Global One Step RT-qPCR Kits Market By Reaction (400 Rxn, 50 Rxn, 25 Rxn, 200 Rxn, 100 Rxn and Others), By Application (Virus Detection, Single Cell RT-PCR, Multiplexing, Gene Expression Analysis and Others), By Detection (Probe-Based and Dye-Based), By End-User (Diagnostic Laboratories, Reference Laboratories, Hospitals, Academic and Research Institutes and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171268

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

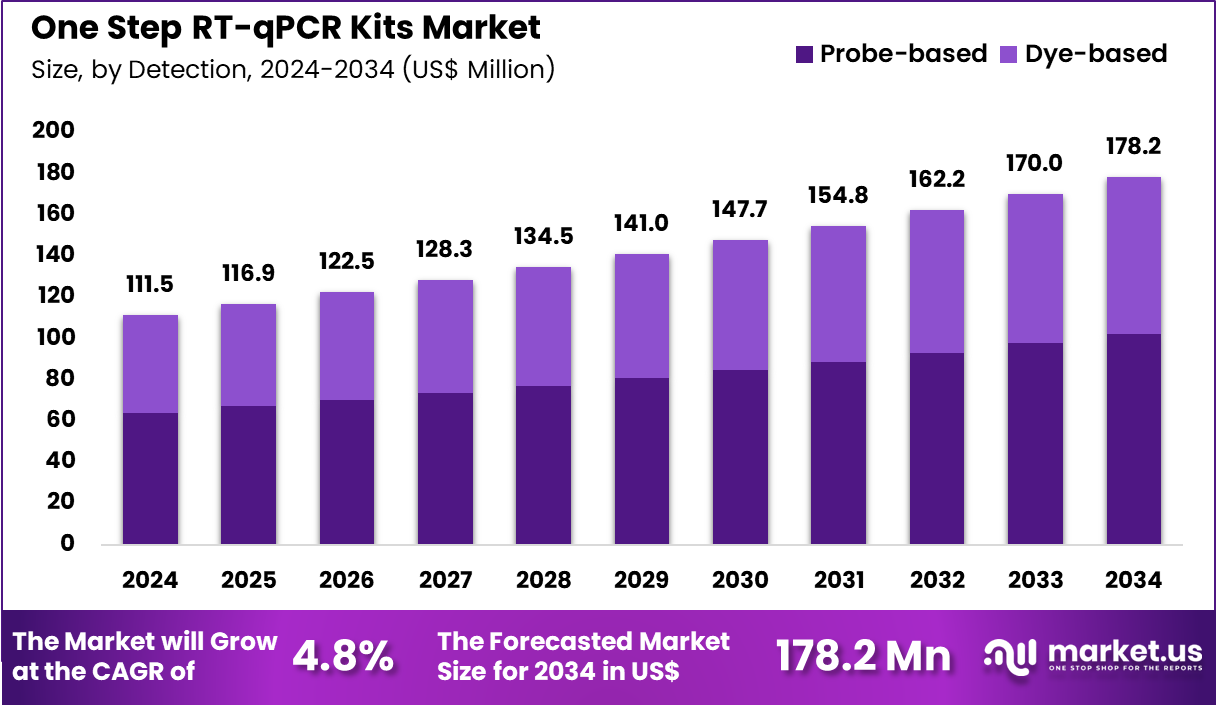

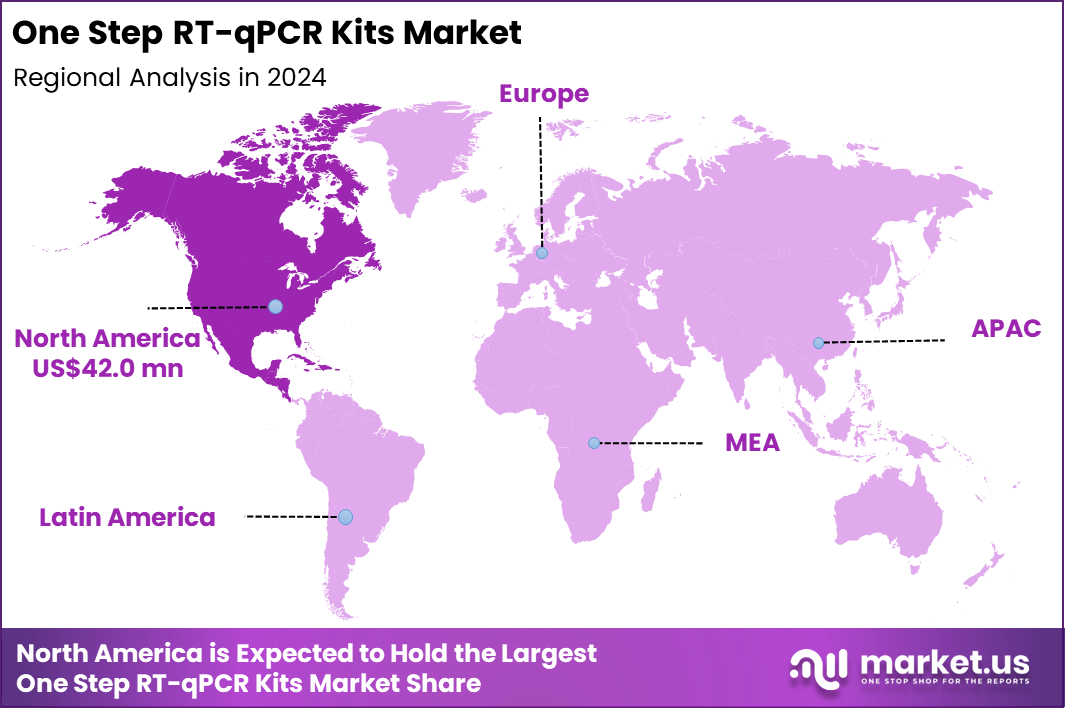

The Global One Step RT-qPCR Kits Market size is expected to be worth around US$ 178.2 Million by 2034 from US$ 111.5 Million in 2024, growing at a CAGR of 4.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.7% share with a revenue of US$ 42.0 Million.

Increasing demand for rapid RNA pathogen detection fuels the One Step RT-qPCR Kits market, as laboratories prioritize streamlined workflows that combine reverse transcription and amplification in a single reaction to accelerate diagnostic turnaround. Manufacturers enhance enzyme formulations that withstand high temperatures, ensuring robust cDNA synthesis and minimal contamination risks.

These kits excel in viral surveillance for emerging RNA viruses like influenza subtypes, enabling real-time outbreak monitoring and containment strategies. Opportunities emerge from integrating kits with portable thermocyclers for field-deployable testing in remote clinical settings. Recent trends highlight the development of lyophilized reagents that extend shelf life and simplify storage, addressing logistical challenges in high-volume testing environments. This evolution positions the market for broader adoption in global health security initiatives.

Growing reliance on gene expression profiling drives the One Step RT-qPCR Kits market, as researchers demand sensitive assays to quantify low-abundance transcripts in complex biological samples. Biotechnology firms innovate with universal primers and master mixes that reduce pipetting errors, optimizing reproducibility across multi-gene panels.

Applications span oncology studies where kits track tumor suppressor gene downregulation during metastasis, facilitating targeted therapy candidate identification. Emerging opportunities include customization for single-cell RNA analysis, unlocking insights into cellular heterogeneity in developmental biology.

Industry leaders now incorporate hot-start polymerases to suppress non-specific amplification, a trend that enhances signal-to-noise ratios in noisy sample matrices. Such advancements sustain the market’s momentum in precision research applications.

Rising integration of multiplex capabilities invigorates the One Step RT-qPCR Kits market, as users seek versatile tools to detect multiple RNA targets simultaneously from limited starting material. Diagnostic developers refine probe designs that enable parallel quantification of host and viral genes, improving diagnostic specificity.

These kits find critical use in vaccine efficacy trials, where they measure immune response transcripts like interferon-beta alongside pathogen loads. Opportunities abound in adapting kits for digital PCR formats, promising absolute quantification without standard curves for rare event detection. Recent innovations feature RNAse-free buffers that preserve fragile transcripts during extraction, a development that bolsters reliability in forensic and environmental RNA analysis. This multifaceted progress cements the market’s role in advancing molecular diagnostics and therapeutic monitoring.

Key Takeaways

- In 2024, the market generated a revenue of US$ 111.5 million, with a CAGR of 4.8%, and is expected to reach US$ 178.2 million by the year 2034.

- The reaction segment is divided into 400 rxn, 50 rxn, 25 rxn, 200 rxn, 100 rxn, and others, with 400 rxn taking the lead in 2024 with a market share of 33.8%.

- Considering application, the market is divided into virus detection, single cell RT-PCR, multiplexing, gene expression analysis, and others. Among these, virus detection held a significant share of 46.2%.

- Furthermore, concerning the detection segment, the market is segregated into probe-based and dye-based. The probe-based sector stands out as the dominant player, holding the largest revenue share of 57.4% in the market.

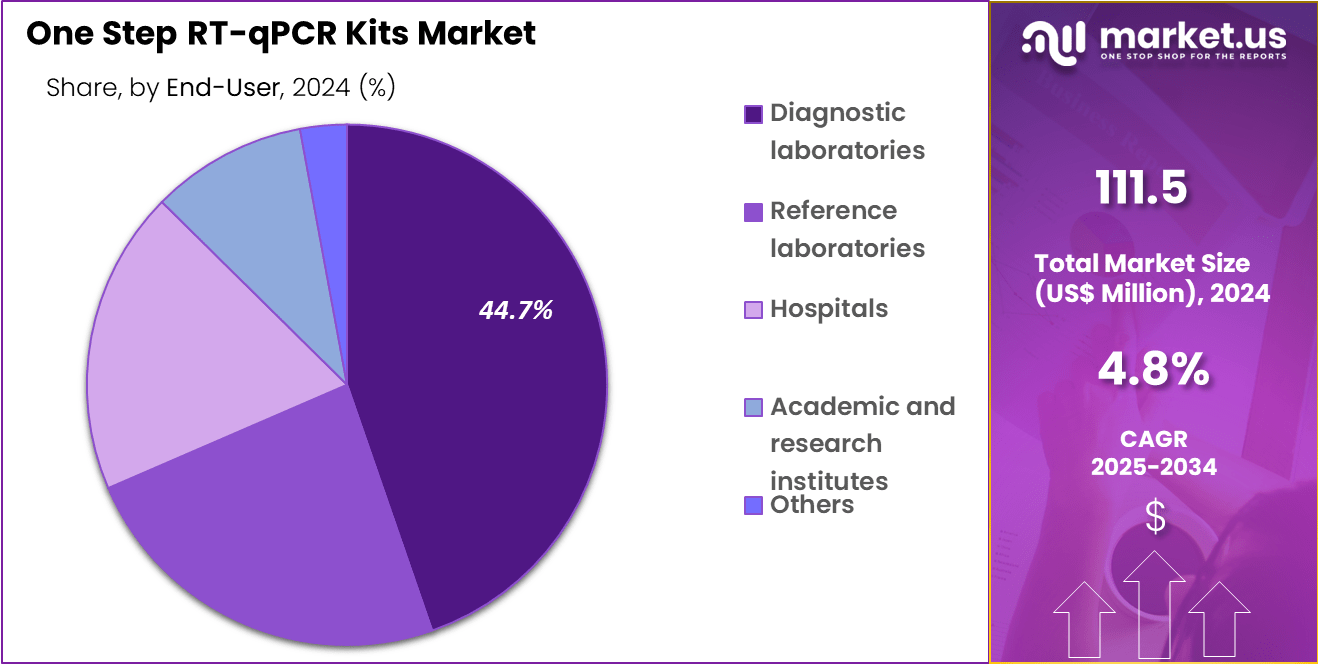

- The end-user segment is segregated into diagnostic laboratories, reference laboratories, hospitals, academic and research institutes, and others, with the diagnostic laboratories segment leading the market, holding a revenue share of 44.7%.

- North America led the market by securing a market share of 37.7% in 2024.

Reaction Analysis

400 rxn, holding 33.8%, is expected to dominate because high-capacity reaction kits support large-scale screening programs and reduce testing cost per sample. Growing infectious disease surveillance and pandemic preparedness strategies increase the need for bulk-reaction solutions. Laboratories performing continuous high-throughput testing prefer 400-reaction formats to maintain operational efficiency and reduce reagent consumption.

Increased automation in molecular workflows strengthens the demand for kits that support frequent batch processing. Contract laboratories and national testing networks rely on larger reaction formats to manage peak sample loads. The segment is anticipated to expand further as governments emphasize scalable testing capacity for emerging viral threats.

Application Analysis

Virus detection, holding 46.2%, is projected to remain the leading application due to the ongoing global focus on rapid pathogen identification. One Step RT-qPCR kits provide both amplification and detection in a single tube, ensuring faster turnaround for clinical decision-making.

Public health monitoring programs continue to depend on molecular assays to control outbreaks of respiratory and zoonotic viruses. Viral genomics research and surveillance of variants strengthen the requirement for accurate nucleic acid detection. Increased travel and population density contribute to the spread of infectious agents, which keeps testing volumes high. These factors maintain virus detection as the dominant application area.

Detection Analysis

Probe-based detection, holding 57.4%, is anticipated to dominate because it offers superior specificity in distinguishing viral targets, even in mixed or low-viral-load samples. Molecular laboratories prefer probe chemistry to minimize false-positive rates and improve diagnostic confidence. Expanding clinical research in oncology and infectious diseases increases the adoption of highly targeted probe assays.

Continuous advancements in fluorescent probe technologies support multiplexing capabilities within a single reaction. As precision and reliability remain priorities, probe-based RT-qPCR is projected to experience sustained demand. The segment remains essential in laboratories requiring regulatory-compliant results.

End-User Analysis

Diagnostic laboratories, holding 44.7%, are expected to remain the dominant end-user segment due to their leading role in routine disease testing and outbreak response. These facilities manage large sample volumes daily, strengthening reliance on rapid molecular workflows. Growing demand for timely diagnostics drives the integration of automated RT-qPCR platforms in reference networks.

Diagnostic labs also serve as primary centers for variant screening and clinical confirmation testing. Increasing investment in molecular infrastructure across global testing networks expands adoption further. These factors keep diagnostic laboratories dominant in the end-user landscape of the RT-qPCR kits market..

Key Market Segments

By Reaction

- 400 Rxn

- 50 Rxn

- 25 Rxn

- 200 Rxn

- 100 Rxn

- Others

By Application

- Virus Detection

- Single Cell RT-PCR

- Multiplexing

- Gene Expression Analysis

- Others

By Detection

- Probe-based

- Dye Based

By End-User

- Diagnostic Laboratories

- Reference Laboratories

- Hospitals

- Academic and Research Institutes

- Others

Drivers

Rising demand for multiplex molecular diagnostics in infectious disease testing is driving the market

The escalating prevalence of emerging infectious diseases has intensified the reliance on one-step RT-qPCR kits for rapid and accurate pathogen detection in clinical and surveillance settings. These kits streamline the reverse transcription and amplification processes into a single reaction, minimizing handling errors and enhancing throughput in high-volume laboratories. Regulatory endorsements from agencies like the U.S. Food and Drug Administration have bolstered confidence in their performance, facilitating widespread adoption across healthcare networks.

Key applications extend beyond acute outbreaks to routine screening for respiratory viruses, including influenza and respiratory syncytial virus. The integration of these kits with automated platforms further amplifies efficiency, reducing turnaround times from hours to under 90 minutes for multiple targets. Public health initiatives, such as those coordinated by the Centers for Disease Control and Prevention, prioritize these technologies for genomic surveillance to track viral evolution.

Consequently, investments in laboratory infrastructure have surged to accommodate the growing test volumes. This demand is particularly pronounced in regions with high population density, where early detection curtails transmission chains. Manufacturers have responded by optimizing reagent formulations for superior sensitivity, achieving detection limits as low as 10 copies per microliter. Overall, this driver underscores the pivotal role of one-step RT-qPCR kits in fortifying global health security architectures.

Restraints

Declining demand for COVID-19-specific assays is restraining the market

The normalization of COVID-19 testing volumes post-pandemic has led to a sharp contraction in sales for one-step RT-qPCR kits tailored exclusively to SARS-CoV-2 detection. Laboratories previously equipped for massive-scale screening are now reallocating resources, resulting in underutilized inventory and reduced procurement cycles. This shift has exposed vulnerabilities in supply chains optimized for surge capacity, prompting cost-cutting measures that delay innovation in kit enhancements.

Competitive pressures from alternative diagnostic modalities, such as antigen tests, further erode market share for PCR-based solutions in low-prevalence scenarios. Economic constraints in public health budgets exacerbate the issue, with funding redirected toward chronic disease management. Variability in reimbursement policies across jurisdictions adds uncertainty, deterring investments in kit validation for new indications. Technical limitations, including the need for specialized thermal cyclers, continue to pose barriers in decentralized testing environments.

As a result, smaller manufacturers struggle to maintain economies of scale, leading to market consolidation. The overall revenue impact is evident in the diagnostics sector, where COVID-related contributions dwindled significantly. This restraint highlights the challenge of transitioning from emergency-driven growth to sustainable, diversified applications.

Opportunities

Expansion into oncology and gene expression profiling is creating growth opportunities

The burgeoning field of precision oncology presents substantial avenues for one-step RT-qPCR kits in quantifying gene expression levels for biomarker discovery and therapeutic monitoring. These kits enable sensitive detection of fusion transcripts and microRNA alterations, critical for stratifying patients to targeted therapies like tyrosine kinase inhibitors. Collaborations between diagnostic developers and pharmaceutical entities are accelerating the design of companion assays, aligning with regulatory requirements for personalized medicine.

In research settings, the kits support high-throughput screening of cancer cell lines, yielding insights into drug resistance mechanisms. Their compatibility with liquid biopsy samples expands accessibility, allowing non-invasive serial assessments of treatment response. Emerging applications in pharmacogenomics further broaden the scope, facilitating dose optimization based on metabolic enzyme expression. Cost efficiencies from multiplex configurations reduce per-sample expenses, making them viable for routine clinical workflows.

Global initiatives to integrate molecular profiling into national cancer control programs amplify demand in underserved regions. Technological synergies with next-generation sequencing workflows enhance data integration for comprehensive genomic reports. Collectively, these opportunities position one-step RT-qPCR kits as indispensable tools in the evolving landscape of cancer diagnostics.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic forces propel the one step RT-qPCR kits market ahead as expanding healthcare investments and persistent demand for rapid molecular diagnostics in infectious diseases and oncology drive laboratories to integrate streamlined, all-in-one testing solutions for efficient RNA quantification. Manufacturers actively expand offerings with high-sensitivity kits featuring integrated reverse transcription, tapping into the global push for point-of-care advancements and personalized medicine.

Stubborn inflation and faltering economic growth, however, constrict lab budgets and elevate raw material expenses, leading facilities to delay kit adoptions and prioritize cost-cutting over innovation in tighter markets. Geopolitical tensions, such as U.S.-China trade conflicts and supply halts from regional disputes, repeatedly block access to vital enzymes and polymers, causing production delays and price volatility for kit suppliers dependent on international chains.

Current U.S. tariffs impose a 10 percent baseline on most imported diagnostic kits alongside up to 55 percent duties on Chinese-origin molecular products, inflating acquisition costs and challenging affordability for American research and clinical users. These tariffs prompt retaliatory levies abroad that restrict U.S. exports of advanced kits and disrupt collaborative development efforts.

Nonetheless, the measures stimulate robust investments in domestic reagent synthesis and localized assembly lines, cultivating secure supply frameworks that will empower sustained innovation and market resilience moving forward.

Latest Trends

FDA clearance for multiplex respiratory pathogen panels is a recent trend

In December 2024, the U.S. Food and Drug Administration granted 510(k) clearance to Thermo Fisher Scientific’s Applied Biosystems TaqPath COVID-19 Diagnostic PCR Kit, transitioning it from emergency use authorization to full in vitro diagnostic status. This milestone validates the kit’s chemistry, which powered over one billion tests during the pandemic, for ongoing SARS-CoV-2 detection in clinical laboratories.

The clearance extends to multiplex capabilities, incorporating assays for influenza A, influenza B, and respiratory syncytial virus in a single reaction. This development aligns with the trend toward consolidated panels that streamline syndromic testing amid co-circulating respiratory threats. Laboratories benefit from reduced reagent costs and simplified protocols, fostering broader implementation in point-of-care environments.

Regulatory pathways like this encourage similar transitions for other one-step RT-qPCR platforms, enhancing supply chain stability. The move reflects a maturing post-pandemic diagnostic ecosystem, emphasizing versatility over single-pathogen focus.

Early adoption data indicates improved compliance with quality standards, minimizing false negatives in diverse sample types. This 2024 advancement signals a regulatory pivot toward sustainable, adaptable molecular tools. Ultimately, it catalyzes innovation in kit design, prioritizing robustness for future health emergencies.

Regional Analysis

North America is leading the One Step RT-qPCR Kits Market

North America accounted for 37.7% of the overall market in 2024, and the region saw strong growth as laboratories continued to rely on One Step RT-qPCR kits for high-throughput viral and genetic screening in clinical and public-health workflows. Increased prevalence of respiratory viruses, including influenza, RSV, and circulating variants of SARS-CoV-2, supported sustained testing volumes across hospitals and diagnostic labs.

Research institutes expanded use of these kits for transcriptomic and pathogen-surveillance studies due to their efficiency and reduced sample-handling steps. Molecular testing remained a critical component in emergency department triage and infection-control programs.

The CDC reported 44 million flu illnesses and 25,000 flu-related deaths in the United States during the 2022-2023 season (CDC — Flu Surveillance Summary, 2023), reinforcing the need for rapid and reliable molecular diagnostics. Automation-ready RT-qPCR formats also improved turnaround times, contributing to expanded procurement. These factors collectively strengthened regional market performance in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to record significant growth during the forecast period as countries invest in advanced molecular-testing infrastructure to manage emerging infectious diseases and improve routine diagnostics. Hospitals integrate high-sensitivity RNA-detection workflows into respiratory-disease monitoring programs.

Expanding pharmaceutical and academic research accelerates adoption of fast and accurate amplification tools for gene-expression and virology studies. Increased awareness of outbreak preparedness drives procurement of scalable, user-friendly diagnostic kits. Public laboratories are broadening surveillance systems across India, China, Japan, and Southeast Asia to address rising viral threats.

The World Health Organization reported continued SARS-CoV-2 transmission across Asia throughout 2023, highlighting the ongoing need for robust molecular-testing strategies. Manufacturers strengthen distribution networks to support faster reagent access, enhancing adoption. These advancements position Asia Pacific for strong forward-looking market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in One Step RT-qPCR Kits strengthen growth by engineering enzyme mixes that support fast cycling, high inhibitor tolerance, and multiplex target detection so labs obtain actionable results efficiently in a single tube. Leadership teams expand their reach by customizing kits for infectious-disease surveillance, oncology biomarkers, and genetic research, ensuring relevance across clinical and academic use cases.

Commercial groups cultivate repeat business by pairing reagents with compatible plasticware and analysis software, enabling standardized workflows across high-volume networks. Scientific teams collaborate with instrument manufacturers and reference labs to validate cross-platform performance and shorten customer onboarding.

Market strategists invest in regional training and responsive technical support to build trust and improve long-term adoption. QIAGEN advances this model through a global portfolio of RT-qPCR reagents and automated sample-prep solutions, supported by manufacturing, logistics, and application-science expertise that secure its role as a key supplier in molecular diagnostics and research.

Top Key Players

- QIAGEN N.V.

- Thermo Fisher Scientific, Inc.

- Roche Diagnostics

- Bio-Rad Laboratories, Inc.

- GeneProof

- Takara Bio, Inc.

- Seegene

- BGI

Recent Developments

- In November 2024, Thermo Fisher Scientific introduced an update to the Applied Biosystems QuantStudio Absolute Q Digital PCR System, adding support for validated single-tube multiplex workflows. By simplifying how multiple targets are analyzed in a single reaction, the enhancement strengthens demand for efficient molecular chemistry solutions such as integrated one-step mixes used in downstream dPCR applications.

- In July 2023, Fortis Life Sciences acquired International Point of Care, Inc. (IPOC), a developer of diagnostic technologies that include lyophilized reagent formats. The deal aligns closely with the industry shift toward stable, room-temperature molecular kits—particularly one-step RT-qPCR products—helping improve storage convenience and usability in laboratory and point-of-care testing environments.

Report Scope

Report Features Description Market Value (2024) US$ 111.5 Million Forecast Revenue (2034) US$ 178.2 Million CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Reaction (400 Rxn, 50 Rxn, 25 Rxn, 200 Rxn, 100 Rxn and Others), By Application (Virus Detection, Single Cell RT-PCR, Multiplexing, Gene Expression Analysis and Others), By Detection (Probe-Based and Dye-Based), By End-User (Diagnostic Laboratories, Reference Laboratories, Hospitals, Academic and Research Institutes and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape QIAGEN N.V., Thermo Fisher Scientific, Inc., Roche Diagnostics, Bio-Rad Laboratories, Inc., GeneProof, Takara Bio, Inc., Seegene, BGI Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  One Step RT-qPCR Kits MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

One Step RT-qPCR Kits MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- QIAGEN N.V.

- Thermo Fisher Scientific, Inc.

- Roche Diagnostics

- Bio-Rad Laboratories, Inc.

- GeneProof

- Takara Bio, Inc.

- Seegene

- BGI