Global Oncology Imaging Software Market By Active Molecules (Thymosins, Lipopolysaccharides, Levamisole, Isoprinosine, Interleukins, Interferons, and Glucan), By Application (Cancer, Organ Transplantation, Immunodeficiency Disorders, and Chronic infections), By Distribution Channels (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Drug Stores), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159916

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

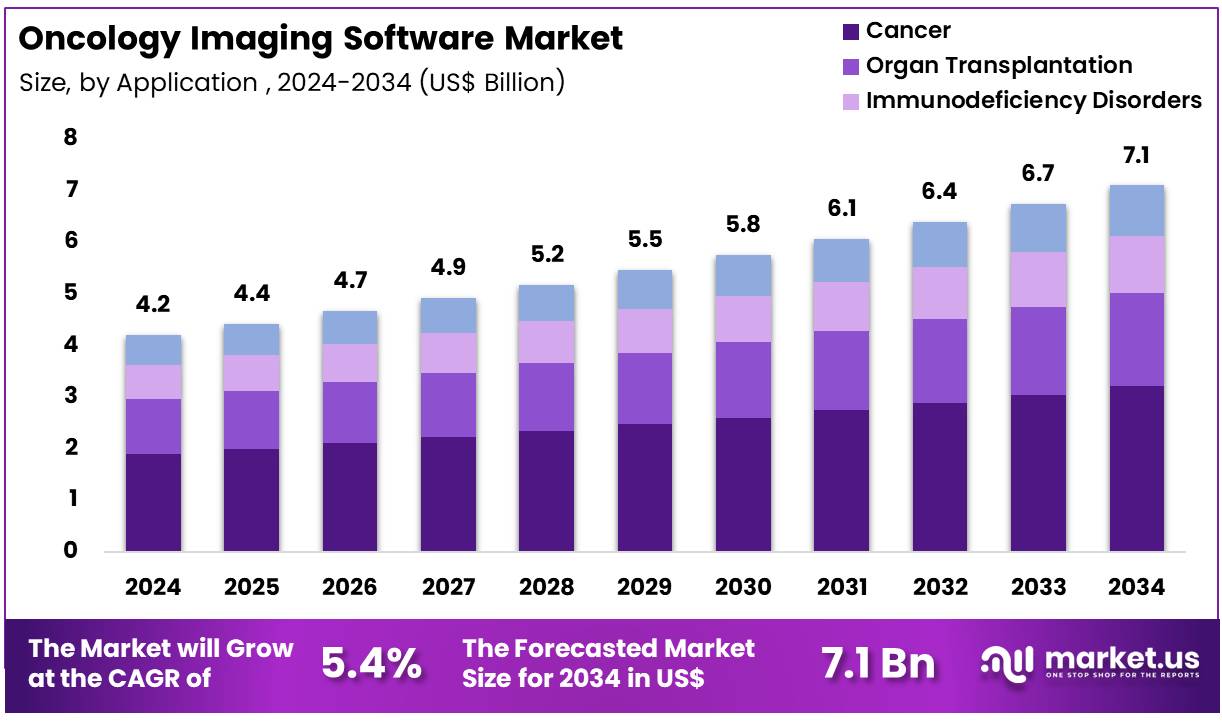

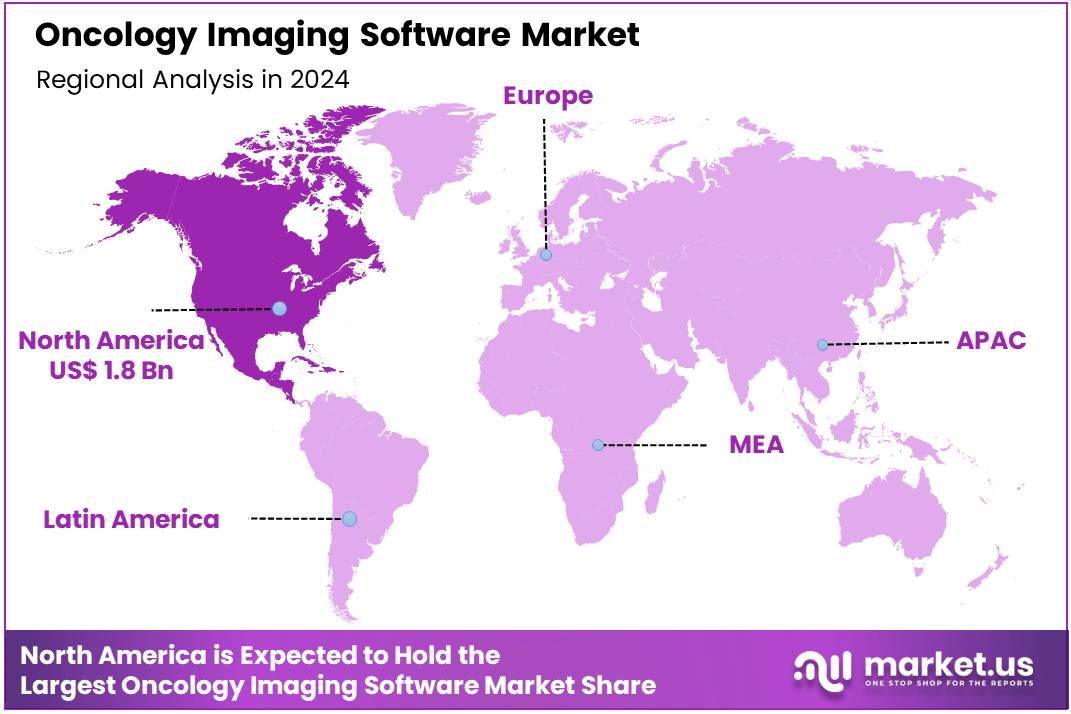

Global Oncology Imaging Software Market size is expected to be worth around US$ 7.1 Billion by 2034 from US$ 4.2 Billion in 2024, growing at a CAGR of 5.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.7% share with a revenue of US$ 1.8 Billion.

Increasing advancements in medical technology drive the adoption of oncology imaging software, a critical tool in the comprehensive diagnosis and treatment of cancer. Oncology imaging software’s primary applications include mammography for breast cancer detection, lung cancer screening via CT imaging, and neuro-oncology for brain tumors.

The market for these advanced solutions is fueled by the rising global prevalence of cancer, with the American Cancer Society estimating over 1.9 million new cancer cases in the United States alone in 2021. This growing patient base necessitates more efficient and accurate diagnostic methods, making imaging software an indispensable part of modern oncology workflows.

Growing opportunities for oncology imaging software are emerging from the increasing integration of AI and machine learning (ML) into diagnostic processes. A Microsoft study from March 2024 revealed that 79% of healthcare organizations already leverage AI technology, with a significant return on investment. The adoption of AI-driven solutions is revolutionizing image analysis, automating tumor detection, and providing clinicians with predictive insights for personalized treatment planning. These innovations are paving the way for more precise diagnoses and improved patient outcomes, especially in complex cases across various cancer types.

The market is also witnessing a trend toward cloud-based solutions and the fusion of different imaging modalities. Cloud platforms provide enhanced accessibility and scalability for data management, enabling seamless collaboration among healthcare providers, which is vital for multi-disciplinary oncology teams. Philips’ introduction of SmartSpeed Precise in early 2025, a next-generation imaging solution powered by a dual-AI engine, underscores this trend.

The updated MR Workspace software enhances workflow efficiency for quicker and more accurate diagnoses, while the expansion of their helium-free BlueSeal MR scanner line with AI-driven automation supports sustainable and efficient imaging. This strategic focus on efficiency and AI-driven automation reflects a broader industry movement toward more integrated, intelligent, and sustainable imaging solutions.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.2 Billion, with a CAGR of 5.4%, and is expected to reach US$ 7.1 Billion by the year 2034.

- The active molecules segment is divided into thymosins, lipopolysaccharides, levamisole, isoprinosine, interleukins, interferons, and glucan, with thymosins taking the lead in 2023 with a market share of 30.5%.

- Considering application, the market is divided into cancer, organ transplantation, immunodeficiency disorders, and chronic infections. Among these, cancer held a significant share of 45.2%.

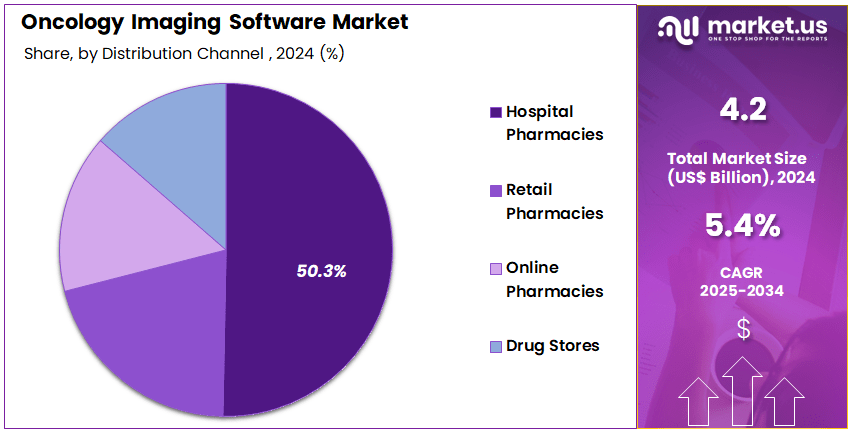

- Furthermore, concerning the distribution channels segment, the market is segregated into hospital pharmacies, retail pharmacies, online pharmacies, and drug stores. The hospital pharmacies sector stands out as the dominant player, holding the largest revenue share of 50.3% in the market.

- North America led the market by securing a market share of 42.7% in 2023.

Active Molecules Analysis

Thymosins hold the largest share in the active molecules segment with 30.5%. Their role in boosting immune function, especially in cancer patients undergoing treatment, has increased their demand in oncology imaging. Thymosins stimulate the immune system, enhancing the body’s ability to fight cancer cells and improving patient responses to chemotherapy and radiation therapy. As the number of cancer cases rises globally, so does the need for therapies like thymosins to support cancer treatment regimens.

Ongoing clinical trials are expanding the understanding of thymosins’ potential in oncology, which is expected to further fuel growth. The combination of therapeutic and immunological benefits makes thymosins an essential active molecule in cancer treatment, driving their continued presence in the oncology imaging market.

Application Analysis

Cancer dominates the application segment with 45.2%. The global burden of cancer continues to rise, and oncology imaging software has become crucial in early diagnosis, treatment planning, and monitoring. As the need for precise and personalized cancer treatments grows, oncology imaging software offers invaluable support to healthcare professionals.

Innovations such as more advanced imaging techniques, including PET and CT scans, are improving accuracy and enabling better outcomes for patients. These advancements, coupled with an increasing demand for real-time monitoring and precision medicine, contribute to the expansion of oncology imaging software. With early detection being critical for improving survival rates, the focus on cancer-related imaging will continue to drive growth in the market.

Distribution Channel Analysis

Hospital pharmacies dominate the distribution channel segment with 50.3%. The need for advanced imaging solutions in hospitals has significantly increased with the rise in cancer cases and the demand for timely diagnoses. Hospital pharmacies play a crucial role in ensuring that the necessary oncology imaging software and diagnostic tools are readily available to physicians. As healthcare systems integrate imaging software with other hospital systems, the workflow becomes more efficient, improving patient care.

Hospitals are investing in advanced diagnostic tools to improve outcomes, and oncology imaging is a central component in that effort. The growing importance of personalized medicine, the increased use of AI and machine learning in oncology diagnostics, and the continuous demand for accurate cancer detection methods are likely to continue supporting the expansion of hospital pharmacies in the oncology imaging sector.

Key Market Segments

By Active Molecules

- Thymosins

- Lipopolysaccharides

- Levamisole

- Isoprinosine

- Interleukins

- Interferons

- Glucan

By Application

- Cancer

- Organ Transplantation

- Immunodeficiency Disorders

- Chronic infections

By Distribution channels

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Drug Stores

Drivers

The increasing prevalence of cancer is driving the market

The global rise in cancer incidence is a key driver for the oncology imaging software market. As the number of cancer diagnoses and survivors increases, the demand for advanced diagnostic and treatment management tools continues to grow. Oncology imaging software is essential for providing high-resolution imaging for early detection, staging, and monitoring treatment response, particularly as personalized and targeted therapies become more prevalent.

The World Health Organization (WHO) reported approximately 20 million new cancer cases and 9.7 million cancer-related deaths globally in 2022, underscoring the global healthcare challenge and the need for effective diagnostic solutions. Additionally, the American Cancer Society projects 2,001,140 new cancer cases in the US alone in 2024, highlighting the consistent demand for sophisticated imaging software capable of handling this volume. This ongoing trend towards early detection and the increase in cancer survivors further fuel the sustained need for cutting-edge oncology imaging software.

Restraints

High cost and complex integration is restraining the market

The high cost associated with implementing and maintaining oncology imaging software serves as a significant restraint on market growth, particularly for smaller hospitals and healthcare facilities in developing regions. These solutions often require a substantial initial investment for software licenses, specialized hardware, and infrastructure upgrades.

In addition to the upfront costs, there are ongoing expenses for maintenance, software updates, and the training of technical staff to operate the complex systems. This financial burden can be a major barrier to adoption, especially for institutions with limited budgets. A report from the National Center for Biotechnology Information (NCBI) on a microsimulation model of 11 cancers indicated that scaling up imaging would cost US$ 6.84 billion between 2020-2030, which highlights the significant investment required to expand access to these technologies.

Moreover, the integration of new software with existing legacy systems, such as electronic health records (EHRs) and other hospital information systems, presents a major technical challenge. This process can be complex, time-consuming, and prone to compatibility issues, leading to workflow disruptions and additional costs.

Opportunities

The rise of AI and machine learning is creating growth opportunities

The integration of artificial intelligence (AI) and machine learning (ML) into oncology imaging software is unlocking substantial growth opportunities by enhancing diagnostic accuracy, streamlining workflows, and enabling more personalized treatment plans. AI algorithms can process large volumes of image data, identifying subtle abnormalities and assisting radiologists in detecting potential tumors earlier than traditional methods. This technology also automates time-consuming tasks, such as image segmentation and volume measurement, which reduces radiologists’ workload and improves turnaround times.

A 2024 study published in the JMA Journal demonstrated how AI-driven surgical support systems could convert 2D imaging data into detailed 3D models, thereby enhancing surgical precision. Additionally, AI enables the extraction of valuable data from medical images through radiomics, which can aid in predicting treatment responses and understanding tumor characteristics. The US FDA’s approval of several AI-based diagnostic tools in 2024 further solidifies the growing adoption and confidence in these transformative technologies for healthcare applications.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the oncology imaging software market, shaping its trajectory through both challenges and opportunities. Global inflation places a strain on healthcare budgets, which may lead to delays in the adoption of advanced platforms that integrate artificial intelligence to improve tumor detection and treatment planning.

As per a July 2025 PwC report, hospitals are seeing declining profit margins, with many rural hospitals facing significant financial strain. Workforce shortages and increasing prices for medications and clinical equipment are among the main factors impacting the healthcare industry, according to a survey of healthcare professionals across 14 countries. This economic environment can make large-scale technology acquisitions more difficult.

Geopolitical tensions also create complexities. Trade conflicts and supply chain disruptions, for instance, can raise the cost of essential components, such as semiconductors and high-fidelity processors, that are vital for advanced imaging software. As per a recent publication, tariffs on certain imported medical goods from China rose by up to 20% in early 2025. These measures can lead to increased prices for developers, which are often passed on to healthcare providers.

However, these challenges also catalyze innovation, as medical technology firms are increasingly diversifying their sourcing and exploring domestic manufacturing options. The US government is supporting these efforts with initiatives like the CHIPS Act, which provides incentives for domestic semiconductor production.

Latest Trends

Artificial intelligence and hybrid imaging are a recent trend

A significant trend observed in the oncology imaging software market in 2024 is the widespread integration of artificial intelligence and the increasing use of hybrid imaging systems. This trend moves beyond simple image analysis to a more comprehensive, multi-modal approach to diagnostics and treatment planning. The trend is exemplified by the growing number of AI-powered tools that are being developed and adopted to assist in everything from initial tumor detection to personalized therapy response prediction.

For instance, in August 2023, the US FDA granted approval for lung imaging technology that uses AI to analyze pulmonary images, which was a result of collaboration between multiple organizations. This not only enhances diagnostic accuracy but also facilitates more informed clinical decision-making.

Simultaneously, the market has seen a surge in the use of hybrid imaging systems like PET/CT and PET/MRI. These systems combine functional imaging (PET) with anatomical imaging (CT or MRI) to provide a more complete picture of a patient’s condition in a single examination. This combination allows for better tumor localization, staging, and monitoring, which is crucial for effective cancer care. The rise of these technologies is revolutionizing how medical professionals visualize and understand complex diseases.

Regional Analysis

North America is leading the Oncology Imaging Software Market

In 2024, North America secured a 42.7% share of the global oncology imaging software market, driven by escalating cancer rates and an aging population necessitating AI-enhanced diagnostic precision. Healthcare providers adopted advanced software for multimodal image fusion, enabling precise tumor margin delineation for radiotherapy planning. The FDA’s streamlined approvals for AI-driven tools boosted clinician trust in automated lesion segmentation, minimizing errors in complex datasets.

Academic-vendor collaborations developed cloud-based platforms for secure, cross-institutional scan analysis, refining diagnostic accuracy across diverse cohorts. Expanded Medicare reimbursements for digital oncology tools spurred community hospitals to integrate predictive analytics for treatment response monitoring. Venture funding fueled startups innovating intraoperative augmented reality for surgical precision.

Post-pandemic hybrid care models increased reliance on remote image viewing for multidisciplinary tumor boards. Economic benefits from reduced repeat scans aligned with value-based care models. The FDA approved seven oncology-related devices in 2024, including imaging systems like the Lumicell Direct Visualization System for residual cancer detection.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific oncology imaging software sector to expand rapidly during the 2024-2030 forecast period, fueled by rising cancer burdens in densely populated regions. Governments invest in national screening programs, equipping hospitals with AI-enhanced platforms for early CT and MRI detection. Pharma firms collaborate with local developers to tailor algorithms for ethnic-specific tumor profiling, speeding up clinical trial validations.

Singapore and South Korea advance open-source imaging pipelines, enabling rural clinics to conduct sophisticated analyses. India’s telemedicine networks anticipate deploying edge-computing tools for real-time PET scan reviews in remote areas. China integrates genomic-driven suites with wearable telemetry for metastatic tracking.

Japan expects robotic platforms to align with spectral imaging for precise biopsies in aging cohorts. Australia allocated US$ 92.9 million across 36 oncology research grants from late 2022 to 2024, supporting diagnostic imaging advancements.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the oncology imaging market drive growth by launching AI-powered platforms that streamline tumor detection and treatment planning for clinicians. They acquire niche firms to integrate advanced algorithms, enhancing their technology portfolios. Companies form partnerships with hospitals and tech providers to co-develop interoperable solutions, accelerating market adoption.

Leaders invest in research to embed machine learning for precise diagnostics and personalized care. They expand into regions like Asia and Europe, tailoring solutions to local regulations. Additionally, firms offer cloud-based analytics services to secure long-term client contracts and stable revenue.

GE HealthCare, headquartered in Chicago and listed on Nasdaq (GEHC), develops advanced imaging software to improve cancer diagnostics and patient outcomes. Its platforms, like MIM Encore, enhance lesion detection and workflow efficiency for healthcare providers. The company invests heavily in R&D, focusing on AI and theranostics to advance oncology care.

CEO Peter J. Arduini leads a global team, emphasizing innovation and collaboration with health systems. GE HealthCare combines imaging hardware expertise with cutting-edge software to maintain leadership in precision medicine. The firm continues to expand its global footprint through scalable, client-focused solutions.

Top Key Players

- Varian Medical Systems

- Siemens Healthineers

- RaySearch Laboratories

- Oracle (Cerner Corporation)

- MIM Software, Inc.

- Koninklijke Philips NV

- Epic Systems Corporation

- EndoSoft LLC

- Elekta

- Accuray Inc.

Recent Developments

- In June 2025, GE HealthCare enhanced its oncology imaging solutions by integrating its proprietary features and algorithms with MIM Encore. This update adds specialized post-processing tools for GE systems, streamlining nuclear medicine and cardiology workflows. The platform now offers automated read preparation and flexible interpretation tools for PET/CT, SPECT/CT, and multi-modality fusion, improving efficiency, reducing manual workload, and supporting more confident clinical diagnoses.

- In February 2025, Siemens Healthineers showcased its AI-driven imaging portfolio at the European Congress of Radiology (ECR), highlighting its collaboration with Varian. The integrated oncology platform streamlines workflows from screening to treatment, with AI technologies like Deep Resolve accelerating MR scans and enhancing patient experience. Their syngo.via platform automates post-processing and provides intelligent tools that increase productivity for advanced visualization and routine imaging tasks.

Report Scope

Report Features Description Market Value (2024) US$ 4.2 Billion Forecast Revenue (2034) US$ 7.1 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Active Molecules (Thymosins, Lipopolysaccharides, Levamisole, Isoprinosine, Interleukins, Interferons, and Glucan), By Application (Cancer, Organ Transplantation, Immunodeficiency Disorders, and Chronic infections), By Distribution Channels (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Drug Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Varian Medical Systems, Siemens Healthineers, RaySearch Laboratories, Oracle (Cerner Corporation), MIM Software, Inc., Koninklijke Philips NV, Epic Systems Corporation, EndoSoft LLC, Elekta, Accuray Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Oncology Imaging Software MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Oncology Imaging Software MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Varian Medical Systems

- Siemens Healthineers

- RaySearch Laboratories

- Oracle (Cerner Corporation)

- MIM Software, Inc.

- Koninklijke Philips NV

- Epic Systems Corporation

- EndoSoft LLC

- Elekta

- Accuray Inc.