Global On-Device AI Market Size, Industry Analysis Report By Component (Hardware, Software), By Deployment (Cloud, On-premises), By Technology (Natural Language Processing, Computer Vision, Speech Recognition, Others), By Device Type (Smartphones & Tablets, Wearables, Smart Home Devices, Automotive, Others), By Vertical (Consumer Electronics, Automotive, Healthcare, Retail, Manufacturing, Security & Surveillance, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155844

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Geopolitics of on-device AI

- U.S. On-Device AI Market Size

- Component Analysis

- Deployment Analysis

- Technology Analysis

- Device Type Analysis

- Vertical Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Latest Trends

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

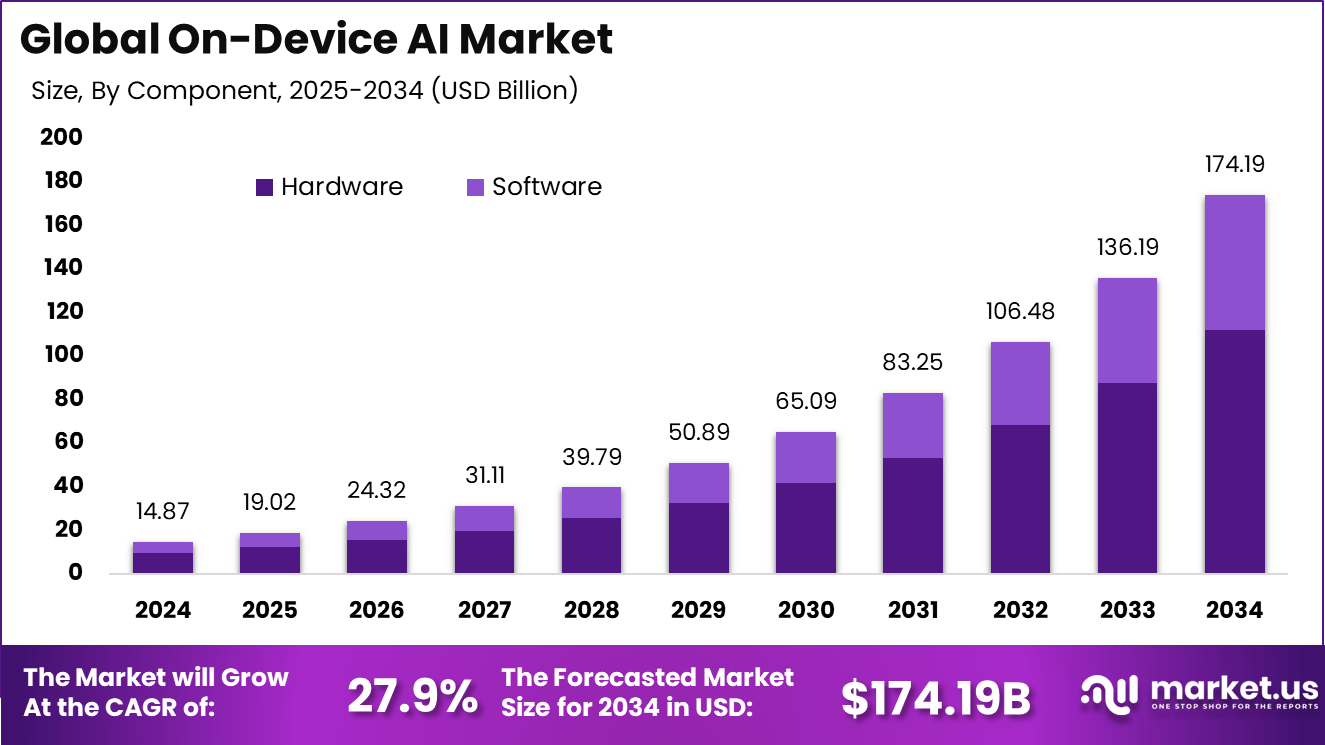

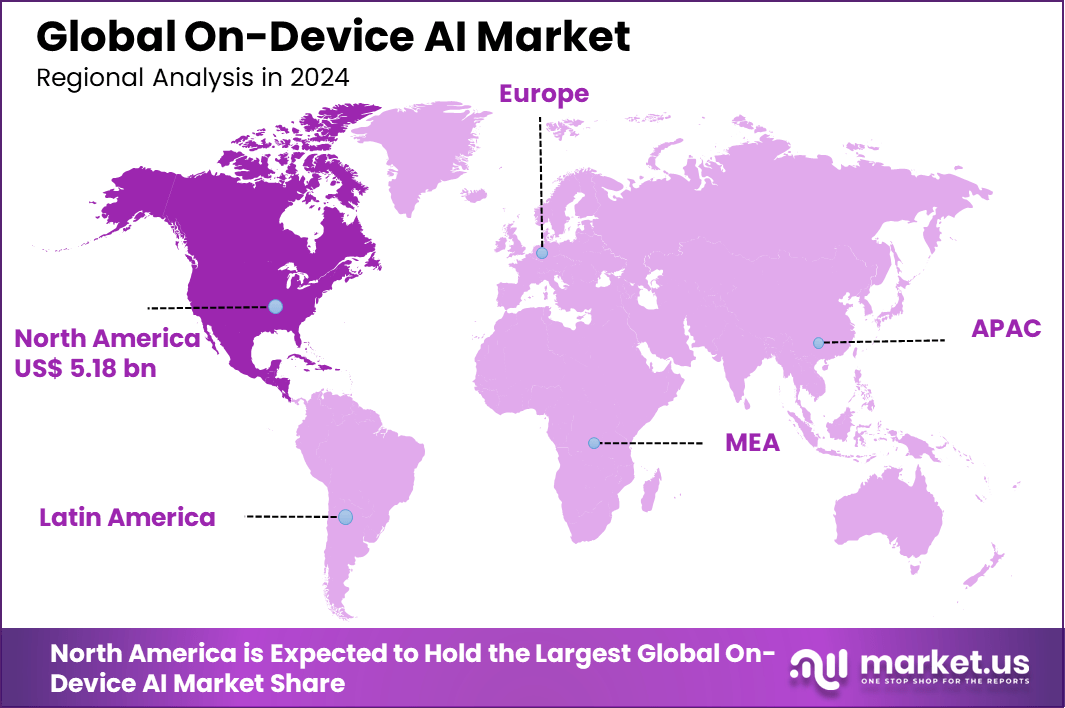

The Global On-Device AI Market size is expected to be worth around USD 174.19 billion by 2034, from USD 14.87 billion in 2024, growing at a CAGR of 27.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.9% share, holding USD 5.18 billion in revenue.

The on‑device AI market refers to the capacity of consumer and industrial devices to execute artificial intelligence tasks locally, without reliance on cloud infrastructure. This approach enables real‑time decision‑making directly on hardware such as specialized chips and optimized software frameworks, ensuring rapid responsiveness and improved reliability in contexts with limited connectivity.

According to Forbes, 97% of business leaders investing in AI reported positive returns, confirming its strong value creation. This year, 25% of enterprises are expected to deploy AI agents, although an adoption gap remains with 81% of workers still not using AI tools. Regional differences are clear, with AI acceptance higher in India (77%) and China (72%), compared to just 32% in America.

The top driving factors of this market include the increasing demand for real-time data processing and enhanced privacy and security. As users and industries become more conscious about how data is managed, processing data on-device minimizes the risks of privacy breaches and ensures compliance with stringent regulations.

For instance, in July 2025, Amazon acquired Bee, a San Francisco-based startup specializing in AI-enabled wearable devices. Bee’s flagship product is a wristband that records and transcribes daily conversations, providing users with personalized summaries and suggestions. This acquisition signifies Amazon’s strategic move into the wearable AI space, aiming to enhance its Alexa ecosystem with more personalized, agentic AI capabilities.

Key Takeaway

- In 2024, hardware led with 64.3% share, driven by demand for faster chips and processors.

- The on-premises model captured 72.1% share, as companies prioritized privacy and data security.

- Computer vision held 34.8% share, reflecting its growing role in surveillance, healthcare, and retail.

- Smartphones and tablets accounted for 48.3% share, confirming their position as the main platform for on-device AI.

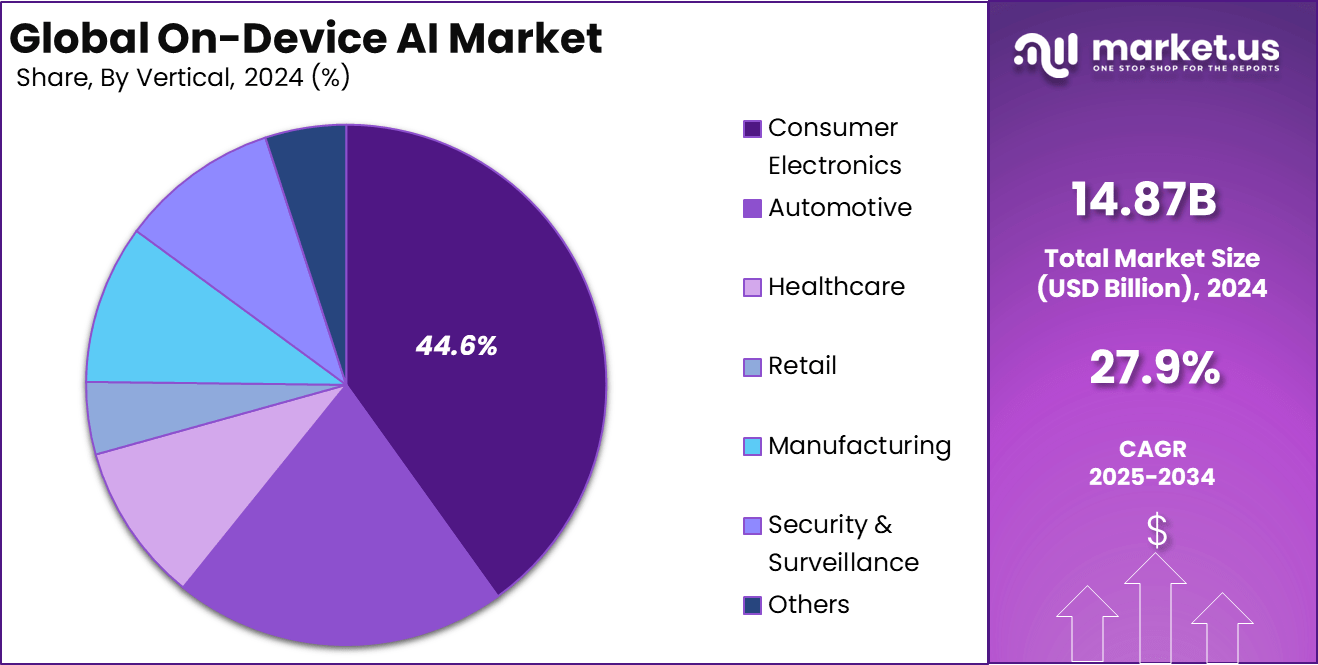

- Consumer electronics reached 44.6% share, supported by adoption in smart TVs, wearables, and connected home devices.

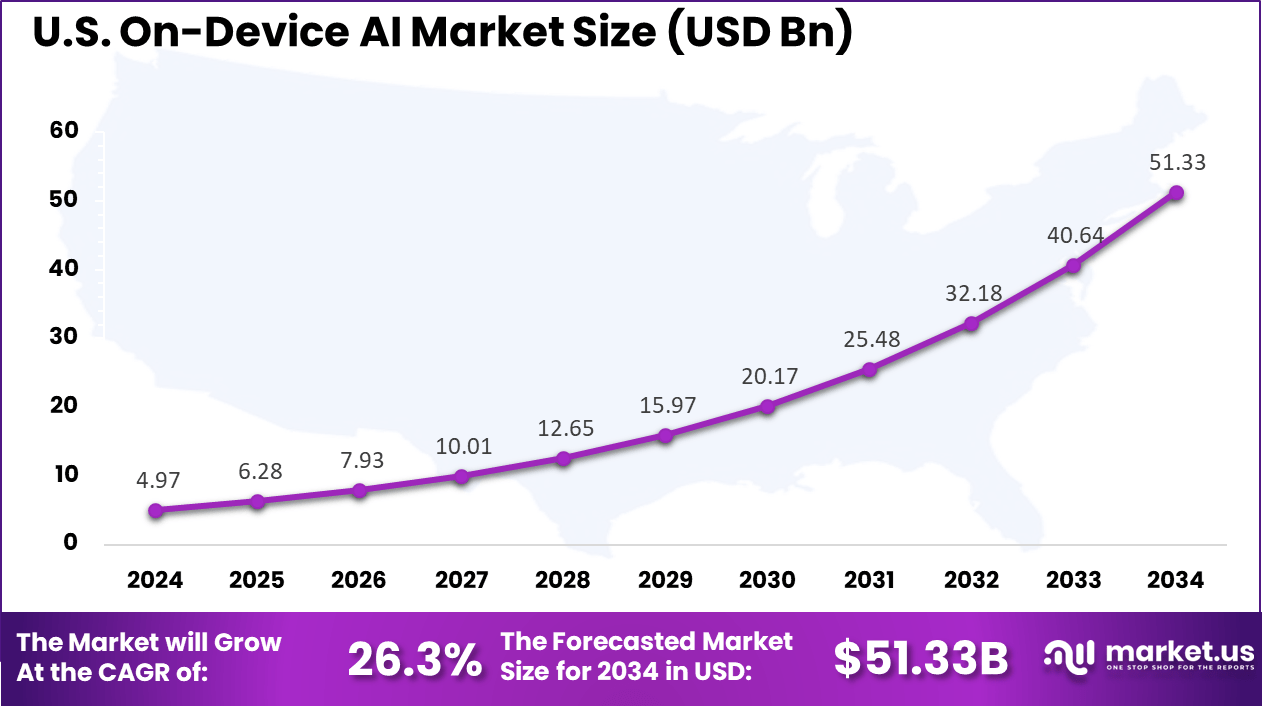

- The U.S. market stood at USD 4.97 billion in 2024, growing at a robust 26.3% CAGR.

- North America dominated with 34.9% share, supported by advanced digital infrastructure and early adoption.

Geopolitics of on-device AI

Based on data from gzeromedia, The geopolitics of on-device AI is changing global power in important ways. AI used to depend mainly on large cloud data centers controlled by a few countries and companies. Now, more AI is being processed directly on devices like smartphones and other gadgets. This cuts down the need for expensive data centers and shifts power away from governments controlling those centers.

Countries with less infrastructure can benefit by using AI on devices without building huge data hubs. The companies making these smart devices gain influence in this new AI landscape. Right now, American companies lead the global mobile device market, while Chinese firms are growing but have less presence worldwide. The countries that innovate in on-device AI will have new opportunities to lead internationally.

U.S. On-Device AI Market Size

The market for On-Device AI within the U.S. is growing tremendously and is currently valued at USD 4.97 billion, the market has a projected CAGR of 26.3%. The market is expanding rapidly due to the growing adoption of smart devices such as smartphones, wearables, and IoT products. Advances in AI hardware and edge computing enable U.S. companies to offer faster, efficient, and privacy-conscious solutions.

The need for real-time data processing, enhanced user experiences, and reduced reliance on cloud servers is driving growth, especially in sectors like healthcare, automotive, and consumer electronics. Specialized hardware like neural processing units and widespread IoT adoption further fuel this growth.

For instance, in April 2025, HP partnered with Reincubate to launch a personalized AI solution, enhancing on-device AI capabilities. This collaboration focuses on delivering AI-powered personalized experiences directly on devices, strengthening the U.S.’s position as a leader in on-device AI innovation. By processing data locally, the solution provides real-time, privacy-focused interactions, reducing dependency on cloud infrastructure.

In 2024, North America held a dominant market position in the Global On-Device AI Market, capturing more than a 34.9% share, holding USD 5.18 billion in revenue. The dominance is due to its strong technological infrastructure, high adoption of smart devices, and significant investments in AI research and development.

The region’s emphasis on innovation in sectors like healthcare, automotive, and consumer electronics has driven the demand for efficient, real-time AI processing. Additionally, the presence of major tech companies and advancements in specialized hardware, such as neural processing units, have further bolstered North America’s leadership in on-device AI.

For instance, in June 2025, NOTA AI and Wind River launched a strategic initiative to bring generative AI to the edge, targeting on-device intelligence. This collaboration highlights North America’s dominance in on-device AI, with both companies leveraging cutting-edge AI technologies to enable real-time data processing locally on devices.

Component Analysis

In 2024, Hardware represents the largest component segment in the On-Device AI market, commanding a significant 64.3% share. This prominence is due to the critical role that specialized AI processors, including GPUs, NPUs (Neural Processing Units), and ASICs, play in enabling real-time AI capabilities directly on devices.

Hardware advancements are key to improving power efficiency, processing speed, and latency reduction, which are essential for running complex AI models locally without dependence on cloud connectivity. Manufacturers increasingly invest in designing optimized hardware components tailored for AI workloads on devices, as these components provide faster inference and enhanced privacy by keeping data processing on-device.

For Instance, In May 2025, the AI Pro Chip was introduced as a major step in on-device AI. It enables faster real-time processing without cloud reliance, boosting performance in voice recognition, image analysis, and autonomous systems.

Deployment Analysis

In 2024, the On-Premises deployment model dominates the On-Device AI market with a 72.1% share, reflecting enterprises’ preference for local data processing. This approach addresses key concerns around data privacy, security, and reduced latency by keeping AI computation within the device or local network, avoiding transmission to public clouds.

On-premises AI deployment is particularly crucial in applications requiring real-time responsiveness and strict data protection. Enterprises in sectors such as healthcare, manufacturing, and consumer electronics benefit from on-premises deployment because it enables more control over sensitive data, reduces dependency on network connectivity, and improves user experience through swift AI-driven actions.

For instance, in May 2025, Dell Technologies advanced enterprise AI innovation with its new infrastructure solutions and services, emphasizing on-premises deployment for on-device AI. By offering powerful computing capabilities locally, Dell enables enterprises to process data securely and efficiently, reducing dependency on the cloud.

Technology Analysis

In 2024, Computer vision technology leading with 34.8% of the market share emphasizes its widespread adoption as a primary AI application on devices. This technology enables devices to interpret and analyze visual data, powering functions such as facial recognition, object detection, augmented reality, and video analytics.

On-device computer vision reduces latency and enhances privacy by processing images and video locally. The increasing demand for smart cameras, surveillance systems, and AR/VR applications drives computer vision adoption on-device. The ability to perform accurate visual recognition in constrained environments without relying on cloud connectivity is critical for many use cases, particularly in consumer electronics and security sectors.

For Instance, in April 2025, HP partnered with Reincubate to introduce a personalized AI solution that leverages on-device computer vision technology. This collaboration enables real-time image and video processing directly on devices, enhancing user experiences with features like facial recognition and advanced visual analytics.

Device Type Analysis

In 2024, Smartphones and tablets constitute the largest device category for On-Device AI with a 48.3% share. These mobile devices are primary platforms for AI applications, ranging from voice assistants and camera enhancements to biometric authentication and personalized user experiences. The integration of AI hardware and algorithms within smartphones empowers faster and more private AI processing.

Driven by consumer demand for smarter, more responsive devices, manufacturers are embedding advanced AI chips and optimizing software to perform AI functions locally. This trend is supporting new features such as real-time language translation, AI-powered photography, and intelligent battery management directly on these portable devices.

For Instance, in May 2025, Google introduced its Gemma 3N model, an open-source AI designed for on-device processing, which is set to revolutionize smartphones and tablets. This advanced AI model enables real-time processing for applications such as image recognition, voice assistants, and personalized recommendations directly on the device.

Vertical Analysis

In 2024, Consumer electronics dominates vertical markets with a 44.6% share in the On-Device AI space. This sector encompasses a wide range of products including smart home devices, wearables, entertainment systems, and personal gadgets. On-device AI enables these electronics to deliver enhanced user interaction, contextual awareness, and autonomous functionalities without relying heavily on cloud services.

The vertical’s significant share is driven by the rapid innovation in smart devices that prioritize privacy, convenience, and low latency. Continued investments in AI capabilities embedded within consumer electronics are expected to strengthen this segment’s leadership role in the coming years.

For Instance, in April 2025, Samsung and Google Cloud expanded their partnership to bring the Gemini AI model to Ballie, a home AI companion robot, integrating on-device AI capabilities. This collaboration enables real-time processing of data locally on the device, enhancing Ballie’s ability to interact with users, recognize objects, and respond to commands more efficiently.

Key Market Segments

By Component

- Hardware

- Software

By Deployment

- Cloud

- On-premises

By Technology

- Natural Language Processing

- Computer Vision

- Speech Recognition

- Others

By Device Type

- Smartphones & Tablets

- Wearables

- Smart Home Devices

- Automotive

- Others

By Vertical

- Consumer Electronics

- Automotive

- Healthcare

- Retail

- Manufacturing

- Security & Surveillance

- Others

Drivers

Growing IoT Adoption

The rise of IoT-connected devices such as smart home gadgets, personal assistants, and wearables is significantly driving the demand for on-device AI. These devices require local data processing and decision-making to function efficiently in real-time, without relying on external cloud servers.

As IoT adoption accelerates, on-device AI becomes crucial for enhancing performance, reducing latency, and offering smarter, personalized user experiences. This shift towards local AI processing is transforming how consumers interact with technology.

For instance, in January 2025, Samsung introduced Galaxy AI as a personal assistant designed for the workplace, leveraging on-device AI to enhance productivity. With the growing adoption of IoT devices, Galaxy AI can seamlessly integrate with various connected devices, providing real-time insights and automation directly on the device.

Restraint

Energy Consumption

Running AI models on-device can be highly energy-intensive, particularly when tasks demand substantial processing power. This increased power consumption poses a challenge for mobile and battery-operated devices like smartphones, wearables, and drones, which rely on long-lasting battery life.

High energy demand can lead to faster battery depletion, limiting the overall usability and convenience of these devices. Therefore, balancing energy efficiency with the performance of AI models remains a key concern for manufacturers.

For instance, in May 2025, iOS 19 introduced an AI-driven battery management feature for iPhones to optimize battery life. However, running advanced AI models on devices can lead to high energy consumption, especially for tasks requiring significant processing power. This highlights a key restraint of on-device AI, where continuous processing demands can reduce device efficiency.

Opportunities

Expansion in Consumer Electronics

The consumer electronics market presents a significant opportunity for on-device AI integration. Devices like smartphones, laptops, and wearables are increasingly incorporating AI to deliver personalized features, real-time processing, and enhanced privacy.

On-device AI can revolutionize user experiences by providing faster, more accurate performance without reliance on cloud servers. This trend is particularly appealing as consumers demand more advanced, privacy-conscious technologies in their everyday devices.

For instance, in August 2025, Google unveiled the ultra-small and efficient open-source AI model, Gemma 3, featuring 270 million parameters. Designed to run on smartphones, this lightweight model allows for advanced AI processing directly on devices, significantly improving performance and reducing reliance on cloud computing.

Challenges

Continuous Upgradation

On-device AI systems require constant updates to remain competitive, adapt to new AI models, and ensure optimal performance. However, frequent upgrades can be resource-intensive, involving significant investments in both hardware and software.

For manufacturers, this presents a challenge in maintaining device efficiency while implementing new technologies. Additionally, updates must be seamless to avoid disrupting the user experience, making it a complex and ongoing challenge for companies to stay ahead in the rapidly evolving AI landscape.

In July 2025, OPPO launched the AI-powered Reno14 series, featuring advanced on-device AI for enhanced camera performance, real-time optimization, and personalized interactions. Alongside, it introduced an AI-driven after-sales service system that adapts through user feedback, highlighting the growing need for continuous upgrades in on-device AI to keep devices competitive and functional without depending on cloud processing.

Latest Trends

Agentic AI and autonomous systems are becoming a major trend, where AI technologies are designed to operate with minimal human intervention. These systems can make decisions and perform tasks autonomously, enhancing efficiency across various industries.

Agentic AI can handle routine tasks, such as scheduling or data analysis, and adapt to evolving contexts. The integration of such systems allows for more proactive, intelligent operations, reducing the need for constant oversight and improving overall productivity in both consumer and enterprise applications.

For instance, in August 2025, the Android 16 QPR2 update introduced a significant enhancement to Google Assistant, giving it agentic AI capabilities. This update enables Google Assistant to perform tasks autonomously, without requiring continuous user input. The integration of on-device AI allows for faster processing and real-time decision-making, as data is processed directly on the device rather than in the cloud.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Apple, Google, Amazon, and Microsoft have emerged as central players in the on-device AI market, leveraging their ecosystems of hardware, software, and cloud integration. Apple focuses on optimizing device-level intelligence through its custom chips, while Google integrates AI into Android and Pixel devices for real-time decision-making.

Chipmakers such as Intel, NVIDIA, Qualcomm, Arm, and Huawei play a crucial role by providing the processing power necessary for advanced on-device AI workloads. Qualcomm and Arm drive mobile AI innovation through specialized architectures, while NVIDIA and Intel strengthen computing capabilities for edge devices and IoT applications.

Baidu and other regional leaders complement this landscape by pushing advancements in AI research and practical deployments in consumer and enterprise devices. Baidu, with its expertise in language and vision models, integrates AI into autonomous driving and edge platforms. Alongside, emerging players and smaller innovators contribute to niche applications such as healthcare diagnostics, industrial automation, and personalized assistants.

Top Key Players in the Market

- Apple Inc.

- Baidu, Inc.

- Amazon.com, Inc.

- Google LLC

- Microsoft

- Intel Corporation

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Huawei Technologies Co., Ltd.

- Arm Limited

- Others

Recent Developments

- In June 2025, Apple unveiled the Apple Intelligence framework, enabling developers to integrate on-device AI capabilities into their apps. This initiative allows for private, intelligent experiences within applications, emphasizing user privacy and offline functionality.

- In April 2025, NVIDIA commenced the production of its Blackwell chips in Arizona, marking the company’s first U.S. based manufacturing of AI supercomputers. This move aims to bolster domestic AI capabilities and reduce reliance on overseas production, aligning with broader efforts to enhance on-device AI infrastructure in the United States.

Report Scope

Report Features Description Market Value (2024) USD 14.87 Bn Forecast Revenue (2034) USD 174.19 Bn CAGR (2025-2034) 27.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software), By Deployment (Cloud, On-premises), By Technology (Natural Language Processing, Computer Vision, Speech Recognition, Others), By Device Type (Smartphones & Tablets, Wearables, Smart Home Devices, Automotive, Others), By Vertical (Consumer Electronics, Automotive, Healthcare, Retail, Manufacturing, Security & Surveillance, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple Inc., Baidu, Inc., Amazon.com, Inc., Google LLC, Microsoft, Intel Corporation, NVIDIA Corporation, Qualcomm Technologies, Inc., Huawei Technologies Co., Ltd., Arm Limited, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Apple Inc.

- Baidu, Inc.

- Amazon.com, Inc.

- Google LLC

- Microsoft

- Intel Corporation

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Huawei Technologies Co., Ltd.

- Arm Limited

- Others