Global On-Demand Transportation Market By Service (Car Sharing, Car Rental, E-Hailing, and Station-Based-Mobility), By Vehicle Type (Micro Mobility, and Four Wheeler), By Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: July 2024

- Report ID: 98790

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

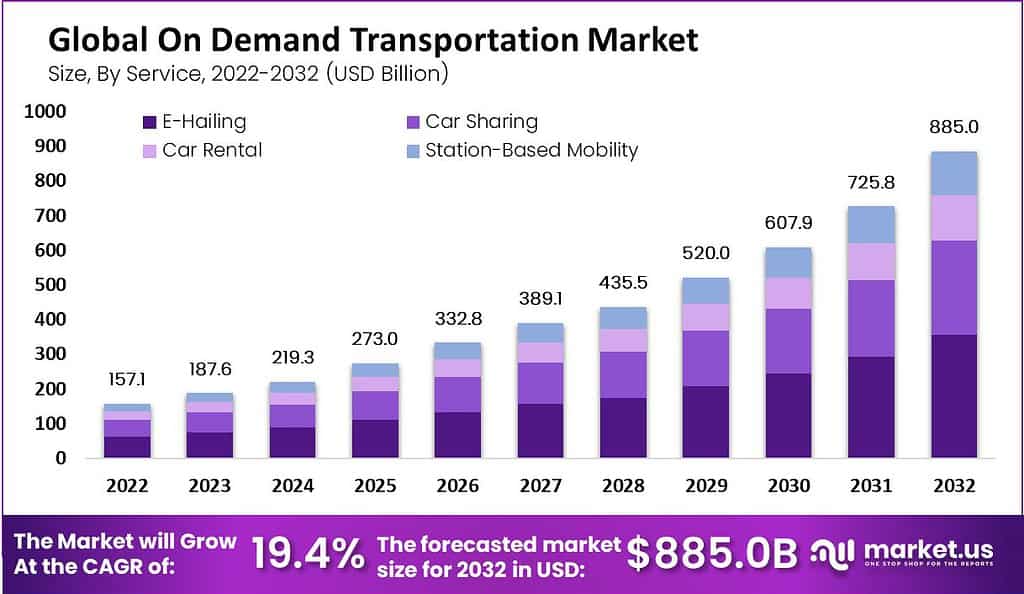

The Global On-demand Transportation Market size is expected to be worth around USD 885.0 Billion By 2033, from USD 187.6 Billion in 2023, growing at a CAGR of 19.4% during the forecast period from 2024 to 2033.

The on-demand transportation market has witnessed significant growth in recent years, revolutionizing the way people travel and commute. On-demand transportation refers to the provision of transportation services, such as ride-hailing, car-sharing, and bike-sharing, through digital platforms and mobile applications. This convenient and flexible mode of transportation has gained popularity due to its ease of use and cost-effectiveness.

Several growth factors have contributed to the expansion of the on-demand transportation market. Firstly, the proliferation of smartphones and the widespread availability of high-speed internet have made it easier for consumers to access and utilize on-demand transportation services. The convenience of booking a ride or sharing a vehicle through a mobile app has attracted a large user base.

Furthermore, changing consumer preferences and the rising need for efficient and sustainable transportation options have fueled the growth of on-demand transportation. People are increasingly seeking alternatives to traditional modes of transportation, such as owning a car or using public transportation. On-demand services provide a flexible and affordable solution, allowing users to travel on-demand without the burden of vehicle ownership.

However, the on-demand transportation market also faces certain challenges. One of the major challenges is regulatory issues and compliance with local transportation laws. Many cities and regions have introduced regulations to govern the operations of on-demand transportation platforms, including driver requirements, safety standards, and licensing. These regulations can vary significantly across different regions, posing obstacles for companies operating on a global scale.

Another challenge is competition among on-demand transportation providers. The market is crowded with multiple players, each striving to gain market share and attract customers. This intense competition often leads to price wars and reduced profit margins, making it challenging for companies to achieve profitability.

Despite the challenges, the on-demand transportation market offers abundant opportunities. The growing demand for efficient transportation solutions, especially in densely populated urban areas, presents a vast market potential. Companies can leverage technological advancements, such as artificial intelligence and data analytics, to optimize their operations, improve customer experience, and gain a competitive edge.

Additionally, the integration of electric and autonomous vehicles in on-demand transportation holds immense opportunities for market players. Electric vehicles can reduce carbon emissions and contribute to environmental sustainability, while autonomous vehicles have the potential to transform the industry by offering fully automated and efficient transportation services.

According to recent data from Winnesota, the transportation industry has witnessed a remarkable surge in investments in on-demand services over the past 12 months. In fact, these investments have tripled the total amount of investments made in the previous four years combined. This staggering increase underscores the growing significance and potential of on-demand transportation solutions in today’s market.

In the retail sector, a significant shift has taken place, with a substantial 51% of global retailers now offering same-day delivery services. This trend highlights the increasing importance of speed and convenience in meeting customer expectations. Retailers are recognizing the need to adapt to evolving consumer demands and provide swift delivery options to stay competitive in the market.

The on-demand economy has experienced impressive traction, attracting a staggering 72% of Americans who have utilized on-demand services. This widespread adoption signifies a change in consumer behavior and a growing reliance on convenient, on-demand solutions. The convenience and flexibility provided by these services have struck a chord with consumers, leading to their widespread acceptance.

In terms of consumer engagement, the on-demand economy is capturing the attention of more than 22.4 million consumers annually, with a substantial spending volume of $57.6 billion. These figures highlight the tremendous market potential and the significant economic impact of on-demand services. As the market continues to grow, opportunities abound for businesses to tap into this lucrative sector and cater to the needs of an expanding consumer base.

When examining the demographics of on-demand service users, it becomes evident that millennials make up the majority, accounting for 49% of customers. However, it is worth noting that this trend extends beyond just one age group. A significant 30% of on-demand service users fall between the ages of 35 and 54, indicating a broad appeal across different generations. This diversity in consumer demographics showcases the widespread appeal of on-demand services and their ability to cater to various age groups.

Furthermore, the importance of fast delivery cannot be overstated. An impressive 18% of consumers cite fast delivery as the most significant factor when selecting their “favorite” store. This finding highlights the critical role that prompt and efficient delivery plays in shaping customer preferences. Businesses that can provide swift and reliable delivery services are likely to gain a competitive edge in today’s highly competitive market.

Key Takeaways

- The global on-demand transportation market was estimated to be valued at USD 157.1 Billion in 2022 and projected to experience compound annual growth rate between 2023-2032; to reach an expected value of USD 885.0 Billion by 2032.

- On-demand transportation (OT) is an internet-based service that enables users to book vehicles for travel from one point to another, with their fare being determined based on distance, vehicle type, and route.

- The market is driven primarily by an expanding urban population that requires on-demand transportation services; as well as rising fuel costs that push individuals toward cost-cutting transport options.

- Key restraining factors include safety concerns for users and a lack of connectivity in some remote areas, leading to government initiatives and regulations aimed at enhancing safety measures and expanding services to underserved regions.

- E-Hailing services are expected to dominate the market, supported by the increasing penetration of the internet and smartphones globally, while four-wheelers are preferred over micro-mobility vehicles due to factors like comfort and reduced noise pollution.

- North America led the market in 2022, with major players like Waymo and Uber, while the Asia Pacific region is anticipated to be the fastest-growing market, driven by increasing urbanization and strict pollution control regulations.

- Major companies deploying advanced technologies like artificial intelligence (AI) are creating opportunities in the market, enabling efficient management and coordination of transportation systems, including autonomous driving systems and traffic management.

- The trend of corporate individuals increasingly utilizing on-demand transportation services in urban areas is fueling market growth, as these services offer a means to avoid traffic congestion and reach destinations more quickly.

- Key players in the market include Ola Inc., Uber Technologies Inc., BlaBlaCar, Careem, Grab, Gett Inc., General Motor Company, Daimler AG, Ford Motor Company, BMW Group, Robert Bosch GmbH, and International Business Machines Corporation (IBM), among others.

Service Analysis

E-Hailing is Anticipated to Dominate the On-Demand Transportation Market During the Forecast Period

Based on services, on-demand transportation is classified into car sharing, car rental, e-hailing, and station-based-mobility. From these services, the e-hailing service is the largest segment and is expected to be the fastest-growing service during the forecast period of 2023 to 2032. The growth of this segment is due to the increasing penetration of the internet and smartphones across the world.

By using the internet, individuals can book the vehicle from any remote location under the area of a service provider. Governments across the world are promoting the use of e-hailing to reduce traffic congestion by private vehicles. These factors are expected to drive the growth of the e-hailing segment in the on-demand transportation market.

After e-hailing, the car-sharing service is anticipated to grow significantly over the forecast period. Major companies like OLA Inc. and Uber offer such services at low costs. This is attracting customers to shift towards car sharing. With increasing population and urbanization, the growth of the car share segment is anticipated to boost the on-demand transportation market during the forecast period.

Vehicle Type Analysis

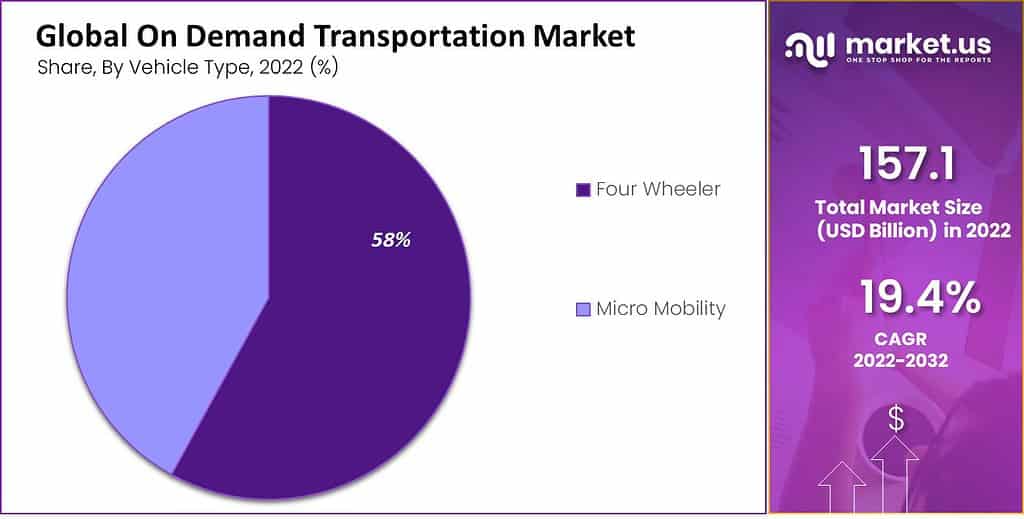

Individuals Prefer Four Wheelers over micro-mobility vehicles

On-demand services are divided into micro-mobility and four-wheelers based on vehicle type. Among these vehicles type, the four-wheelers segment dominates the market with a major revenue share. Individuals across the world prefer four-wheelers over micro-mobility due to the benefits like comfortable experience and less noise pollution than micro-mobility. These factors are driving the growth of four wheeler segment in the on-demand transportation market.

Moreover, rising disposable income in countries like India and China contributes a major share of the on-demand transportation market. Micro-mobility has advantages like low fuel consumption, better flexibility in congested areas, low cost, and high energy efficiency. These factors encourage individuals to use micro-mobility services for transportation. Governments are imposing heavy environmental regulations. This promotes the use of micro-mobility for transportation. Due to these factors, the micro-mobility segment is anticipated to grow at a significant CAGR over the forecast period.

Market Key Segments

Service

- Car Sharing

- Car Rental

- E-Hailing

- Station-Based Mobility

Vehicle Type

- Micro Mobility

- Four Wheeler

Driver

Increasing Urbanization and Technological Advancements

The on-demand transportation market is primarily driven by the rapid urbanization and the associated demand for efficient transportation solutions in congested urban centers. As cities grow, the need for accessible and reliable transportation becomes critical.

Technological advancements, such as the widespread adoption of smartphones and the internet, have facilitated the rise of ride-sharing platforms like Uber and Lyft, revolutionizing how people commute. These platforms offer convenience and flexibility, which traditional public transport systems often lack. Additionally, the integration of AI and machine learning technologies enhances route optimization and customer service, further driving market growth.

Restraint

Safety Concerns and Regulatory Challenges

One significant restraint in the on-demand transportation market is the concern over passenger and driver safety. Incidents of violence and accidents have raised security issues, impacting the market’s growth.

Furthermore, the regulatory landscape for on-demand transportation services varies widely across different regions, posing challenges for service providers. These companies often face strict regulations that can hinder operational flexibility and increase costs. The lack of connectivity and on-demand transportation infrastructure in remote and rural areas also restricts market expansion.

Opportunity

Integration of AI and Electrification of Fleets

A major opportunity in the on-demand transportation market lies in the integration of artificial intelligence and the electrification of vehicle fleets. AI technologies are being employed to improve the efficiency of transportation networks, including optimizing travel routes and managing fleet operations effectively.

The push towards environmental sustainability has also led to an increased focus on electric vehicles (EVs), which are seen as a way to reduce the carbon footprint of transportation services. These advancements are expected to enhance service offerings and attract a broader customer base looking for eco-friendly transportation options.

Challenge

Maintaining High-Quality Service Amidst Rapid Expansion

As the on-demand transportation market expands, maintaining a consistent level of service quality poses a significant challenge. The rapid increase in users and the continuous need for fleet and service updates can strain resources.

Ensuring high-quality customer service, keeping up with technological advancements, and managing a growing workforce require substantial investment and effective strategic planning. Moreover, the intense competition in the market compels companies to innovate continuously while managing costs to stay profitable.

Growth Factors

- Technological Integration: The widespread adoption of advanced technologies such as GPS tracking, mobile applications, and data analytics is a significant driver. These technologies enhance the efficiency and user experience of on-demand transportation services.

- Urbanization: As more people move into urban areas, the demand for efficient and flexible transportation solutions increases. This urban growth drives the on-demand transportation market by providing a large customer base reliant on easy and quick transport services.

- Increasing Environmental Awareness: There is a growing trend towards environmental sustainability, leading to higher demand for eco-friendly transportation options like electric and hybrid vehicles within the on-demand sector.

- Consumer Preference for Convenience: The shift in consumer behavior towards prioritizing convenience and immediacy in services, facilitated by smartphones and online platforms, fuels the growth of on-demand transportation services like ride-hailing and car-sharing.

- Government Initiatives: Supportive government policies and investments in infrastructure that facilitate on-demand services, such as improved road networks and regulations favoring electric vehicles, bolster market growth.

Emerging Trends

- Electrification of Fleets: Companies are increasingly investing in electric vehicles as part of their fleets to meet environmental standards and appeal to eco-conscious consumers.

- Use of Artificial Intelligence (AI): AI is being integrated more extensively to optimize routes, manage fleets, predict demand, and personalize the customer experience, driving efficiencies across the board.

- Multimodal Transportation Solutions: There is a rising trend towards offering seamless integration of different modes of transportation (e.g., scooters, bikes, cars) within a single platform to enhance urban mobility.

- Autonomous Vehicles: The gradual introduction of autonomous vehicles into the on-demand transportation fleet represents a major trend that could reshape the market dynamics by reducing the dependency on human drivers and increasing safety and efficiency.

- Expansion into Rural and Suburban Areas: As urban markets become saturated, on-demand transportation services are expanding into less densely populated areas, creating new growth avenues and reaching untapped customer segments.

Regional Analysis

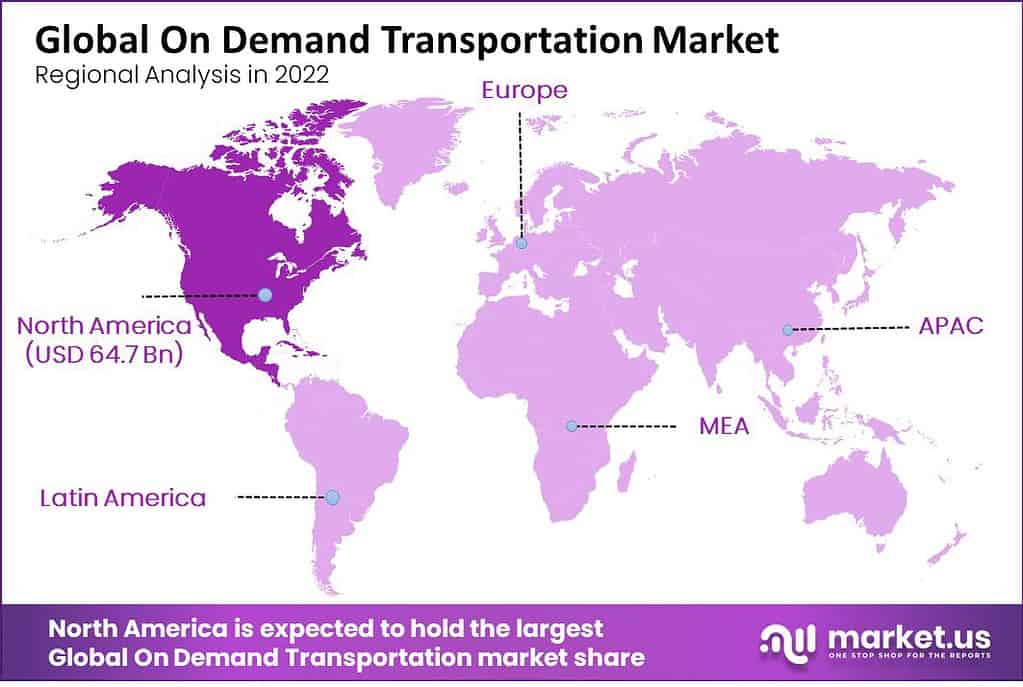

In 2022, North America held a dominant market position in the on-demand transportation market, capturing more than a 41.2% share with a revenue of USD 64.7 billion. This substantial market share can be attributed to several key factors that uniquely position North America as a leader in this industry.

Firstly, the region benefits from a highly developed technological infrastructure, which supports the widespread adoption of on-demand transportation services. The prevalence of smartphones and high-speed internet connectivity enables seamless interaction between service providers and consumers. Moreover, North American consumers show a high propensity to adopt new technologies, which accelerates the penetration of on-demand services across various demographics.

Secondly, regulatory frameworks in North America have evolved to more comprehensively accommodate and sometimes encourage the growth of on-demand transportation. This includes legislative support for ridesharing companies and the facilitation of autonomous vehicle testing and deployment, which are seen as the future of on-demand transport. These regulations not only protect consumers but also provide a stable environment for companies to innovate and expand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The on-demand transportation market is characterized by the presence of several key players who drive innovation and expansion within the industry. Uber Technologies Inc. stands as a global leader, known for its extensive ride-hailing network and diversified services, including UberEats and Uber Freight.

Similarly, Ola Inc. dominates the Indian market, offering a range of services from ride-hailing to electric vehicle solutions, significantly influencing the market dynamics in Asia. BlaBlaCar leads in Europe with its carpooling platform, promoting cost-effective and eco-friendly travel options across the continent.

In the Middle East, Careem has established itself as a prominent player, providing ride-hailing and delivery services and recently expanding into financial services. Grab holds a strong position in Southeast Asia, offering an extensive range of services, from transportation to food delivery and digital payments, catering to a vast user base. Automotive giants like Daimler AG, Ford Motor Company, and General Motor Company are also key players, integrating on-demand mobility solutions with their automotive expertise to create comprehensive transportation ecosystems.

Gett Inc., known for its corporate transportation services, has a significant presence in the U.S. and European markets. Technology companies like Robert Bosch GmbH and International Business Machines Corporation (IBM) are crucial in providing the technological backbone for on-demand transportation services, offering advanced solutions in AI, IoT, and cloud computing to enhance operational efficiency and customer experience.

Top Key Players in the Market

- Ola Inc.

- BlaBlaCar

- Uber Technologies Inc.

- Careem

- Grab

- Daimler AG

- Ford Motor Company

- General Motor Company

- Gett Inc.

- Robert Bosch GmbH.

- International Business Machines Corporation (IBM)

- Other Key Players

Recent Developments

- June 2023: Grab introduced “GrabRentals”, a new service in Singapore that allows users to rent cars on an hourly or daily basis. This service aims to provide flexible transportation options for both short-term and long-term needs.

- February 2023: Gett announced a strategic partnership with Curb Mobility to expand its on-demand transportation services in the United States. This partnership aims to integrate Curb’s taxi fleet into Gett’s platform.

- March 2023: BMW Group expanded its ReachNow car-sharing service to additional cities in the U.S., aiming to enhance its presence in the urban mobility market. The service allows users to rent BMW and MINI vehicles on-demand.

- May 2023: Daimler announced the launch of “Ride4All”, a new ride-sharing platform in Europe. This platform is designed to offer safe and reliable transportation options, particularly focusing on rural areas that are underserved by traditional public transportation.

- November 2023: Careem launched Careem Pay, a digital payment platform aimed at streamlining transactions for their users across various services including rides, food delivery, and online shopping

Report Scope

Report Features Description Market Value (2023) US$ 187.6 Bn Forecast Revenue (2032) US$ 885.0 Bn CAGR (2023-2032) 19.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service – Car Sharing, Car Rental, E-Hailing, and Station-Based-Mobility; By Vehicle Type – Micro Mobility and Four Wheeler. Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Ola, Uber Technologies Inc., BlaBlaCar, Careem, Grab, Gett Inc., General Motor Company, Daimler Group, Ford Motor Company, BMW Group, Robert Bosch GmbH., International Business Machines Corporation (IBM), and other key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the on-demand transportation market?It is a web-based service allowing users to book vehicles for trips based on distance and duration, encompassing ride-hailing, car-sharing, and bike-sharing.

How big is On-demand Transportation Market?The Global On-demand Transportation Market size is expected to be worth around USD 885.0 Billion By 2033, from USD 187.6 Billion in 2023, growing at a CAGR of 19.4% during the forecast period from 2024 to 2033.

What factors are driving market growth?Key drivers include rising urbanization, increasing smartphone penetration, technological advancements, and changing consumer preferences towards convenience and on-demand services.

What challenges does the market face?Challenges include data privacy concerns and regulatory issues impacting service operations and growth.

Which regions are leading the market?In 2022, North America held a dominant market position in the on-demand transportation market, capturing more than a 41.2% share with a revenue of USD 64.7 billion.

On-Demand Transportation MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

On-Demand Transportation MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Ola Inc.

- BlaBlaCar

- Uber Technologies Inc.

- Careem

- Grab

- Daimler AG

- Ford Motor Company

- General Motor Company

- Gett Inc.

- Robert Bosch GmbH.

- International Business Machines Corporation (IBM)

- Other Key Players