Global Oncology Information Systems Market By Product Type (Solutions (Patient Information Systems and Treatment Planning Systems) and Professional Services), By Application (Medical Oncology, Surgical Oncology, and Radiation Oncology), By End-user (Hospitals & Diagnostic Imaging Centers, Research Facilities, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153834

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

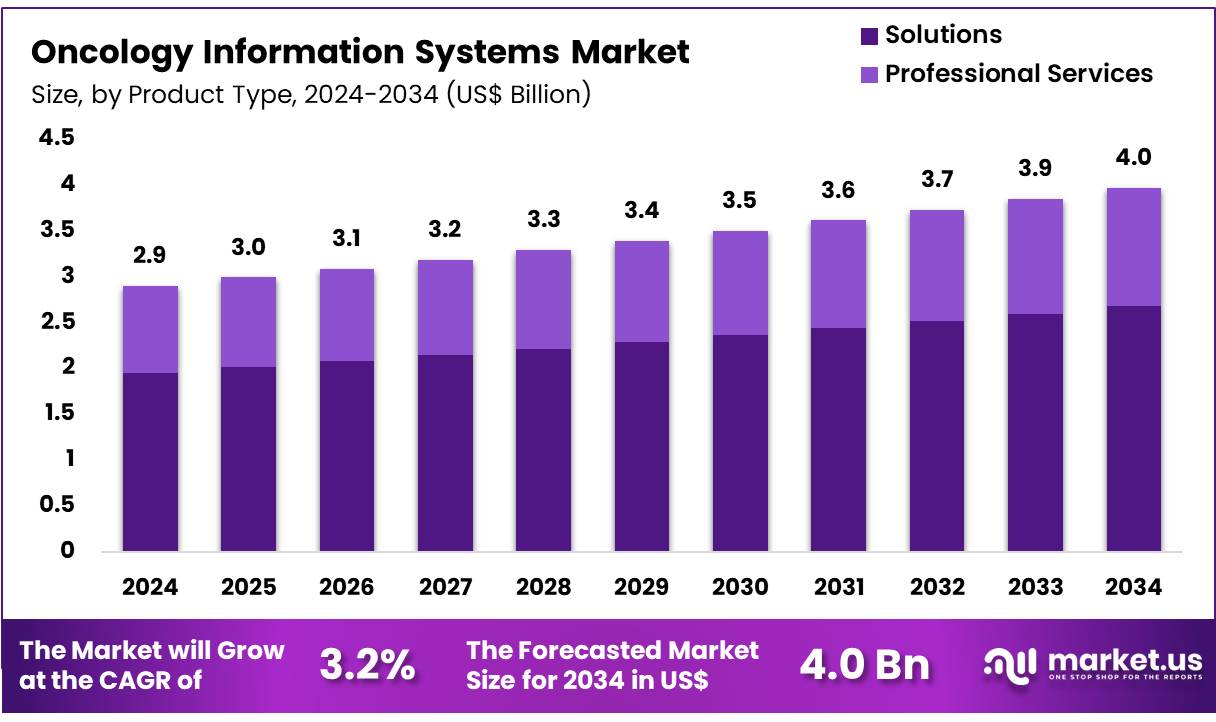

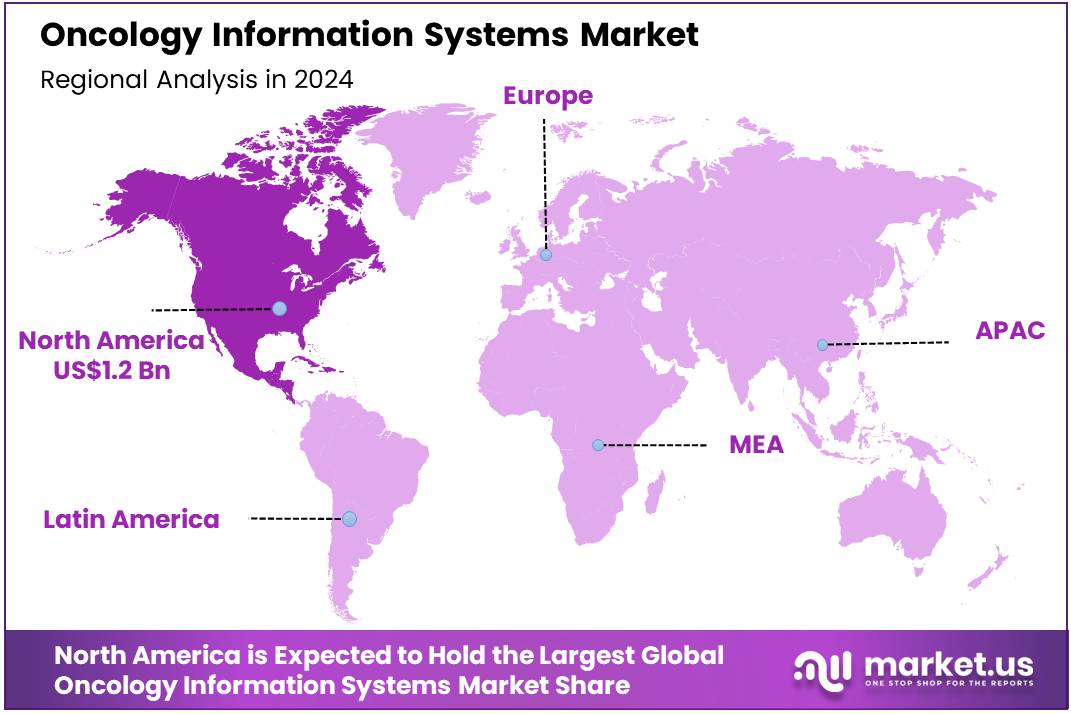

Global Oncology Information Systems Market size is expected to be worth around US$ 4.0 Billion by 2034 from US$ 2.9 Billion in 2024, growing at a CAGR of 3.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.9% share with a revenue of US$ 1.2 Billion.

Increasing complexity in cancer treatment and the growing need for integrated healthcare solutions are driving the growth of the oncology information systems (OIS) market. OIS enables the management and integration of patient data, treatment planning, and imaging information, streamlining clinical workflows in oncology care.

These systems support oncology professionals in delivering personalized treatment, improving decision-making, and ensuring better patient outcomes by centralizing essential data and automating processes. The rise in cancer incidence worldwide, combined with the shift toward precision medicine, creates significant demand for advanced data management and analytics tools. The market benefits from advancements in imaging technologies, such as MRI and CT, which are integrated into OIS to enhance diagnosis and treatment planning.

In January 2023, ViewRay, Inc. announced an order of 10 MRIdian MR-Guided Therapy Systems from Chindex Medical Limited. This order came after the National Medical Products Administration approved the system’s expansion into China in September 2022, enabling the availability of SMART radiation therapy. This highlights the increasing trend of integrating advanced radiation therapy technologies into OIS, further improving treatment accuracy and efficiency.

As healthcare systems focus on enhancing oncology care quality while controlling costs, OIS offers opportunities for improving operational efficiency, reducing errors, and enhancing patient satisfaction. Moreover, the rising adoption of cloud-based solutions in healthcare presents new opportunities for integrating OIS with other healthcare platforms, creating a more unified and comprehensive patient care experience. With these innovations, the oncology information systems market is poised for continued growth, driven by the ongoing digital transformation of oncology care.

Key Takeaways

- In 2024, the market for oncology information systems generated a revenue of US$ 2.9 billion, with a CAGR of 3.2%, and is expected to reach US$ 4.0 billion by the year 2034.

- The product type segment is divided into solutions and professional services, with solutions taking the lead in 2024 with a market share of 67.4%.

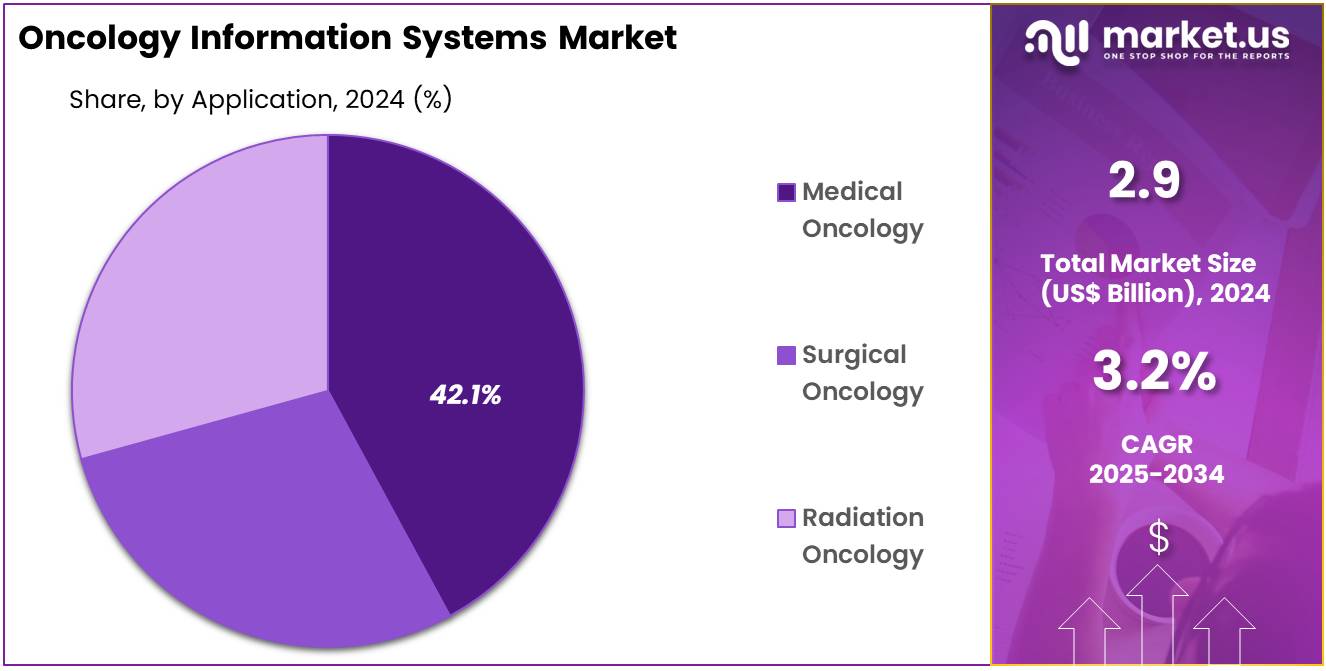

- Considering application, the market is divided into medical oncology, surgical oncology, and radiation oncology. Among these, medical oncology held a significant share of 42.1%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & diagnostic imaging centers, research facilities, and others. The hospitals & diagnostic imaging centers sector stands out as the dominant player, holding the largest revenue share of 52.3% in the oncology information systems market.

- North America led the market by securing a market share of 39.9% in 2024.

Product Type Analysis

Solutions dominate the oncology information systems market with a share of 67.4%. This segment’s growth is expected to continue as healthcare providers increasingly seek integrated, comprehensive tools to manage oncology data. Oncology information systems (OIS) solutions are crucial for managing vast amounts of patient data, treatment plans, and outcomes, helping oncologists deliver personalized care and improve efficiency. The shift toward electronic health records (EHRs) and the growing adoption of digital health tools are anticipated to fuel the demand for oncology solutions.

Additionally, the integration of artificial intelligence (AI) and machine learning into OIS solutions is expected to enhance diagnostic accuracy, predict treatment responses, and provide real-time decision support. As the need for better patient care coordination, optimized workflows, and regulatory compliance grows, the adoption of advanced OIS solutions is likely to increase across hospitals, oncology clinics, and diagnostic centers. The continuous development of software solutions that integrate seamlessly with other healthcare systems is projected to be a major driver of growth in this segment.

Application Analysis

Medical oncology holds the largest share of 42.1% in the application segment of the oncology information systems market. This growth is expected to be driven by the increasing complexity of cancer treatments and the need for precise, data-driven decision-making. Medical oncology focuses on the use of chemotherapy, immunotherapy, and other systemic treatments, which require careful management and coordination of patient data. Oncology information systems play a critical role in managing treatment plans, tracking patient responses, and optimizing therapy regimens.

The increasing prevalence of cancer, particularly in aging populations, is anticipated to further drive demand for medical oncology solutions. As more advanced therapies emerge, medical oncologists require robust IT systems that can manage complex data and integrate various treatment modalities. The ability of OIS solutions to track and analyze patient data over time will likely contribute to improved clinical outcomes. Furthermore, the growing focus on personalized medicine and precision oncology is projected to support the continued dominance of medical oncology in the OIS market.

End-User Analysis

Hospitals and diagnostic imaging centers represent the largest end-user segment in the oncology information systems market, holding 52.3% of the market share. This growth is expected to continue as hospitals and diagnostic centers adopt more advanced OIS solutions to manage cancer care. With the increasing volume of cancer patients, hospitals and diagnostic centers are under pressure to improve care coordination, reduce administrative burdens, and enhance the accuracy of diagnoses and treatment planning.

OIS solutions help these institutions manage clinical data, track patient progress, and integrate imaging systems, enabling better collaboration among oncologists, radiologists, and other healthcare professionals. The growing demand for advanced imaging technologies, such as MRI, CT scans, and PET scans, is projected to drive the need for more sophisticated OIS systems that can integrate with diagnostic imaging equipment. As hospitals and diagnostic centers continue to expand their oncology departments and improve cancer care, the demand for OIS solutions is likely to rise, ensuring continued growth in this segment.

Market Segments

By Product Type

- Solutions

- Patient Information Systems

- Treatment Planning Systems

- Professional Services

By Application

- Medical Oncology

- Surgical Oncology

- Radiation Oncology

By End-user

- Hospitals & Diagnostic Imaging Centers

- Research Facilities

- Others

Drivers

Increasing Complexity of Cancer Treatment Data is Driving the Market

The escalating complexity of cancer treatment, driven by personalized approaches and a proliferation of diagnostic data, is a significant driver propelling the oncology information systems market. Oncologists now integrate diverse information, including genomic sequencing, sophisticated imaging, and patient outcomes, to tailor therapies. This individualized care generates immense volumes of intricate data that traditional manual methods cannot efficiently manage or analyze, leading to potential delays in diagnosis and treatment.

The Centers for Disease Control and Prevention (CDC) reported on June 14, 2024, that in 2022 alone, 279,731 new female breast cancers, 255,395 new prostate cancers, and 218,893 new lung cancers were reported in the US These high numbers underscore the vast amount of patient data that needs to be systematically managed for each individual.

The sheer scale and granularity of data required for modern oncology demand integrated information systems that can centralize, organize, and present this critical information in a usable format. These systems are essential for improving workflow efficiency, enhancing collaborative care among multidisciplinary teams, and ensuring that treatment decisions are based on the most current and comprehensive patient profiles, thereby driving the market forward.

Restraints

Significant Cybersecurity Threats and Staff Training Demands are Restraining the Market

Significant cybersecurity threats to sensitive patient data and the continuous demands for staff training are considerable restraints on the oncology information systems market. These systems handle highly confidential patient health information, making them prime targets for cyberattacks, including ransomware and data breaches. Such incidents can compromise patient privacy, disrupt clinical operations, and result in severe financial penalties and reputational damage for healthcare providers.

According to IS Partners, LLC’s healthcare cybersecurity statistics for 2024, the first half of 2024 saw 387 healthcare data breaches involving 500 or more records, a 9.3% increase compared to the same period in 2023. This report also noted that in 2024, 67% of healthcare organizations experienced ransomware attacks, an increase from 60% in 2023.

Furthermore, effective utilization of advanced oncology information systems requires ongoing training for clinical and administrative staff to ensure proficiency and maximize system capabilities. This training incurs additional costs and can divert staff time from patient care, slowing the adoption process, especially in facilities with limited resources. These persistent challenges necessitate substantial investment in cybersecurity measures and continuous education, thereby restraining market expansion.

Opportunities

Emphasis on Value-Based Care Models is Creating Growth Opportunities

The increasing global emphasis on value-based care models, which tie reimbursement to patient outcomes and quality of care, is creating significant growth opportunities for the oncology information systems market. These models require healthcare providers to meticulously track, measure, and report on various quality metrics, treatment efficacy, and cost-efficiency over a patient’s entire cancer journey. Oncology information systems are indispensable for this purpose, as they provide the integrated platforms needed to collect, aggregate, and analyze these complex data points.

The Centers for Medicare & Medicaid Services (CMS) launched its Enhancing Oncology Model (EOM) in July 2023, a voluntary program involving 38 practices aimed at improving care coordination and reducing costs for Medicare beneficiaries undergoing chemotherapy. This model, which published its second cohort Request for Applications on May 30, 2024, encourages participants to provide personalized services and take on financial and performance accountability for episodes of care.

The necessity to meet the rigorous reporting and performance requirements of such value-based programs is compelling oncology practices to invest in sophisticated information systems that can support advanced analytics, comprehensive patient tracking, and robust outcome reporting, thereby driving market demand.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic conditions, including inflation and the strategic investment priorities of hospitals, significantly influence the oncology information systems market by affecting purchasing power and IT budgets. While inflationary pressures can increase the cost of hardware, software licenses, and skilled IT labor required for these systems, the critical nature of cancer care often compels healthcare organizations to prioritize these investments.

Hospitals recognize that efficient information systems can ultimately lead to long-term cost savings through improved workflow, reduced errors, and better patient outcomes. According to a report by KFF in May 2024, US aggregate hospital operating margins, which had decreased to 2.7% in 2022, rebounded to 5.2% in 2023. Although these margins remained below pre-pandemic levels, the improvement indicates a renewed capacity for strategic investments.

Geopolitical stability is also crucial for ensuring stable global supply chains for the technology components underpinning these systems. Despite economic fluctuations, the enduring need for advanced tools to optimize complex cancer treatment pathways drives continued allocation of resources, fostering resilience and growth in the market.

Evolving US trade policies, particularly the imposition of tariffs on imported IT hardware and related components, are shaping the oncology information systems market by influencing procurement costs and supply chain strategies. Oncology information systems rely on robust computing infrastructure, including servers, data storage, and networking equipment, much of which contains components sourced from international manufacturers.

Tariffs on these imports can increase the capital expenditure for healthcare institutions and technology providers acquiring or deploying these systems in the US A July 2025 perspective from WNS, a global business process management company, noted that recent changes in US trade policy, including new tariffs, are accelerating the urgency for digital transformation and operational redesign within healthcare, as they impact rising input costs.

Furthermore, an American Hospital Association (AHA) press release from April 2025 highlighted that nearly 70% of medical devices marketed in the US are manufactured exclusively overseas, and increased tariffs could significantly raise costs. While this directly impacts devices, the underlying IT infrastructure for managing device data and oncology software also faces similar pressures. These policies also encourage domestic manufacturing and diversification of supply chains to mitigate future risks, promoting a more resilient, albeit potentially more expensive, technological ecosystem for oncology information systems.

Latest Trends

Expansion of Cloud-Based Deployment and Remote Access is a Recent Trend

A prominent recent trend shaping the oncology information systems market in 2024 and continuing into 2025 is the accelerating expansion of cloud-based deployment models and enhanced remote access capabilities. Healthcare organizations are increasingly recognizing the benefits of migrating their information systems from traditional on-premise servers to secure cloud environments. This shift offers advantages such as improved scalability, reduced capital expenditure on local IT infrastructure, and greater flexibility for data storage and processing.

Cloud-based platforms also facilitate seamless remote access for oncologists and multidisciplinary teams, enabling teleconsultations, remote treatment planning, and collaborative care, which are crucial for extending specialized cancer care to underserved areas. A March 2025 article in the Federal News Network highlighted that federal agencies, including those within healthcare, are aggressively pursuing cloud adoption to enhance data agility and security, particularly for sensitive information.

This trend aligns with the broader digital transformation in healthcare, supporting the ability of oncology information systems to manage large datasets securely and provide real-time access to patient information regardless of geographical location, thereby enhancing efficiency and accessibility in cancer care delivery.

Regional Analysis

North America is leading the Oncology Information Systems Market

North America led the market with the largest revenue share of 39.9% owing to the escalating cancer burden, the increasing adoption of electronic health records (EHRs) in oncology centers, and the imperative for integrated data management to enhance patient care. As cancer incidence continues to rise, healthcare providers are increasingly relying on sophisticated information systems to manage complex patient data, streamline workflows, and facilitate multidisciplinary collaboration. The National Cancer Institute (NCI) reported that the rate of new cancer cases in the US was 445.8 per 100,000 men and women per year based on 2018–2022 data, indicating a persistent demand for robust oncology management tools.

Furthermore, the widespread adoption of EHR systems across US hospitals, with 78.6% having installed a telemedicine solution as of February 2024 according to ScienceSoft, provides a strong foundation for integrating specialized cancer care platforms. Key players in the healthcare technology sector have reported strong financial results, reflecting this market expansion.

Siemens Healthineers, which includes Varian (a leading provider of cancer care solutions), achieved comparable revenue growth of 4.7% for its fiscal year 2024, with Varian specifically reporting a 10.5% comparable revenue increase in Q4 FY2024, demonstrating robust demand for its oncology-focused offerings. This growth underscores the critical role of these systems in optimizing cancer treatment pathways, improving data accessibility, and supporting better clinical decision-making across North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the region’s rapidly increasing cancer incidence, significant investments in healthcare infrastructure, and government initiatives promoting digital health adoption in oncology. Countries like China, India, and Japan are facing a growing cancer burden, necessitating efficient and integrated systems to manage patient data, coordinate care, and improve treatment outcomes.

For instance, China reported 4,824,703 new cancer cases in 2022, and India reported 1,413,316 new cases in the same year, according to the World Cancer Research Fund, highlighting the immense need for advanced cancer management solutions. Governments across Asia Pacific are actively supporting the digitalization of healthcare; the World Health Organization (WHO) launched a new Global Initiative on Digital Health in July 2023, emphasizing the importance of digital tools in strengthening health systems. Leading healthcare technology providers with a strong presence in the region are likely to capitalize on this trend.

Siemens Healthineers reported very strong comparable revenue growth in the China region and significant growth in Asia Pacific Japan within its Imaging segment in the first half of fiscal year 2023, indicating a rising demand for advanced medical technology that often integrates with oncology information systems. As healthcare systems in Asia Pacific continue to modernize and focus on comprehensive cancer care, the adoption of integrated platforms for patient management, treatment planning, and data analytics will likely accelerate, contributing to improved clinical efficiency and patient outcomes.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the oncology information systems market employ various strategies to drive growth and enhance patient care. They focus on integrating advanced technologies such as artificial intelligence (AI) and machine learning to optimize treatment planning, improve diagnostic accuracy, and streamline clinical workflows. Companies also prioritize the development of scalable, cloud-based platforms that offer real-time data access and seamless interoperability with existing electronic health record (EHR) systems.

Strategic partnerships with healthcare providers, research institutions, and technology firms enable these companies to expand their market reach and enhance service offerings. Additionally, they invest in user-friendly interfaces and mobile applications to improve accessibility and user experience. Geographical expansion, particularly in emerging markets, further contributes to their growth trajectory.

One key player, Varian Medical Systems, is a global leader in providing integrated oncology solutions. The company offers a comprehensive suite of products, including the ARIA oncology information system, which supports medical and radiation oncology, including proton therapy. ARIA enables healthcare providers to review clinical images, prescriptions, lab results, and outcomes, while automating cancer staging and managing toxicities. Varian’s commitment to innovation and patient-centered care has established it as a significant contributor to advancements in oncology information systems.

Top Key Players

- RaySearch Laboratories

- Oracle (Cerner Corporation)

- FLATIRON HEALTH

- Elekta

- DOSIsoft SA

- Connecticut Proton Therapy Center

- BrainLab

- Accuray Incorporated

Recent Developments

- In August 2024, the Connecticut Proton Therapy Center combined RaySearch Laboratories’ RayCare oncology information system with the IBA ProteusONE compact proton therapy system, offering a unified treatment platform.

- In January 2024, RaySearch Laboratories launched RayStation 2024A, an updated version aimed at optimizing treatment planning workflows. It also includes integration with the RayIntelligence system for oncology analytics.

Report Scope

Report Features Description Market Value (2024) US$ 2.9 Billion Forecast Revenue (2034) US$ 4.0 Billion CAGR (2025-2034) 3.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Solutions (Patient Information Systems and Treatment Planning Systems) and Professional Services), By Application (Medical Oncology, Surgical Oncology, and Radiation Oncology), By End-user (Hospitals & Diagnostic Imaging Centers, Research Facilities, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape RaySearch Laboratories, Oracle (Cerner Corporation), FLATIRON HEALTH, Elekta, DOSIsoft SA, Connecticut Proton Therapy Center, BrainLab, Accuray Incorporated. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Oncology Information Systems MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Oncology Information Systems MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- RaySearch Laboratories

- Oracle (Cerner Corporation)

- FLATIRON HEALTH

- Elekta

- DOSIsoft SA

- Connecticut Proton Therapy Center

- BrainLab

- Accuray Incorporated