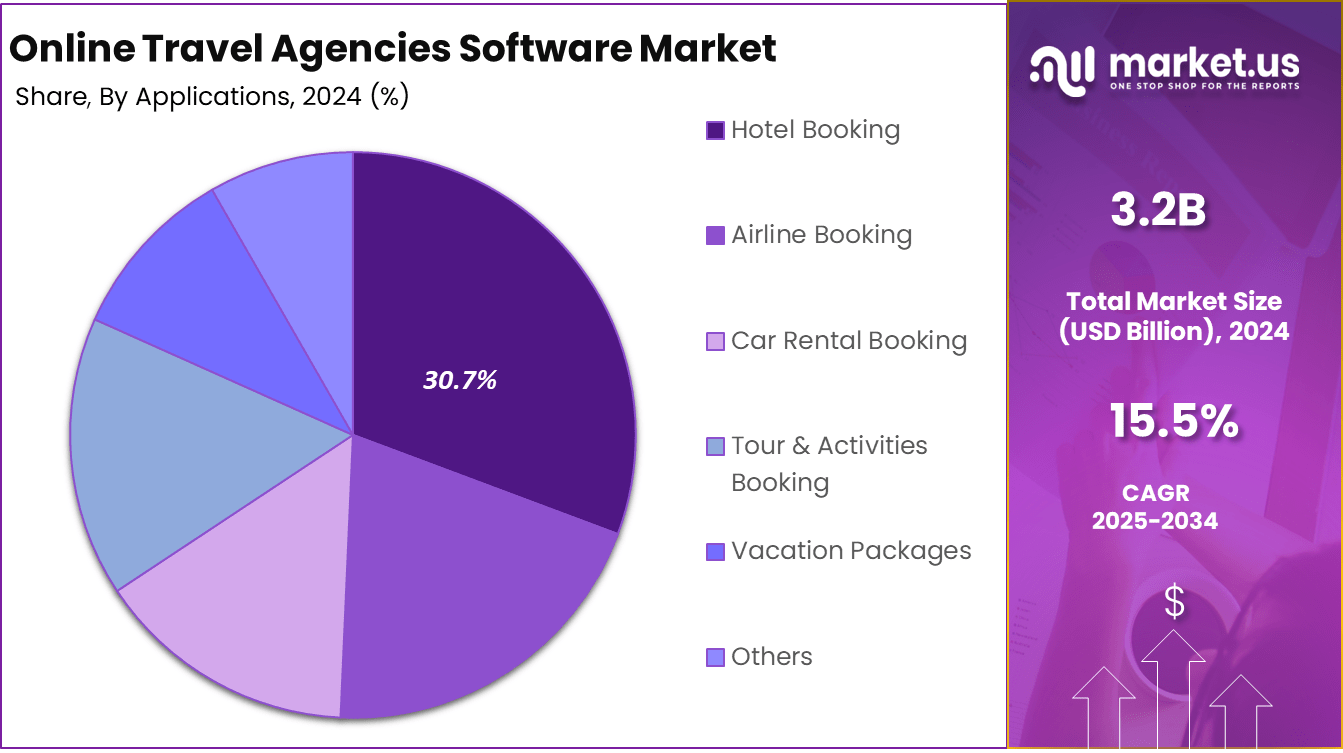

- Hotel Booking was the leading application segment with a 30.7% share, supported by growing online accommodation demand and preference for bundled travel services.

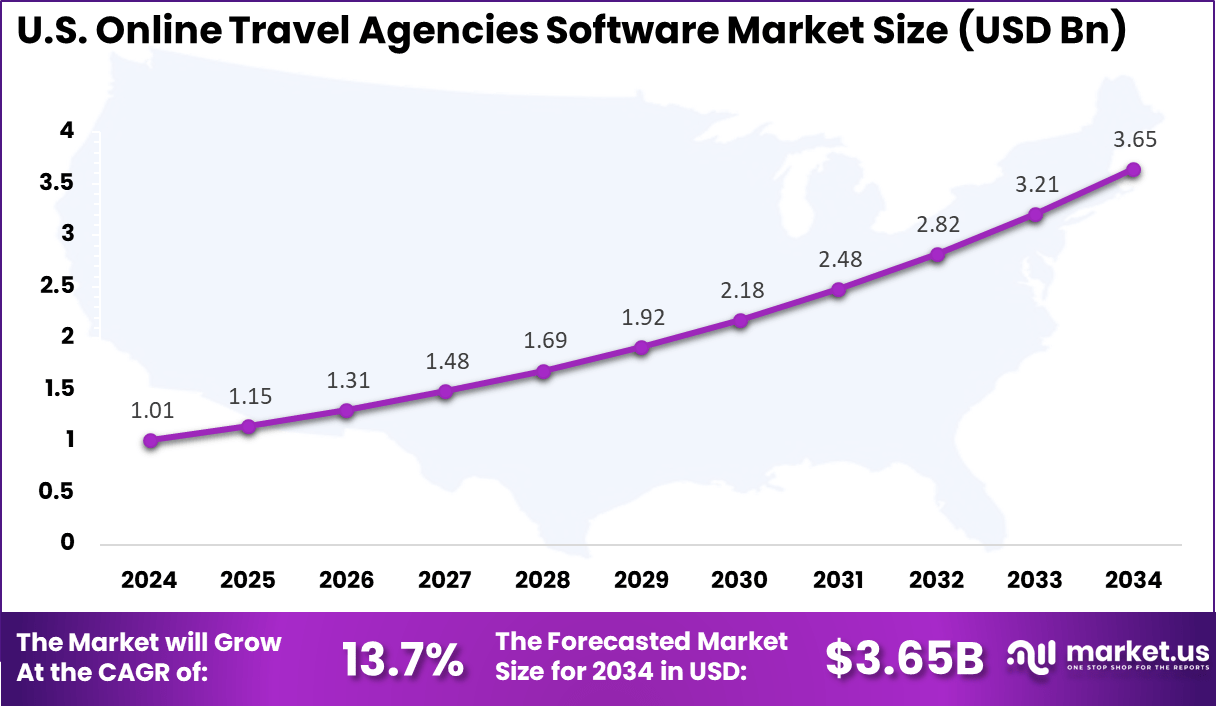

- The U.S. market reached USD 1.01 billion in 2024 and is projected to grow at a robust CAGR of 13.7%, boosted by high digital adoption and travel sector recovery.

- North America accounted for 32.7% of the global market, benefiting from mature travel infrastructure, advanced booking technologies, and rising mobile-based reservations.

Role of AI

Role/Function Description Personalized Customer Experience AI analyzes large datasets to deliver tailored recommendations, dynamic pricing, and customized itineraries. Predictive Analytics Enables forecasting travel trends, demand fluctuations, and consumer behavior for inventory and pricing optimization. Intelligent Virtual Assistants NLP-powered chatbots and voice assistants automate customer support and booking processes. Fraud Detection & Security AI identifies fraudulent transactions and enhances data security across OTA platforms. Automated Workflow Optimization AI streamlines booking management, payment reconciliation, and customer communication. Enhanced Marketing & Segmentation Machine learning models segment customers for targeted and effective marketing campaigns. U.S. Market Size

The market for Online Travel Agencies Software within the U.S. is growing tremendously and is currently valued at USD 1.01 billion, the market has a projected CAGR of 13.7%. Rapid growth in travel bookings is due to the increasing use of online platforms as travelers are seeking simplicity, flexibility, and affordable prices. Smartphone penetration and travel apps are contributing to the rapid growth of this industry, allowing people to book trips from any location.

Additionally, the U.S. travel market is expanding, with more consumers seeking personalized and seamless travel experiences. With the rise of advanced software tools like artificial intelligence and machine learning, online travel agencies are increasingly relying on them to offer better prices and personalized recommendations.

For instance, in April 2024, DerbySoft acquired PKfare, a key player in airline distribution, enhancing its ability to offer a seamless booking experience across both hotel and airline sectors. This acquisition underscores the growing U.S. dominance in the OTA software market, as American companies lead in innovation, acquisitions, and the integration of new technologies in the travel industry.

In 2024, North America held a dominant market position in the Global Online Travel Agencies Software Market, capturing more than a 37.2% share, holding USD 1.19 billion in revenue. The market held a dominant position due to North America’s advanced technological infrastructure, high internet penetration, and widespread use of mobile devices for travel bookings.

The surge in both domestic and international travel boosted demand for centralized, user-friendly platforms. The rise of AI-powered personalization, mobile bookings, and a focus on unique travel experiences, such as eco-friendly stays, further strengthened the market. The presence of major OTAs like Expedia, Booking.com, and Airbnb also fueled the adoption of advanced software solutions, reinforcing the region’s market leadership.

For instance, In August 2025, Expedia reported that AI integration is driving substantial revenue, reinforcing North America’s lead in the Online Travel Agencies software market. By enhancing personalization, dynamic pricing, and user experience, AI is boosting customer engagement and conversions. This dominance is supported by advanced technology infrastructure and the capacity of leading OTA providers to innovate and expand quickly.

Top 5 Growth Factors

Growth Factor Description Increasing Travel Demand Recovery and growth in global travel boost OTA usage and software demand. Digital Transformation Expansion of mobile apps, cloud platforms, and real-time booking drives adoption of sophisticated software. Rising Consumer Preference for Convenience Preference for seamless, instant booking and personalized travel experiences through OTAs. Integration of AI & Advanced Technologies AI/ML, big data analytics, and NLP improve operational efficiency and customer engagement. Expansion in Emerging Markets Rapid growth in Asia-Pacific, Latin America, and Middle East fueled by rising internet penetration and tourism. Top 5 Trends and Innovations

Trend/Innovation Description Cloud-Based & SaaS Platforms Flexible, scalable, and remote-friendly solutions dominate OTA software deployments. Mobile & Voice Booking Interfaces Growing use of mobile apps and voice search enhances accessibility and user experience. AI-Powered Personalization Dynamic pricing, customized recommendations, and itinerary planning fueled by AI. Data Security and Privacy Enhancements Heightened focus on securing transactions and protecting customer data with AI-driven tools. Integration of VR/AR for Visualization Emerging use of virtual and augmented reality for immersive travel previews and selection. Type of Software Analysis

In 2024, the Booking Engine Software segment held a dominant market position, capturing a 38.7% share of the Global Online Travel Agencies Software Market. This dominance is due to the critical role booking engines play in enabling seamless, real-time reservations for flights, hotels, and other travel services.

Due to the growing demand for faster booking services, simplified procedures, and personalized experiences among travelers, online travel agencies are increasingly relying on booking engine software. The growing demand for booking engine systems that can operate on mobile devices and use artificial intelligence to create personalized experiences necessitates strong and efficient systems.

For Instance, in January 2025, P3 Hotel Software introduced a new version of its booking engine, enhancing the booking experience for both travelers and hotel operators. The upgraded platform focuses on providing seamless integration across multiple channels, enabling real-time bookings, personalized experiences, and better management of reservations. The push toward more intuitive, mobile-friendly, and AI-driven booking solutions.

Deployment Type Analysis

In 2024, the On-premises segment held a dominant market position, capturing a 64.4% share of the Global Online Travel Agencies Software Market. The demand in this sector has been driven mainly by the preference of large OTAs and travel organizations for greater control over their systems and data security.

On-premises solutions offer enhanced customization, robust security features, and compliance with industry regulations, which are crucial for businesses handling sensitive customer information. Additionally, the ability to integrate seamlessly with existing infrastructure has made on-premises deployment a favored choice for many established players in the market.

For instance, in March 2024, Sabre offers an on-premises software platform widely used by travel agencies. This system allows agencies to access live, real-time inventory and make bookings for flights, hotels, car rentals, and other travel services all from a unified interface. Agencies benefit from full control over their data and system customization, which is critical for security and regulatory compliance.

Pricing Model Analysis

In 2024, the Subscription-based Pricing segment held a dominant market position, capturing a 72.5% share of the Global Online Travel Agencies Software Market. This dominance is due to the predictable revenue model it offers, allowing OTAs to manage costs efficiently while accessing continuous software updates, support, and new features.

The subscription-based model also appeals to businesses seeking scalability, as it enables them to easily adjust services based on their growth needs. Additionally, it fosters long-term customer relationships by providing ongoing value and ensuring software remains up-to-date with industry innovations.

For Instance, in August 2024, Wizz Air launched a flight subscription service, marking a significant move toward a subscription-based pricing model in the travel industry. This development highlights the growing adoption of subscription models, which provide consistent, predictable revenue streams for service providers while offering customers flexibility and cost savings.

Application Analysis

In 2024, the Hotel Booking segment held a dominant market position, capturing a 30.7% share of the Global Online Travel Agencies Software Market. This dominance is due to the growing demand for seamless, real-time hotel reservations from both leisure and business travelers.

The rising demand for seamless, user-friendly hotel booking platforms that offer competitive pricing, personalized recommendations, and easy payment options has driven this segment’s growth. Additionally, the increasing reliance on mobile apps and online channels for booking accommodations further solidifies the importance of advanced hotel booking software solutions in the OTA market.

For Instance, In December 2023, Alipay partnered with online travel agencies to introduce China tour packages and a travel guide for international visitors. The initiative reflects the growing integration of hotel bookings and travel services within the OTA ecosystem. By providing tailored packages and streamlined booking experiences, the collaboration seeks to improve convenience for travelers, especially in popular destinations such as China.

Key Market Segments

By Type of Software

- Booking Engine Software

- Customer Relationship Management (CRM) Software

- Payment Gateway Solutions

- Tour Operator Software

- Others

By Deployment Type

- Cloud-based

- On-premises

By Pricing Model

- Subscription-based Pricing

- Transaction-based Pricing

By Application

- Airline Booking

- Hotel Booking

- Car Rental Booking

- Tour & Activities Booking

- Vacation Packages

- Others

Drivers

Increasing Online Travel Bookings

One of the primary reasons for the growth of online travel agency software is the shift from traditional booking methods to digital channels. Online travel agencies are becoming more popular due to their convenient, diverse, and immediate availability.

Due to the growing number of travelers utilizing online booking platforms, these agencies are encouraged to utilize advanced software that streamlines booking, enhances customer service, and handles payments efficiently. The rising demand for seamless, user-friendly platforms presents a clear opportunity for software providers to cater to evolving consumer expectations.

For instance, In February 2025, Expedia reported double-digit growth in travel bookings during the previous year’s fourth quarter, reflecting the rising consumer shift toward online travel platforms. This trend is driving demand for advanced OTA software to streamline bookings, enhance customer service, and handle complex transactions efficiently.

Restraint

Security Concerns

As OTAs handle an increasing volume of sensitive customer data, including personal details and payment information, the risk of cyberattacks becomes a critical concern. Ensuring robust cybersecurity measures within OTA software plays an important role in maintaining customer trust and regulatory compliance.

However, the cost of implementing advanced security features can be prohibitive, especially for smaller OTAs, presenting a significant barrier to entry and expansion in the competitive travel market where data protection is paramount. This challenge places financial strain on businesses and acts as a restraint, limiting the affordability and scalability of secure OTA software solutions.

For instance, in January 2024, an Australian travel agency faced a significant security breach after inadvertently leaving its database publicly accessible, exposing sensitive customer data. This incident underscores the growing concerns around cybersecurity within the OTA sector, as travel agencies handle vast amounts of personal and payment information.

Opportunities

Integration with Other Travel Services

OTAs gain a significant advantage by expanding their offerings beyond just booking flights and hotels. These may involve renting out cars, organizing tours, or offering travel insurance as well. This one-stop solution simplifies the task of planning trips without any complications.

OTAs can leverage the potential of tools that combine various travel services to reach a greater number of customers by catering to the diverse needs of today’s travelers and creating more personalized experiences.

For instance, in April 2025, ZentrumHub partnered with FlyAkeed to enhance the travel booking experience in the Middle East, marking a significant move towards integrating multiple travel services. This collaboration is designed to provide a seamless, one-stop shop platform for users to book flights, accommodations, car rentals, and other travel services.

Challenges

Market Fragmentation

The market is highly fragmented, with numerous solutions catering to different types of travel businesses. Small and medium-sized OTAs often struggle to find affordable, customizable software that meets their specific needs, while larger OTAs demand more sophisticated, scalable platforms.

This market fragmentation presents a challenge for software providers, as they must develop flexible solutions that address the various requirements of both small-scale and large-scale OTAs, requiring significant investment in product differentiation and innovation.

For instance, In September 2024, EaseMyTrip introduced ScanMyTrip, a travel platform integrated with ONDC, marking a first in the OTA sector. The launch reflects ongoing market fragmentation, with diverse solutions emerging to address varying customer needs. By leveraging such platforms, small and medium-sized OTAs gain wider digital reach, enhancing their ability to compete with larger market players.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Online Travel Agencies Software Market, leading vendors such as Lemax, Technoheaven, Rezdy, and Traveltek are advancing their platforms with automation, real-time inventory control, and multi-channel distribution. These solutions aim to streamline operations, improve customer experiences, and integrate seamlessly with global suppliers.

Mid-sized providers including PHPTRAVELS, Dolphin Dynamics, Toogonet, Travel Connection Technology, and Tenet Enterprises Solutions focus on cost-effective, customizable systems for small and medium-sized operators. Their platforms feature multilingual support, integrated payment gateways, and modular designs that serve niche segments like activity providers and destination management companies.

Emerging companies such as teenyoffice, Trawex Technologies, WebBookingExpert, TravelCarma, SutiSoft, Tramada, Axis Softech, eTravos, and Sabre are driving innovation with mobile-ready platforms and AI-powered booking tools. These solutions integrate analytics for dynamic pricing, upselling, and targeted marketing.

Top Key Players in the Market

- Lemax

- Technoheaven

- Rezdy

- Traveltek

- PHPTRAVELS

- Dolphin Dynamics

- Toogonet

- Travel Connection Technology

- Tenet Enterprises Solutions

- teenyoffice

- Trawex Technologies

- WebBookingExpert

- TravelCarma

- SutiSoft

- Inc Tramada

- Axis Softech Pvt Ltd

- eTravos

- Sabre

- Others

Recent Developments

- In May 2024, Travelsoft solidified its position as a global leader in travel technology with three strategic acquisitions. This expansion allows Travelsoft to broaden its technological capabilities and enhance its service offerings across the travel industry.

- In October 2023, Rezdy, an Australian online booking platform, was acquired by a US-based private equity firm for $120 million. This acquisition marks a significant development in the OTA software space, highlighting the growing value of booking systems in the travel and tourism industry.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type of Software (Booking Engine Software, Customer Relationship Management (CRM) Software, Payment Gateway Solutions, Tour Operator Software, Others), By Deployment Type (Cloud-based, On-premises), By Pricing Model (Subscription-based Pricing, Transaction-based Pricing), By Application (Airline Booking, Hotel Booking, Car Rental Booking, Tour & Activities Booking, Vacation Packages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Lemax, Technoheaven, Rezdy, Traveltek, PHPTRAVELS, Dolphin Dynamics, Toogonet, Travel Connection Technology, Tenet Enterprises Solutions, teenyoffice, Trawex Technologies, WebBookingExpert, TravelCarma, SutiSoft, Inc. Tramada, Axis Softech Pvt Ltd, eTravos, Sabre, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Online Travel Agencies Software MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Online Travel Agencies Software MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Lemax

- Technoheaven

- Rezdy

- Traveltek

- PHPTRAVELS

- Dolphin Dynamics

- Toogonet

- Travel Connection Technology

- Tenet Enterprises Solutions

- teenyoffice

- Trawex Technologies

- WebBookingExpert

- TravelCarma

- SutiSoft

- Inc Tramada

- Axis Softech Pvt Ltd

- eTravos

- Sabre

- Others