Global Online Gaming Subscription Services Market Size, Share Analysis Report By Device Type (Smartphone, Computer/Laptop, Console, Others), By Gaming Genre (Action, Adventure, Shooting, Fighting, Role-Playing, Sports, Racing, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151088

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

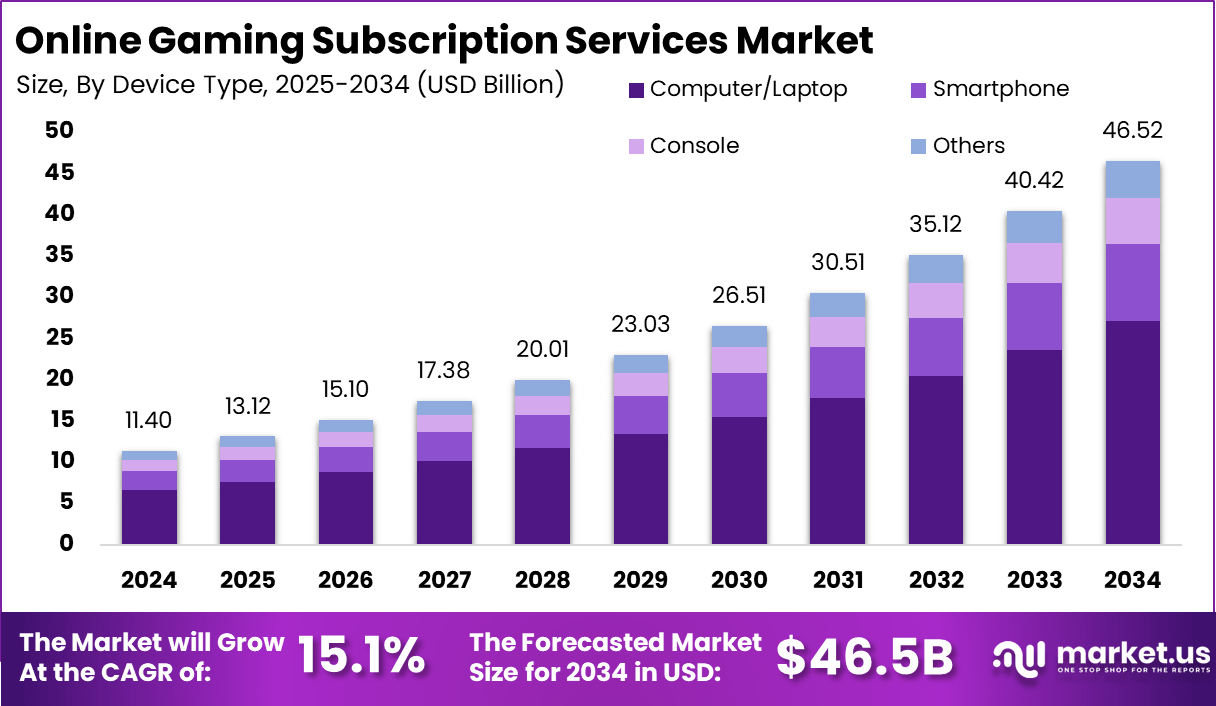

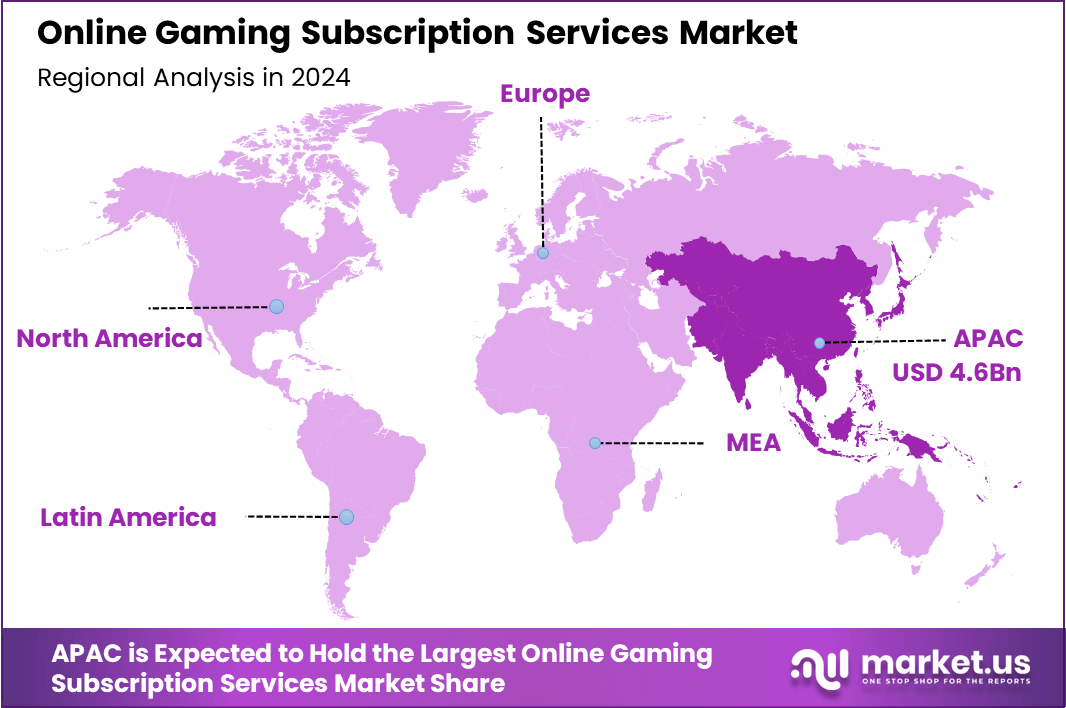

The Global Online Gaming Subscription Services Market size is expected to be worth around USD 46.52 Billion By 2034, from USD 11.4 billion in 2024, growing at a CAGR of 15.1% during the forecast period from 2025 to 2034. In 2024, APAC held a dominant market position, capturing more than a 41.2% share, holding USD 4.6 Billion revenue.

The online gaming subscription services market comprises digital offerings that grant users access to libraries of games via recurring fees. It includes cloud gaming, game‑as‑a‑service platforms, and downloadable subscription packages accessible across devices such as mobile, PC, console, and smart TVs. These services emphasize convenience, continuous updates, and integrated social experiences.

Top Driving Factors include widespread access to high-speed internet and 5G connectivity, which have expanded the reach of cloud-based and mobile gaming. The proliferation of smartphones with advanced processing capabilities has facilitated broader participation. Additionally, the shift toward social and community-focused gaming features – such as in-game chat, collaborative play, and regular live events – has strengthened subscriber loyalty.

For instance, As of March 2023, PlayStation Plus led the global gaming subscription market with over ~47.5 million subscribers. Its success was driven by a strong PlayStation ecosystem, access to free monthly games, and exclusive online multiplayer features. In second place, Nintendo Switch Online recorded 36 million global subscribers, supported by its affordable pricing, access to classic games, and family-focused content.

Investment Opportunities in this market are appealing due to its steady revenue streams and scaling potential. Service providers are extending their offers with exclusive first-party titles, tiered subscription models, and bundled perks – Microsoft’s recent Game Pass strategy exemplifies how major content investment can drive subscription growth from 34 million toward a 110 million‑subscriber target by 2030.

Key Takeaways

- The Global Online Gaming Subscription Services Market is projected to grow from USD 11.4 Billion in 2024 to around USD 46.52 Billion by 2034, registering a CAGR of 15.1% during 2025-2034.

- In 2024, the Asia-Pacific (APAC) region dominated the market with over 41.2% share, generating USD 4.6 Billion in revenue, led by mobile-first economies and rising digital consumption.

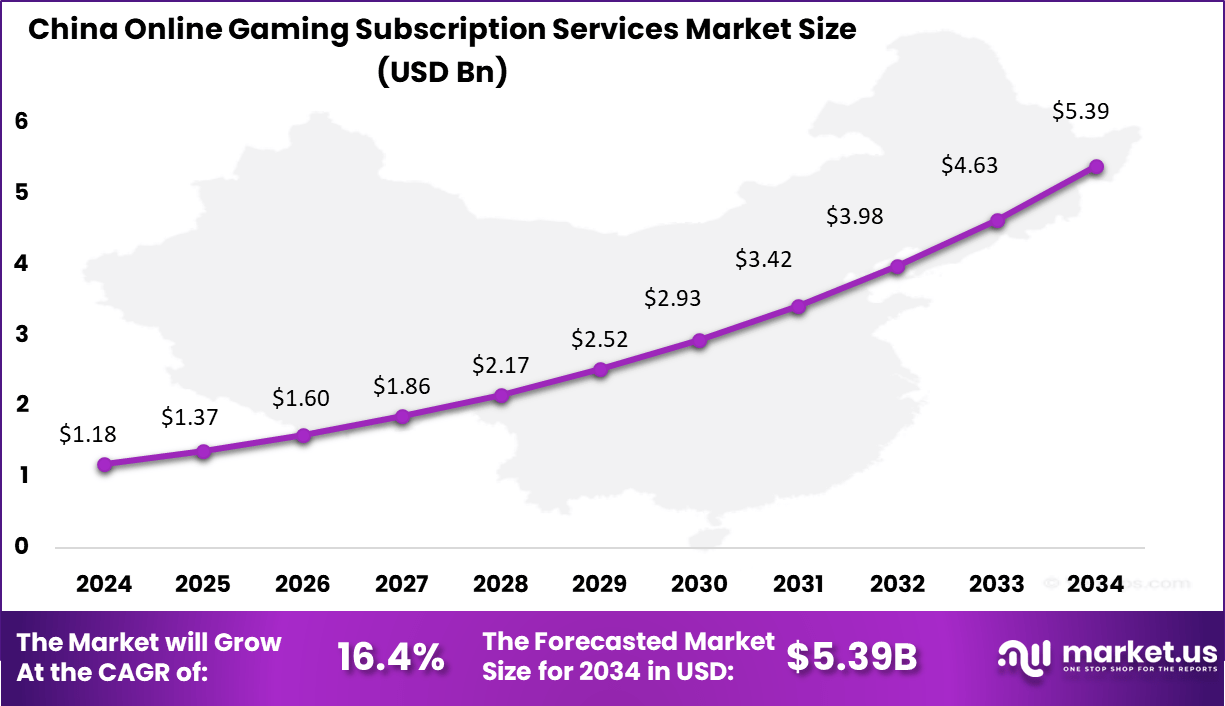

- China alone contributed USD 1.88 Billion in 2024 and is anticipated to expand at a CAGR of 16.4%, supported by rapid broadband penetration and a strong local gaming ecosystem.

- By device type, the Computer/Laptop segment led the market with 58.4% share, driven by high-performance gaming needs and subscription-based PC gaming platforms.

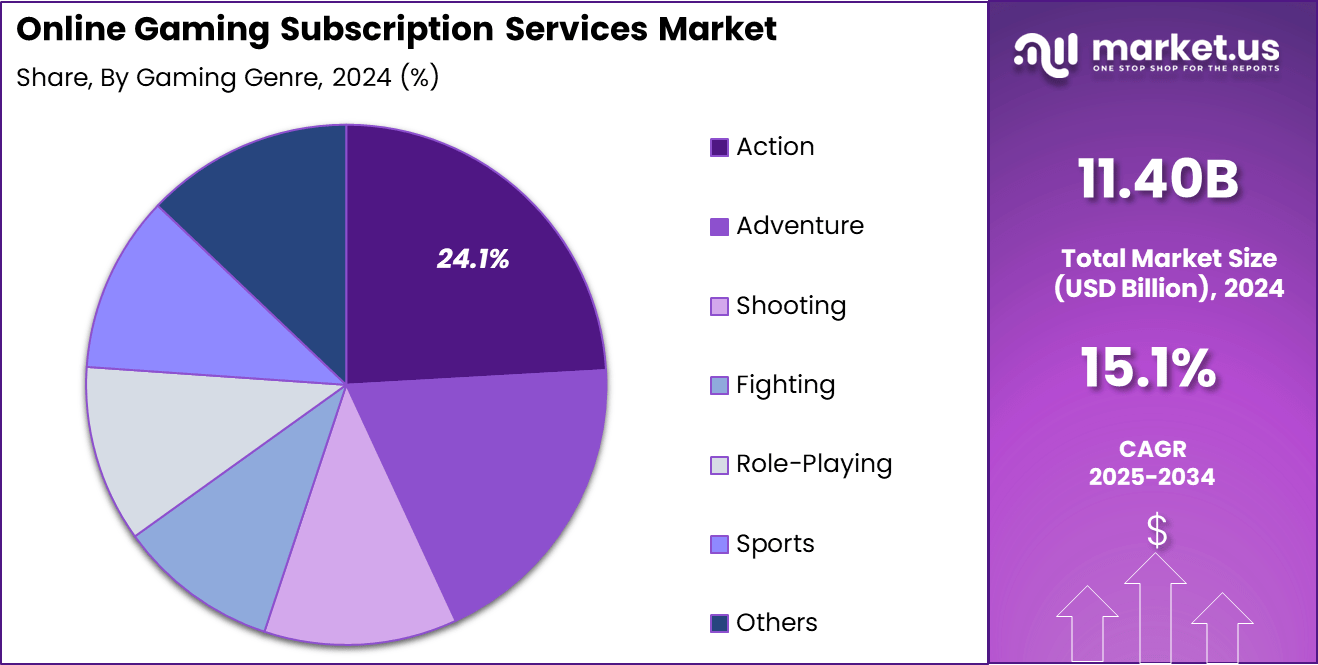

- Among gaming genres, Action games dominated with a 24.1% share, as demand surged for immersive, multiplayer, and competitive gaming experiences.

US Market Expansion

The US Online Gaming Subscription Services Market is valued at USD 1.18 Billion in 2024 and is predicted to increase from USD 2.52 Billion in 2029 to approximately USD 5.39 Billion by 2034, projected at a CAGR of 16.4% from 2025 to 2034.

In 2024, APAC held a dominant market position, capturing more than a 41.2% share, holding USD 4.6 Billion revenue in the Online Gaming Subscription Services Market. This regional dominance can be attributed to the massive surge in mobile gaming users across countries like China, India, Japan, and South Korea.

Affordable internet, growing smartphone penetration, and the rise of local-language game content have significantly enhanced subscriber engagement. Additionally, the increasing popularity of cloud-based gaming platforms and multi-device support has made subscriptions more accessible to a broader audience, especially among the youth demographic.

Moreover, government initiatives promoting digital economies in emerging Asian markets have further accelerated online gaming infrastructure. Regional players are introducing flexible pricing models and localized content strategies to retain users, which has enhanced market competitiveness. Collaborations between gaming companies and telecom providers to bundle game subscriptions with data packages are also creating new revenue streams.

By Device Type Analysis

In 2024, the Computer/Laptop segment held a dominant market position, capturing more than a 58.4% share in the Online Gaming Subscription Services Market. This leadership is primarily driven by the strong preference for high-performance gaming experiences that require advanced hardware and graphics capabilities.

PC and laptop platforms offer superior processing power, larger storage capacity, and customizability, which are critical for demanding multiplayer and open-world games. The segment also benefits from a broad selection of subscription-based platforms offering exclusive titles, premium access to downloadable content, and early release options, all of which attract dedicated gamers.

Additionally, gaming on computers and laptops provides seamless integration with peripherals such as gaming keyboards, high-resolution monitors, and VR headsets, enhancing the overall user experience. The rise of e-sports and competitive gaming communities has further reinforced this segment’s dominance, as professional and serious gamers continue to prefer PCs for their precision and control capabilities.

Segmental Summary – Online Gaming Subscription by Device Type (2024)

Device Type Key Drivers Computer/Laptop Leading with ~58.4% share; driven by high-performance hardware, extensive game libraries, and ecosystem integration Console Strong presence via subscription models like Xbox Game Pass and PlayStation Plus, supported by exclusive titles Smartphone Fastest-growing segment; fueled by mobile-centric services like Apple Arcade and Google Play Pass Others Emerging use cases in cloud-enabled TVs and VR headsets, supported by platforms like Amazon Luna and GeForce Now By Gaming Genre Analysis

In 2024, the Action segment held a dominant market position, capturing more than a 24.1% share in the Online Gaming Subscription Services Market. This segment’s leadership is largely driven by its universal appeal and engaging gameplay that attracts players across all age groups and regions.

Action games offer fast-paced mechanics, competitive multiplayer modes, and immersive graphics, which make them ideal for subscription-based platforms aiming to keep users actively engaged. The genre also benefits from high replay value and frequent content updates, including new missions, characters, and in-game events, encouraging long-term subscriptions.

Segmental Summary – Online Gaming Subscription By Gaming Genre Analysis

Genre Key Drivers Action Leading with ~24.1% share; driven by immersive visuals, fast-paced gameplay, and frequent updates Adventure Growing popularity due to narrative-rich open-world titles; high projected CAGR Shooting Strong presence under action umbrella; significant in FPS and battle royale e-sports Role-Playing High engagement with subscribers via expansive, story-heavy content Sports Consistent demand; boosted by annual releases of popular franchises Racing Niche but dedicated audience; benefits from driving simulations in subscriptions Fighting Stable use-case from competitive gamers; esports and replayability drive retention Others Includes puzzle, simulation, and casual genres for diversified platforms Moreover, action titles are often at the forefront of gaming innovation, adopting advanced technologies like real-time ray tracing, AI-driven enemies, and cross-platform multiplayer integration. These features enhance user immersion and drive longer play sessions, making the genre particularly valuable for subscription services that rely on high user retention.

Key Market Segments

By Device Type

- Smartphone

- Computer/Laptop

- Console

- Others

By Gaming Genre

- Action

- Adventure

- Shooting

- Fighting

- Role-Playing

- Sports

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Rise of All‑You‑Can‑Play Libraries

An emerging trend in the gaming world is the shift towards subscription models that offer broad, access‑all pricing instead of single‑game purchases. Gamers are now choosing platforms where a monthly fee grants access to large libraries of console, PC, cloud, and mobile titles. This model helps reduce upfront cost and encourages exploration across genres.

The trend is reinforced by the growing role of cloud gaming, which allows users to stream high‑quality games to devices like phones and TVs. This reduces the need for powerful hardware and makes subscription packages more appealing to casual players looking for convenience over ownership.

Driver

Youth Engagement & Social Media Influence

A major driving force behind subscription services is the large base of young gamers who prefer value and social connection. Many players discover new titles via influencers and streamers, who often promote subscription platforms as cost‑effective ways to access gaming content. Live streams and online communities are shaping preferences and boosting subscriptions.

This demographic’s comfort with digital subscriptions extends beyond games to music and video services. The familiarity with recurring‑fee models makes it easier for gaming platforms to promote bundles and tiered offerings. Younger audiences are also more receptive to trying multiple titles, enhancing platform stickiness.

Restraint

Device Compatibility and User Friction

Subscription platforms sometimes struggle with technical compatibility across devices. A game available on PC may not work on certain mobile phones or require hardware updates, frustrating users and lowering perceived value.

Additionally, friction in account setup, downloading, and updates can hinder new users. If the experience isn’t smooth, even a broad library loses appeal. Ensuring seamless onboarding across devices is a persistent challenge for service providers.

Opportunity

Cloud Gaming Expansion

Cloud gaming represents a clear opportunity for subscription services. Rather than requiring a console or high‑end PC, players can stream games directly to phones, laptops, and TVs. This lowers the entry barrier and broadens the audience, particularly in regions where hardware costs restrict ownership.

By combining cloud streaming with unique perks – such as exclusive content, early access, or integrated social features – platforms can differentiate in a crowded market. The convenience offered by cloud makes it easier to retain subscribers long‑term.

Challenge

Content Saturation and Subscription Fatigue

As multiple platforms emerge, each expanding their libraries, players can experience “subscription fatigue” where the total cost and overlap diminish perceived value. This creates pressure for services to stand out through exclusive titles or added services.

Technical expectations are also rising. Users expect uninterrupted, low‑latency play – especially on streamed games. Achieving this requires investment in infrastructure, network stability, and responsive interfaces. Failing to meet these expectations can lead to churn and tarnish reputation.

Key Player Analysis

Microsoft remains a defining force in the online gaming subscription landscape through its widely adopted Xbox Game Pass. The company has strategically focused on expanding first-party content availability by integrating high-profile titles such as Call of Duty: Black Ops 6 directly into its subscription ecosystem. Following its acquisition of Activision Blizzard, Microsoft has solidified its competitive edge by offering new releases on Game Pass from day one.

Sony continues to enhance the PlayStation Plus service by tiering its subscription model into Essential, Extra, and Premium offerings, allowing flexible content access for users with varying preferences. Through integration of a vast library of PS4 and PS5 titles and legacy content from earlier generations, Sony has built a nostalgic and forward-looking catalogue.

Apple Arcade has steadily evolved from a curated mobile games service into a platform increasingly embedded across all Apple devices. In 2025, Apple unveiled a dedicated Games app, designed to unify its gaming interface and integrate editorial content, Game Center features, and Arcade subscriptions under one streamlined experience.

Top Key Players Covered

- Amazon Inc.

- Apple Inc.

- Electronic Arts Inc.

- Humble Bundle

- Blacknut

- NVIDIA Corporation

- Microsoft Corporation

- Google LLC

- Ubisoft Entertainment

- Sony Interactive Entertainment Inc.

- Others

Recent Developments

- Spring 2025: Jackbox confirmed plans to launch a cloud‑streaming subscription service on smart TVs via Amazon’s AWS GameLift. After beta testing on select platforms, the service is expected to offer both ad‑supported free content and a full catalog through paid subscription.

- June 2024: LG and Blacknut began offering a single-game subscription service directly on LG smart TVs in the US. This streamlined service model delivers access to individual games rather than full libraries.

Report Scope

Report Features Description Market Value (2024) USD 11.4 Bn Forecast Revenue (2034) USD 46.52 Bn CAGR (2025-2034) 15.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Device Type (Smartphone, Computer/Laptop, Console, Others), By Gaming Genre (Action, Adventure, Shooting, Fighting, Role-Playing, Sports, Racing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Inc., Apple Inc., Electronic Arts Inc., Humble Bundle, Blacknut, NVIDIA Corporation, Microsoft Corporation, Google LLC, Ubisoft Entertainment, Sony Interactive Entertainment Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Online Gaming Subscription Services MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Online Gaming Subscription Services MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Inc.

- Apple Inc.

- Electronic Arts Inc.

- Humble Bundle

- Blacknut

- NVIDIA Corporation

- Microsoft Corporation

- Google LLC

- Ubisoft Entertainment

- Sony Interactive Entertainment Inc.

- Others