Global Online Insurance Market Size, Share Analysis Report By Insurance Type (Life Insurance, Health Insurance, Motor Insurance, Property/Home Insurance, Others), By Policy Provider (Insurance Carriers, Aggregators/Marketplaces, InsurTech Companies), By End-User (Individuals, SMEs, Large Enterprises, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151227

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

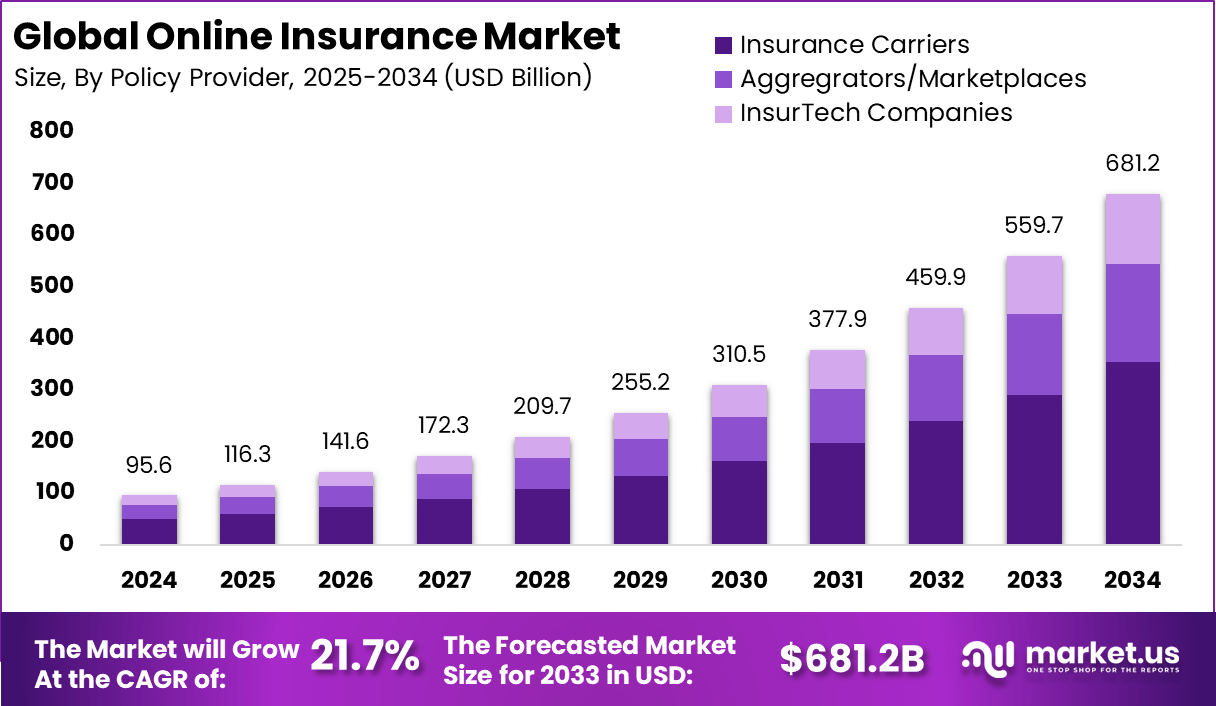

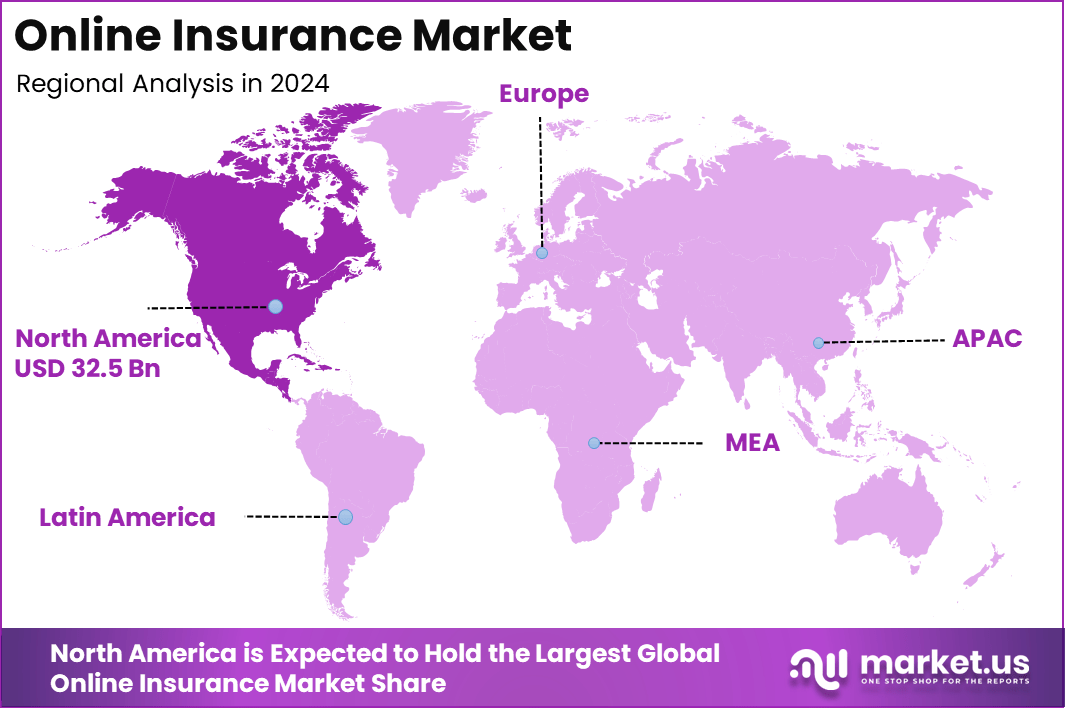

The Global Online Insurance Market size is expected to be worth around USD 681.2 Billion By 2034, from USD 95.6 billion in 2024, growing at a CAGR of 21.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34% share, holding USD 32.50 Billion revenue.

The online insurance market is evolving into a dynamic ecosystem that reshapes how individuals and businesses purchase, manage, and claim policies. Digital transformation is steadily replacing traditional agent-mediated models, offering consumers convenient, on-demand access through mobile apps and web platforms. This trend reflects a broader shift toward user‑centric service delivery, with insurers embracing automation, personalization, and seamless digital experiences.

The primary driving force behind this evolution is the rapid increase in internet and smartphone penetration. As online users become accustomed to digital convenience, insurers are responding with streamlined onboarding, automated underwriting, and instant quotes. Additionally, consumer expectations for customized coverage and transparent pricing have prompted insurers to invest in advanced analytics and AI, strengthening value propositions for online offerings.

Technological innovation is a catalyst for market growth. AI and ML support risk‑based pricing, fraud detection, and personalized product recommendations. IoT devices – such as telematics in vehicles and wearables – enable usage‑based insurance models, while blockchain enhances data transparency and security. Cloud and API‑based systems underpin flexible, scalable digital platforms that support ecosystem integration.

As per the latest insights from Invoca, while 74% of consumers research insurance online, only 25% complete their purchase digitally, highlighting that most users initiate their journey online but finalize decisions through phone calls or in-person interactions. This behavior underscores the complex and personal nature of insurance buying.

Moreover, 78% of customers prefer personalized marketing, making tailored messages essential for conversion. Additionally, 69% of insurance consumers perform a search before booking an appointment, and more than half of these searches occur on mobile devices. Mobile queries like “insurance near me” have more than doubled in recent years.

Notably, the average conversion rate for insurance-related search ads is 5.10%, while display ads see a lower rate of 1.19%. The U.S. insurance sector is expected to invest over $15 billion in digital advertising in 2024, reflecting the growing emphasis on digital engagement strategies.

Businesses stand to gain numerous benefits. Online insurance platforms enable faster time to offer, reduced operating costs, and richer data-driven insights. Enhanced customer experiences – such as paperless policies and instant claim notifications – translate into higher retention and improved brand loyalty. Meanwhile, usage‑based models support better risk management and resilient portfolios

Key Takeaways

- The Global Online Insurance Market is projected to rise significantly from USD 95.6 billion in 2024 to approximately USD 681.2 billion by 2034, registering a strong CAGR of 21.7% during the forecast period.

- In 2024, North America emerged as the leading region, capturing over 34% of the total market, with revenue reaching USD 32.50 billion.

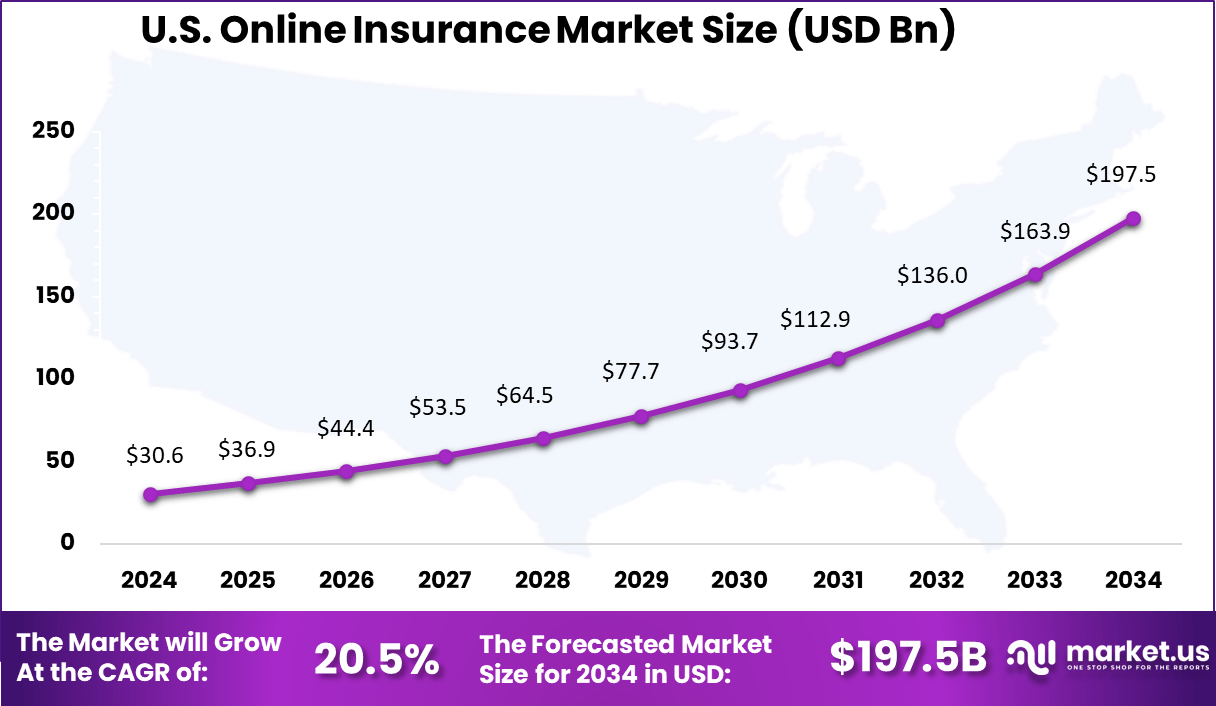

- The United States contributed a major portion, generating USD 30.6 billion and is expected to grow at a steady CAGR of 20.5%, driven by digital-first policy management and consumer preference for online platforms.

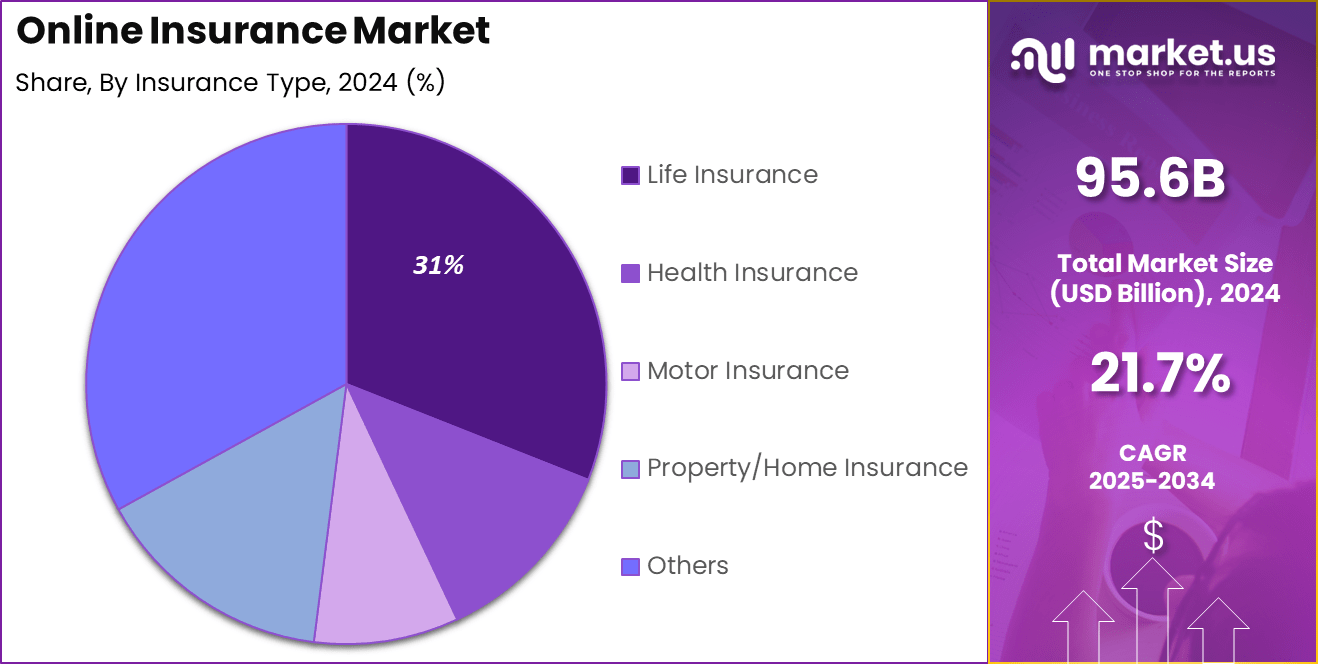

- By insurance type, Life Insurance accounted for the largest share at 31%, supported by increasing demand for digitally managed long-term coverage solutions.

- In terms of policy distribution, Insurance Carriers (Direct) dominated the landscape with a 52% share, reflecting a shift toward self-service platforms and reduced intermediary reliance.

- Among end-users, Individuals formed the largest segment, contributing 64% of the market, as personalized, mobile-accessible policies and instant quotes drove user adoption.

Analysts’ Viewpoint

Investment opportunities in the space are multifaceted. Venture capital is flowing into AI‑powered insurtechs, especially those enabling underwriting automation or instant claims. Geographic expansion, especially across Asia‑Pacific, the Middle East, and Africa, is promising. Collaboration with fintech platforms and embedded insurance models also offers scope for sustained growth.

The regulatory environment is progressively accommodating digital insurance models. In markets like India and Dubai, supportive frameworks for insurtech and digital aggregation are fostering experimentation and market entry. Globally, regulators are promoting online insurance distribution while mandating security, consumer protection, and privacy compliance.

Top factors impacting market growth include legacy system integration, data privacy concerns, cybersecurity risks, and the requirement for digital literacy. Small insurers and underserved segments may face challenges in investing in digital infrastructure or analytics capabilities. However, advances in low-code platforms and plug-and-play AI services are lowering barriers, while partnerships between traditional and digital incumbents are helping navigate complexity.

US Market Dominance

The US Online Insurance Market is valued at USD 30.6 Billion in 2024 and is predicted to increase from USD 77.7 Billion in 2029 to approximately USD 197.5 Billion by 2034, projected at a CAGR of 20.5% from 2025 to 2034.

The United States has emerged as the leading market in online insurance due to its strong digital infrastructure, widespread smartphone adoption, and highly developed financial ecosystem. A major contributing factor is the high internet penetration rate, which enables easy access to digital platforms and mobile apps for policy purchase, renewal, and claim management.

Additionally, U.S. consumers are generally more inclined toward digital-first experiences, especially among younger demographics who prefer self-service models and personalized insurance recommendations powered by AI. The country’s regulatory flexibility has also encouraged the rise of insurtech startups, creating competitive pressure that drives innovation and affordability.

In 2024, North America held a dominant market position, capturing more than a 34% share, with revenue reaching approximately USD 32.5 Billion in the online insurance market. This regional leadership is strongly supported by the widespread digital maturity across the insurance sector in the United States and Canada.

A high penetration of smartphones, faster internet connectivity, and increased consumer preference for convenience-driven digital solutions have significantly accelerated the adoption of online platforms for insurance purchase, renewals, and claims management.

By Insurance Type Analysis

In 2024, the Life Insurance segment held a dominant market position, capturing more than a 31% share of the online insurance market. This leadership can be attributed primarily to the increasing consumer focus on long-term financial security and wealth protection.

Life insurance has become a foundational element of personal financial planning, especially in markets where economic uncertainty, inflation concerns, and aging populations are influencing household savings behavior. With growing awareness around income protection and family security, many individuals are choosing online platforms to compare, purchase, and manage life policies – benefiting from transparent pricing and simplified digital experiences.

The segment’s dominance was further reinforced by the rising availability of customizable life products through digital channels. Insurance providers have adopted AI-based underwriting and automated claim services, which reduced processing times and improved customer trust.

The ease of accessing term, whole, and unit-linked life insurance online has attracted both younger working professionals and middle-aged consumers planning for retirement. Additionally, supportive government initiatives and tax-saving incentives in several countries have strengthened the segment’s appeal, helping life insurance remain the leading contributor within the online insurance ecosystem.

By Policy Provider Analysis

In 2024, the Insurance Carriers (Direct) segment held a dominant market position, capturing more than a 52% share of the online insurance market. This leadership was primarily driven by their long-standing market trust, extensive product portfolios, and strong digital infrastructure.

Direct carriers have successfully transitioned to online models by investing in AI-powered underwriting, real-time claim processing, and user-friendly policy management platforms. Their ability to offer comprehensive insurance solutions without intermediary involvement has improved cost efficiency and built greater consumer confidence, especially in highly regulated markets.

Moreover, these carriers benefited from deep customer data pools, allowing them to personalize offerings and optimize risk assessment more effectively than aggregators or InsurTech firms. Their presence across both life and non-life insurance lines gave them scale advantages and allowed cross-selling opportunities, which further strengthened their online dominance.

With rising consumer preference for direct digital engagement, insurance carriers have reinforced their leadership through continuous platform innovation, seamless onboarding processes, and competitive pricing tailored for online users.

By End-User Analysis

In 2024, Individuals segment held a dominant market position, capturing more than a 64% share of the global online insurance market. This dominance can be attributed to several key factors: first, the widespread adoption of smartphones and internet access enabled individuals to conveniently compare policies, purchase coverage, and manage their insurance needs from their homes.

Second, the shift in consumer preference toward digital-first solutions, especially post‑pandemic, reinforced this trend by driving a move away from traditional agents toward online channels. Finally, insurers have prioritized the development of AI‑powered tools, mobile applications, and personalized offerings, making online platforms more attractive to individual policyholders.

The Individuals segment leads because it meets several inherent motivations unique to private consumers. Convenience and transparency are at its core; individuals can instantly access quotes, compare options, and secure coverage – often at lower premiums – without face‑to‑face interaction.

This online-first model aligns with modern consumer expectations, reinforcing trust through streamlined service and faster claims processing. Additionally, rising general awareness of health, auto, and travel insurance – coupled with digital literacy – has encouraged individuals to adopt online purchasing, further amplifying market share.

Key Market Segments

By Insurance Type

- Life Insurance

- Health Insurance

- Motor Insurance

- Property/Home Insurance

- Others

By Policy Provider

- Insurance Carriers

- Aggregrators/Marketplaces

- InsurTech Companies

By End-User

- Individuals

- SMEs

- Large Enterprises

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Embedded Insurance in Digital Platforms

Online insurance is increasingly being embedded directly into digital ecosystems, including ride-hailing apps, online retailers, travel booking portals, and fintech platforms. This embedded approach allows insurance to become a seamless part of the customer journey, enabling users to purchase coverage in real time as part of a transaction.

For instance, travel insurance can now be bundled at checkout when booking a flight, or device insurance added when purchasing electronics online. This trend reflects a shift from stand-alone insurance selling to a more integrated, context-aware model. The main advantage of embedded insurance lies in its convenience and personalization.

This not only improves uptake but also reduces the friction traditionally associated with policy research and paperwork. Digital-native customers, especially younger demographics, are showing greater receptiveness to these frictionless experiences, making embedded insurance a strategic tool for customer acquisition and retention.

Driver

Convenience and Digital Access

The online insurance model has gained momentum primarily because of its ease of use and accessibility. Customers are increasingly turning to mobile apps and websites to compare policies, generate quotes, and complete purchases within minutes.

Many platforms now offer simplified forms, automated underwriting, AI-powered chatbots for support, and digital documentation – removing the complexities that once discouraged policy buyers. This ease of access is particularly significant in regions with high internet and smartphone penetration, where younger consumers prefer digital-first experiences.

Furthermore, the 24/7 availability of online insurance platforms empowers consumers to explore and purchase products on their own terms. Unlike traditional agents, who may operate within fixed business hours, digital platforms remain constantly active and responsive. This on-demand accessibility not only enhances the customer experience but also shortens the sales cycle and reduces operational costs for insurers.

Restraint

Cybersecurity and Fraud Concerns

As the insurance sector adopts digital tools, cybersecurity and fraud risks have become pressing concerns. Online platforms that handle sensitive data – such as personal identification, financial details, and medical records – are increasingly targeted by cybercriminals.

Data breaches not only compromise user privacy but also expose insurers to reputational damage and regulatory penalties. The growth in digital claims submissions and automated verification also introduces new vulnerabilities that are harder to detect using traditional fraud-prevention methods. In addition, the speed of digital transactions can sometimes outpace risk controls.

Fraudsters may exploit system loopholes to submit false claims or manipulate identity credentials during digital onboarding. As insurers expand into fully online channels, they must balance user convenience with robust cybersecurity frameworks.

Opportunity

Extending Coverage to Underserved Regions

Online insurance offers a transformative opportunity to bring financial protection to previously underserved and uninsured populations. In many developing regions, traditional insurance infrastructure is limited, and agent networks may not penetrate rural or low-income areas.

However, the growing availability of smartphones and mobile internet allows digital platforms to bypass these physical barriers. Additionally, the rise of micro-entrepreneurs and digital insurance aggregators has helped in distributing low-ticket, high-impact products – such as health, accident, and crop insurance – at affordable premiums.

Challenge

Legacy Systems and Interoperability

A significant challenge in online insurance adoption is the reliance on legacy IT systems by many insurers. These older systems, often built decades ago, lack compatibility with modern APIs, cloud services, and real-time data architectures.

This makes it difficult to deliver a smooth digital experience across underwriting, claims, and customer service processes. Integrating new technologies with outdated backend systems requires substantial investment and often leads to delays in digital transformation initiatives.

Beyond technical issues, interoperability between platforms also poses problems. With multiple systems involved – from payment gateways to policy management tools – ensuring seamless data exchange and functionality is complex.

In the absence of standardized protocols, insurers face hurdles in launching scalable and flexible digital insurance products. Until these infrastructure gaps are addressed, many insurers will continue to struggle with agility and efficiency in a rapidly evolving online ecosystem.

Key Player Analysis

The online insurance sector is now driven by a balanced mix of established global insurers and nimble insurtech innovators. In 2025, Allianz deepened its presence in Southeast Asia by acquiring a controlling stake in a regional insurer based in Singapore. This move is seen as part of a broader effort to enhance its digital service capability and build scalable online insurance models in emerging economies.

Ping An emphasized technology upgrades across its online platforms. It expanded its AI-driven underwriting and claim systems, aiming to create a frictionless experience for policyholders. These upgrades are designed to streamline operations, reduce manual intervention, and support scalable risk management in the growing digital environment.

Prudential took a product-centric approach in 2025, focusing on expanding its online direct-to-consumer portfolio. The company enhanced its digital wellness and protection solutions, incorporating predictive analytics to tailor coverage. Instead of pursuing external acquisitions, Prudential is strengthening internal digital infrastructure to meet customer demand more efficiently.

Top Key Players Covered

- Allianz SE

- AXA Group

- Ping An Insurance

- Prudential plc

- Zurich Insurance Group

- Lemonade Inc.

- Root Insurance

- Bajaj Allianz General Insurance

- Next Insurance

- Turtlemint

- Bima

- Digit Insurance

- Others

Recent Developments

- In March 2025, Allianz SE entered into binding agreements to sell its 26 % stake in both Bajaj Allianz General Insurance and Bajaj Allianz Life Insurance to the Bajaj Group (via Bajaj Finserv, Bajaj Holdings & Investments, and Jamnalal Sons). The total consideration was approximately €2.6 billion (₹24,180 crore).

- In March 2025, The company launched Lemonade Car in Colorado, covering approximately 40 % of the U.S. auto-insurance market, and surpassed $1 billion in in-force premiums. Concurrently, management guided toward $1.2 billion IFP by year-end.

Report Scope

Report Features Description Market Value (2024) USD 95.6 Bn Forecast Revenue (2034) USD 681.2 Bn CAGR (2025-2034) 21.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Insurance Type (Life Insurance, Health Insurance, Motor Insurance, Property/Home Insurance, Others), By Policy Provider (Insurance Carriers, Aggregators/Marketplaces, InsurTech Companies), By End-User (Individuals, SMEs, Large Enterprises, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz SE, AXA Group, Ping An Insurance, Prudential plc, Zurich Insurance Group, Lemonade Inc., Root Insurance, Bajaj Allianz General Insurance, Next Insurance, Turtlemint, Bima, Digit Insurance, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Allianz SE

- AXA Group

- Ping An Insurance

- Prudential plc

- Zurich Insurance Group

- Lemonade Inc.

- Root Insurance

- Bajaj Allianz General Insurance

- Next Insurance

- Turtlemint

- Bima

- Digit Insurance

- Others